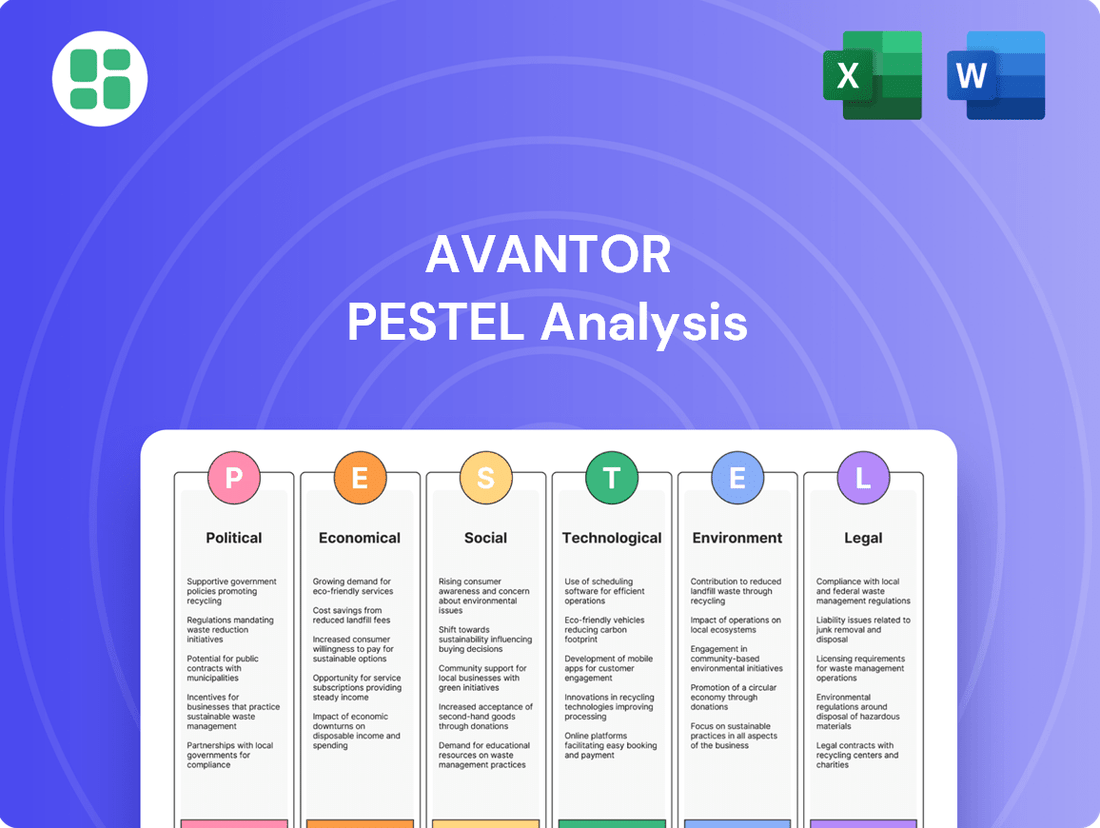

Avantor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avantor Bundle

Navigate the complex external forces shaping Avantor's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for a complete, expert-driven perspective.

Political factors

Government funding for scientific research, especially in biopharma and advanced technologies, directly affects Avantor's customer base and the demand for its offerings. For instance, the U.S. National Institutes of Health (NIH) budget for fiscal year 2024 is proposed at $47.4 billion, a significant figure supporting research that relies on Avantor's products.

Changes in these budgets, often tied to political priorities, can greatly influence market opportunities and investment in new scientific fields. A sustained focus on healthcare and life sciences R&D, as seen in recent years, bodes well for Avantor's growth prospects.

Changes in healthcare policies and evolving drug approval processes globally directly impact Avantor's customer base, influencing demand for its essential products. For instance, the U.S. Food and Drug Administration (FDA) continues to streamline pathways for novel therapies, a trend observed throughout 2024, which can accelerate customer R&D and thus Avantor's product sales.

Stricter medical device regulations, such as those being implemented or refined across the European Union under MDR (Medical Device Regulation), present both compliance hurdles and opportunities for Avantor to supply compliant materials and solutions. The biopharma sector, a key market for Avantor, is actively adapting to these dynamic regulatory shifts, seeking reliable partners to navigate these complexities.

Avantor, a key player in the life sciences industry, navigates a complex global trade landscape. Shifts in trade policies, such as the imposition of tariffs or the renegotiation of trade agreements, directly impact Avantor's ability to source raw materials and distribute its products worldwide. For instance, ongoing trade tensions between major economic blocs can lead to increased costs and logistical hurdles, affecting the company's profitability and market reach.

Geopolitical stability is equally crucial for Avantor's operations. Political unrest or conflicts in regions where Avantor has manufacturing facilities or significant customer bases can disrupt supply chains and create uncertainty. The company's focus on building resilient supply chains, a trend observed across the life sciences sector, is a direct response to these evolving political realities. In 2024, many companies are re-evaluating their global footprint to mitigate risks associated with geopolitical instability.

Intellectual Property Protection Policies

Avantor's business is significantly impacted by intellectual property (IP) protection policies, particularly given its customer base in biopharma and advanced technologies. These sectors depend on strong patent laws and the safeguarding of proprietary research for their innovation and market competitiveness. For instance, the global biopharmaceutical market, valued at over $1.5 trillion in 2023, relies heavily on IP to recoup substantial R&D investments, making robust protection essential for continued scientific advancement and product development.

Government actions that either bolster or dilute IP rights directly shape the innovation environment. Stronger IP protection can encourage greater investment in research and development, leading to new discoveries that Avantor's customers will require. Conversely, weaker protections might stifle innovation, potentially slowing the demand for Avantor's specialized products and services. In 2024, many nations are reviewing and updating their IP frameworks to balance innovation incentives with public access to knowledge.

- Global IP Landscape: Countries like the United States, Germany, and Japan are known for their strong IP protection, fostering significant R&D spending in their respective life sciences and technology sectors.

- Impact on R&D: In 2024, the pharmaceutical industry's R&D expenditure is projected to exceed $250 billion globally, with a significant portion driven by the expectation of IP-backed market exclusivity.

- Biotech Innovation: The biotechnology sector, a key Avantor market, saw over $60 billion in venture capital funding in 2023, with IP strength being a critical factor in investor confidence.

- Policy Evolution: Ongoing discussions in 2025 around patent eligibility and enforcement in emerging fields like AI-driven drug discovery will continue to shape the IP landscape for Avantor's clients.

Environmental and Sustainability Regulations

Governments worldwide are intensifying their focus on environmental protection and sustainability, leading to stricter regulations impacting chemical usage, waste management, and carbon emissions. This directly affects Avantor's operational procedures and its approach to developing new products.

Avantor must continuously adapt its manufacturing processes and supply chain strategies to comply with these evolving environmental mandates. For instance, the European Union's Green Deal initiatives, aiming for climate neutrality by 2050, are driving significant changes across industries, including those Avantor serves.

The increasing regulatory pressure is pushing companies to adopt more eco-friendly materials and sustainable practices. In 2023, global investment in clean energy technologies reached over $2 trillion, signaling a broader market shift that Avantor is navigating.

- Increased Scrutiny on Chemical Lifecycle: Regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe continue to evolve, requiring detailed data on chemical safety and environmental impact throughout their lifecycle.

- Carbon Emission Targets: Many nations are setting ambitious carbon reduction targets, compelling companies like Avantor to invest in energy efficiency and explore lower-emission logistics and manufacturing.

- Waste Reduction and Circular Economy: Growing emphasis on reducing waste and promoting circular economy principles means Avantor needs to optimize its packaging and explore recycling or reuse programs for its products and materials.

- Sustainable Sourcing: There's a growing demand for transparency and sustainability in sourcing raw materials, pushing Avantor to ensure its suppliers adhere to environmental and ethical standards.

Government funding for scientific research, particularly in biopharma and advanced technologies, directly impacts Avantor's customer base and product demand. For example, the U.S. National Institutes of Health (NIH) proposed a budget of $47.4 billion for fiscal year 2024, supporting research reliant on Avantor's offerings.

Evolving healthcare policies and drug approval processes globally influence Avantor's customer base and product demand. The U.S. Food and Drug Administration (FDA) continues to streamline pathways for novel therapies, a trend observed throughout 2024, which can accelerate customer R&D and Avantor's sales.

Stricter medical device regulations, such as the EU's MDR, present compliance challenges and opportunities for Avantor to supply compliant materials. The biopharma sector, a key market for Avantor, is actively adapting to these dynamic regulatory shifts.

Intellectual property (IP) protection policies are critical for Avantor's biopharma and technology clients, influencing R&D investment. The global biopharmaceutical market, exceeding $1.5 trillion in 2023, heavily relies on IP for R&D recoupment, making robust protection essential.

| Factor | Description | Impact on Avantor | 2024/2025 Data Point |

| Government Funding | Support for scientific research | Drives demand for Avantor's products | NIH FY2024 proposed budget: $47.4 billion |

| Healthcare Policy | Drug approval processes | Affects customer R&D and sales | FDA streamlining novel therapy pathways (ongoing 2024) |

| Regulatory Environment | Medical device regulations (e.g., EU MDR) | Creates compliance needs and opportunities | Biopharma adapting to evolving regulations |

| Intellectual Property | Protection of R&D investments | Influences customer innovation and spending | Biopharma R&D expenditure projected >$250 billion (2024) |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Avantor, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions. It offers actionable insights for strategic decision-making by highlighting key trends and potential impacts.

Avantor's PESTLE analysis provides a clear, summarized version of external factors, offering easy referencing during meetings and presentations to alleviate the pain of information overload.

Economic factors

Global economic growth significantly impacts Avantor's business, influencing R&D investments and capital expenditures by its customers. When the global economy is robust, companies tend to increase spending on scientific research and advanced manufacturing, directly benefiting Avantor's product and service demand. For instance, a strong economic outlook for 2025, with many global life sciences executives anticipating revenue increases, suggests a positive environment for Avantor's growth.

Rising inflation and increased costs for raw materials, energy, and logistics present a significant challenge for Avantor, directly impacting its operational expenses and profit margins. For instance, in early 2024, the Producer Price Index (PPI) for chemicals and allied products saw notable year-over-year increases, reflecting these broader cost pressures.

Effective management of these cost pressures is crucial for Avantor. This involves implementing robust supply chain management strategies to secure favorable pricing and availability of essential inputs, alongside carefully considered pricing strategies to pass on some of these increased costs to customers without significantly impacting demand.

Life sciences executives frequently cite inflation and the potential for economic recession as key unpredictable risks. A survey in late 2023 indicated that over 60% of these executives viewed inflation as a top concern, highlighting the pervasive nature of this economic factor across the industry.

Interest rate fluctuations directly impact Avantor's operational and investment strategies. For instance, if interest rates rise, Avantor's costs for financing new facilities or R&D initiatives will increase, potentially making such ventures less attractive. Conversely, a decrease in borrowing costs, anticipated to be a significant factor for the life sciences sector in 2025, could spur investment and boost demand for Avantor's offerings.

Higher interest rates can also constrain Avantor's customers, particularly those in research-intensive industries, by reducing their available capital for purchasing new equipment or expanding operations. This could lead to a slowdown in demand for Avantor's products and services. The Federal Reserve's target range for the federal funds rate, for example, influences borrowing costs across the economy, and any shifts within this range will have a ripple effect on Avantor's market.

R&D Spending Trends in Key Industries

Avantor's growth is closely tied to research and development (R&D) investment in critical sectors. The biopharma, healthcare, and advanced technology industries are major consumers of Avantor's offerings, making their R&D spending a direct indicator of market demand.

Positive R&D trends, especially in drug discovery and materials science, signal significant market potential. For instance, global R&D spending in the biopharmaceutical sector was projected to reach over $250 billion in 2024, a substantial increase that fuels demand for laboratory supplies and equipment.

The broader laboratory equipment market is experiencing strong growth, largely propelled by these escalating R&D activities. Reports from 2024 indicated the global laboratory equipment market was expected to grow at a compound annual growth rate (CAGR) of approximately 6.5% through 2028, underscoring the direct correlation between R&D investment and Avantor's market opportunities.

- Biopharma R&D Spending: Global biopharma R&D investment projected to exceed $250 billion in 2024.

- Market Driver: Increased R&D in drug discovery and materials science directly boosts demand for Avantor's products.

- Lab Equipment Market Growth: The global laboratory equipment market is anticipated to grow at a CAGR of around 6.5% from 2024 to 2028.

Currency Exchange Rate Volatility

Avantor, as a global entity with operations in many countries, faces the inherent risk of currency exchange rate volatility. Fluctuations in these rates can significantly alter the reported value of its revenues, expenses, and overall profits when its foreign currency transactions are translated into its primary reporting currency. This dynamic introduces a notable layer of financial complexity to managing its international business activities.

For instance, during 2024, the US Dollar experienced a strengthening trend against several major currencies. This could mean that Avantor's reported revenues from regions where the local currency weakened against the dollar might appear lower when converted. Conversely, costs incurred in weaker currencies could become more favorable. The specific impact depends on the geographic distribution of Avantor's sales and cost bases.

- Impact on Revenue: A stronger USD in 2024 likely reduced the reported USD value of sales made in Euros and Yen.

- Impact on Costs: Conversely, Avantor's expenses denominated in weaker currencies might have seen a decrease in their USD equivalent.

- Profitability: The net effect on profitability hinges on the balance between revenue and cost exposures in different currency markets.

- Financial Reporting: Exchange rate changes necessitate careful accounting and hedging strategies to mitigate potential earnings volatility.

Economic growth directly fuels Avantor's business by increasing customer R&D and capital spending. A strong global economy in 2025, with life sciences executives anticipating revenue growth, points to a favorable market for Avantor. However, rising inflation, as seen in early 2024 chemical sector price increases, drives up Avantor's operational costs and pressures profit margins.

Interest rate shifts significantly affect Avantor's financing costs and customer investment capacity. Higher rates increase borrowing expenses for new projects, while anticipated rate decreases in 2025 for the life sciences sector could stimulate investment and demand. Consequently, managing these economic variables is crucial for Avantor's financial health and market responsiveness.

| Economic Factor | Impact on Avantor | Supporting Data/Trend (2024-2025) |

| Global Economic Growth | Increased customer R&D and capital expenditure | Life sciences executives expecting revenue increases in 2025. |

| Inflation & Cost Pressures | Higher operational expenses, reduced profit margins | Producer Price Index (PPI) for chemicals saw year-over-year increases in early 2024. |

| Interest Rates | Impacts financing costs and customer investment | Anticipated interest rate decreases in 2025 for life sciences sector. |

Preview Before You Purchase

Avantor PESTLE Analysis

The preview shown here is the exact Avantor PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Avantor. What you’re previewing here is the actual file—fully formatted and professionally structured, offering actionable insights for strategic planning.

You can be confident that the content and structure shown in this preview is the same Avantor PESTLE Analysis document you’ll download after payment, ensuring you get the complete, high-quality report you expect.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, nearly one in six people globally will be over 65. This demographic shift significantly increases the demand for healthcare services, pharmaceuticals, and medical devices. Consequently, this trend directly benefits companies like Avantor, which supply essential products and services to the biopharma and healthcare industries, creating a robust and ongoing growth avenue.

Chronic diseases are a major concern, being the leading cause of death worldwide. This reality fuels the need for sophisticated diagnostic equipment and advanced medical technologies. The increasing prevalence of conditions such as heart disease, cancer, and diabetes necessitates continuous innovation and supply within the healthcare sector, areas where Avantor plays a crucial role.

Growing public health awareness and a focus on preventative care are significant drivers for the life sciences sector. As individuals become more proactive about their well-being, there's a corresponding surge in demand for diagnostics, innovative drug development, and robust scientific research. This societal shift directly fuels the expansion of the life sciences industry, creating a more robust market for companies like Avantor that supply essential products and services to these fields.

The increasing prevalence of chronic diseases globally further amplifies this trend. For instance, the World Health Organization reported in 2024 that non-communicable diseases account for 74% of all deaths worldwide, underscoring the critical need for advanced medical solutions. This societal imperative translates into greater investment in research and development, particularly in areas like early disease detection and personalized medicine, which directly benefits Avantor's portfolio.

The availability of a skilled workforce, particularly in STEM fields, is a critical factor for Avantor and its clientele. For instance, in 2024, the U.S. Bureau of Labor Statistics projected continued growth in STEM occupations, with employment expected to increase by 10.8% from 2022 to 2032, faster than the average for all occupations. This robust demand highlights the importance of a strong talent pipeline for Avantor's operations and its customers' research and development efforts.

Shortages in qualified scientists, engineers, and technicians can directly affect research timelines and manufacturing efficiency. A 2023 report by the National Science Board indicated that while the U.S. produces a significant number of STEM graduates, specific specialized skills can still be in high demand, potentially creating bottlenecks. Avantor's commitment to associate development and engagement is therefore a strategic imperative, aiming to cultivate a high-performing culture capable of meeting these evolving labor market needs.

Ethical Considerations in Biotechnology

Public perception of biotechnology, particularly concerning gene editing and AI in drug discovery, significantly shapes regulatory landscapes and the adoption of new medical treatments. For instance, a 2024 Pew Research Center survey indicated that while a majority of Americans express optimism about AI in healthcare, concerns about data privacy and potential bias remain prominent, influencing how these technologies are integrated and regulated.

Avantor, as a key supplier to the life sciences sector, must navigate these evolving societal attitudes. Shifts in public opinion can directly affect research funding priorities and the speed at which biotechnological innovations, like CRISPR-based therapies or AI-generated drug candidates, reach the market. This requires Avantor to stay attuned to ethical debates and public sentiment to effectively support its clients' development pipelines.

The ethical considerations also extend to the accessibility and affordability of advanced biotechnologies. Discussions around equitable access to gene therapies, for example, can lead to policy changes that impact market demand and Avantor's product portfolio. As of early 2025, the cost of some gene therapies remains a significant barrier, prompting ongoing societal and governmental scrutiny.

- Public Opinion: Surveys in late 2024 showed mixed public sentiment on gene editing, with a growing segment expressing ethical concerns about its application beyond therapeutic uses.

- Regulatory Impact: Ethical debates are directly influencing the development of stricter guidelines for AI in clinical trials, potentially slowing down approval processes for AI-discovered drugs.

- Market Acceptance: Societal trust in AI-driven diagnostics, a key area for Avantor's clients, is still being built, with transparency in algorithms being a critical factor for widespread adoption.

- Research Direction: Ethical frameworks are increasingly guiding research funding, favoring projects with clear societal benefits and robust safety protocols.

Evolving Preferences for Sustainable Products

Societal expectations are shifting, with a noticeable increase in demand for products that are both sustainable and ethically produced. This trend directly impacts consumer choices, pushing companies to adapt their offerings and operational practices. For Avantor, aligning its operations and product development with these evolving preferences is crucial for maintaining a strong brand image and staying competitive in the market.

Avantor's focus on sustainability, demonstrated through initiatives like reducing its carbon footprint and offering eco-friendly product lines, resonates with this growing consumer consciousness. For instance, in 2023, Avantor reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, a tangible step towards meeting these demands.

- Growing Consumer Demand: Over 60% of consumers globally now consider sustainability when making purchasing decisions, a figure that has steadily risen over the past few years.

- Avantor's Sustainability Initiatives: The company has set targets to achieve carbon neutrality in its operations by 2040, aligning with global climate goals.

- Market Competitiveness: Companies demonstrating a strong commitment to ESG (Environmental, Social, and Governance) principles often experience enhanced brand loyalty and attract a wider customer base.

- Product Portfolio Alignment: Avantor's investment in biodegradable packaging and greener chemical solutions directly addresses the market's call for environmentally responsible products.

Societal trends like an aging global population and the increasing prevalence of chronic diseases are significant drivers for Avantor. These demographic shifts directly boost demand for healthcare services, pharmaceuticals, and medical devices, areas where Avantor is a key supplier. Furthermore, heightened public awareness around health and preventative care fuels the life sciences sector, creating a robust market for Avantor's products and services.

Technological factors

Breakthroughs in gene editing, cell and gene therapies, and personalized medicine are demanding more sophisticated materials, chemicals, and equipment, which is a direct boon for Avantor. These advancements in life sciences are reshaping the industry, creating a continuous need for specialized solutions across the entire lifecycle from initial research to large-scale production.

Avantor's customers are increasingly integrating automation, robotics, and artificial intelligence (AI) into their laboratory and manufacturing operations. This trend is significantly boosting efficiency, precision, and the volume of work that can be handled. For instance, in 2024, the global laboratory automation market was valued at approximately USD 5.5 billion, with projections indicating substantial growth driven by these advanced technologies.

Avantor's strategic advantage lies in its capacity to supply products and services that seamlessly integrate with these evolving automation and AI systems. Furthermore, the company's potential to innovate and introduce its own AI-powered solutions will be a crucial driver for its future expansion and market relevance.

The life sciences sector, a core market for Avantor, is heavily invested in digital transformation, with AI and automation at the forefront of this shift. This digital focus is reshaping research, development, and production processes, creating new opportunities for companies like Avantor that can support this technological advancement.

Avantor's performance materials segment benefits directly from ongoing breakthroughs in materials science. Innovations like smart polymers, nanomaterials, and advanced composites are opening new avenues for product development and market expansion. For instance, the smart polymers market alone was projected to reach over $3.5 billion by 2025, indicating substantial growth potential.

Furthermore, the evolution of analytical instrumentation and techniques necessitates Avantor's continuous offering of sophisticated reagents and equipment. As research and development push boundaries, the demand for high-purity chemicals and advanced analytical tools intensifies. The global market for analytical instruments was estimated to be worth around $60 billion in 2023, highlighting the critical role of these technologies.

Digital Transformation and Data Analytics

The scientific and healthcare industries are undergoing a significant digital transformation, with a strong focus on integrating data, leveraging advanced analytics, and adopting digital platforms. This shift means Avantor's capacity to provide digital solutions, improve how customers use their data, and support the development of digital laboratories is becoming crucial for boosting efficiency and better decision-making.

Digital transformation is no longer optional but a fundamental requirement in the life sciences sector. For instance, by 2025, the global life sciences analytics market is projected to reach over $20 billion, highlighting the immense value placed on data-driven insights.

Avantor's commitment to this trend is evident in its investments and offerings. In 2023, the company continued to expand its digital capabilities, aiming to streamline customer workflows and enhance the accessibility of scientific data. This includes advancements in their e-commerce platforms and integrated supply chain solutions, designed to support the increasingly digital nature of research and development.

- Data Integration: Avantor's platforms facilitate seamless integration of data from various sources, crucial for complex research projects.

- Advanced Analytics: The company supports the use of sophisticated analytical tools to derive actionable insights from scientific data.

- Digital Lab Support: Avantor provides solutions that enable customers to build and operate more efficient, digitally-enabled laboratories.

- Market Growth: The life sciences analytics market is expected to see substantial growth, underscoring the demand for digital solutions.

Emergence of Personalized and Precision Medicine

The move towards personalized medicine and precision diagnostics is a significant technological driver. This trend means that industries supporting healthcare, like Avantor, need to supply materials that are exceptionally pure and specific, along with specialized equipment. For instance, the global personalized medicine market was valued at approximately $500 billion in 2023 and is projected to grow substantially, indicating a strong demand for tailored solutions.

This shift directly benefits companies like Avantor, whose core business involves providing mission-critical products for advanced scientific research and applications. As treatments become more individualized, the need for highly specific reagents, advanced cell culture media, and sophisticated diagnostic tools increases. Avantor's commitment to high-purity materials supports these precise requirements, fostering growth in this segment.

The outcome for patients is more targeted and effective treatment options, leading to better health outcomes. This technological advancement is reshaping healthcare delivery, pushing for innovation in both diagnostics and therapeutics. The increasing adoption of genomic sequencing and advanced biomarker analysis in clinical practice further underscores this trend.

- Market Growth: The personalized medicine market is expected to see a compound annual growth rate (CAGR) of over 10% from 2024 to 2030.

- Demand for Purity: The need for ultra-pure reagents and consumables in genomic sequencing and cell therapy production is a key driver for suppliers.

- Avantor's Role: Avantor's portfolio, including high-purity chemicals and single-use technologies, is well-positioned to meet these evolving demands.

- Impact on Healthcare: Precision diagnostics enable earlier disease detection and more effective, less toxic treatment strategies for patients.

Technological advancements in life sciences, such as gene editing and cell therapies, are increasing the demand for specialized materials and equipment, directly benefiting Avantor. The integration of automation, robotics, and AI in laboratories is also a significant trend, with the global laboratory automation market valued at approximately USD 5.5 billion in 2024, driving efficiency and requiring sophisticated solutions.

Avantor's ability to supply products that integrate with these new technologies, alongside potential AI-powered innovations, positions it for future growth. The company's performance materials segment is bolstered by innovations in materials science, with the smart polymers market alone projected to exceed $3.5 billion by 2025.

The digital transformation in scientific and healthcare industries, emphasizing data integration and advanced analytics, is critical. The life sciences analytics market is anticipated to surpass $20 billion by 2025, highlighting the demand for digital solutions that Avantor is increasingly providing through its platforms and integrated supply chain.

The rise of personalized medicine, a market valued at approximately $500 billion in 2023, necessitates ultra-pure materials and specialized equipment, areas where Avantor excels. This trend, coupled with the growing adoption of genomic sequencing, drives demand for Avantor's high-purity chemicals and single-use technologies.

| Technological Factor | Impact on Avantor | Market Data/Projections |

|---|---|---|

| Gene Editing & Cell Therapies | Increased demand for sophisticated materials, chemicals, and equipment. | Reshaping the life sciences industry, creating continuous need for specialized solutions. |

| Automation & AI in Labs | Boosts efficiency and precision, requiring seamless integration of Avantor's products. | Global laboratory automation market: ~USD 5.5 billion (2024), with substantial growth projected. |

| Digital Transformation & Analytics | Enhances research, development, and production; drives need for digital solutions. | Life sciences analytics market: projected to exceed USD 20 billion by 2025. |

| Personalized Medicine & Precision Diagnostics | Requires exceptionally pure and specific materials and specialized equipment. | Global personalized medicine market: ~USD 500 billion (2023), with strong growth. |

Legal factors

Intellectual property laws, particularly patents for scientific inventions and advanced technologies, are crucial for Avantor's business. These regulations safeguard the innovations that drive the biopharma and life sciences sectors, which are key markets for Avantor. Strong patent protection incentivizes research and development, directly influencing the demand for Avantor's specialized materials and services.

The expiration of patents presents a dynamic landscape for Avantor. While it can lead to increased competition for drug manufacturers, it also creates opportunities for generic producers, potentially expanding the market for Avantor's raw materials and manufacturing solutions. For instance, the patent cliff for several blockbuster drugs in the mid-2020s could reshape supply chain demands.

Stringent data privacy regulations like GDPR and HIPAA significantly shape how Avantor handles sensitive customer and patient information, especially within its research and healthcare-focused segments. Non-compliance can lead to substantial fines; for instance, GDPR violations can incur penalties of up to 4% of global annual revenue or €20 million, whichever is higher. Avantor's commitment to secure data access and sharing is therefore crucial for maintaining stakeholder trust and avoiding legal repercussions.

Avantor operates within a stringent legal framework governing product liability and safety standards for its chemical, reagent, and equipment offerings. Compliance with regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe and TSCA (Toxic Substances Control Act) in the United States is paramount to avoid penalties and ensure continued market access.

The company's commitment to rigorous quality control and robust safety protocols is not merely a matter of compliance but a strategic imperative. For instance, in 2023, the global chemical industry saw significant regulatory scrutiny, with fines for non-compliance reaching millions of dollars for some firms, underscoring the financial risks associated with product safety failures.

Maintaining high safety and quality standards directly impacts Avantor's ability to retain customer trust, particularly in sensitive sectors like healthcare and research, where product integrity is non-negotiable. This focus on safety also facilitates seamless market entry and expansion, as adherence to international standards often streamlines regulatory approval processes in new geographies.

Anti-trust and Competition Laws

Avantor's market strategies, including its pricing and potential mergers, are significantly shaped by anti-trust and competition laws across different regions. Navigating these regulations is crucial for maintaining fair market practices and sidestepping regulatory attention, particularly as the life sciences sector experiences consolidation. For instance, the European Commission's scrutiny of mergers in the pharmaceutical and biotech supply chain, which saw a 15% increase in merger filings in 2023 compared to 2022, highlights the importance of compliance.

The company must ensure its actions foster healthy competition, which directly impacts its ability to pursue strategic consolidation and realize value creation opportunities. Failure to comply can lead to substantial fines and operational disruptions, as seen with past antitrust cases in the chemical distribution sector that resulted in multi-million dollar penalties.

- Regulatory Scrutiny: Avantor must adhere to regulations like the Sherman Act in the US and the Treaty on the Functioning of the European Union to prevent monopolistic practices.

- Merger Impact: Competition authorities review acquisitions to ensure they do not harm market competition; for example, the US Federal Trade Commission blocked several healthcare mergers in 2023.

- Pricing Practices: Laws against price-fixing and bid-rigging are paramount, requiring transparent and competitive pricing strategies.

- Market Dynamics: The ongoing consolidation in the life sciences and laboratory supplies market intensifies the need for proactive compliance to facilitate growth.

Labor and Employment Laws

Avantor must navigate a complex web of labor and employment laws across its global operations, impacting everything from hiring practices to daily work conditions. Compliance with these diverse regulations, covering wages, safety standards, and anti-discrimination measures, directly influences operational expenses and the effectiveness of its human resource strategies.

The company's commitment to associate development and engagement is further shaped by these legal frameworks, which dictate employee rights and responsibilities. For instance, in 2024, the average global wage for manufacturing roles can vary significantly; in the US, it might hover around $25-$35 per hour, while in some European countries, it could be €15-€25 per hour, directly affecting Avantor's payroll costs and competitive positioning.

- Global Compliance: Adhering to varying national labor laws, including those in the US, Germany, and China, is critical for Avantor's workforce management.

- Operational Costs: Wage regulations, working condition standards, and benefits mandates directly impact Avantor's cost structure.

- Employee Rights: Laws protecting against discrimination and ensuring fair treatment are fundamental to Avantor's HR policies and associate relations.

- Talent Management: Labor laws influence recruitment, retention, and development strategies, affecting Avantor's ability to attract and keep skilled employees.

Avantor's operations are significantly influenced by intellectual property laws, particularly patents protecting scientific innovations crucial for the biopharma and life sciences sectors. The expiration of patents for key drugs, expected in the mid-2020s, could alter market dynamics and demand for Avantor's materials. Adherence to data privacy regulations like GDPR and HIPAA is essential to protect sensitive information and avoid substantial fines, which can reach up to 4% of global annual revenue.

Environmental factors

Avantor, like many in the life sciences and advanced technologies sectors, operates under stringent environmental regulations governing the disposal of chemical waste and laboratory consumables. For instance, in the US, the Resource Conservation and Recovery Act (RCRA) dictates how hazardous waste is managed from generation to disposal. This means Avantor must implement sophisticated waste management protocols, impacting its operational expenses.

These regulations, while increasing costs for compliant waste management systems, also create opportunities. They are driving demand for more sustainable and recyclable laboratory products. Avantor's commitment to reducing hazardous chemical use and offering eco-friendly alternatives directly addresses these evolving market needs, potentially boosting sales of its greener product lines.

Avantor faces growing demands from regulators, investors, and customers to ensure its supply chain is environmentally sound. This means Avantor must actively evaluate and boost the environmental performance of its suppliers and how it moves goods. Key areas of focus include cutting down on carbon emissions, ensuring materials are sourced ethically, and building a more robust and reliable supply chain.

In response, Avantor initiated its Responsible Supplier Program in 2023. This program underscores the company's commitment to integrating sustainability into its supplier relationships, aiming to drive improvements across environmental, social, and governance criteria. Such initiatives are crucial as global supply chain sustainability reporting standards continue to evolve, with many companies aiming for net-zero emissions in their logistics by 2030 or 2040.

Global and national mandates to curb greenhouse gas emissions directly impact Avantor's energy usage and overall environmental footprint. The company's commitment to sustainability means actively managing its operational impact.

Avantor's strategic investments in renewable energy sources and advanced energy-efficient technologies are pivotal for achieving these emission reduction goals and showcasing its dedication to environmental stewardship. This proactive approach is key to long-term operational viability.

Demonstrating a strong commitment to environmental targets, Avantor successfully met its 2025 greenhouse gas emissions reduction goal a full two years ahead of schedule, a significant achievement underscoring its operational efficiency and strategic focus on sustainability.

Water Usage and Wastewater Treatment Regulations

Avantor's operations, particularly those involving manufacturing and laboratory work, are significantly impacted by regulations governing water usage and wastewater treatment. These rules are crucial for environmental compliance and responsible resource management. For instance, in 2024, Avantor reported progress on its water efficiency initiatives, underscoring the company's commitment to sustainable water practices.

Adherence to these environmental factors is not just about compliance but also about operational efficiency and long-term sustainability. Companies like Avantor are increasingly focused on minimizing their water footprint and ensuring that any discharged water meets stringent quality standards. This focus is driven by both regulatory pressures and a growing awareness of water scarcity as a global issue.

Key aspects of these regulations for Avantor include:

- Water Consumption Limits: Regulations often set caps on the amount of water that can be drawn from various sources, impacting water-intensive processes.

- Wastewater Discharge Standards: Strict limits on pollutants in discharged wastewater are enforced to protect aquatic ecosystems and public health.

- Treatment Technology Requirements: Companies may be mandated to use specific technologies for wastewater treatment to meet discharge quality.

- Reporting and Monitoring Obligations: Regular reporting on water usage and wastewater quality is typically required by environmental agencies.

Circular Economy Principles and Material Recycling

The global push towards a circular economy is transforming industries, pushing companies to prioritize product lifecycles that emphasize reuse, recycling, and biodegradability. Avantor is actively aligning with this trend by developing more sustainable products and solutions designed to lessen environmental impact from creation to disposal. This focus includes enhancing product recyclability and implementing robust waste reduction strategies across its operations.

Avantor's commitment to sustainability is evident in its 2024 initiatives, which include increasing the use of recycled materials in its packaging by 15% and aiming to divert 90% of its operational waste from landfills by the end of 2025. These efforts directly support the circular economy by keeping materials in use for longer and reducing the demand for virgin resources.

- Increased Recycled Content: Avantor aims to boost the recycled content in its product packaging by 15% in 2024.

- Waste Diversion Goals: The company has set a target to divert 90% of its operational waste from landfills by the end of 2025.

- Product Lifecycle Focus: Avantor is investing in R&D for products designed for enhanced recyclability and reduced environmental footprint.

Avantor's environmental strategy is increasingly shaped by global sustainability trends and regulatory pressures. The company is actively pursuing initiatives to reduce its carbon footprint, with a notable achievement being its early attainment of a 2025 greenhouse gas emissions reduction goal. This proactive stance extends to water management, where Avantor is implementing efficiency measures and adhering to strict wastewater discharge standards.

Furthermore, Avantor is embracing the principles of the circular economy by enhancing product recyclability and increasing the use of recycled materials in its packaging. By the end of 2025, the company aims to divert 90% of its operational waste from landfills, demonstrating a commitment to resource conservation and waste reduction.

These environmental efforts are not only about compliance but also about driving innovation and meeting the evolving demands of customers and investors for sustainable solutions. Avantor's Responsible Supplier Program, launched in 2023, further integrates sustainability into its supply chain operations, reflecting a comprehensive approach to environmental stewardship.

Avantor's 2024 sustainability report highlights key performance indicators and targets related to its environmental impact.

| Environmental Initiative | Target/Status | Year |

|---|---|---|

| Greenhouse Gas Emissions Reduction | Achieved 2025 Goal Ahead of Schedule | 2023 |

| Increase Recycled Content in Packaging | 15% Increase | 2024 |

| Operational Waste Diversion from Landfills | 90% Diversion | 2025 |

| Water Efficiency Progress | Reported Progress on Initiatives | 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Avantor is built on a robust foundation of data from leading financial institutions, governmental bodies, and reputable industry analysis firms. We utilize reports on global economic trends, regulatory changes, technological advancements, and societal shifts to ensure comprehensive insights.