Avantor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avantor Bundle

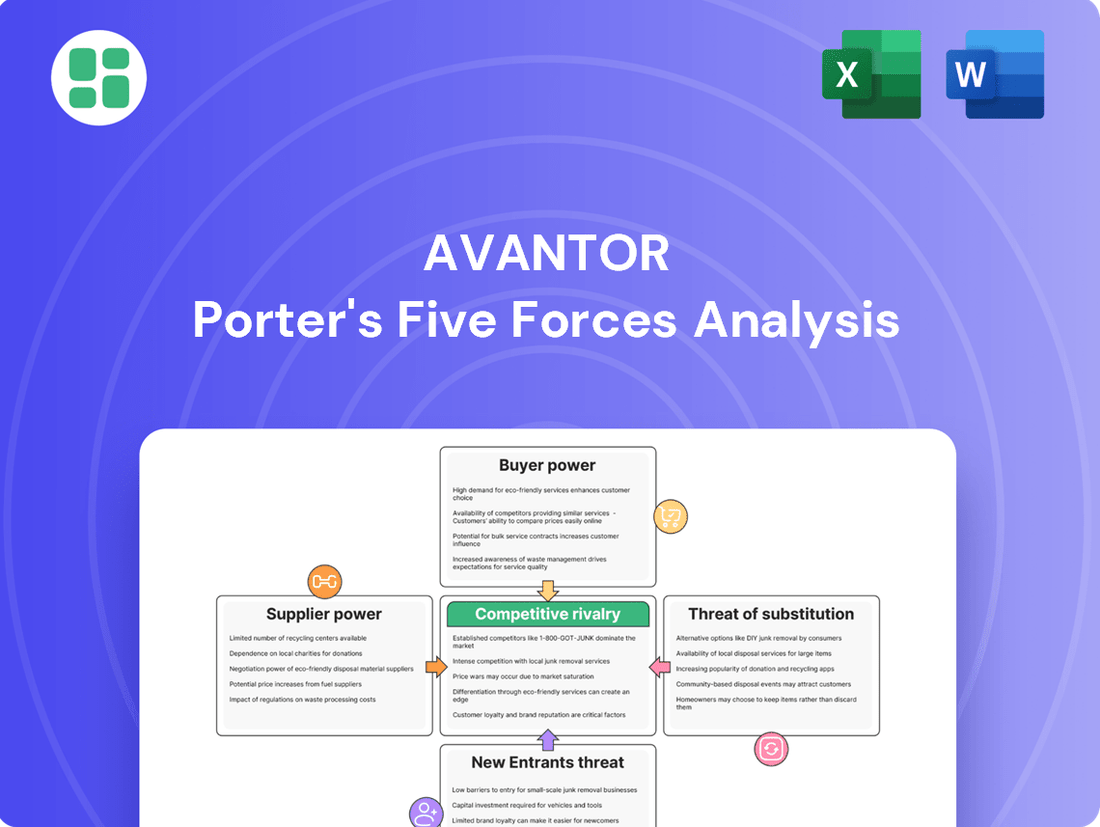

Avantor operates in a dynamic market shaped by intense rivalry, the bargaining power of its customers, and the influence of its suppliers. Understanding these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Avantor’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Avantor's reliance on a concentrated supplier base for specialized inputs like high-purity chemicals and performance materials, particularly for the biopharma industry, grants these suppliers considerable bargaining power. For instance, in 2024, the biopharmaceutical sector continued to demand highly specific and regulated materials, where only a handful of manufacturers could meet Avantor's stringent quality requirements.

This specialization means that if a key supplier faces production issues or decides to increase prices, Avantor has limited alternatives. The critical nature of these materials to Avantor's 'mission-critical products' further amplifies the suppliers' leverage, as disruptions can directly impact Avantor's ability to serve its end customers.

Avantor's suppliers, particularly those providing highly specialized or regulated materials crucial for the biopharmaceutical industry, wield significant bargaining power. Switching these suppliers is not a simple matter of finding a new vendor; it involves extensive and costly qualification processes, securing necessary regulatory approvals, and managing the potential disruption to Avantor's own production lines. These hurdles translate into substantial costs and time delays for Avantor, effectively locking them into existing supplier relationships and strengthening the suppliers' negotiating position.

When suppliers offer products that are highly unique or proprietary, their bargaining power increases significantly. Avantor's reliance on specialized materials, like the ultra-high-purity formulations needed for medical implants, exemplifies this. Suppliers possessing advanced intellectual property or specialized manufacturing processes in these niche areas can command better terms, as Avantor has limited alternatives.

Forward Integration Threat by Suppliers

The threat of suppliers engaging in forward integration, meaning they could start supplying directly to Avantor's customers, is a factor that can influence supplier bargaining power. While this is a less frequent scenario, a supplier demonstrating the capability and intent to bypass Avantor and serve the end market would significantly enhance their leverage.

However, Avantor's robust and established distribution channels, coupled with its comprehensive service portfolio, present a considerable barrier to such forward integration efforts by suppliers. These existing infrastructures make it challenging for a supplier to replicate Avantor's market reach and customer engagement effectively.

Furthermore, Avantor's strategic move into manufacturing certain solutions acts as a direct countermeasure, reducing its reliance on external suppliers for key product components and offerings. This vertical integration by Avantor itself mitigates the potential threat of supplier-driven forward integration.

- Forward Integration Threat: Suppliers may gain power by threatening to supply Avantor's customers directly.

- Avantor's Defenses: Avantor's extensive distribution network and service offerings limit the feasibility of supplier forward integration.

- Mitigation Strategy: Avantor's own expansion into manufacturing key solutions reduces supplier leverage.

Importance of Avantor to Suppliers

Avantor's significance to its suppliers plays a crucial role in determining their bargaining power. If Avantor constitutes a substantial portion of a supplier's total sales, that supplier's leverage over Avantor diminishes, as they are more reliant on Avantor's business. Conversely, if Avantor is a smaller client among many for a supplier, the supplier holds greater power.

Avantor's extensive global presence and vast customer network can position it as a highly desirable client for numerous suppliers. This broad reach may, in turn, create a more balanced power dynamic, as suppliers may compete to secure Avantor's business.

- Supplier Reliance: If a supplier heavily depends on Avantor for a significant percentage of its revenue, its bargaining power is weakened.

- Customer Diversification: If Avantor represents only a small fraction of a supplier's customer base, the supplier possesses stronger leverage.

- Avantor's Market Position: Avantor's large scale and global reach can make it a key account for many suppliers, potentially reducing the supplier's individual bargaining power.

- Supplier Competition: The availability of alternative suppliers for Avantor's needs can further dilute the bargaining power of any single supplier.

Avantor faces considerable bargaining power from its suppliers, particularly those providing specialized inputs essential for the biopharma sector. In 2024, the demand for high-purity chemicals and performance materials with stringent quality specifications meant few suppliers could meet Avantor's needs, increasing their leverage. This reliance on a concentrated supplier base for critical, often proprietary, materials means Avantor has limited alternatives and faces significant costs and delays when switching vendors, amplifying supplier influence.

| Factor | Impact on Avantor | Supplier Leverage |

|---|---|---|

| Supplier Specialization | High reliance on few suppliers for critical inputs | Strong |

| Switching Costs | Significant costs and time for qualification and regulatory approval | Strong |

| Proprietary Materials | Limited alternatives for unique or patented materials | Strong |

| Supplier Dependence on Avantor | Lower if Avantor is a small client; Higher if Avantor is a major client | Variable |

What is included in the product

This analysis meticulously examines the five forces impacting Avantor's competitive environment, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Easily identify and quantify competitive threats and opportunities, allowing for proactive strategy adjustments to mitigate risks and capitalize on market advantages.

Customers Bargaining Power

Avantor's extensive reach, serving over 300,000 customer locations across 180 countries, spans critical sectors like biopharma, healthcare, education, and advanced technologies. This broad and somewhat fragmented customer base inherently dilutes the individual bargaining power of most clients.

While the sheer volume of customers limits the leverage of any single entity, Avantor must still acknowledge the significant influence that large, strategic clients, particularly within the biopharma or government sectors, can exert.

For mission-critical products and services, especially those deeply integrated into complex research and development or manufacturing processes, customers often encounter substantial switching costs. For instance, in the pharmaceutical sector, altering a supplier for a key reagent used in drug discovery or production necessitates extensive re-validation and can involve navigating significant regulatory hurdles. This integration, coupled with the potential for disruption to ongoing projects, significantly curtails the bargaining power of these customers.

Avantor's bargaining power of customers is influenced by how crucial its products are to a customer's overall cost structure. If Avantor's offerings represent a small fraction of a customer's total expenses, even if they are essential for the final product, customers tend to be less sensitive to price changes. This dynamic limits their ability to exert significant downward pressure on Avantor's pricing.

Availability of Alternative Suppliers (Substitutes)

Customers' ability to easily switch to alternative suppliers significantly influences their bargaining power. For Avantor, the presence of numerous other laboratory supply companies and manufacturers offering comparable chemicals, reagents, and equipment means customers often have choices. This accessibility to substitutes empowers them to negotiate better terms or seek out more favorable pricing, thereby increasing their leverage in dealings with Avantor.

The competitive landscape for laboratory supplies is robust, with many players vying for market share. For instance, in 2023, the global laboratory equipment market was valued at approximately $55 billion, indicating a highly fragmented and competitive environment. This broad availability of alternatives for many of Avantor's product categories directly contributes to customer bargaining power.

- Market Fragmentation: The existence of multiple suppliers for common lab consumables and equipment provides customers with readily available alternatives.

- Price Sensitivity: Customers, particularly large research institutions or pharmaceutical companies, can leverage price comparisons across different suppliers.

- Product Standardization: For many standard laboratory chemicals and consumables, product specifications are often similar across suppliers, making switching easier.

- Supplier Switching Costs: While Avantor may offer integrated solutions, for individual product lines, switching costs might be relatively low for customers.

Customer Price Sensitivity and Volume

Customers, particularly large biopharmaceutical firms, wield considerable bargaining power due to their substantial purchasing volumes. These clients often leverage their scale to negotiate more favorable pricing and contract terms. Avantor's Q1 2025 earnings report highlighted this dynamic, mentioning increased competitive pressures leading to reduced volumes from certain customers, a clear indication of customer price sensitivity and the impact of competition on Avantor's sales.

The ability of customers to switch suppliers also contributes to their power. For instance, if Avantor's pricing or service levels are not competitive, major clients can explore alternative providers for their critical laboratory and production materials. This potential for customer churn means Avantor must continually demonstrate value and competitive pricing to retain its key accounts.

- Customer Price Sensitivity: Large customers, like major biopharma companies, are highly sensitive to price due to their significant procurement volumes.

- Negotiating Power: These large customers can demand favorable pricing and contract terms, directly impacting Avantor's profit margins.

- Competitive Impact: Avantor's Q1 2025 results indicated that increased competition led to lower volumes from some customers, underscoring price sensitivity.

- Supplier Switching: The threat of customers switching to competitors if pricing or service is not satisfactory reinforces their bargaining power.

While Avantor serves a vast number of locations, the bargaining power of its customers is significantly shaped by the availability of alternatives and the importance of Avantor's products to their operations. For standard consumables and equipment, where switching costs are low and many suppliers exist, customers can readily negotiate for better terms, as seen in the competitive global laboratory equipment market valued at approximately $55 billion in 2023.

However, for mission-critical products deeply integrated into R&D or manufacturing, especially in sectors like biopharma, customers face high switching costs due to re-validation and regulatory hurdles, which inherently reduces their leverage. Avantor’s Q1 2025 results noted increased competition impacting volumes from some customers, highlighting their price sensitivity and willingness to switch if pricing or service falters.

| Factor | Impact on Customer Bargaining Power | Example/Data Point |

|---|---|---|

| Availability of Substitutes | High | Global laboratory equipment market valued at ~$55 billion (2023) with many players. |

| Switching Costs | Low for standard items, High for integrated solutions | Biopharma clients face significant re-validation costs for critical reagents. |

| Customer Price Sensitivity | Moderate to High | Q1 2025 results indicated customers reduced volumes due to competitive pressures. |

| Importance of Product to Customer | Low if a small cost component, High if critical | If Avantor's products are a minor part of total expenses, customers have less price negotiation power. |

Same Document Delivered

Avantor Porter's Five Forces Analysis

This preview showcases the complete Avantor Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the life sciences and advanced technologies sectors. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, offering actionable insights into industry structure and Avantor's strategic positioning. You're previewing the final version—precisely the same document that will be available to you instantly after buying, ready for your immediate use.

Rivalry Among Competitors

The lab supplies and bioprocessing market is quite competitive, with giants like Thermo Fisher Scientific making substantial investments, intensifying the rivalry Avantor faces. Avantor must contend with both large, comprehensive distributors and smaller, specialized manufacturers, each vying for market share.

This dynamic landscape, populated by well-established and financially strong competitors, fuels a high degree of competitive rivalry. For instance, in 2023, Thermo Fisher Scientific reported over $42 billion in revenue, highlighting the significant scale of some of Avantor's rivals and the pressure to innovate and maintain cost-efficiency.

The biopharma and lab consumables markets are indeed experiencing robust expansion. Projections indicate the lab consumables market alone will reach USD 12,032.8 million by 2025, showcasing a significant upward trend.

While this strong growth generally tempers direct rivalry by expanding the overall pie, it doesn't eliminate it. Intense competition for market share persists, particularly within rapidly advancing segments like bioprocessing, where innovation and efficiency are paramount.

Avantor highlights its mission-critical products and services, coupled with a strong emphasis on innovation. This includes a consistent stream of new product introductions and the development of advanced digital tools designed to enhance customer experience and operational efficiency.

The life sciences and advanced technologies sectors are characterized by intense competition, where sustained differentiation through unique product offerings, superior quality, and exceptional service is paramount. Competitors are also actively investing in research and development, exploring cutting-edge technologies like artificial intelligence to gain a competitive edge.

In 2024, the demand for specialized bioprocessing materials and single-use technologies, areas where Avantor excels, continued to grow, driven by advancements in biopharmaceutical manufacturing. Companies like Thermo Fisher Scientific and Danaher are also making significant R&D investments, with Thermo Fisher reporting over $5 billion in R&D spending in recent years, underscoring the competitive landscape.

High Exit Barriers

High exit barriers significantly shape competitive rivalry within the life sciences and advanced technologies sectors where Avantor operates. The substantial investments required for manufacturing facilities, specialized equipment, and a worldwide distribution network mean that companies face considerable costs if they decide to leave the market.

These substantial upfront and ongoing investments act as a strong deterrent to exiting, even when market conditions are unfavorable. Consequently, competitors may remain active and continue to compete for market share, even during periods of economic downturn or reduced demand. This persistence intensifies the competitive landscape, as companies are less likely to withdraw, leading to a more sustained battle for customers and profitability.

- High Fixed Costs: The life sciences industry, in particular, demands significant capital for R&D, specialized manufacturing processes, and stringent quality control, contributing to high fixed costs.

- Specialized Assets: Assets like advanced bioprocessing equipment or cleanroom facilities are highly specific and difficult to repurpose, increasing the cost of exit.

- Global Network Maintenance: Maintaining a global supply chain and distribution network involves ongoing operational expenses that are hard to shed quickly.

- Industry Dynamics: For example, in 2024, companies within the biopharmaceutical supply chain might be hesitant to divest assets even with temporary market slowdowns due to the long lead times and high costs associated with re-establishing such capabilities later.

Strategic Importance of the Industry

Avantor operates within the life sciences and advanced technology sectors, both of which are critical to global progress and attract substantial investment. This strategic importance naturally fuels intense competition as numerous companies strive for dominance in areas like biopharmaceutical development and material science innovation.

The drive for leadership in crucial fields such as drug discovery, clinical trials, and the creation of cutting-edge materials means that competitive rivalry is not just present but a constant, defining characteristic of these industries. Companies are continually innovating and vying for market share.

In 2024, the life sciences sector, a key market for Avantor, continued its robust growth trajectory. For instance, the global biopharmaceutical market was projected to reach over $700 billion, highlighting the immense value and fierce competition within it. Advanced materials also saw significant investment, with the advanced composites market alone expected to exceed $20 billion globally in 2024, underscoring the competitive landscape Avantor navigates.

- High Investment: The life sciences and advanced technology industries attract billions in R&D and capital expenditure annually.

- Innovation Race: Companies actively compete on speed and quality in developing new therapies, diagnostics, and materials.

- Mergers & Acquisitions: The pursuit of market leadership often leads to consolidation, with significant M&A activity observed in 2024.

- Talent War: Fierce competition exists for specialized scientific and technical talent, crucial for innovation and growth.

Avantor faces significant competitive rivalry within the life sciences and advanced technologies sectors, driven by substantial market growth and high investment from major players. Companies like Thermo Fisher Scientific, with revenues exceeding $42 billion in 2023, and Danaher are heavily investing in R&D, with Thermo Fisher reporting over $5 billion in recent years, intensifying the pressure on Avantor to innovate and maintain cost-efficiency.

The intense competition is further fueled by high exit barriers, including significant capital investments in specialized manufacturing and global distribution networks, making it costly for companies to leave the market. This persistence ensures a sustained battle for market share, especially in rapidly advancing segments like bioprocessing, where innovation is key.

The global biopharmaceutical market, projected to exceed $700 billion, and the advanced composites market, expected to surpass $20 billion in 2024, illustrate the high stakes and fierce competition Avantor navigates. This environment necessitates continuous differentiation through product uniqueness, quality, and service.

| Competitor | 2023 Revenue (Approx.) | Recent R&D Investment (Approx.) |

| Thermo Fisher Scientific | $42+ billion | $5+ billion |

| Danaher | $23+ billion | Significant, but specific figures vary by segment |

SSubstitutes Threaten

Advances in scientific research and technology pose a significant threat of substitution for Avantor. For instance, the biopharmaceutical industry's evolving focus on novel drug modalities like peptides and oligonucleotides, instead of traditional small molecules, could diminish demand for certain chemical reagents and consumables that Avantor currently supplies. Furthermore, rapid advancements in laboratory automation and digital solutions might offer alternative workflows that reduce the reliance on specific manual processes or a broad range of specialized lab supplies.

Large pharmaceutical giants, with their substantial resources, may consider bringing certain manufacturing processes or specialized services in-house. This could reduce reliance on external suppliers like Avantor. However, the significant capital investment and intricate technical expertise required for bioprocessing and advanced chemical synthesis often make outsourcing a more economically viable and efficient strategy for many.

For standard lab consumables and basic chemicals, generic or lower-cost alternatives from less established manufacturers can present a challenge. This threat is amplified when the end-user’s quality or regulatory demands are less rigorous for specific applications, allowing for price-based decision-making. For instance, a university research lab might opt for a cheaper, unbranded reagent for a non-critical experiment, impacting demand for Avantor's comparable offerings.

Changes in Research Funding or Focus

Shifts in research funding can significantly impact demand for Avantor's products. For instance, a redirection of government grants or private investment away from specific scientific fields might lead researchers to seek less expensive or alternative solutions, thereby increasing the threat of substitutes.

A notable example of this dynamic was observed in the first quarter of 2025, where a decline in funding for early-stage biotechnology companies created a noticeable weakness in demand. This suggests that when funding tightens, customers may become more price-sensitive and explore substitute products or services that offer similar functionality at a lower cost.

The threat of substitutes is amplified when:

- Research priorities shift, making existing lab supplies or equipment less relevant.

- Funding for key customer segments decreases, forcing them to cut costs by opting for cheaper alternatives.

- New, more cost-effective technologies emerge that can perform similar functions.

Impact of Digitalization and AI

The increasing sophistication of digital tools and artificial intelligence presents a significant threat of substitutes for traditional laboratory consumables and workflows. As AI accelerates drug discovery and development, it can streamline processes, potentially reducing the need for certain physical materials. For instance, advanced simulation software might decrease the reliance on extensive bench testing that previously consumed large volumes of reagents and consumables.

This shift is particularly relevant to companies like Avantor, which supply a broad range of lab products. The integration of AI in areas like high-throughput screening or automated synthesis could lead to more efficient use of materials or even the development of entirely new methodologies. By 2024, the life sciences sector saw substantial investment in AI-driven research platforms, indicating a growing trend towards digital-first approaches.

- AI-powered simulations can reduce the need for physical material testing.

- Automated synthesis platforms may require fewer specialized consumables.

- Digital tools can optimize experimental design, minimizing waste.

- The life sciences industry's increasing adoption of AI signifies a potential shift in material demand.

The threat of substitutes for Avantor is multifaceted, stemming from technological advancements and evolving research methodologies. Innovations in areas like bioprocessing and digital lab solutions can offer alternative workflows, potentially reducing the demand for Avantor's traditional reagents and consumables. For instance, the rise of AI in drug discovery, as seen with significant investment in AI platforms in the life sciences sector during 2024, can streamline processes and decrease the need for extensive physical material testing.

Furthermore, the availability of lower-cost, generic alternatives for standard lab supplies presents a competitive challenge, particularly when quality or regulatory demands are less stringent. Shifts in research funding priorities can also drive customers towards more economical options, impacting demand for Avantor's product portfolio.

| Factor | Impact on Avantor | Example/Data Point |

|---|---|---|

| Technological Advancements | Potential reduction in demand for certain consumables | AI-driven simulations reducing need for physical material testing; 2024 saw increased investment in AI research platforms in life sciences. |

| Emergence of Digital Solutions | Shift towards automated workflows and digital tools | Automation in high-throughput screening may require fewer specialized consumables. |

| Cost-Effective Alternatives | Price sensitivity from customers | University research labs opting for cheaper, unbranded reagents for non-critical experiments. |

| Research Funding Shifts | Increased demand for cheaper alternatives | Q1 2025 decline in biotech funding led to greater customer price sensitivity. |

Entrants Threaten

Entering Avantor's mission-critical products and services market for biopharma and advanced technologies demands immense capital. New players need significant funds for research and development, state-of-the-art manufacturing facilities, highly specialized equipment, and establishing robust global distribution networks. This high barrier to entry effectively deters many potential competitors from even attempting to enter the market.

The biopharma and healthcare sectors, which are core to Avantor's business, are characterized by significant regulatory barriers. New companies entering these markets must navigate complex approval processes and adhere to strict quality standards like Good Manufacturing Practices (GMP).

These compliance requirements demand substantial investment in infrastructure, documentation, and personnel, creating a high cost of entry. For instance, the average time to bring a new drug to market can exceed 10 years and cost billions, a daunting prospect for potential new competitors.

Avantor benefits from deeply entrenched customer relationships and a robust brand reputation built over years of reliable service. New entrants face a significant hurdle in replicating this trust and loyalty across Avantor's extensive network, which serves over 300,000 customer locations globally.

Economies of Scale and Experience Curve

Existing players in the life sciences and advanced technologies sectors, such as Avantor, leverage significant economies of scale. This allows them to achieve lower per-unit costs in manufacturing, raw material procurement, and distribution networks, creating a substantial barrier for newcomers. For instance, Avantor's extensive global supply chain and large-scale production capabilities in 2024 enable it to negotiate better terms with suppliers and optimize logistics, translating into more competitive pricing.

New entrants would face immense difficulty in replicating these cost efficiencies without substantial upfront investment to achieve comparable production volumes. The experience curve also plays a crucial role; as companies like Avantor have operated for longer, they have refined their processes, leading to increased efficiency and reduced costs over time. This accumulated operational knowledge is not easily transferable or imitable by a new market participant.

- Economies of Scale: Avantor's established infrastructure provides cost advantages in production, purchasing, and logistics, making it hard for new firms to compete on price.

- Experience Curve: Years of operational refinement have honed Avantor's processes, leading to greater efficiency and lower costs that new entrants lack.

- Capital Investment: Matching Avantor's scale and efficiency would require massive capital outlays for manufacturing facilities, supply chains, and research, posing a significant hurdle.

Intellectual Property and Proprietary Technologies

Avantor's strength in specialized performance materials and unique formulations suggests a robust intellectual property portfolio, acting as a deterrent to new entrants. Developing comparable proprietary technologies requires substantial investment in research and development, a significant barrier for newcomers aiming to compete in Avantor's market segments.

The threat of new entrants is further mitigated by the need to replicate Avantor's established technological capabilities. For instance, in the biopharma sector, where Avantor is a key player, the development of cGMP-compliant materials and processes is highly complex and time-consuming. New companies would face considerable challenges in achieving the same level of quality and regulatory approval.

- Intellectual Property Protection: Avantor's patents and trade secrets related to its advanced materials and purification technologies create a significant barrier.

- R&D Investment: New entrants must commit substantial capital to research and development to create competing proprietary technologies.

- Technological Complexity: The specialized nature of Avantor's offerings, particularly in life sciences, requires advanced scientific expertise and manufacturing processes that are difficult to replicate quickly.

- Market Entry Costs: Beyond R&D, establishing the necessary infrastructure and achieving regulatory compliance for high-purity materials represents a considerable financial hurdle for potential competitors.

The threat of new entrants for Avantor is generally low due to substantial barriers. High capital requirements for R&D and manufacturing, stringent regulatory compliance in biopharma, and the need to build trust with established customer relationships present significant hurdles. Avantor's economies of scale, experience curve advantages, and intellectual property further solidify its market position against potential new competitors.

| Barrier Type | Description | Impact on New Entrants |

| Capital Investment | Significant funds needed for R&D, manufacturing, and distribution. | High barrier, requires substantial upfront funding. |

| Regulatory Compliance | Complex approval processes and strict quality standards (e.g., cGMP). | Demands significant investment in infrastructure and documentation. |

| Customer Loyalty & Brand Reputation | Deeply entrenched relationships and years of reliable service. | Difficult for new entrants to replicate trust and loyalty. |

| Economies of Scale | Lower per-unit costs due to large-scale production and procurement. | Newcomers struggle to compete on price without comparable volume. |

| Intellectual Property & Technology | Proprietary formulations, patents, and specialized expertise. | Requires significant R&D investment and technical capability to match. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Avantor is built upon a foundation of robust data, including Avantor's SEC filings, annual reports, and investor presentations. This is supplemented by industry-specific market research reports from firms like Grand View Research and Mordor Intelligence, alongside macroeconomic data from sources such as the World Bank and IMF.