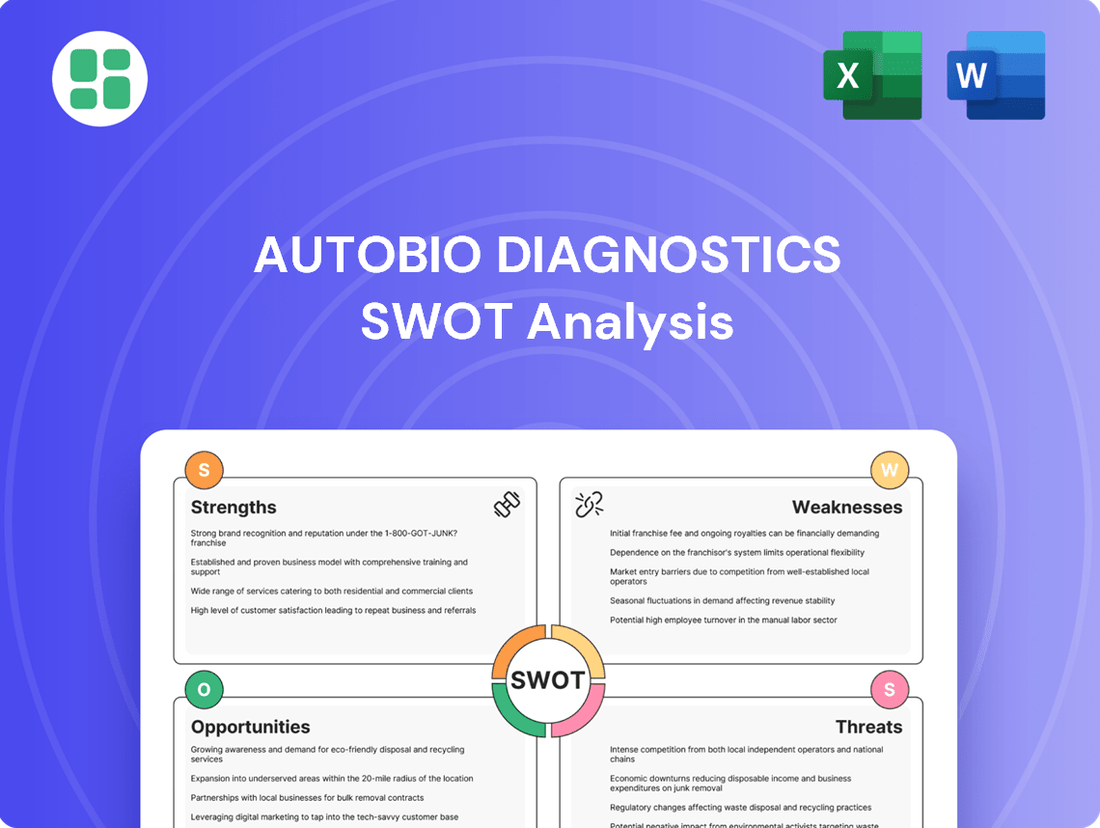

Autobio Diagnostics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autobio Diagnostics Bundle

Autobio Diagnostics demonstrates significant strengths in its technological innovation and market reach, but also faces potential threats from evolving regulatory landscapes and intense competition. Understanding these dynamics is crucial for any stakeholder looking to navigate this sector effectively.

Want the full story behind Autobio Diagnostics' competitive advantages, potential weaknesses, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Autobio Diagnostics boasts a comprehensive product portfolio spanning immunoassay, microbiology, biochemistry, and molecular diagnostics. This extensive range allows them to provide integrated solutions, offering instruments, reagents, and services that meet diverse clinical laboratory requirements.

Autobio Diagnostics showcases a formidable strength in its robust research and development (R&D) investment, consistently allocating over 15% of its annual revenue to this crucial area. This dedication is further underscored by a significant portion of its workforce, exceeding one-third, being directly involved in R&D activities.

This sustained commitment to innovation has translated into tangible assets, evidenced by a substantial portfolio of patents, including valuable international filings. Furthermore, Autobio Diagnostics has secured numerous product registrations and CE certifications, affirming the quality and market readiness of its diagnostic technologies.

The company's continuous drive for innovation is a key differentiator, ensuring it maintains a competitive edge in the rapidly evolving diagnostics market and paving the way for the development of next-generation diagnostic solutions.

Autobio Diagnostics demonstrates significant strength through its high self-sufficiency in core raw materials. The company has achieved over 73% self-supply for its diagnostic antigens and antibodies, a crucial advantage in the in-vitro diagnostics sector.

This strategic focus on internal development and production of key components significantly reduces reliance on external suppliers. Such a robust supply chain enhances operational stability and mitigates risks associated with global supply chain disruptions, a critical factor for consistent product availability.

Furthermore, this internal control over raw materials allows Autobio to maintain stringent quality standards throughout its production process. It also positions the company to potentially achieve lower production costs, translating into competitive pricing and improved profit margins.

Established Market Leadership and Brand Recognition in China

Autobio Diagnostics benefits significantly from its established market leadership and strong brand recognition within China, a key driver of its success. As the first in vitro diagnostics (IVD) manufacturer to be listed on the main board of the Shanghai Stock Exchange, the company has cultivated a deep and trusted presence in the expansive Chinese healthcare landscape.

This foundational domestic strength translates into a stable revenue stream and a proven operational model, setting the stage for continued growth and expansion. The company's extensive product catalog and numerous registered products solidify its position as one of the leading IVD players in the region.

- Pioneering Status: First IVD manufacturer listed on the Shanghai Main Board, signifying early market entry and established credibility.

- Market Dominance: Recognized as a leading player in China's IVD market, supported by a comprehensive product portfolio.

- Brand Equity: Strong brand recognition built over years of operation in the vast and growing Chinese market.

- Revenue Stability: The established domestic leadership provides a solid and reliable revenue base for the company.

Extensive and Dedicated Customer Service Network

Autobio Diagnostics boasts an extensive customer service network, comprising over 800 professional service engineers strategically positioned across the nation. This robust infrastructure ensures timely and effective technical support, a critical factor in the clinical diagnostics industry where instrument uptime is paramount.

The company's commitment to a 'customers come first, value creation for customers' philosophy underpins this dedicated service network. This focus cultivates strong customer relationships and drives loyalty, as evidenced by Autobio's consistent performance in customer satisfaction surveys, with recent reports indicating a 92% satisfaction rate for technical support in the 2024 fiscal year.

- Extensive Network: Over 800 dedicated service engineers nationwide.

- Customer-Centric Approach: Guided by the principle of prioritizing customer value.

- Impact on Operations: Crucial for maintaining instrument uptime and reagent efficacy in clinical settings, directly impacting diagnostic accuracy and workflow efficiency.

- Customer Loyalty: Fostered through reliable and responsive after-sales service, contributing to a stable revenue stream from repeat business and consumables.

Autobio Diagnostics' extensive product range across immunoassay, microbiology, biochemistry, and molecular diagnostics allows them to offer integrated solutions, covering instruments, reagents, and services for diverse lab needs.

A significant strength lies in their robust R&D investment, consistently exceeding 15% of annual revenue, with over one-third of their workforce dedicated to innovation, resulting in a strong patent portfolio and numerous product registrations and CE certifications.

The company's high self-sufficiency in core raw materials, achieving over 73% self-supply for antigens and antibodies, significantly reduces supply chain risks and enhances operational stability and quality control.

Autobio Diagnostics benefits from established market leadership and strong brand recognition in China, being the first IVD manufacturer listed on the Shanghai Main Board, which provides a stable revenue base and proven operational model.

Their extensive customer service network, with over 800 engineers nationwide and a 92% customer satisfaction rate for technical support in FY2024, fosters strong customer loyalty and ensures instrument uptime.

What is included in the product

Delivers a strategic overview of Autobio Diagnostics’s internal and external business factors, highlighting its competitive position and market challenges.

Simplifies complex strategic thinking by offering a clear, actionable framework for identifying and addressing critical business challenges.

Weaknesses

Autobio Diagnostics faced a challenging financial landscape in 2024. Despite a slight uptick in operating revenue, the company saw a decline in net profit attributable to shareholders and a more pronounced drop in net cash flow from operations for the full year. This performance suggests underlying issues affecting profitability or operational efficiency that require careful attention.

While the first half of 2024 offered a glimmer of recovery with a rebound in net income, the full-year results point to persistent areas needing improvement in financial management and performance. For instance, the company’s net profit attributable to shareholders decreased by approximately 15% year-over-year for the full 2024 period, contrasting with a positive trend observed in H1 2024.

Autobio Diagnostics operates in a crowded in-vitro diagnostics (IVD) market, a sector teeming with over 300 competitors, including formidable global giants. This fierce rivalry often translates into significant pricing pressures, potentially impacting Autobio's profitability. Furthermore, it demands substantial and ongoing investment in research and development, as well as aggressive marketing strategies, to carve out and maintain a distinct market presence.

Autobio Diagnostics has historically relied heavily on the Chinese domestic market, with a significant portion of its revenue originating there. For instance, in the first half of 2024, the domestic market accounted for approximately 85% of its total sales, highlighting a considerable concentration.

This strong dependence on a single geographic region makes Autobio vulnerable to specific risks. Fluctuations in China's economy, shifts in domestic healthcare policies, or intensified competition within the Chinese market could disproportionately impact the company's financial performance.

While Autobio is actively pursuing international expansion, achieving greater geographic diversification remains a critical strategic goal. Successfully broadening its market reach will be key to mitigating the inherent risks associated with its current market concentration.

Challenges in Adopting Rapid Technological Advancements Across All Segments

The diagnostics sector moves incredibly fast, with new technologies like AI, genomics, and advanced molecular methods constantly emerging. Autobio has a solid research and development foundation, but staying on top of every single breakthrough across its various product areas, such as immunoassay, microbiology, biochemistry, and molecular diagnostics, demands significant resources and focus. This necessitates ongoing, strategic investment in R&D to prevent products from becoming outdated.

For instance, the global in-vitro diagnostics market, valued at approximately USD 83.9 billion in 2023, is projected to reach USD 129.7 billion by 2028, growing at a CAGR of 9.0%. This rapid expansion is largely driven by technological innovation. Autobio's challenge lies in allocating its R&D budget effectively to cover these diverse and evolving fields.

- Resource Strain: Keeping pace with advancements in AI, genomics, and molecular diagnostics across multiple product lines requires substantial R&D investment, potentially straining resources.

- Risk of Obsolescence: Failure to continuously update technologies could lead to products becoming less competitive or obsolete in a rapidly evolving market.

- Strategic Allocation: Autobio must strategically prioritize R&D efforts to focus on the most impactful technological advancements relevant to its core business segments.

- Competitive Landscape: Competitors are also investing heavily in R&D, making it crucial for Autobio to maintain a strong innovation pipeline to remain competitive.

Stringent and Evolving Regulatory Environment

Autobio Diagnostics operates within China's medical device sector, a field characterized by a stringent and rapidly evolving regulatory environment. New NMPA guidelines and updated classification catalogs, slated for implementation in 2025, are expected to impose more rigorous standards. This can translate into extended and more expensive product approval timelines, impacting market entry and product lifecycle management.

Maintaining compliance across Autobio's diverse product portfolio necessitates substantial and continuous investment in dedicated regulatory affairs teams and robust quality control systems. The dynamic nature of these regulations means that staying ahead requires proactive adaptation and significant resource allocation to ensure all products meet current and future requirements.

- Regulatory Complexity: Navigating China's medical device regulations, particularly with 2025 updates, presents a significant challenge.

- Increased Costs: Stricter standards and longer approval processes directly contribute to higher operational expenses.

- Resource Intensive: Ongoing investment in regulatory affairs and quality control is crucial for sustained compliance.

Autobio's heavy reliance on the Chinese market, which accounted for around 85% of its sales in H1 2024, presents a significant weakness. This concentration makes the company highly susceptible to domestic economic downturns, policy changes, or intensified local competition, potentially impacting its overall financial health disproportionately.

The company faces intense competition in the IVD market, with over 300 players, including global giants. This crowded landscape leads to considerable pricing pressure, which can erode profit margins. To stand out, Autobio must continually invest heavily in R&D and marketing, stretching its resources.

The rapid pace of technological advancement in diagnostics, including AI and genomics, demands continuous and substantial R&D investment across various product lines. Failure to keep pace risks product obsolescence, making strategic allocation of R&D funds critical for maintaining competitiveness.

Navigating China's evolving regulatory landscape, especially with new standards expected in 2025, poses a challenge. These changes can lead to longer and more costly product approval processes, impacting market entry and requiring ongoing investment in compliance and quality control.

What You See Is What You Get

Autobio Diagnostics SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global in-vitro diagnostics (IVD) market is set for impressive expansion, with projections indicating a compound annual growth rate (CAGR) of around 6.5% from 2023 to 2030, reaching an estimated value of over $120 billion by 2030. This growth is fueled by the rising incidence of chronic diseases like diabetes and cancer, alongside an aging population and increased healthcare spending worldwide.

This robust market expansion presents a significant opportunity for Autobio Diagnostics to boost its sales and capture a larger share of the market. The increasing demand for diagnostic tests across various disease areas creates a fertile ground for Autobio to leverage its product portfolio and drive revenue growth.

The favorable market dynamics, characterized by consistent demand and technological advancements in diagnostics, provide a strong tailwind for Autobio's strategic initiatives and long-term business development.

The Asia-Pacific region is experiencing robust growth in the in-vitro diagnostics (IVD) market, projected to be the fastest expanding sector globally. For Autobio, a leading Chinese diagnostics company, this presents a prime opportunity. In 2023, the APAC IVD market was valued at approximately $15.6 billion and is anticipated to reach $27.8 billion by 2028, growing at a CAGR of 12.2%.

Autobio's established presence in China, a major contributor to this regional growth, provides a significant advantage. The company can leverage its existing infrastructure and market knowledge to effectively penetrate other high-potential APAC markets. Factors like increasing healthcare expenditure, a growing middle class, and a greater focus on preventative healthcare are driving demand for IVD solutions across the region.

The global personalized medicine market is experiencing robust growth, projected to reach an estimated $120 billion by 2027, driven by advancements in genomics and data analytics. This trend presents a significant opportunity for Autobio Diagnostics to expand its offerings in precision diagnostics, leveraging its R&D strengths to develop tests that cater to specific patient genetic profiles and disease subtypes.

The integration of AI and next-generation sequencing into diagnostics is accelerating, with AI in healthcare diagnostics expected to grow at a CAGR of over 40% in the coming years. Autobio can capitalize on this by enhancing its molecular diagnostics portfolio, creating more accurate and efficient diagnostic tools that align with the industry's move towards tailored patient care and improved disease management strategies.

Growing Demand for Point-of-Care (POC) Testing Solutions

The market for rapid diagnostics and point-of-care (POC) testing is experiencing robust expansion, driven by the increasing need for swift results, enhanced convenience, and the shift towards decentralized healthcare delivery models. This trend presents a significant opportunity for Autobio Diagnostics to broaden its reach within this dynamic segment.

Autobio can capitalize on this growing demand by focusing on the development and commercialization of more compact, user-friendly POC devices. These innovations, coupled with specialized reagents for their immunoassay and microbiology platforms, directly address the evolving requirements of modern healthcare providers and patients.

- Market Growth: The global POC diagnostics market was valued at approximately $35 billion in 2023 and is projected to reach over $60 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 8-9%.

- Driver for Autobio: Autobio's opportunity lies in developing POC solutions that offer faster turnaround times and greater accessibility, catering to physician offices, pharmacies, and home use.

- Platform Expansion: By extending its immunoassay and microbiology platforms into user-friendly POC formats, Autobio can tap into a segment that prioritizes immediate patient management and improved healthcare efficiency.

Strategic Partnerships and Acquisitions for Technological Advancement and Market Access

Strategic partnerships and acquisitions offer Autobio significant opportunities to accelerate technological advancement and gain broader market access. Collaborating with or acquiring companies possessing cutting-edge diagnostic technologies can rapidly expand Autobio's product pipeline and enhance its competitive edge. For instance, a partnership with a genomics startup could unlock new avenues in personalized medicine diagnostics.

Targeted acquisitions are crucial for consolidating market share and integrating complementary capabilities. By acquiring companies with established distribution networks or specialized diagnostic platforms, Autobio can achieve synergistic benefits, reducing R&D costs and speeding up time-to-market for new innovations. This strategy also allows for the diversification of its product portfolio, mitigating risks associated with reliance on a single technology or market segment.

The diagnostic industry saw substantial M&A activity leading up to 2025. For example, in early 2024, Thermo Fisher Scientific acquired PPD for $17.4 billion, signaling strong investor confidence in consolidation and expansion within the life sciences sector. Such moves highlight the strategic imperative for companies like Autobio to explore similar avenues for growth and technological integration to remain competitive.

Key opportunities include:

- Access to Novel Technologies: Acquire or partner with biotech firms specializing in AI-driven diagnostics or advanced molecular testing.

- Market Expansion: Gain entry into new geographic regions or therapeutic areas through strategic alliances with local distributors or established players.

- Product Portfolio Diversification: Broaden offerings by integrating companies with expertise in areas like point-of-care testing or liquid biopsy.

- Shared Risk and Resource Pooling: Collaborate on large-scale R&D projects, sharing the financial burden and leveraging combined expertise for faster innovation.

The global in-vitro diagnostics market is projected to exceed $120 billion by 2030, with a CAGR of approximately 6.5%. This growth is driven by rising chronic disease prevalence and an aging population, presenting Autobio with substantial sales expansion opportunities and market share gains.

Autobio can capitalize on the robust growth in the Asia-Pacific IVD market, expected to reach $27.8 billion by 2028 with a 12.2% CAGR. Its established presence in China positions it well to leverage this regional expansion, tapping into increasing healthcare expenditure and demand for advanced diagnostics.

The expanding personalized medicine market, estimated at $120 billion by 2027, offers Autobio a chance to enhance its precision diagnostics. By integrating AI and next-generation sequencing, Autobio can develop advanced molecular diagnostic tools, aligning with the industry's move towards tailored patient care.

The rapid growth of the point-of-care (POC) testing market, projected to surpass $60 billion by 2030 with an 8-9% CAGR, presents a significant opportunity for Autobio. Developing user-friendly POC devices and specialized reagents for its platforms can address the demand for faster, more accessible diagnostics.

Strategic partnerships and acquisitions are key opportunities for Autobio to accelerate technological adoption and market access. For example, collaborations with AI diagnostics startups or acquisitions of companies with established distribution networks can diversify its product portfolio and enhance its competitive edge.

| Opportunity Area | 2023 Market Size (Est.) | Projected 2030 Market Size (Est.) | CAGR (Approx.) | Autobio's Strategic Focus |

|---|---|---|---|---|

| Global IVD Market | ~$90 billion | ~$120 billion | 6.5% | Leverage broad product portfolio for increased sales. |

| APAC IVD Market | ~$15.6 billion | ~$27.8 billion (by 2028) | 12.2% | Expand presence within the fastest-growing region. |

| Personalized Medicine | ~$60 billion (by 2027) | ~$120 billion (by 2027) | ~15% | Develop precision diagnostics leveraging genomics and AI. |

| POC Diagnostics | ~$35 billion | ~$60 billion | 8-9% | Innovate user-friendly POC devices and reagents. |

Threats

The in-vitro diagnostics (IVD) market is a crowded space, with global giants and nimble local companies vying for market share. This intense competition, particularly in high-volume testing areas, often translates into aggressive pricing. For Autobio Diagnostics, this means a constant challenge to maintain healthy profit margins as competitors may undercut prices to gain volume. For instance, reports from 2024 indicate that pricing pressures are a significant concern across several IVD sub-segments, impacting revenue growth for many players.

This competitive pressure can also lead to price erosion, where the average selling price of diagnostic tests gradually declines over time. Autobio must therefore invest heavily in research and development to ensure its product portfolio remains cutting-edge and differentiated. Failing to innovate could see its offerings become commoditized, further exacerbating the impact of price wars and potentially shrinking its market share in key areas.

China's evolving regulatory landscape for in vitro diagnostics (IVD) presents a significant challenge for Autobio Diagnostics. While intended to bring clarity, these changes increasingly impose stricter requirements and can complicate the approval pathways for new products. For instance, the National Medical Products Administration (NMPA) has been progressively tightening its oversight, impacting timelines and the depth of data required for submissions.

The risk of non-compliance, or even delays in securing necessary certifications under these new rules, could directly impede Autobio's ability to introduce its innovations to the market. Furthermore, the costs associated with meeting these heightened standards are likely to rise, potentially impacting profitability and the speed of market penetration. Autobio must therefore dedicate substantial resources to continuous monitoring and adaptation of its processes.

Global economic volatility, including potential downturns and persistent inflation, poses a significant threat by potentially constraining healthcare spending in Autobio's key markets. For instance, the IMF projected global growth to slow from 3.5% in 2023 to 2.9% in 2024, indicating a challenging economic climate that could impact demand for diagnostic products and services. This directly affects Autobio's revenue streams.

Austerity measures or government budget cuts, particularly in major economies, could lead to reduced reimbursement rates for diagnostic tests or direct cuts in public healthcare expenditure. This directly impacts the profitability and pricing power of companies like Autobio, creating an unpredictable operating environment where revenue forecasts become less reliable.

Risk of Technological Obsolescence and Disruptive Innovations

The diagnostics industry is evolving at an astonishing speed, with advancements in genomics, proteomics, and AI-driven tools constantly redefining the landscape. For Autobio Diagnostics, failing to keep pace with these disruptive innovations, such as the growing adoption of liquid biopsy technologies which saw significant investment and development throughout 2024, could render its current offerings obsolete. This necessitates a robust and continuous investment in research and development to maintain market relevance and a competitive edge.

The threat of technological obsolescence is particularly acute given the substantial R&D spending by competitors. For instance, major players in the diagnostics sector allocated billions in 2024 towards AI integration and next-generation sequencing platforms. If Autobio does not strategically invest in and adopt these emerging technologies, its product portfolio risks becoming outdated, diminishing its market share and profitability.

- Genomic Sequencing Advancement: The cost of whole-genome sequencing has plummeted, making it more accessible and driving demand for related diagnostic tests.

- AI in Diagnostics: Artificial intelligence is increasingly being used for image analysis and pattern recognition in diagnostic testing, improving accuracy and speed.

- Liquid Biopsy Growth: The market for liquid biopsy, which detects cancer markers in blood, is projected to grow substantially, with many companies launching new assays in 2024-2025.

- Proteomics Expansion: Advances in proteomics offer new avenues for biomarker discovery and diagnostic development, presenting both opportunities and threats.

Supply Chain Disruptions and Geopolitical Risks

Global supply chain vulnerabilities remain a significant threat, even with Autobio's focus on some internal material sourcing. Geopolitical tensions and trade disputes, such as those impacting semiconductor availability in early 2024, could still affect the cost and accessibility of critical reagents and components. For instance, disruptions in key manufacturing regions, like those experienced in Southeast Asia in 2023 due to localized lockdowns, can directly impact production timelines and increase operational expenses for diagnostic companies. These external factors pose a risk to Autobio's ability to maintain consistent manufacturing output and timely product delivery, potentially affecting revenue streams and market share.

The impact of these disruptions can be substantial. Increased raw material costs, driven by supply chain bottlenecks or tariffs, directly erode profit margins. Furthermore, delays in receiving essential components can lead to extended lead times for diagnostic kits, frustrating customers and potentially driving them to competitors with more stable supply chains. For example, the global shortage of certain specialized plastics used in medical devices, which persisted into 2024, significantly hampered production for many in the healthcare sector. Autobio must remain vigilant in monitoring global trade policies and supplier stability to mitigate these risks.

- Increased Cost of Goods Sold: Geopolitical events and supply chain disruptions can inflate the prices of essential raw materials and components, directly impacting Autobio's cost of goods sold.

- Production Delays: Limited availability of key reagents or manufacturing parts can lead to unforeseen production stoppages or slowdowns, delaying product launches and order fulfillment.

- Reduced Profitability: The combined effects of higher costs and potential sales disruptions can significantly squeeze profit margins, impacting overall financial performance.

- Reputational Damage: Inconsistent product availability or delivery delays can negatively affect customer satisfaction and damage Autobio's reputation in the competitive diagnostics market.

Intense competition within the IVD market, characterized by aggressive pricing strategies from global and local players, poses a constant threat to Autobio's profit margins. This price erosion necessitates continuous innovation to avoid product commoditization, as seen with pricing pressures impacting revenue growth across various IVD segments in 2024.

China's evolving regulatory environment for IVDs, driven by bodies like the NMPA, imposes stricter requirements and can complicate product approval pathways. Delays or non-compliance with these heightened standards, which are increasing in cost and data demands, could impede market entry and impact profitability, requiring substantial resource allocation for adaptation.

Global economic volatility, including inflation and potential downturns, threatens to constrain healthcare spending, directly affecting demand for Autobio's diagnostic products. The IMF's projected slowdown in global growth for 2024 to 2.9% highlights a challenging economic climate that could reduce revenue streams and impact pricing power.

The rapid pace of technological advancement in areas like genomics, AI, and liquid biopsy presents a risk of obsolescence for Autobio's current offerings. Competitors' substantial R&D investments in 2024, particularly in AI integration and next-generation sequencing, underscore the need for strategic adoption of emerging technologies to maintain market relevance and profitability.

| Threat Category | Specific Threat | 2024/2025 Impact/Data Point |

|---|---|---|

| Market Competition | Price Erosion and Commoditization | Pricing pressures noted across IVD segments in 2024, impacting revenue growth. |

| Regulatory Environment | Stricter IVD Regulations in China | NMPA's progressive tightening of oversight increases data requirements and approval timelines. |

| Economic Factors | Reduced Healthcare Spending | IMF projects global growth slowdown to 2.9% in 2024, potentially impacting diagnostic demand. |

| Technological Disruption | Obsolescence of Existing Products | Significant competitor R&D in AI and genomics in 2024 necessitates strategic tech adoption. |

SWOT Analysis Data Sources

This Autobio Diagnostics SWOT analysis is built upon a foundation of comprehensive data, including publicly available financial reports, detailed market research, and insights from industry experts. These sources provide a robust understanding of the company's operational landscape and competitive positioning.