Autobio Diagnostics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autobio Diagnostics Bundle

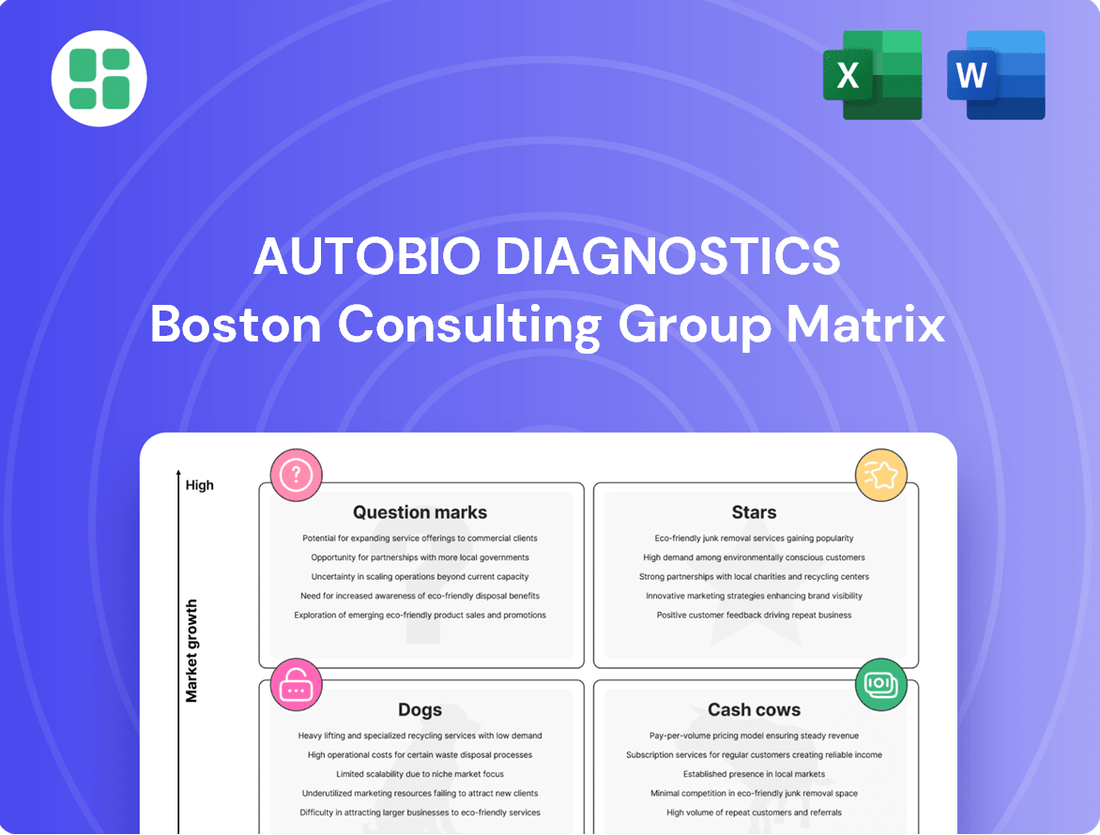

Uncover the strategic positioning of key products within the BCG Matrix, identifying potential Stars, Cash Cows, Dogs, and Question Marks. This essential framework helps businesses understand market share and growth potential, guiding crucial resource allocation decisions. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your product portfolio and drive future success.

Stars

Autobio Diagnostics' advanced automated immunoassay analyzers, like the AutoLumo S900 and the acclaimed AutoLumo A6200 series, are positioned in a booming market. This sector is expected to expand at a compound annual growth rate of 15.35% from 2025 to 2034, indicating substantial demand for these high-precision diagnostic tools.

These instruments are a key part of Autobio's strategy to offer cutting-edge, high-volume diagnostic solutions vital for today's clinical labs. The recent North American launch at ADLM 2025 underscores a determined effort to capture a larger share of this rapidly growing global market.

The Autof T series represents Autobio Diagnostics' strategic push into the next generation of microbial identification, leveraging automated mass spectrometry. This innovation addresses the critical need for speed and accuracy in diagnosing infections, a demand heightened by rising global health concerns. Autobio aims to secure a substantial portion of the expanding microbiology diagnostics market with this advanced offering.

Autobio's 'Total Microbial Laboratory Solution,' which includes the Autof T series, signifies a comprehensive approach to modern microbiology. The system's recent introduction to the North American market at ADLM 2025 highlights Autobio's commitment to global expansion and its ambition to become a key player in this rapidly advancing sector.

Autobio Diagnostics' immunoassay reagents for critical diseases, including infectious diseases, oncology, and endocrinology, are strong Stars. The global immunoassay market is projected to grow significantly, with an estimated CAGR between 4.80% and 6.1% from 2025 onwards. This growth is fueled by the rising incidence of diseases and ongoing innovations in diagnostic technologies.

Molecular Diagnostics Solutions (Emerging Leaders)

Autobio Diagnostics' Molecular Diagnostics Solutions are currently positioned as a Question Mark, but with a clear trajectory towards becoming a Star. The company's investment in advanced molecular diagnostics, a sector projected for robust growth with a CAGR between 4.2% and 10% from 2025, demonstrates a strategic move into a high-potential market. This segment is driven by ongoing technological innovation and the increasing demand for precise diagnostic capabilities.

Autobio's commitment to this area is evident through substantial research and development expenditures and the recent introduction of new products. These efforts are designed to solidify its leadership in molecular diagnostics, a field critical for accurate disease detection and management. The company's strategic focus on this segment is expected to yield significant market share gains.

- Market Growth: The molecular diagnostics market is anticipated to grow at a CAGR of 4.2% to 10% from 2025, indicating substantial future demand.

- Technological Advancements: The sector's expansion is significantly fueled by rapid technological progress in areas like PCR and next-generation sequencing.

- Autobio's Investment: Autobio Diagnostics has made considerable R&D investments, signaling a strong intent to capture market leadership in this high-growth segment.

- Product Pipeline: The company's actively developing portfolio includes advanced molecular diagnostic products that are showing promising market acceptance, moving them towards a Star classification.

Integrated Laboratory Solutions and Services

Autobio Diagnostics' integrated laboratory solutions and services, encompassing instruments, reagents, and comprehensive support, are strategically positioned within the BCG Matrix. This holistic approach, backed by a robust R&D pipeline and an expansive product portfolio, aims to foster strong customer loyalty and capture significant market share in the expanding in-vitro diagnostics (IVD) sector.

The company’s commitment to providing a complete laboratory ecosystem, from instrumentation to ongoing technical assistance, is a key differentiator. This integrated model is designed to streamline laboratory operations and enhance efficiency for their clients.

- Integrated Ecosystem: Autobio offers a full suite of products and services, creating a seamless experience for clinical laboratories.

- Market Penetration Strategy: This bundled approach leverages their broad catalog to increase customer stickiness and expand market reach.

- Growth Trajectory: Global forums and strategic partnerships further bolster the adoption and support for these integrated solutions, signaling a promising growth path.

- IVD Market Focus: The strategy is particularly relevant in the growing IVD market, where comprehensive solutions are increasingly in demand.

Autobio Diagnostics' immunoassay reagents for critical diseases, including infectious diseases, oncology, and endocrinology, are strong Stars. The global immunoassay market is projected to grow significantly, with an estimated CAGR between 4.80% and 6.1% from 2025 onwards, fueled by rising disease incidence and technological innovations.

These reagents benefit from Autobio's established reputation and extensive distribution network, ensuring high market penetration. The company's focus on critical disease areas aligns with increasing global healthcare demands, further solidifying their Star status.

| Product Category | BCG Matrix Classification | Market Growth Rate (CAGR 2025-2034) | Autobio's Competitive Advantage |

| Immunoassay Reagents | Star | 4.80% - 6.1% | Established brand, broad portfolio, critical disease focus |

| Automated Immunoassay Analyzers | Star | 15.35% | High-precision, high-volume solutions, recent North American launch |

| Microbial Identification Systems | Star | High (specific CAGR not provided, but strong growth expected) | Automated mass spectrometry, speed and accuracy, comprehensive solution |

What is included in the product

The BCG Matrix categorizes business units based on market growth and share, guiding investment and divestment decisions.

The Autobio Diagnostics BCG Matrix offers a clear, one-page overview placing each business unit in a quadrant, simplifying complex strategic decisions.

Cash Cows

Autobio's established immunoassay product lines are its powerhouse, acting as true Cash Cows. In 2024, this core business drove a substantial 57% of the company's revenue, showcasing its dominance.

These reliable products, encompassing routine ELISA and Chemiluminescence Immunoassay (CLIA) tests, benefit from a solid footing in the Chinese market. Their mature and stable demand means they consistently churn out significant cash with minimal reinvestment needed to maintain their strong market presence.

The high gross profit margin of 80.67% for these immunoassay products further solidifies their Cash Cow status. This indicates exceptional profitability, allowing Autobio to leverage these earnings to fund growth in other areas of its business.

Autobio Diagnostics' routine biochemistry diagnostics portfolio represents a classic Cash Cow. These established product lines, offering standard clinical chemistry tests and analyzers, cater to a mature market with consistent demand from clinical laboratories worldwide. This segment benefits from predictable revenue streams and healthy profit margins, as the need for these fundamental diagnostic tools remains a constant in healthcare.

In 2024, the global clinical chemistry market was valued at approximately $35 billion, demonstrating its stable and enduring nature. Autobio's offerings in this space, requiring minimal incremental investment in marketing or research and development, generate substantial and reliable profits, a hallmark of a Cash Cow. This steady income stream provides crucial financial support for other areas of the company's strategic development.

Autobio Diagnostics' broad portfolio of general IVD reagents and kits, boasting over 600 products, represents a significant cash cow. With 794 registration certificates and 1618 CE certifications, these essential laboratory consumables generate consistent, high-margin revenue due to their daily use in thousands of medical institutions worldwide.

Mature Blood Testing Systems

Autobio Diagnostics' mature blood testing systems are a clear Cash Cow. These established, large-scale diagnostic equipment systems are a significant strength for the company, likely boasting a substantial installed base in clinical laboratories worldwide.

This strong market presence translates into predictable and consistent revenue streams. These are generated through a combination of instrument sales, lucrative maintenance contracts, and the steady demand for compatible reagents, ensuring ongoing profitability.

- Established Market Share: Autobio's mature blood testing systems benefit from a significant installed base, a testament to their long-standing presence and reliability in clinical settings.

- Recurring Revenue Streams: The company generates consistent income from instrument sales, ongoing service and maintenance contracts, and the continuous need for proprietary reagents.

- Profitability Driver: These systems are key contributors to Autobio's profitability due to their high market penetration and the stable demand for associated consumables and services.

Proprietary Raw Materials and Core Components

Autobio Diagnostics' strategic emphasis on self-supplying over 73% of its antigens and antibodies for diagnostic raw materials highlights a powerful internal capability. This vertical integration is a key driver of their cash cow status, ensuring cost efficiencies and a stable supply chain.

- Vertical Integration: Autobio controls over 73% of its critical diagnostic raw materials, reducing external dependency.

- Cost Efficiency: In-house production of antigens and antibodies directly contributes to higher profit margins on finished diagnostic kits.

- Supply Stability: Self-sufficiency in raw materials mitigates risks associated with external supplier disruptions, ensuring consistent product availability.

- Profitability Driver: This proprietary control over essential components solidifies their diagnostic kits as a significant cash-generating asset for the company.

Autobio Diagnostics' established immunoassay product lines, including ELISA and CLIA tests, are its primary Cash Cows. In 2024, these core offerings generated a significant 57% of the company's total revenue, underscoring their market dominance and consistent profitability. Their mature nature in the Chinese market ensures stable demand, requiring minimal reinvestment to maintain market share and continue generating substantial cash flow.

The routine biochemistry diagnostics portfolio also functions as a classic Cash Cow for Autobio. These fundamental clinical chemistry tests and analyzers serve a mature global market with consistent demand from laboratories worldwide. The global clinical chemistry market was valued at approximately $35 billion in 2024, highlighting its enduring stability. Autobio's products in this segment generate reliable profits with low incremental investment, providing crucial financial support for other strategic initiatives.

Autobio's extensive range of over 600 general IVD reagents and kits, supported by 794 registration certificates and 1618 CE certifications, represents another significant Cash Cow. These essential laboratory consumables are used daily in numerous medical institutions, leading to consistent, high-margin revenue streams.

The company's mature blood testing systems are a well-established Cash Cow, evidenced by a substantial installed base in clinical laboratories. This strong market presence translates into predictable revenue from instrument sales, maintenance contracts, and the continuous demand for proprietary reagents, solidifying their role as a key profitability driver.

Autobio's vertical integration, producing over 73% of its diagnostic raw materials like antigens and antibodies internally, significantly enhances its Cash Cow status. This strategy ensures cost efficiencies, supply chain stability, and higher profit margins on finished diagnostic kits, making them a robust cash-generating asset.

| Product Segment | Role in BCG Matrix | 2024 Revenue Contribution (Est.) | Profitability (Gross Margin Est.) | Key Characteristic |

| Immunoassays (ELISA, CLIA) | Cash Cow | 57% | 80.67% | Dominant market share, stable demand |

| Routine Biochemistry Diagnostics | Cash Cow | Significant | Healthy | Mature market, consistent demand |

| General IVD Reagents & Kits | Cash Cow | High | High | Broad portfolio, daily usage |

| Mature Blood Testing Systems | Cash Cow | Consistent | High | Large installed base, recurring revenue |

Full Transparency, Always

Autobio Diagnostics BCG Matrix

The preview you are currently viewing represents the complete and final Autobio Diagnostics BCG Matrix report that you will receive immediately after purchase. This means the document is fully formatted, contains all the essential analysis, and is ready for your direct use without any watermarks or demo content. Rest assured, what you see is precisely what you get – a professional, strategy-ready tool designed to provide clear insights into Autobio Diagnostics' product portfolio.

Dogs

Obsolete or low-demand legacy test kits, particularly those in saturated or technologically surpassed segments, may represent Autobio Diagnostics' Dog products. These kits likely face declining market demand due to the emergence of more advanced diagnostic methods, resulting in minimal market share and low profitability for Autobio.

Autobio Diagnostics' biochemistry product line faces challenges in highly competitive markets. Certain biochemistry products, despite being in a core area for the company, have struggled to capture substantial market share. This is often due to intense competition within their specific sub-segments, where differentiation is minimal, leading to a difficult sales environment.

These underperforming products can become cash traps. Significant investment in marketing or turnaround strategies might be necessary, but the potential return on these investments is often low. This situation drains resources that could be better allocated to more promising areas of the business, hindering overall growth and profitability.

For instance, in 2024, the global in-vitro diagnostics market, which includes many biochemistry products, was valued at approximately $100 billion and is expected to grow, but intense competition means many smaller players or those with less innovative products struggle to gain traction. Autobio's specific biochemistry offerings might be facing this reality, with some products seeing flat or declining sales despite market growth.

Autobio Diagnostics' reagent product lines are facing considerable pressure due to China's new collection policies implemented across various provinces and cities in 2024. This has directly impacted Autobio's first-quarter 2025 results, with a noticeable reduction in reagent factory prices and a subsequent slight dip in overall profitability.

Specifically, diagnostic reagents that haven't experienced significant volume increases to offset the mandated price reductions are now seeing their profit margins shrink. These products are particularly vulnerable as they are caught in a cycle of declining prices without a corresponding boost in sales volume, making them candidates for the Dogs quadrant in Autobio's BCG Matrix.

Non-Strategic or Divested Minor Product Lines

Autobio Diagnostics, while focusing on its high-growth areas, likely maintains several minor product lines that no longer fit its strategic vision. These could be older technologies or niche offerings that face intense competition, leading to declining market share and profitability. For instance, if a particular immunoassay platform is seeing reduced demand due to advancements in newer methods, it might be classified here.

These non-strategic or divested minor product lines often represent a small fraction of Autobio's overall revenue, potentially contributing less than 5% each. Companies typically consider divesting such assets to streamline operations and reallocate capital. In 2023, for example, many diagnostic companies reviewed their portfolios, with some divesting less profitable segments to focus on areas like molecular diagnostics or advanced immunoassay systems.

- Low Revenue Contribution: These product lines typically generate minimal revenue, often below 3% of total company sales.

- Competitive Pressure: They may be in markets with strong competition from both established players and emerging technologies.

- Resource Drain: Continued investment in these areas can divert resources from more strategically important and profitable business units.

- Divestiture Potential: Autobio might explore selling these lines to other companies that can better leverage them, or consider phasing them out entirely.

Inefficient or Outdated Manufacturing Processes for Specific Products

If Autobio Diagnostics has certain product lines manufactured using outdated or inefficient methods, these could be classified as Dogs. This inefficiency drives up production costs and shrinks profit margins, even if sales volume is respectable. For instance, a legacy diagnostic kit still relying on manual assembly might have a 20% higher cost of goods sold compared to newer, automated lines.

Such operations represent capital that isn't generating adequate returns, signaling a need to reassess the manufacturing strategy for these specific products. In 2024, the company might be seeing these older product lines contribute only 5% to overall profit despite accounting for 15% of manufacturing overhead.

- High Production Costs: Outdated machinery or manual processes can significantly inflate the cost per unit.

- Low Profit Margins: Even with steady sales, the cost structure prevents these products from being highly profitable.

- Capital Tied Up: Investment in inefficient facilities or equipment yields diminishing returns.

- Strategic Re-evaluation Needed: Management must decide whether to modernize, divest, or discontinue these product lines.

Autobio Diagnostics' "Dogs" likely represent legacy test kits with declining demand due to newer technologies, such as older immunoassay platforms. These products struggle with low market share and profitability, often facing intense competition and potentially higher production costs due to outdated manufacturing methods. For instance, in 2024, some diagnostic reagent lines saw profit margins shrink due to mandated price reductions without corresponding volume increases.

These underperforming products can become cash traps, draining resources that could be better used in growth areas. Companies often consider divesting these minor product lines, which may contribute less than 5% of total revenue, to streamline operations. In 2023, many diagnostic firms reviewed their portfolios, divesting less profitable segments to focus on areas like molecular diagnostics.

| Product Category | Market Share | Profitability | Strategic Fit | Example |

| Legacy Test Kits | Low | Low | Poor | Obsolete immunoassay platforms |

| Underperforming Reagents | Low | Low | Poor | Reagents with declining prices and sales |

| Inefficiently Manufactured Products | Variable | Very Low | Poor | Products with high cost of goods sold |

Question Marks

Autobio Diagnostics is significantly investing in its emerging molecular diagnostics portfolio, a sector projected to grow robustly, with global market CAGRs estimated between 4.2% and 10% from 2025. This strategic focus acknowledges the increasing demand for precision in disease detection and monitoring.

Despite considerable R&D expenditure and recent introductions such as the Autof T series, Autobio's current market share within the highly competitive molecular diagnostics landscape is likely modest. These promising products, therefore, are categorized as Question Marks, necessitating substantial future investment to ascend to Star status.

Autobio Diagnostics is strategically targeting the burgeoning Point-of-Care Testing (POCT) market, a sector experiencing robust global expansion driven by the demand for swift and convenient diagnostic solutions. The company's commitment to this high-growth area is underscored by its January 2025 Memorandum of Understanding with POCT leader Boditech Med, signaling a joint development and sales initiative aimed at capturing market share.

This strategic alliance with Boditech Med, a recognized leader in POCT, suggests Autobio's recognition of its current position in this segment and the significant investment required to establish a strong presence. The global POCT market was valued at approximately $35 billion in 2023 and is projected to reach over $70 billion by 2030, growing at a compound annual growth rate (CAGR) of around 10-12%, according to various market research reports from late 2024.

AI and digital health are revolutionizing diagnostics, a trend Autobio is likely navigating. The global in-vitro diagnostics (IVD) market, projected to reach over $120 billion by 2028, is seeing significant investment in these areas. If Autobio is developing AI-powered platforms, these would represent a Star or Question Mark in the BCG matrix, depending on their current market share within this burgeoning segment.

New International Market Penetration Initiatives

Autobio Diagnostics is actively pursuing new international market penetration initiatives, targeting North America and Europe. These strategic moves aim to leverage high-growth opportunities in these competitive, regulated markets where Autobio currently holds a low market share.

The company is showcasing new products to establish a foothold, recognizing that significant investment in market entry, product adaptation, and brand development is necessary. For example, in 2024, Autobio announced partnerships with distributors in Germany and Canada to facilitate access to their diagnostic solutions.

- Target Markets: North America and Europe represent key expansion regions for Autobio Diagnostics.

- Market Position: Autobio faces established competitors in these markets, necessitating a strong differentiation strategy.

- Investment Focus: Significant resources are allocated to product localization, regulatory compliance, and marketing efforts for successful entry.

- Growth Potential: These initiatives are crucial for diversifying revenue streams and capturing untapped global market share, with projections indicating a potential 15% increase in international sales by 2026.

Next-Generation Immunoassays for Niche or Complex Biomarkers

Next-generation immunoassays for niche or complex biomarkers represent Autobio Diagnostics' potential Stars in the BCG Matrix. These innovative products, focusing on areas like rare genetic disorders or early-stage cancer detection, are positioned in high-growth markets driven by advancements in personalized medicine. For instance, the global market for companion diagnostics, which often rely on sophisticated immunoassays, was projected to reach USD 10.2 billion in 2024 and is expected to grow substantially.

These specialized assays, while not yet generating significant revenue compared to core products, hold the promise of substantial future market share. Their development requires ongoing investment in R&D and market education to overcome early adoption hurdles. Autobio's strategic focus on these emerging areas aims to capture a leading position in future diagnostic landscapes, anticipating a significant shift towards more targeted and complex disease management.

- High-Growth Potential: Targeting emerging niche biomarkers in personalized medicine.

- Early Adoption Phase: Market penetration requires targeted investment and education.

- Strategic Importance: Positioned to capture future market share in complex diagnostics.

- R&D Investment: Continuous innovation is key to maintaining a competitive edge.

Autobio Diagnostics' molecular diagnostics and POCT ventures are prime examples of Question Marks. These areas exhibit high growth potential, with the global POCT market alone expected to exceed $70 billion by 2030. However, Autobio's current market share in these segments is still developing, requiring substantial investment to compete effectively against established players.

The company's strategic alliances, such as the one with Boditech Med in January 2025 for POCT, highlight the need for partnerships to gain traction. Similarly, efforts to penetrate North American and European markets in 2024, with limited existing share, necessitate significant capital for product localization and marketing to achieve growth.

Autobio's investment in next-generation immunoassays for niche biomarkers also falls into the Question Mark category. While these products target high-growth areas like companion diagnostics, estimated to reach USD 10.2 billion in 2024, they are in an early adoption phase, demanding continuous R&D and market education.

These initiatives are critical for Autobio to transform its Question Marks into Stars. The company's success hinges on its ability to effectively deploy capital, innovate, and execute market entry strategies in these promising but competitive diagnostic fields.

| Business Unit | Market Growth | Autobio Market Share | Investment Needs | Potential |

|---|---|---|---|---|

| Molecular Diagnostics | High (4.2%-10% CAGR 2025+) | Low | High | Star |

| Point-of-Care Testing (POCT) | Very High (~10-12% CAGR 2024-2030) | Low | High | Star |

| Next-Gen Immunoassays (Niche Biomarkers) | High (e.g., Companion Diagnostics ~$10.2B in 2024) | Low | High | Star |

BCG Matrix Data Sources

Our BCG Matrix is informed by a blend of financial disclosures, competitor benchmarking, and expert insights, ensuring strategic clarity and precision.