Aurizon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurizon Bundle

Aurizon’s strengths lie in its dominant position in the Australian rail freight market, particularly in bulk commodities, giving it significant pricing power and operational scale. However, its reliance on key commodities and infrastructure also presents vulnerabilities to market fluctuations and regulatory changes.

Discover the complete picture behind Aurizon’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Aurizon's position as Australia's largest rail freight operator is underpinned by its vast national rail and road network, a significant strength that facilitates crucial connections. This extensive infrastructure footprint allows Aurizon to efficiently link major mining operations, agricultural producers, and diverse industrial sectors to both domestic and global markets.

This market dominance translates into a formidable competitive advantage, creating substantial barriers to entry for potential competitors. For instance, in the 2024 financial year, Aurizon reported hauling approximately 205 million tonnes of bulk commodities, highlighting the sheer volume and scale of its operational reach.

Aurizon's strength lies in its increasingly diverse freight portfolio beyond its traditional coal focus. While coal remains significant, the company is expanding in bulk commodities, agricultural products, and general freight, with notable growth in containerized freight. This diversification reduces reliance on any single commodity.

The company benefits from a strong contract base, particularly inflation-protected above-rail contracts and regulated network adjustments. These agreements provide a stable and predictable revenue stream, shielding Aurizon from some market volatility.

A key element of revenue certainty comes from many coal contracts operating on a take-or-pay basis. This structure ensures payment even if actual volumes fall short, offering a cushion against fluctuating demand or external disruptions.

Aurizon showcased impressive financial results in Fiscal Year 2024. The company reported a substantial 14% rise in underlying EBITDA, highlighting operational efficiency and revenue growth. This strong performance underpins its capacity for strategic capital allocation and shareholder returns.

A key indicator of Aurizon's financial strength is its free cash flow, which surged by an exceptional 123% in FY24. This significant increase in cash generation provides ample flexibility for capital management activities, including potential dividend increases and share repurchase programs, reinforcing investor confidence.

Commitment to Safety and Sustainability

Aurizon demonstrates a strong commitment to safety, evidenced by a significant 15% decrease in its Total Recordable Injury Frequency Rate (TRIFR) during FY24. This focus on operational safety is a core strength, contributing to a more stable and reliable workforce.

The company is also proactively pursuing a sustainable future, with a clear target of achieving net-zero operational emissions by 2050. This dedication to environmental responsibility is becoming increasingly crucial in securing new business and bolstering its overall corporate image.

- Safety Improvement: Achieved a 15% reduction in TRIFR in FY24.

- Sustainability Goal: Committed to net-zero operational emissions by 2050.

- Reputational Benefit: Sustainability efforts enhance corporate reputation and attract contracts.

Strategic Growth in Emerging Markets

Aurizon is actively pursuing strategic growth in emerging markets, moving beyond its traditional reliance on coal haulage. This diversification is evident in its expanding Bulk and Containerised Freight businesses, signaling a proactive approach to future revenue generation. For instance, the company secured a significant integrated logistics contract with BHP Copper in South Australia, demonstrating its capability to win business in new sectors and reduce dependence on any single commodity.

This strategic shift is crucial for Aurizon's long-term sustainability and market positioning. By securing contracts like the one with BHP Copper, Aurizon is not only diversifying its revenue streams but also proving its adaptability in a changing economic landscape. This focus on new business segments is a key strength, paving the way for continued expansion and resilience.

- Diversification into Growth Markets: Aurizon is strategically investing in and expanding its Bulk and Containerised Freight businesses, targeting new growth opportunities beyond traditional coal transport.

- Securing Key Contracts: Recent successes, such as the integrated logistics solution for BHP Copper in South Australia, underscore Aurizon's ability to win significant contracts in non-coal sectors, validating its diversification strategy.

- Reducing Commodity Reliance: This focus on new business segments is vital for reducing Aurizon's historical reliance on coal, thereby enhancing its long-term growth prospects and overall business stability.

Aurizon's extensive national rail and road network is a foundational strength, enabling efficient connections for major industries. Its market dominance creates significant barriers to entry, as demonstrated by hauling approximately 205 million tonnes of bulk commodities in FY24.

The company's diversified freight portfolio, expanding beyond coal into agriculture and containerized goods, reduces reliance on any single commodity. Strong, inflation-protected contracts provide revenue stability, further bolstered by take-or-pay clauses in many coal agreements, ensuring payment even with lower volumes.

Aurizon's financial performance in FY24 was robust, with a 14% rise in underlying EBITDA and a remarkable 123% surge in free cash flow, providing significant financial flexibility. This financial strength is complemented by a strong commitment to safety, evidenced by a 15% reduction in TRIFR in FY24, and a clear net-zero emissions target by 2050, enhancing its corporate reputation.

| Metric | FY24 Result | Significance |

|---|---|---|

| Tons Hauled (Bulk Commodities) | ~205 million tonnes | Demonstrates operational scale and market reach |

| Underlying EBITDA Growth | 14% | Indicates strong operational efficiency and revenue growth |

| Free Cash Flow Growth | 123% | Provides significant financial flexibility for capital allocation |

| TRIFR Reduction | 15% | Highlights commitment to operational safety and workforce stability |

What is included in the product

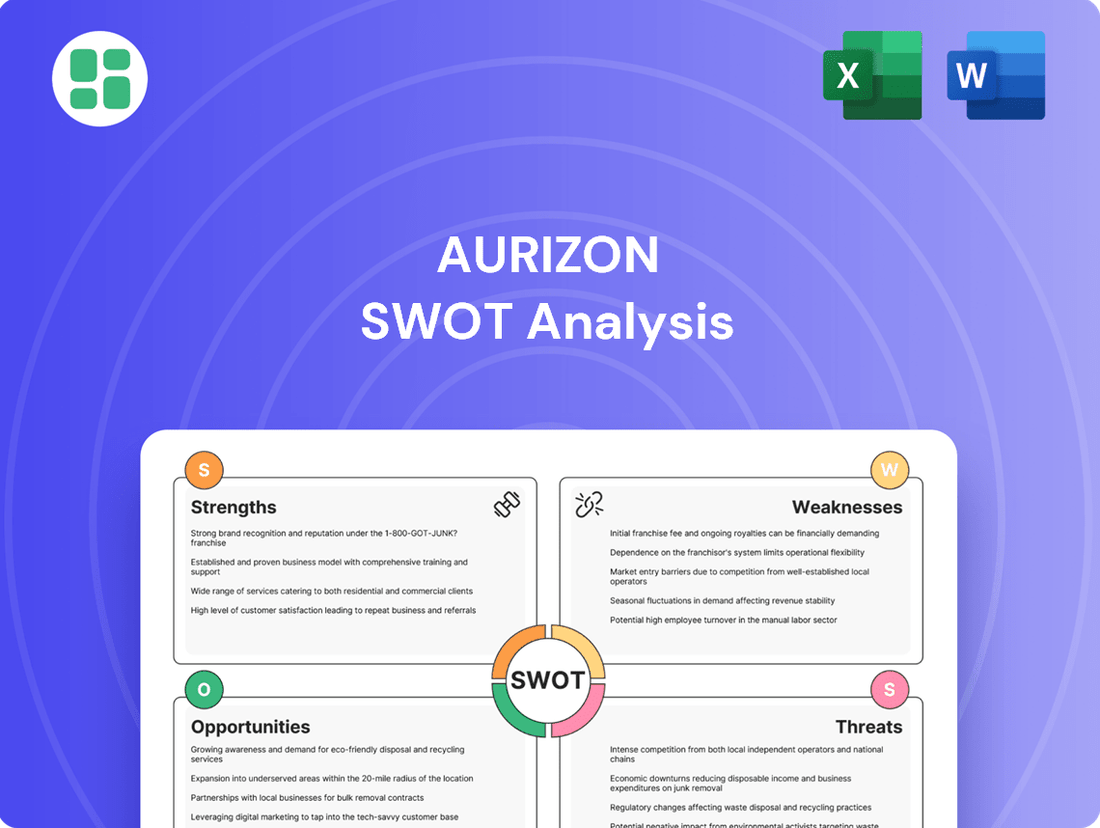

Analyzes Aurizon’s competitive position through key internal and external factors, highlighting its strengths in rail operations and opportunities in decarbonization, while acknowledging weaknesses in infrastructure investment and threats from regulatory changes.

Simplifies complex Aurizon operations by visually mapping strengths, weaknesses, opportunities, and threats for clear strategic direction.

Weaknesses

Aurizon's significant reliance on its coal haulage segment remains a key weakness. In FY24, coal revenues saw a strong rebound, underscoring this dependence. However, this also means the company is vulnerable to the inherent volatility and potential long-term decline of the global coal market.

While Aurizon is investing in diversifying its operations, including haulage for other minerals and containerized freight, these newer ventures have not yet achieved their targeted returns. This lag in performance means the company's overall profitability and financial stability are still heavily tied to the fortunes of the coal sector, exposing it to price fluctuations and demand shifts.

Aurizon contends with significant operational hurdles, notably the disruptive effects of severe weather events and persistent safety concerns that can impede rail network functionality and diminish haulage volumes. For instance, in the first half of FY24, Aurizon reported a 3% decrease in total tonnes hauled year-on-year, partly attributed to weather impacts.

The company is also grappling with escalating operating expenses, including a notable rise in maintenance costs. This cost pressure directly impacts Aurizon's profitability, as seen in their FY24 interim results where underlying earnings before interest and taxes (EBIT) were affected by higher operational expenditures.

These combined factors create inherent variability in Aurizon's operational efficiency and financial performance, making consistent delivery a challenge.

Aurizon's capital allocation strategy has faced scrutiny, with concerns that it might not be maximizing shareholder value. A prime example is the 2022 acquisition of OneRail, which has not yet delivered the expected financial returns, indicating potential issues with the execution or integration of past investment choices.

These suboptimal investment decisions can directly impact Aurizon's ability to grow and maintain profitability. For instance, if acquired assets underperform, it can tie up capital that could have been deployed more effectively elsewhere in the business, potentially hindering future development and shareholder returns.

Board and Governance Gaps

Aurizon faces potential weaknesses stemming from its board and governance structure. Recent assessments highlight a need to bolster board diversity and experience, specifically in areas like regulatory frameworks, advanced technology, and cybersecurity. This is particularly relevant given the recent departure of key female directors and the anticipation of further retirements, which could create a void in critical skill sets.

These governance gaps may hinder Aurizon's strategic oversight capabilities. Without sufficient expertise in evolving regulatory landscapes and emerging technological threats, the company might struggle to make informed decisions and effectively manage risks. For instance, a lack of cybersecurity experience on the board could leave Aurizon vulnerable to sophisticated cyberattacks, impacting operations and data integrity.

- Board Diversity and Expertise: Reports suggest a need for enhanced board diversity and specific expertise in regulatory affairs, technology, and cybersecurity.

- Director Departures and Retirements: The recent exit of female directors and upcoming retirements pose a challenge to maintaining continuity and critical knowledge.

- Strategic Oversight Impact: These gaps could compromise the board's ability to effectively guide the company through complex regulatory and technological challenges.

- Risk Management Vulnerabilities: A deficiency in specialized expertise might weaken the company's capacity to identify and mitigate emerging risks, particularly in cybersecurity.

Underperforming New Freight Segments

Aurizon's newer freight segments are currently struggling to meet financial expectations. Specifically, the containerized freight operations, though strategically vital, only recently finished their ramp-up in May 2024 and have been operating below break-even. This underperformance represents a significant drag on overall profitability.

Adding to these challenges, the bulk segment experienced a decline in volumes during the first half of fiscal year 2025. This was primarily attributed to customer production issues and reduced grain railing activities. Consequently, these key segments are not yet achieving the company's targeted returns, signaling a longer path to full operational and financial optimization.

- Containerized Freight: Operated below break-even, with ramp-up completed May 2024.

- Bulk Segment Volumes: Down in 1HFY25 due to customer production issues and lower grain railings.

- Return Targets: Neither segment is currently meeting company return targets.

- Profitability Impact: These underperforming segments are negatively impacting overall company profitability.

Aurizon's significant reliance on coal haulage, while currently benefiting from strong market conditions, exposes the company to the long-term volatility and potential decline of this sector. Newer ventures in containerized freight and other mineral haulage are still in their early stages, operating below targeted returns and contributing to overall profitability drag. For instance, containerized freight operations were still below break-even as of May 2024, following their ramp-up completion. Furthermore, the bulk segment saw a volume decline in the first half of FY25 due to customer production issues and reduced grain railing, impacting overall performance and delaying the achievement of company return targets.

Operational challenges, including weather disruptions and safety concerns, continue to impact Aurizon's efficiency. The company reported a 3% decrease in total tonnes hauled in the first half of FY24, partly due to weather impacts. Escalating operating expenses, particularly maintenance costs, also exert pressure on profitability, as evidenced by higher operational expenditures affecting underlying EBIT in FY24 interim results. These factors contribute to variability in operational efficiency and financial performance, creating a challenge for consistent delivery.

Aurizon's capital allocation decisions have faced scrutiny, with the 2022 acquisition of OneRail not yet delivering expected financial returns. This suboptimal investment can tie up capital that could be deployed more effectively, potentially hindering future growth and shareholder returns. The company's board structure also presents potential weaknesses, with identified needs for enhanced diversity and expertise in regulatory affairs, technology, and cybersecurity. Recent director departures and upcoming retirements could further challenge the board's strategic oversight and risk management capabilities, particularly in areas like cybersecurity.

What You See Is What You Get

Aurizon SWOT Analysis

This is the same Aurizon SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The Australian rail freight market is on a strong upward trajectory, with projections indicating a robust compound annual growth rate (CAGR) of 5.60% between 2025 and 2034. This expansion is fueled by a growing preference for transport solutions that are both efficient and environmentally conscious, presenting a significant opportunity for Aurizon to broaden its service offerings and capitalize on increased freight volumes across diverse commodities.

Australia is anticipating significant growth in container traffic, with a notable trend towards shifting freight from road to rail. This move is driven by rail's superior capacity and energy efficiency, offering a more sustainable and scalable solution for moving goods.

Government policies are actively encouraging this modal shift, aiming to alleviate road congestion and lower carbon emissions. For instance, the Australian government's National Freight and Supply Chain Strategy, updated in 2023, emphasizes investing in rail infrastructure to support this transition.

Aurizon is strategically positioned to benefit from this evolving landscape. By providing comprehensive integrated rail and logistics services for both general and containerized freight, the company can effectively capture increased demand as businesses opt for more efficient and environmentally friendly transport modes.

Significant government and private sector investments in Australian rail infrastructure, projected to reach billions in the coming years, present a substantial opportunity for Aurizon. These investments aim to boost connectivity and capacity, directly benefiting a major rail operator like Aurizon.

Technological advancements are also a key opportunity. The adoption of automation and real-time tracking systems, for instance, can significantly improve operational efficiency and safety. Aurizon can leverage these innovations to modernize its fleet and network, potentially reducing operational costs and enhancing service delivery by up to 15% in key areas.

Diversification and New Contract Wins

Aurizon is actively pursuing opportunities to diversify its revenue beyond traditional coal haulage. A significant move in this direction is the recent securing of a multi-year contract with BHP for copper logistics, highlighting the potential in emerging commodity markets. This strategic expansion into new freight types, including intermodal solutions that integrate road and sea transport, is crucial for reducing its dependence on the cyclical coal sector.

The company's strategic pivot aims to unlock substantial growth by broadening its service offerings. This includes exploring new geographical regions and industries where its rail expertise can be leveraged.

- Secured BHP copper logistics deal: Demonstrates success in diversifying beyond coal.

- Intermodal integration: Reduces reliance on single commodity transport.

- Expansion into new regions/industries: Unlocks significant untapped growth potential.

Sustainability and ESG Initiatives

Aurizon's dedication to achieving net-zero operational emissions by 2050 is a major opportunity. This commitment, backed by investments in sustainable practices, positions the company favorably in an increasingly environmentally conscious market. For instance, Aurizon has been actively exploring decarbonization strategies, including the potential use of hydrogen in its locomotive fleet, a move that aligns with global trends in sustainable logistics.

This strong focus on Environmental, Social, and Governance (ESG) factors offers several benefits. It can significantly boost Aurizon's brand reputation, making it more attractive to customers and investors who prioritize sustainability. Furthermore, it opens doors to new funding avenues, such as green bonds or government grants specifically aimed at supporting the transition to cleaner transportation solutions. Aurizon's 2023 sustainability report highlighted progress in reducing its Scope 1 and Scope 2 emissions intensity, demonstrating tangible steps towards its net-zero goal.

Embracing ESG principles can also be a catalyst for innovation within Aurizon. By seeking out and investing in sustainable technologies and processes, the company can develop more efficient and environmentally friendly operations. This proactive approach not only addresses climate-related risks but also has the potential to unlock long-term value creation, ensuring the company's resilience and competitiveness in the evolving transportation sector.

Key opportunities stemming from sustainability and ESG initiatives include:

- Enhanced Brand Reputation: Demonstrating a commitment to net-zero emissions and sustainable practices can improve public perception and attract environmentally conscious stakeholders.

- Access to New Funding: A strong ESG profile can unlock access to green financing, impact investments, and government incentives for sustainable infrastructure projects.

- Customer Attraction: Businesses increasingly prefer partners with robust sustainability credentials, creating a competitive advantage for Aurizon in securing contracts.

- Operational Efficiency and Innovation: Investing in cleaner technologies and processes can lead to cost savings and the development of new, more efficient service offerings.

Aurizon is well-positioned to capitalize on the growing demand for rail freight, driven by its efficiency and environmental advantages over road transport. The Australian rail freight market is projected to grow at a CAGR of 5.60% from 2025 to 2034, presenting a substantial opportunity for increased volumes and service expansion.

Strategic diversification into new commodities, such as the recently secured copper logistics contract with BHP, and the integration of intermodal solutions are key to reducing reliance on the coal sector. Furthermore, significant government and private investment in rail infrastructure, totaling billions, will enhance capacity and connectivity, directly benefiting Aurizon.

Aurizon's commitment to net-zero emissions by 2050, including exploring hydrogen for its locomotive fleet, enhances its brand reputation and opens avenues for green financing. This focus on ESG not only attracts environmentally conscious customers but also drives operational efficiencies through sustainable technology adoption.

| Opportunity Area | Key Driver | Aurizon's Action/Benefit | Relevant Data |

|---|---|---|---|

| Market Growth & Modal Shift | Efficiency & Environmental Benefits of Rail | Capitalize on increased freight volumes, expand services | 5.60% CAGR (2025-2034) for Australian rail freight |

| Diversification & New Contracts | Reducing coal dependence, tapping new commodities | Secure contracts in non-coal sectors, integrate intermodal | BHP copper logistics contract |

| Infrastructure Investment | Government & private sector spending | Benefit from enhanced connectivity and capacity | Billions invested in Australian rail infrastructure |

| Sustainability & ESG | Net-zero goals, customer/investor demand | Improve brand, access green finance, attract customers | Net-zero operational emissions by 2050 goal |

Threats

Aurizon's heavy reliance on bulk commodities, especially coal, exposes it to significant price swings and demand shifts. For instance, the average Newcastle thermal coal price experienced considerable volatility throughout 2023 and into early 2024, impacting the economic viability of mining operations and, consequently, haulage volumes.

While long-term contracts provide a degree of insulation, a prolonged slump in commodity prices can still erode Aurizon's customer volumes and overall profitability. This vulnerability is amplified by the global energy transition, which presents a substantial long-term threat to its foundational coal transportation business.

Aurizon operates in a heavily regulated sector, with its access undertakings subject to periodic reviews by the Australian Competition and Consumer Commission (ACCC) and state regulators. These reviews, particularly concerning network access pricing, pose a significant threat. For instance, the ACCC's final decision on Aurizon's Queensland Network Access Undertaking in 2023, while largely favorable, still introduced complexities and potential for future adjustments.

Changes in these regulatory frameworks, or unfavorable outcomes from ongoing reviews, could directly impact Aurizon's revenue streams and operational costs. For example, stricter pricing controls or new operational mandates could reduce profitability. The inherent uncertainty surrounding these reviews creates a challenging environment for long-term financial planning and investment decisions.

Aurizon has faced significant industrial action, with ongoing negotiations for enterprise agreements with various unions. These disputes have previously led to disruptions, impacting service delivery and operational efficiency. For instance, in fiscal year 2023, industrial action contributed to some capacity constraints in specific regions, affecting haulage volumes.

Labor disputes directly translate into increased operating costs through potential wage increases, back-pay, and the expenses associated with managing industrial action. Such disruptions can also damage customer relationships by affecting reliability and capacity availability, a critical factor in the bulk commodities sector where Aurizon operates.

Climate Change and Extreme Weather Events

Climate change presents a significant threat to Aurizon. The increasing frequency and intensity of extreme weather events, like floods and cyclones, directly impact rail infrastructure. For instance, severe weather events in Queensland, a key operational area for Aurizon, have historically led to significant disruptions. In the 2023 financial year, Aurizon reported that extreme weather events impacted its coal haulage volumes, highlighting the vulnerability of its network.

These disruptions translate into tangible financial consequences. Track damage necessitates costly repairs and upgrades, directly affecting maintenance budgets. Furthermore, operational interruptions lead to reduced haulage volumes, impacting revenue streams. Aurizon's ongoing efforts to build resilience into its infrastructure are critical, but the escalating nature of climate impacts presents a persistent challenge to maintaining uninterrupted service and managing costs effectively.

- Increased operational disruptions due to floods and cyclones impacting rail lines.

- Higher maintenance and repair costs for infrastructure damaged by extreme weather.

- Potential for reduced haulage volumes and associated revenue losses following severe weather events.

Competition and Technological Disruption

While rail freight offers inherent efficiencies, Aurizon faces persistent competition from road and shipping sectors, especially for general freight movements. In 2023, the Australian trucking industry, a key competitor, continued to see growth, with freight volumes on major routes remaining robust, putting pressure on rail's market share for certain commodities.

The threat of technological disruption is significant. Advancements in autonomous trucking, electric vehicles, and potentially even drone delivery for smaller, time-sensitive cargo could fundamentally alter the transport landscape. Aurizon must remain agile, as seen in the broader logistics sector where companies are investing heavily in digital twins and AI for route optimization, potentially making other modes more cost-effective or faster for specific applications.

To counter these threats, Aurizon's ongoing investment in fleet modernization and operational efficiency is crucial. For instance, the company's 2024 capital expenditure plans include upgrades to its locomotives and track infrastructure, aiming to improve speed and reliability. Failure to adapt to evolving customer needs and embrace new technologies could see its competitive edge erode.

- Modal Competition: Road and shipping continue to challenge rail's dominance in general freight, with the trucking sector showing resilience and ongoing investment in fleet upgrades.

- Technological Disruption: Emerging technologies like autonomous vehicles and advanced logistics software pose a risk if Aurizon doesn't proactively integrate them into its operations.

- Investment Imperative: Continuous capital investment in modernizing its fleet and infrastructure is essential for Aurizon to maintain cost-competitiveness and service quality against these evolving threats.

Aurizon faces significant threats from the global energy transition, which is gradually reducing demand for coal, its primary commodity. This shift poses a long-term risk to haulage volumes and profitability, even with existing long-term contracts. Furthermore, regulatory reviews, particularly concerning access undertakings and pricing by bodies like the ACCC, create uncertainty and could negatively impact revenue streams and operational costs.

Industrial disputes with unions represent another key threat, leading to potential cost increases and operational disruptions, as seen with past capacity constraints. Climate change also poses a direct threat through extreme weather events like floods and cyclones, which damage infrastructure, increase repair costs, and reduce haulage volumes, impacting revenue. Finally, competition from road and shipping, coupled with the potential for technological disruption from autonomous vehicles, necessitates continuous investment in modernization to maintain competitiveness.

SWOT Analysis Data Sources

This Aurizon SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and accurate strategic overview.