Aurizon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurizon Bundle

Aurizon's future is shaped by a complex web of external forces, from evolving government policies to shifts in the global economy and technological advancements. Understanding these PESTLE factors is crucial for navigating the competitive landscape and identifying both opportunities and risks. Our comprehensive analysis delves deep into these influences, providing you with the strategic intelligence needed to make informed decisions.

Gain a competitive edge by leveraging our expertly crafted PESTLE analysis of Aurizon. Discover how political stability, economic downturns, social trends, technological disruptions, environmental regulations, and legal frameworks are impacting its operations and strategic direction. Download the full version now to unlock actionable insights and strengthen your market strategy.

Political factors

Government investment in rail infrastructure is a key factor for Aurizon, with a significant portion of Australia's public infrastructure budget directed towards land transport projects. These initiatives focus on enhancing rail network connectivity, capacity, and overall efficiency. For instance, the Australian government's commitment to the Inland Rail project, a major undertaking in freight rail infrastructure, directly benefits Aurizon's business model and future growth prospects.

The regulatory landscape for Aurizon is shaped by the Office of the National Rail Safety Regulator (ONRSR), which sets safety standards and priorities, with a strategic outlook extending to 2027. This national oversight is crucial for ensuring consistent safety practices across all Australian states and territories where Aurizon operates. For instance, ONRSR’s 2023 annual report highlighted a focus on fatigue management and track safety, areas directly impacting rail operations.

Further bolstering national consistency, the National Transport Commission (NTC) is actively developing mandatory rail standards. This initiative aims to improve interoperability and streamline operations for companies like Aurizon, reducing complexity and enhancing efficiency across the diverse Australian rail network. The NTC’s work in 2024 is particularly focused on harmonizing regulations related to rolling stock maintenance and operational procedures.

Australia's trade policies and global demand for commodities like coal and iron ore are crucial for Aurizon. These commodities make up more than 75% of Australia's rail freight by weight, directly impacting Aurizon's haulage volumes.

Government support for export industries and trade agreements can boost Aurizon's performance. For instance, in the fiscal year 2023, Aurizon reported a 2% increase in total train tonnes, largely driven by strong export demand for coal.

Market fluctuations in bulk commodities can cause considerable swings in demand for Aurizon's services. The ongoing global energy transition, however, presents both challenges and opportunities for commodity exports and, consequently, for rail freight operators like Aurizon.

Political Stability and Industry Support

Australia's political stability is a significant tailwind for Aurizon. A predictable policy environment in 2024 and projections for 2025 supports the long-term capital investments essential for rail infrastructure. This stability translates into greater confidence for Aurizon's strategic planning and operational execution.

Government support for rail as a green logistics solution is crucial. Policies encouraging modal shift from road to rail, particularly for bulk commodities, directly benefit Aurizon's freight volumes. For instance, the Australian government's commitment to infrastructure upgrades, including rail, as part of its net-zero emissions targets, provides a favorable operating landscape.

Aurizon's core business is intrinsically linked to government support for primary industries. Policies that bolster the mining and agricultural sectors, Aurizon's key customer bases, indirectly fuel demand for rail transport. The Australian government's focus on export growth for resources and agricultural products in 2024-2025 underpins these demand drivers.

- Political Stability: Australia's consistent political climate reduces uncertainty for infrastructure investments.

- Industry Support: Government promotion of rail as a sustainable transport mode enhances Aurizon's market position.

- Primary Industry Linkage: Government policies supporting mining and agriculture directly impact Aurizon's freight volumes.

National Rail Action Plan (NRAP)

The National Rail Action Plan (NRAP), a key initiative by the National Transport Commission, is actively working to enhance Australia's rail network. Its core objective is to foster a more integrated and efficient national rail system through targeted reforms. These reforms focus on reducing bureaucratic hurdles, simplifying approval processes, standardizing digital signaling, and harmonizing operational regulations across various rail networks. For a major rail freight operator like Aurizon, these changes are anticipated to significantly decrease operational complexities and boost the overall efficiency of freight transportation across the country.

Aurizon's operations are directly impacted by the NRAP's focus on streamlining national rail freight. The plan's emphasis on cutting red tape and harmonizing rules aims to create a more predictable and cost-effective operating environment. For instance, the alignment of digital signaling systems is crucial for improving train movements and reducing delays, a key concern for freight operators. The NRAP's progress in 2024 and projected advancements into 2025 will be critical indicators of its success in delivering these anticipated efficiencies.

- Streamlined Approvals: The NRAP aims to reduce the average time for rail project approvals, a process that has historically been lengthy and complex.

- Digital Signaling Harmonization: Efforts are underway to create interoperability between different digital signaling systems, which could reduce the need for costly and time-consuming system upgrades for operators like Aurizon.

- Operational Rule Alignment: The plan seeks to harmonize operational rules across state and private rail networks, simplifying cross-border movements and reducing potential conflicts.

- Increased Productivity: By addressing these systemic issues, the NRAP is projected to contribute to a measurable increase in national rail freight productivity, benefiting major players in the sector.

Government policy directly influences Aurizon's operational environment, with significant investment in rail infrastructure, such as the Inland Rail project, providing substantial opportunities. The regulatory framework, overseen by bodies like the ONRSR and NTC, ensures safety and aims for national standardization, with recent reports highlighting focuses on fatigue and track safety. The NTC's 2024 work on harmonizing rolling stock maintenance and operational procedures is key to efficiency.

Trade policies and commodity demand are vital, as bulk commodities like coal and iron ore, exceeding 75% of Australia's rail freight by weight, directly impact Aurizon's volumes. Government support for exports in 2023, contributing to a 2% increase in Aurizon's total train tonnes, underscores this link. The ongoing energy transition presents both risks and opportunities for commodity exports and rail freight demand.

Australia's political stability offers a predictable environment for Aurizon's long-term capital investments in rail infrastructure. Furthermore, government backing for rail as a green logistics solution and policies encouraging modal shift from road to rail for bulk commodities are favorable. Aurizon's core business also relies on government support for primary industries, with export growth for resources and agricultural products in 2024-2025 being key demand drivers.

| Policy Area | Impact on Aurizon | Data/Example |

|---|---|---|

| Infrastructure Investment | Increased demand for services, network expansion | Australian Government commitment to Inland Rail project |

| Regulatory Standards | Ensured safety, operational consistency | ONRSR's 2023 focus on fatigue management and track safety |

| Trade & Commodity Demand | Directly influences haulage volumes | Coal and iron ore represent >75% of Australia's rail freight by weight |

| Sustainability Initiatives | Favorable operating landscape, modal shift | Government support for rail as a green logistics solution |

What is included in the product

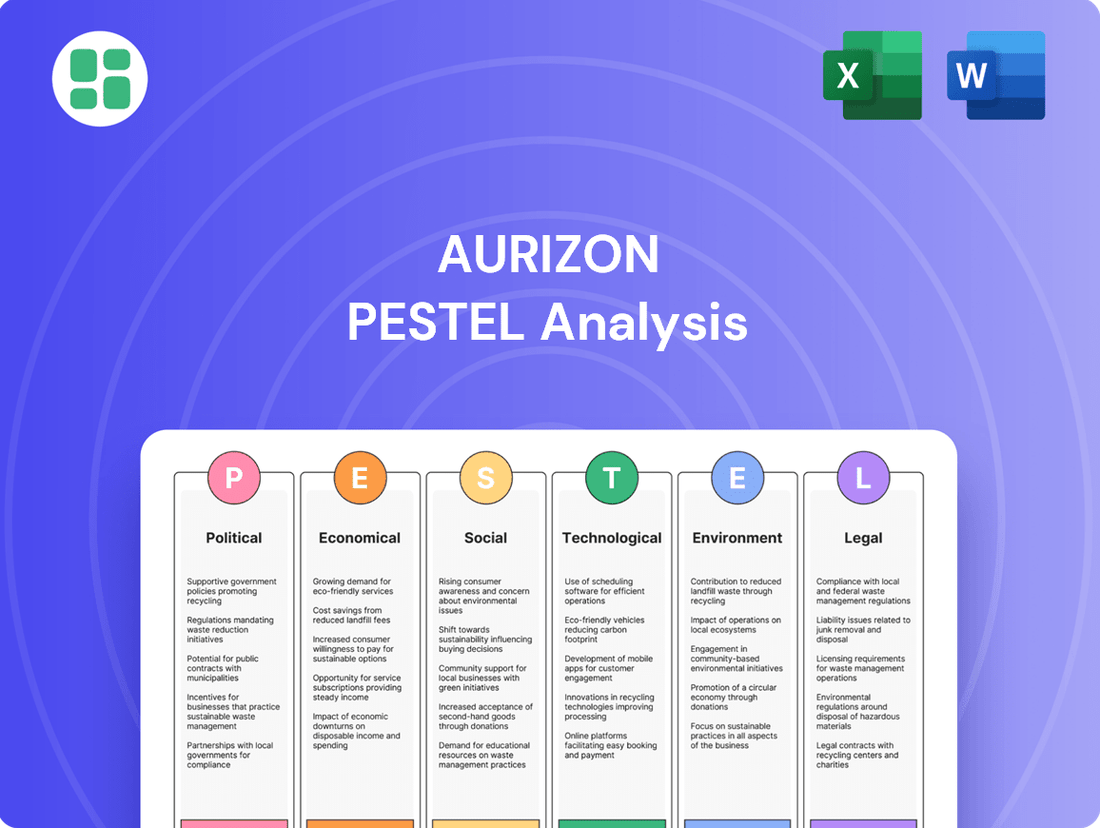

This Aurizon PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

Aurizon's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, acting as a pain point reliever by simplifying complex external factors.

Economic factors

Aurizon's financial performance is intrinsically linked to global commodity prices, especially for coal and iron ore, which are central to its bulk freight operations. Fluctuations in these prices directly affect the demand for transporting these essential materials.

In late 2024, while coal volumes saw a positive uptick, Aurizon's total bulk volumes experienced a decline. This decrease was primarily driven by reduced transport of bauxite/alumina and grain, highlighting the sensitivity of its business to broader commodity market shifts.

Australia's economic health is a crucial driver for Aurizon. The nation's GDP growth, which was 1.5% in the year to March 2024, directly impacts commodity demand and infrastructure investment, both vital for rail freight.

The mining sector, a cornerstone of Australian exports, saw a 1.5% increase in mining production in the March quarter of 2024, signaling continued demand for bulk commodity transport. This underpins Aurizon's core business, as the company is a significant player in moving resources like coal and iron ore.

Furthermore, the broader Australian industrial output, including manufacturing and agriculture, contributes to general freight volumes. The Australian Bureau of Statistics reported a 0.4% rise in manufacturing output in the first quarter of 2024, indicating a steady need for efficient logistics solutions that Aurizon provides.

Rising inflation presents a significant challenge for Aurizon, with the Australian Consumer Price Index (CPI) reaching 5.4% in the March quarter of 2024, up from 4.1% in the December quarter of 2023. This surge directly translates to higher operational expenditures, impacting critical areas such as fuel procurement, essential maintenance supplies, and labor costs, thereby squeezing profit margins.

Furthermore, the Reserve Bank of Australia's response to inflation, which has seen the cash rate increase to 4.35% as of November 2023, elevates Aurizon's cost of capital. This makes borrowing for substantial infrastructure upgrades and new rolling stock more expensive, potentially delaying or scaling back crucial capital investment plans and impacting long-term financial health.

Exchange Rates

Fluctuations in the Australian dollar (AUD) significantly impact Aurizon's operations. A stronger AUD, for instance, can make Australian commodity exports more expensive for international buyers, potentially dampening demand and thus reducing the volume of goods Aurizon transports. For example, in early 2024, the AUD experienced periods of strength against major currencies, which could have presented headwinds for export volumes.

Conversely, a weaker AUD can boost export competitiveness, leading to increased demand for Australian commodities and, consequently, higher transport volumes for Aurizon. However, the exchange rate also affects Aurizon's cost structure. A stronger AUD can lower the cost of importing essential equipment and technology, such as new locomotives or maintenance parts, thereby potentially improving operational efficiency and capital expenditure budgets.

- Impact on Exports: A stronger AUD (e.g., trading around 0.65 USD in early 2024) can increase the price of Australian commodities, potentially reducing global demand and Aurizon's haulage volumes.

- Import Costs: A weaker AUD (e.g., trading around 0.63 USD in mid-2024) can make imported capital goods and technology cheaper for Aurizon, potentially lowering capital expenditure and maintenance costs.

- Competitiveness: Exchange rate movements directly influence the cost-competitiveness of Aurizon's key commodity customers in international markets.

Fuel and Energy Costs

Fuel and energy costs are a major consideration for Aurizon, given its substantial rail operations. Diesel fuel is a significant operating expense, directly affecting the profitability of its large locomotive fleet. For instance, in the fiscal year 2023, Aurizon reported that fuel costs represented a substantial portion of its operational expenditures, though specific figures are often integrated into broader cost categories in public reporting.

The inherent volatility in global fuel prices poses a direct risk to Aurizon's financial performance. Fluctuations can quickly impact margins, making consistent budgeting challenging. To address this, Aurizon is strategically investing in and actively trialing renewable energy alternatives. These initiatives include exploring battery-electric and potentially hydrogen-powered trains, aligning with both cost mitigation and broader sustainability objectives.

- Diesel fuel is a primary operating cost for Aurizon's extensive locomotive fleet.

- Global fuel price volatility directly impacts Aurizon's profitability.

- Aurizon is investing in renewable energy alternatives like battery-electric and hydrogen trains.

- These investments aim to mitigate fuel cost risks and meet sustainability goals.

Economic factors significantly shape Aurizon's operational landscape. Commodity prices, particularly for coal and iron ore, directly influence freight volumes, with late 2024 seeing a decline in total bulk volumes despite a positive uptick in coal. Australia's economic health, reflected in its 1.5% GDP growth to March 2024, underpins demand for resource transportation, further supported by a 1.5% increase in mining production in the same quarter.

Rising inflation, with Australia's CPI at 5.4% in March 2024, escalates operational costs for Aurizon, impacting fuel, maintenance, and labor. The Reserve Bank of Australia's cash rate of 4.35% (as of November 2023) also increases the cost of capital for infrastructure investments.

Currency fluctuations also play a key role. A stronger AUD, around 0.65 USD in early 2024, can reduce the competitiveness of Australian commodity exports, potentially lowering transport volumes. Conversely, a weaker AUD, around 0.63 USD mid-2024, can boost exports but increase the cost of imported equipment.

Fuel costs are a major expense, with diesel prices directly impacting profitability. Aurizon is exploring renewable energy solutions like battery-electric and hydrogen trains to mitigate these risks and align with sustainability goals.

What You See Is What You Get

Aurizon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aurizon PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Aurizon prioritizes community safety, notably through its 'Respect the sign. Lives are on the line.' campaign aimed at reducing level crossing incidents. In 2023, Aurizon reported a 10% reduction in level crossing incidents compared to the previous year, a testament to their public awareness efforts.

The company actively engages with local communities, contributing to societal well-being and addressing concerns surrounding rail operations. Through its Community Giving Fund, Aurizon supported over 50 local initiatives in 2024, fostering positive relationships and demonstrating a commitment to shared prosperity.

The Australian infrastructure sector, particularly rail, is grappling with workforce availability and potential skills gaps. This directly impacts Aurizon, a major player, necessitating proactive strategies for attracting, developing, and retaining talent to maintain operational efficiency and a capable team.

To address these challenges, Aurizon is likely investing in robust training programs and apprenticeships. For instance, the Australian government's commitment to skills development, including initiatives aimed at the transport and logistics sector, provides a supportive backdrop for such efforts. In 2023, the National Skills Commission reported ongoing demand for skilled trades and technicians across various infrastructure-related fields.

Societal demand for environmentally conscious operations is reshaping the logistics landscape. Consumers and businesses alike are increasingly prioritizing supply chains that minimize their carbon footprint. This growing preference directly benefits rail freight, which is inherently more fuel-efficient than road transport.

Aurizon, as a major rail freight operator, is well-positioned to capitalize on this trend. In 2023, rail freight in Australia moved approximately 1.4 billion tonnes of goods, significantly reducing emissions compared to trucking the same volume. For example, moving one tonne of freight by rail typically emits around 20 grams of CO2 per kilometer, compared to 100 grams for road freight, according to industry estimates. This substantial difference makes rail an attractive option for companies aiming to achieve their sustainability targets.

Urbanization and Land Use Planning

Australia's ongoing urbanization, with its population projected to reach 32 million by 2030, directly influences land use planning around rail corridors. This trend intensifies community concerns about noise and vibrations from increased rail activity, impacting areas like Sydney and Melbourne where population density is highest. Aurizon must therefore engage proactively with urban planning authorities and local communities to navigate these evolving land use challenges.

The increasing demand for housing and infrastructure in urban centers can lead to rail corridors being encroached upon or subject to stricter environmental regulations. For instance, the Australian Bureau of Statistics reported a 1.2% increase in the population of major cities in the year ending June 2023. This necessitates careful management of Aurizon's operational footprint and requires robust community consultation to address potential impacts on residential areas.

- Urban Growth: Australia's major cities are experiencing significant population growth, increasing pressure on land adjacent to rail infrastructure.

- Community Scrutiny: Residents in urbanized areas are more likely to raise concerns regarding noise, vibration, and access related to rail operations.

- Planning Integration: Effective land use planning requires Aurizon to collaborate with government bodies and local councils to integrate rail operations with urban development.

- Mitigation Strategies: Proactive engagement and investment in noise and vibration mitigation technologies are crucial for managing community relations in urban environments.

Public Perception of Freight Efficiency and Reliability

Public and commercial views on how efficiently, reliably, and safely rail freight operates significantly shape decisions about using rail for logistics. When businesses perceive rail as a dependable and secure transport method, they are more likely to choose it over other options.

Aurizon, as a key player in freight and logistics, actively works to improve these perceptions by highlighting its end-to-end supply chain capabilities. The company aims to showcase rail's strengths in moving goods safely and punctually across various markets, thereby boosting its appeal.

- Public perception of rail freight reliability directly impacts modal shift.

- In 2024, a significant portion of Australian businesses surveyed cited reliability concerns as a primary barrier to increased rail freight usage.

- Aurizon's focus on integrated supply chain solutions aims to address these perceptions by demonstrating end-to-end service quality.

- The company's investment in new rolling stock and track upgrades throughout 2024-2025 is designed to bolster its reputation for efficiency and safety.

Societal expectations regarding safety and community engagement are paramount for Aurizon. The company's commitment to reducing level crossing incidents, evidenced by a 10% reduction in 2023, demonstrates this focus. Furthermore, Aurizon's support for over 50 local initiatives through its Community Giving Fund in 2024 highlights its dedication to societal well-being and positive community relations.

Technological factors

Aurizon is navigating a significant technological shift in Australian rail transport, with smart technologies like automated signaling systems becoming increasingly prevalent. This evolution is paving the way for the exploration of driverless train technologies, aiming to boost efficiency and capacity.

These advancements are crucial for companies like Aurizon to enhance logistics and operational performance. For instance, the adoption of advanced train control systems is projected to improve track capacity by up to 20% in certain corridors, directly impacting Aurizon's ability to move more freight.

Digitalization is fundamentally reshaping rail freight, with advanced technologies like AI and IoT being integrated into supply chain management. This shift enables real-time tracking and predictive maintenance, significantly boosting efficiency. For instance, by 2024, the global supply chain digitalization market is projected to reach $39.3 billion, highlighting the immense investment and adoption in this area.

Aurizon is actively embracing these digital advancements. Through strategic partnerships and the development of integrated digital platforms, the company aims to streamline its operations and enhance customer experience. This focus on digital capabilities allows for better visibility and control over the entire supply chain, improving service delivery and operational resilience.

Data analytics and AI are increasingly vital for optimizing rail operations, driving predictive maintenance, and boosting service reliability. Aurizon's investment in these areas allows for deeper understanding of network performance, asset condition, and freight logistics, leading to more efficient and secure operations.

Advanced Rail Technology and Fleet Decarbonization

Aurizon is making significant strides in advanced rail technology, particularly focusing on fleet decarbonization. The company is actively trialing battery-electric locomotives (BEL) and battery-electric tenders (BET), with prototypes slated for on-track trials by late 2025 and early 2026.

This commitment to innovation is a cornerstone of Aurizon's strategy to develop zero-emissions capable freight locomotives. The ultimate goal is to achieve net-zero operational emissions by 2050, a critical target in the global effort to combat climate change.

- Battery-Electric Locomotive (BEL) and Tender (BET) Trials: Prototypes expected for on-track trials by late 2025/early 2026.

- Zero-Emissions Capability: Development of next-generation freight locomotives designed for zero-emissions operation.

- Net-Zero Target: Aurizon aims to achieve net-zero operational emissions by 2050.

Cybersecurity Threats

As rail operations increasingly rely on digital systems, cybersecurity threats pose a significant risk to Aurizon's critical infrastructure. The interconnected nature of these systems, from signaling to fleet management, creates vulnerabilities that malicious actors can exploit. Aurizon's commitment to protecting its operational integrity and sensitive data is paramount in this evolving technological landscape.

Aurizon must maintain substantial investments in advanced cybersecurity measures to safeguard its operations. This includes protecting its operational technology (OT) and information technology (IT) systems from breaches that could disrupt freight services. The company's proactive approach ensures the continuity and reliability of its essential supply chain functions.

- Rising Cyber Threats: The Australian Cyber Security Centre reported a 13% increase in cybercrime reports in 2023 compared to the previous year, with critical infrastructure sectors being prime targets.

- Investment in Security: Aurizon's capital expenditure plans for 2024-2025 include dedicated allocations for enhancing digital security and network resilience.

- Data Integrity: Protecting customer data and operational logs from unauthorized access or manipulation is crucial for maintaining trust and compliance.

- Operational Continuity: Cyberattacks can lead to significant service disruptions, impacting Aurizon's ability to deliver freight and potentially causing substantial economic losses.

Aurizon is actively integrating advanced technologies, including AI and IoT, to enhance its supply chain management, enabling real-time tracking and predictive maintenance. By 2024, the global supply chain digitalization market was projected to reach $39.3 billion, underscoring the significant investment in this area.

The company is also at the forefront of decarbonization efforts, with battery-electric locomotive (BEL) and tender (BET) prototypes scheduled for on-track trials by late 2025 and early 2026, aiming for zero-emissions freight operations by 2050.

However, the increasing reliance on digital systems introduces significant cybersecurity risks. The Australian Cyber Security Centre noted a 13% rise in cybercrime reports in 2023, with critical infrastructure sectors being a key target. Aurizon's 2024-2025 capital expenditure includes dedicated funds for digital security enhancements.

| Technology Focus | Key Initiatives | Projected Impact/Data |

|---|---|---|

| Digitalization & AI | Supply chain integration, real-time tracking, predictive maintenance | Global supply chain digitalization market projected at $39.3 billion by 2024 |

| Decarbonization | Battery-Electric Locomotive (BEL) & Tender (BET) trials | On-track trials by late 2025/early 2026; Net-zero operational emissions target by 2050 |

| Cybersecurity | Enhancing OT/IT security, network resilience | 13% increase in Australian cybercrime reports in 2023; Dedicated 2024-2025 capital expenditure for digital security |

Legal factors

Aurizon operates under the stringent oversight of the Office of the National Rail Safety Regulator (ONRSR), adhering to the Rail Safety National Law. This framework is continually updated, with recent reviews in 2023 and ongoing discussions in 2024 focusing on enhancing safety protocols and operational efficiency nationwide.

The company actively engages with ONRSR and industry stakeholders, participating in initiatives like the development of new fatigue management guidelines and the implementation of advanced signalling technologies. This collaboration is crucial for maintaining compliance and driving improvements in rail safety performance across Australia.

Aurizon operates under a framework of environmental protection laws and emissions standards, critical for its rail freight operations. These regulations directly influence how the company manages its environmental impact, particularly concerning air quality and greenhouse gas emissions.

The company's commitment to net-zero operational emissions by 2050, with an interim goal of a 10% reduction in greenhouse gas emissions intensity by 2030, underscores the importance of adapting to and complying with evolving environmental legislation. This includes meeting increasingly stringent reporting requirements and investing in cleaner technologies to achieve these targets.

Aurizon, as Australia's dominant rail freight operator, faces significant oversight from competition laws. The Australian Competition and Consumer Commission (ACCC) actively monitors its market conduct, particularly concerning acquisitions and service pricing, to prevent anti-competitive practices. For instance, the ACCC's review of Aurizon's proposed acquisition of One Rail Australia in 2023 highlighted the commission's role in safeguarding market fairness.

Land Access and Property Rights

Aurizon's extensive rail network necessitates strict adherence to land access and property rights laws. This includes securing and maintaining rights-of-way, which often involves complex negotiations and legal agreements with private landowners and various government entities. Compliance with land use planning and zoning regulations is also paramount for both current operations and future expansion projects, ensuring legal operational continuity.

Navigating these legal complexities is critical for Aurizon's infrastructure development and maintenance. For instance, in 2023, Aurizon continued to manage numerous easement agreements across its vast network, which spans thousands of kilometers. The company's ability to secure new land access for projects, such as upgrades to existing lines or new corridor development, directly impacts its capacity to grow and improve service delivery, often requiring significant legal due diligence and consultation.

Key legal considerations include:

- Easement Acquisition: Securing legal rights to use private land for rail infrastructure, often involving compensation to landowners.

- Land Use Planning: Complying with local, state, and federal zoning laws and environmental impact assessments for new or upgraded rail lines.

- Property Title Management: Maintaining accurate records of land ownership and access rights across the entire network.

- Dispute Resolution: Managing legal challenges related to property access, compensation, or environmental impacts.

Labor Laws and Industrial Relations

Aurizon operates within Australia's robust legal framework governing labor and industrial relations. This includes adherence to the Fair Work Act 2009, which sets national standards for minimum wages, working conditions, and dispute resolution. For instance, as of July 2024, the national minimum wage is AUD $23.23 per hour, a benchmark Aurizon must meet or exceed for its employees.

Compliance with specific regulations, such as those pertaining to the health assessment of rail safety workers, is also paramount. These assessments ensure that employees in safety-critical roles meet the necessary physical and mental standards, contributing to overall operational safety. Aurizon's commitment to these health standards is a key component of its legal obligations.

Effective management of industrial relations is critical for Aurizon's operational continuity. This involves navigating agreements with various unions, such as the Rail, Tram and Bus Union (RTBU), to ensure a productive and stable workforce. Recent industrial relations activity in the Australian rail sector in 2024 highlights the ongoing importance of proactive engagement to prevent disruptions.

- Adherence to Fair Work Act 2009: Ensures compliance with national employment standards.

- Compliance with Rail Safety Worker Health Standards: Mandates health assessments for safety-critical roles.

- Union Engagement: Proactive management of relationships with unions like the RTBU is vital.

- Impact of Industrial Relations: Disputes can lead to operational disruptions, affecting service delivery.

Aurizon must navigate a complex web of competition laws, primarily overseen by the Australian Competition and Consumer Commission (ACCC). The ACCC's scrutiny, as seen in its 2023 review of Aurizon's proposed acquisition of One Rail Australia, ensures fair market practices and prevents monopolistic behavior. This legal oversight directly impacts Aurizon's growth strategies and pricing structures.

Land access and property rights are fundamental legal considerations for Aurizon's vast rail network. Managing thousands of kilometers of easements and complying with land use planning and zoning regulations are ongoing challenges. Securing new land access for infrastructure development, a process involving extensive legal due diligence, is crucial for operational expansion and service improvement.

Labor laws, including the Fair Work Act 2009, dictate employment standards for Aurizon's workforce. Compliance with national minimum wages, such as the AUD $23.23 per hour as of July 2024, and specific health assessment regulations for rail safety workers are non-negotiable. Effective industrial relations management, including proactive engagement with unions like the RTBU, is vital to prevent operational disruptions.

| Legal Area | Key Legislation/Body | 2023/2024 Relevance |

|---|---|---|

| Competition Law | ACCC | Review of One Rail Australia acquisition |

| Land Access | State/Federal Planning Laws | Ongoing easement management, new project approvals |

| Employment Law | Fair Work Act 2009 | National minimum wage (AUD $23.23/hr as of July 2024), worker health standards |

| Industrial Relations | Union Agreements (e.g., RTBU) | Proactive engagement to avoid disruptions |

Environmental factors

Australian government policies on climate change, including national decarbonization objectives, are shaping Aurizon's long-term strategic direction. These policies are a critical factor for the company as it navigates the transition to a lower-carbon economy.

Aurizon has publicly committed to reaching net-zero operational emissions by 2050. This commitment directly supports Australia's broader national climate goals and necessitates significant investment in cleaner energy solutions for its extensive fleet and operational infrastructure.

As of the latest available information, Aurizon is exploring various decarbonization pathways, including the potential use of hydrogen and battery-electric locomotives. These investments are crucial for meeting its net-zero targets and adapting to evolving regulatory and market expectations regarding emissions reduction.

Aurizon's operations, particularly those relying on diesel locomotives, are a significant source of emissions. In 2023, the company reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by 5.1% compared to its 2019 baseline, demonstrating a commitment to improvement.

To further mitigate these emissions, Aurizon is actively investing in cleaner technologies. This includes the development and trialing of battery-electric trains, with pilot programs underway. The company is also exploring the potential of hydrogen-powered locomotives as a future solution.

It's important to note that rail freight, in general, offers a substantial environmental advantage. Compared to road transport, rail freight typically has a lower greenhouse gas emissions intensity per tonne-kilometre, positioning Aurizon as a more sustainable logistics provider.

Responsible water resource management is a key environmental consideration for Aurizon, especially in areas facing water scarcity or under strict water usage rules. The company's operations must focus on using water efficiently and adhering to environmental permits governing water discharge and quality.

In 2023, Aurizon reported its commitment to sustainable operations, including water management, aligning with broader Australian environmental standards. While specific water consumption figures for 2024 are not yet fully detailed, the company's ongoing efforts are geared towards minimizing its water footprint across its extensive rail network.

Biodiversity Protection and Land Rehabilitation

Aurizon's extensive rail network, spanning diverse Australian ecosystems, necessitates a strong focus on biodiversity protection and land rehabilitation. The company is committed to minimizing the ecological footprint of its operations and infrastructure development, actively undertaking measures to restore landscapes impacted by its activities.

In 2023, Aurizon reported investing $21 million in environmental management initiatives, which included biodiversity offsets and rehabilitation projects. This commitment is crucial for maintaining ecological balance across its operational areas, particularly in regions with significant biodiversity value.

- Biodiversity Offsets: Aurizon actively engages in biodiversity offset programs to compensate for unavoidable impacts on native flora and fauna, ensuring that the overall biodiversity value is maintained or enhanced.

- Land Rehabilitation: The company undertakes progressive rehabilitation of disturbed land, aiming to restore it to a stable and ecologically functional state, often focusing on native vegetation regrowth.

- Environmental Monitoring: Continuous monitoring of ecological indicators is a key component of Aurizon's strategy to assess the effectiveness of its environmental management practices and adapt as needed.

- Regulatory Compliance: Adherence to stringent environmental regulations and standards is paramount, guiding Aurizon's approach to biodiversity protection and land rehabilitation efforts.

Extreme Weather Events

Australia's susceptibility to extreme weather, including floods, bushfires, and cyclones, presents substantial environmental risks for Aurizon. These events can severely disrupt operations, damage critical rail infrastructure, and affect the dependability of freight transportation. For instance, the Queensland floods in early 2024 caused significant network outages, impacting coal haulage volumes.

The increasing frequency and intensity of these weather phenomena demand that Aurizon develop and implement robust climate resilience strategies. This includes investing in infrastructure upgrades to withstand extreme conditions and refining emergency response protocols to minimize downtime and ensure safety. The company's 2024 resilience investment program is focused on key vulnerable corridors.

- Increased infrastructure vulnerability due to rising sea levels and more intense rainfall events.

- Operational disruptions leading to delays and increased costs for freight services, particularly impacting the resources sector.

- Need for significant capital expenditure on climate adaptation measures to protect and upgrade rail networks.

- Potential impact on insurance premiums and availability as climate risks escalate.

Aurizon's environmental strategy is deeply intertwined with Australia's climate policies, aiming for net-zero operational emissions by 2050. This involves significant investment in cleaner technologies like hydrogen and battery-electric locomotives, with pilot programs underway and a 5.1% reduction in emissions intensity reported by 2023.

Water resource management and biodiversity protection are also key, with $21 million allocated in 2023 for environmental initiatives including land rehabilitation and biodiversity offsets. The company is also actively addressing the risks posed by extreme weather events, which caused disruptions in early 2024, necessitating resilience investments.

PESTLE Analysis Data Sources

Our PESTLE analysis for Aurizon is grounded in comprehensive data from government transport and infrastructure reports, economic forecasts from reputable financial institutions, and industry-specific publications detailing technological advancements and environmental regulations. We also incorporate analysis of current social trends and legislative changes affecting the rail freight sector.