Aurizon Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurizon Bundle

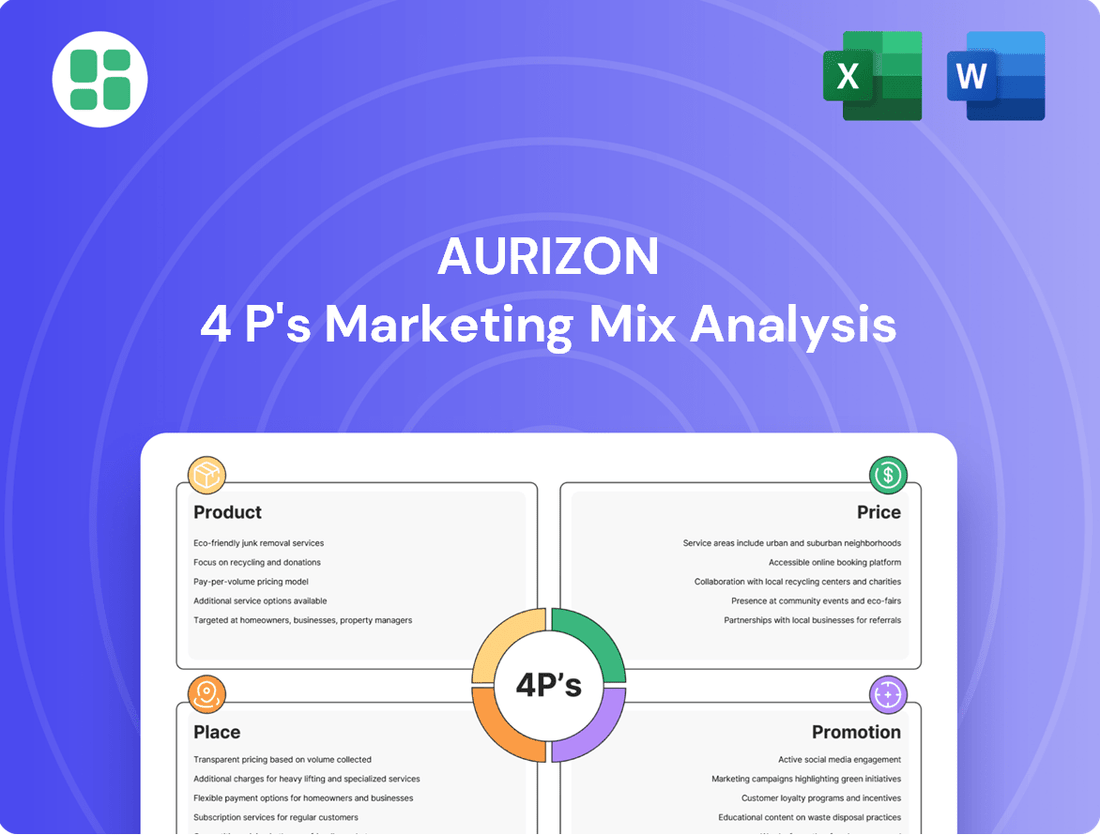

Aurizon's marketing mix is a finely tuned engine, driving its success in the competitive rail freight industry. From its diverse service offerings to strategic pricing, extensive network, and targeted promotions, every element plays a crucial role. Discover the intricate details of how Aurizon leverages its 4Ps to maintain market leadership.

Unlock the full potential of Aurizon's marketing strategy with our comprehensive 4Ps analysis. This in-depth report provides actionable insights into their product portfolio, pricing architecture, distribution network, and promotional campaigns, empowering you with the knowledge to benchmark and strategize effectively.

Product

Aurizon's integrated rail freight and logistics solutions connect vital Australian industries, from mining to agriculture, to global and domestic markets. This means they handle everything from bulk coal and iron ore to grain and general cargo, ensuring efficient movement of essential goods.

The company's strategy extends beyond just moving trains; they offer complete supply chain management. This includes services like port handling and warehousing, providing customers with a seamless, end-to-end logistics experience. For the financial year ending June 30, 2024, Aurizon reported a significant portion of its revenue derived from its bulk haulage segment, underscoring the importance of these integrated commodity movements.

Aurizon's product is fundamentally about specializing in the bulk haulage of essential commodities like coal, iron ore, and grain. This specialization is vital for Australia's economic engine, directly supporting its status as a major global exporter of these resources.

The efficiency and reliability of Aurizon's bulk commodity transport are underpinned by its vast rail infrastructure, meticulously developed to manage immense freight volumes. This strategic focus capitalizes on Aurizon's substantial asset base and deep operational know-how.

In the 2023 financial year, Aurizon reported moving approximately 200 million tonnes of coal, underscoring its significant role in the energy and resources sector. This volume highlights the scale and importance of their bulk commodity specialization.

Aurizon's extensive network access, notably the Central Queensland Coal Network, is a significant asset, allowing third-party operators to utilize its infrastructure. This access is crucial for the broader efficiency of Australia's rail transport system.

Beyond network access, Aurizon provides specialized rail services including design, engineering, construction, management, and maintenance. These infrastructure-focused offerings showcase the company's deep expertise within the rail sector.

In 2023, Aurizon reported a 9% increase in its rail haulage volumes, reaching 178.6 million tonnes, underscoring the utilization of its network and services by various operators.

Growing Containerised Freight and Intermodal Solutions

Aurizon is significantly growing its containerised freight and intermodal solutions, focusing on expanding inter-city and landbridging services to meet increasing demand. This strategic push aims to offer more efficient and adaptable freight transport for a variety of goods, from general merchandise to specialized cargo.

Key to this expansion are investments in advanced intermodal terminals, such as the recently upgraded Melbourne Intermodal Terminal, which enhances connectivity and handling capacity. These developments underscore Aurizon's commitment to providing seamless, integrated logistics across the supply chain.

- Increased Capacity: Aurizon's investment in intermodal infrastructure, like the Melbourne Intermodal Terminal, is designed to boost the volume of containerised freight it can handle.

- Intermodal Growth: The company is actively developing its inter-city and landbridging capabilities, reflecting a broader industry trend towards integrated rail and road solutions.

- Sustainability Focus: By promoting efficient long-haul freight transport, Aurizon's containerised solutions contribute to reduced carbon emissions compared to road-only alternatives.

- Market Reach: These services cater to a diverse range of customers needing flexible and reliable transport for general merchandise and other cargo types.

Customized Supply Chain Offerings

Aurizon's customized supply chain offerings are a key element of its marketing mix, focusing on Product. They develop bespoke logistics solutions by integrating rail with road and port services, addressing unique customer requirements. This flexibility is crucial in today's complex transport environment.

Recent contracts highlight this strategy. For instance, Aurizon secured integrated rail, road, and port logistics solutions for major clients like BHP Copper South Australia. This demonstrates their capability to manage end-to-end supply chains, adding significant value for their partners.

- Integrated Solutions: Combining rail, road, and port services for seamless logistics.

- Customer Focus: Tailoring offerings to meet specific client needs and challenges.

- Recent Wins: Securing contracts with major clients like BHP Copper South Australia for these services.

- Value Enhancement: Optimizing the entire supply chain process to boost customer efficiency and reduce costs.

Aurizon's product offering is multifaceted, encompassing specialized bulk haulage of commodities like coal and iron ore, as well as growing intermodal and containerised freight services. Their integrated logistics solutions extend to port handling and warehousing, providing a comprehensive supply chain management approach.

The company's commitment to its product is evident in its infrastructure investments and operational expertise. For the financial year ending June 30, 2024, Aurizon's bulk haulage segment remained a significant revenue driver, while intermodal services are seeing strategic expansion to cater to diverse cargo needs.

Aurizon's product is defined by its specialization in moving large volumes of essential commodities, supported by extensive rail infrastructure. This focus on bulk haulage, exemplified by moving approximately 200 million tonnes of coal in FY23, is crucial for Australia's export economy.

Furthermore, Aurizon is actively expanding its containerised freight and intermodal solutions, aiming to enhance inter-city and landbridging services. Investments in terminals like the Melbourne Intermodal Terminal underscore this commitment to providing adaptable and efficient freight transport for a broader range of goods.

| Product Segment | Key Characteristics | FY23 Volume/Activity | Strategic Focus |

|---|---|---|---|

| Bulk Haulage | Specialized transport of coal, iron ore, grain | ~200 million tonnes coal (FY23) | Core revenue driver, leveraging extensive infrastructure |

| Intermodal/Containerised | Integrated rail, road, port services for general cargo | 9% increase in rail haulage volumes (178.6 million tonnes in FY23) | Growth in inter-city and landbridging, terminal upgrades |

| Integrated Logistics | End-to-end supply chain management | Secured contracts with BHP Copper SA | Customized solutions, value enhancement for clients |

What is included in the product

This analysis provides a comprehensive examination of Aurizon's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It's designed for professionals seeking a detailed understanding of Aurizon's market positioning, grounded in real-world practices and competitive context.

Streamlines Aurizon's marketing strategy by providing a clear, actionable framework for addressing key challenges in product, price, place, and promotion.

Place

Aurizon commands Australia's most extensive rail freight network, a national asset crucial for linking isolated production hubs to vital domestic and global markets. This vast infrastructure, covering multiple states, ensures broad market access and substantial operational capability.

In 2023, Aurizon reported hauling 156.1 million tonnes of freight, underscoring the sheer volume and reach of its operations across this dominant network. The company's strategic positioning as a critical enabler of Australia's supply chain is directly supported by the scale and integration of its rail infrastructure.

Aurizon's strategic port connections are a cornerstone of its marketing mix, directly linking production sites to major Australian export hubs. This network is crucial for efficiently moving bulk commodities like coal and iron ore to international markets. For instance, in the 2023 financial year, Aurizon moved approximately 195 million tonnes of coal, a significant portion of which flowed through its port-connected rail lines.

Aurizon's strategic placement of intermodal terminals and logistics hubs significantly bolsters its distribution network. These vital nodes facilitate seamless freight transitions between rail, road, and maritime transport, optimizing the supply chain. The company's investment in the Melbourne Intermodal Terminal, a key development in 2024, underscores this commitment to modern, efficient transfer infrastructure.

Direct Customer Interfaces

Aurizon's direct customer interfaces are fundamental to its freight and logistics operations, primarily serving large business-to-business clients through long-term contracts. This direct engagement allows for the development of highly customized solutions and fosters close collaboration on optimizing supply chains. For instance, in the fiscal year 2023, Aurizon reported that its bulk haulage segment, which relies heavily on direct customer relationships, continued to be a significant contributor to revenue.

The company's operational teams work hand-in-hand with clients to manage critical aspects like rail access and transport scheduling. This collaborative approach ensures that Aurizon's services are precisely aligned with customer needs, a necessity for the complex, large-scale B2B freight sector. This direct relationship is particularly vital for securing and maintaining the substantial volumes characteristic of bulk commodity transport.

- Direct Contractual Agreements: Aurizon secures its freight services through direct, often multi-year contracts with major industrial customers.

- Tailored Solutions: The direct model enables the company to design and deliver specific logistics and rail transport solutions for each client's unique requirements.

- Operational Collaboration: Aurizon's teams engage directly with customers to manage the intricacies of rail operations and supply chain integration.

- B2B Focus: This direct interface is a strategic imperative for serving the large-scale, high-volume demands of the business-to-business freight market.

Geographic Reach in Key Resource Regions

Aurizon's geographic reach is strategically anchored in Australia's vital resource hubs. Its operational footprint heavily concentrates in Queensland's prolific coal-producing regions, a long-standing core market. This presence is expanding into Western Australia, catering to the growing demand for iron ore and other bulk commodities. This focused approach ensures Aurizon remains close to its key mining and agricultural clients.

This geographical concentration allows Aurizon to offer highly efficient and specialized transport solutions. The company's extensive rail network is specifically designed to manage the high-volume freight movements characteristic of these resource sectors. For instance, in FY23, Aurizon moved approximately 192 million tonnes of coal, primarily from Queensland's Bowen Basin, highlighting the significance of its regional density.

- Queensland Coal Network: Aurizon operates a significant portion of its rail infrastructure within Queensland's major coal-producing areas, facilitating seamless export logistics.

- Western Australian Expansion: The company is increasing its involvement in Western Australia, serving the burgeoning iron ore and other bulk commodity markets.

- Customer Proximity: This strategic geographic focus ensures Aurizon is positioned to provide timely and cost-effective services directly to its primary resource-based customers.

- Freight Corridor Specialization: Aurizon's network is optimized for the unique demands of high-volume bulk commodity transport along these critical freight corridors.

Aurizon's extensive rail network forms the backbone of its 'Place' strategy, connecting key production areas to export terminals. This infrastructure is not merely a route but a critical asset enabling efficient bulk commodity movement. The company's 2024 investments in network upgrades, such as the Melbourne Intermodal Terminal, further enhance its logistical capabilities, ensuring seamless integration across different transport modes.

The strategic placement of Aurizon's terminals and its direct access to major ports are crucial for its bulk haulage operations. This integrated network is vital for the efficient export of commodities like coal and iron ore. In the financial year 2023, Aurizon's operations facilitated the movement of approximately 192 million tonnes of coal, underscoring the scale of its port-connected logistics.

Aurizon's network is strategically concentrated in resource-rich regions, particularly Queensland's coal basins and Western Australia's iron ore territories. This geographic focus allows for specialized, high-volume freight solutions tailored to mining and agricultural clients. The company's commitment to these corridors ensures it remains a primary logistics partner for Australia's export industries.

| Metric | FY23 Value | Significance |

|---|---|---|

| Total Freight Hauled (Million Tonnes) | 156.1 | Demonstrates broad operational reach. |

| Coal Hauled (Million Tonnes) | 192 | Highlights concentration in key export commodity. |

| Network Reach | National | Enables access to diverse production hubs and markets. |

Full Version Awaits

Aurizon 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Aurizon 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Aurizon's promotional strategy for its B2B services centers on direct engagement and cultivating enduring client relationships. Dedicated account managers are key, diligently working with major industrial, mining, and agricultural partners to tailor freight and logistics solutions.

This relationship-driven approach underscores a commitment to long-term value, emphasizing reliability and efficiency to secure and retain substantial contracts. Aurizon's focus on these high-value partnerships is crucial for its market position.

Aurizon's promotional efforts heavily target the financial community, utilizing investor relations and financial communications as a core component. This involves consistent market briefings, timely half-year and full-year results, dedicated investor days, and active participation in industry conferences. These initiatives are designed to foster transparency, clearly articulate financial performance, and ultimately attract and retain investment.

Key to this communication strategy are ASX announcements, serving as a primary channel for disseminating crucial financial information and strategic updates to shareholders and the broader market. For instance, Aurizon's FY23 results, announced in February 2024, detailed a statutory profit after tax of $975 million and a dividend payout ratio of 75%, underscoring their commitment to shareholder returns and financial transparency.

Aurizon leverages its annual reports, sustainability reports, and modern slavery statements to communicate its core values, operational prowess, and dedication to sustainability. These documents meticulously detail Environmental, Social, and Governance (ESG) efforts, including significant progress towards achieving net-zero operational emissions by 2050 and robust community engagement initiatives, reinforcing its image as a responsible corporate citizen.

Public Relations and Industry Engagement

Aurizon actively manages its public image through strategic public relations, regularly issuing news releases to announce significant achievements like new contract wins and key partnerships. For instance, in 2024, the company secured a multi-year contract with a major resources company, bolstering its revenue streams and market position.

The company's commitment to industry engagement is evident in its participation in crucial working groups and its collaboration with regulatory bodies. These efforts are instrumental in shaping rail access frameworks and championing rail safety initiatives, reflecting Aurizon's proactive approach to industry development.

By engaging in these activities, Aurizon aims to elevate its standing within the logistics and transport sectors and influence policy decisions. A key focus of this engagement is promoting the significant environmental advantages of rail transport over road freight, aligning with broader sustainability goals.

- Contract Wins: Aurizon's 2024 contract with a major resources client is a testament to its strengthened market presence.

- Industry Influence: Active participation in regulatory bodies helps shape favorable rail access and safety policies.

- Environmental Advocacy: Aurizon highlights rail's lower carbon footprint, a key selling point in 2024's sustainability-focused market.

- Partnership Development: Strategic alliances announced in early 2025 further solidify Aurizon's operational capabilities.

Digital Presence and Stakeholder Communication

Aurizon leverages its corporate website as a primary digital channel, offering a comprehensive resource for news, financial reports, career information, and investor relations. This platform facilitates direct and efficient communication with a wide array of stakeholders, including customers, suppliers, employees, and the general public.

The company utilizes its digital presence to ensure timely and accessible information dissemination, fostering transparency and engagement. For instance, features like an emissions calculator on their website highlight rail's environmental benefits, a key aspect of their stakeholder communication strategy in 2024.

- Website as a Central Hub: Aurizon's corporate website acts as a comprehensive source for all essential company information.

- Direct Stakeholder Engagement: Digital channels enable direct communication with customers, suppliers, employees, and the community.

- Information Accessibility: The digital platform ensures that information is readily available and shared in a timely manner.

- Demonstrating Environmental Advantages: Tools like an emissions calculator showcase rail's positive environmental impact, enhancing communication efforts.

Aurizon's promotional strategy is multifaceted, focusing on building strong B2B relationships through dedicated account managers and engaging the financial community via investor relations. Their communication efforts highlight operational efficiency, reliability, and a commitment to sustainability, crucial for securing long-term contracts and investor confidence.

Key promotional activities include consistent market briefings, detailed financial reports, and active participation in industry events. For example, Aurizon's FY23 results, released in February 2024, reported a statutory profit after tax of $975 million, demonstrating financial strength and transparency to stakeholders.

The company also emphasizes its ESG initiatives through annual and sustainability reports, showcasing progress towards net-zero emissions by 2050 and community engagement. Public relations efforts, such as announcing new contract wins in 2024 with major resources companies, bolster their market image and revenue prospects.

Aurizon's corporate website serves as a central digital hub, providing stakeholders with easy access to news, financial data, and information on their environmental advantages, like an emissions calculator, reinforcing their commitment to transparency and sustainability in 2024.

| Promotional Activity | Key Focus | 2023/2024 Highlights |

|---|---|---|

| B2B Relationship Management | Tailored logistics solutions, reliability | Secured multi-year contract with major resources company (2024) |

| Investor Relations | Financial performance, transparency, shareholder returns | FY23 Statutory Profit after tax: $975 million; Dividend payout ratio: 75% (Feb 2024) |

| ESG Communication | Sustainability, net-zero targets, community impact | Progress towards net-zero operational emissions by 2050 |

| Public Relations | Contract wins, partnerships, industry achievements | Announced new contract wins and key partnerships throughout 2024 |

| Digital Presence | Information accessibility, stakeholder engagement, environmental advocacy | Website features emissions calculator highlighting rail benefits |

Price

Aurizon's pricing strategy heavily relies on long-term contracts for its rail freight and network access, especially for bulk commodities. These agreements often feature take-or-pay clauses, which guarantee revenue by obligating customers to pay for reserved capacity, even if it's not fully utilized. For example, in the 2023 financial year, Aurizon reported that a significant portion of its revenue was secured through these long-term contracts, providing a stable base for its operations.

Regulated Access Undertakings are a cornerstone of Aurizon's Network revenue strategy, notably the Queensland Competition Authority's Access Undertaking (UT5). This framework dictates pricing and access terms for third parties using Aurizon's rail infrastructure, directly impacting the Product element of their marketing mix. For instance, UT5's pricing structure is tied to a regulated asset base and allowable revenues, subject to periodic reviews, ensuring a predictable yet regulated revenue stream.

Aurizon's Value-Based and Integrated Pricing strategy moves beyond simple per-tonne-kilometre charges. It focuses on the total value delivered through their integrated logistics and supply chain solutions, aiming to capture benefits like efficiency and reliability.

This approach allows Aurizon to price based on the tangible advantages customers gain, such as reduced environmental impact and improved supply chain performance, rather than just the distance goods travel.

For sophisticated customer needs, pricing is often bundled to encompass a full suite of services, including rail, road, and port operations, offering a holistic solution.

In the 2023-2024 financial year, Aurizon reported that its bulk haulage segment, a key area for integrated solutions, saw significant volumes, highlighting the demand for these value-driven services.

Competitive Market Considerations

While Aurizon operates largely within a regulated framework, its pricing strategies are significantly influenced by competitive pressures in the broader Australian freight sector. For bulk and containerized goods, road transport presents a viable alternative, forcing Aurizon to maintain competitive rates to secure and retain business. This means balancing the need for cost recovery and profitability with the imperative to offer attractive pricing.

Market demand and the pricing of rival services are critical inputs when Aurizon negotiates new contracts and renews existing ones.

- Competitive Freight Market: Aurizon faces competition from road transport, particularly for bulk and containerized freight, impacting its pricing flexibility.

- Balancing Profitability and Competitiveness: The company must align its cost recovery and profit objectives with the need to offer market-competitive rates to attract and retain customers.

- Contractual and Regulatory Environment: Pricing decisions are made within a regulated structure, but also consider market dynamics and competitor actions.

Inflation Indexation and Cost Recovery Mechanisms

Aurizon's contracts frequently feature indexation clauses, directly addressing inflation's impact on operating expenses like fuel, labor, and maintenance. This strategy safeguards Aurizon's profit margins by ensuring costs are adjusted upwards in line with inflation. For example, in the 2024 financial year, the Australian Consumer Price Index (CPI) averaged around 3.5%, a key benchmark for such indexation.

Furthermore, Aurizon's regulated network business incorporates specific mechanisms designed for the recovery of maintenance and capital expenditures. These built-in cost recovery frameworks are vital for ensuring the financial viability and long-term sustainability of its extensive, capital-intensive infrastructure operations.

- Inflation Protection: Indexation clauses in contracts protect Aurizon’s margins against rising operating costs, such as fuel and labor.

- Cost Recovery: Regulated network operations include mechanisms to recover maintenance and capital costs over time.

- Financial Sustainability: These mechanisms are critical for maintaining the long-term financial health of capital-intensive infrastructure.

- Economic Context: The average Australian CPI for FY24, around 3.5%, provides a reference point for inflation adjustments.

Aurizon's pricing for bulk haulage is largely driven by long-term contracts, often with take-or-pay clauses ensuring revenue stability. For its regulated network, pricing is governed by frameworks like UT5, linked to a regulated asset base and allowable revenues, with recent reviews influencing these structures. The company also employs value-based pricing, bundling services for integrated logistics solutions to reflect the total value delivered to customers.

Aurizon's pricing strategy is a careful balance between contractual obligations, regulatory requirements, and market competitiveness. Inflation protection through indexation clauses, referencing benchmarks like the FY24 Australian CPI of approximately 3.5%, is crucial for maintaining margins. The company must also ensure cost recovery for its extensive infrastructure, particularly for maintenance and capital expenditures, while remaining competitive against alternatives like road transport.

| Pricing Strategy Element | Description | Example/Impact |

|---|---|---|

| Long-Term Contracts | Secures revenue through agreements with take-or-pay clauses. | Provides a stable revenue base for bulk commodities. |

| Regulated Network Pricing | Governed by frameworks like UT5, tied to asset base and allowable revenues. | Ensures predictable revenue streams for network access. |

| Value-Based Pricing | Focuses on total value delivered through integrated solutions. | Captures benefits like efficiency and reliability, not just distance. |

| Inflation Indexation | Contracts include clauses to adjust prices based on inflation. | Protects profit margins against rising operating costs (e.g., FY24 CPI ~3.5%). |

| Cost Recovery | Mechanisms within regulated operations to recover maintenance and capital costs. | Ensures financial sustainability of capital-intensive infrastructure. |

| Competitive Positioning | Balancing profitability with market-competitive rates against road transport. | Essential for securing and retaining business in a competitive freight sector. |

4P's Marketing Mix Analysis Data Sources

Our Aurizon 4P's Marketing Mix Analysis is built upon a foundation of publicly available company data, including annual reports, investor presentations, and official press releases. We also incorporate insights from industry publications and competitive intelligence reports to ensure a comprehensive understanding of Aurizon's strategic positioning.