Aurenis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurenis Bundle

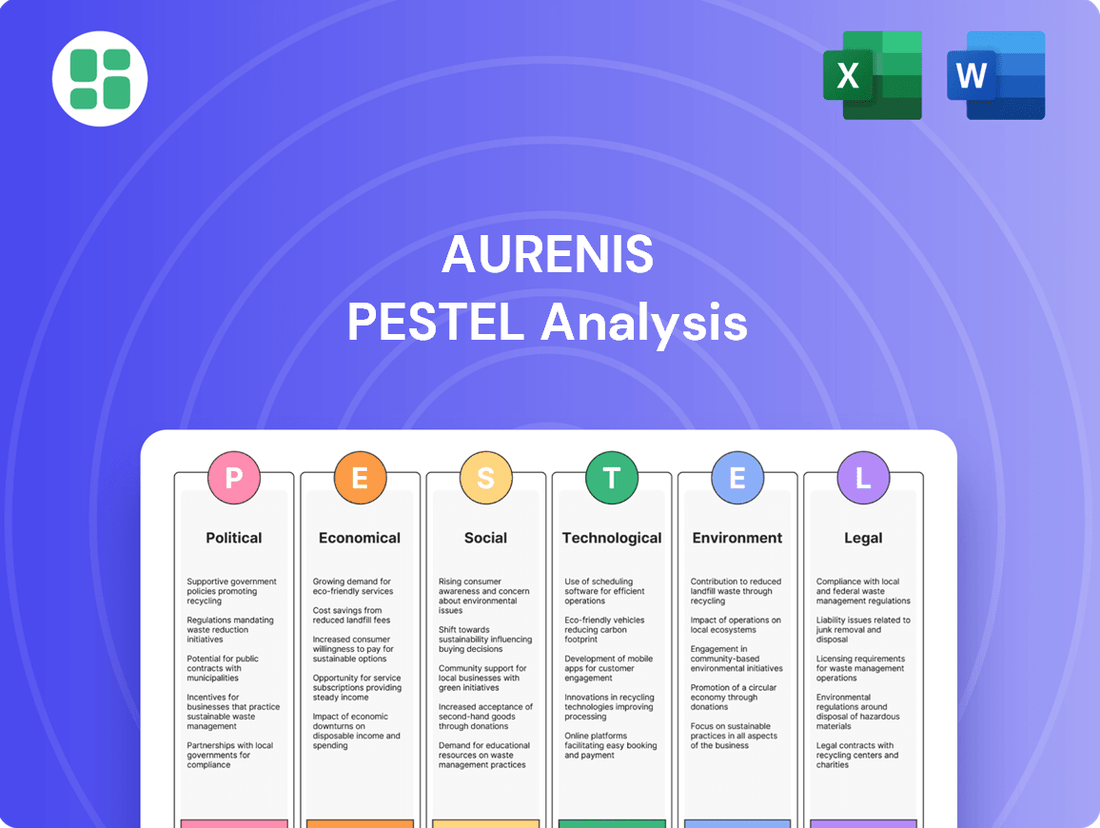

Uncover the critical external forces shaping Aurenis's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact its operations and growth. Gain the strategic foresight needed to navigate these complexities and make informed decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

France, in line with broader European Union goals, is actively pushing for a circular economy through enhanced recycling mandates and extended producer responsibility (EPR) frameworks. These initiatives, exemplified by the AGEC law, directly bolster Aurenis's primary operations by prioritizing waste reduction and resource reclamation.

The European Commission's recent approval of a €500 million investment in chemical recycling for the textile and plastic sectors in France presents a significant growth avenue for companies like Aurenis, potentially unlocking new revenue streams and operational efficiencies.

France's shift to an opt-in system for commercial calls from January 1, 2026, significantly impacts telemarketing operations. This move requires Aurenis to ensure explicit consent from individuals before engaging in telemarketing, a substantial change from previous opt-out models.

Coupled with existing General Data Protection Regulation (GDPR) mandates, these stricter rules necessitate advanced data privacy and consent management. Non-compliance with these regulations can result in severe financial penalties, potentially impacting Aurenis's service delivery for foreign publishers.

Global trade policies significantly impact Aurenis's operations. Potential tariffs or restrictions on importing and exporting waste materials and recycled metals could disrupt supply chains and limit market access. For instance, the EU's new Regulation on waste shipments, effective May 2024, aims to streamline and ensure responsible cross-border waste movements, influencing how Aurenis sources and disposes of materials internationally.

While the European Union is prioritizing domestic recycling and circular economy initiatives, international demand and regulations for secondary raw materials remain crucial. The global market for recycled metals, for example, is substantial, with the London Metal Exchange (LME) listing several recycled metal contracts, indicating the growing importance of these materials in international trade and the potential for policy shifts to create both opportunities and challenges for companies like Aurenis.

Government Incentives and Subsidies for Recycling

Governments, especially within the European Union, are actively providing financial incentives and subsidies to bolster the recycling sector. These programs are designed to encourage investments in cutting-edge recycling technologies, ultimately enhancing operational efficiency and minimizing environmental footprints, particularly for metal reuse.

For companies like Aurenis, this governmental backing translates into reduced operational expenses and a more favorable environment for expansion. For instance, the EU's Circular Economy Action Plan, with its ambitious targets for waste reduction and increased recycling rates, directly supports businesses committed to sustainable practices.

- EU Green Deal funding: Significant financial support is available for projects focused on circular economy principles and advanced recycling infrastructure.

- National subsidies: Individual member states, such as France, offer their own grants and tax breaks for recycling initiatives, further lowering capital investment barriers.

- Research and Development grants: Funding is allocated to innovative recycling technologies, fostering advancements that can benefit companies like Aurenis in adopting more efficient processes.

Political Stability and Geopolitical Events

Political stability within France and the European Union fosters a predictable environment for businesses like Aurenis, aiding long-term strategic planning and investment. This stability is a key factor in maintaining consistent operational frameworks and access to markets.

Geopolitical events, such as the ongoing conflict between Russia and Ukraine, directly influence global commodity prices and disrupt supply chains, particularly for precious metals vital to Aurenis's recycling operations. For instance, the price of gold saw significant fluctuations in 2024 due to these tensions, impacting the cost of raw materials.

- Impact on Precious Metals: Geopolitical instability can lead to increased volatility in gold and silver prices, affecting Aurenis's procurement costs and the value of recycled materials.

- Supply Chain Disruptions: Events like the Russia-Ukraine war can hinder the transportation and availability of essential components or even the precious metals themselves, creating operational challenges.

- Regulatory Shifts: Political changes or international agreements stemming from geopolitical events can alter environmental regulations or trade policies relevant to Aurenis's industry.

- Market Sentiment: Broader geopolitical uncertainty can influence investor confidence and consumer spending on luxury goods or industrial products that utilize recycled precious metals, impacting demand.

Governmental policies in France and the EU are increasingly focused on promoting a circular economy, directly benefiting Aurenis's recycling and resource recovery operations. Initiatives like the AGEC law and substantial investments in chemical recycling, such as the €500 million allocated by the European Commission, create a supportive regulatory and financial landscape.

New regulations, like France's opt-in system for commercial calls effective January 1, 2026, and the EU's updated waste shipment regulation from May 2024, necessitate stringent data privacy and consent management, impacting telemarketing and cross-border material movements.

Geopolitical events, notably the Russia-Ukraine conflict, have caused significant price volatility for precious metals in 2024, impacting Aurenis's raw material costs and the overall market value of recycled materials.

Financial incentives and subsidies from both the EU and national governments, such as EU Green Deal funding and French national subsidies, are crucial for lowering capital investment barriers and fostering innovation in recycling technologies.

| Policy/Regulation | Impact on Aurenis | Effective Date/Period | Key Data Point |

|---|---|---|---|

| AGEC Law (France) | Prioritizes waste reduction & resource reclamation | Ongoing | Aims to increase recycling rates across various sectors. |

| EU Chemical Recycling Investment | Unlocks new revenue streams in textile/plastic recycling | Recent Approval | €500 million investment allocated. |

| French Opt-in for Commercial Calls | Requires explicit consent for telemarketing | January 1, 2026 | Significant shift from opt-out models. |

| EU Waste Shipment Regulation | Streamlines responsible cross-border waste movements | May 2024 | Influences international sourcing and disposal. |

| Russia-Ukraine Conflict | Increased volatility in precious metal prices | 2024 | Example: Gold price fluctuations due to geopolitical tensions. |

What is included in the product

This comprehensive PESTLE analysis of Aurenis examines the influence of political, economic, social, technological, environmental, and legal factors on its strategic landscape.

Aurenis PESTLE analysis provides a structured framework to identify and mitigate external threats, acting as a proactive pain point reliever by highlighting potential market disruptions before they impact business operations.

Economic factors

Aurenis's metal recycling business faces significant profitability challenges due to the inherent volatility in precious and non-ferrous metal prices. For instance, the price of copper, a key component in many recycled streams, saw significant fluctuations throughout 2024, impacting margins.

Looking ahead, a bearish sentiment regarding recycled commodity pricing is projected for the final quarter of 2024 and extending into 2025, as noted by industry leaders in waste management. This suggests potential downward pressure on Aurenis's revenue streams from recycled materials.

However, Aurenis can mitigate some of these pricing pressures by leveraging advancements in automation to enhance the quality of its recycled metal streams. Improved purity and consistency in output can command better pricing, even in a down market, potentially offsetting some of the bearish outlook.

The global appetite for recycled metals and materials is on a significant upswing, fueled by a growing emphasis on resource conservation and ambitious sustainability targets. This trend directly benefits companies like Aurenis, as industries actively seek to reduce their environmental footprint and secure more stable supply chains. For instance, the European Union aims to increase the recycling rate of metals to 70% by 2030, a clear indicator of this demand shift.

Key sectors such as electronics, construction, automotive, and the burgeoning renewable energy industry are increasingly integrating recycled content into their manufacturing processes. This integration creates a consistent and expanding market for Aurenis’s recycled output. In 2024, the global market for recycled metals was valued at over $400 billion, with projections indicating continued robust growth through 2025 and beyond, driven by these industrial adoption patterns.

Global economic growth directly impacts the volume of industrial waste available for recycling, a key input for Aurenis. In 2024, the IMF projected global GDP growth at 3.2%, suggesting a steady demand for raw materials and, consequently, a consistent supply of recyclable waste. This economic expansion fuels production across various sectors, creating more material byproducts that can be channeled into Aurenis's operations.

Industrial output, a more direct measure, also plays a crucial role. For instance, the manufacturing sector's performance, which saw a 1.1% increase in the US industrial production index in April 2024 compared to the previous year, directly translates to more potential waste streams. Higher industrial activity means more manufacturing processes, leading to a greater quantity of scrap materials and byproducts that Aurenis can process.

Conversely, economic downturns can significantly reduce waste availability. A projected slowdown in certain key economies in late 2024 or early 2025 could lead to decreased production and consumption, thereby shrinking the feedstock for recycling businesses like Aurenis. For example, if manufacturing output contracts by 2% in a major region, Aurenis might face a corresponding dip in the volume of recyclable materials.

Cost of Energy and Labor

The cost of energy and labor are critical operational factors for Aurelis. Recycling facilities, particularly those involved in metal processing, are energy-intensive operations. Similarly, call centers rely heavily on human capital, making labor a primary expense. Managing these costs effectively is paramount for maintaining profitability in both sectors.

In 2024, global energy prices have remained volatile, impacting the operational budgets of recycling plants. For instance, the average industrial electricity price in the European Union was approximately €0.25 per kilowatt-hour in early 2024, a figure that directly affects the energy-intensive nature of metal recycling. Concurrently, labor costs continue to rise. In 2024, average hourly wages for customer service representatives in developed economies have seen an increase of 3-5% year-over-year, putting pressure on call center overheads.

- Energy Consumption: Metal recycling processes, such as smelting and shredding, are significant energy consumers.

- Labor Intensity: Call centers require a substantial workforce, making wages a major component of their operating expenses.

- Cost Pressures: Fluctuations in energy markets and upward wage trends directly impact Aurelis's bottom line.

- Strategic Importance: Efficient energy sourcing and competitive labor management are key to sustained profitability.

Market Growth in Outsourced Call Center Services

The French call and contact center outsourcing market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) of approximately 10.4% between 2025 and 2030. This upward trajectory suggests a burgeoning demand for specialized services, including telemarketing and outsourced call center operations.

This economic climate presents a favorable environment for companies like Aurenis, particularly for its publishing support division, which can leverage this growth. The increasing reliance on outsourced customer interaction solutions underscores a key economic factor driving opportunities in this sector.

- Projected Market Growth: The French outsourced call center market is expected to grow at a CAGR of roughly 10.4% from 2025 to 2030.

- Revenue Potential: This growth is anticipated to translate into significant revenue figures within the sector.

- Demand for Services: The expansion signifies a rising demand for telemarketing and outsourced call center functions.

- Economic Foundation: This trend provides a strong economic basis for Aurenis's publishing support services.

Global economic growth directly influences the volume of industrial waste available for recycling, a crucial input for Aurelis. The IMF projected global GDP growth at 3.2% for 2024, indicating steady demand for raw materials and a consistent supply of recyclable waste. This expansion fuels production across sectors, creating more byproducts for Aurelis's operations.

Same Document Delivered

Aurenis PESTLE Analysis

The preview you see here is the exact Aurenis PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive understanding of Aurenis's operating environment.

The content and structure shown in the preview is the same Aurenis PESTLE Analysis document you’ll download after payment, offering actionable insights into political, economic, social, technological, legal, and environmental factors.

Sociological factors

Growing public awareness of environmental issues like waste pollution and climate change is significantly influencing consumer choices. This heightened concern translates into a stronger demand for sustainable practices and products made from recycled materials.

This societal shift creates a particularly favorable market for Aurenis's recycling operations. As consumers and businesses alike increasingly prioritize eco-friendly solutions, Aurenis is well-positioned to meet this growing demand.

For instance, a 2024 report indicated that 78% of consumers are more likely to purchase from brands committed to sustainability, and this trend is projected to continue its upward trajectory through 2025.

Consumer willingness to participate in recycling and embrace products made from recycled materials is a significant driver for circular economy initiatives. In 2023, global recycling rates for plastics varied, with some regions achieving over 40% but many lagging, highlighting the need for increased consumer engagement.

Governmental nudges, such as France's mandatory bio-waste separation from January 1, 2024, are designed to cultivate more responsible waste management practices. This policy is expected to divert a substantial portion of organic waste from landfills, contributing to a more circular approach to resource management.

The availability of skilled workers is crucial for Aurenis, particularly for specialized recycling tasks like managing hazardous waste or operating complex machinery. In 2024, the global shortage of skilled technicians in advanced manufacturing and environmental services continued to be a significant challenge, impacting operational capacity for companies like Aurenis.

Furthermore, Aurenis's need for multilingual call center staff highlights another sociological aspect. The demand for customer service representatives fluent in various languages, especially those supporting international operations, remains high. In 2025, reports indicate that companies are increasingly investing in robust training programs to upskill their existing workforce and attract new talent, recognizing that retaining skilled employees is key to maintaining service quality and operational efficiency.

Demand for Corporate Social Responsibility (CSR)

Societal expectations are increasingly pushing companies towards robust corporate social responsibility (CSR) initiatives and transparent Environmental, Social, and Governance (ESG) reporting. Investors and consumers alike are demanding that businesses operate ethically and sustainably. For Aurenis, their established recycling operations provide a tangible foundation for a compelling CSR narrative, directly addressing environmental concerns.

The growing emphasis on ESG means that companies with strong environmental credentials, like Aurenis's recycling efforts, are often viewed more favorably. This trend is reflected in investment flows, with sustainable funds experiencing significant growth. For instance, global sustainable fund assets reached over $3.7 trillion by the end of 2023, indicating a clear market preference for responsible businesses.

- Investor Scrutiny: A significant majority of institutional investors now integrate ESG factors into their investment decisions, with over 80% considering ESG in their portfolio construction as of early 2024.

- Consumer Preferences: Surveys consistently show that a growing percentage of consumers, often upwards of 60-70%, are willing to pay more for products and services from companies with strong CSR commitments.

- Regulatory Tailwinds: Governments worldwide are introducing regulations that mandate or encourage ESG disclosure, further amplifying the demand for demonstrable social responsibility.

- Brand Reputation: Positive CSR engagement directly correlates with enhanced brand reputation and customer loyalty, crucial intangible assets in competitive markets.

Cultural Acceptance of Outsourced Services

The cultural perception of outsourcing in France significantly impacts Aurenis's potential market penetration for call center and telemarketing services. While global trends favor outsourcing for cost efficiency, French consumers and businesses often exhibit a preference for domestic service providers, particularly concerning customer interactions and data handling.

This cultural inclination is often rooted in concerns about data privacy and a desire to maintain direct relationships with companies. For instance, a 2024 survey by OpinionWay indicated that 65% of French consumers prefer interacting with customer service representatives located within France, citing trust and understanding of local nuances as key factors.

Aurenis must navigate this cultural landscape by highlighting the benefits of its services while addressing potential reservations. Emphasizing data security compliance with stringent EU regulations like GDPR, and showcasing how local French teams can be integrated into outsourced operations, will be crucial for building trust and acceptance.

- Consumer Preference: 65% of French consumers in a 2024 survey preferred domestic customer service agents.

- Data Privacy Concerns: Strong adherence to GDPR is paramount for market acceptance.

- Trust and Nuance: Cultural value placed on local understanding influences outsourcing adoption.

- Market Strategy: Aurenis needs to balance cost-efficiency with culturally sensitive service delivery.

Societal trends are increasingly prioritizing sustainability and ethical business practices, directly impacting consumer purchasing decisions and investor sentiment. Aurenis's focus on recycling aligns with this, as 78% of consumers in a 2024 report favored sustainable brands.

The demand for skilled labor in environmental services remains a challenge, with a global shortage of technicians impacting operational capacity in 2024.

Consumer preference for domestic service providers in France, with 65% favoring local customer service in a 2024 survey, necessitates a culturally sensitive approach for Aurenis's outsourcing services.

ESG investing continues to grow, with global sustainable fund assets exceeding $3.7 trillion by the end of 2023, underscoring the financial benefits of responsible operations.

| Sociological Factor | Impact on Aurenis | Supporting Data (2023-2025) |

|---|---|---|

| Environmental Awareness | Increased demand for recycling services | 78% of consumers prefer sustainable brands (2024) |

| Skilled Labor Availability | Operational capacity challenges | Global shortage of environmental technicians (2024) |

| Consumer Preference (France) | Need for localized customer service strategy | 65% prefer domestic customer service (France, 2024) |

| ESG Investment Growth | Enhanced investor appeal for sustainable operations | Global sustainable fund assets > $3.7 trillion (End of 2023) |

Technological factors

Technological progress in recycling is accelerating, with AI-driven sorting, robotics, and sophisticated optical scanners transforming waste management. These advancements are boosting precision and speed, enabling Aurenis to handle more diverse waste streams and yield superior recycled materials.

For instance, by 2024, the global waste management market, heavily influenced by recycling tech, was projected to reach over $1.6 trillion, with recycling technologies being a key driver of this growth. These innovations directly improve Aurenis's operational efficiency and the quality of its output, making it more competitive.

Smart waste bins, increasingly equipped with sensors and IoT capabilities, are revolutionizing collection efficiency. For Aurenis, this means optimized routes and schedules, directly cutting operational costs and reducing emissions. For instance, cities adopting smart bin technology have reported savings of up to 30% on fuel costs by eliminating unnecessary stops.

Real-time data from these bins provides actionable insights into fill levels and waste composition. This allows for predictive maintenance on collection vehicles, minimizing downtime and further enhancing the efficiency of Aurenis's entire waste management value chain, ensuring smoother operations and improved service delivery.

The call center industry's rapid embrace of digitalization and automation, featuring AI, voice bots, and advanced CRM systems, is fundamentally reshaping operational efficiency and customer engagement. For Aurenis, this trend presents a significant opportunity to bolster its outsourced call center solutions, offering foreign publishers more streamlined and scalable services.

By integrating these technologies, Aurenis can expect to see improvements in key performance indicators. For instance, studies from 2024 indicate that AI-powered chatbots can handle up to 80% of routine customer inquiries, significantly reducing wait times and freeing up human agents for more complex issues. This efficiency gain is crucial for Aurenis in delivering cost-effective and high-quality support to its international clientele.

Data Security and Traceability Technologies

Technologies like blockchain are increasingly being used to boost transparency and accountability in tracking materials through the recycling supply chain. This technology creates permanent, unchangeable records of every transaction, offering a clear audit trail. For instance, in 2024, the global blockchain in supply chain market was valued at approximately $2.5 billion and is projected to grow significantly, indicating strong adoption trends.

For call center operations, which often handle sensitive client and customer data, strong cybersecurity measures and data encryption are absolutely vital. These protections are essential to prevent breaches and maintain trust. In 2025, the average cost of a data breach globally is estimated to be around $4.5 million, highlighting the substantial financial and reputational risks associated with inadequate security.

- Blockchain Adoption: Enhances transparency and immutability in recycling material tracking.

- Cybersecurity Importance: Critical for call centers to protect sensitive client data.

- Data Encryption: A key component in safeguarding information against unauthorized access.

- Market Growth: The blockchain in supply chain market is expanding rapidly, with projections showing continued upward momentum.

Development of New Recycling Processes (e.g., Chemical Recycling)

The advancement of novel recycling techniques, particularly chemical recycling for plastics and textile waste, opens up significant opportunities for Aurenis to broaden its material processing capacity. This innovation allows for the breakdown of complex waste streams into their original components, creating higher-value recycled materials.

Governments are actively backing these developments. For instance, France has committed €500 million to support the growth of chemical recycling technologies, signaling a robust and expanding market for these advanced methods.

- Emerging Technologies: Chemical recycling offers a pathway to process previously unrecyclable waste, enhancing Aurenis's circular economy offerings.

- Market Validation: Significant government investment, like France's €500 million program, validates the economic viability and future demand for these processes.

- Competitive Advantage: Early adoption of these technologies can provide Aurenis with a distinct advantage in the evolving waste management and material recovery sector.

- Resource Efficiency: These processes can yield purer raw materials, potentially reducing Aurenis's reliance on virgin resources and improving overall operational efficiency.

Technological advancements in waste sorting, like AI and robotics, are significantly improving efficiency and material quality for Aurenis. Smart bins with IoT capabilities are optimizing collection routes, leading to cost savings and reduced emissions, with some cities seeing up to 30% fuel cost reductions.

Digitalization and automation in call centers, including AI chatbots, are enhancing customer engagement and operational efficiency for Aurenis's outsourced services. By 2024, AI chatbots could handle up to 80% of routine inquiries, drastically cutting wait times.

Emerging technologies like blockchain are boosting transparency in recycling supply chains, with the market valued at approximately $2.5 billion in 2024. Robust cybersecurity and data encryption are paramount for call centers, as the average cost of a data breach in 2025 is estimated at $4.5 million.

| Technology Area | Impact on Aurenis | Key Data/Trend (2024-2025) |

| AI & Robotics in Recycling | Increased sorting precision, speed, and material yield. | Global waste management market projected over $1.6 trillion (2024). |

| IoT & Smart Bins | Optimized collection routes, reduced operational costs and emissions. | Up to 30% fuel savings reported by cities adopting smart bins. |

| AI & Automation in Call Centers | Enhanced customer engagement, improved efficiency, scalable services. | AI chatbots handling up to 80% of routine inquiries (2024). |

| Blockchain in Supply Chain | Improved transparency and traceability in material tracking. | Blockchain in supply chain market valued at ~$2.5 billion (2024). |

| Cybersecurity & Data Encryption | Essential for protecting sensitive client data and maintaining trust. | Average cost of data breach estimated at $4.5 million (2025). |

Legal factors

Aurelis operates within a stringent legal landscape shaped by French national and EU waste management directives. These regulations set ambitious recycling rate targets and push for significant reductions in landfill waste. For instance, the EU's Waste Framework Directive outlines hierarchical approaches to waste, prioritizing prevention, reuse, and recycling over disposal.

The upcoming Packaging and Packaging Waste Regulation (PPWR), set to be fully effective in February 2025, will impose even more specific recycling obligations on companies like Aurelis. This legislation aims to harmonize packaging design and waste management across member states, influencing material choices and operational strategies to meet new recycling quotas and potentially increase compliance costs.

France and the broader EU are actively expanding and reinforcing Extended Producer Responsibility (EPR) schemes. These regulations place the onus on producers to manage their products throughout their entire lifecycle, critically including the crucial end-of-life recycling phase. This focus on producer accountability is a significant legal development.

For Aurenis, these strengthened EPR schemes present a dual benefit. They can create a more predictable and stable supply of recycled materials, essential for manufacturing processes. Furthermore, the funding mechanisms inherent in these schemes can directly support and enhance the recycling infrastructure that Aurenis relies upon.

Aurenis's outsourced call center operations must meticulously comply with the General Data Protection Regulation (GDPR) and France's own stringent data protection legislation. This means robust data handling protocols are essential to protect customer information.

France's evolving legal landscape, notably the planned shift to an opt-in consent model for telemarketing by 2026, will significantly impact Aurenis's data acquisition strategies. This change necessitates a proactive approach to obtaining explicit consent for marketing communications, ensuring transparency and user control.

Labor Laws and Employment Regulations

Compliance with French labor laws, covering everything from working conditions and minimum wages to employee rights, is a significant consideration for Aurenis’s operations. For instance, the French minimum wage, known as the SMIC, saw an increase in January 2024, impacting labor costs across all sectors. Adhering to these regulations is not just about avoiding legal penalties but also about maintaining a stable and productive workforce, which directly affects operational efficiency and overall human resource management for both recycling and call center activities.

These employment regulations shape Aurenis’s approach to human capital. In 2024, France continued to emphasize worker protections, including regulations on working hours and leave entitlements. Failure to comply can lead to substantial fines and reputational damage, making proactive management of labor law adherence a strategic imperative. This includes ensuring fair compensation, safe working environments, and adherence to collective bargaining agreements where applicable.

- Minimum Wage Compliance: Aurenis must ensure all employees, particularly in its labor-intensive recycling division, are paid at least the SMIC, which was €11.65 per hour as of January 1, 2024.

- Working Hour Regulations: Adherence to the standard 35-hour work week and regulations on overtime pay is critical for both divisions.

- Employee Rights Protection: Ensuring compliance with laws regarding dismissal, discrimination, and workplace safety is paramount to avoid legal challenges and maintain employee morale.

Licensing and Permitting for Recycling Facilities

Operating recycling facilities necessitates strict adherence to a complex web of licensing and permitting regulations. These legal frameworks, often established at federal, state, and local levels, typically mandate thorough environmental impact assessments and rigorous compliance with safety protocols. For instance, in the United States, the Resource Conservation and Recovery Act (RCRA) sets forth guidelines for waste management, impacting how recycling operations are permitted and managed.

These legal obligations are not merely bureaucratic hurdles; they are fundamental to ensuring responsible and sustainable operations within the recycling sector. Compliance influences the timeline and financial investment required for both establishing new facilities and expanding existing ones. In 2024, the average time to obtain all necessary permits for a new recycling facility in the US could range from 12 to 24 months, with associated costs potentially reaching tens of thousands of dollars, depending on the project's scale and location.

- Environmental Impact Assessments: Facilities must often demonstrate minimal negative effects on local ecosystems and communities.

- Safety Standards: Compliance with workplace safety regulations, such as those from OSHA, is critical to protect workers.

- Operational Permits: Specific permits are required for collecting, processing, and transporting recyclable materials.

- Regulatory Changes: Evolving environmental laws and recycling mandates can necessitate ongoing adjustments and re-permitting.

The legal framework governing Aurelis is heavily influenced by EU directives and French national laws, particularly concerning waste management and environmental protection. Upcoming regulations like the PPWR, effective February 2025, will mandate stricter recycling targets for packaging. Extended Producer Responsibility (EPR) schemes are also expanding, increasing producer accountability for end-of-life product management.

Compliance with data protection laws like GDPR is critical for Aurelis's outsourced call center operations, especially with France moving towards an opt-in consent model for telemarketing by 2026. French labor laws, including the SMIC (minimum wage), which was €11.65 per hour in January 2024, also impact operational costs and workforce management.

Recycling facilities must navigate a complex system of licensing and permitting, often requiring environmental impact assessments and adherence to safety standards. In the US, obtaining permits for a new recycling facility in 2024 could take 12-24 months and cost tens of thousands of dollars.

| Regulation Area | Key Legislation/Requirement | Impact on Aurelis | Effective Date/Status |

|---|---|---|---|

| Waste Management | EU Waste Framework Directive | Prioritizes prevention, reuse, recycling over landfill. | Ongoing |

| Packaging | Packaging and Packaging Waste Regulation (PPWR) | Stricter recycling targets for packaging materials. | Fully effective Feb 2025 |

| Producer Responsibility | Extended Producer Responsibility (EPR) Schemes | Increased accountability for product lifecycle management; potential for stable recycled material supply. | Expanding |

| Data Protection | GDPR & French Data Protection Laws | Robust data handling for call center operations; opt-in consent for telemarketing by 2026. | Ongoing / Upcoming |

| Labor Law | French Labor Laws (SMIC, working hours) | Impacts labor costs and workforce management; SMIC €11.65/hr as of Jan 2024. | Ongoing |

| Permitting (US Example) | RCRA, OSHA, Local Permits | Requires environmental assessments, safety compliance, operational permits; 12-24 month lead time for new facilities. | Ongoing |

Environmental factors

Aurenis's recycling success hinges on a steady supply of quality waste, especially materials rich in precious and non-ferrous metals. Fluctuations in waste composition, driven by initiatives like mandatory bio-waste sorting in many regions, and improved source separation directly affect operational efficiency and, consequently, profitability.

Aurenis faces the challenge of minimizing the environmental footprint of its recycling operations, which inherently consume energy and water, and can generate emissions. For instance, the global recycling industry's energy consumption is a significant consideration, with estimates suggesting that recycling aluminum saves up to 95% of the energy required to produce it from raw materials.

Adhering to stringent environmental standards, such as those set by the EPA or EU directives, is paramount for Aurenis. Continuous improvement in process efficiency, perhaps through adopting advanced sorting technologies or optimizing energy usage in material processing, will be key to ensuring sustainable operations and maintaining regulatory compliance in 2024 and beyond.

The global push towards circular economy models, strongly supported by the EU, is a significant environmental factor for Aurelis. This shift prioritizes reusing, refurbishing, and recycling materials, directly benefiting companies like Aurelis that manage resources. For instance, the EU's Circular Economy Action Programme aims to double resource productivity by 2030, a target that creates a robust market for Aurelis's expertise in sustainable resource management.

This environmental trend translates into a clear market imperative for Aurelis. By offering services that facilitate the reuse and recycling of products and materials, Aurelis is well-positioned to capitalize on the growing demand for sustainable solutions. The increasing regulatory focus on waste reduction and extended producer responsibility, seen in initiatives like the European Green Deal, further strengthens the business case for Aurelis's circular economy services.

Resource Scarcity and Conservation Initiatives

Growing concerns over resource scarcity, particularly for critical raw materials like precious and non-ferrous metals, are driving increased investment and focus on recycling. The global demand for metals like copper and lithium, essential for renewable energy technologies and electronics, continues to surge, putting pressure on primary extraction. For instance, the International Energy Agency (IEA) highlighted in its 2024 report that demand for critical minerals could increase by a factor of four to six by 2040 for clean energy technologies.

Aurenis plays a vital role in resource conservation by recovering valuable materials, aligning with national and international sustainability goals. By reprocessing electronic waste and other metallic streams, Aurenis contributes to a circular economy, reducing the need for virgin material extraction. This focus on recycling supports initiatives like the European Union's Circular Economy Action Plan, which aims to make sustainable products the norm.

- Global demand for critical minerals is projected to rise significantly by 2040, driven by clean energy transitions.

- Aurenis's recycling operations directly address resource scarcity by recovering valuable metals.

- The company's activities support broader sustainability goals and circular economy principles.

Climate Change and Carbon Footprint Reduction

The global push to combat climate change is reshaping industries, creating opportunities for businesses focused on sustainability. Reducing greenhouse gas emissions is paramount, and activities like recycling play a crucial role. For instance, recycling aluminum requires up to 95% less energy than producing it from raw materials, significantly lowering its carbon footprint.

Aurenis's operations align with these decarbonization efforts, particularly through its metal recycling processes. By reprocessing materials, Aurenis directly contributes to a circular economy, lessening the demand for primary resource extraction and its associated environmental impact. This focus on recycling helps lower overall carbon emissions within the supply chain.

The market for recycled materials is expanding, driven by both regulatory pressures and increasing consumer awareness. Companies are setting ambitious environmental, social, and governance (ESG) targets, which often include commitments to sourcing recycled content. This trend is expected to continue, with projections indicating substantial growth in the global recycling market over the coming years.

- Climate Change Imperative: Growing global focus on reducing greenhouse gas emissions.

- Recycling Benefits: Significant carbon footprint reduction compared to virgin material production, e.g., aluminum recycling uses 95% less energy.

- Aurenis's Role: Contribution to decarbonization through metal recycling, supporting a circular economy.

- Market Growth: Expanding demand for recycled materials driven by ESG targets and consumer awareness.

Environmental regulations are increasingly shaping Aurelis's operational landscape. Stricter emissions standards and waste management protocols are becoming the norm globally. For example, the EU's Industrial Emissions Directive continues to set benchmarks for pollution control, requiring significant investment in cleaner technologies for recycling facilities.

The growing emphasis on the circular economy presents both challenges and opportunities for Aurelis. Companies are under pressure to minimize waste and maximize resource recovery, directly benefiting Aurelis's core business. The European Green Deal, for instance, aims to make sustainable products the norm, driving demand for advanced recycling services.

Resource scarcity, particularly for critical metals like copper and lithium essential for the energy transition, is a significant driver for Aurelis. The International Energy Agency (IEA) projected in its 2024 outlook that demand for critical minerals could increase substantially by 2040, highlighting the strategic importance of recycling these materials.

| Environmental Factor | Impact on Aurelis | Supporting Data/Trend |

|---|---|---|

| Regulatory Compliance | Need for investment in cleaner technologies and adherence to stricter emission standards. | EU Industrial Emissions Directive continues to evolve, setting benchmarks. |

| Circular Economy Push | Increased demand for resource recovery and waste minimization services. | European Green Deal promotes sustainable products and circularity. |

| Resource Scarcity | Growing market for recycled critical metals due to demand in clean energy. | IEA (2024) projects significant increase in critical mineral demand by 2040. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using a blend of public and proprietary data sources. We integrate insights from reputable market research firms, official government publications, and leading economic indicators to ensure a comprehensive and relevant assessment of the macro-environment.