Aurenis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurenis Bundle

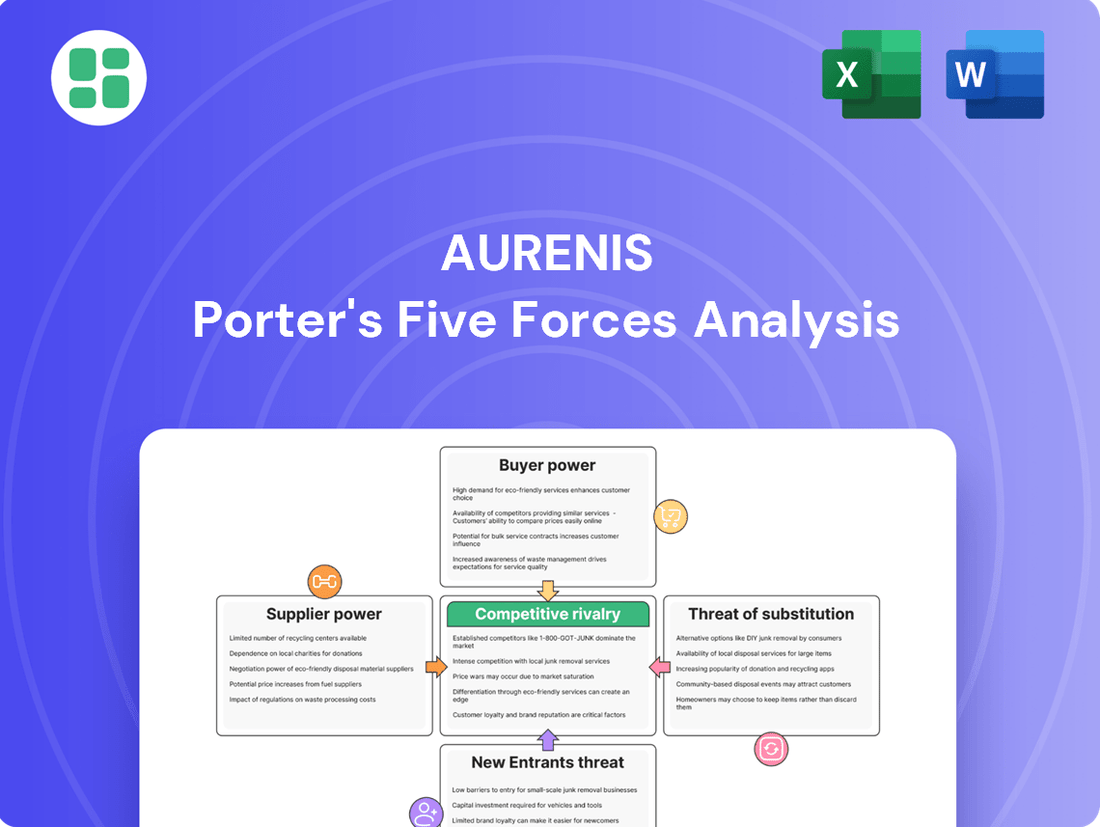

Aurenis's competitive landscape is defined by the interplay of five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Understanding these dynamics is crucial for any business operating in or considering entry into Aurenis's market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aurenis’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of Aurenis's suppliers is significantly shaped by the concentration of specialized waste streams, especially those rich in precious and non-ferrous metals. When only a limited number of suppliers can provide these critical materials, their leverage naturally grows, as Aurenis depends on a steady supply for its recycling processes. For instance, the global market for recovered platinum group metals, a key input for many recycling operations, is characterized by a relatively small number of large-scale suppliers, giving them considerable pricing power.

For Aurenis's recycling division, the availability of substitute inputs is quite limited. The specific waste materials containing precious and non-ferrous metals are crucial, and few alternatives exist. This scarcity means suppliers of these unique waste streams hold significant bargaining power. For instance, a major supplier of electronic scrap, which is a key input for precious metal recovery, might have the leverage to dictate terms, especially if their output is particularly rich in sought-after metals.

Conversely, in Aurenis's publishing support arm, the situation is different. Suppliers of generic IT infrastructure or basic telecommunication services generally possess lower bargaining power. This is due to the wide availability of numerous alternative providers in the market. For example, if Aurenis needs cloud storage, the presence of multiple reputable providers like AWS, Azure, or Google Cloud means no single supplier can exert undue influence on pricing or terms.

Aurenis could face substantial switching costs when changing suppliers for its specialized recycling equipment and advanced processing technologies. The capital expenditure required for new machinery or reconfiguring existing facilities for different waste streams can be significant, potentially running into millions of dollars for advanced sorting or chemical recycling systems.

For its customer service operations, switching between major telecommunications providers or specialized CRM software platforms could lead to considerable financial outlays and operational disruptions. For instance, integrating a new customer relationship management system might involve data migration costs, employee training, and potential downtime, impacting service continuity.

Impact of Regulations and Policies

Stringent environmental regulations, like France's Anti-Waste Law for a Circular Economy (AGEC) and Extended Producer Responsibility (EPR) schemes, directly impact the bargaining power of suppliers in the recycling industry. These policies compel proper waste management and recycling, which can increase the overall supply of recyclable materials.

This increased supply of waste, driven by regulatory compliance, can dilute the power of individual waste generators. As more entities seek compliant disposal solutions, suppliers offering these services may find their bargaining position strengthened, able to dictate terms more effectively.

- Increased Supply: Regulations like AGEC and EPR in France are designed to boost the volume of materials entering the recycling stream.

- Supplier Leverage: With a larger pool of waste to process, recycling suppliers can potentially command better terms.

- Compliance Costs: Businesses needing to comply with these regulations may face higher disposal costs, indirectly benefiting waste management suppliers.

Labor and Technology Suppliers

Suppliers of skilled labor, like specialized recycling technicians or multilingual customer service representatives, can wield considerable influence, particularly when there's a scarcity of particular expertise. In 2024, for instance, reports indicated a growing shortage of skilled tradespeople across several European countries, potentially increasing their bargaining power. France, with its generally skilled workforce, might see this leverage amplified for roles requiring highly specialized abilities or fluency in less common languages for publishing support services.

Providers of advanced recycling technologies or sophisticated business process outsourcing (BPO) software also possess significant leverage. Their unique, high-value offerings can command better terms, especially if they are critical to a company's operational efficiency or competitive advantage. For example, the global BPO market was projected to reach over $400 billion in 2024, highlighting the significant investment and reliance companies place on these technology suppliers.

- Labor Shortages: In 2024, specific sectors in France experienced noticeable shortages in skilled labor, potentially increasing wage demands from qualified technicians and multilingual staff.

- Technological Dependence: Companies relying on proprietary recycling technologies or advanced BPO software often face suppliers with strong bargaining positions due to the specialized nature of their products.

- Niche Language Skills: Demand for proficiency in niche languages for customer support or content processing can elevate the bargaining power of individuals or agencies possessing these specific linguistic skills.

Aurenis's suppliers of specialized waste streams, particularly those rich in precious metals, hold significant bargaining power due to limited availability and high demand. This is compounded by the fact that switching to alternative inputs is often not feasible, increasing dependence on these key suppliers. For instance, the global market for recovered platinum group metals, a critical input for Aurenis's recycling operations, is dominated by a few large suppliers, granting them considerable pricing leverage.

The bargaining power of Aurenis's suppliers is influenced by the concentration of specialized waste streams, especially those containing valuable metals. When only a few entities can provide these essential materials, their negotiation strength increases, as Aurenis relies on a consistent supply for its recycling processes. For example, the global market for recovered platinum group metals, a key input for many recycling operations, is characterized by a relatively small number of large-scale suppliers, giving them considerable pricing power.

Suppliers of specialized recycling equipment and advanced processing technologies can also exert substantial bargaining power due to high switching costs for Aurenis. The significant capital investment required for new machinery or facility modifications for different waste streams can be prohibitive. For example, implementing advanced sorting or chemical recycling systems could necessitate millions of dollars in expenditure.

| Supplier Type | Bargaining Power Factor | Example Impact on Aurenis |

|---|---|---|

| Specialized Waste Streams (Precious Metals) | Limited availability, high demand | Higher input costs for recycling division |

| Advanced Recycling Equipment | High switching costs, proprietary technology | Increased capital expenditure, reliance on specific vendors |

| Skilled Labor (e.g., Technicians) | Labor shortages in specific regions (2024 data) | Potential for higher wage demands, recruitment challenges |

| Generic IT/Telecom Services | High availability of alternatives | Low bargaining power for suppliers, competitive pricing |

What is included in the product

This analysis dissects the competitive forces impacting Aurenis, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes.

Eliminate the guesswork in competitive analysis by providing a structured framework to identify and address market threats and opportunities.

Customers Bargaining Power

Aurenis's recycled metals business likely caters to major manufacturers in industries such as automotive and electronics. These large-scale buyers, often purchasing significant volumes, possess considerable leverage. For instance, a single automotive manufacturer might account for 10-15% of Aurenis's recycled metal sales, giving them substantial power to negotiate pricing and terms.

Customers seeking precious and non-ferrous metal recycling often find alternatives, as less specialized waste streams can be handled by various recyclers or waste management firms. This abundance of choice directly impacts the bargaining power of these customers.

For foreign publishers, the availability of alternative business process outsourcing (BPO) providers or the option for in-house telemarketing and call center solutions significantly strengthens their negotiating position.

The French BPO market's expansion in 2024, with numerous new entrants and service offerings, has further amplified customer choice, giving them greater leverage when selecting providers.

For recycling clients, switching from Aurenis could involve moderate costs. These might include the effort to identify and vet new collection and transportation partners, or the time spent ensuring a new provider meets all waste management regulatory compliance standards. This can create a slight barrier to immediate defection.

Publishing clients considering a change from Aurenis's outsourced call center services face potential switching costs. These can include expenses for training new personnel, migrating customer data to a new system, and the risk of temporary service disruptions during the transition. These factors give them some leverage.

However, the overall ease of finding alternative Business Process Outsourcing (BPO) partners in a highly competitive market can significantly lessen the switching costs for publishing clients. The availability of numerous providers ready to offer similar services can dilute Aurenis's pricing power.

Price Sensitivity of Customers

Customers for recycled metals often exhibit significant price sensitivity because the cost of raw materials directly influences their own production expenses. This means they are constantly looking for the best deals to keep their overheads down.

Foreign publishers seeking to enter the French market are similarly focused on finding cost-effective solutions. This drive for affordability means they will actively compare prices from various service providers.

This heightened price sensitivity empowers customers, forcing companies like Aurenis to maintain competitive pricing strategies. In 2024, global commodity prices, including those for recycled metals, saw fluctuations influenced by geopolitical events and supply chain disruptions, further amplifying customer focus on cost.

- Price Sensitivity Impact: High price sensitivity among customers in the recycled metals sector directly pressures Aurenis to offer competitive pricing.

- Market Entry Costs: Foreign publishers prioritize cost-effective solutions, increasing their leverage in price negotiations for services in the French market.

- 2024 Market Dynamics: Fluctuations in global commodity prices in 2024 heightened customer attention to cost, strengthening their bargaining position.

Customer Information and Market Transparency

Increased market transparency, driven by readily available industry reports and online platforms, significantly bolsters customer bargaining power in both recycling and BPO sectors. Customers can now effortlessly compare pricing, service quality, and alternative providers, giving them a distinct advantage when negotiating with Aurenis. This heightened awareness empowers them to demand better terms and conditions.

The growing emphasis on the circular economy further amplifies this trend. Customers are increasingly informed about sustainable practices and the environmental impact of their choices. This knowledge allows them to prioritize suppliers who align with their values, adding another layer to their negotiation leverage. For instance, a recent survey in 2024 indicated that over 60% of B2B buyers consider sustainability credentials when selecting service providers.

- Informed Decision-Making: Customers possess greater access to data on pricing, service levels, and competitor offerings.

- Negotiation Leverage: Enhanced transparency allows customers to effectively challenge Aurenis's pricing and service proposals.

- Circular Economy Awareness: Growing customer knowledge of sustainability practices influences supplier selection and negotiation.

- Market Benchmarking: Customers can readily benchmark Aurenis's performance against industry standards and competitors.

Customers for Aurenis's recycled metals and BPO services wield significant bargaining power. This stems from their price sensitivity, the availability of alternatives, and increasing market transparency. In 2024, for example, the global commodity market volatility meant that recycled metal buyers were highly attuned to price fluctuations, directly impacting Aurenis's ability to dictate terms.

| Customer Segment | Key Bargaining Factors | Impact on Aurenis | 2024 Data Point |

|---|---|---|---|

| Recycled Metals Buyers | Price Sensitivity, Availability of Alternatives | Pressure on pricing, need for competitive offers | Global recycled metal prices saw an average dip of 5% in Q1 2024 due to oversupply. |

| BPO Clients (Publishing) | Switching Costs, Market Transparency | Leverage in contract negotiations, demand for service quality | The French BPO market grew by 8% in 2024, increasing provider competition. |

Preview Before You Purchase

Aurenis Porter's Five Forces Analysis

This preview showcases the complete Aurenis Porter's Five Forces analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The French waste management and recycling sector is quite robust, featuring a mix of large, established companies and smaller, specialized outfits. This fragmentation means Aurenis contends with a broad spectrum of rivals, from comprehensive service providers to those focusing on specific recycling streams.

In 2023, the French waste management market was valued at approximately €25 billion, with the recycling segment showing consistent growth. For instance, the recycling rate for municipal waste in France reached around 50% in 2022, a figure that continues to climb, attracting more specialized players.

The business process outsourcing (BPO) market in France, especially for call center services, is equally mature. It's populated by numerous providers, both domestic and international, offering a wide array of customer service solutions. This competitive intensity requires Aurenis to differentiate itself through service quality and technological innovation.

Aurenis operates in markets with robust growth prospects, which can unfortunately fuel intense competition. The French waste management sector is expected to see a compound annual growth rate exceeding 7.8% between 2024 and 2029. This expansion is largely propelled by stricter environmental regulations and a growing emphasis on sustainable practices across industries.

Similarly, the French business process outsourcing (BPO) market is also on an upward trajectory, with forecasts indicating substantial revenue increases. Such expanding markets naturally attract more players, intensifying the rivalry as companies aggressively pursue market share and seek to capitalize on the growing demand.

Aurenis stands out by focusing on precious and non-ferrous metal recycling, offering a full-service solution from collection to processing. This specialization creates a distinct advantage in a market that can otherwise be fragmented.

For its publishing support, Aurenis targets foreign publishers entering the French market. This niche strategy differentiates them from broader BPO providers, offering specialized expertise that commands a premium.

However, general Business Process Outsourcing (BPO) services, such as telemarketing, face intense competition. Without a clear unique selling proposition, these services can become commoditized, leading to price wars. For instance, the global BPO market was valued at approximately $232 billion in 2023, indicating significant competition.

High Fixed Costs and Exit Barriers

The recycling industry is characterized by substantial fixed costs, primarily stemming from the significant investment required for recycling facilities and specialized machinery. For instance, advanced sorting equipment and processing plants can represent millions of dollars in capital expenditure. These high upfront costs act as considerable exit barriers, making it economically challenging for companies to divest or cease operations without incurring substantial losses on their sunk investments. Consequently, businesses often remain in the market, striving to optimize the utilization of their existing capacity, which can intensify competitive pressures as firms vie for market share to cover their fixed cost base.

While Business Process Outsourcing (BPO) may generally exhibit lower fixed costs compared to heavy industrial sectors like recycling, certain aspects can still erect significant exit barriers. The development of specialized infrastructure, such as secure data centers or tailored technological platforms, represents a considerable investment. Furthermore, the deep integration of BPO providers into client operations and the establishment of strong, long-term client relationships create switching costs and tacit knowledge that are difficult for competitors to replicate or for clients to abandon easily. These factors can lock in providers and clients, reducing the ease of market exit and potentially influencing competitive dynamics.

- High Fixed Costs: Recycling facilities and specialized equipment require substantial capital investment, often running into millions of dollars for advanced processing capabilities.

- Exit Barriers in Recycling: Sunk costs in recycling infrastructure make it difficult for companies to leave the market, leading to a drive to maintain capacity utilization.

- BPO Exit Barriers: While generally lower, BPO exit barriers can arise from specialized infrastructure investments and entrenched client relationships.

- Impact on Competition: High fixed costs and exit barriers in both sectors can lead to more aggressive competition as firms seek to cover their investments.

Regulatory Environment and Compliance

France's commitment to a circular economy, with ambitious 2025 recycling targets, imposes significant compliance costs on waste management companies. This regulatory landscape, while a barrier for newcomers, forces established players to constantly innovate and invest in new technologies to meet evolving standards.

The intensifying rivalry stems from the need to differentiate through superior compliance and efficiency. Companies that can effectively navigate and even leverage these regulations gain a competitive advantage.

- France's 2025 recycling targets necessitate substantial investment in compliant infrastructure and processes.

- Stringent regulations act as a barrier to entry, concentrating market power among existing, compliant firms.

- Continuous adaptation to new standards fuels competition, driving innovation in waste management solutions.

Competitive rivalry in France's waste management and BPO sectors is significant, driven by market growth and differentiation needs. Aurenis faces a fragmented waste management landscape with many specialized recyclers, while the BPO market presents intense competition from numerous domestic and international providers. This necessitates a focus on unique value propositions, such as Aurenis's specialized precious metal recycling and niche publishing support services, to stand out in markets expecting robust growth, with the French waste management sector projected to grow over 7.8% annually through 2029.

| Sector | Key Competitors | Aurenis's Differentiation | Market Growth Factor | Competitive Intensity Driver |

|---|---|---|---|---|

| Waste Management | Veolia, Suez, Paprec, Smaller specialized recyclers | Precious & non-ferrous metal recycling, full-service solutions | Circular economy initiatives, 2025 recycling targets | High fixed costs, exit barriers, need for regulatory compliance |

| Business Process Outsourcing (BPO) | Capgemini, Teleperformance, Concentrix, numerous smaller BPO firms | Specialized publishing support for foreign publishers | Digital transformation, demand for customer service efficiency | Price wars in commoditized services, client relationship lock-in |

SSubstitutes Threaten

While environmental regulations are pushing away from it, landfilling still presents a substitute for comprehensive recycling, particularly for specific waste streams. However, France's commitment to reducing landfilling by 2025, aiming for less than 30% of municipal waste to go to landfill, significantly diminishes this threat.

Incineration, especially for waste-to-energy, offers an alternative disposal method, but it lacks the material recovery benefits inherent in recycling. This distinction means it doesn't directly compete on the same value proposition as robust recycling services.

The primary substitute for recycled precious and non-ferrous metals is the production of metals from virgin raw materials via mining and smelting. This threat is directly influenced by the volatility of virgin metal prices. For instance, in early 2024, gold prices surged past $2,000 per ounce, making virgin gold extraction a more economically attractive, albeit environmentally impactful, alternative to recycling.

However, the growing global emphasis on circular economy principles and sustainable sourcing increasingly favors recycled materials. This trend is supported by initiatives like the EU's Circular Economy Action Plan, which aims to reduce reliance on primary raw materials. Consequently, while virgin production remains a direct substitute, its long-term competitive advantage is being challenged by environmental regulations and consumer demand for greener supply chains.

Foreign publishers might bypass external service providers like Aurenis by developing their own in-house capabilities for market entry, telemarketing, and customer support within France. This strategy offers greater control over operations and customer relationships, particularly appealing to larger publishing houses with the financial capacity and strategic intent to manage these functions internally.

Digital and AI-driven Alternatives

The threat of digital and AI-driven alternatives is significant for Aurenis's publishing support services. Publishers are increasingly exploring automated customer service platforms, chatbots, and AI-powered telemarketing to streamline operations and potentially cut costs. For instance, the global AI in customer service market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, indicating a strong push towards these technologies.

While these digital solutions can handle routine inquiries efficiently, the need for human interaction in managing complex customer issues or providing nuanced support remains a key differentiator for traditional service providers like Aurenis. However, the ongoing advancements in AI mean that the capabilities of these substitutes will likely expand, potentially encroaching on areas previously requiring human expertise.

- AI adoption in customer service is accelerating, with many companies aiming to automate 60-70% of customer interactions by 2025.

- Chatbots can handle a significant volume of queries, freeing up human agents for more complex tasks, but often struggle with emotional nuance or intricate problem-solving.

- The cost savings associated with AI-driven solutions are a major incentive for publishers, potentially leading them to reduce their reliance on external support services if automation meets their needs.

- Aurenis must focus on the unique value proposition of human-centric support, emphasizing empathy, complex problem resolution, and relationship building to counter the appeal of purely automated alternatives.

Changes in Publishing Market Entry Strategies

The publishing industry is seeing a significant shift where digital-first strategies are increasingly substituting the traditional need for physical market entry support. Foreign publishers can now leverage online platforms and e-commerce directly, bypassing the need for extensive local operational infrastructure.

This trend is further amplified by the ongoing digital transformation within publishing. As more content moves online and distribution channels become primarily digital, the demand for traditional outsourced services, like physical printing and distribution, is likely to decrease.

- Digital Platforms: Publishers can now reach global audiences directly through online bookstores and e-reader platforms, reducing reliance on local distributors and agents.

- E-commerce Growth: The global e-commerce market for books was projected to reach over $25 billion in 2024, showcasing the power of direct-to-consumer digital sales.

- Reduced Physical Infrastructure: This shift lowers the barrier to entry for foreign publishers, as they no longer need significant investment in physical offices or warehousing in new markets.

The primary substitute for Aurenis's services is the potential for foreign publishers to develop in-house capabilities for market entry, telemarketing, and customer support. This allows for greater operational control and direct customer relationship management, particularly attractive to larger entities with the resources to invest internally.

Digital and AI-driven alternatives pose a significant threat, with publishers increasingly adopting automated customer service and AI-powered telemarketing to boost efficiency and cut costs. The global AI in customer service market, valued at approximately $1.5 billion in 2023, highlights this trend, with many companies aiming to automate 60-70% of customer interactions by 2025.

While AI excels at routine tasks, human-centric support remains crucial for complex issues and emotional nuance. Publishers are weighing these cost savings against the need for sophisticated problem-solving, creating a dynamic competitive landscape where Aurenis must emphasize its unique value proposition.

Entrants Threaten

Entering the precious and non-ferrous metal recycling sector demands significant upfront investment. Aurenis, for instance, would need to allocate substantial capital for advanced processing equipment, secure specialized facilities, and establish robust logistical networks to handle the collection and transportation of materials.

These considerable capital requirements act as a formidable barrier, deterring many potential new entrants from challenging established players like Aurenis in the recycling market. For example, setting up a state-of-the-art precious metal refinery can easily cost tens of millions of dollars, a figure that immediately filters out smaller or less capitalized operations.

The waste management and recycling sector in France presents a formidable barrier to new entrants due to its highly regulated nature. Companies must navigate a complex web of licenses, permits, and strict environmental laws. For instance, compliance with the AGEC Act (Anti-Gaspillage pour une Économie Circulaire) and Extended Producer Responsibility (EPR) schemes requires substantial investment and specialized knowledge.

These stringent regulatory requirements demand significant upfront investment in legal expertise and administrative processes, making it difficult for smaller or less established companies to enter the market. The time and resources needed to obtain all necessary approvals can deter potential new players, effectively limiting competition.

The threat of new entrants concerning access to supply chains and distribution channels for Aurenis is relatively low. Aurenis has cultivated robust waste collection and transportation relationships spanning 17 European countries, leveraging a network of over 1,000 partners. This extensive infrastructure makes it exceedingly difficult for newcomers to establish comparable supply chains for waste materials efficiently.

Replicating Aurenis's established channels for distributing recycled metals or securing foreign publisher clients presents a substantial hurdle for potential entrants. The sheer scale and operational complexity of Aurenis's existing network create a significant barrier to entry, as building such a comprehensive system from scratch would require immense capital investment and time.

Brand Loyalty and Reputation

Aurenis's long-standing reputation, built over three decades in waste management and recycling, acts as a significant barrier to new entrants. This established trust and consistent service quality in both recycling and niche publishing support markets are not easily replicated, making it challenging for newcomers to gain market acceptance and cultivate customer loyalty.

New companies entering the waste management and recycling sector face substantial hurdles in matching Aurenis's brand recognition and the loyalty it commands. For instance, in 2024, businesses continue to prioritize established partners with proven track records for environmental compliance and service reliability, sectors where Aurenis has consistently demonstrated its capabilities.

- Brand Loyalty: Aurenis's over 30 years of operation have fostered deep customer loyalty, a difficult asset for new entrants to acquire quickly.

- Reputation for Reliability: The company's established reputation for expertise and dependability in waste management and recycling creates a high bar for new competitors.

- Market Acceptance: Building the necessary trust and brand presence in specialized markets like niche publishing support requires sustained effort and consistent quality, posing a threat to new entrants attempting rapid market penetration.

Specialized Expertise and Technology

Aurenis's deep specialization in precious and non-ferrous metals recycling necessitates unique technical expertise and highly advanced processing technologies. For instance, the intricate chemical processes involved in separating and purifying rare earth elements from electronic waste require specialized knowledge that is not readily available.

Developing or acquiring this level of specialized knowledge and technology, alongside the critical need for a highly skilled workforce trained in complex metallurgical and chemical engineering, presents a significant barrier to entry for potential new competitors in this specific recycling niche.

The capital investment required for state-of-the-art facilities capable of handling diverse metal streams and adhering to stringent environmental regulations further amplifies this barrier. In 2024, the global precious metals recycling market was valued at approximately $20 billion, with advanced technological capabilities being a key differentiator among leading players.

- High Capital Investment: Setting up recycling facilities with advanced separation and purification technology can cost tens of millions of dollars, deterring smaller entrants.

- Proprietary Technology: Companies like Aurenis often possess proprietary processes for efficient metal recovery, creating a competitive advantage that is difficult to replicate.

- Skilled Workforce Requirements: The need for specialized chemists, metallurgists, and process engineers with experience in hazardous material handling and complex extraction techniques limits the pool of qualified personnel for new entrants.

- Regulatory Compliance: Navigating complex environmental, health, and safety regulations specific to metal recycling requires significant legal and technical expertise, adding another layer of difficulty for newcomers.

The threat of new entrants into the precious and non-ferrous metal recycling sector is considerably low for Aurenis. Significant capital investment is required for advanced processing equipment and specialized facilities, with refinery setup costs easily reaching tens of millions of dollars. Furthermore, stringent regulations in France, such as compliance with the AGEC Act, demand substantial investment in legal and administrative expertise, deterring less capitalized firms.

Aurenis's established supply chains, built over years with over 1,000 partners across 17 European countries, present a formidable barrier. Replicating this extensive network for waste material collection and distribution is challenging and resource-intensive for newcomers. The company's three-decade-long reputation for reliability and customer loyalty in both recycling and niche publishing support markets also creates a high bar for market acceptance and brand presence.

The specialized nature of precious and non-ferrous metal recycling, requiring unique technical expertise and advanced processing technologies, further limits new entrants. The need for a highly skilled workforce, including specialized chemists and metallurgists, coupled with the high capital investment for compliant facilities, creates significant entry barriers. For instance, the global precious metals recycling market, valued around $20 billion in 2024, highlights the importance of advanced technological capabilities.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront investment for advanced processing equipment and specialized facilities (e.g., refinery costs in tens of millions of dollars). | Deters smaller or less capitalized operations. |

| Regulatory Environment | Complex web of licenses, permits, and strict environmental laws (e.g., AGEC Act, EPR schemes in France). | Requires substantial investment in legal expertise and administrative processes. |

| Supply Chain & Distribution | Established network of over 1,000 partners across 17 European countries for waste collection and transportation. | Makes it exceedingly difficult for newcomers to establish comparable infrastructure efficiently. |

| Brand Reputation & Loyalty | Over 30 years of operation fostering deep customer loyalty and a reputation for reliability. | Challenging for newcomers to gain market acceptance and cultivate customer loyalty quickly. |

| Technical Expertise & Technology | Need for specialized knowledge in complex metallurgical and chemical engineering for metal separation and purification. | Limits the pool of qualified personnel and requires investment in proprietary processes. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aurenis is built upon a robust foundation of data, drawing from publicly available financial reports, industry-specific market research, and expert commentary from leading financial analysts.