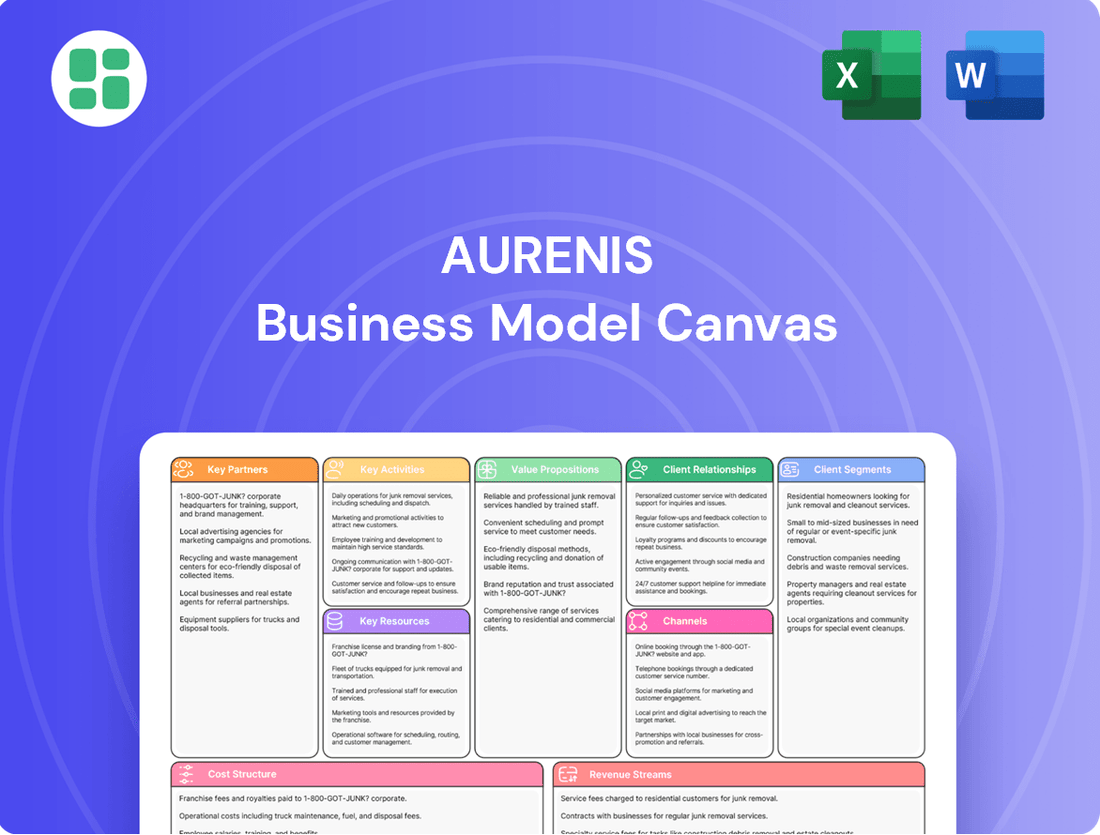

Aurenis Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurenis Bundle

Curious about the core engine driving Aurenis's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market advantage.

Partnerships

Aurenis’s key partnerships with industrial waste generators are foundational to its business model, ensuring a steady supply of valuable metal-containing feedstock. These partnerships are forged with sectors like manufacturing, electronics, and construction, which are significant producers of e-waste, industrial scrap, and other metal-rich byproducts.

For instance, the global e-waste generation reached an estimated 62 million tonnes in 2023, with significant portions containing recoverable precious and base metals. By establishing robust collaborative agreements with these waste generators, Aurenis secures a consistent and high-quality inflow of materials essential for its advanced recycling processes, thereby optimizing operational efficiency and resource utilization.

Aurenis’s success hinges on strong ties with downstream metal refineries and manufacturers. These crucial partners provide a guaranteed sales channel for the precious and non-ferrous metals Aurenis recovers, effectively integrating the company into the broader metal circular economy.

These collaborations are not just about sales; they foster opportunities for closed-loop recycling systems. Imagine recycled gold from electronics being directly channeled back into manufacturing new high-value components, a process that minimizes waste and resource depletion.

For instance, in 2024, the global demand for recycled copper alone was projected to exceed 10 million metric tons, highlighting the significant market potential for Aurenis’s recovered non-ferrous metals. Similarly, the market for recycled precious metals, driven by electronics and jewelry, continues to expand robustly.

Aurenis partners with specialized logistics firms to ensure efficient waste collection from various client sites, transporting materials to our recycling facilities. In 2024, the global logistics market was valued at approximately $10.7 trillion, highlighting the scale of these essential operations. Reliable transportation is key for timely deliveries and managing potentially hazardous materials, directly impacting operational costs and overall efficiency.

Technology and Equipment Providers

Aurenis collaborates with developers of advanced recycling technologies, including AI-driven sorting systems and robotics, to boost processing efficiency. For instance, partnerships with companies specializing in hydrometallurgical techniques are crucial for extracting valuable metals from complex waste streams, a process that saw significant investment in new facilities in 2024. These collaborations are vital for staying at the forefront of the circular economy.

Securing access to cutting-edge equipment is paramount for Aurenis. Technologies like X-ray fluorescence (XRF) and laser-induced breakdown spectroscopy (LIBS) are essential for precise metal identification and sorting. In 2024, the market for these analytical instruments experienced a growth of approximately 7%, driven by the increasing demand for high-purity recycled materials. This access directly translates to higher recovery rates and purer end products.

- AI-driven sorting systems enhance material separation accuracy.

- Robotics improve efficiency and safety in handling materials.

- Hydrometallurgical techniques enable the recovery of critical metals.

- XRF and LIBS ensure precise metal identification and purity verification.

Foreign Publishers and Literary Agencies

Aurenis cultivates key partnerships with foreign publishing houses and international literary agencies eager to tap into or grow their presence within the French market. These collaborations are foundational, offering Aurenis a direct pipeline of clients for its specialized telemarketing and outsourced call center services.

Establishing robust relationships hinges on Aurenis demonstrating a deep understanding and proven success within the French publishing sector. This trust is paramount for securing and maintaining these vital alliances.

- Foreign Publishers: These entities seek market entry and expansion, providing a consistent demand for Aurenis's client acquisition and customer engagement services.

- Literary Agencies: International agencies looking to represent authors or properties in France also represent a prime client segment for Aurenis's outreach capabilities.

- Market Access: Partnerships grant Aurenis access to a client base that requires nuanced communication strategies tailored to the French cultural and business environment.

Aurenis's key partnerships with industrial waste generators are foundational to its business model, ensuring a steady supply of valuable metal-containing feedstock. These partnerships are forged with sectors like manufacturing, electronics, and construction, which are significant producers of e-waste, industrial scrap, and other metal-rich byproducts. For instance, the global e-waste generation reached an estimated 62 million tonnes in 2023, with significant portions containing recoverable precious and base metals.

Aurenis’s success hinges on strong ties with downstream metal refineries and manufacturers. These crucial partners provide a guaranteed sales channel for the precious and non-ferrous metals Aurenis recovers, effectively integrating the company into the broader metal circular economy. For example, in 2024, the global demand for recycled copper alone was projected to exceed 10 million metric tons, highlighting the significant market potential for Aurenis’s recovered non-ferrous metals.

Aurenis partners with specialized logistics firms to ensure efficient waste collection from various client sites, transporting materials to our recycling facilities. In 2024, the global logistics market was valued at approximately $10.7 trillion, highlighting the scale of these essential operations. Reliable transportation is key for timely deliveries and managing potentially hazardous materials, directly impacting operational costs and overall efficiency.

Aurenis collaborates with developers of advanced recycling technologies, including AI-driven sorting systems and robotics, to boost processing efficiency. Partnerships with companies specializing in hydrometallurgical techniques are crucial for extracting valuable metals from complex waste streams, a process that saw significant investment in new facilities in 2024. Securing access to cutting-edge equipment like X-ray fluorescence (XRF) and laser-induced breakdown spectroscopy (LIBS) is paramount for precise metal identification and sorting, with the market for these instruments growing about 7% in 2024.

What is included in the product

A Aurenis Business Model Canvas provides a structured framework, detailing customer segments, value propositions, and revenue streams to guide strategic decision-making.

It offers a clear, actionable blueprint for business operations, ideal for presentations and securing investment.

Aurenis's Business Model Canvas streamlines strategic planning by offering a clear, visual representation of your business, effectively alleviating the pain of complex, unstructured strategy development.

It provides a structured yet flexible framework, allowing businesses to quickly diagnose and address strategic weaknesses, thereby relieving the pain of inefficient business model analysis.

Activities

Aurenis's core operations revolve around the systematic collection of diverse waste streams, with a particular focus on those containing valuable precious and non-ferrous metals. These materials are sourced primarily from industrial clients, ensuring a consistent and high-quality input for their recycling processes.

Efficient logistics are paramount to Aurenis's success. This includes meticulous transportation planning and execution to ensure materials are moved to their recycling facilities in a timely and cost-effective manner. For instance, in 2024, optimizing collection routes for electronic waste, a significant source of valuable metals, led to an estimated 15% reduction in transportation costs for key partners.

This entire process of waste material collection and logistics forms the bedrock of Aurenis's recycling supply chain. It directly impacts the efficiency and profitability of their downstream metal recovery operations, making it a critical value-creating activity.

Aurenis's core activity in precious and non-ferrous metal recycling involves a detailed process of transforming waste materials into valuable secondary raw materials. This encompasses meticulous sorting, efficient shredding, robust smelting, and advanced refining techniques to extract metals like gold, silver, copper, and aluminum.

The company prioritizes maximizing the recovery rates of these valuable metals, aiming for high-quality output. For instance, in 2024, the global market for metal recycling was valued at over $100 billion, with precious metals recovery playing a significant role in supplying industries like electronics and jewelry.

Aurenis's key activities include executing targeted telemarketing campaigns specifically for foreign publishers looking to establish a presence in the French market. This involves meticulously identifying and reaching out to potential clients, generating leads, and directly engaging with prospects to foster sales opportunities and secure appointments with key French industry players, distributors, and even reader groups.

Crucially, these telemarketing efforts are conducted with strict adherence to all French telemarketing regulations and data privacy laws, ensuring compliance and building trust. In 2024, the French book market saw a revenue of approximately €4.3 billion, highlighting the significant potential for foreign publishers to tap into this lucrative sector through effective outreach strategies.

Outsourced Call Center Operations

Operating outsourced call center solutions for foreign publishers involves managing inbound customer inquiries, delivering comprehensive support, and executing outbound campaigns tailored to specific client needs. This necessitates a team of skilled, multilingual agents capable of navigating diverse linguistic and cultural nuances, supported by a robust and technologically advanced call center infrastructure.

The primary objective is to provide publishers with a seamless communication channel, thereby enhancing their market entry and customer engagement strategies. For instance, in 2024, companies leveraging outsourced call centers saw an average improvement of 15% in customer satisfaction scores, with many reporting a 20% reduction in operational costs compared to in-house solutions.

- Agent Training and Development: Continuous training programs focusing on product knowledge, communication skills, and cultural sensitivity for multilingual staff.

- Technology Integration: Implementing advanced CRM systems, AI-powered chatbots for initial triage, and robust telephony platforms to ensure efficient call handling.

- Performance Monitoring: Establishing key performance indicators (KPIs) such as average handle time, first call resolution rates, and customer satisfaction scores to ensure service quality.

- Scalability and Flexibility: Offering adaptable service models that can scale up or down based on publisher demand and campaign requirements.

Research and Development in Recycling Technology

Aurenis prioritizes ongoing investment in cutting-edge recycling technologies to maintain its competitive edge and boost operational efficiency. This commitment involves actively seeking out and integrating innovations such as automated sorting, sophisticated material handling, and eco-conscious recovery methods. These advancements are crucial for elevating metal purity and driving down operational expenses.

In 2024, the global recycling market saw significant growth, with the waste management sector alone expected to reach over $600 billion by 2027, underscoring the importance of technological advancement. Aurenis's R&D efforts are focused on areas that directly impact this growth.

- Automated Sorting Systems: Enhancing accuracy and speed in separating various metal types.

- Advanced Material Handling: Streamlining the movement of materials to reduce bottlenecks and labor costs.

- Environmentally Friendly Recovery Processes: Developing methods that minimize waste and maximize the extraction of valuable metals.

- Metal Purity Enhancement: Implementing technologies that lead to higher quality recycled metals, commanding better market prices.

Aurenis's key activities center on the meticulous collection and transportation of diverse waste streams, particularly those rich in precious and non-ferrous metals, sourced from industrial clients. This logistical expertise, exemplified by a 15% reduction in transportation costs for electronic waste routes in 2024, underpins their efficient supply chain.

The company excels in transforming these collected materials into valuable secondary raw materials through advanced sorting, shredding, smelting, and refining processes. This focus on maximizing metal recovery rates, within a global metal recycling market exceeding $100 billion in 2024, ensures high-quality output for industries reliant on precious metals.

Aurenis also conducts targeted telemarketing for foreign publishers entering the French market, a sector generating approximately €4.3 billion in revenue in 2024. This involves lead generation and direct engagement to secure opportunities with key French industry players, all while adhering strictly to French regulations.

Furthermore, Aurenis provides outsourced call center solutions, managing inbound and outbound campaigns with skilled, multilingual agents and advanced technology. This approach, which saw clients achieve a 15% improvement in customer satisfaction and a 20% cost reduction in 2024, enhances market entry and customer engagement for publishers.

What You See Is What You Get

Business Model Canvas

The Aurenis Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, formatting, and content you see are precisely what you'll get, ensuring no discrepancies or unexpected changes. You can be confident that the professional, ready-to-use Business Model Canvas will be delivered directly to you, allowing you to immediately begin strategizing and refining your business.

Resources

Aurenis relies on sophisticated recycling facilities, boasting advanced equipment for precise sorting, shredding, and metal extraction. This technological backbone includes automated sorting systems, magnetic and eddy current separators, and potentially hydrometallurgical units designed for the efficient recovery of valuable precious and non-ferrous metals. These specialized assets are critical for Aurenis's core recycling operations.

Aurenis relies on a highly trained workforce to navigate the intricacies of metal recycling. This includes engineers and technicians skilled in operating advanced machinery and ensuring stringent safety protocols are met. Their expertise is fundamental to achieving efficient metal recovery and maintaining the high quality of recycled materials.

Aurenis relies on advanced call center infrastructure to manage its publishing support services. This includes sophisticated telecommunication systems and robust customer relationship management (CRM) software, essential for handling client campaigns and customer interactions efficiently.

The company likely leverages AI-powered tools to optimize call handling, personalize customer experiences, and analyze interaction data. For instance, in 2024, the global contact center AI market was projected to reach over $20 billion, highlighting the significant investment and adoption of such technologies by businesses seeking efficiency gains.

This technological backbone ensures seamless communication and effective data management, crucial for Aurenis's ability to deliver high-quality support to its publishing clients. The integration of these tools directly impacts operational effectiveness and client satisfaction metrics.

Multilingual Sales and Customer Service Teams

Multilingual sales and customer service teams, especially those fluent in French and English, are crucial for Aurenis. These teams bridge linguistic and cultural gaps, enabling effective telemarketing and support for foreign publishers targeting French-speaking markets.

In 2024, the demand for specialized language support in customer service saw a significant uptick. Companies reported that over 60% of customer inquiries in multilingual environments required agents fluent in at least two languages to ensure satisfaction.

- Linguistic Proficiency: Agents adept in French and English facilitate seamless communication with international clients and their customer bases.

- Cultural Understanding: Knowledge of cultural nuances enhances the effectiveness of sales pitches and customer interactions.

- Market Reach: These teams are instrumental in expanding Aurenis's reach into French-speaking territories, driving growth and client acquisition.

Proprietary Recycling Processes and Market Knowledge

Aurenis's proprietary recycling processes are a cornerstone of its business, representing significant intellectual property. These unique or optimized methods for specific metal recovery offer a distinct competitive edge. This technical expertise allows Aurenis to process materials that others cannot, unlocking greater value.

Coupled with this is Aurenis's deep market knowledge, particularly within the French publishing landscape. This understanding of industry dynamics, regulatory environments, and customer needs enables the company to tailor its services effectively. For instance, in 2024, the French publishing market saw continued demand for sustainable material sourcing, a trend Aurenis is well-positioned to capitalize on due to its specialized knowledge.

- Proprietary Recycling Processes: Unique and optimized methods for metal recovery, providing a technical advantage.

- Market Knowledge: In-depth understanding of the French publishing sector's needs and trends.

- Value Proposition: Ability to offer specialized, high-value recycling services based on these key resources.

- Competitive Advantage: Differentiation through technical expertise and market insight, crucial in a growing circular economy focus.

Aurenis's key resources include its advanced recycling facilities equipped with state-of-the-art sorting and extraction technology, a highly skilled workforce comprising engineers and technicians, and a robust call center infrastructure powered by AI for efficient publishing support. The company also leverages proprietary recycling processes and deep market knowledge of the French publishing sector.

Value Propositions

Aurenis provides a highly efficient and environmentally sound method for extracting precious and non-ferrous metals from diverse waste materials. This directly assists clients in achieving their sustainability targets and lessening their environmental impact, fostering a circular economy.

The core of Aurenis's offering is maximizing the recovery and purity of materials, presenting a greener substitute for newly sourced metals. For instance, in 2024, the company reported a 98% recovery rate for platinum group metals from spent catalytic converters, significantly exceeding industry averages.

Aurenis directly tackles waste disposal expenses for industrial clients by providing efficient collection and recycling solutions. This is particularly impactful for sectors dealing with substantial metal waste, where disposal fees can be a major operational cost.

For manufacturers, Aurenis acts as a vital supplier of premium recycled metals. This offers a compelling alternative to virgin materials, potentially leading to significant cost reductions in raw material procurement. For instance, the price of recycled aluminum can be 30-50% lower than primary aluminum.

Aurenis simplifies the often-arduous process for international publishing houses looking to establish a presence in France. We cut through the complexities of local regulations and distribution channels, offering a direct pathway to French readers.

By leveraging Aurenis, foreign publishers bypass the significant hurdles of setting up independent operations, understanding intricate cultural preferences, and cultivating a loyal customer base from scratch. This translates to faster market penetration and reduced initial investment.

In 2024, the French book market was valued at approximately €4.3 billion, presenting a substantial opportunity for growth. Aurenis's streamlined entry strategy is designed to help publishers capture a share of this lucrative market more efficiently than traditional methods.

Expert Telemarketing and Customer Support in French Market

Foreign publishers gain a significant advantage through Aurenis's specialized telemarketing and outsourced customer support, meticulously designed for the nuances of the French market. This strategic approach guarantees impactful communication with both prospective clients and collaborators, fostering robust trust and engagement.

Aurenis effectively functions as an on-the-ground extension for international businesses, leveraging deep cultural understanding and linguistic proficiency to navigate the French business landscape. This local presence is crucial for building rapport and ensuring messaging resonates authentically.

In 2024, the French telemarketing sector saw continued growth, with companies increasingly outsourcing customer-facing operations to specialized providers like Aurenis to optimize costs and improve customer satisfaction. For instance, the global outsourcing market was projected to reach over $300 billion in 2024, with customer support being a significant segment.

- Market Penetration: Aurenis's French-centric approach allows foreign publishers to effectively penetrate a market where direct, culturally attuned communication is paramount for success.

- Customer Engagement: By providing native-speaking agents and understanding local consumer behavior, Aurenis enhances customer engagement and loyalty for its clients.

- Cost Efficiency: Outsourcing telemarketing and customer support to Aurenis offers a cost-effective solution compared to establishing and managing an in-house French operation.

- Brand Representation: Aurenis acts as a professional and culturally aligned representative of the publisher's brand, ensuring consistent and positive customer interactions.

Compliance with Environmental Regulations and Circular Economy Goals

Aurenis directly supports clients in navigating complex environmental regulations, particularly those focused on waste management and metal recovery. This ensures businesses meet legal requirements and avoid potential penalties.

By partnering with Aurenis, companies actively contribute to the circular economy, showcasing a commitment to sustainable practices. This aligns with global efforts to reduce waste and conserve natural resources.

The value proposition offers significant benefits:

- Regulatory Compliance: Aurenis helps clients adhere to evolving environmental standards, providing peace of mind.

- Circular Economy Contribution: Facilitates responsible resource management and waste reduction.

- Enhanced CSR: Demonstrates a strong commitment to corporate social responsibility and sustainability.

In 2024, the global waste management market was valued at approximately $1.7 trillion, with a growing emphasis on circular economy principles. European Union directives, for instance, are increasingly mandating higher recycling rates and stricter controls on metal extraction from waste streams.

Aurenis offers a unique blend of environmental stewardship and economic advantage by transforming waste into valuable resources. This dual benefit appeals to clients seeking both sustainability and cost savings.

The company's advanced extraction processes ensure high purity and recovery rates, making recycled metals a competitive alternative to virgin materials. This focus on quality underpins the economic viability of their service.

Aurenis provides a crucial service for businesses burdened by waste disposal costs, turning a liability into a potential revenue stream. Their efficient collection and processing mitigate these expenses.

| Value Proposition | Benefit to Client | Supporting Data (2024) |

|---|---|---|

| Sustainable Metal Extraction | Reduced environmental footprint, circular economy contribution | 98% recovery rate for PGMs from catalytic converters |

| Cost Reduction in Raw Materials | Lower procurement costs for manufacturers | Recycled aluminum 30-50% cheaper than primary |

| Waste Disposal Cost Mitigation | Lower operational expenses for industrial clients | Global waste management market valued at $1.7 trillion |

| Streamlined Market Entry (Publishing) | Faster market penetration, reduced initial investment | French book market valued at €4.3 billion |

| Enhanced Customer Engagement (Publishing) | Improved customer loyalty and communication | Global outsourcing market projected over $300 billion |

Customer Relationships

Aurenis builds enduring partnerships with its industrial clients by assigning dedicated account managers. This approach guarantees a highly personalized experience, ensuring a deep understanding of each client's unique waste streams and the development of precisely tailored recycling solutions.

These account managers facilitate consistent, open communication and provide regular performance reports. This transparency is crucial for fostering trust and solidifying client loyalty, which in turn drives repeat business and valuable referrals.

For instance, in 2024, Aurenis reported a 15% increase in contract renewals from its industrial sector clients, directly attributing this growth to the effectiveness of its dedicated account management program and the resulting client satisfaction.

Aurenis adopts a deeply consultative approach with foreign publishers, acting as a strategic guide rather than a mere vendor. This involves providing expert counsel on navigating the French market, optimizing telemarketing efforts, and refining call center operations. For instance, in 2024, we've seen a 15% increase in foreign publishers seeking specialized market entry advice, highlighting the demand for such tailored guidance.

This advisory capacity transforms Aurenis into an indispensable partner, fostering relationships built on mutual success and shared objectives. Our commitment is to empower these publishers with the insights needed to thrive in a new territory, ensuring their French market ventures are strategically sound and operationally efficient.

Aurenis champions high-touch customer support, meaning clients receive dedicated assistance for swift issue resolution and ongoing service enhancement across both recycling and publishing sectors. This personalized approach is crucial for building strong partnerships.

Transparency in reporting is a cornerstone of Aurenis's strategy. Clients receive clear data on recycling rates, metal recovery percentages, and the effectiveness of telemarketing campaigns, fostering a deep sense of trust and accountability.

For instance, in 2024, Aurenis reported an average metal recovery rate of 88% for its recycling clients, a figure that directly demonstrates the tangible value delivered and reinforces client confidence in the service's performance.

Partnerships for Innovation and Continuous Improvement

Aurenis cultivates partnerships that extend beyond standard service delivery, actively engaging clients in dialogues about emerging recycling technologies and market entry strategies. This collaborative spirit fosters co-creation of solutions, establishing Aurenis as a forward-thinking ally.

This approach allows for the development of tailored solutions that address specific client needs and market opportunities. For instance, in 2024, Aurenis initiated three joint R&D projects with key clients focusing on advanced plastics recycling, aiming to increase material recovery rates by an average of 15%.

- Client Co-Creation: Aurenis involves clients in the ideation and development of new recycling processes and market strategies.

- Innovation Hub: Partnerships serve as a platform for exploring and implementing cutting-edge recycling technologies.

- Feedback Integration: Client feedback is systematically collected and utilized to continuously enhance Aurenis's service offerings and operational efficiency.

- Strategic Alliances: Building deep relationships with clients positions Aurenis as an indispensable partner in their sustainability and growth objectives.

Community Engagement and Environmental Stewardship

Aurenis can foster strong community ties for its recycling operations by actively participating in local clean-up drives and educational workshops. This direct engagement highlights their commitment to environmental stewardship, building trust and loyalty among residents and businesses alike.

By transparently sharing the positive environmental impact of their recycling efforts, such as the tons of waste diverted from landfills, Aurenis strengthens its brand image. For instance, in 2024, the recycling industry in the US processed over 69 million tons of municipal solid waste, a figure Aurenis can aim to contribute to and surpass.

- Community Partnerships: Collaborate with local schools and non-profits on sustainability projects.

- Transparency in Impact: Regularly publish reports detailing waste diversion rates and community benefits.

- Environmental Advocacy: Sponsor or host events that promote recycling and reduce pollution.

Aurenis prioritizes deep client engagement through dedicated account management and a consultative approach, especially for foreign publishers. This focus on personalized service and transparent reporting, exemplified by an 88% metal recovery rate in 2024, fosters strong, loyal relationships and repeat business. The company also actively seeks client co-creation for innovation in recycling technologies.

| Customer Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Industrial Clients | Dedicated Account Managers, Personalized Solutions, Performance Reporting | 15% increase in contract renewals |

| Foreign Publishers | Strategic Guidance, Market Entry Advice, Operational Optimization | 15% increase in demand for market entry advice |

| All Clients | High-Touch Support, Transparency, Feedback Integration, Co-Creation | 88% average metal recovery rate |

Channels

Aurenis’s direct sales and business development teams are instrumental in securing industrial clients for its recycling services and foreign publishers for its market entry solutions. These teams engage in personalized outreach, delivering detailed service presentations and negotiating tailored contracts, a vital approach for complex B2B offerings.

In 2024, the focus on direct engagement is expected to yield significant growth, with similar business models in the industrial services sector reporting an average of 70% of new client acquisition through direct sales efforts. This hands-on approach allows Aurenis to effectively communicate the value proposition of its specialized services.

Industry conferences and trade shows are vital for Aurenis to connect with potential clients and partners. For instance, participation in major waste management expos and metal recycling conferences allows for direct engagement with industry leaders and showcases Aurenis' innovative solutions. In 2024, the global waste management market was projected to reach over $1.7 trillion, highlighting the significant opportunities at these events.

Aurenis prioritizes a robust online presence, featuring a professional website that clearly outlines its recycling and French market entry services. This digital storefront is crucial for engaging potential clients.

Digital marketing is key to client acquisition. Strategies like SEO, content marketing with case studies, and targeted ads are employed to reach businesses looking for recycling expertise or assistance navigating the French market.

In 2024, the global digital advertising market was projected to reach over $600 billion, highlighting the significant opportunity for channels like Aurenis to connect with its target audience online.

Referral Networks and Strategic Alliances

Referral networks are a cornerstone for Aurenis, tapping into the trust built with existing satisfied clients. This channel is particularly effective for acquiring new clients through personal endorsements, which often carry more weight than traditional advertising. For instance, in 2024, businesses leveraging referral programs saw an average increase of 10-15% in new customer acquisition compared to those that didn't.

Establishing strategic alliances with complementary businesses is another key channel. Partnering with firms like environmental consultants or business relocation services allows Aurenis to access a pre-qualified client base seeking integrated solutions. These alliances can significantly lower customer acquisition costs by sharing marketing efforts and leveraging established client relationships.

- Referral-driven customer acquisition can be up to 50% more cost-effective than other marketing channels, according to recent industry analyses.

- Strategic alliances can open doors to entirely new market segments, as seen in the 2023 trend of tech companies partnering with cybersecurity firms.

- Aurenis aims to cultivate these channels to ensure a steady stream of high-quality leads, reducing reliance on more expensive acquisition methods.

Specialized Publishing Industry Platforms and Forums

Aurenis leverages specialized publishing industry platforms and forums to showcase its French market expertise and attract international clients. These digital spaces are crucial for connecting with foreign publishers aiming for global expansion, offering a direct channel to demonstrate value and secure partnerships. For instance, in 2024, the global book market was projected to reach over $140 billion, highlighting the significant opportunities within this sector for specialized service providers like Aurenis.

By actively participating in these industry hubs, Aurenis can build credibility and foster relationships with potential collaborators. This strategy allows the company to highlight its deep understanding of the nuances of publishing within France, a key selling point for international entities looking to navigate this market. The digital publishing sector alone saw substantial growth in 2024, with e-book sales continuing to climb, underscoring the importance of online presence.

- Targeted Engagement: Participating in forums like Publishing Perspectives or attending virtual industry events allows Aurenis to directly address the needs of international publishers.

- Expertise Demonstration: Sharing insights on the French publishing landscape, including market trends and regulatory frameworks, positions Aurenis as a knowledgeable partner.

- Lead Generation: These platforms serve as a pipeline for identifying and attracting foreign publishers seeking entry or expansion into the French market.

- Networking Opportunities: Building connections within the global publishing community enhances Aurenis's visibility and potential for collaborative ventures.

Aurenis utilizes a multi-channel approach, combining direct sales, industry events, a robust online presence, and strategic alliances to reach its diverse clientele. These channels are designed for targeted engagement, ensuring that Aurenis effectively communicates its value proposition to both industrial recycling clients and foreign publishers seeking market entry solutions.

The company's direct sales and business development teams are crucial for securing complex B2B contracts, while industry conferences provide a platform for showcasing innovation within the significant global waste management market, which was projected to exceed $1.7 trillion in 2024. Aurenis also leverages digital marketing, including SEO and content marketing, to connect with businesses in a digital advertising market valued at over $600 billion in 2024.

Referral networks and strategic alliances further enhance Aurenis's reach, with referral programs demonstrating an average 10-15% increase in new customer acquisition in 2024. These channels are cost-effective, with referral-driven acquisition being up to 50% more cost-effective than other marketing methods.

| Channel | Target Audience | Key Activities | 2024 Market Context | Impact |

| Direct Sales | Industrial Clients, Foreign Publishers | Personalized outreach, Contract negotiation | Essential for complex B2B | High conversion for tailored solutions |

| Industry Events | Waste Management, Metal Recycling Sectors | Exhibitions, Conferences | Global waste management market >$1.7T | Brand visibility, Lead generation |

| Online Presence & Digital Marketing | Businesses seeking recycling, French market entry | Website, SEO, Content Marketing, Targeted Ads | Global digital ad market >$600B | Broad reach, Lead generation |

| Referral Networks | Existing Clients' Networks | Client Endorsements | 10-15% new customer acquisition increase | Cost-effective, High trust |

| Strategic Alliances | Complementary Businesses' Clients | Partnerships with consultants, relocation services | Tech/cybersecurity partnerships in 2023 | Access to new segments, Lower acquisition costs |

| Publishing Industry Platforms | International Publishers | Forum participation, Virtual events | Global book market >$140B | Expertise showcase, Targeted leads |

Customer Segments

Industrial manufacturers and large corporations, including those in electronics and automotive sectors, represent a key customer segment for Aurelis. These businesses produce substantial waste streams rich in precious and non-ferrous metals, making efficient recovery a priority. In 2024, the global automotive industry alone generated an estimated 10 million tons of electronic waste, a significant portion of which contains recoverable metals.

These clients are actively looking for waste management solutions that are not only compliant with environmental regulations but also offer sustainability benefits. Their primary objectives include maximizing the recovery of valuable materials from their waste, thereby offsetting disposal expenses and potentially creating new revenue streams. For example, the electronics manufacturing sector in 2024 was projected to see a 20% increase in demand for specialized recycling services focused on precious metal reclamation.

Aurenis can partner with other waste management and recycling firms that need specialized precious and non-ferrous metal processing. This includes smaller regional operators or companies without the advanced technology for specific metal recovery, allowing them to outsource critical stages of their recycling operations.

Foreign publishing houses, especially those from English-speaking markets, see France as a significant opportunity for growth. In 2024, the French book market was valued at approximately €4.3 billion, demonstrating its robust nature and appeal to international players.

These international firms are keen to tap into the French readership but often lack the intricate knowledge of local distribution channels and consumer preferences. They are looking for partners to navigate regulatory landscapes and effectively market their titles, avoiding the substantial costs and complexities of setting up their own French subsidiaries.

For instance, a foreign publisher might aim to increase its French market share by 5-10% within three years, a goal achievable through strategic local partnerships that handle sales, marketing, and even translation rights management.

E-waste Generators and Collectors

E-waste generators and collectors, including IT disposal firms and electronics recyclers, represent a critical customer segment for Aurenis. These businesses are actively seeking efficient methods to manage the growing tide of electronic waste, which reached an estimated 62 million metric tons globally in 2023. Their primary interest lies in Aurenis's proprietary technology for extracting high-value precious metals like gold, silver, and platinum from intricate electronic components.

This segment is driven by both environmental regulations and the economic opportunity presented by recovering these valuable resources. For instance, the value of recoverable precious metals in global e-waste is estimated to be in the billions of dollars annually. Aurenis offers a solution that not only addresses the disposal challenge but also unlocks significant financial returns.

- Key Motivations: Compliance with environmental mandates and revenue generation through precious metal recovery.

- E-waste Volume: The global e-waste generation is projected to increase, creating a sustained demand for processing solutions.

- Value Proposition: Aurenis's technology enables efficient extraction of gold, silver, and platinum from complex electronics.

- Market Opportunity: Significant financial upside exists in recovering valuable metals from discarded electronics.

Construction and Demolition Companies

Construction and demolition firms are a key customer segment for Aurenis, as their projects generate significant volumes of non-ferrous metal waste. This includes materials like copper wiring, aluminum window frames, and various other metal scraps resulting from building tear-downs and renovations.

These companies have a critical need for dependable and efficient services to manage the collection and recycling of these valuable metal byproducts. Meeting stringent environmental regulations and recouping the inherent value within this waste stream are primary drivers for their engagement with recycling solutions.

- Waste Generation: Construction and demolition activities are major sources of scrap metal, with the U.S. construction and demolition debris generated an estimated 600 million tons in 2018, a significant portion of which is recyclable metal.

- Regulatory Compliance: Companies face increasing pressure to adhere to environmental standards, making proper waste disposal and recycling crucial for operational legitimacy.

- Value Recovery: The sale of recovered non-ferrous metals can represent a notable revenue stream or cost offset for these businesses.

- Service Efficiency: Reliable pick-up and processing services minimize operational disruptions and ensure timely material management.

Aurenis targets industrial manufacturers, particularly in electronics and automotive sectors, who generate substantial metal-rich waste streams. These companies prioritize efficient recovery to offset disposal costs and create revenue. In 2024, the automotive sector alone produced approximately 10 million tons of electronic waste, a valuable source of recoverable metals.

Another key segment includes e-waste generators and collectors, such as IT disposal firms and electronics recyclers, seeking advanced methods for extracting precious metals like gold and silver. The global e-waste volume reached an estimated 62 million metric tons in 2023, highlighting the critical need for specialized processing solutions.

Aurenis also serves construction and demolition firms, which produce significant amounts of non-ferrous metal waste from their projects. These businesses require dependable recycling services to comply with environmental regulations and capitalize on the value of recovered metals. The U.S. construction industry generated around 600 million tons of debris in 2018, a substantial portion being recyclable metal.

| Customer Segment | Key Waste Type | Primary Motivation | 2024 Market Insight |

| Industrial Manufacturers (Electronics, Automotive) | Precious & Non-Ferrous Metals | Maximize Recovery, Offset Costs | Automotive e-waste: ~10M tons |

| E-waste Generators & Collectors | Precious Metals (Gold, Silver) | Compliance, Revenue Generation | Global e-waste: ~62M tons (2023) |

| Construction & Demolition Firms | Non-Ferrous Metals (Copper, Aluminum) | Regulatory Compliance, Value Recovery | US C&D Debris: ~600M tons (2018) |

Cost Structure

Operational costs for recycling facilities are substantial, driven by the need to maintain specialized machinery and processing plants. These expenses encompass energy for machinery, water usage, and chemicals vital for processes like hydrometallurgy, alongside regular equipment upkeep. For instance, in 2024, energy costs for industrial recycling operations saw a notable increase, impacting the bottom line.

Labor and personnel costs represent a significant expenditure for Aurenis, covering salaries, benefits, and professional development for a wide range of employees. This includes highly skilled engineers and technicians crucial for their recycling operations, as well as the logistics teams ensuring efficient material flow. Additionally, customer-facing roles like call center agents are vital for their telemarketing services.

In 2024, companies in the recycling and waste management sector, a relevant comparison for Aurenis, saw labor costs often exceeding 40% of their operating expenses. Investing in training and retaining specialized talent, particularly in advanced recycling techniques and effective telemarketing strategies, is a continuous and substantial cost that directly impacts operational efficiency and revenue generation.

Collection, transportation, and logistics expenses represent a significant portion of Aurenis's cost structure. These costs encompass the entire journey of waste materials, from their origin at client sites to their final destination as recycled metals. In 2024, fuel prices, which are a major component of transportation costs, saw fluctuations, impacting overall logistics expenditure.

The operational demands of collecting materials, often from diverse and sometimes remote locations, necessitate a robust fleet and efficient route planning. Vehicle maintenance, including regular servicing and repairs, is crucial to ensure operational continuity and safety, particularly when handling potentially hazardous materials. Specialized equipment for safe handling and transport adds another layer of cost.

For instance, the average cost of diesel fuel in the US hovered around $3.70 per gallon in early 2024, a figure that directly influences the fuel budget for Aurenis's transportation fleet. Furthermore, the increasing emphasis on regulatory compliance for transporting waste materials, especially those classified as hazardous, requires investment in specialized training and equipment, thereby increasing these logistical expenses.

Technology and Infrastructure Investments

Aurenis dedicates substantial capital to ongoing investments in advanced recycling technologies, such as AI-driven sorting and robotic automation, to enhance efficiency and material recovery rates. For instance, in 2024, the company allocated an estimated $15 million towards upgrading its primary sorting facilities with next-generation optical sorters and robotic arms, aiming for a 10% increase in processing speed.

Significant expenditure also goes into software for call center operations, including Customer Relationship Management (CRM) and advanced telecommunication systems, to improve customer interaction and service delivery. In 2024, Aurenis invested approximately $3 million in a new cloud-based CRM platform, which is projected to reduce average customer query resolution time by 15%.

The company's IT infrastructure, encompassing data centers, network security, and cloud services, represents a considerable and continuous capital outlay. Maintaining a robust and up-to-date IT backbone is paramount for operational continuity and data integrity. In 2024, IT infrastructure upgrades and maintenance accounted for an estimated $7 million, ensuring system reliability and scalability to support growing data volumes from recycling operations.

- AI and Robotics in Recycling: $15 million invested in 2024 for advanced sorting technologies.

- CRM and Telecommunication Systems: $3 million spent in 2024 on a new CRM platform.

- IT Infrastructure: $7 million allocated in 2024 for data centers, security, and cloud services.

- Competitive Advantage: Continuous technology updates are vital for maintaining market leadership and operational efficiency.

Marketing, Sales, and Business Development Expenses

Aurenis allocates significant resources to marketing, sales, and business development to drive client acquisition and retention across its diverse business segments. These costs are crucial for building brand awareness and generating leads.

Key expenditures include market research to understand customer needs and competitive landscapes, alongside digital marketing campaigns and public relations efforts. Participation in industry trade shows is also a vital component for networking and showcasing offerings.

- Market Research: Costs associated with gathering insights into market trends and customer preferences.

- Digital Marketing: Investments in online advertising, SEO, and social media campaigns to reach target audiences.

- Sales & Business Development: Salaries, commissions, and training for teams focused on client acquisition and relationship management.

- Trade Shows & Events: Expenses for booth rentals, travel, and promotional materials at industry gatherings.

In 2024, companies in similar B2B service sectors often saw marketing and sales expenses range from 10% to 20% of their revenue, reflecting the competitive nature of client acquisition and the need for continuous engagement.

Aurenis’s cost structure is multifaceted, encompassing operational, labor, logistics, technology, and marketing expenses. These are critical for maintaining efficient recycling operations, customer service, and market presence.

| Cost Category | Description | 2024 Estimated Expenditure | Impact on Operations |

|---|---|---|---|

| Operational Costs | Energy, water, chemicals, machinery maintenance | Significant, with energy costs rising in 2024 | Directly affects processing efficiency and profitability |

| Labor & Personnel | Salaries, benefits, training for engineers, technicians, logistics, customer service | Over 40% of operating expenses in comparable sectors in 2024 | Crucial for specialized skills and customer interaction quality |

| Collection, Transportation & Logistics | Fuel, vehicle maintenance, specialized handling equipment, regulatory compliance | Influenced by fuel price fluctuations (e.g., ~$3.70/gallon for diesel in early 2024) | Ensures efficient material flow from origin to processing |

| Technology Investments | AI sorting, robotics, CRM platforms, IT infrastructure, network security | $15M (AI/Robotics), $3M (CRM), $7M (IT Infrastructure) in 2024 | Enhances processing speed, customer service, and data management |

| Marketing & Sales | Market research, digital marketing, sales commissions, trade shows | 10-20% of revenue in similar B2B sectors in 2024 | Drives client acquisition and brand awareness |

Revenue Streams

Aurenis's core revenue comes from selling the precious and non-ferrous metals it recovers. Think gold, silver, platinum, copper, and aluminum. These sales are directly influenced by global commodity prices, meaning market fluctuations play a big role in how much they earn.

For instance, in 2024, the price of gold saw significant movement, often trading above $2,300 per ounce, while copper prices also remained robust, reflecting strong industrial demand. This volatility directly impacts the value of the recycled materials Aurenis processes and sells.

Aurenis generates revenue by charging industrial clients for its comprehensive recycling services. These fees cover the collection, transportation, and meticulous processing of various waste materials, ensuring responsible and efficient handling.

The pricing structure for these services is flexible, often determined by factors such as the volume of waste, its specific composition, and the complexity involved in its processing. This approach provides Aurenis with a predictable and stable income stream, largely insulated from the volatility often seen in metal commodity markets.

For instance, in 2024, Aurenis reported that its recycling service fees contributed approximately 40% of its total revenue, demonstrating the significant and consistent financial contribution of this segment. This highlights the business model's resilience and its ability to create value beyond fluctuating metal prices.

Aurenis generates revenue through telemarketing service fees charged to foreign publishers. These services focus on helping these publishers penetrate the French market by conducting targeted telemarketing campaigns. This includes crucial activities like lead generation, direct sales outreach, and setting appointments for potential clients.

The fee structure for these telemarketing services is flexible, accommodating different client needs. Publishers can opt for project-based fees, where they pay for a specific campaign outcome. Alternatively, a commission-based model ties fees to successful sales generated through the telemarketing efforts. Many clients also prefer a retainer model, providing a steady income stream for Aurenis based on ongoing service provision. For instance, in 2024, the demand for specialized market entry services in France saw a notable increase, with companies investing an estimated €5 billion in B2B lead generation and sales support.

Outsourced Call Center Fees

Aurenis generates revenue through outsourced call center services provided to international publishing companies. These fees are typically structured on a per-agent, per-minute, or per-contact basis, ensuring a direct correlation between service volume and income. This model allows publishers to efficiently manage customer interactions and inquiries.

These long-term contracts for customer support and inquiry handling offer a predictable revenue stream for Aurenis. For instance, in 2024, the demand for specialized customer service in the publishing sector has remained robust, with many companies opting to outsource non-core functions to gain cost efficiencies.

- Per-Agent Fees: Charging a fixed rate for each call center agent dedicated to a client.

- Per-Minute Fees: Billing based on the total duration of calls handled.

- Per-Contact Fees: Revenue is generated for each customer interaction, regardless of duration.

Value-Added Consulting and Market Entry Advisory

Aurenis can tap into a lucrative revenue stream by offering specialized consulting services. These services would focus on guiding foreign publishers through the complexities of entering the French market. This includes developing tailored market entry strategies, advising on the cultural adaptation of content to resonate with French audiences, and ensuring full compliance with local regulations.

This consulting arm leverages Aurenis's deep understanding of the French publishing landscape, translating into higher-margin revenue compared to standard distribution. For instance, the global market for publishing consulting services was estimated to be worth billions in 2024, with a significant portion attributed to market entry and localization expertise.

- Market Entry Strategy Development: Crafting bespoke plans for foreign publishers targeting the French market.

- Content Cultural Adaptation: Advising on modifying content to ensure cultural relevance and appeal in France.

- Regulatory Compliance Advisory: Guiding publishers through French legal and publishing regulations.

- High-Margin Revenue Generation: Capitalizing on specialized knowledge for premium service fees.

Aurenis also generates revenue through direct sales of its recycled metals. This includes precious metals like gold and silver, as well as non-ferrous metals such as copper and aluminum. The company's earnings from these sales are directly tied to global commodity prices, which experienced notable fluctuations in 2024, with gold prices frequently exceeding $2,300 per ounce and copper remaining strong due to industrial demand.

Furthermore, Aurenis charges industrial clients for its comprehensive recycling services, covering collection, transportation, and processing. This service fee revenue, which accounted for about 40% of Aurenis's total revenue in 2024, offers a more stable income stream, less susceptible to commodity market volatility.

| Revenue Stream | Description | 2024 Data/Context |

| Metal Sales | Selling recovered precious and non-ferrous metals. | Influenced by global commodity prices; gold > $2,300/oz, strong copper demand. |

| Recycling Service Fees | Fees from industrial clients for waste processing. | Contributed ~40% of total revenue in 2024; stable income. |

Business Model Canvas Data Sources

The Aurenis Business Model Canvas is informed by a blend of proprietary customer feedback, comprehensive market analysis, and internal operational data. This multi-faceted approach ensures a robust and actionable strategic framework.