Artia PLC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Artia PLC Bundle

Artia PLC's strengths lie in its robust technological infrastructure and a dedicated, skilled workforce, positioning it well in a competitive market. However, potential threats from evolving regulations and aggressive competitor strategies warrant careful consideration.

Want the full story behind Artia PLC's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Atria Plc commands a leading position within the Finnish food sector, complemented by a robust presence in both Sweden and Denmark. This significant market penetration enables Atria to effectively cater to a broad customer base, encompassing retailers, the food service sector, and other food industry players.

The company's strong brand portfolio, featuring well-recognized names, reinforces its competitive edge. In many key product categories, Atria holds either the top market share or a strong second-place ranking, underscoring its market leadership.

Artia PLC showcased exceptional financial health in 2024, reaching a record adjusted EBIT of EUR 65.4 million, a substantial leap from the prior year. This robust performance underscores Artia's adeptness in managing expenses, executing effective sales initiatives, and optimizing operations, notably within its Atria Sweden and Atria Finland segments. This financial fortitude positions the company favorably for sustained expansion and provides a solid buffer against market volatility.

Atria's strategic investments in modernization are a significant strength. The company completed a EUR 165 million expansion of its poultry production in Nurmo in 2024, bolstering capacity and efficiency.

Further demonstrating this commitment, Atria announced an additional EUR 82.4 million investment in July 2025. This capital is earmarked for modernizing convenience food production and implementing green energy solutions, enhancing operational capabilities and sustainability.

These substantial capital expenditures are designed to drive future growth by improving production efficiency, expanding capacity, and fostering innovation in high-quality product development, positioning Atria favorably in key market segments.

Commitment to Sustainability

Atria PLC demonstrates a strong commitment to sustainability, targeting a carbon-neutral food chain by 2035. This dedication is underscored by its improved 'B' rating in CDP's 2024 Climate Change assessment, reflecting significant progress in environmental management.

Recent strategic investments bolster this commitment, notably in biogas plants and the transition to carbon-dioxide-free heat production at its Nurmo facility. These initiatives are projected to yield substantial reductions in energy consumption and CO2 emissions, aligning with global environmental goals.

This proactive approach to sustainability not only enhances Atria's brand reputation but also resonates with an increasing consumer preference for ethically produced and environmentally responsible food products.

- Carbon-neutral food chain target by 2035.

- Achieved an improved 'B' rating in CDP's 2024 Climate Change assessment.

- Investments in biogas plants and CO2-free heat production at Nurmo plant.

- Enhanced brand reputation and alignment with consumer demand for sustainable food.

Diversified Customer Base and Export Growth

Artia PLC's strength lies in its robust and diversified customer base, serving key sectors like retail, food service, and the broader food industry. This broad reach significantly reduces the company's vulnerability to downturns in any single market segment.

Further bolstering its position, Artia PLC demonstrates strong export growth. In 2024, the company successfully exported its products to 25 different countries, with notable expansion into important Asian markets such as South Korea and China. This global footprint is a testament to the international appeal and quality of its offerings.

The strategic confirmation of an export license for chicken meat to China in late 2024 is a significant development. This opens up substantial new avenues for international sales and revenue generation, further diversifying income streams and capitalizing on growing global demand.

- Diversified Revenue Streams: Serving retail, food service, and food industries mitigates sector-specific risks.

- Global Market Reach: Products exported to 25 countries in 2024, including key Asian markets.

- Enhanced Export Potential: China chicken meat export license secured late 2024, unlocking significant growth opportunities.

Atria PLC's market leadership is a cornerstone strength, holding top or strong second-place positions in many key product categories across Finland, Sweden, and Denmark. This dominance is further solidified by a robust financial performance, evidenced by a record adjusted EBIT of EUR 65.4 million in 2024, showcasing effective operational management and sales strategies.

Strategic investments in modernization, including a EUR 165 million poultry production expansion in Nurmo completed in 2024 and an additional EUR 82.4 million planned for July 2025 to upgrade convenience food production and green energy solutions, underscore Atria's commitment to future growth and efficiency.

The company's proactive stance on sustainability, targeting a carbon-neutral food chain by 2035 and achieving an improved 'B' rating in CDP's 2024 Climate Change assessment, alongside investments in biogas and CO2-free heat production, enhances brand reputation and appeals to environmentally conscious consumers.

Atria's diversified customer base, spanning retail and food service, coupled with expanding export markets, including a significant late 2024 export license for chicken meat to China, creates multiple revenue streams and mitigates sector-specific risks, fostering resilience and growth.

| Metric | 2023 | 2024 |

| Adjusted EBIT (EUR million) | 49.8 | 65.4 |

| Poultry Production Expansion (EUR million) | N/A | 165 |

| Planned Modernization Investment (EUR million) | N/A | 82.4 (announced July 2025) |

| CDP Climate Change Assessment | C | B |

| Export Markets (Countries) | 23 | 25 |

What is included in the product

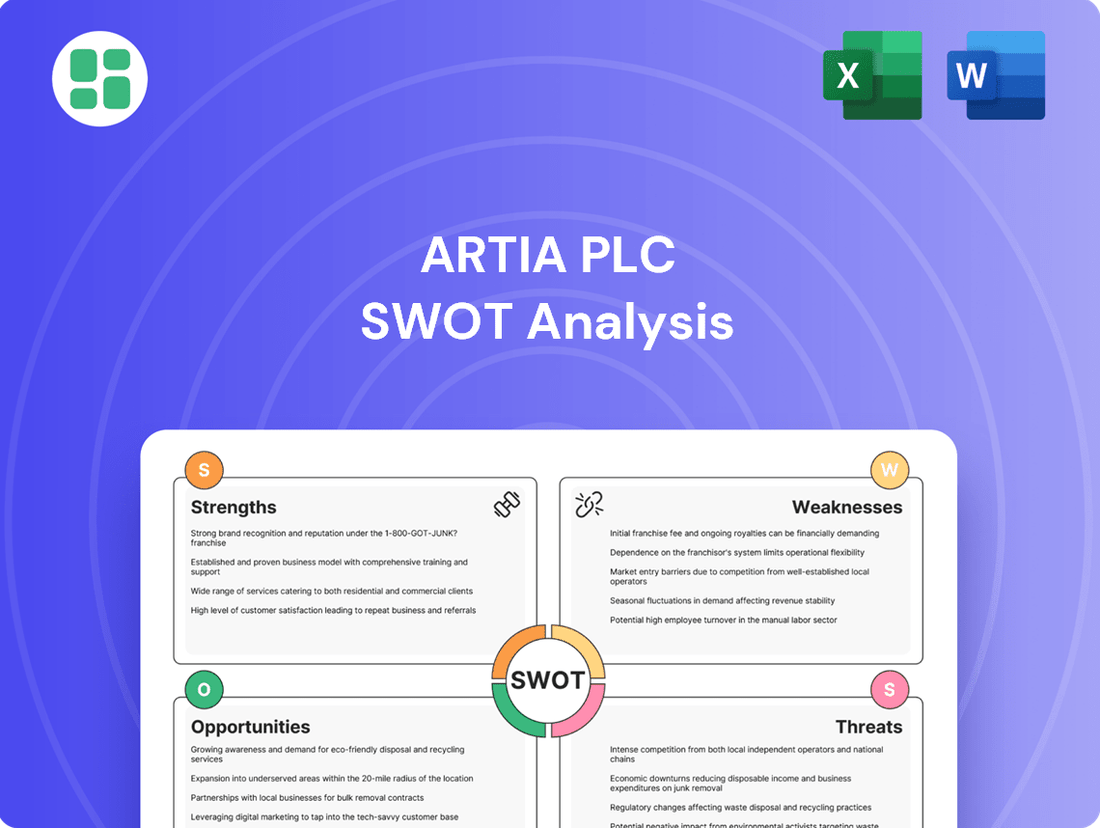

Delivers a strategic overview of Artia PLC’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable roadmap by highlighting Artia PLC's key strengths and opportunities, while mitigating weaknesses and threats.

Weaknesses

Atria PLC faces a projected decline in its Earnings Before Interest and Taxes (EBIT) for 2025. The company's adjusted EBIT is anticipated to fall below the record EUR 65.4 million it achieved in 2024. This forecast signals potential challenges or a necessary period of adjustment after a strong performance and substantial investments in the preceding year.

This anticipated downturn in EBIT raises questions about the sustainability of recent growth and the impact of market conditions or strategic decisions. Stakeholders will be keenly observing whether this dip in profitability is a short-term anomaly or an indicator of more significant, persistent issues impacting Atria's earnings power.

The Finnish retail market, a key arena for Atria, has experienced persistent sluggishness. This economic drag directly impacted Atria Finland's net sales in the first half of 2025, indicating a difficult domestic operating environment.

This slowdown in consumer spending, possibly linked to reduced purchasing power or shifts in what consumers want, presents a significant hurdle. Atria must consider innovative approaches to boost demand or counteract the negative sales trends in its home market.

Artia PLC's operations are susceptible to disruptions from industrial action, as evidenced by a strike by the Finnish Food Workers' Union in April 2025. This event negatively impacted deliveries, net sales, and EBIT in Finland, underscoring the company's vulnerability to labor disputes and their cascading effects on the supply chain and financial performance.

The company faces ongoing risks due to labor market negotiations in Finland, which could lead to further operational instability. Such actions can result in lost sales and increased costs, directly affecting profitability and highlighting a key weakness in Artia PLC's operational resilience.

Product Recall Incidents

Product recall incidents represent a significant weakness for Artia PLC. In 2024 alone, the company experienced five product recalls, highlighting potential vulnerabilities in their product safety and quality assurance protocols.

While five recalls might seem manageable against the backdrop of extensive operations, the impact on brand perception and consumer trust can be substantial. Such events can erode confidence, leading to decreased sales and increased customer acquisition costs.

The financial implications of these recalls also warrant attention, encompassing costs associated with the recall itself, potential legal liabilities, and the loss of revenue from affected products.

- 2024 Product Recalls: Artia PLC recorded five product recalls during the year.

- Impact on Brand: Recalls can negatively affect brand reputation and consumer trust.

- Financial Costs: These incidents incur direct costs and potential future revenue loss.

- Quality Assurance Focus: Continuous improvement in quality control is essential to mitigate future risks.

Dependence on Meat Products

Atria's continued strong reliance on meat products, despite diversification efforts, presents a significant weakness. This dependence becomes more pronounced as consumer preferences increasingly shift towards healthier eating, greater sustainability, and a noticeable move away from red meat towards poultry and plant-based options. For instance, in 2024, global meat consumption growth slowed, with a particular slowdown in red meat categories in developed markets.

This reliance on a traditional product base could hinder Atria's ability to capture emerging market opportunities and adapt to evolving consumer demands. The company faces the challenge of innovating and expanding its offerings in areas like plant-based alternatives, which saw a market growth of over 10% globally in 2024, to remain competitive and relevant in the long term.

- Product Portfolio Risk: Heavy reliance on meat products exposes Atria to risks associated with changing consumer tastes and health trends.

- Market Adaptation Lag: Potential for slower adaptation to the growing demand for plant-based and alternative protein sources.

- Sustainability Pressures: Meat production faces increasing scrutiny regarding environmental impact, which could affect brand perception and operational costs.

- Competitive Disadvantage: Competitors with more diversified portfolios, including significant plant-based offerings, may gain market share.

Atria PLC's significant reliance on meat products, particularly in the face of shifting consumer preferences towards healthier, more sustainable options like poultry and plant-based alternatives, represents a key weakness. This is underscored by a global slowdown in meat consumption growth in 2024, with developed markets showing a particular decline in red meat categories.

The company's vulnerability to industrial action in Finland, exemplified by the April 2025 strike by the Finnish Food Workers' Union, directly impacted deliveries, net sales, and EBIT, highlighting operational fragility. Ongoing labor market negotiations in Finland continue to pose a risk of further instability and financial impact.

Atria experienced five product recalls in 2024, indicating potential weaknesses in quality assurance and product safety protocols. These incidents not only incur direct costs but also risk damaging brand perception and consumer trust, potentially leading to decreased sales.

The projected decline in Atria's adjusted EBIT for 2025, falling below the EUR 65.4 million achieved in 2024, signals potential sustainability issues with recent growth and highlights the impact of a sluggish Finnish retail market, where net sales were negatively affected in the first half of 2025.

| Weakness Category | Specific Issue | Impact/Data Point |

|---|---|---|

| Product Portfolio | Heavy reliance on meat products | Global meat consumption growth slowed in 2024; red meat declining in developed markets. |

| Operational Risk | Vulnerability to industrial action in Finland | April 2025 strike impacted deliveries, sales, and EBIT. Ongoing labor negotiations pose continued risk. |

| Quality & Safety | Product recall incidents | Five recalls in 2024; potential damage to brand reputation and consumer trust. |

| Financial Performance | Projected EBIT decline in 2025 | Anticipated fall below 2024's EUR 65.4 million; impacted by sluggish Finnish retail market. |

Preview Before You Purchase

Artia PLC SWOT Analysis

This is a real excerpt from the complete Artia PLC SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive overview of the company's strategic position.

Opportunities

The increasing consumer demand for convenient meal solutions and snacks is a clear opportunity for Atria. This trend is driving significant growth in the ready-meal and snacking categories, areas where Atria can leverage its production capabilities.

Atria is strategically capitalizing on this by investing EUR 82.4 million in July 2025 to upgrade its Nurmo plant's convenience food production. This substantial investment is aimed at enhancing product innovation and quality, utilizing advanced technology to secure a greater market share in this burgeoning segment.

Artia PLC is making a significant move into expanding its poultry meat production, with a substantial EUR 165 million investment in Nurmo that wrapped up in 2024. This investment is set to boost their capacity by roughly 40%, positioning them to meet growing demand.

The company's strategic focus on poultry is further bolstered by a recent export license for chicken meat to China, with deliveries already commencing. This development opens up crucial new international markets for Artia PLC.

This strategic expansion aligns perfectly with the global trend of increasing consumption of poultry meat, presenting a significant opportunity for substantial growth and market penetration for Artia PLC in the coming years.

Atria's robust dedication to sustainability, evidenced by its ambition for a carbon-neutral food chain and continuous improvement in CDP (formerly Carbon Disclosure Project) scores, presents a prime opportunity to bolster its brand reputation. This focus can attract a growing segment of consumers who prioritize environmental responsibility in their purchasing decisions.

By investing in green energy and sustainable operational practices, Atria can carve out a distinct competitive advantage. This aligns perfectly with the escalating consumer and regulatory demand for demonstrable corporate accountability, potentially leading to increased market share and enhanced brand loyalty.

Strategic Acquisitions and Partnerships

Artia PLC's successful acquisition of Swedish convenience food company Gooh! in May 2024, valued at approximately €10 million, showcases its adeptness in strategic expansion via mergers and acquisitions. This move not only broadened its product portfolio but also provided a significant foothold in the Nordic market.

Further strategic acquisitions of businesses with complementary product lines or market presence can bolster Artia's competitive edge. For instance, acquiring a player in the plant-based protein sector could tap into the growing demand for sustainable food options, a market projected to reach $162 billion globally by 2030.

Forming strategic partnerships offers another avenue for growth. Collaborations with technology firms to enhance supply chain efficiency or with innovative food startups to introduce novel products could unlock new revenue streams and market segments. These alliances can also facilitate market entry into regions where Artia currently has limited presence, potentially leveraging partner distribution networks.

- Strategic Acquisitions: The Gooh! acquisition in May 2024, valued at €10 million, demonstrates Artia's M&A execution capability.

- Market Expansion: Identifying targets in high-growth areas like plant-based foods (global market projected at $162 billion by 2030) can drive significant revenue growth.

- Partnership Opportunities: Collaborating with tech firms for supply chain optimization or food startups for product innovation can create synergistic value.

- Geographic Reach: Partnerships can accelerate entry into new international markets, leveraging established distribution channels.

Product and Market Diversification

Atria PLC has a significant opportunity to diversify its product portfolio beyond traditional meat offerings, tapping into the growing demand for plant-based alternatives. This strategic move aligns with the company's stated goal of continuous renewal and innovation, potentially opening up new revenue streams and customer bases. For instance, the global plant-based food market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, indicating substantial growth potential.

Expanding into new market segments and product categories can help Atria mitigate risks associated with potential saturation in its core meat markets. By catering to evolving consumer preferences, such as increased interest in sustainable and healthier food options, the company can enhance its competitive positioning. This diversification strategy is crucial for long-term resilience and growth in a dynamic food industry landscape.

Key diversification opportunities for Atria PLC include:

- Plant-Based Innovations: Developing and marketing a range of plant-based meat alternatives, leveraging existing production and distribution channels.

- Convenience Foods: Expanding into ready-to-eat meals and meal kits featuring both meat and plant-based options to cater to busy consumers.

- International Market Expansion: Identifying and entering new geographical markets where demand for diversified protein sources is rising.

- Value-Added Products: Creating premium or specialized meat products, such as organic or ethically sourced options, to appeal to niche segments.

Atria's strategic acquisitions, like the €10 million Gooh! purchase in May 2024, demonstrate a strong capability to expand its market reach and product offerings. The company can further capitalize on the burgeoning plant-based food sector, a market projected to exceed $100 billion by 2030, by acquiring or developing innovative alternatives.

Partnerships with technology firms for supply chain optimization or with food startups for novel product development offer avenues for synergistic growth and market penetration. Furthermore, Atria's expansion into new international markets, such as China for poultry exports, unlocks significant revenue potential and diversifies its geographic footprint.

| Opportunity | Key Action | Relevant Data |

|---|---|---|

| Strategic Acquisitions | Acquire plant-based food companies | Global plant-based market: $100B+ by 2030 |

| Market Expansion | Export poultry to China | Deliveries commenced |

| Partnerships | Collaborate with tech/food startups | Enhance supply chain/product innovation |

Threats

Ongoing global trade tensions and geopolitical conflicts present a significant threat to Artia PLC. A weakened economic outlook, particularly for 2025, could dampen consumer confidence and slow market growth. This instability can directly impact Artia's sales by reducing consumer purchasing power and altering demand patterns.

Supply chain disruptions stemming from these global issues could also lead to increased operational costs for Artia. Higher raw material prices or difficulties in sourcing essential components can squeeze profit margins. Artia's 2025 outlook specifically anticipates these weakening effects from the broader economic environment.

Updated national nutrition recommendations, especially those released in autumn 2024, pose a significant threat to meat product sales. For instance, a hypothetical major health organization's revised guidelines in late 2024 could advise a substantial reduction in red meat consumption, directly impacting demand for Atria's core products.

A broader societal trend away from red meat, driven by increasing health consciousness and environmental concerns, could further erode Atria's market share. If consumer surveys in 2025 indicate a 10% year-over-year increase in individuals actively reducing or eliminating red meat from their diets, this presents a clear challenge.

Atria must strategically adapt its product offerings and marketing strategies to align with these evolving dietary landscapes and consumer preferences. This could involve expanding plant-based alternatives or highlighting leaner protein options, a move that could be critical for maintaining market relevance in the face of shifting nutritional advice.

The specter of animal diseases looms large for Atria, with outbreaks like African swine fever posing a significant threat. The detection of this disease on an Atria pig farm in Estonia in June 2025 highlights the immediate risk of widespread contamination and its severe economic repercussions.

Such disease incursions can trigger substantial direct costs associated with containment and eradication efforts, alongside crippling production disruptions. Furthermore, export bans implemented in response to outbreaks can severely limit market access, impacting revenue streams. The reputational damage and loss of consumer trust in meat products following such an event can be long-lasting and difficult to repair.

Labor Market Disputes

Labor market disputes, particularly in Finland where negotiations are common, pose a significant threat. The Finnish Food Workers' Union strike in April 2025 serves as a recent example of how such actions can directly impact operations, leading to delivery disruptions and a potential decrease in net sales and EBIT.

These industrial actions, if prolonged or recurring, can result in sustained financial setbacks and strain crucial relationships with both employees and customers. This ongoing operational risk demands proactive and careful management strategies to mitigate potential damage to Artia PLC's performance and reputation.

- Disruptions: Strikes can halt production and distribution, impacting supply chains.

- Financial Impact: Reduced sales and EBIT are direct consequences of labor disputes.

- Reputational Damage: Frequent conflicts can harm employee morale and customer trust.

- Operational Risk: Unresolved labor issues represent a persistent threat to business continuity.

Intense Competition and Private Labels

The food industry presents a formidable competitive landscape, marked by the persistent growth of private label brands. This trend directly impacts Atria PLC by potentially eroding its market share and constraining its pricing flexibility, particularly within its primary operating regions.

For instance, in 2023, private label market share in the US grocery sector reached approximately 20%, a figure that has steadily climbed, posing a significant challenge to established brands like those within Atria's portfolio.

To navigate this, Atria must focus on strengthening brand loyalty through consistent quality and effective marketing.

- Intensified Competition: The food sector is characterized by numerous established players and a growing number of agile, niche brands.

- Private Label Growth: Retailers' own brands continue to gain traction, offering consumers value and often matching the quality of national brands.

- Pricing Pressure: The rise of private labels directly challenges Atria's ability to maintain premium pricing.

- Brand Relevance: Continuous investment in innovation and marketing is essential to keep Atria's brands appealing to consumers amidst these pressures.

The increasing prevalence of private label brands in the food industry, projected to capture a larger market share in 2025, poses a significant threat to Artia PLC by intensifying competition and pressuring pricing strategies. This trend, evidenced by private labels accounting for roughly 20% of the US grocery market in 2023, demands Artia's focus on brand loyalty and differentiation to maintain its competitive edge.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, encompassing Artia PLC's official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded perspective on the company's operational landscape and strategic positioning.