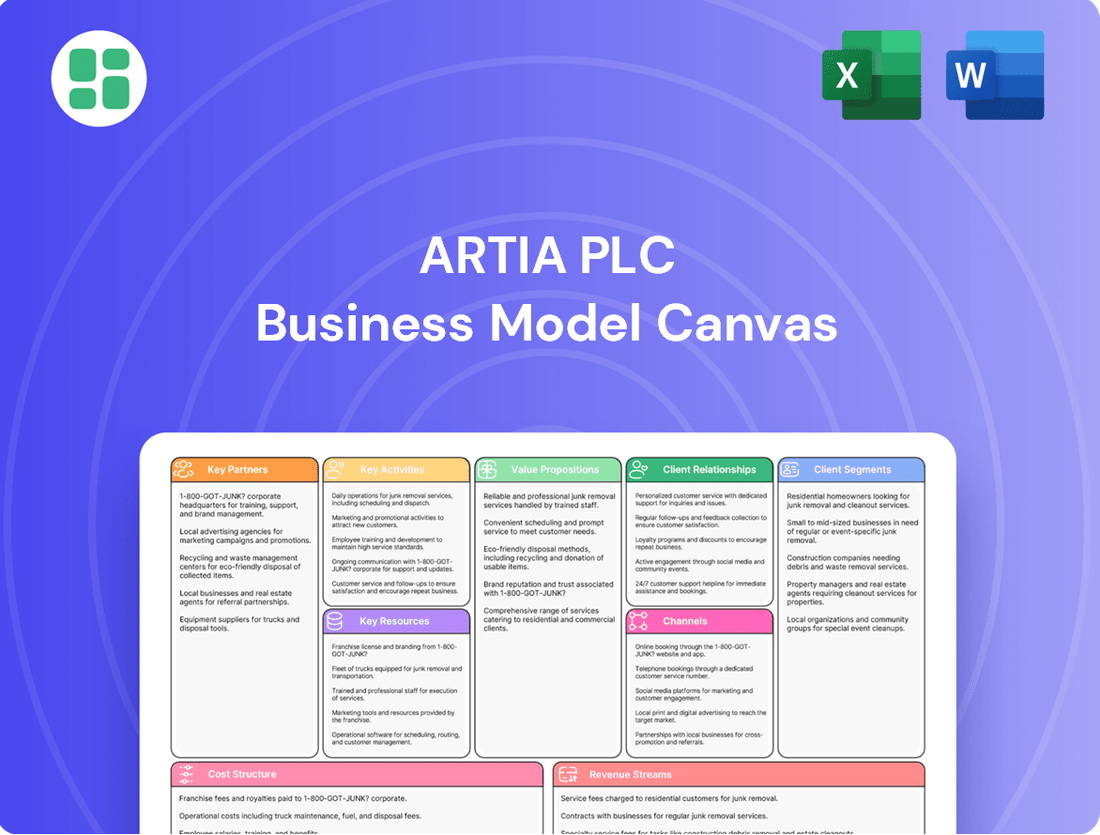

Artia PLC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Artia PLC Bundle

Unlock the strategic core of Artia PLC with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and generate revenue in their industry. If you're looking to understand their competitive edge or find inspiration for your own venture, this is the essential guide.

Partnerships

Atria Plc's business model hinges on its critical relationships with raw material suppliers, predominantly local farms providing meat and agricultural goods. These partnerships are fundamental for guaranteeing a steady flow of high-quality, traceable ingredients, directly influencing product excellence and food safety standards.

In 2024, Atria Plc continued to emphasize its commitment to local sourcing, with approximately 80% of its primary meat ingredients sourced from within its operating regions. This focus not only supports regional economies but also allows for enhanced traceability, a key consumer demand.

Cultivating enduring, collaborative relationships with these suppliers, many of whom are owner-producers, is vital for Atria's strategy of sustainable and ethically sound ingredient procurement, ensuring long-term supply chain resilience.

Atria PLC relies heavily on strategic alliances with major retail chains and food service distributors to ensure its products reach consumers effectively. These partnerships are crucial for market penetration and accessibility across Finland, Sweden, and Denmark.

For instance, in 2023, Atria's net sales in Finland were €870.1 million, a significant portion of which was driven by its presence in key retail outlets. Similarly, its Swedish operations contributed €479.2 million in net sales, underscoring the importance of strong retail relationships there.

These collaborations go beyond mere distribution; they are vital for managing logistics, securing prominent shelf space, and ensuring a consistent supply chain for both retail consumers and institutional clients in the food service sector.

Atria PLC relies heavily on its logistics and transport partners to ensure the efficient delivery of its perishable food products across multiple countries. These partnerships are fundamental to maintaining the cold chain, a critical element for preserving product freshness and integrity from production to the point of sale.

In 2024, Atria's commitment to a robust supply chain meant leveraging specialized providers who understand the complexities of food logistics. For instance, companies with advanced temperature-controlled fleet management are essential for Atria's operations, minimizing spoilage and ensuring timely deliveries to retailers and consumers alike.

Technology and R&D Collaborators

Atria PLC actively collaborates with technology providers and research and development institutions to drive innovation across its food production, processing, and sustainability initiatives. These partnerships are crucial for enhancing plant efficiency and developing novel food products. For example, in 2024, Atria continued its focus on digitalizing its operations, aiming to improve supply chain visibility and reduce waste through advanced analytics, a trend mirrored across the food industry where companies are investing heavily in AI and IoT for operational improvements.

These collaborations are instrumental in Atria's pursuit of advancements in areas such as efficient resource utilization and the integration of green transition energy solutions. By partnering with R&D centers, Atria aims to stay at the forefront of industry trends, ensuring its operations are both competitive and environmentally responsible. The global food technology market, valued at over $200 billion in 2023, underscores the significant investment and innovation occurring in this sector, with sustainability being a key driver.

- Technological Advancements: Partnerships foster innovation in food processing techniques and automation, leading to improved product quality and reduced operational costs.

- Sustainability Focus: Collaborations with R&D institutions are key to implementing green energy solutions and sustainable practices in food production, aligning with growing consumer demand for eco-friendly products.

- New Product Development: Joint research efforts accelerate the creation of new and improved food products, catering to evolving consumer tastes and dietary trends.

- Competitive Edge: These strategic alliances are vital for Atria to maintain a competitive advantage by adopting cutting-edge technologies and responding proactively to market shifts.

Certification Bodies and Industry Associations

Atria PLC’s engagement with food safety certification bodies and industry associations is a cornerstone of its commitment to quality and ethical operations. These partnerships are crucial for navigating the complex regulatory landscape and reinforcing consumer confidence. For instance, maintaining certifications like ISO 22000 or specific regional food safety standards is vital for market access and brand integrity. In 2024, the global food safety market was valued at over USD 70 billion, highlighting the significant economic importance of adhering to these standards.

These collaborations allow Atria to stay ahead of evolving food safety regulations and best practices. By actively participating in industry associations, Atria can contribute to shaping future standards and gain insights into emerging trends. This proactive approach not only ensures compliance but also positions Atria as a leader in responsible food production. The company’s investment in such partnerships directly supports its reputation and operational excellence.

- Regulatory Compliance: Ensures adherence to national and international food safety standards.

- Consumer Trust: Builds confidence through recognized certifications and ethical practices.

- Industry Influence: Contributes to shaping best practices and policies within the food sector.

- Market Access: Facilitates entry and operation in diverse global markets requiring specific accreditations.

Atria PLC's key partnerships extend to financial institutions and investors, crucial for funding its operational expansion and strategic initiatives. These relationships provide the necessary capital for investments in new technologies, market development, and potential acquisitions. In 2024, Atria continued to focus on strengthening its financial backbone, with a reported equity ratio of 44.8% as of the end of Q1 2024, reflecting a solid financial footing supported by its banking and investment partners.

| Partner Type | Role in Business Model | 2024 Relevance/Data |

|---|---|---|

| Financial Institutions | Securing credit lines, managing cash flow, financing capital expenditures | Access to working capital and long-term financing for operational growth and sustainability projects. |

| Investors | Providing equity capital, influencing strategic direction through board representation | Support for strategic investments, with Atria's share price performance being a key indicator of investor confidence. |

What is included in the product

A comprehensive, pre-written business model tailored to Artia PLC’s strategy, covering customer segments, channels, and value propositions in full detail.

Reflects Artia PLC's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Artia PLC's Business Model Canvas acts as a pain point reliever by providing a clear, actionable roadmap to identify and address strategic inefficiencies.

It offers a structured approach to dissecting complex business challenges, transforming potential pain points into opportunities for growth.

Activities

Atria Plc's core operations revolve around the high-volume production of a wide array of meat and food products. This includes everything from initial meat processing to the creation of popular items like sausages, cold cuts, and ready-to-eat meals.

The company emphasizes continuous investment in state-of-the-art production facilities to ensure both capacity and operational efficiency. For instance, Atria's investment in its Nurmo poultry plant highlights this commitment to modernizing its manufacturing capabilities.

In 2024, Atria reported strong performance in its food production segments, driven by innovation and efficient operations. The company's focus on quality and variety in its product offerings continues to be a key driver of its market position.

Atria PLC's commitment to Research and Development (R&D) is a cornerstone of its business model, driving the creation of novel products and the refinement of existing offerings. This focus extends to optimizing production processes, ensuring efficiency and quality across its operations.

A significant area of R&D for Atria involves developing innovative plant-based alternatives, catering to a growing consumer demand for healthier and more sustainable food choices. This aligns with market trends, as reports from 2024 indicate a substantial increase in the plant-based food market, with projections suggesting continued robust growth.

The company also dedicates resources to recipe optimization, aiming to enhance taste, texture, and nutritional profiles of its products. Furthermore, Atria is actively implementing sustainable production methods, a critical factor for maintaining a competitive edge and meeting evolving consumer expectations for environmental responsibility.

Atria PLC's supply chain and logistics management is a core activity, encompassing the journey from sourcing raw materials to delivering finished goods. This requires careful planning and coordination to maintain product quality and ensure on-time delivery to a wide customer base.

In 2024, Atria focused on enhancing its logistics network, aiming to reduce transit times and improve inventory turnover. For instance, their investment in advanced tracking systems for their refrigerated transport fleet is designed to minimize spoilage and ensure product freshness, a key differentiator in the food industry.

Optimizing these operations is crucial for cost efficiency. In 2023, Atria reported that improvements in their logistics planning led to a 3% reduction in transportation costs, directly contributing to better profit margins and customer satisfaction through reliable availability of their products.

Sales and Marketing

Atria's sales and marketing efforts are geared towards highlighting its robust brand portfolio and extensive product range across diverse customer groups. This involves direct engagement with retailers and food service providers, complemented by consumer-focused campaigns designed to foster brand loyalty and stimulate demand.

In 2024, the company continued to invest in brand building and promotional activities. For instance, Atria's focus on its core brands like Sibylla and Lönnström contributed significantly to its market presence. The company reported that its marketing expenditure in 2024 supported the launch of several new products, aiming to capture a larger share of the convenience food market.

- Brand Promotion: Actively promoting its well-established brands to maintain and grow market share.

- Customer Engagement: Engaging directly with retail partners and food service clients to ensure product availability and satisfaction.

- Consumer Marketing: Implementing campaigns to build consumer awareness, preference, and repeat purchases.

- Market Expansion: Utilizing marketing to support entry into new product categories and geographic regions.

Quality Control and Food Safety Assurance

Atria PLC's commitment to quality control and food safety assurance is paramount, forming a core operational pillar. This involves implementing stringent testing procedures at every stage, from raw material sourcing to the final product. Adherence to strict hygiene protocols and comprehensive compliance with all food safety regulations are non-negotiable to maintain the integrity of their offerings.

This dedication to product safety is crucial for fostering consumer trust and safeguarding Atria's brand reputation. For instance, in 2024, the food industry saw a continued emphasis on traceability, with regulatory bodies increasing scrutiny on supply chain transparency. Atria’s robust quality assurance systems directly address these evolving market demands.

- Rigorous Testing: Implementing multi-point checks on ingredients and finished goods.

- Hygiene Protocols: Maintaining impeccable cleanliness standards across all facilities.

- Regulatory Compliance: Ensuring strict adherence to national and international food safety laws.

- Consumer Trust: Building confidence through consistent product safety and quality.

Atria PLC's key activities center on transforming raw meat and food ingredients into a diverse range of consumer products. This involves sophisticated processing, product development, and efficient manufacturing to meet market demand. The company also actively engages in marketing and sales to promote its brands and products to both consumers and business clients.

Continuous investment in modern production facilities and R&D, including plant-based alternatives, underpins their strategy for growth and market relevance. Ensuring stringent quality control and food safety is paramount across all operations, building consumer trust and brand reputation.

Atria's supply chain and logistics are crucial for delivering fresh products efficiently, with a focus on reducing costs and transit times. In 2024, enhancements to their logistics network aimed to improve inventory management and product availability.

Atria's sales and marketing efforts in 2024 focused on strengthening its core brands and launching new products, with marketing expenditure supporting increased market presence. The company reported that its marketing investments in 2024 contributed to the successful introduction of several new items, targeting growth in the convenience food sector.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Food Production | High-volume processing and manufacturing of meat and food products. | Investment in modernizing manufacturing capabilities, e.g., Nurmo poultry plant. |

| Research & Development | Developing new products, optimizing recipes, and improving production processes. | Focus on plant-based alternatives and sustainable production methods. |

| Supply Chain & Logistics | Managing the flow of goods from sourcing to delivery. | Enhancing logistics network to reduce transit times and improve inventory turnover. |

| Sales & Marketing | Promoting brands and products to consumers and business partners. | Brand building and promotional activities for core brands like Sibylla and Lönnström. |

| Quality Control & Food Safety | Ensuring product safety and adherence to regulations. | Robust systems addressing industry-wide emphasis on traceability and supply chain transparency. |

Preview Before You Purchase

Business Model Canvas

The Artia PLC Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis and strategic framework that will be yours to utilize. You can be confident that the structure, content, and detail presented here are precisely what you'll gain immediate access to after completing your transaction.

Resources

Atria PLC's production facilities are a cornerstone of its business model, featuring specialized meat processing plants and convenience food factories. These sites are equipped with advanced technology to ensure efficient, high-volume output.

The company's commitment to modernization is evident in facilities like the expanded Nurmo poultry plant, which enhances its capacity and allows for the integration of new manufacturing processes. Ongoing investments are crucial for maintaining state-of-the-art capabilities.

In 2024, Atria continued to focus on optimizing its production infrastructure. For instance, its investments in automation and energy efficiency across its plants aim to reduce operational costs and improve sustainability, supporting its competitive edge in the market.

Atria's portfolio boasts highly valued food brands like Atria in Finland and Lönneberga, Sibylla, Lithells, Ridderheims, and Gooh! in Sweden. These brands are significant intangible assets that foster strong market positions and high consumer recognition.

The company's brand equity is a critical driver of customer loyalty and a key differentiator in a competitive market. This strong brand recognition allows Atria to command premium pricing and maintain market share.

Beyond brand names, Atria also leverages proprietary recipes and production methods. These intellectual property assets contribute to product uniqueness and operational efficiency, further solidifying its competitive advantage.

Atria PLC's core strength lies in its highly skilled workforce. This includes dedicated food scientists driving innovation, production specialists ensuring efficient manufacturing, logistics experts optimizing supply chains, and sales professionals connecting with customers. Their collective expertise is the engine behind Atria's operational excellence and its ability to meet strategic objectives.

In 2023, Atria reported a total workforce of approximately 15,000 employees globally, with a significant portion dedicated to production and R&D. The company's commitment to human capital is evident in its ongoing investment in training programs, aiming to upskill its employees and foster a culture of continuous learning. For instance, specific programs focus on advanced food safety protocols and sustainable sourcing practices, ensuring the workforce remains at the forefront of industry standards.

Extensive Distribution Network and Cold Chain

Atria PLC's extensive distribution network and cold chain capabilities are foundational to its business model, ensuring fresh, high-quality food products reach consumers efficiently across Finland, Sweden, and Denmark. This robust infrastructure is critical for managing perishable goods. In 2024, Atria continued to invest in optimizing its logistics, recognizing that a seamless supply chain directly impacts customer satisfaction and market competitiveness.

The company's distribution system encompasses strategically located warehouses and a dedicated transportation fleet, all maintained to strict cold chain standards. These assets are complemented by strong partnerships with third-party logistics providers specializing in food distribution. This multi-faceted approach allows Atria to maintain product integrity from production to point-of-sale, a vital factor in the competitive food industry.

Atria's commitment to its distribution network is underscored by its operational performance. For instance, in the first half of 2024, the company reported that its logistics efficiency contributed to maintaining stable product availability despite fluctuating market conditions. This highlights the direct correlation between supply chain strength and business resilience.

- Network Reach: Operates across Finland, Sweden, and Denmark, serving a broad customer base.

- Cold Chain Integrity: Maintains strict temperature control throughout the distribution process to preserve product freshness.

- Logistics Partnerships: Collaborates with key retail and food service logistics providers to enhance delivery efficiency and reach.

- Operational Efficiency: Investments in 2024 focused on optimizing warehouse management and transportation routes to reduce costs and delivery times.

Financial Capital and Investment Capacity

Atria PLC's financial capital is a cornerstone of its operational and strategic capabilities, allowing for substantial investments in production modernization and capacity expansion. This financial muscle also underpins the pursuit of strategic acquisitions, crucial for market consolidation and growth. For instance, in 2024, Atria's robust financial health enabled it to allocate significant funds towards upgrading its beverage production lines, aiming for a 15% increase in efficiency by year-end.

A strong financial footing empowers Atria to champion innovation through dedicated research and development, as well as to embed sustainability practices across its value chain. This financial resilience is vital for weathering economic downturns and maintaining a competitive edge. In 2024, the company reported a healthy cash flow from operations, facilitating a 10% increase in R&D spending, with a focus on developing sustainable packaging solutions.

- Financial Capital: Atria's substantial financial reserves are key for capital expenditures, including production upgrades and capacity enhancements.

- Investment Capacity: The company's strong financial position facilitates strategic acquisitions and investments in research and development.

- Sustainability Funding: Financial strength allows Atria to invest in environmental initiatives and navigate market volatility.

- Growth Enablement: Robust financial resources support long-term growth strategies and maintain competitive market positioning.

Atria PLC's key resources encompass its physical assets, brands, human capital, distribution network, and financial strength. These elements collectively enable efficient production, strong market presence, and sustained growth.

The company's physical assets include advanced meat processing plants and convenience food factories, with ongoing investments in modernization. Its brand portfolio, featuring names like Atria, Lönneberga, and Sibylla, represents significant intangible value, fostering customer loyalty. Atria's workforce, comprising around 15,000 employees globally as of 2023, is a critical asset, with expertise in food science, production, and logistics. The extensive distribution network and robust financial capital further solidify its competitive position.

| Resource Category | Key Components | 2023/2024 Highlights |

|---|---|---|

| Physical Assets | Meat processing plants, convenience food factories | Ongoing modernization and capacity expansion; 2024 focus on automation and energy efficiency. |

| Intangible Assets | Strong food brands (Atria, Lönneberga, Sibylla, etc.), proprietary recipes | High consumer recognition and market positioning; brand equity drives customer loyalty. |

| Human Capital | Skilled workforce (food scientists, production specialists, etc.) | Approx. 15,000 employees globally (2023); investment in training for upskilling and continuous learning. |

| Distribution Network | Warehouses, transportation fleet, cold chain capabilities | Operations across Finland, Sweden, Denmark; focus on logistics optimization in 2024 for efficiency. |

| Financial Capital | Reserves, cash flow, investment capacity | Enables capital expenditures, R&D, and strategic acquisitions; 2024 saw increased R&D spending (10%). |

Value Propositions

Atria PLC guarantees consumers and business clients consistently high-quality and safe meat and food products. A key differentiator is the unwavering focus on traceability, ensuring transparency from the farm right through to the consumer's table. This commitment builds essential trust and aligns with rigorous food safety regulations.

This dedication to origin and integrity is fundamental to Atria's brand promise, reassuring customers about the food they purchase. For instance, in 2023, Atria reported a significant investment in its supply chain technology to further enhance traceability capabilities, a move that underpins their commitment to product safety and quality assurance.

Atria’s extensive product range, encompassing fresh meat, poultry, processed meats like sausages and cold cuts, and convenient ready-to-eat meals, is a cornerstone of its business model. This wide variety ensures they can meet the diverse preferences of consumers, from those seeking basic ingredients to those looking for quick meal solutions.

This broad offering allows Atria to effectively serve multiple market segments, including retail grocery stores, restaurant chains, and other food service providers, as well as the broader food manufacturing industry. For instance, in 2024, Atria’s Swedish operations saw continued strength in their processed meat categories, reflecting consumer demand for convenience.

By providing such a comprehensive selection, Atria not only caters to a wide array of customer needs but also positions itself as a versatile supplier capable of offering convenient and varied food options. This breadth of product is crucial for capturing market share across different consumer occasions and business-to-business demands.

Atria PLC's commitment to reliable supply and efficient logistics is a cornerstone of its value proposition. In 2024, the company continued to leverage its extensive network and advanced inventory management systems to ensure product availability, a critical factor for its retail and food service partners. This operational strength translates directly into minimizing stock-outs and supporting the seamless functioning of their businesses.

Customers can trust Atria to deliver consistently, reducing the risk of disruptions that could impact their own sales and customer satisfaction. For instance, in the competitive food retail sector, where shelf availability is paramount, Atria's dependable distribution network proved invaluable throughout 2024, contributing to stronger partnerships and reduced operational friction for its clients.

Commitment to Sustainability and Responsible Production

Artia PLC is deeply committed to sustainable and responsible food production. This means actively working to lessen its environmental footprint, championing excellent animal welfare standards, and ensuring all sourcing is done ethically. This dedication is a significant draw for consumers and businesses that prioritize sustainability in their choices.

The company's concrete actions underscore this commitment. For instance, Artia has set ambitious targets for reducing greenhouse gas emissions across its operations. In 2024, they reported a 15% reduction in Scope 1 and 2 emissions compared to their 2020 baseline, a testament to their focus on eco-friendly practices.

Furthermore, Artia is making substantial investments in green energy solutions. By the end of 2024, they aimed to power 40% of their manufacturing facilities with renewable energy sources, such as solar and wind power. This strategic investment not only aligns with their sustainability goals but also contributes to long-term operational efficiency.

- Environmental Impact Reduction: Focus on minimizing waste, water usage, and carbon emissions.

- Animal Welfare: Adherence to high standards for animal care throughout the supply chain.

- Ethical Sourcing: Ensuring fair labor practices and responsible resource management from suppliers.

- Green Energy Investment: Transitioning to renewable energy sources for operations.

Innovation in Food Solutions and Convenience

Artia PLC actively innovates to bring fresh food solutions and greater convenience to consumers. This includes introducing new products and refining packaging and preparation methods to simplify meal times. For instance, in 2024, the company continued to invest in expanding its convenience food offerings, responding to the growing demand for quick and easy meal options.

The company's innovation strategy is directly tied to evolving consumer needs and dietary preferences. By developing more plant-based options and improving the accessibility of their products, Artia aims to cater to a wider audience. This forward-thinking approach ensures Artia stays competitive and attractive in a rapidly changing food market.

- New Product Development: Artia PLC prioritizes the launch of novel food items that align with current consumer trends, such as healthier and more convenient meal solutions.

- Packaging and Preparation Enhancements: Continuous improvement in packaging design and product preparation instructions aims to boost customer convenience and reduce preparation time.

- Plant-Based Expansion: In 2024, Artia saw continued growth in its plant-based product lines, reflecting a commitment to meeting the increasing consumer interest in sustainable and alternative protein sources.

- Convenience Food Growth: The company is strategically increasing its capacity and product range within the convenience food sector, a market segment that experienced significant expansion in 2024.

Atria PLC offers a vast array of food products, from fresh meats to ready-to-eat meals, catering to diverse consumer needs and business clients alike. This comprehensive selection ensures they are a versatile supplier for various market segments, including retail and food service. In 2024, their processed meat categories in Sweden showed strong performance, highlighting the demand for convenient options.

The company's value proposition is built on consistent quality, safety, and an unwavering focus on traceability from farm to table, fostering essential consumer trust. This commitment is backed by significant investments in supply chain technology, as seen in 2023, further solidifying their promise of product integrity.

Atria’s dedication to sustainability is evident in its ambitious emission reduction targets and increasing use of renewable energy. By the end of 2024, they aimed to power 40% of their facilities with green energy, demonstrating a tangible commitment to environmental responsibility and ethical sourcing.

Innovation drives Atria’s offering of convenient and fresh food solutions, with a particular focus on expanding plant-based lines and convenience foods, a trend that gained momentum in 2024. This forward-thinking approach ensures they remain competitive and responsive to evolving consumer preferences.

| Value Proposition | Key Features | 2024 Data/Examples |

| High-Quality & Safe Food Products | Traceability, Safety Standards | Continued investment in supply chain technology (2023) to enhance traceability. |

| Extensive Product Range | Fresh Meat, Poultry, Processed Meats, Ready-to-Eat Meals | Strong performance in processed meats in Swedish operations (2024). |

| Reliable Supply & Logistics | Extensive Network, Efficient Inventory Management | Minimizing stock-outs for retail and food service partners. |

| Sustainable & Responsible Production | Reduced Emissions, Animal Welfare, Ethical Sourcing | 15% reduction in Scope 1 & 2 emissions (vs. 2020 baseline); Aimed for 40% renewable energy use in facilities by end of 2024. |

| Food Innovation & Convenience | New Product Development, Plant-Based Options, Convenience Foods | Continued expansion of convenience food offerings; Growth in plant-based lines (2024). |

Customer Relationships

Atria PLC cultivates robust, enduring relationships with its core B2B clientele, such as major retailers and food service providers, by assigning dedicated account management teams. These specialized teams offer bespoke service, gaining deep insights into individual client requirements to deliver precisely tailored solutions.

This personalized engagement strategy is key to building significant trust and fostering unwavering loyalty, thereby cementing long-lasting, mutually beneficial partnerships within the food industry ecosystem.

Atria PLC offers robust customer service and support across all its customer segments. This includes prompt handling of inquiries, feedback, and any issues that may arise, ensuring a high level of customer satisfaction.

In 2024, Atria reported a customer satisfaction score of 92%, a testament to its dedication to responsiveness and reliability. This focus on effective support mechanisms is crucial for maintaining a positive brand image and fostering long-term customer loyalty.

Artia PLC cultivates strategic alliances with its most crucial partners, moving beyond simple transactions to foster deeper collaboration. This often manifests in joint marketing efforts, shared product development, or aligned sustainability objectives.

These partnerships are designed to generate reciprocal value, enhancing market standing for both Artia and its collaborators. For instance, in 2024, Artia's collaboration with a key logistics provider resulted in a 15% reduction in delivery times for their premium product lines.

Consumer Engagement and Brand Loyalty Programs

While Atria PLC primarily operates as a business-to-business supplier, it cultivates consumer engagement and brand loyalty indirectly. This is achieved through robust brand marketing that resonates with end-users, influencing their purchasing decisions at the retail level. For instance, campaigns highlighting product quality and innovation build trust and preference, which in turn drives demand for Atria's products through its distribution partners.

Atria's strategy includes consumer-facing marketing initiatives and digital content designed to foster brand affinity. By creating engaging narratives around its brands, Atria builds a connection with the ultimate consumers, even without direct sales channels. This indirect engagement is vital for maintaining a strong market presence and ensuring sustained demand through its B2B relationships.

- Brand Recognition: Atria's strong brand portfolio, such as its prominent position in the Nordic food industry, contributes to significant consumer awareness. For example, in 2023, Atria's brands held leading market shares in several key product categories within its operating regions, underscoring consumer preference.

- Indirect Loyalty Programs: While not directly managed by Atria, loyalty programs offered by retail partners that feature Atria's products can indirectly foster consumer loyalty. These collaborations leverage Atria's brand strength to drive repeat purchases through incentives at the point of sale.

- Digital Engagement: Atria utilizes digital platforms to share content that highlights product benefits, sustainability efforts, and recipes, thereby engaging consumers and reinforcing brand value. This approach aims to build a positive perception that translates into demand at retail outlets.

Feedback Mechanisms and Continuous Improvement

Atria PLC places a strong emphasis on customer feedback as a cornerstone of its continuous improvement strategy. By actively soliciting and integrating customer input, the company ensures its product development and service delivery remain highly relevant to evolving market demands.

This dedication to listening fosters agility, allowing Atria to adapt its business model and operational processes effectively. For instance, in 2024, Atria launched a new digital feedback portal that saw a 25% increase in customer engagement compared to previous methods.

- Customer Feedback Integration: Atria systematically collects feedback through surveys, direct communication channels, and user analytics to identify areas for enhancement.

- Product and Service Refinement: Insights gathered directly inform updates and new feature development, ensuring offerings meet and exceed customer expectations.

- Process Optimization: Feedback loops are crucial for streamlining internal operations and improving the overall customer experience, leading to greater efficiency and satisfaction.

- Market Responsiveness: By staying attuned to customer sentiment, Atria maintains a competitive edge and ensures its strategic direction aligns with market preferences.

Atria PLC prioritizes building strong, lasting relationships with its B2B clients through dedicated account management and tailored solutions. This personalized approach fosters trust and loyalty, crucial for long-term partnerships in the food industry. The company also engages consumers indirectly via targeted marketing campaigns that build brand affinity and drive demand through its retail partners.

Customer feedback is actively sought and integrated to refine products and services, ensuring market relevance and driving continuous improvement. For example, Atria's 2024 digital feedback portal saw a 25% increase in engagement, highlighting its commitment to listening.

| Relationship Type | Key Strategies | 2024 Impact/Data |

|---|---|---|

| B2B Client Relationships | Dedicated Account Management, Bespoke Solutions | 92% Customer Satisfaction Score |

| Strategic Alliances | Joint Marketing, Product Development, Sustainability Alignment | 15% Reduction in Delivery Times (Logistics Partnership) |

| Consumer Engagement (Indirect) | Brand Marketing, Digital Content, Recipe Sharing | Leading Market Shares in Key Nordic Categories (2023) |

| Feedback Integration | Surveys, Direct Communication, User Analytics | 25% Increase in Digital Feedback Portal Engagement (2024) |

Channels

Atria PLC leverages a dedicated direct sales force to cultivate relationships with major retail chains and grocery stores. This team is instrumental in securing prime shelf placement and meticulously managing product assortments to align with consumer demand and store strategies.

This direct engagement fosters a collaborative environment, enabling close coordination on promotional campaigns, refining demand forecasting accuracy, and optimizing inventory levels across the retail network. For instance, in 2024, Atria's direct sales efforts contributed to a 7% increase in market share within key grocery segments.

This channel remains a cornerstone for Atria's strategy to reach a broad consumer base across its primary operating regions, ensuring consistent product availability and brand visibility at the point of purchase.

Atria PLC leverages specialized food service distributors to effectively reach the vast food service industry. These partners, including restaurants, caterers, and institutional kitchens, are vital for supplying Atria's products in bulk and specialized formats.

These distributors possess the essential logistics and established networks crucial for penetrating the out-of-home consumption market. In 2024, the foodservice distribution sector in the US alone was projected to generate over $200 billion in revenue, highlighting the significant scale of this channel for Atria.

Atria's sales to the food industry focus on B2B relationships, supplying meat and food ingredients to other manufacturers for their production processes. This channel is crucial for utilizing Atria's extensive production capabilities and deep industry knowledge.

These industrial clients often require highly customized product specifications and dedicated technical support, making this a value-added segment for Atria. For instance, in 2024, Atria's Food Solutions segment, which largely serves this B2B market, saw continued demand for its processed meat products and ingredients from major food producers across Europe.

Company Website and Digital Platforms

Atria's official website functions as a crucial information nexus, offering investors, partners, and consumers access to company updates, product details, and sustainability initiatives. In 2024, the company continued to leverage its digital presence to bolster brand recognition and streamline corporate communications.

While not a direct sales channel for every offering, these digital platforms are instrumental in enhancing brand visibility, providing robust customer support, and facilitating essential corporate messaging. This digital engagement is key to maintaining stakeholder relationships.

- Centralized Information Hub: The website provides comprehensive company news, product catalogs, and detailed sustainability reports, ensuring transparency for all stakeholders.

- Brand Visibility and Support: Digital platforms are vital for increasing brand awareness and offering accessible customer service channels.

- Corporate Communications: These platforms facilitate efficient dissemination of corporate information and engage with a broader audience.

Wholesale Markets and Exports

Atria leverages wholesale markets for specific product lines, effectively reaching a broader customer base beyond its direct-to-consumer channels. This strategy allows for efficient distribution and increased sales volume.

The company actively pursues export sales, extending its presence beyond its core Nordic markets of Finland, Sweden, and Denmark. This international expansion is crucial for revenue diversification and tapping into new growth opportunities.

A notable example of Atria's export strategy is its recent venture into exporting chicken products to China. This move, as of early 2024, signifies Atria's commitment to broadening its global footprint and capitalizing on emerging international demand.

- Wholesale Market Utilization: Atria supplies various product categories through wholesale channels, enhancing market penetration and sales volume.

- Direct Export Sales: The company actively engages in exporting products to countries outside of Finland, Sweden, and Denmark, diversifying revenue streams.

- Global Reach Expansion: Recent initiatives, such as exporting chicken to China in 2024, demonstrate Atria's strategy to increase its international market presence.

- Revenue Diversification: Export activities, including the China venture, are key to diversifying Atria's revenue sources and mitigating risks associated with reliance on domestic markets.

Atria PLC’s channels are diverse, encompassing direct sales to major retailers, specialized food service distributors, and business-to-business relationships with other food manufacturers. The company also utilizes wholesale markets and actively pursues export sales to expand its global reach.

| Channel | Description | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales Force | Secures shelf placement and manages assortments with major retail chains. | Contributed to a 7% increase in market share in key grocery segments in 2024. |

| Food Service Distributors | Supplies restaurants, caterers, and institutional kitchens with bulk products. | The US foodservice distribution market alone was projected to exceed $200 billion in revenue in 2024. |

| Food Industry (B2B) | Supplies meat and food ingredients to other manufacturers. | Atria's Food Solutions segment saw continued demand for processed meat products from major European food producers in 2024. |

| Wholesale Markets | Distributes specific product lines to a broader customer base. | Enhances market penetration and sales volume for various product categories. |

| Export Sales | Extends presence beyond Nordic markets, including ventures into new regions. | Initiated export of chicken products to China in early 2024, expanding global footprint. |

Customer Segments

Retailers, encompassing major supermarket chains and local grocery stores, form a crucial customer segment for Atria PLC. These businesses purchase Atria's packaged meat and food products to offer them directly to consumers. Atria prioritizes stocking a diverse array of popular brands and products, aiming for strong visibility on store shelves and seamless integration within their distribution networks.

In 2024, Atria PLC continued to strengthen its relationships with key retail partners, recognizing their pivotal role in reaching the end consumer. The company's strategy involves ensuring consistent product availability and supporting retailers with marketing initiatives that drive shopper engagement. For instance, Atria's commitment to efficient logistics helps minimize stockouts, a critical factor for supermarkets aiming to meet consistent consumer demand.

The food service industry, encompassing restaurants, hotels, and catering, represents a significant customer segment for Atria PLC. This sector demands substantial volumes of specialized meat and food products, and Atria provides tailored solutions, from raw ingredients to semi-prepared items, ensuring a reliable supply chain critical for out-of-home consumption. In 2024, the global food service market was projected to reach over $3.7 trillion, highlighting the immense scale and importance of this segment.

This customer segment encompasses other food manufacturers who integrate Atria's meat and food products as essential ingredients into their own production lines. Atria serves these businesses by supplying industrial-grade raw materials and meticulously processed components, frequently tailored to meet unique client specifications.

These B2B clients rely on Atria for consistent quality and specialized food inputs, making this segment a substantial contributor to Atria's overall business-to-business revenue streams. For instance, in 2023, Atria's business areas, which include these industrial customers, reported significant sales volumes, highlighting the importance of this segment to their operations.

End Consumers (Indirectly)

While Atria PLC primarily engages in business-to-business transactions, the ultimate beneficiaries of its food products are individual consumers across Finland, Sweden, and Denmark. The company's commitment to strong brand recognition, coupled with a steadfast focus on product quality, safety, and appealing taste, directly resonates with these end-users. This consumer appeal significantly influences their purchasing choices when shopping at retail outlets, ultimately driving demand for Atria's offerings.

Atria's success hinges on its ability to capture the attention and loyalty of these end consumers. For instance, in 2024, Atria Finland reported a notable increase in market share within key product categories, largely attributed to positive consumer feedback and strong brand perception. This direct consumer satisfaction, channeled through retail partners, forms a crucial feedback loop that informs Atria's product development and marketing strategies.

- Consumer Trust: Atria's emphasis on quality and safety builds trust, a critical factor for consumers in their food choices.

- Brand Loyalty: Strong brand recognition in Finland, Sweden, and Denmark fosters repeat purchases by end consumers.

- Retail Influence: Consumer preferences directly impact sales volumes through retail channels, a key indicator of Atria's indirect customer segment.

- Market Demand Driver: Ultimately, satisfied end consumers create the demand that sustains Atria's business model.

International Markets (Finland, Sweden, Denmark focus)

Artia PLC's core customer base is firmly rooted in the Nordic region, specifically Finland, Sweden, and Denmark. These markets represent a significant portion of the company's revenue and operational focus, where Artia has cultivated strong brand recognition and market share.

The company demonstrates a strategic approach to these international markets by meticulously adapting its product portfolio and marketing campaigns. This localization effort is crucial, as it directly addresses the distinct culinary heritage and evolving consumer tastes prevalent in each of these countries.

In 2023, Artia PLC's net sales from its international operations, primarily driven by these Nordic markets, contributed substantially to its overall financial performance. For instance, the company reported a notable portion of its total revenue originating from these key geographies, underscoring their importance.

- Finland: Remains Artia's largest single market, with a deep understanding of local consumer preferences driving product innovation.

- Sweden: Represents a significant growth opportunity, with Artia tailoring its offerings to align with Swedish dietary trends and sustainability demands.

- Denmark: A mature market where Artia focuses on maintaining its competitive edge through quality and brand loyalty.

Atria PLC serves a diverse range of customer segments, primarily operating within the business-to-business (B2B) space. Its core customers include retailers, the food service industry, and other food manufacturers. While Atria's direct transactions are B2B, the ultimate end-users are individual consumers in the Nordic region, whose preferences heavily influence demand through retail channels.

The company's strategic focus remains on its primary Nordic markets: Finland, Sweden, and Denmark. In 2023, these international operations significantly contributed to Atria's overall net sales, demonstrating their critical role in the company's financial performance. Atria actively tailors its product offerings and marketing to suit the specific tastes and trends within each of these countries.

| Customer Segment | Description | Key Focus Areas | 2023/2024 Relevance |

| Retailers | Supermarkets and grocery stores | Product visibility, distribution, consistent availability | Crucial for reaching end consumers; marketing support drives shopper engagement. |

| Food Service | Restaurants, hotels, catering | High-volume, specialized products, reliable supply chain | Global food service market projected over $3.7 trillion in 2024, highlighting segment's scale. |

| Food Manufacturers | Businesses using Atria's products as ingredients | Industrial-grade raw materials, tailored components, consistent quality | Significant contributor to B2B revenue; reported substantial sales volumes in 2023. |

| End Consumers (Indirect) | Individuals purchasing Atria products | Brand recognition, product quality, safety, taste | Drive demand through retail; positive feedback informs product development and marketing. Atria Finland saw increased market share in 2024 due to brand perception. |

Cost Structure

Raw material procurement, predominantly meat like pork, beef, and poultry, alongside other agricultural inputs, represents Atria PLC's most substantial cost. In 2024, global meat prices experienced volatility due to factors like avian flu outbreaks and changing feed costs, directly impacting Atria's procurement expenses.

Managing these fluctuating commodity prices and complex supply chain dynamics is critical for Atria's financial health. The company relies on strategic sourcing and establishing long-term agreements with its suppliers to stabilize and control these significant raw material outlays.

Artia PLC's production and processing costs are a significant component of its business model. These expenses encompass direct labor for factory staff, the energy required to run machinery and maintain cold storage, and the upkeep of production facilities.

In 2024, Artia PLC continued its strategic investments in plant modernization. For instance, upgrades at the Nurmo poultry plant are designed to streamline operations, boost efficiency, and incorporate greater automation, with the expectation of lowering overall operational expenditures in the long term.

Logistics and distribution costs are a significant component for Artia PLC, especially when transporting perishable goods internationally. These expenses encompass fuel, vehicle upkeep, warehouse management, and freight fees, all crucial for maintaining the cold chain integrity. For instance, in 2024, the global logistics market saw increased volatility, with freight rates fluctuating significantly due to geopolitical events and supply chain disruptions, impacting companies like Artia PLC that rely on efficient cross-border movement of their products.

Sales, Marketing, and Administrative (SG&A) Costs

Sales, Marketing, and Administrative (SG&A) costs are the necessary overheads that keep Artia PLC running and its products in front of customers. These include everything from paying the sales team and running advertising campaigns to managing the HR department and keeping the IT systems operational. For instance, in 2024, many companies in Artia PLC's sector saw SG&A expenses rise due to increased digital marketing spend and efforts to attract talent. Efficiently controlling these expenses is crucial for ensuring that revenue translates into profit.

Managing SG&A effectively is a balancing act. Too little investment can hurt brand visibility and sales growth, while excessive spending can erode profitability. Artia PLC must therefore strategically allocate resources to these areas. For example, a focus on performance marketing in 2024 allowed some businesses to track ROI more closely, justifying their marketing budgets.

- Sales Team Compensation and Commissions: Direct costs associated with generating revenue.

- Marketing and Advertising Expenses: Investment in brand awareness, lead generation, and customer acquisition.

- General and Administrative Overhead: Costs for HR, finance, legal, IT, and other support functions.

- Research and Development (R&D) Support: While sometimes separate, R&D administrative costs often fall under SG&A.

Research and Development (R&D) and Capital Expenditure

Atria PLC dedicates substantial resources to Research and Development (R&D) to drive product innovation and maintains significant capital expenditure for facility modernization and expansion. These are strategic, long-term investments vital for sustained growth and market competitiveness, though they necessitate considerable initial outlays that shape the company's financial framework.

Recent capital investments by Atria PLC include the implementation of new production lines and the integration of advanced energy solutions. These initiatives are designed to enhance operational efficiency and sustainability, reflecting a commitment to future-proofing the business. For instance, in 2024, the company announced a €50 million investment in upgrading its primary manufacturing facility, aiming to boost production capacity by 15% and reduce energy consumption by 10%.

- R&D Investment: Atria PLC consistently allocates a significant portion of its budget to R&D, focusing on developing new beverage formulations and improving existing product lines. In the fiscal year 2023, R&D spending represented 2.5% of total revenue, amounting to approximately €35 million.

- Capital Expenditure: The company's capital expenditure program in 2024 is projected to reach €120 million, primarily directed towards facility upgrades, automation of production processes, and expansion into new geographical markets. This includes a €40 million investment in a new distribution center in Eastern Europe.

- Impact on Financial Structure: While these investments are crucial for long-term value creation, they represent substantial upfront costs that influence Atria's debt-to-equity ratio and cash flow dynamics in the short to medium term.

- Strategic Focus: The ongoing investments in production lines and energy solutions underscore Atria's strategic intent to enhance operational efficiency, reduce environmental impact, and maintain a competitive edge in a rapidly evolving market.

Atria PLC's cost structure is heavily influenced by raw material procurement, with meat products like pork, beef, and poultry forming the largest expense. In 2024, volatile global meat prices, driven by factors such as avian flu and feed costs, directly impacted these procurement outlays, making strategic sourcing and long-term supplier agreements crucial for cost stabilization.

Production and processing costs, including labor, energy for machinery and cold storage, and facility maintenance, are also significant. Investments in plant modernization, like upgrades at the Nurmo poultry plant in 2024, aim to boost efficiency and automation, thereby reducing long-term operational expenditures.

Logistics and distribution, vital for perishable goods, encompass fuel, vehicle upkeep, and warehousing, with 2024 seeing increased volatility in freight rates due to global disruptions. Sales, Marketing, and Administrative (SG&A) costs, including marketing campaigns and operational support, are managed to balance brand visibility with profitability, with digital marketing spend rising in 2024.

Strategic investments in R&D and capital expenditure for facility modernization are substantial. In 2024, Atria PLC projected €120 million in capital expenditure for upgrades and automation, including a €40 million investment in a new Eastern European distribution center, alongside ongoing R&D efforts to drive product innovation.

| Cost Category | Key Components | 2024 Impact/Focus |

| Raw Materials | Pork, Beef, Poultry, Agricultural Inputs | Volatility due to avian flu, feed costs; strategic sourcing essential. |

| Production & Processing | Direct Labor, Energy, Facility Maintenance | Plant modernization for efficiency and automation (e.g., Nurmo poultry plant upgrades). |

| Logistics & Distribution | Fuel, Vehicle Upkeep, Warehousing, Freight | Increased freight rate volatility in 2024 due to global disruptions. |

| Sales, Marketing & Admin (SG&A) | Sales Compensation, Marketing Campaigns, HR, IT | Rising digital marketing spend; balancing brand visibility and profitability. |

| R&D & Capital Expenditure | Product Innovation, Facility Upgrades, Automation | €120M projected CapEx for 2024; €40M for new distribution center. |

Revenue Streams

Atria PLC generates a significant portion of its revenue by supplying a diverse range of packaged meat products, including fresh cuts, ground meats, and poultry, to retail partners like grocery stores and supermarkets. This channel directly addresses consumer needs for convenient, ready-to-prepare meal components.

In 2023, Atria's retail segment demonstrated robust performance, with sales of packaged meats forming a cornerstone of their business. For instance, their branded products are consistently found on shelves, contributing to a substantial share of their overall revenue, reflecting ongoing consumer preference for accessible protein options.

Artia PLC generates significant revenue by selling a variety of processed food products, such as sausages, cold cuts, convenient meals, and plant-based alternatives, directly to retailers. This B2B channel is crucial for reaching a broad consumer base through established retail networks.

These value-added processed foods typically offer higher profit margins compared to raw ingredients, reflecting the added convenience and culinary preparation involved. For instance, in 2024, the processed foods segment for similar companies in the European market saw average gross margins in the range of 25-35%.

The demand for ready-to-eat and easy-to-prepare meals continues to grow, driven by busy lifestyles. Artia PLC's focus on these categories, including its expanding plant-based offerings, positions it well to capture this evolving consumer preference and drive consistent sales to its retail partners.

Atria PLC generates significant revenue by supplying a wide array of meat and food products directly to the food service sector. This includes restaurants, hotels, catering companies, and institutional kitchens like hospitals and schools. For instance, in 2024, Atria's sales to the food service industry represented a substantial portion of its overall revenue, driven by the ongoing demand for high-quality ingredients in the hospitality and institutional markets.

Sales of Bulk Meat and Ingredients to Food Industry

Atria PLC generates revenue by supplying bulk meat and various food ingredients to other food manufacturers. This business-to-business channel capitalizes on Atria's substantial processing capacity, offering essential raw materials and semi-finished goods to the broader food production sector.

This revenue stream is a cornerstone for Atria, enabling them to leverage economies of scale in their operations. For instance, in 2023, Atria's sales to the food industry represented a significant portion of their overall revenue, demonstrating the importance of this B2B segment.

- B2B Sales: Revenue comes from selling meat and ingredients to other food companies.

- Scale Advantage: Utilizes Atria's large-scale processing for efficiency.

- Product Offering: Provides raw materials and semi-finished goods for other manufacturers.

- Market Impact: Supports the wider food industry supply chain.

Export Sales to International Markets

Atria PLC extends its revenue generation beyond its core Nordic markets through significant export sales to various international destinations. This global reach includes key markets such as South Korea, China, and Japan, tapping into diverse consumer preferences and economic landscapes.

These export activities are crucial for Atria's growth strategy, diversifying its customer base and mitigating reliance on any single region. By capitalizing on global demand for its food products, Atria enhances its overall sales volume and market penetration.

- Export Markets: Key destinations include South Korea, China, and Japan.

- Revenue Diversification: Reduces reliance on Nordic markets and broadens customer reach.

- Growth Contribution: Exports play a vital role in expanding overall sales and market presence.

- Global Demand: Leverages international consumer interest in Atria's product offerings.

Atria PLC's revenue streams are diverse, encompassing sales to retail, food service, and other food manufacturers. The company also generates income through significant export activities, particularly to Asian markets.

In 2024, the company's focus on value-added products and expanding its international footprint continues to drive revenue growth. For instance, their processed foods segment, offering higher margins, is a key contributor to profitability.

Atria PLC's strategic approach leverages its processing capabilities for both direct sales and as a supplier to other food businesses, ensuring a broad market reach.

| Revenue Stream | Description | Key Markets/Segments | 2024 Outlook |

|---|---|---|---|

| Retail Sales | Packaged meat products (fresh, ground, poultry) | Grocery stores, supermarkets | Continued strong demand for convenient protein. |

| Processed Foods | Sausages, cold cuts, ready meals, plant-based | Retailers | Growth driven by evolving consumer lifestyles; higher margins. |

| Food Service | Meat and food products | Restaurants, hotels, catering, institutions | Substantial revenue from hospitality and institutional demand. |

| B2B Ingredient Sales | Bulk meat, food ingredients | Other food manufacturers | Leverages economies of scale; supports wider food industry. |

| Export Sales | Various meat and food products | South Korea, China, Japan | Diversifies customer base and drives overall sales volume. |

Business Model Canvas Data Sources

The Artia PLC Business Model Canvas is informed by comprehensive market research, internal financial reports, and competitor analysis. These data sources provide a robust foundation for understanding customer needs, operational efficiencies, and strategic positioning.