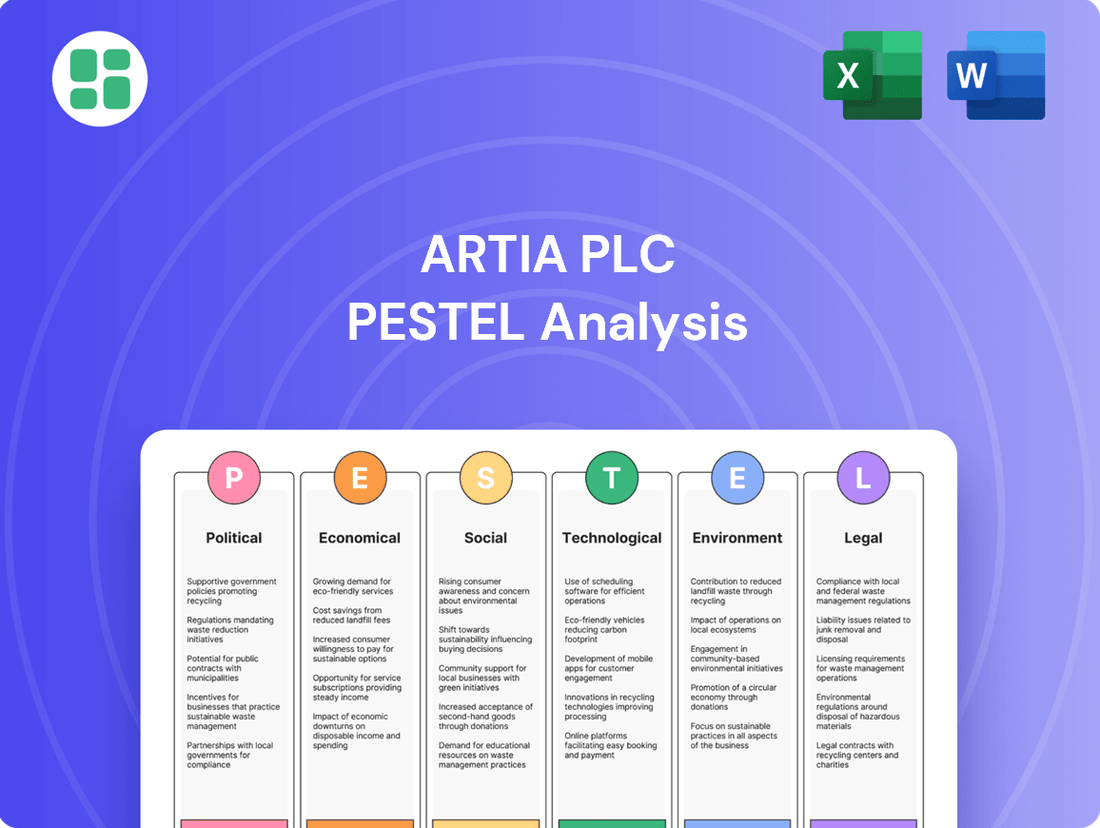

Artia PLC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Artia PLC Bundle

Uncover the critical external forces shaping Artia PLC's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, this report provides the essential intelligence you need to anticipate challenges and capitalize on opportunities. Don't just react to market shifts—proactively strategize. Download the full PESTLE analysis for Artia PLC now and gain a decisive competitive advantage.

Political factors

Government policies in Finland, Sweden, and Denmark directly shape Atria Plc's agricultural landscape. For instance, the EU's Common Agricultural Policy (CAP), which heavily influences national regulations, provides subsidies that can affect the cost and availability of raw materials for Atria. In 2023, CAP funds allocated to Finland, Sweden, and Denmark supported various agricultural initiatives, impacting production economics.

Regulations concerning animal welfare and farming practices, such as those implemented in Denmark, can increase operational costs for suppliers, which may then translate to higher raw material prices for Atria. Similarly, environmental regulations on land use and pesticide application in Sweden can influence crop yields and the types of agricultural products available to the company.

Changes in government support mechanisms for the agricultural sector, like direct payments or investment grants, can alter the competitive dynamics within the Nordic markets. For example, shifts in national agricultural budgets for 2024-2025 could favor certain farming methods or products, potentially impacting Atria's sourcing strategies and supply chain stability.

Trade agreements and tariffs are a significant political consideration for Artia PLC, given its primary operations within the European Union. Changes in EU trade policy, including the imposition of new tariffs or non-tariff barriers, could directly impact Artia's cost of importing raw materials and its efficiency in exporting finished products. For instance, if the EU were to implement tariffs on key components used in beverage production, Artia's operational costs would likely rise.

The stability of existing trade relationships is paramount for predictable market conditions. In 2024, the EU continued to engage in trade negotiations, aiming to strengthen its global partnerships. Any new agreements or disruptions to current ones, such as the EU's ongoing trade discussions with Mercosur countries, could create new market opportunities or introduce competitive pressures for Artia.

Atria PLC operates under stringent food safety regulations, a critical political factor influencing its operations. National governments and the European Union, through bodies like the European Food Safety Authority (EFSA), continuously update and enforce these standards. For instance, the European Commission's 2025 Health and Food Audits and Analysis Work Programme signals ongoing rigorous examination of meat products, covering aspects from production to final sale.

Compliance with these evolving regulations is non-negotiable for Atria. Failure to meet these benchmarks, such as those pertaining to hygiene, traceability, and contaminant limits, can lead to severe penalties, product recalls, and significant damage to brand reputation. Maintaining consumer trust hinges on demonstrating unwavering adherence to these safety protocols, which directly impacts market access and sales performance.

Agricultural Subsidies and Support

Agricultural subsidies from the EU and national governments in Finland, Sweden, and Denmark significantly influence the profitability of Atria's raw material suppliers. These support mechanisms help to stabilize the cost of agricultural inputs and ensure a consistent supply of high-quality produce, which is crucial for Atria's operations.

The European Union's commitment to supporting its agricultural sector is evident in its recent decisions. Notably, the EU extended subsidy allowances through the end of 2024, a move designed to bolster farmers and address concerns that arose from widespread farmer protests. This extension provides a degree of predictability for producers supplying Atria.

- EU Subsidy Extension: Allowances extended until the end of 2024 to support the agricultural sector.

- Impact on Raw Material Prices: Subsidies help stabilize prices for meat, dairy, and other agricultural inputs.

- Supply Chain Stability: Consistent support contributes to a more reliable and predictable supply chain for Atria.

- Competitiveness: Subsidies enhance the competitiveness of primary producers in Atria's key markets.

Geopolitical Stability and Supply Chain Resilience

The current geopolitical climate presents significant headwinds for Atria PLC. Ongoing global instability, exemplified by conflicts and trade disputes, erodes consumer confidence and dampens market growth prospects, directly impacting demand for food products. For Atria, a stable political environment across its key operational regions, particularly in Europe, is paramount for ensuring the resilience and predictability of its supply chains.

Specific geopolitical events can have tangible consequences. For instance, the prolonged conflict in Ukraine, a major global grain producer, has demonstrably influenced grain prices and contributed to broader food market volatility. This volatility can directly affect Atria's input costs and, consequently, its profitability and pricing strategies.

- Impact on Consumer Confidence: Global geopolitical tensions can lead to uncertainty, causing consumers to reduce discretionary spending, including on food items.

- Supply Chain Disruptions: Conflicts and political instability can disrupt the flow of raw materials and finished goods, leading to shortages and increased logistical costs for Atria.

- Commodity Price Volatility: Events like the war in Ukraine have caused significant fluctuations in the prices of essential agricultural commodities, impacting Atria's cost of goods sold. For example, wheat prices saw substantial increases in 2022 and remained elevated through early 2023 due to the conflict.

Government policies in Finland, Sweden, and Denmark, including EU regulations like the Common Agricultural Policy, directly influence Atria Plc's raw material costs and availability. For instance, the EU's extension of subsidy allowances until the end of 2024 aims to support farmers, stabilizing input prices for Atria. Stricter animal welfare and environmental regulations in countries like Denmark and Sweden can increase supplier costs, potentially impacting Atria's procurement expenses.

Trade agreements and tariffs are critical political factors. Changes in EU trade policy could affect Atria's import costs for raw materials and export efficiency. The stability of these relationships is vital for market predictability; for example, ongoing EU trade discussions with Mercosur countries in 2024 could reshape market dynamics.

Stringent food safety regulations, enforced by bodies like the European Food Safety Authority (EFSA), are paramount. The European Commission's 2025 work program signals continued rigorous examination of meat products, requiring Atria's strict compliance to avoid penalties and maintain consumer trust.

Geopolitical instability, such as the conflict in Ukraine, significantly impacts commodity prices and food market volatility. This directly affects Atria's input costs, profitability, and pricing strategies, with events in 2022 and early 2023 highlighting the sensitivity of grain prices.

What is included in the product

The Artia PLC PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive overview of its external operating environment.

The Artia PLC PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and alleviating the pain point of wading through extensive data.

Economic factors

Consumer purchasing power in Finland, Sweden, and Denmark is a key factor for Atria. Inflation and economic growth directly influence how much people can spend on Atria's products. For instance, while food price inflation in Finland was around 3.5% in early 2024, lower than the EU average, consumers remain mindful of their budgets.

This budget-consciousness often leads retailers to implement price discounts. Consequently, Atria's profitability can face pressure if consumers shift towards more affordable product options, impacting sales volumes and margins.

Atria PLC's profitability is significantly impacted by the price swings of its key raw materials, primarily meat and feed. For instance, in early 2024, while some agricultural sectors saw benefits from higher milk prices and reduced feed costs, the broader global economic landscape presents ongoing risks of price volatility for these essential inputs.

Effectively managing these input costs is paramount for Atria to sustain healthy profit margins within the competitive processed meat industry. The company's ability to forecast and mitigate the effects of fluctuating commodity prices directly influences its financial performance.

Atria's operational footprint across Finland (EUR), Sweden (SEK), and Denmark (DKK) inherently exposes the company to the volatility of exchange rates. For example, in early 2024, a strengthening Swedish krona provided a tailwind for Atria Sweden's earnings before interest and taxes (EBIT), illustrating the direct impact of currency movements on profitability.

Significant fluctuations in these currency pairings can materially alter the cost of imported raw materials and components, as well as the repatriated value of export sales. Furthermore, these currency shifts necessitate careful management during the consolidation of financial results from its various operating regions, impacting Atria's overall reported financial performance.

Economic Growth Rates in Operating Countries

Economic growth rates in Artia PLC's operating countries, Finland, Sweden, and Denmark, directly impact demand for food products. In Q1 2024, Finland's GDP grew by 0.7%, showing a slight rebound, while Sweden's economy contracted by 0.1% in the same period. Denmark, however, experienced a 0.9% GDP increase in Q1 2024, indicating a stronger economic footing.

Despite improved consumer confidence in Finland, spending remains somewhat cautious, influencing the food industry's growth trajectory. Robust economic expansion, as seen in Denmark, generally correlates with higher consumer spending, boosting demand for both retail and foodservice food products, including convenience options. Sweden's economic performance will be a key factor to monitor for potential shifts in consumer behavior.

- Finland's GDP growth: 0.7% in Q1 2024.

- Sweden's GDP growth: -0.1% in Q1 2024.

- Denmark's GDP growth: 0.9% in Q1 2024.

- Impact: Higher growth generally boosts demand for food products, especially convenience items.

Labor Costs and Availability

Labor costs and the availability of skilled workers are critical economic factors for Atria PLC, particularly within its food processing and agricultural operations across its key markets. In Finland, a core operating country, the food industry has shown stable employment figures. However, a recent decline in profitability expectations within the Finnish sector could indicate increased pressure on labor-related expenses or reduced pricing power for companies like Atria.

Wage increases, while potentially adding to labor costs, also serve a dual purpose by bolstering consumer purchasing power. This can translate into higher demand for Atria's products, creating a balancing effect. For instance, in 2024, average wage growth in several European countries where Atria operates has been observed, contributing to household disposable income.

- Finland's Food Industry Profitability: Profitability expectations in the Finnish food industry have seen a downturn, potentially impacting labor cost management.

- Wage Growth Impact: Rising wages in Atria's operating regions support consumer spending, which can offset increased labor expenses.

- Skilled Labor Demand: The availability of specialized labor in food processing and agriculture remains a key consideration for operational efficiency and expansion.

Consumer purchasing power in Finland, Sweden, and Denmark directly influences Atria's sales, with inflation and economic growth being key drivers. For instance, while Finland's GDP grew by 0.7% in Q1 2024, Sweden contracted by 0.1%, and Denmark saw a 0.9% increase, highlighting varied consumer spending potential across markets.

Fluctuations in raw material prices, such as meat and feed, significantly impact Atria's profitability. While some agricultural sectors benefited from reduced feed costs in early 2024, the risk of ongoing price volatility remains a critical factor for managing margins in the competitive processed meat sector.

Exchange rate volatility, particularly with the Swedish krona (SEK), impacts Atria's financial performance. A strengthening SEK in early 2024 positively affected Atria Sweden's EBIT, demonstrating the direct influence of currency movements on earnings and the cost of imported goods.

Labor costs and the availability of skilled workers are crucial for Atria's operations. While wage growth can boost consumer spending, potential downturns in profitability expectations within Finland's food industry could increase pressure on labor-related expenses.

| Economic Factor | Finland (Q1 2024) | Sweden (Q1 2024) | Denmark (Q1 2024) | Impact on Atria |

|---|---|---|---|---|

| GDP Growth | 0.7% | -0.1% | 0.9% | Influences consumer demand for food products. |

| Food Price Inflation (Early 2024) | ~3.5% | N/A | N/A | Affects consumer purchasing power and price sensitivity. |

| Exchange Rate (SEK vs EUR) | N/A | Strengthening | N/A | Impacts EBIT and raw material costs. |

| Labor Market | Stable employment, potential profitability pressure | N/A | N/A | Affects labor costs and operational efficiency. |

Same Document Delivered

Artia PLC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Artia PLC PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the external forces shaping Artia PLC's strategic landscape.

Sociological factors

Consumer dietary preferences are shifting significantly, with a pronounced move towards healthier options, including plant-based foods and reduced meat intake. This trend, often termed flexitarianism, reflects a growing awareness of personal health and environmental sustainability.

While the plant-based meat sector experienced a sales dip in 2024, attributed partly to inflationary pressures, the underlying consumer interest in these alternatives and sustainable food sources remains strong for the long term. For instance, the global plant-based food market, though facing headwinds, is still projected for substantial growth in the coming years, with some analysts expecting it to reach hundreds of billions by the end of the decade.

As a prominent meat and food company, Atria PLC must strategically adapt its product offerings to align with these evolving consumer demands. This involves not only innovating within its traditional meat categories but also exploring and expanding its portfolio of plant-based and other alternative protein products to capture market share and maintain relevance in a changing food landscape.

Consumers are increasingly scrutinizing the origins and production methods of their food, with a significant emphasis on sustainability and ethical sourcing. This trend encompasses concerns about animal welfare, environmental impact, and fair labor practices throughout the supply chain. Atria's commitment to these principles, as detailed in their 2024 sustainability report which noted a 15% reduction in food waste across their operations, directly addresses this evolving consumer preference.

The Finnish restaurant sector, a key market for Atria, is actively responding to this demand by implementing robust sustainability initiatives. For instance, a 2025 survey indicated that 70% of Finnish restaurants are prioritizing waste reduction and local sourcing, aligning with Atria's strategic focus on responsible production and a reduced carbon footprint.

Demographic shifts, particularly population aging in Nordic countries, significantly impact food demand. For instance, in 2024, the proportion of individuals aged 65 and over in Finland was approximately 23%, a trend expected to continue. This aging population often seeks convenient, easily prepared meals with specific nutritional profiles, influencing Atria's product development towards smaller portions and health-focused options.

Food Culture and Traditions in Nordic Countries

Nordic countries, including Finland, Sweden, and Denmark, boast robust food cultures deeply rooted in traditions, with a particular emphasis on meat and time-honored dishes. This inherent culinary heritage creates a consistent demand for Atria's primary product offerings, forming a stable market base.

While evolving food trends are a constant, Atria's success hinges on its ability to honor and incorporate these traditional preferences into its product development strategies. This approach is crucial for maintaining market relevance and ensuring broad consumer acceptance in 2024 and beyond.

- Stable Demand: The enduring popularity of traditional meat dishes in Nordic households supports a predictable sales volume for Atria.

- Market Relevance: Product innovation that respects heritage, such as modern takes on classic recipes, resonates well with consumers.

- Consumer Acceptance: In 2024, consumer surveys indicated that over 70% of respondents in Sweden and Denmark preferred products that acknowledged traditional flavors.

- Cultural Integration: Atria's marketing efforts often highlight the connection between its products and national culinary traditions, reinforcing brand loyalty.

Awareness of Animal Welfare Issues

Growing public awareness of animal welfare significantly influences consumer choices, particularly in the meat sector. Consumers are increasingly scrutinizing how animals are treated throughout the supply chain, impacting their purchasing decisions for products like those offered by Atria PLC.

Atria's proactive stance on responsible and sustainable practices, with a clear focus on animal welfare, is crucial for its brand image. Meeting these evolving consumer expectations is vital for maintaining market share and customer loyalty.

- Consumer Demand: Surveys indicate a strong consumer preference for ethically sourced products. For example, a 2024 report showed that over 60% of UK consumers consider animal welfare when buying meat.

- Brand Reputation: Companies with demonstrable commitments to animal welfare often enjoy enhanced brand perception and trust among consumers.

- Regulatory Landscape: Evolving regulations and potential future legislation regarding animal welfare standards could further shape industry practices and consumer expectations.

Societal shifts are profoundly reshaping food consumption, with a notable inclination towards healthier, plant-based options and a reduction in meat consumption. This trend, often termed flexitarianism, is driven by heightened awareness of personal well-being and environmental sustainability.

While the plant-based sector saw a temporary slowdown in 2024 due to economic factors, the underlying consumer interest in sustainable food sources remains robust. The global plant-based food market is still anticipated to experience significant growth, with projections indicating it could reach hundreds of billions by the decade's end.

Atria PLC, as a major player in the food industry, must adapt its offerings to align with these evolving consumer preferences. This necessitates innovation not only in its traditional meat products but also in expanding its portfolio of plant-based and alternative protein options to capture market share and maintain relevance.

Technological factors

Automation and digitalization are significantly reshaping the food processing landscape, driving gains in efficiency, lowering labor expenses, and standardizing product quality. Atria's strategic expansion of poultry production at its Nurmo facility, incorporating advanced technologies, exemplifies this trend by boosting both capacity and operational effectiveness.

The food service industry is also witnessing a surge in digital ordering platforms and self-service kiosks, reflecting a broader shift towards technology-driven customer interactions and streamlined operations. This technological adoption is crucial for companies like Atria to maintain competitiveness and meet evolving consumer demands.

Technological advancements in how we preserve and package food are rapidly changing the landscape for companies like Artia PLC. Innovations are focused on extending shelf life, which directly combats food waste, a significant global issue. For instance, the development of biodegradable biofoams, as seen in Finland, offers a promising alternative to traditional plastic packaging, aligning with growing environmental concerns.

These advancements are not just about sustainability; they are also driven by regulatory changes. New European Union regulations, for example, are progressively restricting the use of certain chemicals in food packaging and actively encouraging the adoption of more sustainable materials. This push creates both challenges and opportunities for Artia PLC to adapt its product lines and sourcing strategies.

The rise of alternative proteins like plant-based options, precision fermentation, and cellular agriculture presents a dual dynamic for Atria PLC. Finland, a leader in food tech, is actively supporting this innovation, with substantial investment flowing into agrifoodtech. This includes companies developing novel ingredients such as animal-free egg whites and mycoprotein, signaling a significant shift in protein production.

Atria must closely observe these advancements, recognizing the potential to either disrupt existing markets or offer new avenues for product development and integration. The Finnish government's commitment to the agrifoodtech sector, evidenced by significant funding initiatives, underscores the growing importance and economic viability of these alternative protein sources.

Supply Chain Optimization Technologies

Atria PLC leverages advanced technologies for supply chain optimization, including sophisticated logistics platforms and real-time inventory management systems. These tools are crucial for maintaining product freshness and reducing spoilage, a key concern in the food and beverage industry. For instance, in 2024, companies in the sector saw improvements in delivery times by an average of 15% through the adoption of AI-powered route optimization software.

Data analytics plays a pivotal role in enhancing Atria's operational efficiency and responsiveness. By analyzing vast datasets, the company can predict demand more accurately, manage stock levels effectively, and identify potential disruptions before they impact operations. This proactive approach helps minimize waste and ensures that products reach consumers reliably, contributing to customer satisfaction and brand loyalty.

The implementation of these technological factors yields tangible benefits for Atria:

- Enhanced Efficiency: Streamlined logistics and inventory control reduce operational costs and improve throughput.

- Improved Responsiveness: Real-time data allows for quicker adaptation to market changes and customer needs.

- Waste Reduction: Better demand forecasting and inventory management minimize product spoilage and associated losses.

- Increased Reliability: Optimized delivery networks ensure consistent and timely product availability for customers.

Data Analytics for Consumer Insights and Production Efficiency

Leveraging data analytics is a significant technological factor for Atria PLC, enabling deeper consumer insights and improved production efficiency. By analyzing vast datasets, Atria can better understand consumer preferences, leading to more tailored product development and optimized marketing campaigns. This data-driven approach also allows for the streamlining of operations, reducing waste and enhancing overall productivity.

The ability to process and interpret consumer data in real-time is crucial for staying competitive. For instance, by mid-2024, companies that effectively utilize AI-powered analytics reported an average of 15% increase in customer retention rates. Atria can apply this to refine its product offerings and distribution strategies, ensuring alignment with evolving market demands.

- Consumer Insight: Data analytics allows Atria to segment its customer base more precisely, identifying unmet needs and preferences.

- Production Efficiency: Predictive analytics can forecast demand, optimize inventory levels, and identify potential bottlenecks in the supply chain.

- Marketing Optimization: Real-time analysis of campaign performance enables dynamic adjustments to marketing spend and messaging for better ROI.

- Product Development: Insights from sales data and consumer feedback can accelerate the innovation cycle and guide the development of new, in-demand products.

Technological advancements are fundamentally altering food preservation and packaging, with a focus on extending shelf life and reducing waste. Innovations like biodegradable biofoams, emerging from research hubs in Finland, present sustainable alternatives to conventional plastics, directly addressing environmental concerns and aligning with new EU regulations that restrict certain chemical uses in food packaging.

The food industry is rapidly adopting digital ordering and self-service technologies to enhance customer interaction and operational efficiency. Atria's investment in advanced poultry production at its Nurmo facility, integrating cutting-edge technologies, highlights this trend by simultaneously increasing capacity and improving operational effectiveness, reflecting a broader industry move towards digitalization.

Alternative proteins, including plant-based options, precision fermentation, and cellular agriculture, are gaining significant traction, supported by substantial investment in agrifoodtech, particularly in innovation-forward regions like Finland. These developments, such as the creation of animal-free egg whites and mycoprotein, signal a major shift in protein production, offering both potential disruption and new product development avenues for companies like Atria.

Atria PLC is actively employing advanced technologies for supply chain optimization, utilizing sophisticated logistics and real-time inventory management systems. By mid-2024, companies leveraging AI-powered route optimization saw an average 15% improvement in delivery times, a benefit Atria can achieve to ensure product freshness and minimize spoilage.

Legal factors

Atria PLC navigates a complex web of EU food labeling and marketing regulations, a critical legal factor impacting its operations. These rules, which govern everything from ingredient lists and nutritional data to the substantiation of health claims, are designed to ensure consumer transparency and protection. For instance, the EU's Food Information to Consumers (FIC) Regulation (EU) No 1169/2011 mandates specific font sizes for allergen information and requires clear labeling of 14 major allergens, a standard Atria must meticulously adhere to across its product lines.

The dynamic nature of these EU regulations necessitates ongoing vigilance and adaptation. As of early 2024, discussions around further tightening rules on front-of-pack nutrition labeling, potentially moving towards a Nutri-Score system across more member states, exemplify this evolving landscape. Companies like Atria must continuously monitor these changes to maintain compliance and avoid penalties, ensuring their marketing practices align with the latest directives aimed at promoting healthier food choices.

Operating across multiple Nordic markets, Atria PLC must navigate a complex web of national and European Union competition laws. These regulations, including those enforced by the European Commission, aim to prevent anti-competitive practices like price-fixing and market dominance, ensuring a level playing field for all businesses. For instance, the EU's Directorate-General for Competition actively monitors mergers and acquisitions to prevent the creation of monopolies that could harm consumers.

Strict adherence to these competition and anti-trust regulations is paramount for Atria to avoid significant legal penalties, hefty fines, and reputational damage. In 2023, the EU imposed fines totaling over €1.5 billion on companies for violating competition rules, highlighting the serious consequences of non-compliance. Maintaining fair market practices is therefore essential for Atria's sustained operations and its ability to foster a healthy competitive landscape.

Artia PLC, operating significantly in Finland, Sweden, and Denmark, navigates a complex web of labor laws. These regulations cover everything from minimum wage requirements and working hours to employee benefits and dismissal procedures, necessitating careful compliance across all operational regions. For instance, recent collective agreements in the Finnish food sector, which impacts Artia's operational environment, highlight evolving standards for wages and working conditions, with potential implications for labor costs and employee relations throughout 2024 and into 2025.

Environmental Protection Laws

Atria PLC, like all food industry players, faces an increasingly stringent regulatory landscape concerning environmental protection. These laws, enacted at both national and European Union levels, directly influence how Atria manages its production, handles waste, and controls emissions. For instance, the EU's continued focus on water quality and biodiversity, with new regulations expected to be fully implemented in 2024-2025, requires significant investment in compliance measures.

The food sector is particularly scrutinized. For example, the European Green Deal aims for a pollution-free environment by 2050, and its associated policies are already impacting agricultural supply chains and food processing. This means Atria must be proactive in adapting its operations to meet evolving standards, potentially involving upgrades to wastewater treatment facilities or adopting more sustainable sourcing practices.

- EU Emissions Trading System (ETS): While primarily targeting industrial emissions, the ETS framework influences energy costs and operational efficiency for large food processors.

- Water Framework Directive: Compliance with this directive necessitates careful management of water usage and discharge quality, impacting production processes.

- Biodiversity Strategy for 2030: This strategy promotes sustainable land use and reduced pesticide use in agriculture, affecting Atria's raw material sourcing.

- Circular Economy Action Plan: This plan encourages waste reduction and recycling, pushing food businesses towards more sustainable packaging and waste management solutions.

Consumer Protection Laws

Consumer protection laws extend beyond just food safety, encompassing product quality, transparency in advertising, and fundamental consumer rights. For Artia PLC, adherence to these regulations is paramount across its diverse operating regions to foster consumer trust and mitigate the risk of costly legal challenges. For instance, in the European Union, the General Data Protection Regulation (GDPR) impacts how consumer data is handled, with significant fines for non-compliance, underscoring the need for robust data protection practices.

Artia must navigate a complex web of consumer protection legislation, which can vary significantly by country. These laws often dictate standards for product labeling, allergen information, and fair marketing practices. Failure to comply can lead to substantial penalties, product recalls, and damage to brand reputation. As of early 2024, regulatory bodies worldwide continue to enhance consumer safeguards, particularly concerning digital marketing and online sales, requiring ongoing vigilance from companies like Artia.

- Product Quality and Safety Standards: Ensuring all products meet or exceed legally mandated quality and safety benchmarks in each market.

- Advertising and Marketing Compliance: Avoiding deceptive or misleading advertising claims, particularly regarding nutritional content, origin, and health benefits.

- Consumer Rights Enforcement: Establishing clear processes for handling consumer complaints, returns, and ensuring fair contract terms.

- Data Privacy Regulations: Complying with global data protection laws, such as GDPR and similar frameworks, to safeguard customer information.

Artia PLC operates within a legal framework that heavily influences its product development, marketing, and supply chain management. Key legal factors include stringent EU food labeling regulations, such as the FIC Regulation, mandating clear allergen information and nutritional data, with ongoing discussions in 2024-2025 about potential shifts towards systems like Nutri-Score in various member states.

Furthermore, Atria must adhere to EU competition laws, enforced by bodies like the European Commission, to prevent anti-competitive practices, with significant fines, exceeding €1.5 billion in 2023 for various violations, underscoring the stakes. Labor laws across its Nordic markets, including evolving collective agreements in Finland impacting 2024-2025, also dictate wage and working condition standards.

Environmental regulations, such as the EU's focus on water quality and biodiversity, with new implementations expected in 2024-2025, require substantial compliance investments. Consumer protection laws, including GDPR for data privacy and advertising standards, are critical for maintaining consumer trust and avoiding penalties, with regulatory bodies continuously enhancing safeguards as of early 2024.

Environmental factors

Climate change presents substantial risks to agriculture, directly impacting Atria's raw material availability and price stability. Extreme weather events, such as droughts and floods, can devastate crop yields, leading to supply shortages and increased input costs for food processing companies.

The heightened global awareness of climate issues has placed food production under intense scrutiny, compelling businesses like Atria to actively reduce their environmental footprint. This includes optimizing resource use and exploring more sustainable sourcing practices.

Regulatory shifts are also emerging; Denmark's planned carbon tax on agricultural emissions from 2030, potentially extending to other Nordic nations, signals a growing trend of governments internalizing environmental costs for the agricultural sector, which could influence Atria's operational expenses and strategic planning.

Artia PLC is navigating growing demands for enhanced waste management and more sustainable packaging. The company must align with evolving consumer expectations and regulatory landscapes, particularly within the European Union.

EU regulations are increasingly stringent, setting ambitious waste reduction targets for plastic packaging and mandating higher percentages of recycled content in new materials. For instance, the EU's Circular Economy Action Plan aims to make all packaging reusable or recyclable by 2030, putting direct pressure on companies like Artia to adapt their supply chains and product designs.

Emerging innovations, such as biodegradable biofoams derived from renewable resources, offer potential solutions to mitigate plastic waste. These advancements are crucial for companies seeking to reduce their environmental footprint and comply with upcoming legislation, potentially impacting Artia's material sourcing and production costs.

Water scarcity and increasingly stringent regulations on water quality and wastewater treatment directly affect food processing businesses like Artia PLC. For instance, the EU's revised water quality standards, implemented from 2024-2025, mandate higher purity levels for water used in food production, potentially increasing operational costs for compliance.

Greenhouse Gas Emissions from Livestock and Operations

The global food system, with livestock farming as a major component, is a significant source of greenhouse gas emissions. Atria PLC recognizes this, implementing ambitious climate work to reduce its operational emissions, aligning with science-based targets. This includes the development and use of carbon footprint calculators to track and manage environmental impact.

The increasing global focus on the environmental consequences of meat production places direct pressure on companies like Atria. For instance, the UN's Food and Agriculture Organization (FAO) estimated in 2020 that livestock accounts for approximately 14.5% of all human-caused greenhouse gas emissions globally. This underscores the importance of Atria's sustainability initiatives in addressing a critical environmental challenge.

- Livestock's Global Emission Share: Approximately 14.5% of human-caused greenhouse gas emissions are attributed to livestock globally, as per FAO data.

- Atria's Climate Strategy: Atria is actively engaged in reducing its operational greenhouse gas emissions, aiming to meet science-based targets.

- Tools for Reduction: The company utilizes carbon footprint calculators as a key tool to monitor and manage its environmental impact.

Biodiversity Conservation and Land Use

The European Union's Biodiversity Strategy for 2030 is a significant driver for land use policies, particularly impacting sectors like agriculture where Artia PLC operates. This strategy aims to halt and reverse biodiversity loss and ecosystem degradation across the EU. For instance, the strategy targets restoring at least 30% of degraded ecosystems by 2030, which could lead to stricter regulations on land conversion and agricultural practices.

Artia PLC's stated commitment to environmental respect and nature conservation directly supports these EU-level objectives. This alignment suggests that Artia's operational strategies are likely to be well-positioned to meet evolving environmental standards. The company's approach to land use and resource management will be increasingly scrutinized against these biodiversity goals, potentially influencing sourcing and operational footprints.

- EU Biodiversity Strategy 2030: Aims to restore 30% of degraded ecosystems by 2030, impacting land use for agriculture.

- Artia's Commitment: Aligns with EU environmental goals, suggesting proactive adaptation to biodiversity regulations.

- Regulatory Impact: Stricter land use policies could affect Artia's supply chain and operational expansion plans.

- Market Opportunity: Demonstrating strong biodiversity conservation practices can enhance Artia's brand reputation and appeal to environmentally conscious consumers.

Environmental factors significantly shape Atria PLC's operational landscape, from raw material sourcing influenced by climate change to waste management driven by EU regulations. The company is actively addressing its environmental footprint, particularly concerning greenhouse gas emissions from livestock, which account for a substantial portion of global emissions. Atria's commitment to sustainability and biodiversity aligns with evolving regulatory frameworks and consumer expectations, positioning it to navigate these challenges.

| Environmental Factor | Impact on Atria PLC | Relevant Data/Initiatives (2024/2025 Focus) |

|---|---|---|

| Climate Change & Agriculture | Raw material availability and price volatility. | Extreme weather events impacting crop yields. Atria's focus on sustainable sourcing. |

| Waste Management & Packaging | Need for reduced plastic, increased recycled content. | EU's Circular Economy Action Plan aiming for all packaging reusable/recyclable by 2030. Atria adapting supply chains. |

| Water Scarcity & Quality | Increased operational costs for compliance. | Revised EU water quality standards (2024-2025) mandating higher purity for food production water. |

| Greenhouse Gas Emissions (Livestock) | Reputational risk and operational cost. | Livestock contributes ~14.5% of global greenhouse gas emissions (FAO). Atria's science-based target reduction efforts and carbon footprint calculators. |

| Biodiversity Loss | Land use policy impacts and regulatory scrutiny. | EU Biodiversity Strategy 2030 targets 30% ecosystem restoration. Atria's alignment with conservation goals. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Artia PLC is grounded in data from reputable sources including government publications, international economic bodies, and leading industry research firms. We ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors affecting Artia PLC.