Atlas Energy Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Energy Solutions Bundle

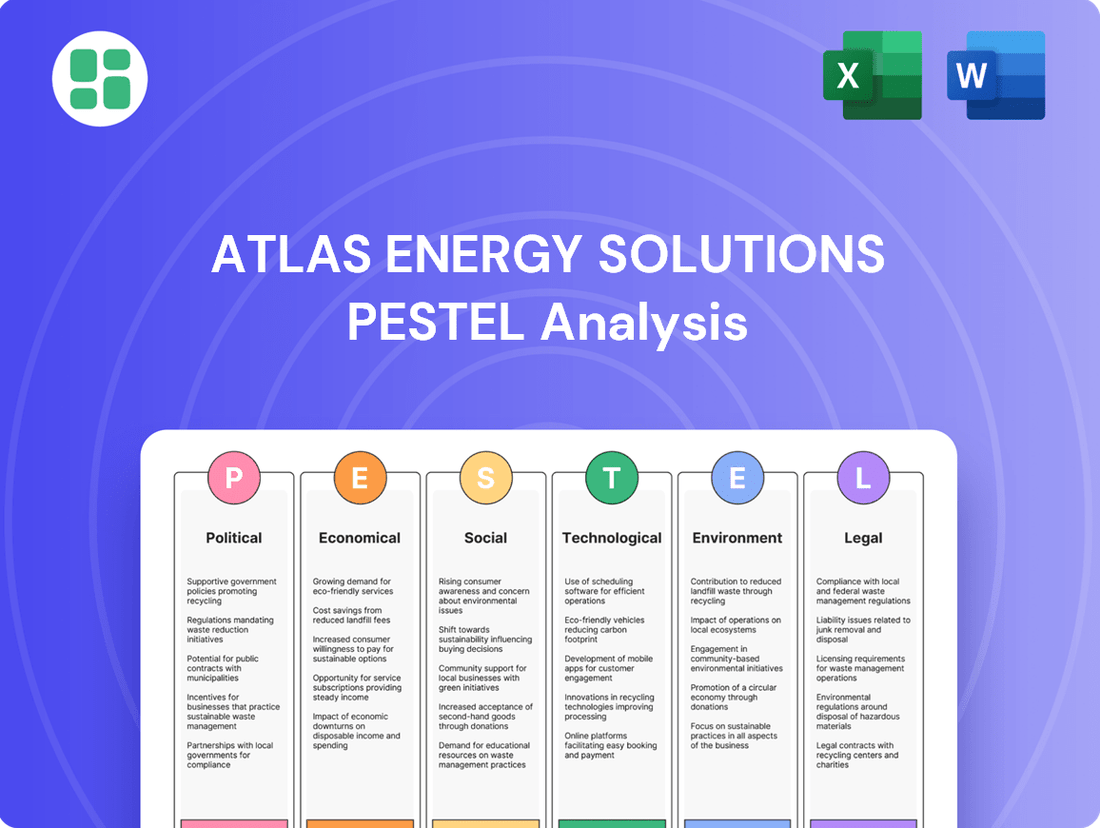

Navigate the complex external forces shaping Atlas Energy Solutions with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact their strategy and future growth. Don't get left behind – download the full analysis now to gain critical insights and make informed decisions.

Political factors

Government energy policy shifts in the US significantly impact Atlas Energy Solutions. The Biden administration's approach, balancing fossil fuel production with renewable energy goals, creates a dynamic operational landscape. For instance, the pause on new Liquefied Natural Gas (LNG) export permits, though recently reviewed, highlights the administration's focus on climate change, potentially affecting demand for proppants used in natural gas extraction.

Recent policy developments, such as the potential streamlining of drilling approvals and the lifting of pauses on some LNG export permits in early 2024, could signal a more favorable environment for oil and gas operations. This could translate into increased demand for Atlas Energy Solutions' proppant products. However, the long-term trajectory of policies promoting green energy, like investments in solar and wind power, may present headwinds for traditional fossil fuel demand.

The regulatory landscape for oil and gas is a critical political factor influencing Atlas Energy Solutions. Government bodies like the Environmental Protection Agency (EPA) and state-level agencies, such as the Texas Railroad Commission, impose rules that directly affect drilling and hydraulic fracturing operations. These regulations shape the operational environment and, consequently, the demand for essential materials like frac sand.

New methane emission standards, for instance, are designed to curb greenhouse gas releases from oil and gas production. Proposed permitting reforms could also streamline or complicate the approval process for new projects. In 2024, the EPA finalized new rules targeting methane emissions from oil and gas facilities, which could increase compliance costs for producers and indirectly impact frac sand demand.

Atlas Energy Solutions must remain agile and responsive to these evolving regulations. Adapting to stricter environmental standards and navigating changes in permitting processes are essential for maintaining operational efficiency and ensuring compliance, which directly affects their business model and the demand for their products.

Global geopolitical shifts significantly influence international oil and gas prices, which in turn ripple through to domestic energy markets like the Permian Basin. For instance, ongoing tensions in Eastern Europe in early 2024 continued to create price volatility, impacting the cost of raw materials and transportation for energy companies.

The drive for US energy independence, a recurring theme in political discourse, directly translates into policies that support domestic production. This focus can boost demand for essential materials like proppants and related logistics services, ensuring continued investment in vital shale regions.

In 2024, the US maintained its position as a leading oil producer, with output in the Permian Basin remaining robust. This sustained production is partly a consequence of geopolitical strategies aimed at stabilizing global energy supplies and reducing reliance on volatile international markets.

Trade Policies and Tariffs

Changes in trade policies, particularly the imposition or removal of tariffs, can directly influence the cost of essential equipment and materials for the oil and gas sector. For Atlas Energy Solutions, this could mean fluctuations in expenses for specialized machinery or components sourced internationally, impacting their operational budget. For instance, a proposed tariff on imported steel in late 2023 could have increased costs for drilling equipment manufacturers, indirectly affecting Atlas's procurement.

While Atlas Energy Solutions emphasizes in-basin solutions, thereby mitigating some direct international supply chain risks, broader trade dynamics still shape the economic landscape for domestic energy production. Policies that make imported oil and gas more expensive, for example, can bolster the competitiveness of U.S.-produced energy, potentially increasing demand for Atlas's services. Conversely, trade disputes could disrupt global energy markets, creating uncertainty.

- Tariff Impact: Potential increases in the cost of imported drilling equipment and materials due to new tariffs could raise Atlas Energy Solutions' operational expenses.

- Domestic Competitiveness: Trade policies favoring domestic energy production may enhance the demand for Atlas's services by making U.S. oil and gas more economically attractive.

- Global Market Influence: Broader trade tensions can introduce volatility into global energy prices, indirectly affecting the overall economic viability of domestic operations.

- Supply Chain Resilience: Even with an in-basin focus, understanding global trade flows is crucial for anticipating potential disruptions or cost advantages in the wider energy ecosystem.

State and Local Government Support

The level of backing from state and local governments in Texas and New Mexico, the core operational areas of Atlas Energy Solutions within the Permian Basin, significantly impacts the company's trajectory. This support often manifests through the permitting process for mining activities, the establishment of land use regulations, and the development of essential infrastructure. Favorable policies enacted at these levels can streamline expansion efforts and boost operational efficiency, potentially reducing project timelines and associated costs.

Conversely, governmental opposition or overly restrictive regulations can introduce considerable hurdles. For instance, delays in obtaining necessary permits for new facilities or expansions can directly impact revenue generation and project feasibility. In 2024, the Permian Basin saw continued focus on environmental regulations, with state-level agencies in Texas and New Mexico issuing updated guidelines for water usage and emissions control, which Atlas Energy Solutions must navigate.

- Permitting Efficiency: Streamlined permitting processes at the state and local levels in Texas and New Mexico can reduce project lead times for Atlas Energy Solutions, directly impacting its ability to capitalize on market opportunities.

- Land Use Regulations: Local zoning and land use ordinances dictate where Atlas Energy Solutions can operate and expand its mining and infrastructure projects, influencing operational flexibility and potential growth areas.

- Infrastructure Support: Government investment in or facilitation of infrastructure development, such as roads and utilities, is critical for efficient logistics and operations in the vast Permian Basin region.

- Regulatory Environment: Changes in state and local environmental and operational regulations can impose new compliance costs or create opportunities for companies like Atlas Energy Solutions that can adapt quickly.

Government energy policy shifts in the US significantly impact Atlas Energy Solutions, influencing demand for proppants. The Biden administration's focus on climate change, while promoting renewable energy, has led to policy adjustments like the pause on new LNG export permits in early 2024, which could affect natural gas production and thus proppant demand.

New methane emission standards finalized by the EPA in 2024 aim to curb greenhouse gases from oil and gas production, potentially increasing compliance costs for producers and indirectly impacting frac sand demand. Permitting reforms are also being considered, which could streamline or complicate project approvals.

The US maintaining its position as a leading oil producer in 2024, with robust output in regions like the Permian Basin, is partly driven by geopolitical strategies supporting domestic production and energy independence. This sustained production generally benefits companies supplying essential materials to the sector.

State and local government policies in Texas and New Mexico are crucial for Atlas Energy Solutions. Favorable permitting and land use regulations can streamline expansion, while updated guidelines for water usage and emissions control in 2024 necessitate careful navigation by companies operating in the Permian Basin.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Atlas Energy Solutions, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for the company's future growth and risk management.

Atlas Energy Solutions' PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliver by simplifying complex market dynamics for strategic decision-making.

Economic factors

Fluctuations in crude oil and natural gas prices are a major economic factor for Atlas Energy Solutions. These price swings directly impact drilling and completion activity in key regions like the Permian Basin. When prices are high, exploration and production companies tend to ramp up their operations, which in turn boosts demand for services like frac sand and logistics that Atlas provides.

For instance, in early 2024, West Texas Intermediate (WTI) crude oil prices hovered around the $70-$80 per barrel range, supporting robust activity levels. Conversely, a significant drop in prices, such as the dip seen in late 2023 when WTI briefly fell below $70, can lead to a slowdown in drilling, directly impacting demand for Atlas's services.

This volatility means Atlas must remain agile, adapting its operations and resource allocation based on market price signals. A sustained period of higher commodity prices generally translates to increased revenue and profitability for Atlas, while prolonged low prices can put pressure on margins and operational volumes.

The demand for hydraulic fracturing services, especially within shale and tight oil plays, directly drives the market for frac sand, a key component. This sustained need is crucial for Atlas Energy Solutions' operational capacity and financial performance.

Global frac sand market projections show continued expansion, largely fueled by increased hydraulic fracturing activities, with North America being a significant contributor. For instance, in 2023, North American oil and gas producers continued robust drilling and completion programs, supporting demand for fracturing services and, consequently, frac sand.

Inflationary pressures are significantly impacting operating costs for companies like Atlas Energy Solutions. In 2024, the US Consumer Price Index (CPI) saw a notable increase, with energy prices contributing to higher expenses for fuel, labor, and equipment maintenance. These rising inputs directly squeeze profit margins.

Atlas Energy Solutions' strategic investment in efficient logistics, such as the Dune Express, aims to directly counter these escalating operational costs. By optimizing transportation routes and reducing reliance on traditional, more expensive shipping methods, Atlas seeks to mitigate the financial impact of inflation on its delivery expenses. This focus on cost efficiency is crucial for maintaining competitiveness.

Effectively managing these fluctuating cost inputs is paramount for Atlas Energy Solutions to sustain healthy profit margins. As of early 2025, continued inflation forecasts suggest that operational expenses, particularly for labor and raw materials essential for their services, will remain a key challenge. Proactive cost management strategies are therefore vital for the company's financial performance.

Capital Expenditure and Investment Trends

Investment levels in the oil and gas sector, especially for drilling and completion in the Permian Basin, directly influence the market for proppant providers like Atlas Energy Solutions. Despite a recent dip in completion activity, major Permian operators are projected to maintain substantial capital expenditures, which will bolster demand for Atlas's offerings.

For instance, in 2024, Permian Basin capital expenditure by major players was anticipated to remain robust, with some estimates suggesting it could reach or exceed 2023 levels, which were around $50 billion. This sustained investment is crucial for Atlas.

Atlas Energy Solutions' own capital expenditure plans for 2024 and 2025 are designed to align with this anticipated market growth and support strategic expansion initiatives. These investments are critical for maintaining their competitive edge and operational capacity.

- Permian Basin CAPEX: Major operators in the Permian Basin are expected to continue significant capital expenditures throughout 2024 and into 2025, providing a stable demand base for proppant services.

- Completion Activity: While completion activity can fluctuate, the underlying investment by large producers in the Permian underpins the long-term market for companies like Atlas.

- Atlas's Investment: Atlas Energy Solutions' capital expenditure plans are strategically aligned with anticipated market demand and future growth opportunities.

Frac Sand Supply and Demand Dynamics

The market for frac sand, a critical component in hydraulic fracturing, is shaped by a delicate balance between supply and demand. In-basin sand sourcing, where sand is obtained closer to drilling sites, has become increasingly important. This trend directly benefits companies like Atlas Energy Solutions, which operate local mines and possess integrated logistics capabilities, leading to significant cost reductions and improved operational efficiency for oil and gas producers.

For instance, in 2024, the Permian Basin saw a notable increase in in-basin sand utilization, driven by these cost-saving advantages. Atlas Energy Solutions reported that its proximity to key shale plays allowed it to capture a larger share of this growing market. This shift away from more distant sand sources can shave off substantial transportation costs, often amounting to hundreds of dollars per ton, directly impacting well economics.

- In-basin sand sourcing offers significant cost advantages, reducing transportation expenses for operators.

- Atlas Energy Solutions benefits from its local mining operations and integrated logistics, aligning with the industry's efficiency drive.

- Market conditions can be volatile, with potential impacts from oversupply or evolving sand quality requirements.

- The demand for frac sand is closely tied to overall oil and gas drilling activity, which saw a moderate but steady pace in key US basins throughout 2024.

Economic factors significantly influence Atlas Energy Solutions, primarily through volatile commodity prices and inflationary pressures. Higher oil and gas prices in 2024, with WTI around $70-$80 per barrel, boosted drilling activity and demand for Atlas's services. However, rising inflation in 2024, reflected in the US CPI, increased operational costs for fuel, labor, and equipment, impacting profit margins.

Investment levels in the oil and gas sector, particularly in the Permian Basin, are critical. Projected robust capital expenditures by major Permian operators in 2024, potentially exceeding $50 billion, provide a stable demand base for Atlas's proppant services. Atlas's own capital expenditure plans for 2024-2025 are aligned with this anticipated market growth.

The increasing trend of in-basin sand sourcing in the Permian Basin during 2024 offers cost advantages for Atlas due to its local mines and integrated logistics. This shift reduces transportation costs, often by hundreds of dollars per ton, enhancing well economics for operators and benefiting Atlas's market share.

| Economic Factor | 2024/2025 Impact | Atlas Energy Solutions Relevance |

|---|---|---|

| Crude Oil Prices (WTI) | Hovered $70-$80/bbl in early 2024; sustained higher prices generally boost activity. | Directly correlates with demand for frac sand and logistics services. |

| Inflation (US CPI) | Notable increase in 2024, impacting fuel, labor, and equipment costs. | Increases operational expenses, necessitating cost-efficiency strategies like optimized logistics. |

| Permian Basin CAPEX | Projected robust spending by major operators, potentially exceeding $50 billion in 2024. | Provides a stable demand base for proppant services and supports Atlas's strategic expansion. |

| In-basin Sand Sourcing | Increased utilization in Permian Basin during 2024 due to cost savings. | Benefits Atlas's local mining and logistics, reducing transportation costs for clients. |

Preview Before You Purchase

Atlas Energy Solutions PESTLE Analysis

The preview you see here is the exact Atlas Energy Solutions PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting Atlas Energy Solutions.

The content and structure shown in the preview is the same Atlas Energy Solutions PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Public sentiment regarding fossil fuels, particularly hydraulic fracturing (fracking), significantly shapes the operational landscape for companies like Atlas Energy Solutions. Growing environmental activism and public concern over climate change can translate into increased regulatory scrutiny and a dampened appetite for investment in the sector. For instance, a 2024 Pew Research Center survey indicated that 60% of Americans believe the government should do more to regulate the oil and gas industry.

While Atlas Energy Solutions may benefit from operating in regions with established energy sector support, the overarching societal shift towards cleaner energy sources presents a long-term challenge. Broader views on climate change and the energy transition can indirectly impact future demand for fossil fuels and influence how investors perceive the company's long-term viability. This is underscored by the fact that global investment in renewable energy sources surpassed $500 billion in 2024, signaling a clear market trend.

Consequently, companies in the oil and gas sector are increasingly pressured to showcase not just operational efficiency but also a commitment to responsible environmental practices. Demonstrating a proactive approach to sustainability and transparently communicating efforts to mitigate environmental impact are becoming crucial for maintaining positive investor relations and public trust. This includes investments in technologies that reduce emissions and improve safety protocols.

Atlas Energy Solutions prioritizes robust community relations in the Permian Basin, recognizing its vital role in maintaining operational continuity. By actively addressing local concerns such as land use, noise, dust, and truck traffic, the company aims to foster a cooperative environment. This proactive approach is essential for securing a social license to operate, thereby mitigating potential disruptions and safeguarding its reputation.

The availability of skilled labor in the Permian Basin is a critical factor for Atlas Energy Solutions. The region's demand for experienced personnel in mining, logistics, and oilfield services directly influences operational efficiency and cost structures. For instance, a report from the Texas Alliance of Energy Producers in late 2024 highlighted a persistent shortage of experienced rig hands and specialized equipment operators, driving up labor costs by an estimated 10-15% compared to the previous year.

Workforce demographics and training needs are also significant sociological considerations. As the energy sector evolves, there's an increasing need for workers with expertise in new technologies and sustainable practices. The average age of experienced oilfield workers is rising, necessitating robust training programs to onboard and upskill new entrants. Atlas Energy Solutions' success hinges on its capacity to attract and retain this vital talent pool amidst intense competition.

Health and Safety Standards

Adherence to robust health and safety standards is critical for Atlas Energy Solutions, particularly in its mining and transportation operations. The energy sector, by its nature, faces intense public and regulatory scrutiny regarding worker safety, directly impacting operational procedures and compliance expenditures. For instance, in 2023, the Occupational Safety and Health Administration (OSHA) reported a total of 5,484 worker fatalities in private industry, with the construction and extraction sector accounting for a significant portion of these incidents, underscoring the inherent risks. Atlas Energy Solutions must therefore maintain a proactive safety culture to safeguard its employees and preserve its corporate image.

The financial implications of safety compliance are substantial. In 2024, companies in high-risk industries are investing heavily in advanced safety technologies and training programs. Atlas Energy Solutions' commitment to safety not only mitigates the risk of accidents and associated liabilities but also enhances operational efficiency and employee morale. Failure to meet these standards can lead to severe penalties, operational shutdowns, and irreparable damage to brand reputation.

- Regulatory Compliance: Atlas Energy Solutions must comply with evolving safety regulations, such as those from OSHA and the Department of Transportation, which can increase operational costs.

- Worker Safety: Prioritizing employee well-being through comprehensive safety protocols is essential for retaining talent and preventing costly accidents.

- Public Perception: A strong safety record positively influences public opinion and stakeholder trust, which is vital for a company operating in the energy sector.

- Operational Efficiency: Investing in safety often leads to more streamlined and efficient operations by reducing downtime caused by incidents.

Corporate Social Responsibility (CSR)

Stakeholders increasingly expect companies like Atlas Energy Solutions to go beyond profit and actively contribute to societal well-being. This translates to a growing demand for ethical sourcing, fair labor practices throughout the supply chain, and meaningful investment in the communities where they operate. For instance, in 2024, a significant majority of consumers indicated they would switch brands if another brand supported a cause they cared about, highlighting the financial impact of CSR.

Atlas Energy Solutions’ commitment to Corporate Social Responsibility significantly shapes its public image and operational success. Demonstrating robust CSR initiatives can bolster brand reputation, making the company more attractive to investors and fostering stronger relationships with local communities and regulatory bodies. Transparency in operations and a proactive approach to environmental stewardship are key components of this. For example, companies with strong ESG (Environmental, Social, and Governance) ratings often outperform their peers, with some studies in 2024 showing a 3-5% higher return on equity compared to those with weaker ESG profiles.

- Ethical Sourcing: Ensuring raw materials are obtained responsibly, avoiding exploitative practices.

- Fair Labor Practices: Upholding safe working conditions and fair wages for all employees and contractors.

- Community Investment: Contributing to local economic development and social programs.

- Environmental Stewardship: Minimizing ecological impact through sustainable operations and emissions reduction.

Public opinion on fossil fuels, especially fracking, is a major influence for Atlas Energy Solutions. Concerns about climate change and environmental activism can lead to stricter regulations and reduced investment, as seen in a 2024 survey where 60% of Americans favored more government oversight of the oil and gas industry.

Societal shifts towards renewable energy also impact the long-term outlook for fossil fuel companies. Global investments in renewables exceeded $500 billion in 2024, indicating a clear market trend that influences investor perception of companies like Atlas Energy Solutions.

Companies in this sector face pressure to demonstrate environmental responsibility. Proactive sustainability efforts and transparent communication about mitigating environmental impact are crucial for maintaining investor confidence and public trust, including investments in emission-reducing technologies.

Atlas Energy Solutions actively manages community relations in the Permian Basin, addressing local concerns like land use and traffic to ensure operational continuity and maintain its social license to operate.

Technological factors

Innovations like extended-reach drilling and multi-well pad development are significantly altering the proppant landscape, directly impacting the volume and specifications of frac sand needed for each well. These sophisticated techniques are designed to boost well productivity and operational efficiency, which in turn fuels a greater demand for high-quality frac sand.

Atlas Energy Solutions is well-positioned to capitalize on these technological shifts, as exploration and production companies increasingly prioritize maximizing hydrocarbon recovery through advanced drilling methods. For instance, the widespread adoption of longer laterals means more sand is pumped per stage, increasing the overall proppant intensity per well, a trend that directly benefits suppliers like Atlas.

The proppant market is seeing innovation with materials like fine mesh and resin-coated ceramics. These advancements directly influence what customers like Atlas Energy Solutions need to offer, pushing for products that boost well performance and tackle tough geological conditions.

Atlas Energy Solutions needs to keep pace with these evolving proppant technologies to remain competitive. For instance, the demand for low-dust proppant systems is on the rise, reflecting a growing emphasis on worker safety and environmental considerations within the industry.

Technological advancements are reshaping logistics and transportation, directly impacting companies like Atlas Energy Solutions. Innovations such as autonomous trucking promise to significantly cut operational costs and improve delivery efficiency. For instance, the ongoing development and testing of self-driving trucks by major players in the automotive and tech sectors are paving the way for wider adoption in freight transport, potentially reducing labor expenses and enhancing safety in the coming years.

Integrated rail systems, exemplified by Atlas's Dune Express, are also crucial for optimizing the movement of materials like proppants. These systems streamline the supply chain by offering a more cost-effective and environmentally friendly alternative to road transport for long hauls. The efficiency gains translate to reduced delivery times and increased reliability, which are critical competitive factors in the energy sector.

Atlas's strategic emphasis on sophisticated last-mile logistics further solidifies its competitive edge. By leveraging technology to ensure timely and precise delivery of proppants directly to well sites, Atlas minimizes downtime for its clients and enhances overall operational productivity. This focus on the final leg of the delivery process is becoming increasingly important as the industry seeks to optimize every stage of the oil and gas extraction process.

Data Analytics and Automation in Operations

Atlas Energy Solutions is leveraging data analytics and automation to streamline its operations. This includes real-time monitoring across mining, processing, and logistics, which is crucial for boosting efficiency and controlling costs. For instance, predictive maintenance, powered by data analytics, can reduce unexpected downtime, a significant expense in the energy sector.

The integration of these technologies allows for more informed decisions regarding resource allocation and the optimization of delivery routes. This data-driven approach directly impacts profitability by minimizing waste and ensuring timely service delivery. In 2024, companies in the industrial sector saw an average operational efficiency improvement of 15% through automation, a trend Atlas Energy Solutions is actively participating in.

- Enhanced Efficiency: Real-time data analytics allows for immediate adjustments in operational processes.

- Cost Reduction: Predictive maintenance minimizes costly equipment failures and downtime.

- Optimized Logistics: Automated scheduling and route planning reduce transportation expenses and delivery times.

- Improved Resource Management: Data insights enable better allocation of personnel and materials.

Emerging Energy Technologies

While Atlas Energy Solutions operates within traditional oil and gas, the energy sector is rapidly evolving with emerging technologies. Carbon capture and storage (CCS) and hydrogen production are gaining significant traction, potentially reshaping future energy demand. For instance, global investment in CCS projects reached an estimated $10 billion in 2023, signaling a growing commitment to decarbonization strategies.

These advancements could indirectly impact the long-term demand for fossil fuels, a core area for Atlas. However, they also present opportunities for companies to pivot or expand into related services. The International Energy Agency (IEA) projects that clean hydrogen production could reach 130 million tonnes by 2030, creating a substantial new market.

- Shifting Demand: Emerging technologies like CCS and hydrogen could reduce reliance on conventional oil and gas, influencing future market dynamics.

- Diversification Opportunities: New energy solutions offer avenues for Atlas to explore new service lines or strategic partnerships, potentially mitigating risks associated with fossil fuel dependency.

- Investment Trends: Significant global investments are flowing into green energy technologies, indicating a strong market signal for innovation and adaptation. For example, the global renewable energy market was valued at over $1 trillion in 2023 and is projected to grow substantially.

Technological advancements in drilling, such as extended-reach drilling and multi-well pad development, are increasing the demand for high-quality frac sand. Innovations in proppant materials like fine mesh and resin-coated ceramics are also influencing product specifications. Atlas Energy Solutions is adapting by focusing on these evolving needs to maintain its competitive edge.

The company is leveraging technology to optimize its logistics and supply chain, including the use of integrated rail systems like its Dune Express. Furthermore, data analytics and automation are being employed for real-time monitoring, predictive maintenance, and improved resource management, aiming to boost operational efficiency by an estimated 15% in 2024.

Emerging energy technologies like carbon capture and storage (CCS) and hydrogen production are gaining traction, with global CCS investment reaching an estimated $10 billion in 2023. While these could indirectly affect fossil fuel demand, they also present potential diversification opportunities for companies like Atlas.

| Technological Factor | Impact on Atlas Energy Solutions | Supporting Data/Trend |

|---|---|---|

| Advanced Drilling Techniques | Increased demand for high-spec proppants; higher proppant intensity per well. | Widespread adoption of longer laterals requires more sand per stage. |

| Proppant Material Innovation | Need to offer advanced materials like fine mesh and resin-coated ceramics. | Focus on products that boost well performance and handle challenging geology. |

| Logistics & Transportation Tech | Enhanced efficiency and cost reduction through autonomous trucking and integrated rail. | Atlas's Dune Express optimizes material movement; autonomous trucking promises reduced labor costs. |

| Data Analytics & Automation | Improved operational efficiency, cost control, and resource management. | Predictive maintenance reduces downtime; automation expected to yield 15% efficiency gains in 2024. |

| Emerging Energy Technologies | Potential long-term shifts in fossil fuel demand; opportunities for diversification. | $10 billion invested in CCS in 2023; clean hydrogen market projected to reach 130 million tonnes by 2030. |

Legal factors

Atlas Energy Solutions navigates a stringent regulatory landscape, encompassing air quality standards for methane emissions, water resource management, land restoration mandates, and waste management protocols. These environmental laws directly impact operational procedures and capital expenditure for compliance.

The U.S. Environmental Protection Agency's (EPA) recent updates, including the New Source Performance Standards (OOOOb/c) for oil and natural gas facilities, impose significantly stricter emission controls and enhanced reporting requirements. For instance, these standards aim to reduce methane emissions, a potent greenhouse gas, by 75% by 2030 compared to 2012 levels, according to the EPA's projections, which translates to increased investment in advanced monitoring and abatement technologies for companies like Atlas.

The legal framework for Atlas Energy Solutions hinges on securing and upholding permits for sand extraction and processing. This includes adhering to stringent environmental regulations and safety standards. For instance, in 2024, the U.S. Bureau of Land Management continued to emphasize compliance with the National Environmental Policy Act (NEPA) for new mining projects, impacting timelines and operational feasibility.

Land use laws are equally vital, dictating the geographical expansion of Atlas's operations. These laws are particularly restrictive concerning sensitive ecological zones and proximity to residential areas. In 2025, state-level zoning boards are increasingly scrutinizing proposals, potentially leading to longer approval processes for new sites, as seen with proposed developments in Texas facing heightened community review.

Strict adherence to these mining permits and land use regulations is not merely a procedural requirement but fundamental to Atlas Energy Solutions' core business continuity and growth. Non-compliance can result in significant fines, operational shutdowns, and reputational damage, impacting their ability to supply essential materials for infrastructure projects.

Regulations governing the transportation of proppant, including road and rail safety standards, weight limits, and hazardous material handling, directly impact Atlas Energy Solutions' logistics operations. For instance, the Federal Motor Carrier Safety Administration (FMCSA) sets stringent rules for commercial vehicles. Failure to comply with these DOT and state-specific regulations can lead to significant fines, operational delays, and jeopardize the safety of deliveries, affecting Atlas's efficiency and profitability.

Labor and Employment Laws

Atlas Energy Solutions operates within a framework of stringent labor and employment laws. These regulations govern critical aspects of its workforce, including worker safety, minimum wage requirements, overtime rules, and the right to unionize. For instance, the Occupational Safety and Health Administration (OSHA) sets industry-specific safety standards that Atlas must adhere to, with penalties for non-compliance. In 2024, OSHA continued its focus on enforcement, particularly in industries with higher risks like energy services.

Changes in labor legislation can significantly affect Atlas Energy Solutions’ operational costs and its approach to human resource management. For example, a mandated increase in the federal minimum wage or new regulations on independent contractor classification could alter payroll expenses and staffing models. The Bureau of Labor Statistics reported that average hourly earnings for all employees in the oil and gas extraction sector saw an increase through 2024, reflecting broader wage pressures.

Maintaining a safe and compliant working environment is not merely good practice; it is a fundamental legal imperative for Atlas Energy Solutions. Failure to meet these standards can result in substantial fines, legal challenges, and reputational damage. The company's commitment to safety is directly tied to its ability to operate legally and efficiently, minimizing disruptions and ensuring workforce stability.

- Worker Safety Compliance: Adherence to OSHA standards and industry best practices to prevent workplace accidents and injuries.

- Wage and Hour Laws: Ensuring fair compensation for all employees, including compliance with minimum wage, overtime, and equal pay regulations.

- Union Relations: Navigating laws concerning collective bargaining, employee representation, and labor relations.

- Employment Discrimination: Upholding laws that prohibit discrimination based on race, gender, age, religion, and other protected characteristics.

Corporate Governance and Financial Reporting

As a publicly traded entity, Atlas Energy Solutions operates under strict corporate governance mandates and financial reporting requirements, including those set forth by the Securities and Exchange Commission (SEC). Adherence to these legal frameworks is crucial for fostering transparency, safeguarding investor interests, and upholding market trust. For instance, the Sarbanes-Oxley Act of 2002 continues to shape internal control and reporting processes.

Compliance with evolving regulations necessitates ongoing vigilance and adaptation. Atlas Energy Solutions' commitment to these standards is reflected in its timely filings and disclosures. In 2023, the SEC continued to emphasize robust internal controls over financial reporting, a key area for companies like Atlas Energy Solutions.

- SEC Filings: Atlas Energy Solutions regularly submits 10-K (annual) and 10-Q (quarterly) reports, detailing financial performance and operational risks.

- Sarbanes-Oxley Act (SOX): Compliance with SOX mandates, particularly Section 404 regarding internal controls, remains a significant legal factor.

- Investor Protection: Regulations aim to ensure fair disclosure and prevent fraud, thereby protecting the company's shareholder base.

- Regulatory Changes: Anticipating and adapting to new or revised financial reporting standards, such as potential updates from the Financial Accounting Standards Board (FASB), is critical.

Atlas Energy Solutions faces a complex web of legal requirements impacting its operations, from environmental protection to labor standards and corporate governance. Strict adherence to these regulations is paramount for maintaining its license to operate and ensuring long-term viability.

Environmental laws, such as the EPA's methane emission standards, directly influence capital expenditures for compliance, with projections indicating a need for substantial investment in advanced monitoring technologies by 2025. Similarly, land use and mining permits, as emphasized by the Bureau of Land Management in 2024, dictate operational feasibility and project timelines.

Labor laws, including OSHA safety mandates, and corporate governance regulations from the SEC, such as Sarbanes-Oxley, are critical for operational continuity and investor confidence. Non-compliance in any of these areas can lead to significant financial penalties, operational disruptions, and reputational damage.

| Regulatory Area | Key Legislation/Agency | Impact on Atlas Energy Solutions | 2024/2025 Focus |

|---|---|---|---|

| Environmental Emissions | EPA (OOOOb/c Standards) | Increased CAPEX for methane abatement and monitoring technology | Stricter methane reduction targets, enhanced reporting |

| Land Use & Mining | BLM, State Zoning Boards | Permitting timelines, operational expansion constraints | Increased scrutiny on NEPA compliance, community review |

| Worker Safety | OSHA | Workplace safety protocols, potential fines for non-compliance | Continued enforcement focus on high-risk industries |

| Corporate Governance | SEC, Sarbanes-Oxley Act | Internal control implementation, financial reporting accuracy | Emphasis on robust internal controls over financial reporting |

Environmental factors

Hydraulic fracturing, a core process for many of Atlas Energy Solutions' clients, is exceptionally water-intensive. This reliance on water presents a significant environmental challenge, particularly in water-scarce regions. For instance, the Permian Basin, a key operational area, faces increasing pressure on its water resources.

While Atlas Energy Solutions directly provides proppants, their business is intrinsically linked to the water consumption of the oil and gas extraction activities they support. The average hydraulic fracturing job can utilize millions of gallons of water, highlighting the indirect impact of Atlas's supply chain.

Consequently, the industry's approach to sustainable water management is under growing scrutiny from regulators and the public. Operators are increasingly adopting water recycling and alternative water sources, a trend that could influence demand for proppant services and the overall operational landscape for companies like Atlas.

The mining and processing of frac sand, a key component in oil and gas extraction, inherently creates dust and noise. Atlas Energy Solutions' operations, particularly those involving heavy machinery and extensive truck traffic for transporting materials, contribute to these environmental concerns. For instance, in 2024, the Permian Basin, a major area for oil and gas activity, saw significant increases in truck movements, exacerbating potential dust issues.

Addressing these impacts is crucial for Atlas Energy Solutions. Implementing advanced dust suppression technologies, such as water sprays and chemical agents, can significantly reduce airborne particulate matter. Furthermore, strategic scheduling of noisy operations and the use of quieter equipment are vital for minimizing noise pollution and maintaining positive relationships with nearby communities, ensuring compliance with evolving environmental standards like those being strengthened in Texas in 2025.

While Atlas Energy Solutions' proppant production isn't a primary source of direct emissions, the oil and gas sector it supports is a major contributor to greenhouse gases. The company's own logistics, a necessary part of its operations, also generate emissions, and there's a growing expectation for all energy supply chain participants to lower their carbon impact.

Regulatory actions, particularly those targeting methane emissions, directly affect Atlas's clients in the oil and gas industry. These regulations can influence their operational efficiency and, consequently, their demand for proppants, impacting Atlas's market.

Land Use and Biodiversity Impact

Mining operations, the bedrock of energy solutions, inevitably lead to substantial land disturbance. This disturbance directly impacts local ecosystems, often resulting in habitat destruction and increased soil erosion. For Atlas Energy Solutions, adhering to rigorous land reclamation plans is not just a regulatory requirement but a critical aspect of responsible operation, aiming to mitigate these environmental effects and restore mined areas for future use.

The company's commitment to post-mining land use planning is paramount. This involves strategic decisions on how to best utilize the reclaimed land, whether for agricultural purposes, reforestation, or recreational areas, ensuring a positive long-term impact. By 2024, the energy sector saw increased scrutiny on land use practices, with reports indicating that over 1.5 million hectares of land globally were under active mining or restoration efforts, highlighting the scale of this environmental consideration.

- Habitat Destruction: Mining activities can fragment and destroy critical habitats, impacting biodiversity.

- Soil Erosion: Removal of vegetation and topsoil during mining exposes land to wind and water erosion.

- Land Reclamation: Atlas Energy Solutions must implement comprehensive plans to restore mined land, often involving re-vegetation and soil stabilization.

- Biodiversity Offsetting: In some regions, companies are required to offset biodiversity losses by protecting or restoring habitats elsewhere, a practice gaining traction in 2025 environmental policy discussions.

Waste Management and Disposal

Atlas Energy Solutions faces significant environmental hurdles concerning waste management and disposal from its mining and processing activities. The generation of byproducts necessitates robust strategies to prevent soil and water contamination, aligning with stringent environmental regulations. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stricter oversight on industrial waste, with penalties for non-compliance potentially reaching millions of dollars per violation.

Responsible handling of industrial waste and byproducts is crucial for Atlas Energy Solutions to maintain its operational license and public trust. This involves investing in advanced treatment technologies and secure disposal sites. By 2025, it's projected that companies in the energy sector will need to allocate an average of 5-8% of their operational budget towards environmental compliance, including waste management, to meet evolving standards.

- Regulatory Compliance: Adherence to national and local waste disposal laws is paramount, with potential fines for non-compliance increasing in 2024-2025.

- Technological Investment: Implementing advanced waste treatment and containment systems is essential to mitigate environmental impact.

- Soil and Water Protection: Proper management of mining byproducts directly impacts the prevention of contamination in local ecosystems.

- Operational Costs: Waste management represents a growing segment of operational expenditures for energy companies, projected to rise by 2025.

Environmental factors significantly shape Atlas Energy Solutions' operations, primarily through water usage, land disturbance, and waste management. The intensive water needs of hydraulic fracturing, a key service, create substantial strain on resources, especially in arid regions like the Permian Basin, where water scarcity is a growing concern in 2024.

Mining and processing of materials like frac sand generate dust and noise, impacting local environments and communities. Atlas's logistical operations, including extensive truck traffic, contribute to these issues, with increased activity in areas like the Permian Basin in 2024 exacerbating potential dust problems.

Land disturbance from mining is a critical environmental consideration, necessitating robust reclamation plans to mitigate habitat destruction and soil erosion. By 2024, global efforts to restore mined lands were substantial, underscoring the importance of responsible land use practices for companies like Atlas.

Waste management and disposal from mining and processing activities pose further environmental challenges, requiring strict adherence to regulations to prevent soil and water contamination. The EPA's increased oversight in 2024 highlights the financial and operational risks associated with non-compliance.

| Environmental Factor | Impact on Atlas Energy Solutions | 2024-2025 Data/Trend |

|---|---|---|

| Water Intensity | High water consumption in hydraulic fracturing creates resource strain. | Permian Basin facing increased water scarcity pressure. |

| Land Disturbance | Mining activities lead to habitat destruction and soil erosion. | Global mining restoration efforts significant; focus on land reclamation plans. |

| Emissions & Pollution | Dust and noise from mining/transport; indirect greenhouse gas contributions. | Increased truck traffic in Permian Basin (2024) exacerbates dust concerns; stricter emission regulations impacting clients. |

| Waste Management | Generation of byproducts necessitates careful disposal to prevent contamination. | Stricter EPA oversight on industrial waste (2024); projected 5-8% operational budget allocation for environmental compliance by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Atlas Energy Solutions is built on a robust foundation of data from official government publications, reputable industry associations, and leading market research firms. We meticulously gather information on regulatory changes, economic indicators, and technological advancements to provide a comprehensive overview.