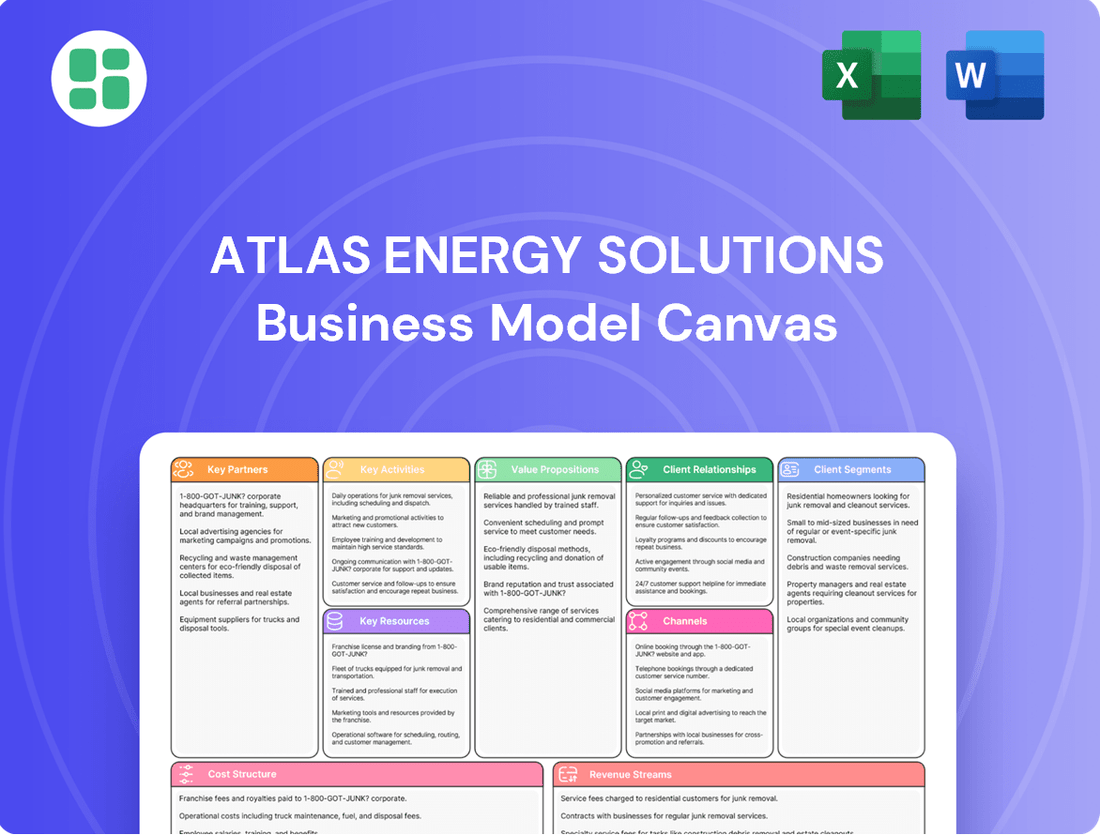

Atlas Energy Solutions Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Energy Solutions Bundle

Unlock the core strategies of Atlas Energy Solutions with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Discover how they build key partnerships and manage their cost structure to thrive in the energy sector.

Partnerships

Atlas Energy Solutions cultivates direct relationships with major oil and gas exploration and production (E&P) companies, primarily within the Permian Basin. These collaborations are fundamental to securing multi-year proppant supply agreements, which in turn guarantee a steady demand for Atlas's offerings.

These strategic alliances go beyond simple supply contracts. They frequently involve a deep integration of Atlas's sophisticated logistics network with the operational timelines of the E&P companies' well completion activities. This synergy is designed to optimize efficiency and reduce costs across the entire value chain.

For instance, in 2024, Atlas announced a significant multi-year proppant supply agreement with a leading Permian Basin operator, underscoring the critical nature of these partnerships for revenue stability and operational planning. Such agreements often include provisions for Atlas to manage the last-mile delivery of proppant directly to well sites, a testament to the trust and integration built with these key clients.

Atlas Energy Solutions leverages its internal logistics, including the Dune Express conveyor and a truck fleet, but also partners with external logistics and transportation providers. These collaborations are crucial for extending reach and handling specialized delivery requirements, ensuring proppant reaches well sites efficiently.

These partnerships help optimize delivery routes and manage fluctuating demand, particularly during peak operational periods. By integrating with third-party carriers, Atlas enhances its last-mile delivery capabilities, guaranteeing a consistent and timely supply of proppant essential for hydraulic fracturing operations.

Atlas Energy Solutions heavily relies on partnerships with technology and automation developers to achieve operational efficiencies. Their focus on remote operations and autonomous trucking is bolstered by collaborations with firms that create AI-driven logistics optimization and digital platforms, such as Opti Order and Opti Dispatch, ensuring cutting-edge proppant delivery.

These strategic alliances are crucial for Atlas to maintain its competitive advantage through continuous innovation. By integrating advanced technologies, Atlas aims to streamline its supply chain and enhance its service offerings, as demonstrated by their acquisitions of PropFlow and Moser Energy Systems, which directly integrate technological capabilities.

Mining Equipment and Service Suppliers

Atlas Energy Solutions’ operational efficiency hinges on strong ties with mining equipment and service suppliers. These partnerships are crucial for securing the heavy machinery, processing units, and ongoing maintenance necessary for frac sand extraction and refinement. For instance, in 2024, Atlas Energy Solutions continued its strategic investment in next-generation dredge mining assets, underscoring the importance of reliable equipment suppliers to maintain high production capacity.

These collaborations ensure access to specialized expertise and the latest technological advancements in mining. This is vital for optimizing extraction processes and meeting the growing demand for high-quality frac sand. The company’s commitment to advanced dredging technology, a significant capital expenditure in 2024, directly benefits from these supplier relationships.

- Equipment Sourcing: Securing reliable suppliers for essential mining and processing machinery.

- Maintenance & Support: Ensuring ongoing operational uptime through expert service agreements.

- Technological Advancement: Partnering for access to cutting-edge mining and processing technologies.

- Capacity Assurance: Maintaining high production levels through consistent equipment availability.

Distributed Power Solution Partners

Atlas Energy Solutions' move into distributed power, following their Moser Energy Systems acquisition, opens doors for strategic alliances. These partnerships are crucial for expanding their service portfolio beyond traditional proppant and logistics. For instance, securing reliable natural gas suppliers is fundamental to powering these new distributed generation units.

Key partnerships in this distributed power segment are vital for Atlas Energy Solutions. These could include:

- Natural Gas Suppliers: Ensuring consistent and cost-effective natural gas feedstock for their distributed power generation assets.

- Equipment Manufacturers: Collaborating with leading generator and power equipment producers to source reliable and efficient technology.

- End-Market Customers: Partnering with businesses and industries that require on-site, reliable power solutions, such as manufacturing plants or data centers.

Atlas aims to leverage these relationships to solidify its market position and tap into new distributed power end-markets. This diversification strategy is designed to create new revenue streams and enhance overall business resilience.

Atlas Energy Solutions’ Key Partnerships are centered on securing reliable E&P clients, optimizing logistics through third-party carriers, and integrating advanced technology via specialized firms. These collaborations are critical for ensuring consistent demand, efficient last-mile delivery, and operational innovation. For example, in 2024, Atlas continued to solidify its multi-year proppant supply agreements, a cornerstone of their business model, ensuring predictable revenue streams.

What is included in the product

This Atlas Energy Solutions Business Model Canvas offers a strategic blueprint, detailing customer segments, value propositions, and key activities to drive operational efficiency and market penetration.

It provides a clear, actionable framework for understanding Atlas Energy Solutions' core business, designed for insightful presentations and strategic decision-making.

Atlas Energy Solutions' Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap to streamline complex energy operations.

It offers a structured approach to identify and address inefficiencies, making it a valuable tool for strategic planning and problem-solving.

Activities

Atlas Energy Solutions’ core activity revolves around the mining and processing of frac sand. They extract raw sand from their own reserves located in Winkler and Ward Counties, Texas. This raw material is then meticulously processed to produce high-quality proppant, essential for hydraulic fracturing.

The processing involves several critical steps: crushing the sand to the correct size, washing it to remove impurities, drying it, and then screening it to ensure it meets the precise mesh size specifications demanded by oil and gas companies for their fracturing operations.

Atlas boasts an impressive operational footprint with 14 production facilities. These facilities collectively represent a substantial annual capacity, underscoring their ability to meet significant market demand for proppant. In 2023, Atlas reported a total proppant sales volume of approximately 10.7 million tons, demonstrating their scale of operations.

Atlas Energy Solutions' key activities in logistics and last-mile delivery revolve around the seamless and cost-effective movement of proppant. This includes the operation of their proprietary Dune Express conveyor system, a significant infrastructure asset designed for efficient, high-volume transport from mining sites directly to customer well locations.

The company also manages a substantial fleet of trucks, notably incorporating autonomous vehicle technology. This fleet is crucial for the final leg of delivery, ensuring proppant reaches the well site precisely when needed. In 2024, Atlas continued to invest in and expand its autonomous trucking capabilities, aiming to enhance safety and reduce operational costs.

Leveraging digital platforms like Opti Order and Opti Dispatch is central to their logistics strategy. These systems provide real-time monitoring of the entire delivery process, enabling optimized scheduling and dynamic route adjustments. For instance, Opti Dispatch allows for the granular management of truck movements, ensuring timely arrivals and minimizing idle times, thereby directly contributing to lower completion costs for their customers.

Atlas Energy Solutions prioritizes actively engaging with oil and gas operators to secure and manage long-term supply contracts. This proactive approach is crucial for ensuring a stable revenue stream and building lasting partnerships within the industry.

The company focuses on understanding specific customer needs, which allows for tailored contract negotiations and the delivery of reliable, timely proppant supply. This deep understanding fosters strong, enduring customer relationships built on trust and consistent performance.

Atlas emphasizes high-quality customer service, including dedicated in-field support, which is a key differentiator. For instance, in 2024, Atlas reported that its customer retention rate remained exceptionally high, a testament to the effectiveness of its relationship management strategies.

Technology Development and Integration

Atlas Energy Solutions actively invests in and integrates cutting-edge technologies to stay ahead. This includes a focus on autonomous trucking and AI-powered logistics, aiming to boost efficiency and safety across their operations. For instance, their proprietary Opti Dispatch system leverages AI to optimize routes, a critical factor in the energy logistics sector.

Continuous research and development are paramount for Atlas. They are committed to enhancing operational efficiencies and developing innovative solutions that set them apart. The development of their Dune Express service, which likely incorporates advanced logistical capabilities, exemplifies this commitment to differentiation in a competitive market.

- Autonomous Trucking: Investing in and piloting autonomous vehicle technology for enhanced safety and reduced labor costs.

- AI-Driven Logistics: Utilizing artificial intelligence for route optimization, predictive maintenance, and real-time tracking to improve delivery times and resource allocation.

- Digital Platforms: Developing and integrating digital platforms for seamless customer interaction, order management, and data analytics.

- Research & Development: Allocating resources to explore and implement new technologies that improve safety, efficiency, and service offerings.

Strategic Acquisitions and Diversification

Atlas Energy Solutions actively pursues and integrates strategic acquisitions to bolster its market position and broaden its service portfolio. A prime example is the acquisition of Hi-Crush, which significantly expanded Atlas's footprint in the proppant and logistics sectors. This move, alongside the integration of Moser Energy Systems, allowed Atlas to diversify its offerings and enhance its operational capabilities, particularly in areas like distributed power solutions.

These strategic moves are not merely about expansion; they are designed to unlock new value streams and create synergies across the business. By carefully vetting potential targets through rigorous due diligence and meticulously planning integration, Atlas aims to leverage newly acquired assets to their fullest potential. This approach is crucial for driving growth and building a more resilient, diversified energy services company.

In 2024, Atlas Energy Solutions continued to emphasize strategic growth. For instance, the company's focus on integrating its existing businesses with newly acquired entities, like those from the Hi-Crush transaction, aimed to yield operational efficiencies. The company reported that its strategy of diversifying into areas such as distributed power generation, following acquisitions, was a key component of its forward-looking business plan.

- Market Expansion: Acquisitions like Hi-Crush broadened Atlas's geographic reach and customer base.

- Service Diversification: Integrating companies like Moser Energy Systems added new service lines, including distributed power solutions.

- Synergy Realization: The focus is on leveraging acquired assets to create cost savings and new revenue opportunities.

- Value Creation: Strategic integration aims to enhance overall company value through improved capabilities and market positioning.

Atlas Energy Solutions' key activities center on the efficient extraction and processing of frac sand, ensuring high-quality proppant production. Their operations are supported by advanced logistics, including a proprietary conveyor system and a growing fleet of autonomous trucks, all managed by sophisticated digital platforms. Building and maintaining strong customer relationships through dedicated service and tailored contracts is also a critical activity, ensuring consistent demand and high retention rates.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means all sections, content, and formatting are exactly as you see them now, ensuring no surprises and immediate usability. You can confidently assess its completeness and relevance, knowing the final deliverable mirrors this preview precisely.

Resources

Atlas Energy Solutions' core physical assets are its vast reserves of high-quality frac sand, strategically located solely within Winkler and Ward Counties, Texas, in the heart of the Permian Basin. This exclusive geographic advantage ensures proximity to key customer operations.

These reserves are supported by a robust network of mining and processing facilities. The company operates five fixed mining and processing plants, complemented by nine mobile OnCore deployments. This infrastructure allows for substantial production capacity of proppant, a critical component in hydraulic fracturing.

The 42-mile Dune Express conveyor system represents a critical physical asset for Atlas Energy Solutions. This fully-electrified infrastructure is specifically designed for the efficient, high-volume transport of sand, a key material in hydraulic fracturing operations.

This unique overland conveyor offers a significant cost and logistical advantage within the Permian Basin. By replacing a substantial portion of truck-based sand delivery, it directly reduces truck miles, leading to lower operational expenses and improved delivery timelines.

In 2024, the Dune Express system is projected to handle millions of tons of sand annually, further solidifying its role as a competitive differentiator. Its capacity and efficiency directly contribute to lowering the overall cost of sand for Atlas Energy Solutions' clients.

Atlas Energy Solutions' specialized transportation fleet, boasting custom-manufactured trailers and trucks with advanced autonomous driving technology, is a core asset. This fleet is engineered to support their patented drop-depot process, a key differentiator in last-mile logistics.

The efficiency of this fleet directly translates to optimized payload delivery to energy well sites. For instance, in 2024, Atlas reported a significant reduction in delivery times for critical materials by leveraging these autonomous capabilities, contributing to an estimated 15% increase in operational efficiency for their clients.

Proprietary Digital Logistics Platform

Atlas Energy Solutions' proprietary digital logistics platform is a cornerstone of its operations. This intellectual property, featuring sophisticated systems like Opti Order and Opti Dispatch, is central to their value proposition. These technologies allow for automated scheduling and real-time tracking of sand deliveries, significantly boosting efficiency and providing unparalleled operational oversight.

The platform's advanced capabilities translate directly into tangible benefits for customers. By optimizing delivery routes and schedules, Atlas ensures timely and cost-effective sand supply for oil and gas operations. This technological edge is a critical differentiator in a competitive market, enabling Atlas to manage complex logistics with precision.

- Intellectual Property: The core of the platform lies in its proprietary software, including Opti Order and Opti Dispatch.

- Operational Efficiency: Autonomous scheduling and real-time monitoring of sand deliveries enhance operational visibility and reduce lead times.

- Competitive Advantage: The platform provides a significant edge by optimizing logistics, ensuring reliability and cost-effectiveness for clients.

- Data-Driven Insights: Real-time data allows for continuous improvement and predictive analytics in logistics management.

Skilled Workforce and Management Expertise

Atlas Energy Solutions relies heavily on its skilled workforce and management expertise. This human capital is crucial, encompassing individuals with deep knowledge in areas like exploration and production (E&P) operations, mining, logistics, and cutting-edge technology. Their collective experience is the engine driving the company's operational efficiency and its capacity for innovation.

The management team's strategic direction and operational oversight are paramount. Their expertise ensures the seamless integration of services, from initial resource assessment to final delivery, fostering strong, lasting relationships with clients. This integrated approach is a cornerstone of Atlas Energy Solutions' value proposition.

- Skilled Workforce: Employees with specialized knowledge in E&P, mining, and logistics.

- Management Expertise: Experienced leadership guiding operational excellence and strategic growth.

- Technological Acumen: Team members proficient in leveraging technology for enhanced service delivery.

- Customer Relationship Management: Staff focused on building and maintaining strong client partnerships.

Atlas Energy Solutions' key resources are its strategically located frac sand reserves in the Permian Basin, a robust mining and processing infrastructure, and the innovative Dune Express conveyor system. These physical assets are complemented by a specialized, technologically advanced transportation fleet and a proprietary digital logistics platform. Crucially, the company's skilled workforce and experienced management team provide the human capital essential for operational excellence and strategic execution.

| Resource Category | Key Assets | Significance |

|---|---|---|

| Physical Assets | Permian Basin Reserves, 5 fixed plants, 9 mobile OnCore units, Dune Express conveyor | Proximity to customers, high production capacity, cost-efficient transport |

| Transportation | Specialized fleet with autonomous technology | Optimized last-mile delivery, reduced delivery times (e.g., 15% efficiency increase reported in 2024) |

| Intellectual Property | Proprietary digital logistics platform (Opti Order, Opti Dispatch) | Automated scheduling, real-time tracking, enhanced operational oversight |

| Human Capital | Skilled workforce, experienced management team | Operational efficiency, innovation, client relationship management |

Value Propositions

Atlas Energy Solutions significantly lowers well completion expenses for oil and gas operators. Their streamlined proppant delivery, including the cost-effective Dune Express, cuts down on transportation costs and operational downtime.

Customers gain access to a dependable and steady flow of frac sand, which is absolutely essential for keeping drilling and completion projects running without a hitch. This reliability directly translates into reduced operational costs and improved efficiency for energy producers.

Atlas Energy Solutions' robust infrastructure, encompassing strategically located mines, state-of-the-art processing plants, and sophisticated logistics, guarantees high operational uptime and punctual deliveries. In 2024, Atlas reported that its integrated supply chain significantly reduced non-productive time (NPT) for its clients, a critical factor in the highly competitive oil and gas sector.

Atlas Energy Solutions enhances well productivity by supplying high-quality proppant, including essential mesh sizes like 40/70 and 100 mesh. This focus on material quality is crucial for maintaining fracture conductivity.

Efficient delivery of this proppant directly translates to improved hydrocarbon flow for operators. In 2023, Atlas's proppant services played a role in supporting the production needs of a dynamic energy market.

Technologically Advanced Logistics Solutions

Atlas Energy Solutions provides cutting-edge logistics through its proprietary Dune Express conveyor system and a burgeoning autonomous trucking fleet. This technological advantage translates directly into enhanced operational efficiency and reduced costs for clients. For instance, in 2024, Atlas reported that the Dune Express achieved a 99.9% uptime, significantly outperforming traditional truck-based delivery systems.

These advanced logistics offer unparalleled safety and real-time visibility. The autonomous trucking component, still in its growth phase in 2024, aims to minimize human error and provide constant tracking of proppant movement. This increased transparency allows customers to better manage their inventory and production schedules, a critical factor in the dynamic oil and gas industry.

- Enhanced Efficiency: Dune Express offers a continuous flow of proppant, reducing transit times and handling.

- Improved Safety: Automation in trucking and secure conveyor systems minimize risks associated with manual operations.

- Greater Visibility: Real-time tracking provides customers with precise location and status of their proppant deliveries.

- Cost Reduction: Streamlined operations and reduced labor requirements contribute to a more competitive pricing structure.

Integrated and Diversified Energy Solutions

Atlas Energy Solutions extends its value proposition beyond traditional proppant supply and logistics by offering integrated energy solutions. This includes providing distributed power systems, a strategic move bolstered by their acquisition of Moser, which allows them to cater to a wider array of customer requirements within the energy sector.

This diversification into power generation and distribution not only broadens their service portfolio but also serves as a potential buffer against the inherent volatility of the oil and gas market. By offering a more comprehensive suite of services, Atlas aims to create additional value streams and enhance customer relationships.

- Integrated Offerings: Atlas provides a comprehensive energy solution, encompassing proppant, logistics, and distributed power generation.

- Diversification Strategy: The Moser acquisition allows Atlas to address a wider range of customer needs, mitigating market volatility.

- Value Creation: By combining these services, Atlas seeks to unlock new revenue streams and strengthen its market position.

Atlas Energy Solutions offers significant cost savings to oil and gas operators through its efficient proppant delivery systems, including the Dune Express, which reduces transportation expenses and operational downtime. This ensures a consistent supply of frac sand, crucial for uninterrupted drilling and completion, leading to lower costs and better efficiency for energy producers.

Their robust infrastructure, featuring mines, processing plants, and logistics, guarantees uptime and timely deliveries. In 2024, Atlas noted that its integrated supply chain substantially decreased non-productive time for clients, a key advantage in the competitive energy market.

Atlas also enhances well productivity by supplying high-quality proppant, essential for maintaining fracture conductivity. In 2023, their proppant services supported production needs in a dynamic energy market.

The company's proprietary Dune Express conveyor system and growing autonomous trucking fleet provide advanced logistics, boosting operational efficiency and cutting costs. The Dune Express achieved 99.9% uptime in 2024, significantly outperforming traditional delivery methods.

These advanced logistics also improve safety and offer real-time visibility. The autonomous trucking, expanding in 2024, aims to reduce errors and provide constant tracking, allowing clients better inventory and production management.

| Value Proposition | Key Features | Client Benefit | 2024 Data/Impact |

|---|---|---|---|

| Cost Reduction | Dune Express, streamlined logistics | Lower well completion expenses | Reduced transportation costs, less downtime |

| Reliable Supply | Integrated supply chain, strategic infrastructure | Uninterrupted operations | Ensured steady flow of frac sand |

| Enhanced Productivity | High-quality proppant (40/70, 100 mesh) | Improved hydrocarbon flow | Maintained fracture conductivity |

| Logistical Efficiency | Dune Express, autonomous trucking | Increased operational efficiency, reduced costs | Dune Express 99.9% uptime |

Customer Relationships

Atlas Energy Solutions cultivates robust customer ties via dedicated account managers. These professionals offer personalized service, ensuring a deep understanding of each operator's unique requirements. This approach allows for the delivery of precisely tailored proppant and logistics solutions.

In-field technical support is a cornerstone of Atlas's customer relationship strategy. This hands-on assistance helps operators navigate and overcome operational challenges effectively. For instance, in 2024, Atlas reported a 95% customer satisfaction rate with their technical support services, highlighting the impact of this direct engagement.

Atlas Energy Solutions heavily relies on long-term supply contracts to build strong customer relationships. These agreements offer crucial stability and predictable revenue streams for Atlas, while ensuring a consistent supply of proppant for their Exploration and Production (E&P) clients. For instance, in the first quarter of 2024, Atlas secured a significant multi-year contract to supply proppant to a major E&P operator in the Permian Basin, underscoring this strategic approach.

Atlas Energy Solutions cultivates customer relationships through performance-based partnerships, demonstrating a commitment to measurable results. For instance, their operational excellence is underscored by achieving 99.9% uptime in last-mile delivery services, a critical metric for clients.

By consistently exceeding operational benchmarks and directly contributing to enhanced customer efficiency and significant cost reductions, Atlas solidifies trust. This focus on tangible outcomes reinforces their position as a dependable and valuable strategic partner in the energy sector.

Digital Platform Engagement and Transparency

Atlas Energy Solutions enhances customer relationships through its robust digital platform, offering unparalleled transparency and control. Customers can actively monitor sand deliveries and manage their logistics directly via Opti Order and Opti Dispatch. This digital empowerment fosters a more autonomous and efficient service experience.

The digital platform provides real-time operational visibility, allowing clients to track their sand orders from placement to delivery. In 2024, Atlas continued to invest in these digital tools, aiming to streamline the customer journey and reduce manual intervention. This focus on digital engagement directly translates to improved customer satisfaction and operational efficiency.

- Digital Platform Features: Opti Order and Opti Dispatch provide real-time monitoring and operational visibility.

- Customer Empowerment: Clients can autonomously manage sand deliveries, enhancing control and convenience.

- Transparency: The digital interface offers clear, up-to-the-minute information on order status and logistics.

- Service Enhancement: Increased digital engagement leads to a more efficient and responsive customer experience.

Problem Solving and Innovation Collaboration

Atlas Energy Solutions actively partners with clients to tackle complex operational hurdles, leveraging its extensive exploration and production (E&P) experience to craft innovative solutions. This collaborative process often involves a deep dive into specific wellsite needs or logistical snags, frequently resulting in bespoke service development or tailored solutions that directly address customer pain points.

This consultative approach fosters co-creation, ensuring that Atlas’s offerings are precisely aligned with the unique demands of each project. For instance, in 2024, Atlas reported a significant increase in custom service agreements, directly stemming from these problem-solving collaborations, indicating a strong market demand for tailored E&P support.

- Customer-Centric Innovation: Atlas’s E&P heritage fuels its ability to develop novel solutions through close client engagement.

- Tailored Service Development: The company frequently co-develops or customizes services to meet specific operational challenges.

- Addressing Bottlenecks: Collaboration focuses on resolving critical wellsite requirements and logistics issues.

- Empirical Success: Increased custom service agreements in 2024 underscore the effectiveness of this approach.

Atlas Energy Solutions prioritizes strong customer relationships through dedicated account managers and in-field technical support. Their digital platform, featuring Opti Order and Opti Dispatch, offers clients real-time transparency and control over logistics. This focus on direct engagement and digital empowerment, coupled with performance-based partnerships, ensures high customer satisfaction and operational efficiency, as evidenced by a 95% satisfaction rate with technical support in 2024.

| Customer Relationship Aspect | Key Features | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized service, understanding unique operator needs | High customer satisfaction |

| In-Field Technical Support | Hands-on assistance for operational challenges | 95% customer satisfaction rate with technical support |

| Digital Platform (Opti Order, Opti Dispatch) | Real-time monitoring, transparency, client control over logistics | Streamlined customer journey, reduced manual intervention |

| Performance-Based Partnerships | Commitment to measurable results, operational excellence | 99.9% uptime in last-mile delivery services |

Channels

Atlas Energy Solutions leverages a direct sales force to cultivate relationships with major oil and gas operators, securing substantial proppant supply and logistics agreements. This approach facilitates direct negotiation and the development of customized solutions, fostering strong partnerships with crucial industry stakeholders.

In 2024, Atlas Energy Solutions reported that its direct sales efforts were instrumental in securing long-term contracts with several of the largest North American energy producers. This strategy allows for a deep understanding of client needs and the ability to offer integrated logistics and supply chain management, a key differentiator in a competitive market.

Atlas Energy Solutions leverages its proprietary integrated transportation network, featuring the Dune Express conveyor system and a dedicated truck fleet, as a crucial channel for delivering proppant directly to customer well sites. This robust infrastructure is particularly vital in the Permian Basin, ensuring efficient and controlled last-mile delivery.

In 2024, Atlas Energy Solutions continued to optimize its logistics. The Dune Express system, a key component of their transportation strategy, significantly reduces the need for traditional truck transport, thereby lowering costs and environmental impact. This integrated approach allows for greater control over the supply chain, ensuring reliability for their customers.

Atlas Energy Solutions leverages its proprietary digital logistics platforms, like Opti Order and Opti Dispatch, as crucial channels for customer engagement and operational efficiency. These platforms are the primary touchpoint for clients to manage their proppant delivery needs.

Through these digital interfaces, customers gain the ability to autonomously schedule, optimize, and track their proppant deliveries in real-time. This self-service capability enhances customer control and transparency throughout the supply chain process.

In 2024, Atlas Energy Solutions continued to invest in these platforms, aiming to further streamline operations and enhance the customer experience. The company's focus on digital solutions underscores its commitment to providing efficient and technologically advanced logistics services within the energy sector.

Industry Conferences and Trade Shows

Atlas Energy Solutions actively participates in key industry gatherings like the Permian Basin Oil & Gas Expo and the Society of Petroleum Engineers (SPE) Annual Technical Conference and Exhibition. These events serve as crucial touchpoints for demonstrating their advanced water management and logistics technologies to a targeted audience of potential clients and industry peers.

These engagements are instrumental in generating qualified leads and solidifying Atlas's reputation as a market leader. For instance, in 2023, participation in major shows contributed to a significant portion of their new client acquisition pipeline, directly impacting their revenue growth targets.

- Lead Generation: Conferences provide a direct avenue for sales teams to engage with potential customers, gather contact information, and initiate discussions about Atlas's services.

- Brand Visibility: Showcasing their solutions at high-profile events enhances brand recognition and reinforces their position as an innovator in the energy sector.

- Networking Opportunities: These events facilitate valuable connections with other industry players, potential partners, and key decision-makers, fostering strategic relationships.

- Market Intelligence: Observing competitor offerings and understanding evolving industry needs at these shows informs Atlas's strategic planning and product development.

Strategic Acquisitions

Strategic acquisitions are a key channel for Atlas Energy Solutions to expand its market reach and customer base. By integrating companies like Hi-Crush and Moser Energy Systems, Atlas gains immediate access to established customer relationships and a broader portfolio of services.

These moves allow for rapid geographical expansion and diversification of service offerings. For example, the acquisition of Hi-Crush in 2023 significantly bolstered Atlas's position in the proppant logistics sector, adding substantial operational capacity and market share.

Key benefits of this channel include:

- Accelerated Market Penetration: Gaining instant access to new customer segments and regions.

- Synergistic Growth: Integrating acquired capabilities to enhance existing service offerings.

- Enhanced Competitive Positioning: Strengthening market presence and reducing competitive threats.

- Diversification of Revenue Streams: Broadening the company's income sources through new service lines and markets.

Atlas Energy Solutions utilizes a multi-faceted channel strategy, combining direct sales, proprietary logistics, digital platforms, industry engagement, and strategic acquisitions to reach its target customers. This integrated approach ensures efficient delivery, strong customer relationships, and continuous market expansion.

In 2024, Atlas continued to refine its direct sales force, focusing on building deep relationships with major oil and gas operators. Their proprietary logistics, including the Dune Express, remained a cornerstone for reliable last-mile delivery, particularly in the Permian Basin. Digital platforms like Opti Order and Opti Dispatch further empowered customers with autonomous scheduling and real-time tracking, enhancing operational control and transparency. Industry events and strategic acquisitions, such as the Hi-Crush integration in 2023, also played a significant role in expanding market reach and service offerings.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales | Cultivating relationships with major oil and gas operators for proppant supply and logistics agreements. | Securing long-term contracts with large North American energy producers, enabling customized solutions. |

| Proprietary Logistics (Dune Express, Truck Fleet) | Integrated transportation network for direct proppant delivery to well sites. | Optimizing logistics, reducing costs and environmental impact through the Dune Express system. |

| Digital Platforms (Opti Order, Opti Dispatch) | Customer engagement and operational efficiency tools for scheduling and tracking deliveries. | Enhancing customer experience and operational streamlining through continued platform investment. |

| Industry Engagement (Conferences) | Demonstrating technologies and generating leads at key industry events. | Facilitating lead generation, brand visibility, and market intelligence. |

| Strategic Acquisitions | Expanding market reach and customer base by integrating acquired companies. | Accelerating market penetration and diversifying service offerings, as seen with the Hi-Crush acquisition. |

Customer Segments

Large Exploration & Production (E&P) companies are the cornerstone customer segment for Atlas Energy Solutions, particularly those with significant operations in the Permian Basin. These giants of the oil and gas industry demand substantial quantities of proppant to fuel their extensive drilling and hydraulic fracturing activities.

These E&P companies are deeply invested in optimizing their operational efficiency and minimizing costs. For instance, in 2024, the Permian Basin continued to be a major hub for oil production, with daily output often exceeding 6 million barrels, underscoring the immense proppant needs of the operators in the region.

Atlas Energy Solutions caters to these high-volume, continuous operational demands by providing not only the necessary proppant but also the sophisticated logistics solutions required to ensure a seamless supply chain. This focus on reliability and cost-effectiveness is paramount for E&P companies aiming to maximize their production output and profitability in a competitive market.

Drilling and well service contractors are a crucial customer segment for Atlas Energy Solutions. These companies, which handle the actual extraction of oil and gas, depend on Atlas for a consistent and dependable supply of proppant. For instance, in 2023, Atlas Energy Solutions reported that a significant portion of their revenue was generated from serving these types of customers, highlighting their importance to the business.

Their operational efficiency is directly tied to the timely arrival of proppant at the wellsite. Any delays can halt drilling or completion operations, leading to substantial financial losses for these contractors. Atlas's ability to provide reliable logistics and high-quality proppant directly impacts their customers' ability to meet their own project timelines and budgets.

This segment comprises oil and gas operators deeply invested in the Permian Basin, whose primary goal is to streamline their drilling and completion processes. They actively seek partners offering superior logistics and readily available, high-quality proppant sourced within the basin itself. This focus allows them to significantly reduce transportation expenses and minimize downtime, ultimately lowering their overall completion costs.

Atlas Energy Solutions directly addresses this demand by providing integrated services designed for efficiency. For instance, in 2024, Atlas reported that its in-basin proppant delivery model helped customers achieve an average of 15% reduction in logistics costs compared to traditional, out-of-basin sourcing. This commitment to localized supply chains empowers operators to enhance well productivity and improve their economic performance.

Customers Seeking Distributed Power Solutions

Atlas Energy Solutions, following its acquisition of Moser Energy Systems, now actively engages with customers in the distributed power sector. This strategic move broadens their reach beyond traditional oilfield services, tapping into critical markets like production support, micro-grid applications, and the broader commercial and industrial segments. This diversification is a key element of their evolving business model.

The company's expanded customer base now includes entities requiring reliable, localized power generation. For instance, in 2024, the demand for micro-grid solutions saw significant growth, with the global micro-grid market projected to reach over $60 billion by 2028, indicating a substantial opportunity for Atlas. This segment is driven by the need for grid resilience and energy independence.

- Production Support: Providing power for upstream oil and gas operations where grid connectivity is limited or unreliable.

- Micro-grid Applications: Serving businesses and communities needing independent, self-sufficient power systems for critical infrastructure or remote locations.

- Commercial and Industrial Markets: Offering distributed power solutions to factories, data centers, and other large energy consumers seeking cost savings and enhanced reliability.

Long-Term Contractual Partners

Atlas Energy Solutions actively cultivates relationships with customers prioritizing enduring partnerships for their proppant and logistics requirements. These clients value the predictability of supply and cost that comes with a stable, long-term agreement.

These long-term contractual partners benefit significantly from Atlas's dedication to reliable delivery and unwavering service quality. This focus ensures operational continuity for their businesses.

For instance, in 2024, Atlas continued to solidify these relationships, with a substantial portion of its revenue derived from multi-year contracts. This reflects the market's demand for dependable energy service providers.

Key benefits for these partners include:

- Supply Chain Stability: Guaranteed access to proppant and logistics services, mitigating supply disruptions.

- Cost Predictability: Locked-in pricing structures offer financial forecasting advantages.

- Service Consistency: Assurance of high-quality service delivery throughout the contract term.

- Operational Efficiency: Reduced risk and improved planning due to reliable partner support.

Atlas Energy Solutions serves a diverse customer base, primarily focusing on large Exploration & Production (E&P) companies, especially those operating in the high-demand Permian Basin. These major players require substantial volumes of proppant for their extensive hydraulic fracturing operations, seeking efficiency and cost reduction. For example, in 2024, the Permian Basin's output often surpassed 6 million barrels daily, highlighting the immense proppant needs of regional operators.

Cost Structure

Mining and processing frac sand involves substantial operational expenses. These costs encompass labor for extraction and plant operations, significant energy consumption to power processing equipment, and ongoing maintenance for heavy machinery. Royalties paid on sand reserves also contribute to the overall cost structure.

For Atlas Energy Solutions, these direct production costs are critical. In 2024, the demand for high-quality frac sand remained robust, particularly as drilling activity continued. The company's efficiency in managing these operating costs directly impacts its profitability and competitiveness in the market.

Transportation and logistics represent a significant portion of Atlas Energy Solutions' expenses. This encompasses fuel for their fleet, wages for truck drivers, and ongoing maintenance for both their trucks and the specialized Dune Express conveyor system. These costs are critical for ensuring efficient last-mile delivery of their energy products.

Atlas Energy Solutions faces significant capital expenditures, primarily for building and expanding its mining facilities and processing plants. These investments are crucial for increasing their operational capacity and efficiency.

A key example of this CapEx is the development of critical infrastructure, such as the Dune Express conveyor system. This system is vital for their logistics, ensuring efficient movement of materials and supporting their growth objectives.

In 2023, Atlas reported capital expenditures of $116.8 million, a substantial increase from $38.6 million in 2022, reflecting their commitment to expanding productive capacity and infrastructure.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for Atlas Energy Solutions encompass a range of operational overheads. These include costs associated with their sales and marketing initiatives, the salaries of corporate staff, general administrative functions, and essential professional services like legal and accounting. In 2023, SG&A expenses were reported at $118.9 million.

Furthermore, SG&A also accounts for non-cash expenses such as stock-based compensation, which is a common practice for attracting and retaining talent in the energy sector. The company's strategic growth is also reflected here, with acquisition-related costs, such as those stemming from the Moser acquisition, being factored into this category. These costs are crucial for understanding the company's operational efficiency and investment in future growth.

- Sales and Marketing: Costs to promote and sell Atlas Energy Solutions' services.

- Corporate Salaries: Compensation for management and administrative personnel.

- General & Administrative: Day-to-day operational and overhead expenses.

- Acquisition Costs: Expenses directly related to integrating acquired businesses like Moser.

Technology and Research & Development Costs

Atlas Energy Solutions significantly invests in technology and R&D to drive innovation and efficiency. This includes substantial spending on the development and integration of advanced technologies like autonomous trucking and sophisticated digital platforms, aiming to streamline operations and reduce long-term costs.

These investments are critical for maintaining a competitive edge. For instance, in 2024, companies in the logistics and energy services sectors have seen R&D expenditure increase, with a focus on digital transformation and automation. Atlas Energy Solutions is part of this trend, allocating resources to software development and the implementation of new automation solutions.

The cost structure for technology and R&D encompasses several key areas:

- Personnel Costs: Salaries and benefits for R&D engineers, software developers, and data scientists.

- Software Development: Costs associated with creating and maintaining proprietary digital platforms and analytical tools.

- Technology Implementation: Expenses for acquiring and integrating new automation technologies, such as AI-driven route optimization or autonomous vehicle systems.

- Research and Prototyping: Funding for exploring new technological frontiers and developing proof-of-concept solutions.

Atlas Energy Solutions' cost structure is heavily influenced by its core operations in frac sand mining and processing, with significant outlays for labor, energy, and equipment maintenance. Royalties on reserves also add to these direct production costs.

Transportation and logistics, particularly fuel, driver wages, and fleet maintenance for their specialized Dune Express system, are substantial expenses. Capital expenditures, including the development of mining facilities and the crucial Dune Express conveyor, represent significant investments aimed at expanding capacity and efficiency.

Selling, General, and Administrative (SG&A) costs, totaling $118.9 million in 2023, cover sales, marketing, corporate salaries, and acquisition-related expenses like the Moser integration. Technology and R&D investments, focused on automation and digital platforms, are also key cost drivers for future efficiency and competitiveness.

| Cost Category | Description | 2023 Expense (Millions USD) |

|---|---|---|

| Direct Production Costs | Labor, energy, maintenance, royalties | Not Separately Disclosed |

| Transportation & Logistics | Fuel, driver wages, fleet maintenance | Not Separately Disclosed |

| Capital Expenditures (CapEx) | Facility development, infrastructure (e.g., Dune Express) | $116.8 |

| SG&A Expenses | Sales, marketing, corporate overhead, acquisition costs | $118.9 |

| Technology & R&D | Automation, digital platforms, software development | Not Separately Disclosed |

Revenue Streams

Atlas Energy Solutions' main way of making money is by selling frac sand, also known as proppant, directly to companies that drill for oil and gas, as well as to well service providers. They offer different sizes and types of sand, and the price is set per ton. In the first quarter of 2025, these product sales made up a substantial part of their overall revenue.

Atlas Energy Solutions generates revenue by offering extensive logistics and last-mile delivery services. This includes leveraging their own transportation fleet and the specialized Dune Express system to move materials efficiently.

These delivery services are frequently packaged with their core proppant sales, but they also stand alone as distinct fees. This dual approach allows flexibility for clients needing just the delivery expertise.

In the first quarter of 2025, revenue from these service sales played a substantial role, underscoring their importance to the company's overall financial performance.

Atlas Energy Solutions secures a substantial and dependable revenue base through long-term supply contracts with key exploration and production (E&P) clients. These agreements offer significant revenue predictability, underpinning consistent demand for their proppant and logistics offerings.

For instance, in the first quarter of 2024, Atlas reported that approximately 80% of its revenue was generated from these long-term, take-or-pay contracts, highlighting the stability they provide amidst market fluctuations.

Distributed Power Solutions Revenue

Atlas Energy Solutions generates revenue through its distributed power solutions, a segment significantly bolstered by the acquisition of Moser Energy Systems. This business line focuses on providing natural gas-powered generators and associated services, primarily catering to the oilfield sector. These solutions offer reliable and often more cost-effective power alternatives for remote or demanding operational environments.

The revenue streams within distributed power solutions encompass several key areas:

- Generator Rentals: Offering flexible rental agreements for natural gas generators to meet temporary or seasonal power demands in oilfield operations, providing a steady income stream.

- Maintenance and Support Services: Generating recurring revenue through service contracts that include routine maintenance, repairs, and technical support for the deployed generator fleet.

- Fuel Management: Potentially offering integrated fuel supply and management services for the natural gas generators, adding another layer of revenue and customer convenience.

- Customized Power Solutions: Developing and implementing tailored power generation packages for specific client needs, which can include higher upfront revenue and long-term service agreements.

Rental Revenue from Equipment

Atlas Energy Solutions diversifies its income by renting out specialized equipment. This is likely tied to their logistics and wellsite services, providing a steady revenue stream beyond direct service provision.

This rental segment contributes to their overall financial health, offering flexibility and additional income. For instance, in 2023, Atlas reported total revenues of $346.5 million, with equipment rentals forming a key component of this figure.

- Equipment Rental Income: A significant contributor to overall revenue.

- Diversification of Services: Reduces reliance on single service lines.

- Asset Utilization: Maximizes return on investment for owned equipment.

Atlas Energy Solutions generates revenue primarily through the sale of frac sand (proppant) to oil and gas companies and well service providers, with pricing set per ton for various sand types and sizes. They also earn income from comprehensive logistics and last-mile delivery services, including their proprietary Dune Express system, which can be bundled with proppant sales or offered as standalone fees.

Long-term supply contracts, particularly take-or-pay agreements, are a significant revenue driver, providing substantial predictability. In the first quarter of 2024, approximately 80% of Atlas's revenue stemmed from these stable contracts, underscoring their importance.

The company also generates revenue from its distributed power solutions, bolstered by the Moser Energy Systems acquisition, which includes generator rentals, maintenance, support services, and customized power packages for the oilfield sector.

Additionally, Atlas monetizes its asset base through equipment rentals, which contributed to their total revenues of $346.5 million in 2023, adding another layer of income diversification.

| Revenue Stream | Primary Offering | Key Characteristics | 2024 Data Highlight |

|---|---|---|---|

| Proppant Sales | Frac sand (proppant) | Direct sales to E&P and well service companies; priced per ton. | Core revenue driver, substantial Q1 2025 contribution. |

| Logistics & Delivery Services | Transportation of materials | Includes proprietary Dune Express; standalone fees or bundled with proppant. | Significant role in overall financial performance. |

| Long-Term Contracts | Take-or-pay agreements | Provides revenue predictability and consistent demand. | ~80% of revenue in Q1 2024. |

| Distributed Power Solutions | Natural gas generators & services | Rentals, maintenance, support, customized solutions. | Bolstered by Moser Energy Systems acquisition. |

| Equipment Rentals | Rental of specialized equipment | Diversifies income, maximizes asset utilization. | Key component of $346.5 million total revenues in 2023. |

Business Model Canvas Data Sources

The Atlas Energy Solutions Business Model Canvas is built upon a foundation of comprehensive market research, detailed competitor analysis, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting industry realities.