Atlas Energy Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Energy Solutions Bundle

Atlas Energy Solutions operates within a dynamic energy sector, where understanding the competitive landscape is crucial for success. Our initial analysis highlights significant pressures from substitute products and the bargaining power of buyers, impacting Atlas Energy Solutions's strategic positioning.

The complete report reveals the real forces shaping Atlas Energy Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability of high-quality frac sand, essential for hydraulic fracturing, is geographically concentrated, especially in key operational areas like the Permian Basin. This scarcity can grant significant bargaining power to landowners or mineral rights holders who control these limited, desirable deposits. For instance, in 2024, the Permian Basin continued to be a focal point for oil and gas production, underscoring the strategic importance of reliable frac sand access.

Suppliers of highly specialized mining and processing equipment, such as custom-built drills or proprietary crushing machinery, can exert considerable bargaining power over Atlas Energy Solutions. This power stems from the significant investment required for Atlas to switch to alternative equipment, potentially involving extensive retraining and infrastructure modifications. For instance, if a key piece of equipment is patented or has unique integration requirements, switching costs could be prohibitive, forcing Atlas to accept supplier terms.

However, for more standardized equipment, like basic conveyor systems or common heavy machinery, supplier bargaining power is considerably weaker. The availability of multiple vendors offering comparable products means Atlas can readily source alternatives, fostering a competitive environment that limits individual suppliers' ability to dictate terms. In 2024, the global market for mining equipment saw robust demand, but also increased competition among manufacturers of non-proprietary machinery, which generally kept price increases in check for standard components.

Atlas Energy Solutions, despite its integrated logistics including the Dune Express, still depends on external transportation providers for certain segments. This reliance on third-party rail and specialized trucking services for long-haul and last-mile deliveries means suppliers can exert significant influence.

Any disruptions or price hikes from these external transportation suppliers, particularly those crucial for reaching final delivery points, directly affect Atlas’s operational efficiency and, consequently, its profit margins. For instance, a 5% increase in rail freight costs in 2024 could directly impact Atlas's cost of goods sold for services requiring such transport.

Labor Market for Skilled Workers

The availability of skilled labor directly impacts the bargaining power of suppliers in the energy sector. For Atlas Energy Solutions, a shortage of specialized engineers, experienced heavy equipment operators, or skilled logistics personnel can significantly shift power towards these workers.

In 2024, the U.S. Bureau of Labor Statistics reported a continued demand for skilled trades, with occupations like mechanical engineers and industrial machinery mechanics experiencing strong job growth projections. This tight labor market for specialized roles means that Atlas may face increased wage pressures, as qualified candidates can command higher compensation due to limited supply.

- Skilled Labor Shortages: A scarcity of workers experienced in mining operations, processing facilities, and complex logistics systems empowers these individuals.

- Wage Inflation: When demand for specialized skills outstrips supply, companies like Atlas often see higher wage demands, increasing operational costs.

- Impact on Operations: Difficulty in securing and retaining skilled labor can lead to project delays and increased expenses for Atlas Energy Solutions.

Regulatory Compliance and Environmental Services

Suppliers of environmental compliance and specialized waste management services wield significant bargaining power. This strength stems from the increasingly complex and rigorous regulatory landscape governing the mining and oil and gas sectors. Companies like Atlas Energy Solutions must rely on these specialized providers to navigate environmental permits and manage waste effectively, as non-compliance can result in substantial financial penalties.

The demand for these services is amplified by the potential for costly fines. For instance, in 2023, environmental regulatory fines in the energy sector globally exceeded billions of dollars, underscoring the critical need for expert assistance. This creates a scenario where reliable and knowledgeable environmental service providers are indispensable.

- Stringent Regulations: Evolving environmental laws create a constant need for specialized compliance expertise.

- High Penalties for Non-Compliance: Significant financial risks incentivize companies to secure reliable environmental services.

- Specialized Expertise Required: The niche nature of environmental permitting and waste management limits the pool of qualified providers.

- Critical Operational Dependence: Atlas Energy Solutions, like its peers, depends on these suppliers to maintain operational continuity and avoid shutdowns.

The bargaining power of suppliers for Atlas Energy Solutions is influenced by several factors. Highly specialized equipment suppliers and providers of critical environmental compliance services can exert significant influence due to high switching costs and the severe penalties associated with non-compliance, respectively. The scarcity of skilled labor in mining, processing, and logistics also empowers these workers, leading to potential wage inflation.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Atlas Energy Solutions (2024 Example) |

|---|---|---|

| Specialized Mining Equipment | Proprietary technology, high switching costs | Potential for higher equipment lease/purchase prices, longer lead times |

| Environmental Compliance Services | Complex regulations, high non-compliance penalties | Increased service contract costs, reliance on expert advice to avoid fines |

| Skilled Labor (Operators, Engineers) | Shortage of qualified personnel | Upward pressure on wages, potential for project delays if talent is scarce |

| Third-Party Logistics (Rail/Trucking) | Dependence on specific routes or specialized transport | Vulnerability to freight rate increases, potential disruptions in supply chain |

What is included in the product

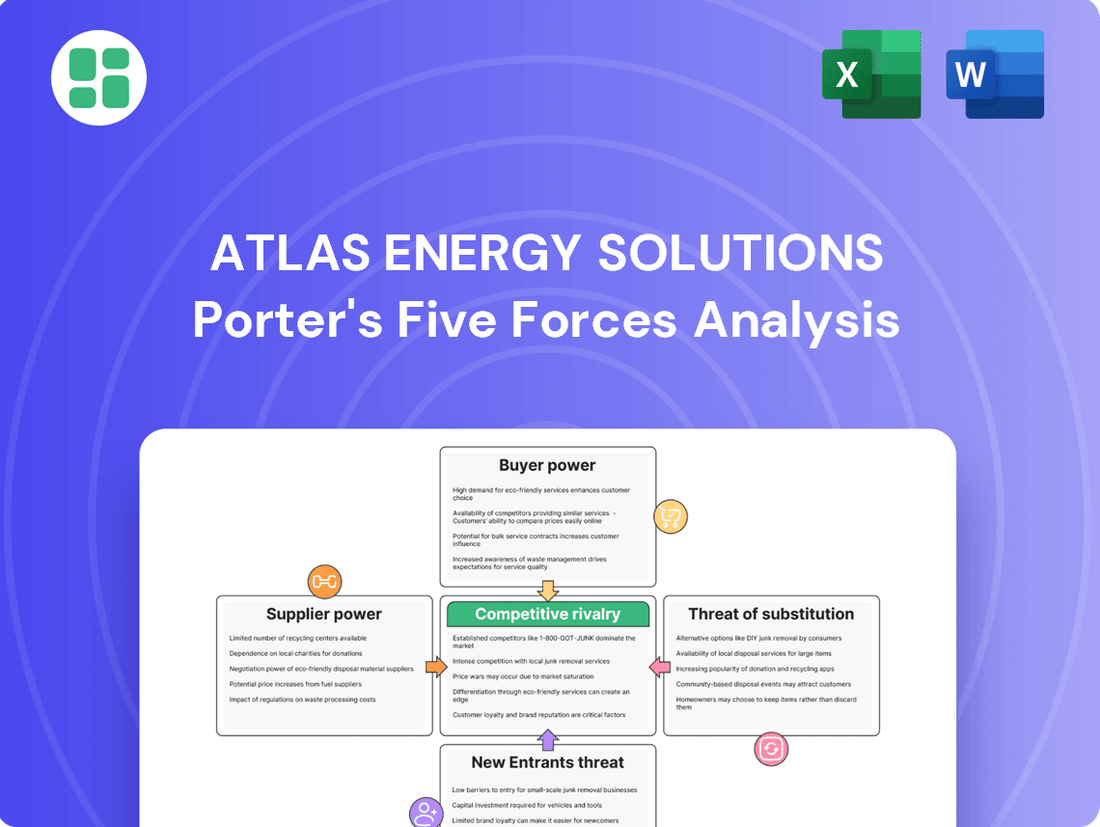

This analysis dives into the competitive forces impacting Atlas Energy Solutions, examining industry rivalry, buyer and supplier power, new entrant threats, and the availability of substitutes.

Instantly visualize competitive intensity with a dynamic heat map, highlighting key areas of pressure.

Effortlessly model the impact of supplier power shifts with adjustable input parameters.

Customers Bargaining Power

Atlas Energy Solutions primarily serves large oil and gas exploration and production (E&P) companies, with a significant focus on those operating in the prolific Permian Basin. This concentration of major clients means that a handful of these E&P giants, due to their substantial purchasing volumes, wield considerable influence over pricing and contract terms.

For standard frac sand, a commodity product, customers often face low switching costs. This means if Atlas Energy Solutions’ competitors offer similar quality sand at more attractive prices or more favorable contract terms, customers can easily shift their business. This dynamic directly impacts Atlas's ability to command higher prices for its core offering.

In 2024, the frac sand market continued to exhibit these characteristics. For instance, while specific pricing varies by region and quality, the general commoditization means that a slight price advantage from a competitor can be a significant driver for customer decisions. Atlas, like others in the sector, must remain competitive on price and service to retain its customer base.

Customers, particularly large exploration and production (E&P) companies, possess the ability to backward integrate, meaning they could develop their own frac sand mining operations or logistics infrastructure. This capability acts as a significant check on the pricing power of proppant suppliers like Atlas Energy Solutions. For instance, if the cost of procuring proppant from external sources, such as Atlas, escalates beyond a certain threshold, a major E&P firm might find it economically viable to invest in its own production facilities. This was a consideration in 2024 as the cost of raw materials and transportation experienced volatility.

Price Sensitivity Due to Overall Well Costs

Proppant expenses represent a substantial portion of the total well completion expenses for Exploration and Production (E&P) operators. This significant cost component makes customers acutely price-sensitive, particularly when oil and gas prices fluctuate. For instance, in early 2024, the volatility in crude oil markets directly influenced E&P operators' willingness to invest in new drilling, thereby increasing pressure on proppant suppliers to maintain competitive pricing structures.

The bargaining power of customers is amplified by their sensitivity to these well costs. Suppliers are thus compelled to offer favorable pricing to secure contracts, especially when E&P operators have multiple proppant sourcing options. This dynamic is evident as many E&P companies actively seek cost reductions across their supply chains to maximize profitability in a challenging commodity price environment.

- Proppant costs are a major factor in E&P well completion budgets.

- Customers exhibit high price sensitivity, especially during periods of commodity price volatility.

- This sensitivity forces proppant suppliers to compete aggressively on price.

Availability of Alternative Proppant Suppliers

The bargaining power of customers for Atlas Energy Solutions is significantly influenced by the availability of alternative proppant suppliers, particularly within the Permian Basin. This region, a core operational area for Atlas, has experienced a notable rise in local and regional frac sand mines. This expansion has, at times, created an oversupply scenario.

This abundance of suppliers directly translates to increased leverage for Atlas's customers. When multiple proppant providers are readily available, clients can more easily compare pricing, quality, and delivery terms. This competitive landscape empowers them to negotiate more favorable contracts, potentially driving down prices for proppant services.

- Increased Supplier Competition: The Permian Basin saw a significant increase in frac sand mines, leading to more choices for oil and gas operators.

- Oversupply Dynamics: Periods of oversupply in the proppant market further amplify customer bargaining power by creating a buyer's market.

- Price Sensitivity: Customers can leverage multiple bids to secure the most cost-effective proppant solutions, impacting Atlas's pricing power.

- Negotiating Leverage: The ease of switching between suppliers means customers can demand better terms and conditions.

Atlas Energy Solutions' customers, primarily large E&P companies, wield significant bargaining power due to their substantial purchasing volumes and the commoditized nature of frac sand. In 2024, the Permian Basin, a key market for Atlas, experienced increased competition with new sand mines, leading to potential oversupply and amplifying customer leverage. This environment forces Atlas to compete aggressively on price and contract terms, as customers can easily switch suppliers if better offers are available.

| Factor | Impact on Atlas Energy Solutions | 2024 Context |

|---|---|---|

| Customer Concentration | High influence from a few large clients | E&P majors continue to dominate purchasing |

| Low Switching Costs | Easy for customers to change suppliers | Commodity nature of sand facilitates switching |

| Backward Integration Potential | Threat of customers producing their own sand | Volatility in raw material costs can trigger this |

| Proppant Cost Sensitivity | Customers are highly price-sensitive | Well completion costs are a major budget item |

| Supplier Competition | Increased availability of alternative suppliers | Permian Basin saw new mine expansions in 2024 |

Same Document Delivered

Atlas Energy Solutions Porter's Five Forces Analysis

This preview showcases the complete Atlas Energy Solutions Porter's Five Forces Analysis, detailing the competitive landscape of the oil and gas services sector. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. This comprehensive analysis is ready for immediate use, equipping you with the strategic intelligence needed to understand Atlas Energy Solutions' market position.

Rivalry Among Competitors

The frac sand market, especially in the Permian Basin, is crowded with many companies. This leads to more sand available than is needed, creating an oversupply. This situation naturally pushes prices down for everyone involved, including Atlas Energy Solutions, squeezing profit margins.

Frac sand, a key component in hydraulic fracturing, is largely a commodity. This means the basic product offered by various suppliers, like Atlas Energy Solutions, has minimal differentiation. Consequently, the market often devolves into intense price-based competition.

Companies in this space, including Atlas, must focus heavily on cost efficiency to remain competitive. In 2023, the average price of Northern White frac sand saw fluctuations, with some regions experiencing price points around $40-$60 per ton, heavily influenced by transportation costs and regional demand. This price sensitivity directly impacts profit margins.

Atlas Energy Solutions operates in an industry where significant capital is tied up in fixed assets like mines and processing plants. For instance, the development of a new frac sand mine can cost tens of millions of dollars. These substantial upfront investments create a constant need to keep operations running at high capacity.

This pressure to maximize utilization means companies often compete fiercely on price to win contracts and maintain sales volumes. In 2024, the demand for frac sand, while recovering, still necessitates efficient operations to offset the high fixed costs inherent in the business.

Strategic Differentiation through Logistics

Atlas Energy Solutions is actively carving out its competitive edge by prioritizing sophisticated logistics, a departure from solely focusing on sand quality. Their innovative Dune Express conveyor system is a prime example, designed to deliver sand more affordably, safely, and with a lighter environmental footprint.

- Cost Efficiency: The Dune Express aims to reduce per-ton delivery costs by minimizing reliance on traditional trucking, a significant factor in the competitive landscape of proppant delivery.

- Safety Enhancements: By moving sand via a controlled conveyor system, Atlas seeks to mitigate the inherent safety risks associated with heavy truck traffic on well sites.

- Environmental Impact: This logistics innovation directly addresses environmental concerns by reducing emissions and road wear associated with truck transportation, a growing priority for the industry.

- Competitive Battleground: Logistics efficiency is emerging as a critical differentiator, allowing Atlas to compete on factors beyond the physical characteristics of the sand itself.

Industry Consolidation and M&A Activity

The frac sand industry is experiencing significant consolidation, with larger companies actively acquiring smaller competitors. This trend is driven by the pursuit of greater market share and the realization of economies of scale. For instance, Atlas Energy Solutions' acquisition of Moser Energy Systems in 2024 exemplifies this strategic move, underscoring the industry's ongoing M&A activity aimed at fortifying competitive standing.

This consolidation can intensify rivalry as fewer, larger players dominate the market. Companies like Atlas aim to leverage these acquisitions to enhance operational efficiencies and cost structures, thereby creating a more competitive advantage against remaining independent players or those less involved in M&A.

- Industry Consolidation: The frac sand sector is actively consolidating.

- M&A Activity: Leading players are acquiring smaller firms to boost market share.

- Economies of Scale: Consolidation aims to achieve greater operational efficiencies.

- Atlas's Strategy: The 2024 acquisition of Moser Energy Systems by Atlas Energy Solutions highlights this trend.

Competitive rivalry in the frac sand market is intense due to numerous suppliers and the commodity nature of the product, forcing companies like Atlas Energy Solutions into price-based competition. High fixed costs associated with mining and processing necessitate high utilization rates, further fueling this price pressure.

The industry is also seeing significant consolidation, with companies like Atlas acquiring others to gain scale and efficiency. For example, Atlas Energy Solutions' 2024 acquisition of Moser Energy Systems is a strategic move to bolster its competitive position in a consolidating market.

Atlas is differentiating itself through logistics innovation, such as its Dune Express conveyor system, aiming to reduce delivery costs and environmental impact, thereby shifting the competitive battleground beyond just sand quality.

| Factor | Impact on Atlas Energy Solutions | 2024 Context |

|---|---|---|

| Number of Competitors | High; leads to oversupply and price pressure. | Permian Basin remains a highly competitive frac sand market. |

| Product Differentiation | Low; frac sand is largely a commodity. | Focus shifts to services and logistics for differentiation. |

| Cost Structure | High fixed costs require high utilization. | Efficiency gains are crucial for profitability amidst fluctuating demand. |

| Industry Consolidation | Drives M&A for scale and efficiency. | Atlas's 2024 Moser Energy Systems acquisition exemplifies this trend. |

SSubstitutes Threaten

While frac sand holds the dominant market share, alternative proppant materials such as ceramic proppants and resin-coated proppants present a potential threat of substitutes for Atlas Energy Solutions. These alternatives can offer enhanced strength or improved conductivity, making them suitable for specific well conditions that might not be optimally served by traditional sand. For instance, ceramic proppants can withstand higher closure stresses, crucial in deeper or more demanding formations.

The primary barrier to widespread adoption of these substitutes is their typically higher cost compared to frac sand. However, if advancements in manufacturing or economies of scale lead to a significant reduction in their price point, their appeal could increase substantially. This potential shift could challenge the current pricing power of frac sand suppliers and impact the cost structure for hydraulic fracturing services.

Innovations in hydraulic fracturing, like advanced fluid designs or novel drilling techniques, could lessen the proppant volume or change proppant requirements per well. This ongoing technological evolution poses a long-term threat of substitution by making existing methods less necessary.

Oil and gas companies are constantly looking for ways to get more out of each well while cutting expenses. This drive for efficiency means they're adopting new technologies and methods to use proppant more effectively, which could reduce the total amount needed for each well.

For instance, advancements in hydraulic fracturing techniques and proppant technology itself are allowing operators to achieve similar or better results with less material. This trend directly impacts the demand for proppant, making it a significant factor in the competitive landscape.

Shift to Different Energy Sources

The growing global emphasis on sustainability and climate change mitigation presents a significant substitute threat to the oil and gas industry, and by extension, to suppliers like Atlas Energy Solutions. A substantial shift in energy policy or evolving consumer preferences away from fossil fuels towards renewable energy sources could drastically reduce the demand for oil and gas extraction. This, in turn, would diminish the need for essential materials such as frac sand and other proppants used in hydraulic fracturing.

This long-term, macroeconomic trend represents a fundamental substitute threat. For instance, by the end of 2023, global renewable energy capacity additions reached an unprecedented 510 gigawatts, a 50% increase compared to 2022, according to the International Energy Agency (IEA). This rapid expansion in alternatives directly competes with the traditional energy sources that drive demand for Atlas Energy Solutions’ products.

- Macroeconomic Shift: A broad move towards renewable energy, driven by policy and consumer demand, directly reduces the need for oil and gas extraction.

- Demand Reduction: This shift diminishes the market for frac sand and other proppants used in oil and gas production.

- Renewable Growth: Global renewable energy capacity saw a 50% increase in additions in 2023 compared to 2022, highlighting the growing viability of substitutes.

Recycled or Reused Proppants

The threat of substitutes for frac sand, particularly recycled or reused proppants, is a growing concern for companies like Atlas Energy Solutions. Ongoing research and development into extracting and repurposing proppants from flowback fluid could significantly alter market dynamics. If these recycling technologies achieve commercial viability and scalability, they could directly reduce the demand for newly sourced frac sand.

This potential shift could impact Atlas Energy Solutions' market share and profitability. For instance, advancements in proppant recycling could lead to a cost advantage for operators who adopt these methods, making new sand a less attractive option. By 2024, the oil and gas industry's focus on cost efficiency and environmental sustainability is likely to accelerate the adoption of such innovative solutions.

- Proppant Recycling Technology: Emerging R&D into recycling proppants from flowback fluid presents a direct substitute.

- Commercial Viability: The scalability and cost-effectiveness of these recycling technologies are key factors in their potential to disrupt the market.

- Demand Reduction: Successful implementation of proppant reuse could lead to a substantial decrease in demand for new frac sand.

- Market Impact: This substitution threat could pressure pricing and market share for primary proppant suppliers like Atlas Energy Solutions.

The threat of substitutes for frac sand, while currently moderate, is poised to grow. While ceramic and resin-coated proppants offer performance advantages, their higher cost remains a barrier. However, advancements in recycling technologies for used proppants could significantly reduce demand for new sand, driven by industry focus on cost efficiency and sustainability in 2024.

| Substitute Type | Key Advantage | Cost Factor | Market Threat (2024 Outlook) |

|---|---|---|---|

| Ceramic Proppants | Higher strength, better conductivity | Higher | Niche applications, limited broad threat |

| Resin-Coated Proppants | Improved flow, reduced dust | Higher | Niche applications, limited broad threat |

| Recycled/Reused Proppants | Cost savings, environmental benefit | Lower (potential) | Growing threat due to efficiency drive |

Entrants Threaten

Establishing a competitive frac sand operation, particularly one with integrated logistics like Atlas Energy Solutions' Dune Express, demands significant upfront capital. This includes costs for acquiring land, purchasing heavy mining and processing equipment, and building essential transportation infrastructure. For instance, in 2024, the cost of a new, large-scale frac sand plant can easily range from $50 million to over $100 million, not including the fleet of trucks or railcars needed for efficient delivery.

This substantial financial commitment acts as a considerable deterrent for many potential new players looking to enter the frac sand market. The sheer scale of investment required means only well-capitalized companies or those with strong financial backing can realistically consider competing, thereby limiting the threat of new entrants.

Securing access to economically viable, high-quality silica sand deposits, especially in crucial basins like the Permian, presents a substantial hurdle for potential new entrants. Atlas Energy Solutions, like many established players, has already secured prime locations, creating a significant barrier for newcomers seeking comparable reserves.

Established players in the energy sector, including those like Atlas Energy Solutions, often leverage significant economies of scale. This means that as production volume increases, the cost per unit of energy produced decreases due to efficiencies in mining, processing, and transportation infrastructure. For instance, large-scale operations can negotiate better prices for raw materials and spread fixed costs over a larger output, giving them a substantial cost advantage.

New entrants face the daunting task of replicating these cost efficiencies without the benefit of established infrastructure and high-volume operations. Building new mining facilities, processing plants, and transportation networks requires immense capital investment. Until they reach a comparable scale, new companies will likely operate at a higher per-unit cost, making it challenging to compete on price with established energy providers.

Regulatory and Permitting Complexities

The intricate web of environmental permits and the navigation of local, state, and federal regulations for mining and substantial industrial undertakings present a formidable barrier to entry. This complexity inherently extends timelines and inflates costs, effectively acting as a significant deterrent for prospective new players in the market.

For instance, in 2024, the average time to secure major environmental permits for new industrial facilities in the United States could range from 18 months to over three years, depending on the project's scope and location. The associated costs for studies, legal counsel, and application fees can easily run into hundreds of thousands, if not millions, of dollars.

- Regulatory Hurdles: Obtaining permits for operations like those of Atlas Energy Solutions involves extensive environmental impact assessments and compliance checks at multiple governmental levels.

- Time and Cost Investment: New entrants must budget significant time and capital to satisfy these regulatory demands before commencing operations.

- Deterrent Effect: The sheer complexity and expense of regulatory compliance discourage many potential competitors from entering the market.

Integrated Logistics and Supply Chain Expertise

Atlas Energy Solutions' integrated logistics and supply chain expertise, particularly in proppant supply and last-mile delivery, presents a substantial barrier to new entrants. Replicating this intricate network, which includes advanced transportation systems and deep operational know-how, demands significant capital investment and time. For instance, the sheer scale of managing a national proppant logistics network, as Atlas does, requires a fleet of specialized vehicles and sophisticated tracking technology, a hurdle few newcomers can easily overcome.

The threat of new entrants is therefore considered moderate to low due to these high entry barriers.

- High Capital Requirements: Establishing a comparable logistics infrastructure, including transportation fleets and storage facilities, can cost hundreds of millions of dollars.

- Operational Complexity: Managing the end-to-end supply chain for a critical commodity like proppant requires specialized knowledge in transportation, inventory management, and regulatory compliance.

- Established Relationships: Atlas has cultivated strong relationships with suppliers and customers, built over years of reliable service, which are difficult for new players to replicate quickly.

- Technological Integration: The need for advanced tracking, optimization software, and real-time data analytics further elevates the technical barrier for potential competitors.

The threat of new entrants in the frac sand market, particularly for companies like Atlas Energy Solutions, is significantly mitigated by substantial capital requirements. Building a new frac sand operation with integrated logistics in 2024 could easily cost upwards of $100 million, encompassing land, equipment, and transportation infrastructure, thus limiting competition to well-funded entities.

Securing prime silica sand reserves and navigating complex environmental regulations, which can take over three years and cost millions in 2024, further erects formidable barriers. These combined factors, alongside the economies of scale and integrated logistics expertise possessed by established players, render the threat of new entrants moderate to low.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Atlas Energy Solutions is built upon a foundation of verified data, including their annual reports, industry-specific publications, and regulatory filings. We also leverage macroeconomic databases to ensure accurate insights into the competitive landscape.