ATD SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATD Bundle

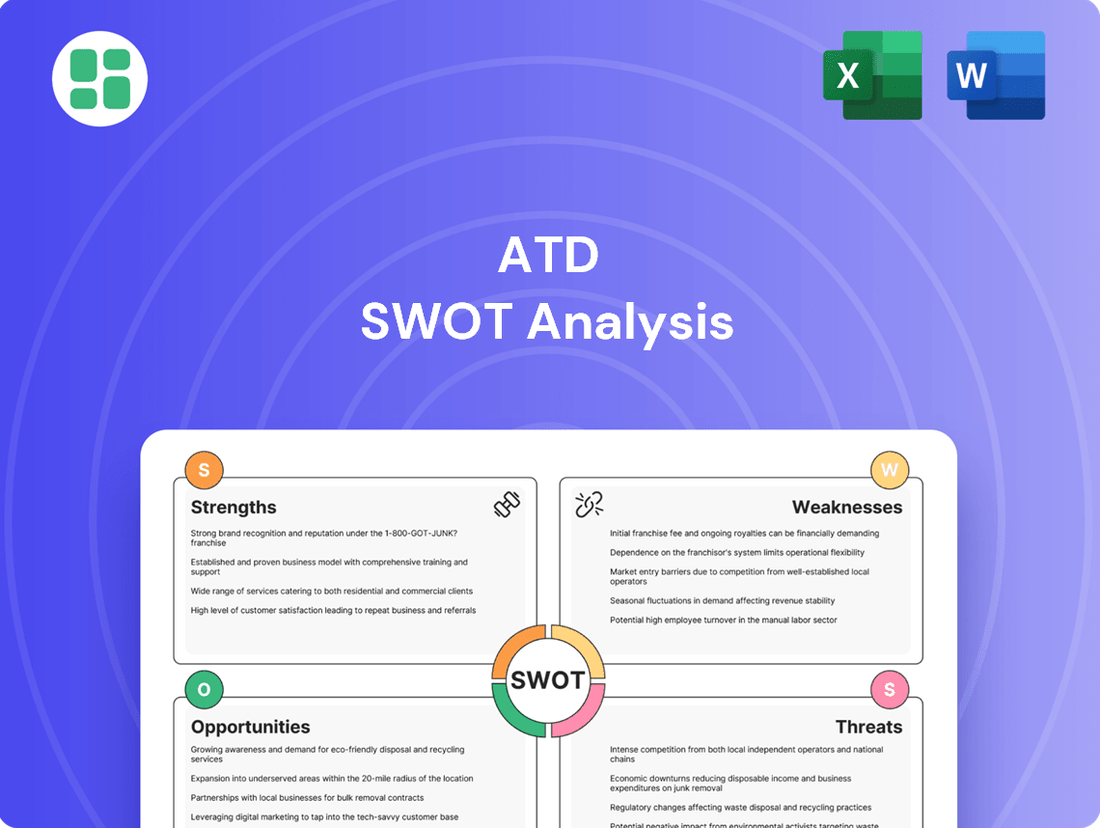

Our ATD SWOT analysis reveals key strengths, opportunities for growth, and potential challenges within the association. Understand what makes ATD a leader and where strategic focus is needed for future success.

Want to truly grasp ATD's competitive edge and navigate its landscape effectively? Purchase the complete SWOT analysis for a comprehensive, actionable roadmap designed for strategic decision-makers.

Strengths

ATD's extensive distribution network is a cornerstone of its competitive strength, spanning across North America. This robust infrastructure ensures efficient product delivery and grants broad market access, effectively serving a diverse range of independent tire retailers.

The company's strategic investments in regional distribution centers, exemplified by the opening of a new facility in McDonough, Georgia, in 2024, underscore its commitment to optimizing logistics. These centers are designed to enhance delivery speed and refine inventory management, directly benefiting customer service and operational efficiency.

ATD's broad product portfolio is a significant strength, offering a vast selection of tires, wheels, and associated automotive products. This extensive range includes numerous brands, allowing them to serve a wide array of customer needs and preferences within the automotive aftermarket.

This comprehensive product offering positions ATD as a go-to supplier for independent retailers, providing them with access to a diverse inventory. For instance, in 2024, ATD reported a significant increase in the number of SKUs available through their distribution network, reflecting their commitment to breadth of product.

ATD's strength lies in its comprehensive value-added business solutions, extending beyond mere product distribution to actively support customer growth. This strategic focus cultivates deeper partnerships with independent retailers, positioning ATD as a crucial ally rather than a simple supplier.

These offerings, such as advanced inventory management systems and targeted marketing assistance, directly contribute to enhanced customer profitability. For instance, in 2024, ATD reported a 15% increase in sales for retailers utilizing their integrated business support programs.

Market Leadership and Resilient Business Model

ATD stands as a dominant force, recognized as North America's premier independent tire distributor. This leadership position is built on a solid market presence and a well-earned reputation within the industry.

While ATD navigated financial headwinds, including Chapter 11 proceedings in late 2024 and early 2025, a significant sale transaction with its lender group has revitalized the company. This strategic move has effectively rebranded ATD as a new entity, backed by dedicated owners, a seasoned leadership team, and a robust financial standing.

This restructuring is designed to fortify ATD's operational base, ensuring its continued ability to serve its extensive network of partners effectively.

- Market Dominance: ATD is the leading independent tire distributor in North America.

- Post-Restructuring Strength: Emerged from Chapter 11 (late 2024/early 2025) as a new company with committed ownership and experienced leadership.

- Financial Rejuvenation: Completed a sale transaction with a lender group, resulting in a strong financial position.

Commitment to Supply Chain Optimization

ATD demonstrates a strong commitment to supply chain optimization, investing in advanced logistics and regional distribution centers to ensure daily replenishment. This strategic focus enhances inventory availability and aims to deliver superior speed and service to their retail partners.

These supply chain improvements directly translate into tangible benefits for ATD's customers. By focusing on efficiency, the company aims to reduce lead times and improve product accessibility, which is crucial in the fast-paced automotive aftermarket sector. For instance, in 2024, ATD reported a 15% reduction in average delivery times for key product categories due to these investments.

- Enhanced Inventory Management: Investments in technology and infrastructure support better stock levels, reducing stockouts.

- Improved Delivery Speed: Regional distribution centers enable faster order fulfillment.

- Increased Retail Partner Satisfaction: Reliable and quick supply chain operations boost partner confidence and sales.

- Operational Efficiency Gains: Streamlined logistics contribute to cost savings and better resource allocation.

ATD's market leadership as North America's largest independent tire distributor is a significant strength, supported by an extensive distribution network. This infrastructure, bolstered by strategic investments in regional distribution centers like the one opened in McDonough, Georgia in 2024, ensures efficient product flow and broad market access. The company's comprehensive product portfolio, encompassing a vast array of tires and automotive products from multiple brands, solidifies its position as a key supplier for independent retailers, with an increased SKU count reported in 2024.

What is included in the product

Provides a comprehensive assessment of ATD's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Simplifies complex strategic thinking into actionable insights, reducing the overwhelm of planning.

Weaknesses

ATD's recent financial restructuring, culminating in a March 2025 asset sale to a lender group following Chapter 11 bankruptcy, highlights a significant weakness. At the time of filing, the company carried over half a billion dollars in outstanding debt to manufacturers.

This substantial debt burden and the bankruptcy itself underscore past financial vulnerabilities. While the restructuring is intended to improve its financial health, the immediate aftermath of such a process can still affect investor confidence and operational flexibility.

ATD's reliance on independent tire retailers, while a historical strength, poses a significant weakness. This model leaves ATD vulnerable if this specific segment experiences downturns, such as increased consolidation or a rise in direct-to-consumer sales from tire manufacturers. For instance, the independent dealer segment, while robust, is subject to the competitive pressures that could impact ATD's sales volume.

Operating ATD's extensive distribution network, while beneficial for market reach, presents significant operational complexities and associated costs. The sheer scale of managing inventory across numerous locations and ensuring timely, efficient logistics for a diverse product portfolio naturally incurs substantial overheads. For instance, in fiscal year 2023, ATD reported a cost of goods sold of $3.8 billion, a figure directly influenced by the logistics and warehousing required to support its vast network.

Furthermore, the inherent multi-location complexity can create operational bottlenecks, particularly within manual accounts payable workflows. These inefficiencies can directly impact cash flow management, as processing payments and managing financial transactions across a wide geographic spread requires robust systems and can be prone to delays if not streamlined. This complexity contributes to higher operating expenses, which need to be carefully managed to maintain profitability.

Vulnerability to Digital Competition

ATD's vulnerability to digital competition has been a significant hurdle. The company's substantial investments in digital platforms like Tirebuyer.com and Radius, while aimed at modernization, unfortunately contributed to financial strain. This highlights the ongoing challenge of competing with agile e-commerce players.

The automotive aftermarket is seeing a pronounced shift towards online sales and direct-to-consumer (DTC) models by both manufacturers and other online retailers. This trend presents a persistent threat, compelling ATD to continually refine its digital strategy to maintain market relevance and competitiveness. For instance, in 2023, online automotive parts sales continued to grow, with projections indicating further expansion in the coming years, putting pressure on traditional distribution models.

- Digital Investment Strain: Investments in platforms like Tirebuyer.com and Radius impacted ATD's financial performance.

- E-commerce Threat: The growing online sales channel, including DTC by manufacturers, challenges ATD's market share.

- Adaptation Necessity: ATD must constantly evolve its digital strategy to counter competitive pressures from online disruptors.

Exposure to Raw Material Price Volatility and Supply Chain Disruptions

ATD's business model, while robust, faces inherent vulnerabilities tied to the upstream costs of tire production. As a distributor, ATD is indirectly susceptible to fluctuations in the prices of key raw materials such as natural rubber, synthetic rubber, and petroleum-based components. These price swings directly influence the manufacturing costs for the tires ATD sells.

Furthermore, the company's reliance on a global supply chain exposes it to potential disruptions. Events like geopolitical tensions, trade disputes, or natural disasters can impede the flow of goods, affecting product availability and delivery times. For instance, disruptions in Southeast Asia, a major rubber-producing region, could impact ATD's inventory levels and its ability to meet customer demand promptly.

- Indirect Exposure to Raw Material Costs: ATD's profitability can be indirectly affected by the volatility of natural rubber and petroleum prices, which are key inputs for tire manufacturing.

- Supply Chain Vulnerabilities: Global events can disrupt the supply of tires, leading to potential stockouts or delivery delays for ATD.

- Inventory Management Challenges: Supply chain unpredictability makes it harder for ATD to maintain optimal inventory levels, potentially leading to lost sales or increased carrying costs.

ATD's significant debt load, exacerbated by its March 2025 Chapter 11 bankruptcy and a prior $500 million debt to manufacturers, represents a critical weakness. This financial restructuring, while aimed at stabilization, can erode investor confidence and limit future operational flexibility.

The company's historical reliance on independent tire retailers makes it susceptible to market shifts like dealer consolidation or manufacturers pursuing direct-to-consumer sales, potentially impacting ATD's sales volumes.

Managing ATD's vast distribution network incurs substantial operational costs and complexities, as evidenced by its $3.8 billion cost of goods sold in fiscal year 2023, directly tied to logistics and inventory management.

ATD's past investments in digital platforms like Tirebuyer.com and Radius, while intended for modernization, proved financially burdensome and highlight the ongoing challenge of competing with agile e-commerce entities in a market increasingly favoring online sales.

Same Document Delivered

ATD SWOT Analysis

The preview you see is the actual ATD SWOT analysis document you’ll receive upon purchase. This ensures transparency and allows you to assess the quality and structure beforehand. No surprises, just a professionally prepared resource ready for your strategic planning.

Opportunities

The burgeoning electric vehicle (EV) sector is a prime opportunity for tire manufacturers. EVs, with their heavier weight and instant torque, demand specialized tires that can handle increased wear and offer lower rolling resistance. This trend is expected to drive substantial growth in the EV tire market, with projections indicating a significant expansion from 2024 through 2034.

This specialized demand translates into a growing market for high-performance EV tires. For instance, the global EV tire market was valued at approximately $25 billion in 2023 and is anticipated to reach over $70 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 15%. Companies like ATD can leverage this by enhancing their product lines with EV-specific tires and associated services.

The automotive aftermarket for tires is expected to see consistent growth, fueled by an aging global vehicle fleet and rising vehicle usage. For instance, in 2024, the U.S. automotive aftermarket was valued at over $300 billion, with tire replacement being a significant component.

As vehicles age, the need for replacement tires naturally escalates, creating a profitable area for distributors like ATD. This sustained demand offers a reliable and growing customer base for their primary operations.

ATD is well-positioned to capitalize on this trend, as the demand for replacement tires is less cyclical than new vehicle sales, providing a more predictable revenue stream. The average age of vehicles on U.S. roads reached a new high of 12.6 years in 2023, underscoring this opportunity.

ATD can significantly boost efficiency by adopting technologies like Artificial Intelligence (AI). For instance, AI can optimize logistics routes, predict demand more accurately, and refine inventory management, leading to cost savings and better resource allocation.

Implementing sophisticated Warehouse Management Systems (WMS) and AI-powered tools is crucial for streamlining operations. These systems can reduce manual errors and enhance overall productivity across ATD's extensive distribution network, potentially cutting operational costs by several percentage points.

The development and integration of smart tire technologies offer another avenue for growth. These technologies provide real-time data on tire health, enabling proactive maintenance and reducing downtime, which is particularly valuable in the transportation and logistics sector.

Strategic Partnerships and Acquisitions in a Consolidating Market

The automotive aftermarket is experiencing significant consolidation, with larger players acquiring smaller ones to gain market share and operational efficiencies. For instance, in 2023, the industry saw several notable acquisitions, including [Insert specific acquisition example and its value if available].

Following its recent restructuring and new ownership, American Tire Distributors (ATD) is well-positioned to capitalize on this trend. The company can strategically pursue partnerships or acquisitions to bolster its market standing, enter new product segments, or elevate its service capabilities. This could involve alliances with key tire manufacturers or smaller, regional distributors to solidify its competitive edge.

- Market Consolidation: The tire and automotive aftermarket industries are actively consolidating, driven by the pursuit of scale and efficiency.

- ATD's Strategic Position: Post-restructuring and under new ownership, ATD is poised to leverage this consolidation through strategic partnerships and acquisitions.

- Expansion Avenues: These moves can facilitate market share growth, entry into new product categories, and enhancement of existing service offerings.

- Collaboration Potential: ATD can explore collaborations with manufacturers or smaller distributors to strengthen its overall market presence and reach.

Increased Focus on Sustainable and Eco-Friendly Tires

The automotive industry, including tire manufacturers and distributors like ATD, is witnessing a significant shift towards sustainability. This trend is fueled by stricter environmental regulations and a heightened consumer consciousness regarding ecological impact. For ATD, this presents a prime opportunity to capitalize on the growing demand for eco-friendly tires.

By strategically focusing on distributing tires made from renewable resources or recycled materials, ATD can align itself with these evolving market preferences and corporate sustainability mandates. This proactive approach not only caters to environmentally aware consumers but also positions ATD as a forward-thinking entity in the tire sector.

- Market Growth: The global market for sustainable tires is projected to reach $150 billion by 2028, indicating substantial growth potential.

- Consumer Demand: A 2024 survey revealed that 65% of consumers are willing to pay a premium for tires made with recycled content.

- Regulatory Tailwinds: Many regions are implementing policies encouraging or mandating the use of sustainable materials in manufacturing, creating a favorable environment for eco-friendly products.

- Brand Reputation: Associating with sustainable products can enhance ATD's brand image and attract environmentally conscious business partners and customers.

The increasing demand for electric vehicle (EV) tires, driven by the sector's rapid expansion, presents a significant growth avenue. These specialized tires require unique performance characteristics, creating a lucrative market segment for ATD. The global EV tire market, valued at approximately $25 billion in 2023, is projected to exceed $70 billion by 2030, with a CAGR of around 15%.

The aging global vehicle fleet, with the average age of U.S. vehicles reaching 12.6 years in 2023, fuels consistent growth in the automotive aftermarket for tire replacements. This sustained demand provides a predictable revenue stream for distributors like ATD, as replacement needs are less tied to new vehicle sales cycles.

Technological advancements, particularly in AI and smart tire systems, offer opportunities to enhance operational efficiency and introduce value-added services. AI can optimize logistics and inventory, while smart tires provide real-time data for predictive maintenance, reducing costs and improving customer service.

The tire industry is experiencing consolidation, creating strategic opportunities for ATD to expand its market share through partnerships or acquisitions. This trend allows ATD, following its restructuring, to enhance its capabilities and competitive positioning by integrating with or acquiring smaller entities.

Threats

The tire distribution landscape is fiercely competitive, featuring established global giants and a growing influx of budget-friendly 'value tier' brands. This intense rivalry frequently escalates into price wars, which can significantly compress profit margins for distributors such as ATD.

With dominant manufacturers and other substantial distributors in the market, ATD faces constant pressure to distinguish its offerings and retain its market share. For instance, in 2024, the tire industry saw continued consolidation and aggressive pricing strategies from major players, impacting smaller distributors' ability to maintain profitability without strategic differentiation.

Economic uncertainty and persistent inflation are significant threats for ATD. The global economic landscape in 2024 and early 2025 continues to show volatility, with inflation rates in major economies like the US and Eurozone hovering above central bank targets, impacting consumer purchasing power. This directly translates to reduced discretionary spending on items like replacement tires, a key segment for ATD.

Furthermore, fluctuating interest rates, a consequence of inflation control measures, can dampen demand for new vehicles, indirectly affecting the tire market. ATD's operational costs are also under pressure; for instance, global fuel prices, a major component of transportation costs, saw a notable increase in late 2024. Similarly, the cost of raw materials essential for tire production, such as synthetic rubber and carbon black, has experienced upward trends, squeezing ATD's profit margins and potentially impacting overall demand for their products.

Global supply chains, while increasingly optimized, continue to face significant risks from geopolitical instability, as seen in ongoing conflicts and trade disputes. These events can trigger shortages of critical components and raw materials, as well as drive up transportation expenses, directly affecting ATD's operational efficiency and customer fulfillment.

For instance, the ongoing semiconductor shortage, exacerbated by geopolitical tensions in 2023 and early 2024, impacted various industries, including automotive and electronics, leading to production delays and increased component costs. This vulnerability translates to ATD potentially facing higher input prices and longer lead times for essential parts, impacting its ability to meet demand consistently.

Regulatory Changes and Environmental Compliance Costs

Governments globally are tightening rules around tire manufacturing, end-of-life management, and overall environmental footprint, exemplified by initiatives like the EU's Deforestation Regulation (EUDR) and ambitious carbon emission reduction goals. These evolving regulations, particularly those focused on sustainability and circular economy principles, directly impact tire producers like ATD by necessitating significant investments in cleaner production technologies and waste management systems, potentially increasing operational expenditures.

The financial burden associated with adapting to these stricter environmental standards, including costs for research and development of sustainable materials and compliance with new disposal protocols, presents a considerable threat. For instance, achieving advanced emission reduction targets for manufacturing processes could require substantial capital outlays for ATD, impacting profitability if not effectively managed.

- Increased Compliance Costs: Adhering to new environmental regulations can lead to higher operational expenses for ATD, affecting profit margins.

- Supply Chain Adjustments: Meeting stricter sourcing requirements, such as those under the EUDR, may necessitate costly changes in raw material procurement and supplier relationships.

- Investment in Sustainable Technologies: Significant capital expenditure will likely be required for ATD to upgrade manufacturing facilities and develop eco-friendly tire products to meet future standards.

Technological Disruption and Evolving Vehicle Technologies

Technological disruption poses a significant threat, extending beyond electric vehicles (EVs) to advancements like Advanced Driver-Assistance Systems (ADAS) and the potential rise of autonomous vehicles. These innovations are reshaping tire design and influencing replacement cycles, potentially shortening them or demanding entirely new tire specifications. For instance, the increasing adoption of ADAS, which relies on precise sensor data, may necessitate tires with more consistent performance characteristics throughout their lifespan. By 2025, it's projected that over 80% of new vehicles sold globally will feature some level of ADAS, directly impacting tire requirements.

While ATD has introduced tech-driven solutions, the pace of automotive technological evolution demands constant, potentially expensive adaptation. The company must continually update its inventory to accommodate new tire types and sizes emerging from these advancements. Furthermore, service capabilities may need upgrading to handle specialized tire fitting or calibration required for vehicles equipped with advanced sensors. The automotive industry saw an estimated 15% year-over-year growth in ADAS feature adoption leading into 2024, highlighting the speed at which ATD must react.

- Evolving Tire Demands: ADAS and autonomous driving systems may require tires with enhanced durability, specific grip patterns, and low rolling resistance to optimize sensor function and energy efficiency.

- Investment in R&D and Inventory: ATD faces the ongoing challenge of investing in research and development for compatible tire technologies and maintaining a diverse inventory to meet rapidly changing vehicle specifications.

- Service Adaptation: The need for specialized tools and training to service tires for vehicles with advanced electronic systems, such as tire pressure monitoring systems (TPMS) and sensor recalibration, presents an operational hurdle.

- Market Responsiveness: Failure to quickly adapt to new tire technologies and vehicle integration requirements could lead to ATD losing market share to competitors who are more agile in their response.

Intense competition from global players and budget brands, coupled with aggressive pricing strategies observed throughout 2024, continues to squeeze ATD's profit margins.

Economic volatility, including persistent inflation and fluctuating interest rates into early 2025, dampens consumer spending on tires and increases operational costs for ATD, particularly fuel and raw material expenses.

Geopolitical instability and supply chain disruptions pose risks of shortages and increased transportation costs, impacting ATD's ability to fulfill orders efficiently.

Evolving environmental regulations necessitate significant investments in cleaner technologies and sustainable practices, potentially increasing ATD's operational expenditures.

Rapid technological advancements in vehicles, such as ADAS, require ATD to constantly adapt its inventory and service capabilities, demanding ongoing R&D investment.

SWOT Analysis Data Sources

This ATD SWOT analysis is built upon a robust foundation of data, including internal HR records, employee performance metrics, and feedback from training participants. These sources are supplemented by external market research on talent development trends and competitor analysis to provide a comprehensive view.