ATD PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATD Bundle

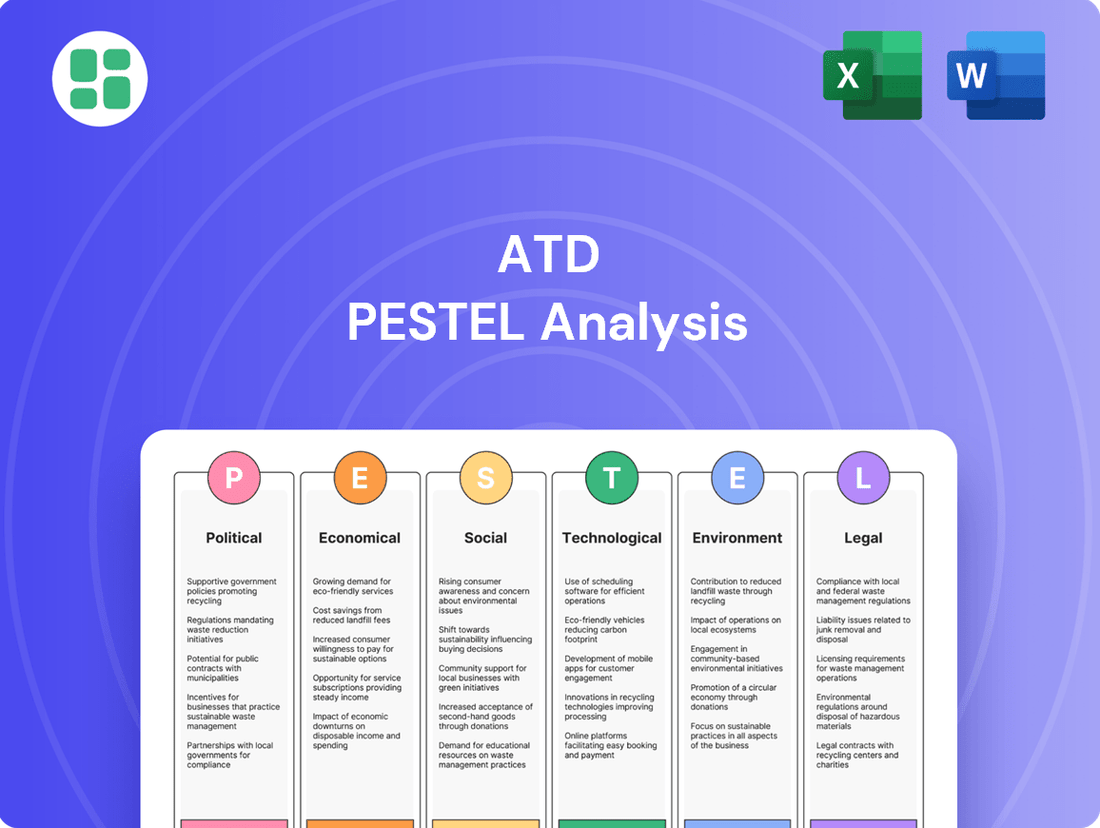

Unlock the hidden forces shaping ATD's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive advantage. Purchase the full analysis now and navigate the external landscape with confidence.

Political factors

Changes in trade policies, like the 25% tariffs on auto parts and vehicles implemented in April and May 2025, directly affect ATD's procurement expenses and the market position of imported tires. These broad tariffs, announced March 26, 2025, impact all import sources except those under USMCA, with potential for further expansion to other product categories.

The imposition of a 19% tariff on Indonesian imports, which includes rubber tires, introduces significant complexity for tire distributors like ATD. This evolving tariff landscape creates uncertainty regarding sourcing costs and the overall pricing strategy for imported tire products.

Stricter environmental regulations, such as the EPA's multi-pollutant emissions standards for model years 2027 and later, directly influence vehicle production, impacting tire demand and the specific types of tires ATD distributes. These evolving standards encourage manufacturers to produce lighter, more fuel-efficient vehicles.

The tightening of Corporate Average Fuel Economy (CAFE) standards further shifts consumer preferences towards these lighter, more efficient vehicles, which in turn affects the mix of tires ATD needs to stock and supply. For instance, a trend towards smaller, more aerodynamic cars necessitates different tire designs and sizes compared to larger SUVs.

Furthermore, regulations like California's Vehicle Safety Systems Inspection (VSSI), which mandates Advanced Driver-Assistance Systems (ADAS) calibration for repair shops, present opportunities for specialization within the aftermarket. Businesses like ATD that invest in the required tools and training for ADAS calibration can tap into a growing service segment.

Government investment in infrastructure, such as the federal Outdoor Act, is projected to significantly boost demand for off-road accessories, directly influencing specific tire segments. This act, alongside other initiatives, signals a growing market for durable and specialized tire products.

The IMPACT Act, actively supported by the U.S. Tire Manufacturers Association (USTMA) as of March 2025, champions innovative pavement technologies like rubber-modified asphalt. This development could lead to reduced tire wear and altered road maintenance requirements, impacting the automotive sector.

Furthermore, policies promoting the integration of recycled tire technologies into national infrastructure projects underscore a commitment to sustainability. This trend not only supports environmental goals but also opens avenues for new product development and market opportunities within the tire industry.

Labor Laws and Workforce Policies

Changes in labor laws and workforce policies present significant considerations for ATD. For instance, potential port strikes, a concern in 2024 with ongoing vigilance for similar disruptions in 2025, directly impact operational efficiency and supply chain reliability.

Labor compliance risks are also escalating. Increased scrutiny on issues like forced labor within supply chains, especially relevant for luxury automotive brands, could indirectly influence the broader automotive aftermarket sector.

- Port Strike Impact: The threat of labor actions at major ports, as observed in 2024, can lead to significant delays and increased logistics costs, affecting ATD's ability to source and distribute parts efficiently.

- Supply Chain Scrutiny: Growing international pressure to ensure ethical labor practices in supply chains means ATD must maintain robust due diligence, particularly concerning components sourced from regions with higher risks of labor violations.

- Regulatory Shifts: Evolving regulations around worker classification, minimum wage, and benefits can directly impact ATD's operational costs and workforce management strategies.

Geopolitical Stability and Supply Chain Resilience

Geopolitical tensions and ongoing supply chain disruptions remain a significant challenge for the automotive sector heading into 2025. The lingering effects of events like the semiconductor chip shortage, which saw global automotive production impacted by millions of units in prior years, continue to necessitate robust risk management. For ATD, this translates to a critical need to actively diversify its supplier base and enhance supply chain resilience to buffer against production delays and rising component costs.

The automotive industry in 2025 is still navigating the complexities of securing essential components. For instance, the scarcity of specialized metals vital for electric vehicle batteries and advanced electronics continues to affect manufacturing timelines. ATD must therefore prioritize building stronger relationships with a wider array of global suppliers to ensure a steadier flow of parts, thereby mitigating the financial impact of unforeseen shortages and price volatility.

- Semiconductor Shortage Impact: While easing, residual effects continue to influence production schedules in 2025, with some analysts projecting full normalization not before late 2025 or early 2026.

- Specialized Metal Sourcing: Geopolitical factors in key mining regions are impacting the availability and price of lithium, cobalt, and rare earth elements.

- Production Cost Increases: Supply chain bottlenecks and increased raw material costs have contributed to an estimated 5-10% rise in component costs for many automotive manufacturers in early 2025.

- Resilience Strategies: ATD's proactive diversification of suppliers and investment in supply chain visibility are crucial for maintaining operational continuity and competitive pricing.

Government trade policies significantly shape ATD's operational landscape. For example, the 25% tariffs on auto parts and vehicles implemented in April and May 2025, affecting all imports except those under USMCA, directly increase procurement expenses for ATD and impact the competitiveness of imported tires. Furthermore, a 19% tariff on Indonesian imports, including rubber tires, adds complexity to sourcing strategies and pricing decisions.

Environmental regulations are driving shifts in vehicle design and, consequently, tire demand. Stricter emissions standards for model years 2027 and later encourage lighter, more fuel-efficient vehicles, necessitating ATD to adapt its inventory to include tires suited for these models. Similarly, tightening CAFE standards reinforce this trend, making it crucial for ATD to stock a diverse range of tire sizes and designs aligned with consumer preferences for efficient vehicles.

Government investments in infrastructure, such as the federal Outdoor Act, are projected to boost demand for off-road accessories, directly benefiting specific tire segments. Simultaneously, policies promoting recycled tire technologies in infrastructure projects support sustainability goals and create new market opportunities for ATD in eco-friendly tire solutions.

Labor policies and geopolitical factors pose ongoing challenges. The threat of port strikes, a concern in 2024 with continued vigilance in 2025, can disrupt ATD's supply chain and increase logistics costs. Moreover, increased scrutiny on ethical labor practices in supply chains requires ATD to maintain robust due diligence, especially for components sourced from high-risk regions.

What is included in the product

The ATD PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the ATD, providing a comprehensive understanding of the external landscape.

The ATD PESTLE Analysis provides a structured framework to identify and understand external factors, effectively alleviating the pain of uncertainty and enabling more informed strategic decisions.

Economic factors

Consumer spending and disposable income are key drivers for the automotive aftermarket, directly impacting new vehicle sales and the demand for replacement tires. As of late 2024, persistent inflation and higher interest rates have put pressure on household budgets, leading many consumers to delay new vehicle purchases. For instance, the average new car price remained elevated, contributing to this trend.

This economic environment encourages consumers to hold onto their existing vehicles for longer periods. Consequently, the need for maintenance and repairs, including tire replacements, sees a significant uptick. This shift benefits companies like ATD, which are well-positioned to supply replacement tires to a growing aftermarket segment.

Inflationary pressures and elevated interest rates are significantly impacting the automotive aftermarket. For instance, the US Consumer Price Index for motor vehicle parts and equipment saw a notable increase in late 2023 and early 2024, contributing to higher operational costs for businesses.

These economic headwinds directly translate to increased expenses throughout the supply chain, from the sourcing of raw materials for tire production to the logistics of distribution. This cost escalation can squeeze profit margins for aftermarket product manufacturers and distributors.

Furthermore, higher interest rates make financing more expensive for both consumers looking to purchase vehicles and businesses investing in fleet maintenance or upgrades. This can lead to reduced demand for new vehicles, indirectly affecting the aftermarket sector, and can also make essential purchases like new tires less affordable for individual car owners and commercial fleets alike.

The North American automotive market is poised for continued expansion. Global light vehicle sales are projected to see a modest increase in 2025, a trend that directly influences the demand for tires.

While new vehicle sales drive demand for original equipment (OE) tires, ATD's core business also benefits significantly from the replacement tire market. The increasing number of vehicles in operation, many of which are aging, coupled with rising vehicle miles traveled, ensures a consistent and robust demand for replacement tires.

Supply Chain Costs and Raw Material Prices

The automotive sector's supply chain is navigating significant headwinds in 2024 and 2025, primarily driven by escalating raw material costs. For instance, aluminum prices, a key component in vehicle manufacturing, saw a notable increase, trading around $2,500 per metric ton in early 2024, up from approximately $2,200 in early 2023. This upward trend directly impacts automakers like ATD, increasing their procurement expenses and potentially squeezing profit margins.

Ongoing disruptions, including geopolitical tensions and logistical bottlenecks, further exacerbate these cost pressures. These challenges can lead to extended lead times for critical components, forcing ATD to manage inventory more cautiously and potentially absorb higher shipping fees. The ability to maintain a diverse and readily available stock of vehicle brands becomes more complex and costly under these conditions.

- Rising Material Costs: Key commodities like steel, copper, and battery metals (lithium, cobalt) are experiencing price volatility, with some showing year-over-year increases exceeding 10% as of mid-2024.

- Logistical Hurdles: Freight rates, while having eased from pandemic peaks, remain elevated compared to pre-2020 levels, adding to the overall cost of bringing parts and finished vehicles to market.

- Inventory Management Strain: The unpredictability of supply chains forces ATD to balance the need for sufficient stock against the risk of holding costly, slow-moving inventory.

Market Competition and Pricing Strategies

The North American tire market, a significant sector valued at approximately $59.7 billion in 2024, is characterized by intense competition. ATD operates within this dynamic landscape, where numerous established brands and distributors vie for market share.

ATD's leadership as an independent distributor is directly impacted by its pricing strategies. The company must navigate the pricing pressures exerted by competitors and the increasing availability of value-tier tire brands entering the North American market, which present both opportunities and challenges for dealers.

Key competitive factors influencing ATD's market position include:

- Intense Rivalry: A large number of tire manufacturers and distributors operate in North America, leading to aggressive competition.

- Pricing Sensitivity: Dealers and end-consumers are often price-sensitive, making effective pricing strategies crucial for market penetration and retention.

- Emergence of Value Brands: The growing presence of new, lower-cost tire brands offers dealers more options but also intensifies price competition for ATD.

- Distribution Network Efficiency: ATD's ability to efficiently manage its distribution network and offer competitive pricing on a wide range of products is vital to maintaining its leading independent distributor status.

Economic factors significantly shape the automotive aftermarket. Persistent inflation and higher interest rates, evident in late 2024, continue to strain consumer budgets, prompting extended vehicle ownership and boosting demand for maintenance and replacement tires. For instance, the US Consumer Price Index for motor vehicle parts and equipment saw a notable increase in late 2023 and early 2024, impacting operational costs.

These economic conditions also increase supply chain expenses, from raw materials to distribution, potentially squeezing profit margins for companies like ATD. Higher interest rates further complicate financing for both consumers and businesses, potentially reducing demand for new vehicles and making essential purchases like tires less affordable.

The North American tire market, valued at approximately $59.7 billion in 2024, faces intense competition, with ATD navigating pricing pressures from rivals and the influx of value-tier brands. This dynamic requires ATD to maintain efficient distribution and competitive pricing across its product range.

Preview the Actual Deliverable

ATD PESTLE Analysis

The ATD PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis upon completing your purchase.

The content and structure shown in the preview is the same document you’ll download after payment, providing you with a complete and actionable PESTLE framework for ATD.

Sociological factors

Consumer preferences are a major driver in the automotive industry, and this directly influences tire demand. For instance, the continued popularity of SUVs and trucks means a steady need for the larger, more robust tires these vehicles require. In 2024, the market saw continued growth in these segments, with SUVs making up over 50% of new vehicle sales in many developed markets.

The surge in electric vehicle (EV) adoption presents a significant shift, demanding specialized tires. These EV tires are engineered for lower rolling resistance to maximize range and are built to withstand the instant torque and heavier weight of battery packs. By mid-2025, it's projected that EVs will represent over 20% of global new car sales, highlighting the critical need for ATD to stock and promote these specialized tire options.

Consumers are holding onto their vehicles longer than ever before. In 2023, the average age of vehicles on U.S. roads reached a record high of 12.5 years, a significant increase from previous years. This trend is largely driven by elevated new and used car prices, making vehicle ownership more expensive.

This aging vehicle parc directly translates into a greater need for maintenance and repair services. As cars get older, they naturally require more frequent and complex servicing, including tire replacements. For instance, the U.S. automotive aftermarket industry was valued at over $400 billion in 2023, with a substantial portion attributed to maintenance and repair.

This demographic shift presents a substantial opportunity for companies like ATD and its independent retailer network. The increased demand for aftermarket repairs, especially for tires, directly benefits businesses positioned to serve this growing segment of older vehicles.

The shift towards online purchasing is profoundly impacting the tire industry, with e-commerce sales for automotive parts and accessories projected to reach $27.5 billion in the US by 2027. This trend means independent tire retailers must adapt by integrating robust digital strategies, from online appointment booking to virtual consultations, to capture market share.

ATD's role in supporting these retailers involves equipping them with the digital tools necessary to thrive in this evolving landscape. This includes offering solutions that enhance their online presence and streamline the customer journey, ensuring they can effectively compete with larger online players and meet the growing demand for convenient, digital-first service experiences.

Awareness of Environmental Impact and Sustainability

Consumer demand for sustainable products is a significant sociological driver. In 2024, a significant percentage of consumers, often cited as over 60%, actively seek out brands with strong environmental credentials when making purchasing decisions, including for automotive products like tires.

ATD can leverage this trend by highlighting tires manufactured using recycled materials or those produced by companies with demonstrable commitments to reducing their carbon footprint. For instance, Michelin has set ambitious goals to use 100% sustainable materials by 2050 and has already introduced tires with higher percentages of recycled content.

- Growing Consumer Demand: Over 60% of consumers prioritize eco-friendly brands in 2024.

- Sustainable Materials Appeal: Tires made from recycled rubber or bio-based compounds resonate with environmentally aware buyers.

- Manufacturer Commitments: Brands demonstrating reduced emissions and sustainable production processes gain favor.

- Market Opportunity: ATD can tap into this segment by offering or promoting eco-conscious tire options.

Changing Attitudes Towards Vehicle Ownership

Shifting perspectives on personal vehicle ownership are becoming a notable sociological factor. While many still value the freedom of owning a car, a growing segment of the population, particularly younger demographics in urban areas, are exploring alternative mobility solutions. This includes a greater reliance on ride-sharing services and a keen interest in the future potential of autonomous vehicles.

These evolving attitudes directly influence long-term demand for tires. As more individuals opt for shared or self-driving transportation, the need for individually owned tires could see a gradual decline. For example, a 2024 study indicated that over 30% of urban dwellers aged 18-35 in major metropolitan areas consider ride-sharing a primary mode of transport, a figure expected to rise.

ATD must remain attuned to these societal shifts. Adapting business strategies to support retailers in navigating this changing mobility landscape is crucial. This might involve offering solutions that cater to fleet management for ride-sharing companies or exploring partnerships within the burgeoning autonomous vehicle sector.

- Growing adoption of ride-sharing: In 2024, ride-sharing services saw a 15% increase in active users compared to the previous year, particularly in cities with robust public transportation.

- Interest in autonomous vehicles: Surveys from early 2025 suggest that over 60% of consumers are curious about autonomous vehicle technology, with a significant portion open to using them for daily commutes.

- Urban mobility trends: The average number of privately owned vehicles per household in major urban centers has plateaued, contrasting with continued growth in suburban areas.

- Generational differences: Millennials and Gen Z are more likely to prioritize access to mobility over ownership compared to older generations, impacting future vehicle purchase decisions.

Sociological factors significantly shape the automotive aftermarket, influencing consumer behavior and demand for tires. Trends like the growing preference for SUVs and the increasing age of vehicles on the road directly translate into sustained demand for tire replacements and services. Furthermore, evolving consumer values, such as the prioritization of sustainability and changing attitudes towards personal vehicle ownership, are creating new market dynamics that businesses like ATD must address.

Technological factors

Innovations in tire materials are significantly impacting the automotive distribution sector. For instance, the push for eco-friendly and bio-based materials in tire manufacturing, like those derived from guayule rubber, is gaining momentum. This shift influences the product lines that distributors such as ATD can offer, aligning with growing consumer and regulatory demand for sustainable options.

Manufacturers are increasingly investing in recyclable tire materials, aiming to reduce reliance on petrochemicals. This trend is critical as it directly affects the supply chain and the types of tires available for distribution. For example, companies are exploring advanced recycling techniques to create higher-value materials from end-of-life tires, potentially lowering costs and environmental impact for distributors.

The burgeoning electric vehicle (EV) market is a powerful catalyst for innovation in tire manufacturing. Specialized EV tires are crucial, engineered to handle the instant torque of electric powertrains, minimize rolling resistance for extended battery range, and contribute to overall vehicle efficiency. For instance, by 2025, it's projected that EV sales will continue their upward trajectory, making it imperative for companies like ATD to offer these technologically advanced tire solutions.

North America stands as a key battleground for EV adoption and, consequently, for EV tire demand. As of early 2024, EV market share continues to grow significantly across Canada and the United States. ATD's strategic product development must align with this trend, ensuring a robust offering of EV-specific tires to capture a substantial portion of this expanding market segment.

The automotive industry is seeing a significant technological shift with the emergence of smart tire technology. These tires are equipped with advanced sensors that can continuously monitor crucial metrics like tire pressure, temperature, tread wear, and even road surface conditions in real-time. This data provides invaluable insights for vehicle performance and safety.

This real-time monitoring capability allows for predictive maintenance, alerting drivers or fleet managers to potential issues before they become critical. For instance, by tracking wear patterns, smart tires can optimize tire rotation schedules, extending their lifespan and reducing replacement costs. This proactive approach is projected to significantly improve vehicle uptime and reduce operational expenses for fleet operators.

The integration of smart tire technology with connected and autonomous vehicles (CAVs) presents a substantial opportunity. As vehicles become more sophisticated and reliant on sensor data, smart tires will play a pivotal role in providing accurate, real-time information to onboard systems. This synergy can enhance safety features, improve fuel efficiency through optimized tire performance, and unlock new service models for companies like ATD.

Digitalization of Supply Chain and Logistics

The digitalization of supply chain and logistics is profoundly impacting the automotive tire distribution sector. Automation and AI are not just buzzwords; they are actively streamlining tire production and enhancing efficiency across the entire supply chain. For a major player like ATD, this means significant opportunities to optimize its extensive distribution network.

Leveraging advanced robotics and AI-powered analytics can lead to substantial improvements in ATD's operations. This includes optimizing inventory management, reducing the likelihood of stockouts or overstocking, and minimizing waste throughout the distribution process. Furthermore, enhanced delivery efficiency is a direct benefit, leading to faster fulfillment and improved customer satisfaction.

Consider the impact on operational costs: A 2024 report indicated that companies implementing AI in their supply chains saw an average reduction in operational costs by up to 15%. For ATD, this translates to significant savings across its distribution centers and transportation fleet. The ability to predict demand more accurately through AI analytics also plays a crucial role in this cost optimization.

- AI-driven demand forecasting: ATD can leverage AI to predict tire demand with greater accuracy, reducing overstocking and associated carrying costs.

- Robotic process automation (RPA): Implementing RPA in warehouse operations, such as order processing and inventory tracking, can significantly boost efficiency and reduce human error.

- Real-time tracking and visibility: Digital platforms provide end-to-end visibility of the supply chain, allowing ATD to monitor inventory levels and shipment progress in real-time, improving responsiveness.

- Optimized logistics routes: AI algorithms can analyze traffic patterns, weather conditions, and delivery schedules to optimize routing for ATD's delivery fleet, reducing fuel consumption and delivery times.

E-commerce Platforms and Digital Tools for Retailers

The automotive aftermarket is increasingly leveraging e-commerce platforms and digital tools, particularly for predictive maintenance in tires. For instance, data analytics adoption is on the rise, with companies reporting significant improvements in operational efficiency and customer satisfaction through these technologies. ATD, as a business solutions provider, can empower its independent retailers by furnishing them with sophisticated digital platforms. These tools are crucial for deepening customer relationships, streamlining inventory management, and refining sales approaches.

These digital solutions enable retailers to offer more personalized customer experiences, a key differentiator in today's market. For example, advanced CRM systems integrated with e-commerce platforms can track customer purchase history and preferences, allowing for targeted marketing campaigns and service reminders. This data-driven approach not only boosts sales but also fosters loyalty.

Furthermore, the adoption of digital inventory management systems can lead to substantial cost savings. Retailers can reduce overstocking and stockouts by gaining real-time visibility into their inventory levels across multiple locations. This optimization is vital for maintaining healthy profit margins.

- Data Analytics Adoption: Studies indicate that businesses utilizing advanced data analytics see an average revenue increase of 5-10% and a reduction in operational costs by up to 15%.

- E-commerce Growth: The global e-commerce market for automotive parts and accessories is projected to reach $150 billion by 2027, highlighting the critical importance of online presence.

- Customer Engagement Tools: Digital platforms offering loyalty programs and personalized communication can improve customer retention rates by as much as 25%.

- Inventory Optimization: Implementing digital inventory management can decrease carrying costs by 10-20% and improve order fulfillment accuracy.

Technological advancements are reshaping the tire industry, from materials science to digital integration. The rise of electric vehicles (EVs) necessitates specialized tires designed for instant torque and extended range, a trend expected to accelerate through 2025. Smart tire technology, incorporating sensors for real-time monitoring of pressure, temperature, and wear, is enhancing vehicle safety and enabling predictive maintenance. This data integration with connected and autonomous vehicles offers significant potential for improved performance and new service models.

Legal factors

Strict product liability laws mean tire manufacturers like ATD face significant legal exposure if their products cause harm. Evolving safety standards, such as those for tire durability and performance in various conditions, are paramount. For instance, the National Highway Traffic Safety Administration's (NHTSA) push for automatic emergency braking (AEB) systems, mandated for new vehicles by September 2029, could indirectly lead to updated tire performance requirements to ensure optimal integration and effectiveness of these advanced safety features.

Environmental Protection Agency (EPA) regulations and state-level mandates are increasingly stringent on tire recycling and disposal, making compliance a critical operational factor for tire businesses in 2025. These regulations aim to reduce landfill waste and promote sustainable practices, impacting how companies like ATD manage end-of-life tires. Failure to adhere can result in significant fines, with some states imposing penalties that can reach thousands of dollars per violation.

ATD and its partners must prioritize proper storage, processing, and disposal of scrap tires to ensure legal compliance and support broader sustainability goals. For example, many states now require specific permits for tire storage facilities and mandate the use of certified recyclers. In 2024, the tire recycling industry processed an estimated 280 million tires in the US, highlighting the scale of the challenge and the importance of robust compliance frameworks.

Antitrust laws are crucial for maintaining a level playing field in the tire distribution market, ensuring that companies like ATD operate fairly and don't engage in monopolistic practices. These regulations are especially important as ATD navigates its new ownership structure following an asset sale in March 2025, a move intended to bolster its market position and partnership capabilities.

Adherence to these competition laws is paramount for ATD, particularly as it operates as a major independent distributor. The transition in March 2025, which saw a significant change in ownership, underscores the need for ATD to demonstrate robust compliance with antitrust frameworks to maintain trust and operational integrity within the industry.

Data Privacy Laws

With the growing reliance on digital platforms for business operations and customer interactions, data privacy laws are becoming increasingly critical. ATD, by offering business solutions that handle sensitive customer and transaction data, must navigate a complex web of regulations designed to protect personal information. Failure to comply can lead to significant penalties and reputational damage.

The landscape of data privacy is constantly shifting. For instance, in 2024, many jurisdictions are strengthening enforcement of existing laws like GDPR and CCPA, while also introducing new regulations focused on areas such as AI-generated data and cross-border data transfers. ATD's commitment to robust data protection practices is therefore not just a legal obligation but a strategic imperative to maintain customer trust and operational integrity.

- GDPR Fines: In 2023, the total fines issued under the General Data Protection Regulation (GDPR) exceeded €1.5 billion, highlighting the significant financial risks of non-compliance.

- Consumer Trust: A 2024 survey indicated that over 70% of consumers are more likely to do business with companies that demonstrate strong data privacy practices.

- Evolving Regulations: The number of new data privacy laws enacted globally has seen a steady increase year-over-year, with an estimated 30% rise in significant legislative changes between 2023 and early 2025.

Import/Export Regulations and Trade Compliance

Beyond tariffs, general import and export regulations are critical for ATD's North American distribution. For instance, in 2024, the U.S. Customs and Border Protection continued to enforce stringent rules on product origin and documentation, impacting ATD’s ability to move goods efficiently across the Canadian and Mexican borders. Compliance failures can lead to significant delays and penalties.

Trade policy shifts, particularly those affecting cross-border e-commerce and the automotive supply chain, demand proactive strategies. Uncertainty in these areas, as seen with ongoing discussions around regional trade agreements in late 2024, requires ATD to maintain agile compliance frameworks to mitigate potential cost increases and operational disruptions. This includes staying abreast of evolving customs procedures and product standards.

Key compliance considerations for ATD include:

- Accurate Harmonized System (HS) Codes: Ensuring correct classification for all imported and exported goods to avoid duty discrepancies.

- Country of Origin Marking: Adhering to specific labeling requirements for products entering the U.S., Canada, and Mexico.

- Regulatory Certifications: Obtaining necessary certifications for automotive parts and accessories, such as those mandated by NHTSA in the U.S.

- Import/Export Licenses: Securing any required licenses or permits for specific product categories or trade routes.

Legal compliance remains a cornerstone for ATD's operations, encompassing product liability, environmental regulations, antitrust laws, and data privacy. Strict adherence to evolving safety standards, like those influenced by NHTSA's push for advanced vehicle safety features, is critical for tire manufacturers. Furthermore, navigating stringent EPA regulations on tire disposal and recycling, which saw approximately 280 million tires processed in the US in 2024, is essential to avoid substantial fines.

Antitrust laws are vital for ATD, particularly after its asset sale in March 2025, to ensure fair market practices and maintain trust as a major independent distributor. Data privacy laws are also increasingly significant, with global GDPR fines exceeding €1.5 billion in 2023, underscoring the financial risks of non-compliance and the growing consumer demand for data protection, with over 70% of consumers in a 2024 survey favoring companies with strong privacy practices.

Import and export regulations, including accurate HS codes and country of origin marking, are crucial for ATD's North American distribution. Trade policy shifts and evolving customs procedures, as discussed in late 2024 regarding regional trade agreements, require agile compliance frameworks to mitigate potential disruptions and cost increases.

Environmental factors

Environmental regulations surrounding tire disposal and recycling are tightening. By 2025, the U.S. Environmental Protection Agency (EPA) and various state-level bodies are implementing stricter mandates for tire recycling. These rules are designed to curb illegal dumping, reduce the risk of tire fires which can release toxic pollutants, and prevent environmental contamination from leachate.

This means companies like ATD and their supply chain partners must adhere to more rigorous end-of-life tire management practices. The U.S. generates over 300 million scrap tires annually, and ensuring their responsible handling is a significant challenge and a growing compliance cost.

Consumers are increasingly seeking tires made from recycled and bio-based materials, a trend that surged in 2024 and is projected to continue growing. This heightened environmental awareness is pushing manufacturers, including those in the automotive sector that ATD serves, to innovate with sustainable sourcing. For instance, by 2025, several major tire companies are expected to launch new product lines featuring a significant percentage of recycled rubber and plant-derived compounds, responding to consumer demand for a reduced carbon footprint.

The carbon footprint from tire manufacturing and ATD's vast distribution network is a critical environmental concern. In 2024, the automotive industry, including tire production, contributed significantly to global greenhouse gas emissions, with estimates suggesting manufacturing processes alone can account for a substantial portion of a vehicle's lifecycle impact. ATD's commitment to reducing these emissions through optimized logistics and the adoption of greener production technologies is vital for meeting evolving environmental standards and consumer expectations.

ATD's strategic focus on incorporating rubber-modified asphalt in infrastructure projects offers a dual benefit: it helps manage end-of-life tires and simultaneously lowers the carbon intensity of road construction. Studies indicate that using recycled rubber in asphalt can reduce the energy required for production by up to 10% and extend pavement life, thereby decreasing the need for frequent replacements and associated emissions. This aligns ATD with broader climate goals and promotes a circular economy approach.

Impact of Climate Change on Driving Conditions

Climate change is increasingly altering driving conditions, leading to more frequent and intense extreme weather events. This shift directly impacts tire demand, pushing consumers towards all-weather or specialized tires capable of handling diverse and challenging environments, such as heavy snow, intense rain, or extreme heat. For instance, the increasing frequency of severe winter storms in regions previously unaccustomed to them, as observed in parts of North America and Europe during late 2024 and early 2025, highlights this trend.

This evolving landscape necessitates that tire manufacturers and retailers, like ATD, adapt their product focus and inventory management. The growing need for tires that offer reliable performance across a wider spectrum of conditions can significantly influence sales volumes and profit margins. According to industry reports from late 2024, the global market for all-season tires saw a notable uptick in demand, projected to continue its growth trajectory through 2025.

- Increased Demand for All-Weather Tires: Consumer preference is shifting towards tires designed for year-round performance, driven by unpredictable weather patterns.

- Product Innovation Focus: Tire companies are investing more in research and development for advanced tread compounds and designs that enhance grip and durability in varied conditions.

- Supply Chain Adjustments: Retailers like ATD may need to adjust their stock levels to accommodate higher demand for specialized tires, potentially impacting warehousing and logistics strategies.

Resource Scarcity for Raw Materials

The tire industry's dependence on natural rubber and petroleum derivatives means resource scarcity is a significant environmental concern. For instance, natural rubber prices saw considerable volatility in early 2024, influenced by weather patterns in key producing regions like Southeast Asia, with some benchmarks trading over $1,800 per metric ton at various points.

Geopolitical tensions and ongoing supply chain disruptions, which were particularly acute in 2022-2023 and continue to pose risks, can further tighten the availability of these crucial raw materials. This scarcity directly translates to increased production costs for tire manufacturers, potentially impacting pricing and consumer access to new tires.

The drive towards sustainability is pushing tire companies to explore and implement alternative materials, such as bio-based polymers and recycled rubber. For example, Michelin has been investing in advanced recycling technologies, aiming to increase the use of recycled materials in its tires significantly by 2030.

- Natural rubber prices experienced fluctuations in early 2024, with some periods seeing them exceed $1,800 per metric ton.

- Petroleum-based components, essential for tire manufacturing, are subject to price volatility driven by global energy markets and geopolitical events.

- Supply chain vulnerabilities, highlighted by events in 2022-2023, can amplify the impact of resource scarcity on tire production.

- Industry leaders are actively pursuing sustainable alternatives, with targets to increase recycled content in tires by the end of the decade.

Environmental regulations are becoming more stringent, impacting tire disposal and recycling. The U.S. EPA and state agencies are enforcing stricter rules by 2025 to combat illegal dumping and pollution, affecting over 300 million scrap tires generated annually in the U.S.

Consumer demand for sustainable tires, using recycled and bio-based materials, surged in 2024 and is expected to grow. This trend is pushing manufacturers to innovate with greener sourcing, with new product lines featuring recycled rubber anticipated by 2025.

Climate change is influencing tire demand, with a notable increase in consumer preference for all-weather tires due to unpredictable weather patterns. This shift was evident in late 2024 and early 2025, driving demand for tires that perform reliably in diverse conditions.

| Environmental Factor | Impact on ATD | Key Data/Trends (2024-2025) |

| Stricter Recycling Mandates | Increased compliance costs, need for improved end-of-life management | 300+ million scrap tires annually in the U.S.; EPA/state regulations tightening by 2025 |

| Consumer Demand for Sustainability | Opportunity for product innovation, potential market share gains | Growing demand for recycled/bio-based tires; new product lines expected by 2025 |

| Climate Change & Extreme Weather | Shift in product demand towards all-weather/specialty tires | Increased demand for all-season tires observed in late 2024; growth projected through 2025 |

| Resource Scarcity (Natural Rubber, Petroleum) | Price volatility, potential supply chain disruptions, increased production costs | Natural rubber prices fluctuated, exceeding $1,800/metric ton in early 2024; petroleum derivatives subject to market volatility |

PESTLE Analysis Data Sources

Our ATD PESTLE Analysis draws from a comprehensive blend of public government data, reputable industry-specific reports, and leading economic indicators. This ensures each factor, from technological advancements to socio-cultural shifts, is grounded in verifiable, current information.