Asustek Computer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asustek Computer Bundle

Asustek Computer operates within a dynamic global market, influenced by evolving political landscapes, economic fluctuations, and rapid technological advancements. Understanding these external forces is crucial for strategic planning and sustained growth. Our comprehensive PESTLE analysis delves deep into these factors, providing actionable intelligence. Unlock the full picture and gain a competitive edge – download our expert-crafted Asustek Computer PESTLE analysis today!

Political factors

ASUS, as a Taiwanese tech giant with a global footprint, faces significant risks from escalating geopolitical tensions, especially concerning US-China relations. For instance, the ongoing trade disputes and potential for technology export controls directly impact ASUS's ability to source components and sell products in key markets.

The company's reliance on global manufacturing and sales means that tariffs, like those imposed during the US-China trade war, can directly increase costs and reduce competitiveness. In 2023, the semiconductor industry, a core area for ASUS, continued to be a focal point of these geopolitical strategies, with countries implementing measures to secure domestic supply chains.

Navigating cross-strait issues between Taiwan and mainland China also presents unique challenges. ASUS must maintain a delicate balance to ensure operational continuity and market access in both regions, requiring flexible strategies to mitigate potential disruptions to its extensive supply network.

Taiwan's government actively supports its burgeoning tech industry through various initiatives, directly benefiting companies like ASUS. These include substantial R&D tax credits and direct subsidies for advanced manufacturing, aiming to bolster domestic technological prowess. For instance, the Ministry of Economic Affairs' continued investment in semiconductor research and development, coupled with robust intellectual property protection frameworks, creates a fertile ground for innovation and global competitiveness.

ASUS navigates a complex web of international trade agreements and regional regulations, significantly influencing its global operations. Adherence to frameworks like the EU's single market regulations and North American trade pacts is paramount for market access and smooth supply chain management. For instance, in 2024, the EU continued to emphasize digital sovereignty and data protection, requiring ASUS to ensure its products and services comply with GDPR and upcoming AI regulations, potentially impacting product development cycles and data handling practices.

Compliance with diverse product standards, import/export duties, and intellectual property laws across its key markets, including Asia, Europe, and the Americas, is critical for ASUS. For example, in 2025, ongoing discussions around tariffs and trade barriers between major economic blocs could introduce new costs or operational complexities for ASUS's hardware manufacturing and distribution. The company's ability to adapt to evolving intellectual property protections, particularly concerning advanced technologies like AI-powered devices, will be key to maintaining its competitive edge.

Supply Chain Resiliency Initiatives

Governments globally are prioritizing supply chain resilience, particularly for electronics. For example, the US CHIPS and Science Act, enacted in 2022, aims to boost domestic semiconductor manufacturing, potentially impacting ASUS's sourcing strategies and manufacturing locations. This push for localization could encourage ASUS to explore diversifying its production facilities beyond current key hubs to mitigate risks tied to geopolitical tensions or unforeseen disruptions.

While diversifying manufacturing might initially involve higher operational costs, it offers a strategic advantage by reducing long-term vulnerabilities. This approach can shield ASUS from the financial impacts of trade disputes, natural calamities, or other geopolitical instabilities that could disrupt its existing, more concentrated supply networks. The global electronics manufacturing landscape saw significant shifts in 2024, with increased investment in Southeast Asia and India as companies sought to de-risk from over-reliance on single regions.

- Government Incentives: Many nations are offering tax breaks and subsidies for establishing manufacturing in their territories, as seen with initiatives like the EU's Chips Act.

- Diversification Strategy: ASUS may need to invest in new factories or partner with local manufacturers in regions like Vietnam or India to meet these evolving geopolitical demands.

- Risk Mitigation: Building a more distributed manufacturing footprint can safeguard ASUS against disruptions, ensuring business continuity and potentially stabilizing component costs in the face of global uncertainty.

Cybersecurity and Data Sovereignty Policies

Increasingly stringent cybersecurity and data sovereignty policies in major markets, including the EU's GDPR and similar regional legislation, directly impact ASUS's product development and data management strategies. Compliance with these evolving regulations, which often mandate localized data storage and enhanced security protocols, is essential for ASUS to operate and maintain trust in these critical regions.

These governmental actions necessitate significant investment in robust data protection measures and transparent data handling practices. For instance, ASUS must ensure its cloud services and software designs adhere to varying national standards, potentially impacting the global rollout and functionality of its offerings. Failure to comply can result in substantial fines and reputational damage, as seen with other tech companies facing penalties under GDPR.

- GDPR Fines: Companies have faced fines totaling hundreds of millions of Euros for non-compliance with data protection regulations since its implementation in 2018.

- Data Localization Requirements: Several countries are enacting laws requiring user data to be stored within their borders, increasing operational complexity and costs for global tech firms.

- Cybersecurity Investments: The global cybersecurity market is projected to reach over $300 billion by 2025, reflecting the significant resources companies are dedicating to compliance and security.

Geopolitical tensions, particularly between the US and China, significantly influence ASUS's global operations, affecting component sourcing and market access. Trade disputes and potential export controls create cost increases and competitive pressures, as seen with tariffs impacting the semiconductor sector in 2023.

Taiwan's government actively supports its tech industry through R&D tax credits and subsidies, fostering innovation. However, ASUS must also navigate complex cross-strait relations, balancing operations and market access in both Taiwan and mainland China to maintain its supply network.

ASUS must comply with diverse international trade agreements and regulations, such as the EU's digital sovereignty and data protection laws, impacting product development and data handling. Evolving intellectual property laws and potential tariffs in 2025 will also shape its competitive strategy.

Governments worldwide are prioritizing supply chain resilience, prompting initiatives like the US CHIPS Act. This encourages companies like ASUS to diversify manufacturing locations, potentially to regions like Vietnam or India, to mitigate risks associated with geopolitical instability and ensure business continuity.

What is included in the product

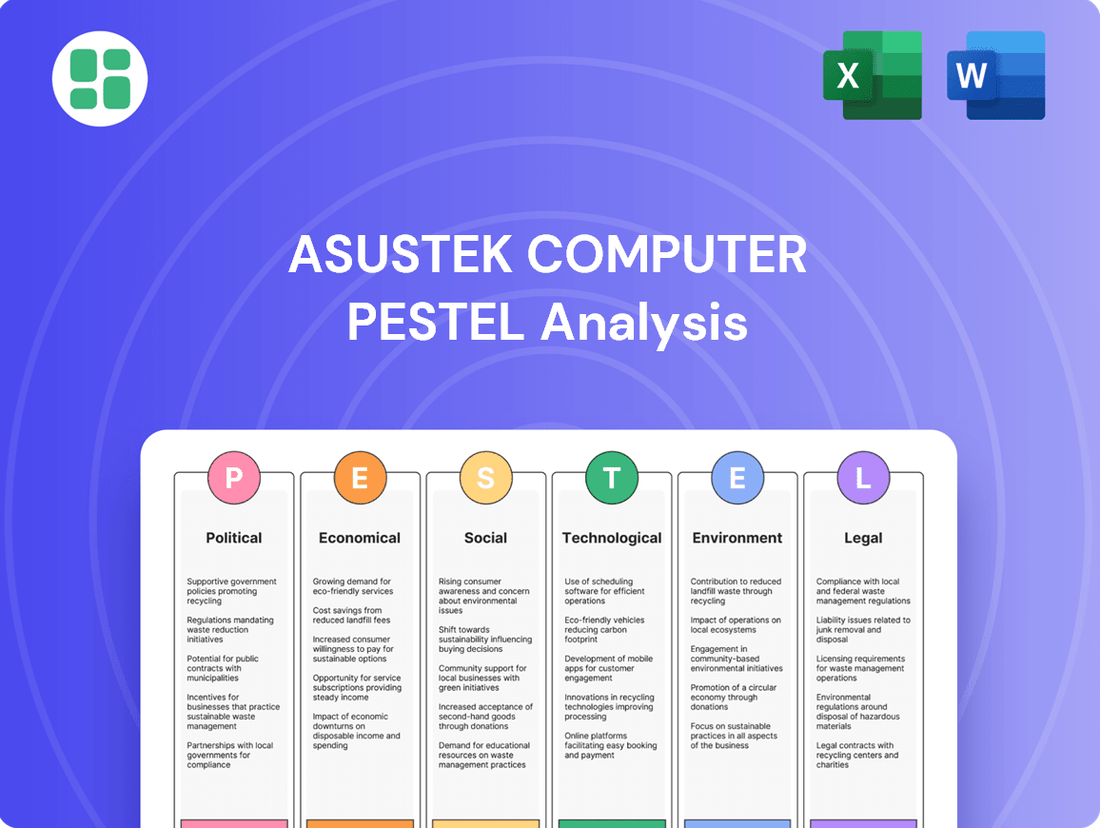

This PESTLE analysis of Asustek Computer examines the influence of political, economic, social, technological, environmental, and legal factors on its global operations and strategic planning.

A concise, easily digestible Asustek PESTLE analysis that cuts through complexity, enabling rapid understanding of external factors impacting the business.

This PESTLE analysis acts as a pain point reliever by providing a clear, actionable framework for identifying and mitigating external risks, thereby streamlining strategic decision-making for Asustek.

Economic factors

ASUS's performance is closely tied to the global economic climate and how much consumers are willing and able to spend on electronics. The consumer electronics market is anticipated to reach $1.46 trillion by 2025, with smart-home, gaming, and health-tech devices fueling this expansion.

Overall consumer spending on tech goods is projected to reach $1.29 trillion in 2025, marking a modest 2% rise from 2024. However, the electronics sector's growth isn't uniform, and ASUS must stay agile, adjusting its product lineup to match changing consumer tastes and their spending capacity.

Inflationary pressures in 2024 and early 2025 continue to impact Asustek's operational costs. Rising prices for raw materials like aluminum and plastics, coupled with increased energy expenses, directly affect manufacturing and logistics. For instance, global inflation rates, hovering around 3-5% in many key markets during 2024, translate to higher input costs for ASUS.

As a significant purchaser of semiconductor components, Asustek is particularly sensitive to fluctuations in chip prices. The ongoing demand for advanced processors and GPUs, alongside supply chain constraints that persisted into early 2025, kept component costs elevated. This directly squeezes profit margins, especially for their high-volume consumer electronics and gaming segments.

Managing these escalating input costs is a critical challenge for Asustek. The company must navigate efficient procurement strategies and consider strategic price adjustments for its laptops, motherboards, and graphics cards to maintain profitability in a volatile economic landscape, a balancing act that became even more pronounced in the 2024-2025 period.

ASUS operates globally, making it susceptible to currency exchange rate fluctuations. For instance, a stronger US Dollar against the New Taiwan Dollar (TWD) can increase the cost of components imported from the US, impacting ASUS's cost of goods sold. Conversely, a weaker USD might make ASUS products more competitive in dollar-denominated markets.

In 2024, the TWD experienced volatility against major currencies. For example, the TWD saw fluctuations against the USD, trading in a range that could significantly affect ASUS's reported earnings when converting international sales back to TWD. This dynamic directly influences their profit margins on products sold in different regions.

The impact of these shifts is substantial. If ASUS generates a large portion of its revenue in Euros or US Dollars, and these currencies weaken against the TWD, the translated revenue will be lower. This necessitates robust financial risk management, including the use of hedging instruments, to stabilize profitability and protect against adverse currency movements.

Market Competition and Pricing Pressures

The personal computer and broader electronics sectors are intensely competitive, with a crowded field of manufacturers constantly vying for consumer attention and market share. This fierce rivalry frequently translates into significant pricing pressures, particularly within established product categories such as traditional desktop and laptop computers.

ASUS, like its competitors, faces the challenge of navigating these market dynamics. To sustain its market position and command premium pricing, especially in rapidly expanding segments like AI-powered personal computers and high-performance gaming laptops, the company must prioritize continuous innovation and product differentiation. For instance, in the first half of 2024, the global PC market shipments saw a modest increase of 3% year-over-year, according to IDC, highlighting the ongoing demand but also the competitive landscape where differentiation is key.

- Intense Competition: The global PC market features numerous established brands and emerging players, leading to aggressive market share battles.

- Pricing Pressures: Mature segments of the PC market, like standard laptops, often experience downward price trends due to oversupply and competition.

- ASUS's Strategy: ASUS focuses on innovation in high-growth areas such as AI PCs and gaming to justify premium pricing and maintain a competitive edge.

- Market Data: Global PC shipments in Q1 2024 reached 57.2 million units, a 1.5% increase year-over-year, indicating a stabilization but still a highly competitive environment for vendors like ASUS.

E-commerce Growth and Distribution Channels

The consumer electronics market is increasingly moving online, with e-commerce sales expected to hit 38.1% by 2025. This trend directly influences ASUS's distribution approach, pushing for stronger online capabilities.

This digital shift presents opportunities for ASUS to expand its reach through direct-to-consumer sales and optimize its online marketing efforts. However, it also demands significant investment in e-commerce infrastructure and efficient supply chain management to effectively compete for online consumer spending.

ASUS needs to strategically manage its existing relationships with traditional retailers while simultaneously building and enhancing its direct digital channels to cater to evolving consumer purchasing habits.

- E-commerce Penetration: Consumer electronics e-commerce sales projected to reach 38.1% in 2025.

- Direct Sales Opportunity: Increased online presence allows for direct customer engagement and potentially higher margins.

- Logistical Demands: Efficient warehousing, shipping, and returns processing are critical for online success.

- Channel Strategy: Balancing traditional retail partnerships with a robust direct-to-consumer digital strategy is key.

Global economic conditions significantly impact ASUS's sales, as consumer spending on electronics is closely linked to disposable income. The personal computer market, a core segment for ASUS, saw a modest 1.5% year-over-year increase in shipments in Q1 2024, reaching 57.2 million units, indicating a competitive but stabilizing demand. This environment necessitates strategic pricing and product innovation to capture market share, particularly in high-growth areas like AI PCs and gaming, where differentiation is key to commanding premium pricing.

| Economic Factor | 2024/2025 Data/Trend | Impact on ASUS |

|---|---|---|

| Global Consumer Spending | Projected to reach $1.29 trillion in 2025 (2% rise from 2024) | Influences demand for ASUS products; requires agile product strategy. |

| Inflation | Hovering around 3-5% in key markets (2024) | Increases raw material and energy costs, squeezing profit margins. |

| Semiconductor Prices | Elevated due to demand and supply chain constraints (early 2025) | Directly impacts ASUS's cost of goods sold, especially for high-performance components. |

| Currency Exchange Rates | Volatility of TWD against USD and EUR in 2024 | Affects reported earnings and product competitiveness in international markets. |

Preview the Actual Deliverable

Asustek Computer PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Asustek Computer delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

The content and structure shown in the preview is the same document you’ll download after payment. You will gain a deep understanding of the external forces shaping Asustek's business landscape, enabling informed decision-making.

What you’re previewing here is the actual file—fully formatted and professionally structured. This detailed report provides actionable insights into the opportunities and threats Asustek Computer faces in the global market.

Sociological factors

The global shift towards hybrid work and remote learning continues to fuel demand for personal computing devices. In 2024, the PC market saw a stabilization after a pandemic-driven surge, with shipments projected to reach around 250 million units, according to IDC. This sustained need for reliable laptops and monitors directly benefits ASUS, as consumers and businesses invest in technology that supports these evolving work and study habits.

Increased digital entertainment consumption also plays a significant role. With more people spending time at home, the demand for high-quality displays and powerful computing for gaming and streaming remains strong. ASUS's gaming brand, ROG, is well-positioned to capitalize on this trend, as the global gaming market is expected to surpass $200 billion in 2024, according to Newzoo.

Furthermore, the integration of artificial intelligence into personal computing is creating new opportunities. AI-powered features in laptops, such as enhanced performance optimization and intelligent task management, are shaping user experiences and driving demand for more sophisticated devices. ASUS's focus on innovation in AI integration will be crucial for meeting these emerging consumer expectations.

The global esports market is projected to reach $2.75 billion by 2025, a significant increase from $1.38 billion in 2022, directly boosting demand for powerful gaming hardware. Content creation, particularly on platforms like Twitch and YouTube, has also surged, with over 10 million creators actively streaming in 2024. This sustained growth creates a robust market for high-performance laptops and specialized PCs, areas where ASUS, through its Republic of Gamers (ROG) brand, is a key player.

Consumer awareness regarding environmental impact is significantly shaping the electronics market, driving demand for sustainable products. ASUS has been actively addressing this by incorporating recycled materials in their devices and highlighting energy-efficient designs, such as their Zenbook and Vivobook lines which often feature ENERGY STAR certifications. This focus on sustainability not only appeals to environmentally conscious buyers but also aligns with global trends towards a circular economy, pushing the entire industry to adopt greener practices.

Digital Inclusion and Accessibility

The global drive for digital inclusion is expanding the market for computing devices, particularly in developing nations and educational institutions. ASUS's commitment to offering a varied product range, such as their education-focused Chromebooks, actively helps to narrow the digital gap. This focus on accessibility is crucial, as evidenced by the projected growth in the global education technology market, which was valued at over $120 billion in 2023 and is expected to continue its upward trajectory.

By tailoring products to different levels of digital literacy and affordability, ASUS can tap into previously underserved market segments. For instance, the increasing adoption of affordable laptops in emerging markets, which saw a significant year-over-year increase in shipments in late 2024, demonstrates the potential for companies that prioritize accessibility.

- Market Expansion: Digital inclusion initiatives are opening up new customer bases for computing hardware.

- ASUS Strategy: ASUS's diverse product portfolio, including budget-friendly options, aligns with this trend.

- Growth Potential: Adapting to varying economic capacities can unlock substantial market share in emerging economies.

Brand Reputation and Customer Loyalty

In the fiercely competitive tech landscape, ASUS's brand reputation is a cornerstone for cultivating customer loyalty. This reputation is meticulously built through consistent product quality, a drive for innovation, and exceptional customer service. For instance, ASUS's strong performance in the 2024 gaming laptop market, where it secured a significant market share, underscores its established brand trust.

ASUS's strategic focus on innovation, particularly in areas like AI-driven features in its Zenbook and ROG series, alongside its increasing commitment to sustainability, actively bolsters its brand image. These initiatives resonate with a growing segment of consumers who prioritize forward-thinking and environmentally conscious brands. Reports from early 2025 indicate a positive consumer perception shift towards brands demonstrating clear sustainability goals.

Ultimately, positive customer experiences, amplified by effective brand communication, are paramount for ASUS's long-term success. Fostering repeat purchases hinges on these elements, ensuring customers remain engaged and satisfied with the ASUS ecosystem. Customer satisfaction scores for ASUS products in late 2024 remained high, reflecting the effectiveness of their customer-centric approach.

- Brand Strength: ASUS consistently ranks among the top technology brands, with its Republic of Gamers (ROG) sub-brand holding particular sway with enthusiasts.

- Innovation Perception: Consumer surveys in early 2025 highlighted ASUS's perceived leadership in integrating AI into consumer electronics, particularly laptops.

- Customer Retention: Data from 2024 indicated a strong repeat purchase rate for ASUS laptop users, suggesting high customer loyalty driven by product reliability and brand experience.

- Sustainability Impact: ASUS's 2024 sustainability reports, detailing reduced carbon footprints in manufacturing, have positively influenced brand perception among environmentally conscious buyers.

Societal trends toward conscious consumerism and ethical purchasing are increasingly influencing electronics choices. ASUS's proactive stance on sustainability, evident in its 2024 initiatives to increase the use of recycled materials in its products and its focus on energy-efficient designs, directly addresses this growing consumer demand. This aligns with a broader societal shift where environmental impact is a key factor in purchasing decisions, potentially boosting brand loyalty and market share for companies demonstrating genuine commitment to eco-friendly practices.

Technological factors

Artificial Intelligence (AI) is a game-changer for ASUS, influencing everything from their AI PCs and servers to their IoT devices and robotics. They're embedding AI directly into their hardware, like laptops designed for robust NPU performance.

This strategic push into AI is anticipated to spark a major upgrade cycle in the PC sector. ASUS is positioning itself to lead this evolution, with AI-enabled devices expected to command premium pricing, reflecting their advanced capabilities.

Continuous advancements in CPU, GPU, and NPU technologies are absolutely critical for ASUS's product performance and its ability to stay competitive. For instance, the latest Intel Core Ultra processors, launched in late 2023 and early 2024, offer significant improvements in AI processing capabilities, directly impacting ASUS's AI-powered features in its laptops.

ASUS heavily relies on leading-edge chips from key partners like Intel and AMD to deliver the exceptional performance expected in its laptops and other computing systems. In 2024, AMD's Ryzen 8000 series processors, featuring integrated RDNA 3 graphics, are enabling more powerful and efficient mobile gaming experiences for ASUS users.

These technological innovations allow ASUS to push boundaries, particularly in demanding sectors like gaming, content creation, and AI-driven applications. The introduction of NVIDIA's RTX 40 series GPUs continues to enhance visual fidelity and processing power in ASUS's Republic of Gamers (ROG) line, with sales in the gaming segment remaining robust.

ASUS's strategic push into the Internet of Things (IoT) and cloud computing solutions marks a pivotal technological expansion. By developing interconnected devices and scalable cloud infrastructure, ASUS is effectively broadening its market reach beyond traditional consumer electronics to serve both individual users and enterprise clients.

This diversification capitalizes on ASUS's established hardware prowess, enabling the creation of integrated ecosystems and intelligent solutions. For instance, the company's focus on edge computing for IoT devices, coupled with its cloud platform offerings, positions it to capture a growing share of the smart home and industrial automation markets. In 2024, the global IoT market was valued at approximately $1.1 trillion, with projections indicating continued robust growth, presenting a substantial opportunity for ASUS to leverage its hardware and software integration capabilities.

Research and Development (R&D) Investment

ASUS's commitment to Research and Development (R&D) is a cornerstone of its strategy to stay ahead in the fast-paced technology market. This sustained investment fuels the creation of new product lines, the refinement of existing technologies, and exploration into future growth areas such as AI and advanced robotics.

In 2023, ASUS demonstrated its dedication to innovation by allocating a significant portion of its resources to R&D. For instance, the company's focus on next-generation display technologies and more efficient cooling systems for its gaming laptops, like the ROG series, directly stems from these R&D efforts. This proactive approach allows ASUS to consistently introduce cutting-edge features, solidifying its leadership across various digital lifestyle and business segments.

- Innovation Pipeline: ASUS consistently invests in R&D to develop groundbreaking products and enhance existing offerings, ensuring a competitive edge.

- Emerging Technologies: The company actively explores and invests in future-oriented fields like AI-powered features and robotics.

- Market Leadership: High R&D spending enables ASUS to introduce advanced technologies, maintaining its strong position in consumer electronics and business solutions.

Cybersecurity Technology Evolution

As digital threats become more sophisticated, cybersecurity technology must advance in tandem. ASUS is committed to continuous investment in cutting-edge security features for both its hardware and cloud services. This proactive approach is essential for safeguarding user data and maintaining the integrity of its systems, especially as global data protection regulations tighten.

The evolving threat landscape necessitates robust security measures. For instance, the number of data breaches globally continued to rise, with the average cost of a data breach reaching $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. This underscores the critical need for companies like ASUS to integrate advanced cybersecurity into their product development and service offerings.

- Hardware-level security: Implementing features like TPM (Trusted Platform Module) and secure boot processes to protect against firmware-level attacks.

- Software-level security: Regularly updating operating systems, firmware, and applications with the latest security patches and developing proprietary security solutions.

- Cloud security: Enhancing the security of ASUS cloud services through encryption, access controls, and continuous monitoring to prevent unauthorized access and data loss.

- User education: Providing resources and guidance to users on best practices for cybersecurity to minimize risks associated with phishing and malware.

Technological advancements are profoundly shaping ASUS's product development, particularly with the integration of AI into their PCs and servers, driving demand for enhanced processing power. The company's reliance on cutting-edge components, such as Intel's Core Ultra processors and AMD's Ryzen 8000 series, directly fuels its ability to deliver superior performance in AI-driven applications and gaming experiences.

ASUS's strategic expansion into IoT and cloud computing leverages its hardware expertise to create integrated, intelligent solutions, tapping into a global IoT market valued at approximately $1.1 trillion in 2024. This diversification is supported by significant R&D investment, exemplified by advancements in display technology and cooling systems for their ROG gaming laptops.

The company's commitment to cybersecurity is paramount, with continuous investment in hardware and software security features to combat rising global data breaches, which cost an average of $4.45 million in 2024.

Legal factors

ASUS operates in a highly competitive tech landscape where intellectual property (IP) disputes are common. The company frequently navigates patent litigation, particularly concerning innovations in chip technology and hardware design. For instance, in 2023, ASUS was involved in ongoing cases related to memory and data-security patents, alongside litigation concerning video coding technologies.

These legal challenges pose significant risks, potentially leading to costly damage awards and injunctions that could disrupt product availability. For example, a major patent infringement ruling could force ASUS to cease sales of certain products or pay substantial licensing fees, impacting its financial performance and market position. This underscores the critical importance of a proactive and robust IP strategy, including thorough patent analysis and defense mechanisms.

ASUS must navigate a complex web of product liability and consumer protection laws across its global markets. These regulations, varying by jurisdiction, hold ASUS accountable for any harm caused by product defects, influencing everything from warranty terms to repair and return procedures. For instance, in 2023, the European Union's General Product Safety Regulation was updated, reinforcing stricter safety requirements and recall procedures for electronic goods, directly impacting ASUS's product lifecycle management.

Failure to adhere to these stringent legal frameworks can lead to significant financial penalties, costly litigation, and damaging product recalls. In 2024, several major tech companies faced substantial fines for non-compliance with consumer protection laws, highlighting the critical need for robust compliance strategies. ASUS's commitment to rigorous quality control and transparent consumer policies is therefore paramount to safeguarding its brand reputation and financial stability.

Strict data privacy regulations, like the EU's GDPR and similar global laws, significantly influence how ASUS handles customer information. The company must ensure its devices, software, and cloud offerings adhere to these ever-changing legal requirements.

Failure to comply can result in substantial penalties, with GDPR fines potentially reaching up to 4% of a company's annual global turnover or €20 million, whichever is higher. For instance, in 2023, the Italian Data Protection Authority fined a tech company €5 million for data privacy violations, highlighting the financial risks involved.

Maintaining robust data security is therefore a critical legal priority for ASUS, directly impacting consumer trust and brand reputation. The increasing volume of cyber threats and data breaches globally underscores the necessity of proactive compliance measures.

Anti-Trust and Competition Laws

Asus, a significant global technology provider, must navigate a complex web of anti-trust and competition laws. These regulations, aimed at fostering fair market practices and preventing monopolistic behavior, directly impact Asus's pricing, market access, and collaboration strategies. For instance, in 2024, the European Union's Digital Markets Act (DMA) continues to scrutinize large tech platforms, potentially affecting how Asus partners with software providers or distributes its products.

Regulatory bodies worldwide actively monitor the tech sector for anti-competitive practices. Asus must ensure its business operations, from product bundling to exclusive agreements, comply with these evolving legal frameworks to avoid penalties and maintain market access. Failure to do so could lead to investigations and significant fines, impacting financial performance and brand reputation.

- Regulatory Scrutiny: Asus faces ongoing scrutiny from bodies like the US Federal Trade Commission (FTC) and the European Commission regarding its market conduct.

- Pricing and Bundling: Anti-trust laws can limit Asus's ability to engage in certain pricing strategies or bundle products in ways that might disadvantage competitors.

- Market Entry and Partnerships: Regulations influence how Asus enters new markets and the types of partnerships it can form, ensuring a level playing field for smaller players.

E-waste and Recycling Directives

Legal directives concerning electronic waste (e-waste) and product recycling, like the EU's WEEE Directive, place the onus on manufacturers like ASUS for the end-of-life management of their products. ASUS actively participates in global take-back programs and strives to boost its product recycling rates. For instance, in 2023, ASUS reported collecting and recycling a significant portion of its products through various initiatives worldwide, though specific global percentages are often aggregated within broader sustainability reports. Adhering to these stringent environmental regulations is vital not only for corporate environmental stewardship but also for mitigating the risk of substantial fines and reputational damage.

These legal frameworks require manufacturers to invest in and manage collection, treatment, and recycling infrastructure. ASUS's commitment is demonstrated through its participation in producer responsibility schemes and its efforts to design products with recyclability in mind. By staying ahead of evolving e-waste legislation, ASUS aims to ensure sustainable operations and maintain its market access in environmentally conscious regions.

- WEEE Directive Compliance: ASUS adheres to the Waste Electrical and Electronic Equipment (WEEE) Directive in the European Union, ensuring proper disposal and recycling of its products.

- Global Take-Back Programs: The company operates product take-back services in various regions to facilitate the responsible collection and recycling of e-waste.

- Recycling Rate Improvement: ASUS is committed to increasing its product recycling rate globally, aligning with circular economy principles and environmental goals.

- Regulatory Adherence: Compliance with e-waste and recycling directives is a critical legal requirement, safeguarding ASUS against penalties and reinforcing its environmental responsibility.

ASUS faces continuous legal challenges related to intellectual property, including patent litigation that can lead to significant financial penalties and product disruption. For example, ongoing cases in 2023 involved memory, data-security, and video coding patents, highlighting the need for robust IP defense strategies.

Product liability and consumer protection laws across its global markets hold ASUS accountable for product defects, influencing warranty and repair policies. Updates like the EU's General Product Safety Regulation in 2024 reinforce stricter safety and recall procedures, demanding rigorous quality control.

Data privacy regulations, such as GDPR, necessitate strict adherence to customer data handling, with potential fines up to 4% of global annual turnover for non-compliance, as seen in a 2023 Italian fine of €5 million to a tech firm.

Anti-trust laws, like the EU's Digital Markets Act in 2024, scrutinize market conduct, impacting ASUS's pricing, partnerships, and market access, with potential investigations and fines for non-compliance.

Environmental factors

ASUS is actively pursuing climate action, setting ambitious goals to achieve net-zero emissions by 2050 and transition to 100% renewable energy across its global operations centers by 2035. This commitment is already showing results, with the company reporting 55% renewable energy usage in 2024.

The company is also focusing on reducing its carbon footprint within its supply chain, a critical area for electronics manufacturers. These efforts underscore ASUS's dedication to environmental stewardship and its alignment with international climate objectives.

ASUS is actively embracing the circular economy, aiming to shift from a linear production model to one that prioritizes material efficiency and resource reuse. This involves a significant push towards incorporating recycled materials into their products and packaging, alongside developing modular designs that facilitate easier repair and component upgrades.

A key target for ASUS is achieving 100% environmentally friendly materials and packaging by 2025. Furthermore, the company has set a goal to reach a 20% global product recycling rate, demonstrating a commitment to closing the loop on their product lifecycle and minimizing environmental impact.

ASUS is deeply committed to sustainable manufacturing and supply chain practices, recognizing their critical environmental impact. This commitment extends beyond their own operations to encompass their entire network of suppliers, ensuring a holistic approach to environmental responsibility.

The company mandates that its key suppliers adhere to stringent information security standards and engage in the responsible sourcing of critical materials. This focus on ethical sourcing helps mitigate environmental risks associated with raw material extraction and processing. For instance, in 2023, ASUS reported that over 90% of its key suppliers had undergone sustainability assessments, demonstrating tangible progress in supply chain oversight.

Further solidifying its dedication, ASUS has rolled out a carbon data management platform specifically designed for its suppliers. This initiative aims to enhance transparency and facilitate the reduction of carbon footprints throughout the supply chain. By 2024, the company aims to have 75% of its suppliers actively reporting their carbon emissions through this platform, a significant step towards building a more resilient and low-carbon ecosystem.

Energy Consumption of Products and Operations

ASUS is making significant strides in reducing the energy consumption of both its products and its operational footprint. This commitment is central to their environmental strategy, aiming to create more sustainable technology. The increasing demand for energy-intensive AI applications makes this focus even more critical for the future.

A key target for ASUS is to ensure their products consistently surpass ENERGY STAR® standards by a minimum of 30% each year. This ambitious goal not only reduces the environmental impact but also resonates strongly with consumers who are increasingly prioritizing eco-friendly choices. For instance, in 2023, ASUS reported a 33% improvement in energy efficiency for its selected product lines compared to ENERGY STAR® requirements.

- Energy Efficiency Goal: Exceed ENERGY STAR® standards by at least 30% annually.

- Consumer Appeal: Lower carbon emissions attract environmentally conscious buyers.

- AI Workload Impact: Efficiency is crucial for managing the growing energy needs of AI.

- 2023 Performance: Achieved 33% energy efficiency improvement over ENERGY STAR® benchmarks for key products.

E-waste Management and Product Take-back

ASUS is actively engaged in managing electronic waste, offering take-back services that extend across a substantial portion of its global sales markets. This initiative is crucial for addressing the growing challenge of discarded electronics.

The company has set an ambitious target to recycle at least 20% of its products worldwide by 2025. This commitment underscores ASUS's dedication to reducing its environmental footprint and promoting a circular economy for electronics.

This proactive approach to product end-of-life management not only helps ASUS comply with increasingly stringent environmental regulations but also meets the rising expectations of consumers who demand greater corporate responsibility.

Key aspects of ASUS's e-waste management strategy include:

- Take-back Programs: Offering convenient options for customers to return used ASUS products for proper recycling.

- Recycling Targets: Aiming to recycle 20% of global product sales by 2025, demonstrating a quantifiable commitment.

- Regulatory Compliance: Ensuring adherence to various national and international e-waste directives and legislation.

- Consumer Demand: Responding to growing consumer preference for environmentally conscious brands and sustainable practices.

ASUS is prioritizing sustainability by aiming for net-zero emissions by 2050 and 100% renewable energy in its operations by 2035, having already reached 55% renewable energy usage in 2024. The company is also focusing on incorporating recycled materials into products and packaging, with a goal of using 100% environmentally friendly materials by 2025 and achieving a 20% global product recycling rate.

ASUS is committed to reducing energy consumption, with products designed to exceed ENERGY STAR® standards by at least 30% annually; in 2023, selected product lines showed a 33% improvement. Furthermore, the company is actively managing e-waste through take-back programs and a target to recycle 20% of its products globally by 2025.

| Environmental Goal | Target Year | 2023/2024 Status | Key Initiative |

|---|---|---|---|

| Net-Zero Emissions | 2050 | Progressing | Supply chain carbon management platform |

| 100% Renewable Energy (Operations) | 2035 | 55% (2024) | Transitioning global operations centers |

| 100% Environmentally Friendly Materials & Packaging | 2025 | Progressing | Circular economy focus, material efficiency |

| Global Product Recycling Rate | 2025 | Progressing | E-waste take-back programs |

| Energy Efficiency (Products vs. ENERGY STAR®) | Annual | 33% improvement (2023) | Designing for reduced energy consumption |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Asustek Computer is meticulously crafted using data from official government publications, reputable financial news outlets, and leading technology industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.