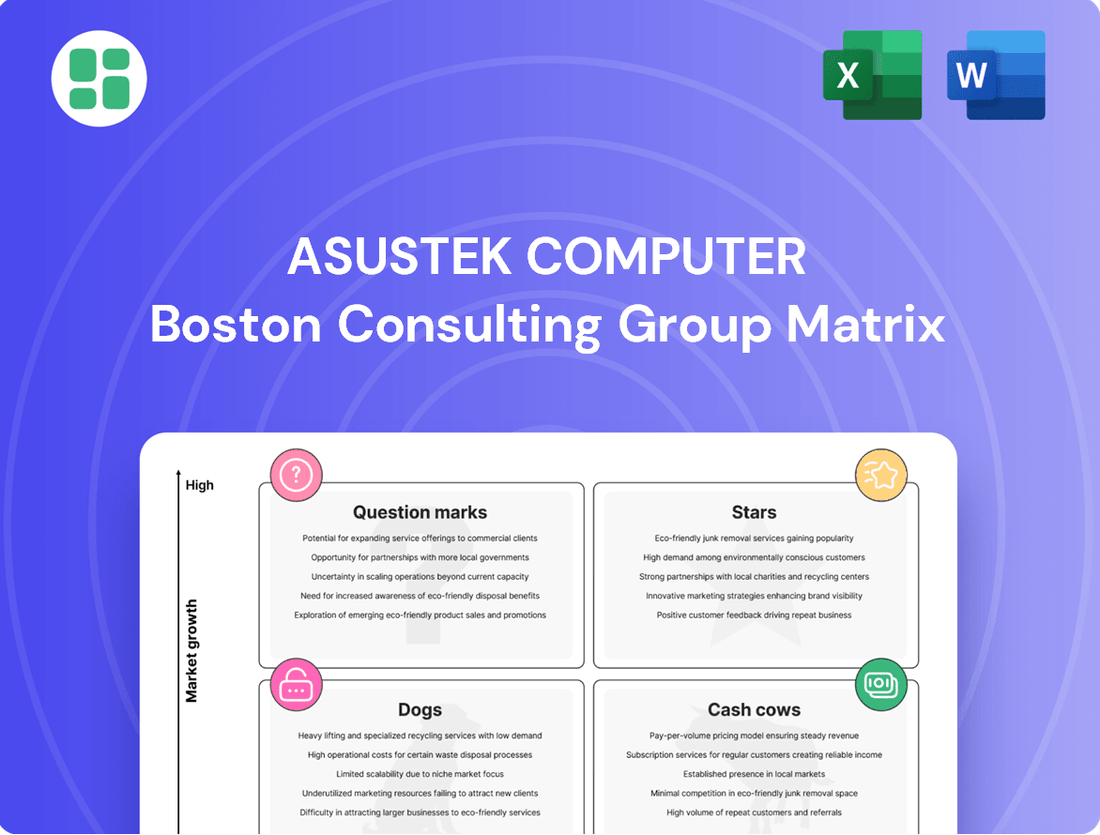

Asustek Computer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asustek Computer Bundle

Curious about Asustek Computer's product portfolio performance? This glimpse into their BCG Matrix reveals the potential for growth and stability across their offerings. Understand which of their innovations are poised to be market leaders and which might require a strategic rethink.

Ready to unlock the full strategic advantage? Purchase the complete Asustek Computer BCG Matrix to gain detailed quadrant placements, data-driven insights, and actionable recommendations. This comprehensive report is your key to making informed decisions and optimizing your investment in the dynamic tech landscape.

Stars

ASUS's Republic of Gamers (ROG) line is a powerhouse in the booming gaming hardware market. This segment is seeing a robust comeback, with projections indicating continued growth through 2024 and into 2025, fueled by the insatiable demand for top-tier performance and the rise of esports. ASUS consistently ranks among the leading gaming laptop brands, underscoring its substantial market share within this high-growth industry.

ASUS dominates the motherboard market, projected to ship around 15 million units in 2024, securing over 13% global market share. The high-end gaming and enthusiast segment, a key area for ASUS's innovation like PCIe 5.0, is experiencing strong growth, outpacing the broader motherboard market. This strategic focus on a rapidly expanding, high-value niche positions these products as Stars within the BCG matrix.

ASUS's high-end graphics cards, particularly its ROG Astral series, are positioned as Stars within the BCG Matrix. As a leading add-in board partner for NVIDIA and AMD, ASUS leverages cutting-edge cooling and performance technologies in these products, catering to the demanding gaming PC market.

The gaming PC sector, a primary driver for discrete GPUs, is projected for robust growth. Industry forecasts anticipate a significant recovery and expansion through 2025 and into the future, indicating a strong market trajectory for ASUS's specialized offerings.

AI-Powered PCs (Copilot+ PCs)

ASUS is positioning its AI-Powered PCs, including the new Copilot+ PC lineup, as a significant growth driver, aiming for a leadership role in this expanding market segment. The company anticipates this category will substantially boost the overall PC market in 2025.

New models like the Zenbook A14 and ROG Strix SCAR are being launched with integrated AI features and robust Neural Processing Units (NPUs), reflecting ASUS's substantial investment in this high-potential area. These products are designed to capitalize on the anticipated demand for AI-enhanced computing experiences.

- Market Entry: ASUS is aggressively entering the AI PC market, exemplified by its Copilot+ PC offerings.

- Growth Projection: The company forecasts significant growth for the AI PC sector, expecting it to uplift the broader PC market in 2025.

- Product Innovation: Key models like the Zenbook A14 and ROG Strix SCAR are equipped with advanced AI capabilities and NPUs.

- Strategic Focus: ASUS's early product launches and strategic emphasis highlight these AI PCs as having high future growth potential.

High-Performance Monitors

High-Performance Monitors, specifically within the gaming segment, represent a promising area for Asustek Computer. This niche, a part of the larger monitor market, saw record shipments in the second quarter of 2024, with projections indicating continued strong growth extending into 2025. ASUS has established itself as a significant competitor, known for its advanced displays featuring high refresh rates and resolutions, positioning these specialized products as Stars within the BCG Matrix.

ASUS's commitment to innovation in the gaming monitor space is evident. The company consistently introduces new models that cater to the demands of esports enthusiasts and serious gamers alike, pushing the boundaries of visual performance. This strategic focus on a high-growth, high-demand segment allows ASUS to capture market share and build brand loyalty.

- Market Growth: The gaming monitor segment is experiencing robust expansion, with Q2 2024 setting new shipment records.

- ASUS's Position: ASUS is a leading vendor in this specialized market, offering cutting-edge technology.

- Product Characteristics: High refresh rates and high resolutions are key features driving demand for these monitors.

- BCG Classification: These products are classified as Stars due to their strong market share in a rapidly growing industry.

ASUS's AI-Powered PCs, including its new Copilot+ PC lineup, are positioned as Stars. The company anticipates this category will significantly boost the overall PC market in 2025, with new models like the Zenbook A14 and ROG Strix SCAR featuring advanced AI capabilities and NPUs. This strategic emphasis on AI PCs highlights their high future growth potential and ASUS's aggressive market entry.

What is included in the product

Asustek's BCG Matrix offers a strategic overview of its product portfolio, guiding investment decisions for growth.

A clear BCG Matrix visualizes Asustek's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Mainstream laptops and desktops represent a significant cash cow for ASUS. The company consistently ranks among the top five global PC vendors, securing approximately 6-7% of the market share throughout 2024 and into Q1 2025. This established position ensures a reliable stream of revenue from its broad range of products, such as the Vivobook and ExpertBook lines, even as the traditional PC market sees only moderate growth.

Standard motherboards represent a significant cash cow for Asustek Computer. Despite the broader market for these components experiencing more modest growth, ASUS's commanding global market share, estimated to be around 40% in 2023, ensures consistent and substantial cash generation. This stability is driven by their established brand loyalty and the ongoing demand from the PC building and upgrade market.

ASUS's strong presence in PC components, contributing roughly 32-40% of its revenue in 2023, positions these products as significant cash cows. This segment, along with peripherals like keyboards, mice, and audio gear, operates in a mature market characterized by steady demand.

The company leverages its established brand reputation to maintain a substantial market share within these stable, profitable categories. Consequently, these offerings require more moderate investment, allowing ASUS to generate consistent returns and fund growth in other business areas.

Networking Equipment

ASUS's networking equipment, encompassing routers and mesh Wi-Fi systems, serves both individual consumers and small businesses. This segment typically operates in a mature market, where ASUS's established brand recognition for dependable performance plays a key role in securing a stable market share and consistent revenue generation.

While precise 2024-2025 market share figures for ASUS's networking division weren't explicitly provided, the company's consistent presence in consumer electronics suggests a solid, albeit potentially slow-growing, revenue stream. The demand for reliable home and small office networking solutions remains robust, positioning this as a reliable Cash Cow for ASUS.

- Product Range: ASUS offers a comprehensive suite of networking solutions, including high-performance routers and user-friendly mesh Wi-Fi systems.

- Market Position: In the mature networking equipment market, ASUS leverages its brand reputation for quality and innovation to maintain a competitive edge.

- Revenue Stability: The consistent demand for reliable internet connectivity ensures a stable revenue stream from this product category, characteristic of a Cash Cow.

- Brand Loyalty: ASUS's commitment to product reliability and customer support fosters brand loyalty, contributing to sustained sales in this segment.

Server Motherboards and Entry-Level Servers

ASUS holds a position in the server motherboard market, a crucial part of the overall motherboard industry. This segment, particularly for standard server motherboards and entry-level server systems, is characterized by more consistent, though typically slower, growth compared to the rapidly expanding AI server sector.

The company's participation in this established market contributes a reliable source of income. For instance, in 2023, the global server motherboard market was valued at approximately USD 4.8 billion, with projections indicating a CAGR of around 5.5% through 2030, highlighting its stable revenue-generating potential for ASUS.

- Stable Revenue: Entry-level server motherboards offer a predictable income stream for ASUS.

- Market Size: The global server motherboard market was valued at roughly USD 4.8 billion in 2023.

- Growth Rate: This segment is expected to grow at a CAGR of approximately 5.5% until 2030.

ASUS's mainstream laptops and desktops are a strong cash cow, consistently placing them among the top five global PC vendors with roughly 6-7% market share in 2024. This sustained presence ensures reliable revenue from popular lines like Vivobook, even with moderate market growth.

Standard motherboards are another significant cash cow, with ASUS holding an estimated 40% global market share in 2023. This dominance, despite slower market growth, generates substantial and consistent cash due to strong brand loyalty and ongoing demand from PC builders.

The company's PC components segment, contributing 32-40% of revenue in 2023, also acts as a cash cow. Operating in a mature market with steady demand, these products, alongside peripherals, require less investment, allowing ASUS to generate consistent returns.

ASUS's networking equipment, including routers and mesh Wi-Fi, provides a stable revenue stream. While specific 2024-2025 market share data isn't detailed, the robust demand for reliable connectivity ensures this segment remains a dependable cash cow for the company.

| Product Category | 2023 Market Share (Est.) | Revenue Contribution (2023) | Market Growth Trend |

| Mainstream Laptops/Desktops | 6-7% | Significant | Moderate |

| Standard Motherboards | ~40% | Substantial | Modest |

| PC Components & Peripherals | N/A (Broad Segment) | 32-40% | Mature/Steady |

| Networking Equipment | N/A (Consistent Presence) | Stable | Mature/Robust Demand |

What You See Is What You Get

Asustek Computer BCG Matrix

The Asustek Computer BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously crafted with current market data, is ready for immediate integration into your strategic planning processes. You will gain full access to all analyzed segments and actionable insights without any further modifications required.

Dogs

ASUS's ZenFone series operates within the smartphone market, a sector characterized by intense competition and rapid innovation. Despite efforts, the ZenFone line has consistently held a very small global market share.

In Q1 2025, the overall smartphone market saw only modest growth, further highlighting the challenges for smaller players. ASUS does not rank among the top five smartphone vendors globally, reinforcing the ZenFone series' position in a saturated market where it struggles to gain significant traction against dominant competitors.

The contribution of ASUS's smartphone business, including the ZenFone series, to the company's total revenue remains minimal, typically in the low single digits, around 1-2%. This small revenue share, combined with the low market share in a slow-growth segment, places the ZenFone series in the "Dog" quadrant of the BCG Matrix.

Chromebooks, historically, have represented a challenging segment for Asustek Computer. Despite a notable surge in shipments, with a 43% year-over-year increase in Q2 2025, ASUS's overall market share in this category has remained modest, typically placing them fourth or fifth globally. This limited market penetration, coupled with the inherent lower price points of Chromebooks, means that even with increased volume, the profitability per unit is often constrained.

The recent growth is largely attributed to specific educational initiatives, which may not translate into sustained demand across broader consumer or enterprise markets. If these educational contracts are not renewed or if the product line doesn't successfully diversify into higher-margin segments, the investment required to maintain or grow market share could outweigh the returns. This scenario positions Chromebooks as a potential ‘Dog’ in the BCG matrix, demanding careful consideration regarding resource allocation.

Older generation and low-end graphics cards represent a challenging segment for ASUS. As newer, more powerful GPUs become available, demand for these older models naturally wanes. This is further exacerbated by advancements in integrated graphics, which are becoming increasingly capable for basic tasks, reducing the need for a separate, low-end discrete card for many users.

ASUS's strength lies in its high-performance graphics card offerings. However, the company's participation in the very low-end, outdated GPU market can be viewed as a Dog within the BCG matrix. Competition in this space is intense, and profit margins are typically slim, making it difficult to generate significant returns or market share growth.

The global discrete graphics card market saw shipments decline by approximately 15% year-over-year in the first quarter of 2024, according to Jon Peddie Research. This overall market contraction disproportionately affects the lower-end segments, where ASUS might maintain some presence but with diminishing returns.

Legacy Desktop PCs (Non-Gaming, Basic Models)

Legacy Desktop PCs, the non-gaming, basic models, are likely positioned as Dogs within Asustek Computer's BCG Matrix. These machines offer minimal performance and cater to a declining user base with very basic computing requirements. Their low profit margins and fierce competition from more adaptable mainstream laptops and tablets further solidify this classification.

The market for these entry-level desktops has been steadily shrinking. For instance, global desktop PC shipments saw a decline in 2023, with a significant portion of this contraction attributed to the lower end of the market where these legacy models reside. Asustek's focus has increasingly shifted towards higher-performance and more versatile computing solutions.

- Market Share: Low, due to a shrinking user base and competition.

- Growth Rate: Negative, as users migrate to more modern computing devices.

- Profitability: Minimal, characterized by low margins and intense price competition.

- Strategic Recommendation: Consider phasing out or divesting from this product category to reallocate resources.

Specific Niche Consumer Electronics with Limited Adoption

ASUS, a prominent technology innovator, might have ventured into niche consumer electronics that haven't achieved widespread adoption. These could be products targeting very specific user groups or those in markets with limited growth potential. Hypothetically, if these products hold a small market share within a slow-moving segment, they would be categorized as Dogs in the BCG matrix.

For instance, consider ASUS's potential foray into specialized audio equipment or unique gaming peripherals that, while innovative, cater to a small, specialized audience. Without concrete sales figures or market penetration data for such hypothetical products, it's challenging to place them definitively. However, the principle remains: low market share in a low-growth environment defines a Dog.

- Hypothetical Niche Product: Ultra-specialized gaming headset with advanced haptic feedback.

- Market Segment: High-end gaming peripherals, but with a very specific feature set.

- Market Growth: Estimated low single-digit annual growth for this specific niche.

- ASUS Market Share: Assumed to be less than 5% within this very narrow segment.

Products classified as Dogs in ASUS's BCG Matrix represent business areas with low market share in slow-growing industries. These offerings typically generate minimal profits and may even require significant investment to maintain, often failing to contribute meaningfully to overall company growth. Strategic decisions for these products usually involve divestment or phasing out to reallocate resources to more promising ventures.

The ZenFone series, legacy desktop PCs, and older generation graphics cards exemplify ASUS's Dog quadrant. These product lines struggle against dominant competitors and evolving consumer preferences, resulting in low market penetration and limited revenue contribution. The company's strategic focus is increasingly on its Star and Cash Cow segments, such as high-end laptops and gaming peripherals.

| Product Category | Market Share | Industry Growth Rate | Profitability | BCG Quadrant |

|---|---|---|---|---|

| ZenFone Series (Smartphones) | Low (<2%) | Slow/Moderate | Low | Dog |

| Legacy Desktop PCs | Low | Declining | Very Low | Dog |

| Older Generation Graphics Cards | Low | Declining | Low | Dog |

Question Marks

ASUS is heavily investing in the booming AI server and enterprise AI infrastructure sector, securing significant orders that highlight its strategic focus. This market is experiencing rapid expansion, presenting considerable growth opportunities for the company.

Despite the high growth potential, ASUS is actively working to establish a stronger market presence against well-entrenched competitors in the server industry. Their dedication to developing comprehensive AI solutions and a complete AI ecosystem underscores this segment's high-growth, yet currently nascent, market share position for ASUS.

ASUS's IoT solutions, including edge AI and embedded devices, cater to diverse industries like manufacturing, healthcare, and smart cities. The global IoT market is booming, with continued strong growth anticipated through 2025 and beyond, reaching an estimated $1.1 trillion in 2025. ASUS is investing in this sector, but its presence in the highly fragmented IoT market means its current market share is likely still modest, positioning it as a Question Mark.

ASUS's Robotics & AI Center is actively developing cutting-edge solutions for robotics and the industrial metaverse, positioning this segment as a potential high-growth area. This initiative represents a nascent but promising venture for the company, requiring substantial investment to capture market share.

While ASUS is committed to R&D and demonstrating its capabilities, its current market penetration in the broader robotics sector is likely limited due to its early stage. Consequently, this segment fits the profile of a Question Mark, demanding strategic capital allocation to unlock its future potential.

ASUS NUC Mini PCs

Following its acquisition of Intel's NUC business in 2024, ASUS has introduced its own line of NUC mini PCs, targeting the burgeoning AI computing market. This strategic move positions ASUS in a segment poised for significant growth, particularly with the increasing demand for AI-enabled solutions across consumer and business sectors.

The ASUS NUC mini PCs are currently considered a Question Mark within the BCG Matrix. This classification reflects the early stage of ASUS's involvement in this product category and the developing market share. While the potential for high growth exists, the long-term success and market dominance are yet to be fully established.

- Market Entry: ASUS officially took over Intel's Next Unit of Computing (NUC) business in September 2024, marking a significant expansion into the compact PC market.

- AI Focus: The new ASUS NUCs are designed to support AI workloads, a key driver for future computing demand.

- Growth Potential: The global mini PC market is projected to grow substantially, with AI integration expected to accelerate this trend, offering considerable upside for ASUS.

New Wearable Technologies (e.g., ASUS AirVision M1 glasses)

ASUS's venture into new wearable technologies, exemplified by the AirVision M1 glasses introduced at CES 2024, positions them in a rapidly expanding market. This segment, particularly augmented and virtual reality applications, is experiencing significant growth, with projections indicating a substantial increase in consumer and enterprise adoption in the coming years. For instance, the global AR/VR market was valued at approximately $28.2 billion in 2023 and is anticipated to reach over $200 billion by 2028, demonstrating a compound annual growth rate of over 40%.

However, as a nascent product category for ASUS, the AirVision M1 glasses currently represent a low market share. This places them in the "Question Mark" quadrant of the BCG Matrix. Significant investment in research, development, marketing, and distribution will be necessary to drive market penetration and establish a strong foothold.

- Market Entry: ASUS AirVision M1 glasses represent a strategic entry into the burgeoning wearable display market.

- Growth Potential: The AR/VR sector, where these devices fit, is a high-growth area with substantial future revenue potential.

- Current Position: As new products, they currently possess a low market share, necessitating significant investment to gain traction.

- Strategic Imperative: ASUS must invest heavily to convert these "Question Marks" into future market leaders or divest if they fail to gain momentum.

ASUS's AI server and enterprise AI infrastructure initiatives, while in a high-growth sector, are still establishing significant market share. Their focus on building a complete AI ecosystem demonstrates a strategic commitment to capturing future demand in this rapidly evolving space. The company's investment in these areas positions them to capitalize on the projected substantial growth of AI computing, though they face established competitors.

The NUC mini PC line, acquired in 2024, represents a new venture for ASUS in a market segment poised for AI-driven expansion. While the potential is high, ASUS's market share in this specific category is still developing, requiring strategic investment to solidify its position. This makes it a prime candidate for the Question Mark quadrant, needing careful management to convert potential into market leadership.

ASUS's entry into wearable technologies, such as the AirVision M1 glasses, targets the high-growth AR/VR market. Despite the sector's impressive expansion, with global AR/VR market value projected to exceed $200 billion by 2028, ASUS's current market share in this niche is minimal. This necessitates substantial investment to foster growth and establish a competitive presence.

BCG Matrix Data Sources

Our Asustek Computer BCG Matrix is constructed using a blend of Asustek's official financial reports, market share data from leading industry analysts, and recent consumer electronics market research to ensure a comprehensive view.