Asustek Computer Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asustek Computer Bundle

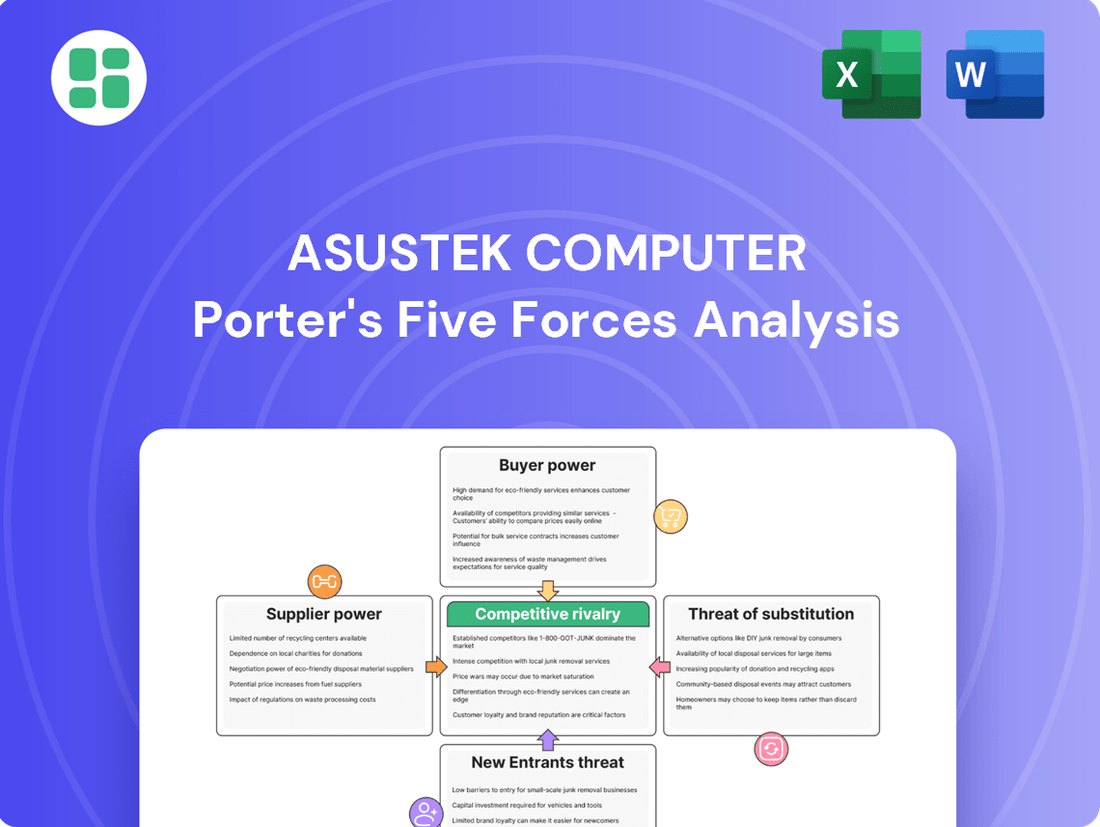

Asustek Computer navigates a dynamic tech landscape where intense rivalry and the threat of substitutes significantly shape its market. Understanding the bargaining power of both buyers and suppliers is crucial for sustained growth. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Asustek Computer’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ASUSTeK Computer, like many in the electronics sector, faces significant supplier power due to the concentration of key component providers. Companies like Intel and AMD dominate the CPU market, while NVIDIA and AMD hold sway over GPUs, and Samsung, SK Hynix, and Micron are critical for memory chips. This limited supplier base means ASUSTeK has less leverage in negotiating prices and terms.

The reliance on a few dominant semiconductor giants grants these suppliers considerable bargaining power. They can influence pricing, dictate delivery schedules, and steer the innovation roadmap for essential components, directly impacting ASUSTeK's product development cycles and cost structures. For instance, fluctuations in memory chip prices, a common occurrence, can significantly affect the cost of goods sold for laptops and motherboards.

ASUSTeK Computer faces significant supplier power when sourcing highly specialized or proprietary components. The costs and complexities associated with re-designing products, re-qualifying new suppliers, and the potential for production delays create substantial switching barriers. For instance, a shift away from a supplier of a unique motherboard chipset could necessitate extensive engineering work and lengthy testing phases, potentially impacting ASUSTeK's time-to-market and incurring millions in R&D expenses.

Suppliers who consistently innovate, especially in critical areas like AI-enabled chips and sophisticated manufacturing, gain significant leverage. ASUSTeK's capacity to deliver high-performance products is directly tied to its suppliers' technological prowess, which in turn amplifies the suppliers' influence over product specifications and capabilities.

The burgeoning AI chip market, projected to reach hundreds of billions in the coming years, exemplifies this trend. Suppliers leading in AI chip development can dictate terms, as ASUSTeK and other PC manufacturers rely heavily on these components to remain competitive in both consumer and data center markets.

Impact of Global Supply Chain Disruptions

Global supply chain disruptions, fueled by geopolitical tensions and natural disasters, significantly amplify the bargaining power of suppliers for critical electronic components. For instance, the semiconductor shortage that began in late 2020 and continued through 2024, impacting numerous industries including PC manufacturing, meant that ASUSTeK faced increased costs and longer wait times for essential chips. This forces companies like ASUSTeK to potentially accept less favorable terms to ensure component availability, leading to price volatility and extended lead times.

These disruptions can lead to price volatility and extended lead times, forcing ASUSTeK to accept less favorable terms to secure necessary parts. For example, during the peak of the chip shortage in 2022, lead times for certain advanced processors extended to over a year, and prices saw significant increases. Building supply chain resilience through strategies like diversifying suppliers and holding strategic inventory becomes crucial for mitigating these impacts.

- Increased Supplier Leverage: Geopolitical events and natural disasters can restrict the availability of key electronic components, giving suppliers who maintain stable production greater leverage over buyers like ASUSTeK.

- Price Volatility and Lead Times: Disruptions directly translate to unpredictable pricing and longer delivery schedules for essential parts, impacting ASUSTeK's production planning and cost management.

- Strategic Sourcing and Resilience: ASUSTeK must actively pursue strategies such as dual sourcing, building stronger supplier relationships, and investing in supply chain visibility to counter these supplier pressures and ensure continuity.

Supplier's Forward Integration Potential

The bargaining power of suppliers for ASUSTeK is influenced by their potential for forward integration. If key component suppliers, such as those providing advanced chipsets or high-performance display panels, were to integrate forward into manufacturing finished products like laptops or monitors, they could directly compete with ASUSTeK. This capability would significantly enhance their leverage in price negotiations, as ASUSTeK would be hesitant to antagonize a supplier that could easily transition into a rival. For instance, a leading memory module manufacturer could potentially begin assembling complete motherboards or even entire systems, thereby directly challenging ASUSTeK's market position.

This threat of forward integration gives suppliers considerable bargaining power. ASUSTeK's reliance on specialized components means that alienating a supplier with the capacity to enter the finished goods market would be a strategic risk. Suppliers could leverage this potential by demanding better terms, higher prices, or preferential treatment, knowing that ASUSTeK has limited alternative sources for critical components. In 2024, the semiconductor industry, a key supplier area for ASUSTeK, saw continued consolidation and strategic moves by major players to diversify their offerings, increasing the relevance of this threat.

- Supplier Forward Integration: Key component suppliers for ASUSTeK possess the capability to integrate forward into finished product manufacturing, potentially becoming direct competitors.

- Enhanced Supplier Leverage: This integration potential grants suppliers greater bargaining power, allowing them to negotiate more favorable terms with ASUSTeK due to the risk of ASUSTeK alienating a future rival.

- Strategic Considerations: ASUSTeK must carefully manage relationships with suppliers who have the capacity to enter the finished product market, balancing procurement needs with competitive threats.

The bargaining power of suppliers for ASUSTeK is significant due to the concentrated nature of key component providers in the electronics industry. For instance, in 2024, major CPU manufacturers like Intel and AMD, and GPU providers such as NVIDIA, continue to hold substantial influence. This limited supplier base means ASUSTeK has less leverage in negotiating prices and terms for critical components, impacting its cost structure and product development timelines.

ASUSTeK's reliance on a few dominant semiconductor giants grants these suppliers considerable bargaining power, allowing them to influence pricing and delivery schedules. The threat of suppliers integrating forward into finished product manufacturing, a trend observed in the semiconductor sector in 2024, further amplifies their leverage. This potential for competition means ASUSTeK must carefully manage these relationships to avoid alienating critical partners who could easily become rivals.

Global supply chain disruptions, exemplified by the semiconductor shortages experienced through 2024, significantly amplify supplier bargaining power. These events lead to price volatility and extended lead times, forcing companies like ASUSTeK to accept less favorable terms to secure essential parts, thereby impacting production planning and cost management.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Asustek Computer's position in the PC and component market, highlighting the intense rivalry and buyer power.

Instantly visualize Asustek's competitive landscape with a dynamic Porter's Five Forces analysis, revealing key pressure points to inform strategic adjustments.

Customers Bargaining Power

In the fiercely competitive PC and electronics sectors, customers, whether individuals or businesses, often show significant sensitivity to price. This means that even small price differences can influence purchasing decisions.

The sheer volume of alternative brands and products available means consumers can readily compare prices and switch suppliers. This readily available comparison power puts downward pressure on ASUSTeK's pricing and, consequently, its profit margins. For instance, in 2024, the average selling price for laptops across the industry saw a slight decline due to intense competition.

Online retail platforms and sophisticated price comparison tools further amplify this customer bargaining power. These digital tools make it incredibly easy for buyers to find the best deals, forcing manufacturers like ASUSTeK to remain highly competitive on price to capture market share.

The sheer volume of choices available to consumers in the PC market significantly amplifies their bargaining power. Competitors to ASUSTeK, from global giants to niche manufacturers, offer a vast spectrum of laptops, desktops, and crucial components. This extensive product diversity means customers can easily find alternatives that meet their specific needs and budgets, diminishing reliance on any single brand.

Customers can readily compare specifications, features, and pricing across numerous brands, from budget-friendly options to high-performance machines. This wide array of form factors, from ultraportables to powerful workstations, and varying performance tiers ensures that if one brand's offering isn't satisfactory, another is likely to be. For instance, in 2024, the global PC market saw shipments of over 260 million units, providing ample choice for every consumer segment.

For many of ASUSTeK's standard computing products, such as laptops and desktops, customers face low switching costs. This means it's generally not difficult or expensive for a consumer to move from an ASUSTeK device to one made by a competitor. While some customers may be loyal to the ASUSTeK brand, the technical and financial hurdles to adopting an equivalent product from another company are often quite small. This situation gives customers leverage, as they can readily explore other brands for better pricing or features.

The ease of switching can vary. For individual consumers, the decision to buy a new laptop might simply involve comparing prices and specifications online, with minimal disruption. However, for enterprise clients, switching costs might be higher due to the need for software compatibility, IT support integration, and employee training. Despite these differences, the overall landscape for many consumer-grade computing products still favors the customer due to the readily available alternatives and the relatively uniform nature of core functionalities.

Access to Comprehensive Product Information and Reviews

Customers now have unprecedented access to detailed product information, including comprehensive specifications, performance benchmarks, and user reviews. This widespread transparency, fueled by tech media and active user forums, allows them to thoroughly research and compare offerings from various brands, including Asustek. For instance, in 2024, platforms like TechRadar and Tom's Hardware provided in-depth reviews of the latest ASUS ROG laptops, detailing their gaming performance and thermal management. This readily available data significantly enhances a customer's ability to make informed decisions.

This informational advantage directly translates into increased bargaining power for consumers. They can effectively negotiate prices, demand better value propositions, and even influence product development by voicing their preferences and criticisms. The ability to easily compare features and prices across the market means that companies like Asustek must remain competitive not only on product quality but also on pricing and customer service to retain market share.

- Informed Purchasing Decisions: Customers can easily access detailed specifications, performance benchmarks, and comparative analyses of laptops, motherboards, and other computer components.

- Influence of Tech Media and User Forums: Platforms like YouTube tech channels and Reddit communities often provide unbiased reviews and discussions that shape consumer perceptions and purchasing habits.

- Negotiation Leverage: Armed with market knowledge, customers can more effectively negotiate prices and demand better terms from retailers and manufacturers.

- Demand for Value: The ease of comparison encourages customers to seek the best price-to-performance ratio, pushing companies to offer competitive pricing and superior features.

Influence of Large Enterprise and Government Buyers

Large enterprise, educational institutions, and government entities wield considerable bargaining power when procuring electronics in bulk. Their substantial order volumes enable them to negotiate significant discounts and demand customized solutions, directly impacting ASUSTeK's profit margins in these crucial segments.

For instance, in 2024, major government procurement tenders often specify stringent pricing requirements, forcing vendors like ASUSTeK to optimize their cost structures to remain competitive. The ability to secure long-term contracts with these buyers is vital, providing predictable revenue streams and a degree of stability against market volatility.

- Bulk Purchasing Power: Large buyers can leverage their volume to secure lower per-unit costs.

- Customization Demands: Enterprise and government clients often require tailored specifications, increasing ASUSTeK's development and production costs.

- Long-Term Contracts: Securing multi-year agreements provides revenue visibility but can lock ASUSTeK into specific pricing or product roadmaps.

- Competitive Bidding: Government and large corporate tenders frequently involve competitive bidding processes where price is a primary factor.

Customers possess significant bargaining power due to the abundance of choices and low switching costs in the PC market. This allows them to easily compare prices and features, pushing ASUSTeK to maintain competitive pricing. For instance, in 2024, the global PC market shipped over 260 million units, highlighting the vast array of options available.

The ease with which consumers can access detailed product information and reviews further amplifies their leverage. Platforms providing in-depth analyses, such as those in 2024 by TechRadar for ASUS ROG laptops, empower buyers to make informed decisions and demand better value, impacting ASUSTeK's pricing strategies.

Large institutional buyers, like educational and government entities, exert even greater bargaining power through bulk purchases and demanding customized solutions, often through competitive bidding processes. In 2024, government tenders frequently imposed strict pricing, compelling vendors like ASUSTeK to optimize costs to secure these vital, high-volume contracts.

| Factor | Impact on ASUSTeK | 2024 Data/Example |

|---|---|---|

| Product Availability | High availability of alternatives reduces customer reliance on ASUSTeK. | Over 260 million PC units shipped globally in 2024. |

| Switching Costs | Low switching costs for standard consumer products empower customers to change brands easily. | Individual consumers face minimal technical or financial hurdles to switch laptops. |

| Information Transparency | Access to reviews and benchmarks enhances customer knowledge and negotiation power. | Tech media provided detailed 2024 reviews of ASUS ROG laptops. |

| Buyer Volume | Large enterprise and government orders grant significant negotiation leverage for discounts and customization. | Government tenders in 2024 often included stringent pricing requirements. |

What You See Is What You Get

Asustek Computer Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces Analysis of Asustek Computer details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This in-depth analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The global computer hardware and electronics market is intensely competitive, with numerous well-established and powerful players. ASUSTeK faces direct competition across its diverse product portfolio from giants like Lenovo, HP, Dell, Apple, Samsung, and Acer. This fierce rivalry translates into aggressive battles for market share.

Competitive rivalry within the PC industry, including for companies like ASUSTeK, is intensely fueled by a relentless pursuit of technological innovation and product differentiation. The advent of AI PCs, for instance, is creating a new battleground where performance and unique features are paramount. ASUSTeK, like its peers, must therefore commit substantial resources to research and development to stay ahead. Failure to innovate quickly risks ceding valuable market share to more agile competitors, particularly in high-demand segments such as gaming laptops and AI-powered devices.

The PC and component market is intensely competitive, forcing players like ASUSTeK to engage in aggressive pricing and marketing. This often translates into frequent sales events and significant advertising investments to capture consumer attention. For instance, in 2024, the global PC market saw continued efforts from manufacturers to stimulate demand through promotional pricing, impacting overall industry profitability.

ASUSTeK must constantly battle for market share through these price wars and marketing campaigns. Success hinges on efficiently managing costs to maintain healthy profit margins while simultaneously building strong brand perception and customer loyalty through programs and superior product offerings.

Market Share Dynamics and Growth Trends

The competitive rivalry within the PC market remains intense, directly impacting ASUSTeK's market share. Fluctuations in global PC shipment volumes are a key indicator of this rivalry. For instance, IDC reported that worldwide PC shipments declined by 7.1% in the first quarter of 2024 compared to the same period in 2023, reaching 57.2 million units. This contraction intensifies the fight for market share among major players.

Even small percentage shifts in market share translate to substantial revenue changes in this highly competitive landscape. ASUSTeK, alongside giants like Lenovo, HP, and Dell, is constantly striving to capture even a fraction of a percent more market share. This drives aggressive pricing strategies, product innovation, and marketing efforts as each company vies for every sale.

Recent market data highlights this dynamic. In Q1 2024, Lenovo maintained its lead with 23.0% market share, followed by HP at 21.0%, and Dell at 17.0%. ASUSTeK, while a significant player, often finds itself in a battle to solidify its position against these larger competitors, making the drive for incremental market share gains a critical component of its strategy.

- Global PC shipments saw a 7.1% year-over-year decline in Q1 2024, totaling 57.2 million units.

- Lenovo led the market in Q1 2024 with a 23.0% share, followed by HP (21.0%) and Dell (17.0%).

- ASUSTeK's efforts to gain market share are intensified by the contraction in overall PC demand.

- Even minor gains or losses in market share represent significant revenue shifts, fueling fierce competition.

Diversification into New Technology Segments

Competitive rivalry is intensifying as companies like ASUSTeK Computer expand beyond traditional PC and component markets into newer technology segments. This diversification means ASUSTeK now faces competition in areas such as the Internet of Things (IoT), cloud computing solutions, and even robotics, creating entirely new battlegrounds for market share.

This strategic pivot requires ASUSTeK to not only excel in its established product categories but also to innovate and capture emerging markets. For instance, in the IoT space, competition comes from a wide array of players, from established tech giants to specialized startups, all vying for dominance in connected devices and platforms. ASUSTeK's ability to forge strategic partnerships and build robust ecosystems will be crucial for success in these nascent, yet rapidly growing, technology frontiers.

- Diversification into New Technology Segments: ASUSTeK's expansion into IoT, cloud solutions, and robotics introduces new competitive fronts, requiring innovation beyond traditional hardware.

- Emerging Market Competition: The company now competes with a broader range of players, including tech giants and specialized startups, in these rapidly evolving technology sectors.

- Strategic Partnerships and Ecosystems: Success in these new segments hinges on ASUSTeK's ability to develop strong partnerships and cultivate comprehensive technology ecosystems.

The competitive rivalry for ASUSTeK Computer is extremely high, driven by a crowded market with numerous established players and aggressive pricing strategies. This intense competition forces ASUSTeK to constantly innovate and invest heavily in marketing to maintain its market position.

The global PC market's contraction, with a 7.1% year-over-year decline in Q1 2024 shipments to 57.2 million units, intensifies the battle for market share among key players like Lenovo, HP, and Dell, who held 23.0%, 21.0%, and 17.0% respectively in that quarter.

ASUSTeK's expansion into new technology areas like IoT and cloud computing introduces further competitive pressures, requiring strategic partnerships and ecosystem development to succeed against both established tech giants and agile startups.

| Market Share (Q1 2024) | Share (%) | Shipments (Millions) |

|---|---|---|

| Lenovo | 23.0 | 13.2 |

| HP | 21.0 | 12.0 |

| Dell | 17.0 | 9.7 |

| ASUSTeK | N/A* | N/A* |

*Note: Specific market share data for ASUSTeK in Q1 2024 was not readily available in the provided context, but its position is understood to be in competition with the listed leaders.

SSubstitutes Threaten

The rise of increasingly powerful smartphones and tablets presents a significant threat of substitution for ASUSTeK's traditional laptop and desktop offerings. For many consumers, particularly casual users and those focused on content consumption or basic productivity, these mobile devices now fulfill a wide range of needs, offering superior portability and convenience. This trend directly impacts demand for ASUSTeK's core PC products.

For instance, in 2024, global tablet shipments were projected to reach over 120 million units, indicating their widespread adoption. While power users still require the performance and versatility of laptops for demanding tasks like video editing or complex software development, the average user can perform activities like web browsing, email, social media, and even light document creation on their mobile devices, effectively substituting the need for a separate PC.

The increasing adoption of cloud-based computing and thin client solutions poses a significant threat to ASUSTeK's traditional hardware sales. These technologies allow organizations to centralize computing power and data, reducing the demand for high-specification individual devices like laptops and desktops. For instance, many businesses and educational institutions are migrating to virtual desktop infrastructure (VDI) or desktop-as-a-service (DaaS) models, where users access applications and data remotely from less powerful, often cheaper, endpoints. This shift, driven by cost savings and simplified IT management, directly substitutes the need for robust local hardware that ASUSTeK specializes in.

The rise of dedicated handheld gaming consoles, such as Valve's Steam Deck and ASUSTeK's own ROG Ally, presents a significant threat of substitution for traditional gaming PCs. These devices offer a compelling blend of portability and performance, allowing gamers to enjoy high-fidelity titles on the go, a convenience that a desktop or even a high-end gaming laptop cannot easily match. For instance, the ROG Ally, launched in 2023, directly competes in this space, demonstrating ASUSTeK's awareness of this evolving market.

Furthermore, cloud gaming streaming services like Xbox Cloud Gaming, GeForce Now, and PlayStation Plus Premium are increasingly viable alternatives. These services eliminate the need for powerful local hardware altogether, offering access to a vast library of games on a wider range of devices, including smartphones and less powerful laptops, often at a lower initial cost than a dedicated gaming PC. This accessibility can draw consumers away from investing in expensive gaming hardware like ASUSTeK's ROG laptops.

Multi-functional Smart Devices and Home Hubs

The increasing prevalence of multi-functional smart devices and home hubs presents a significant threat of substitution for traditional computing devices. These integrated systems, often featuring voice assistants like Amazon Alexa or Google Assistant, can now handle many basic household computing tasks. For instance, accessing information, managing calendars, and controlling smart home appliances can be done without a dedicated PC.

This trend directly impacts the market for entry-level computers and tablets. Consumers may opt for a smart display or a smart speaker with a screen as their primary interface for everyday information and entertainment needs. This erosion of demand for basic computing functions means fewer first-time buyers entering the traditional PC market.

In 2024, the smart home market continued its robust growth. The global smart home market size was projected to reach over $160 billion, with smart speakers and displays being key drivers. This indicates a substantial and growing installed base of devices capable of fulfilling functions previously exclusive to PCs, thereby intensifying the substitution threat for Asustek.

- Smart Device Integration: Smart displays and home hubs offer voice-activated access to information, entertainment, and home control, directly substituting for PC functions in many households.

- Erosion of Entry-Level Market: The convenience and cost-effectiveness of these devices can deter consumers from purchasing entry-level PCs for basic tasks.

- Voice Assistant Dominance: The increasing sophistication and adoption of voice assistants further enhance the utility of smart devices as PC substitutes.

- Market Growth: The projected over $160 billion global smart home market in 2024 highlights the significant and expanding reach of these substitute products.

Increased Lifespan and Upgrade Cycles of Existing PCs

The increasing durability and performance of personal computers mean consumers are holding onto their devices longer. This extended lifespan acts as a substitute for new purchases, directly impacting demand for ASUSTeK's products. For instance, a PC that was cutting-edge in 2020 might still meet the needs of many users in 2024, especially with software optimizations.

Furthermore, the ability to upgrade individual components, such as RAM or storage, allows users to refresh their existing machines rather than buying entirely new ones. This trend is exacerbated by the fact that many users found their existing hardware perfectly capable of running Windows 11, a major operating system upgrade that historically spurred PC sales.

- Extended Upgrade Cycles: Consumers are delaying PC purchases due to improved product longevity.

- Component Upgradability: Users can refresh existing PCs, reducing the need for new units.

- Software Optimization: Operating system updates like Windows 11 often run well on older hardware, diminishing the urgency to upgrade.

- Impact on Demand: This substitution effect directly curtails the overall market demand for new PCs, affecting ASUSTeK's sales volumes.

The threat of substitutes for ASUSTeK's PC business is multifaceted, encompassing mobile devices, cloud computing, and even longer product lifecycles. The growing capabilities of smartphones and tablets mean many users can now handle tasks previously requiring a laptop or desktop. For example, global tablet shipments were expected to exceed 120 million units in 2024, highlighting their widespread adoption as functional alternatives.

Cloud gaming services and smart home devices also chip away at the traditional PC market. Cloud gaming eliminates the need for powerful local hardware, while smart devices can manage many basic computing tasks. The increasing durability and upgradability of existing PCs further reduce the incentive for new purchases, as users can extend the life of their current machines. This trend is amplified by operating systems like Windows 11 often running smoothly on older hardware, delaying upgrade cycles.

| Substitute Category | Key Characteristics | Impact on ASUSTeK | 2024 Data/Trend |

| Smartphones & Tablets | Portability, convenience, sufficient for basic tasks | Reduces demand for entry-level and mid-range PCs | Global tablet shipments projected > 120 million units |

| Cloud Computing/Services | Centralized processing, reduced hardware dependency | Decreases need for high-specification individual devices | Growing adoption of VDI/DaaS models in enterprises |

| Cloud Gaming | Access to games without powerful local hardware | Threatens sales of gaming laptops and desktops | Expansion of services like GeForce Now, Xbox Cloud Gaming |

| Smart Home Devices | Voice control, basic information access, home automation | Substitutes for PC functions in casual use cases | Global smart home market projected > $160 billion |

| Extended PC Lifespan/Upgradability | Durability, component upgrades | Delays new PC purchase decisions | Windows 11 compatibility with older hardware |

Entrants Threaten

Entering the competitive computer hardware and electronics manufacturing arena demands significant upfront capital. ASUSTeK, like its peers, must invest heavily in advanced manufacturing facilities, robust supply chain networks, and ongoing research and development to stay ahead. For instance, the semiconductor industry alone, a crucial component for many hardware products, sees billions poured into fabrication plants and cutting-edge chip design.

These substantial financial barriers make it incredibly challenging for newcomers to challenge established players like ASUSTeK. The sheer scale of investment required for chip design, fabrication, and global distribution creates formidable entry hurdles. ASUSTeK benefits from its existing economies of scale and well-established infrastructure, making it difficult for less capitalized firms to achieve comparable cost efficiencies or market reach.

ASUSTeK, like its major competitors, has cultivated decades of strong brand loyalty. This makes it difficult for newcomers to gain consumer trust and market share. For instance, in 2023, ASUS maintained a significant presence in the gaming laptop market, a segment heavily influenced by brand perception and community endorsement.

Established players also benefit from robust, well-developed global distribution channels. New entrants would face immense hurdles and substantial investment to replicate these networks, secure shelf space, and ensure product availability. This includes the critical aspect of building comprehensive after-sales service and support infrastructure, which is a key differentiator for established brands.

ASUSTeK's extensive intellectual property and patent portfolios, particularly in areas like advanced motherboard designs and innovative cooling technologies, present a significant hurdle for potential new entrants. These robust protections mean newcomers must either navigate costly licensing agreements for established technologies or undertake substantial R&D to develop distinct, non-infringing innovations, effectively raising the barrier to entry.

Economies of Scale in Manufacturing and Procurement

ASUSTeK Computer leverages significant economies of scale in its manufacturing and component procurement, a key factor in deterring new entrants. Its massive production volumes allow for substantial cost reductions per unit, making it difficult for newcomers to match ASUSTeK's pricing without sacrificing profit margins.

- Lower Per-Unit Costs: ASUSTeK's ability to produce millions of units annually translates into lower manufacturing costs for each individual product.

- Bulk Purchasing Power: By procuring raw materials and components in vast quantities, ASUSTeK secures more favorable pricing from suppliers compared to smaller, emerging companies. For instance, in 2023, ASUSTeK's revenue reached approximately $14.7 billion, indicating the scale of its operations and purchasing influence.

- Assembly Efficiency: Large-scale, optimized assembly lines further reduce labor and overhead costs per unit, creating a cost barrier for new players.

Regulatory Hurdles and Compliance Costs

The threat of new entrants for Asustek Computer is significantly influenced by substantial regulatory hurdles and the associated compliance costs. Entering the global electronics market requires new players to meticulously navigate a complex web of international standards, environmental regulations, and safety certifications. For instance, compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in the European Union, or FCC regulations in the United States, demands significant investment in testing and documentation.

These requirements are not only time-consuming but also financially burdensome, creating a considerable barrier for smaller or less capitalized companies looking to compete. Furthermore, the increasing focus on e-waste management and responsible sourcing of materials, such as conflict minerals, adds another layer of complexity and expense that potential new entrants must overcome to establish a legitimate and sustainable presence in the market.

The threat of new entrants for Asustek Computer is relatively low due to the immense capital required for R&D, manufacturing, and global distribution networks. Established brand loyalty and extensive intellectual property further solidify Asustek's position, making it difficult for newcomers to gain traction. Significant economies of scale in production and procurement also create substantial cost advantages for Asustek, presenting a formidable barrier.

New entrants also face considerable regulatory compliance costs and the need to build complex after-sales service infrastructure. For example, Asustek's 2023 revenue of approximately $14.7 billion underscores the scale of operations and purchasing power that new companies would struggle to match. These combined factors create a high barrier to entry in the competitive computer hardware market.

| Factor | Impact on New Entrants | Asustek's Advantage |

| Capital Requirements | Very High (R&D, Manufacturing, Distribution) | Established Infrastructure, Economies of Scale |

| Brand Loyalty | Challenging to Build | Decades of Market Presence, Gaming Community Focus |

| Intellectual Property | Requires Licensing or Innovation | Extensive Patent Portfolios (Motherboards, Cooling) |

| Economies of Scale | Difficult to Achieve | Lower Per-Unit Costs, Bulk Purchasing Power (e.g., $14.7B revenue in 2023) |

| Distribution Channels | Costly to Replicate | Global Network, Established Retailer Relationships |

| Regulatory Compliance | Time-Consuming and Expensive | Existing Expertise and Processes |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Asustek Computer leverages data from company annual reports, financial statements, and investor relations disclosures. We also incorporate insights from reputable industry research firms and market intelligence platforms to comprehensively assess competitive dynamics.