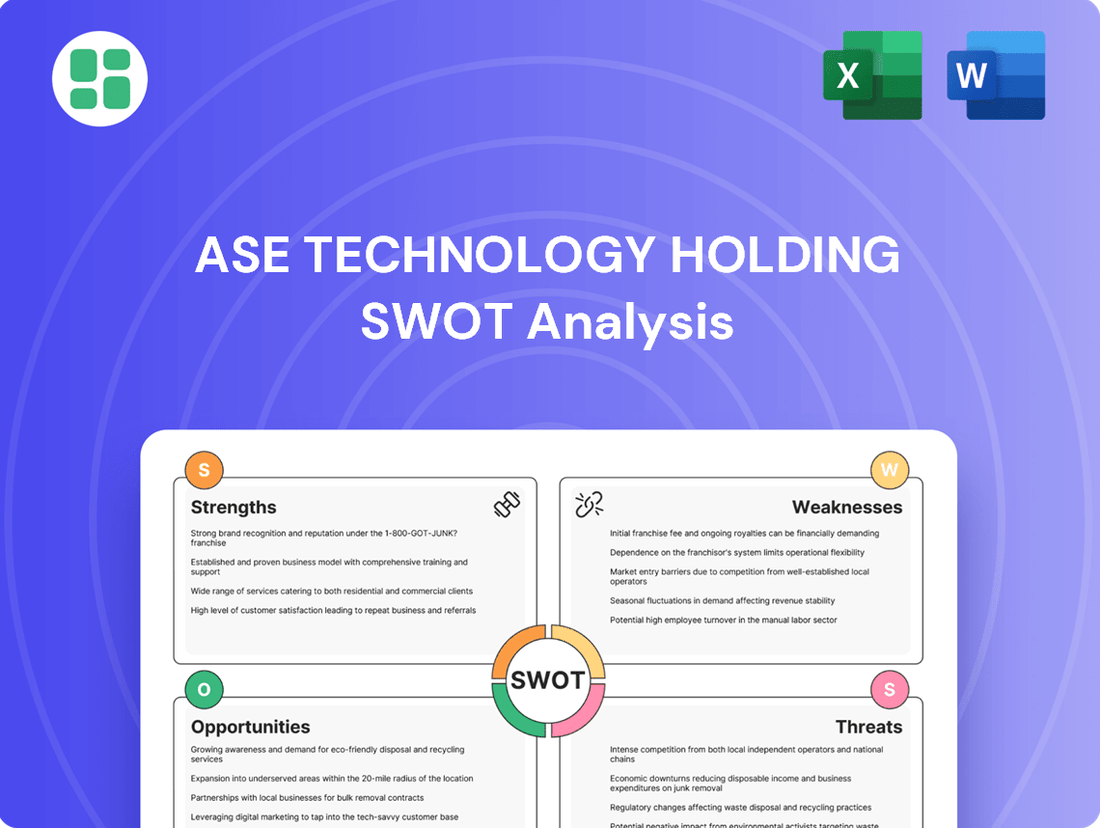

ASE Technology Holding SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASE Technology Holding Bundle

ASE Technology Holding's robust market position is built on significant strengths in advanced packaging and testing, but understanding its full potential requires a deeper dive. Our comprehensive SWOT analysis reveals critical opportunities for expansion and potential threats to navigate effectively.

Want the full story behind ASE's competitive advantages, potential weaknesses, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

ASE Technology Holding stands as the undisputed global leader in semiconductor assembly and testing services, holding a commanding 44.6% share of the OSAT market in 2024. This unparalleled scale translates into significant cost advantages and operational efficiencies, allowing ASE to deliver highly competitive solutions to a broad customer base. Its vast global manufacturing network further cements its dominant position.

ASE Technology Holding boasts a comprehensive service portfolio that covers the entire semiconductor manufacturing process. This includes critical stages like front-end engineering test, wafer probing, IC packaging, and final testing, offering truly integrated turnkey solutions. This end-to-end capability positions ASE as a vital partner for IC design firms seeking a single, reliable source for their manufacturing needs.

ASE Technology Holding’s diversified end-market exposure is a significant strength. The company caters to a broad spectrum of vital industries, including communications, computing, consumer electronics, industrial applications, and the automotive sector. This wide reach insulates ASE from downturns in any single market, offering substantial resilience against economic volatility.

This broad market penetration is particularly beneficial given current trends. For example, the burgeoning demand for artificial intelligence (AI) chips and advanced computing solutions has directly fueled impressive growth within ASE's advanced technology manufacturing (ATM) segment. This demonstrates the tangible benefit of their diversified strategy in capitalizing on high-growth areas.

Technological Leadership in Advanced Packaging and Testing

ASE Technology Holding boasts a significant technological advantage in advanced semiconductor packaging and testing. Its expertise spans critical areas such as bumping, flip chip, Wafer-Level Packaging (WLP), and System-in-Package (SiP). These advanced solutions are increasingly in demand, as evidenced by their contribution to 47% of ASE's ATM segment revenue in 2024.

The company's commitment to innovation is underscored by substantial R&D investments. In 2024, ASE allocated $16.3 billion towards research and development, with a strategic focus on enhancing automation, developing smart factories, and integrating ESG principles. This forward-looking investment fuels advancements in cutting-edge packaging technologies essential for high-growth sectors like artificial intelligence (AI) and high-performance computing (HPC).

- Technological Edge: Dominance in advanced packaging like WLP and SiP.

- Revenue Contribution: Advanced packaging accounted for 47% of ATM segment revenue in 2024.

- R&D Investment: $16.3 billion invested in 2024 for automation and AI/HPC solutions.

Critical Role in Semiconductor Supply Chain

ASE Technology Holding holds a critical position within the global semiconductor supply chain, acting as a vital enabler for integrated circuit design firms to successfully launch their products. This indispensable role makes ASE a key partner for a wide range of semiconductor players, including fabless companies, integrated device manufacturers (IDMs), and foundries.

The company's expertise in handling the escalating complexity and continuous miniaturization of semiconductors is fundamental to the ongoing progress of the entire industry. For instance, ASE's advanced packaging solutions are essential for advanced nodes, with leading-edge nodes like 3nm and 2nm requiring sophisticated integration techniques that ASE specializes in.

- Indispensable Partner: ASE's services are crucial for the go-to-market strategy of chip designers.

- Enabling Innovation: The company's capabilities facilitate the development and production of next-generation chips.

- Industry Advancement: ASE's support for complex chip designs drives technological progress across the semiconductor sector.

ASE Technology Holding's market leadership is a significant strength, evidenced by its commanding 44.6% share of the OSAT market in 2024. This scale provides substantial cost advantages and operational efficiencies, enabling competitive pricing and attracting a diverse global clientele. Its extensive manufacturing footprint further solidifies this dominant market position.

The company's comprehensive, end-to-end service portfolio, from front-end engineering to final testing, makes it an indispensable partner for IC design firms. This integrated approach streamlines the manufacturing process, offering a single point of contact for complex production needs. ASE's ability to handle the intricate demands of advanced semiconductor manufacturing, including support for leading-edge nodes like 3nm and 2nm, is critical for industry innovation.

Diversified end-market exposure across communications, computing, consumer electronics, industrial, and automotive sectors provides significant resilience. This broad reach allows ASE to capitalize on growth in high-demand areas like AI and HPC, as seen in its advanced technology manufacturing segment. Their commitment to R&D, with $16.3 billion invested in 2024, fuels advancements in crucial areas like AI/HPC packaging.

| Metric | 2024 Data | Significance |

|---|---|---|

| OSAT Market Share | 44.6% | Global leadership and scale advantage |

| ATM Segment Revenue Contribution (Advanced Packaging) | 47% | Strong demand for cutting-edge solutions |

| R&D Investment | $16.3 billion | Focus on future technologies (AI, HPC) and automation |

What is included in the product

This analysis maps out ASE Technology Holding’s market strengths, operational gaps, and risks, providing a comprehensive view of its competitive landscape.

Offers a clear, actionable framework for leveraging ASE Technology Holding's strengths and addressing its weaknesses.

Weaknesses

ASE Technology Holding's position as a leading OSAT provider means it's deeply intertwined with the semiconductor industry's inherent cyclicality. This exposure means that shifts in global demand for electronics, from smartphones to automotive components, directly impact ASE's business. For instance, a slowdown in consumer spending, as seen in parts of 2023, can lead to reduced chip orders, creating overcapacity within the industry and subsequently putting downward pressure on pricing for ASE's services.

This cyclical nature necessitates robust capacity planning and a flexible operational strategy to navigate periods of both high demand and downturns. The company must be adept at scaling its operations up or down to match market conditions, a challenge amplified by the capital-intensive nature of semiconductor manufacturing. For example, while the industry experienced strong growth in 2021, the subsequent inventory correction in 2022 and 2023 highlighted the volatility ASE must manage.

Maintaining technological leadership and expanding capacity in advanced packaging and testing requires significant, ongoing capital investment. ASE Technology Holding has seen its capital expenditures rise substantially, with a considerable portion directed towards cutting-edge technologies.

For instance, ASE's capital expenditure for 2024 was projected to be between $1.2 billion and $1.4 billion, a notable increase reflecting the need for advanced capacity. This heavy investment, while crucial for future growth, can strain the company's financial liquidity and impact its short-term profit margins.

ASE Technology Holding operates in a highly competitive arena, facing significant pressure from established OSAT (Outsourced Semiconductor Assembly and Test) players and emerging Chinese competitors. These rivals, often bolstered by domestic market demand and government support, can exert downward pressure on pricing, particularly in commoditized assembly services.

This intense rivalry directly impacts ASE's profit margins. For instance, while the semiconductor industry saw robust growth in 2024, the OSAT segment often experiences thinner margins compared to chip design or manufacturing. ASE's ability to maintain its market share and profitability hinges on its capacity to innovate and offer higher-value, differentiated services that command better pricing power.

Reliance on Key Customers and Market Segments

ASE Technology Holding's reliance on a few major clients presents a notable weakness. In the second quarter of 2025, its top five customers represented a significant 43% of the company's total revenue, highlighting a concentration risk. This dependence means that the loss or reduced business from even a single large customer could materially affect ASE's financial results.

Furthermore, performance fluctuations within specific business units can create vulnerabilities. For instance, the electronic manufacturing services (EMS) segment experienced a 6.6% year-over-year revenue decrease in Q2 2025. While other segments may be growing, a downturn in a key area like EMS can drag down overall performance.

- Customer Concentration: Top 5 customers accounted for 43% of Q2 2025 revenue.

- Segmental Weakness: EMS business saw a 6.6% year-over-year decline in Q2 2025.

Geopolitical Risks and Supply Chain Vulnerabilities

ASE Technology Holding, as a Taiwan-based entity with extensive global operations, faces significant exposure to geopolitical risks. Tensions between major economic powers like the U.S. and China, alongside cross-strait relations, create a volatile operating environment.

These geopolitical factors can directly translate into tangible business challenges for ASE. Potential outcomes include the imposition of trade restrictions, which could hinder market access or increase the cost of doing business. Furthermore, disruptions to raw material supply chains are a persistent concern, impacting production schedules and overall operational efficiency.

The uncertainty stemming from these geopolitical dynamics can lead to increased operational uncertainties for ASE. For instance, the semiconductor industry, where ASE is a major player, is particularly sensitive to trade policies and national security concerns. As of early 2025, ongoing discussions around technology decoupling and export controls continue to shape the landscape for companies like ASE, potentially affecting their ability to source components or serve key markets.

- Geopolitical Sensitivity: ASE's Taiwan domicile places it at the nexus of significant international geopolitical developments, particularly U.S.-China relations.

- Supply Chain Disruption Risk: Global trade tensions and regional instability directly threaten the continuity and cost-effectiveness of ASE's intricate supply chains.

- Operational Uncertainty: Heightened geopolitical risks contribute to an unpredictable business environment, impacting strategic planning and investment decisions.

- Trade Policy Impact: Changes in trade regulations and export controls, especially concerning advanced technologies, pose a direct threat to ASE's market access and profitability.

ASE Technology Holding's significant capital expenditure, projected between $1.2 billion and $1.4 billion for 2024, while necessary for advanced packaging, can strain its financial liquidity and impact short-term profit margins. Intense competition from established OSAT players and emerging Chinese firms, often with government backing, pressures pricing and narrows profit margins, especially in commoditized services. The company's reliance on a few major clients, with the top five accounting for 43% of Q2 2025 revenue, creates a substantial concentration risk where the loss of a major customer could severely affect financial results.

Full Version Awaits

ASE Technology Holding SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. Gain immediate access to the complete ASE Technology Holding SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The explosive growth in artificial intelligence (AI) and high-performance computing (HPC) presents a substantial opportunity for ASE Technology Holding. The need for more powerful and energy-efficient processors to handle complex AI algorithms and massive data processing in HPC environments directly fuels demand for ASE's advanced packaging and testing solutions.

ASE's expertise in advanced packaging is critical for enabling the performance gains and thermal management necessary for AI and HPC chips. For example, the increasing complexity of AI accelerators, often requiring multiple chiplets integrated into a single package, plays directly into ASE's strengths in heterogeneous integration. This trend is expected to continue its upward trajectory throughout 2024 and 2025, driving significant revenue for ASE.

The advanced packaging market is experiencing robust expansion, fueled by the ongoing drive for smaller, more powerful, and integrated electronic components. This growth is particularly pronounced in areas like heterogeneous integration, where different types of chips are combined, and chiplet architectures, which break down complex processors into smaller, specialized units. Analysts project this segment to grow significantly in the coming years, with some estimates placing the compound annual growth rate (CAGR) in the high single digits or even low double digits through 2025.

ASE Technology Holding is strategically positioned to capitalize on this trend. Their ongoing investment in and development of cutting-edge packaging solutions, such as Fan-Out Chip-on-Substrate-Bridge with Through Silicon Via (TSV) technology, directly addresses the industry's demand for advanced capabilities. This innovation allows for greater density and performance, enabling ASE to secure a more substantial portion of this burgeoning market as manufacturers increasingly rely on these sophisticated packaging methods.

The semiconductor industry's ongoing shift sees Integrated Device Manufacturers (IDMs) and fabless companies increasingly relying on specialized Outsourced Semiconductor Assembly and Test (OSAT) providers. This strategic move enables chip designers to concentrate their resources on innovation and product development, fueling consistent demand for ASE Technology Holding's advanced assembly and testing capabilities.

This trend is particularly evident as the global semiconductor outsourcing market continues its upward trajectory. For instance, the OSAT market was valued at approximately $27 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2028, highlighting a robust and expanding opportunity for companies like ASE that offer comprehensive and cost-efficient solutions.

Geographical Diversification and New Market Penetration

ASE Technology Holding's global presence, extending beyond its Taiwan stronghold into rapidly growing Southeast Asian markets, presents a significant opportunity. This geographical diversification is particularly advantageous as regions like Vietnam and Malaysia are actively fostering semiconductor manufacturing through supportive policies, driving expansion in the Outsourced Semiconductor Assembly and Test (OSAT) sector. ASE's existing footprint in these areas positions it well to capitalize on this trend.

Expanding operations or forging new strategic alliances in these emerging economies can significantly bolster ASE's revenue diversification. This strategic move also serves to reduce reliance on any single region, thereby mitigating potential risks associated with geopolitical shifts or concentrated market dependencies. For instance, the semiconductor industry in Southeast Asia experienced robust growth in 2024, with several countries offering attractive investment incentives.

- Southeast Asia's OSAT Market Growth: The OSAT market in Southeast Asia is projected to see substantial growth, driven by government initiatives and increasing foreign direct investment in the semiconductor sector throughout 2024 and into 2025.

- Risk Mitigation through Diversification: Establishing a stronger presence in markets like Vietnam and Malaysia can dilute the impact of any potential geopolitical tensions affecting Taiwan, a key operational hub for ASE.

- Leveraging Existing Infrastructure: ASE's current operational capabilities in Southeast Asia provide a foundation for further expansion, allowing for quicker market penetration and operational scaling compared to establishing entirely new bases.

Strategic Partnerships and Mergers & Acquisitions

Collaborations with leading foundries, particularly TSMC in advanced packaging like CoWoS, offer a significant avenue for ASE to bolster its technological prowess and ensure a steady stream of orders. This strategic alignment is crucial in the rapidly evolving semiconductor landscape.

ASE can leverage these partnerships to gain access to cutting-edge manufacturing processes, which is essential for staying competitive. For instance, TSMC's CoWoS technology is a key enabler for high-performance computing and AI chips, areas where ASE's advanced packaging solutions are in high demand.

Furthermore, strategic acquisitions or joint ventures present a compelling opportunity for ASE to broaden its technological offerings, increase its market penetration, and extend its global footprint. This inorganic growth strategy can accelerate market share gains and diversify its service portfolio.

- Enhanced Capabilities: Partnerships with foundries like TSMC for advanced packaging (e.g., CoWoS) allow ASE to access and integrate leading-edge technologies.

- Secured Orders: Collaborations in advanced packaging are expected to drive robust order volumes, particularly for high-demand sectors like AI and HPC.

- Portfolio Expansion: Strategic acquisitions and joint ventures can broaden ASE's technological expertise and service offerings.

- Market and Geographic Reach: Inorganic growth strategies can significantly boost ASE's market share and expand its operational presence globally.

The surging demand for AI and high-performance computing (HPC) creates a substantial opportunity for ASE Technology Holding, as advanced packaging is crucial for these powerful chips. The global advanced packaging market is projected for robust growth, with some forecasts indicating a CAGR in the high single digits or low double digits through 2025, directly benefiting ASE's expertise.

ASE's strategic global expansion, particularly into Southeast Asia, offers a significant growth avenue. This diversification into markets like Vietnam and Malaysia, which are actively promoting semiconductor manufacturing, positions ASE to capitalize on regional growth and mitigate geopolitical risks. The OSAT market in Southeast Asia is expected to see substantial growth through 2025, driven by government initiatives and increasing investment.

Collaborations with leading foundries, such as TSMC for advanced packaging technologies like CoWoS, are vital for ASE to enhance its technological capabilities and secure consistent orders. These partnerships are essential for staying competitive in the rapidly evolving semiconductor industry, especially as demand for AI and HPC solutions continues to escalate.

Strategic acquisitions and joint ventures also present a compelling opportunity for ASE to expand its technological portfolio, market reach, and global footprint. This inorganic growth strategy can accelerate market share gains and diversify its service offerings, further solidifying its position in the advanced packaging sector.

Threats

A global economic slowdown, particularly impacting consumer electronics, poses a significant threat to ASE Technology Holding. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.8% in 2024, down from 3.2% in 2023, indicating potential headwinds for demand in ASE's core markets.

Customer inventory adjustments, often a reaction to softening demand, can directly translate into fewer orders for ASE's assembly, testing, and packaging services. This can lead to revenue compression and impact profitability as the company navigates periods of reduced order volumes.

Ongoing geopolitical tensions, especially the US-China trade disputes and the situation around Taiwan, present a substantial threat to ASE Technology Holding's operations and its intricate supply chain. These tensions can lead to unpredictable disruptions, impacting everything from raw material sourcing to the final delivery of finished semiconductor products.

The implementation of export controls and tariffs by various nations, coupled with a global trend towards regional self-sufficiency in semiconductor manufacturing, directly threatens to fragment global trade. This could severely limit ASE's market access and increase the cost of doing business across different regions.

The semiconductor sector demands relentless innovation, forcing companies like ASE Technology Holding to pour significant resources into research and development. For instance, global semiconductor R&D spending was projected to exceed $100 billion in 2024, a testament to this competitive pressure. Falling behind on next-generation technologies or absorbing these escalating R&D costs can severely impact profitability and market share.

Intensifying Competition from Domestic and International Players

ASE Technology Holding navigates an increasingly competitive landscape, facing pressure from both established global Outsourced Semiconductor Assembly and Test (OSAT) providers and burgeoning domestic competitors, particularly within China. This intensified rivalry can manifest as aggressive pricing strategies or the introduction of highly specialized services by rivals, potentially triggering price wars and eroding ASE's market share.

For instance, while ASE remains a dominant force, the growth of Chinese OSAT companies, often supported by national initiatives, presents a significant challenge. These players are rapidly advancing their technological capabilities and expanding their capacity. In 2024, the global OSAT market is projected to see continued growth, but this expansion will be accompanied by heightened competition, impacting profit margins for all participants.

Key competitive pressures include:

- Price Sensitivity: Competitors may engage in aggressive pricing to gain market entry or expand their footprint, forcing ASE to potentially lower its own prices.

- Technological Advancement: Emerging players are investing heavily in R&D, aiming to match or surpass ASE's technological prowess in areas like advanced packaging.

- Regional Focus: Domestic competitors in key markets, like China, benefit from local government support and a deep understanding of regional customer needs, creating localized competitive advantages.

Supply Chain Disruptions and Raw Material Shortages

Global supply chains continue to present significant risks, with events like the ongoing geopolitical tensions and the lingering effects of the COVID-19 pandemic creating persistent vulnerabilities. These disruptions can directly impact ASE Technology Holding's ability to source essential materials and components. For instance, the semiconductor industry, in general, has faced significant lead time extensions for key materials throughout 2024, impacting production schedules across the board.

Shortages or sudden price hikes for critical raw materials, such as silicon wafers or specialized chemicals, pose a direct threat to ASE's profitability and operational efficiency. The cost of polysilicon, a fundamental material for wafer production, saw fluctuations in late 2023 and early 2024, with some reports indicating a nearly 15% increase in certain grades due to supply constraints. Such volatility directly affects ASE's manufacturing expenses and its ability to maintain competitive pricing.

- Vulnerability to Geopolitical Events: Ongoing international conflicts and trade disputes can interrupt the flow of critical components and raw materials.

- Pandemic-Related Lingering Effects: While the immediate crisis has passed, the pandemic's impact on logistics and labor availability continues to create supply chain fragilities.

- Raw Material Price Volatility: Fluctuations in the cost of essential inputs like silicon, copper, and specialized chemicals directly impact ASE's cost of goods sold.

- Component Lead Time Extensions: Extended lead times for advanced packaging materials and specialized equipment can delay production and impact order fulfillment.

The semiconductor industry's inherent cyclicality, coupled with a global economic slowdown, presents a significant threat. For example, the World Semiconductor Trade Statistics (WSTS) projected a 2.9% decline in the global semiconductor market for 2023, with a modest rebound expected in 2024, highlighting the sensitivity to broader economic conditions.

Intensifying competition, particularly from Chinese OSAT players backed by government initiatives, challenges ASE's market position. These rivals are rapidly enhancing technological capabilities and capacity, potentially leading to price wars. The OSAT market is expected to grow, but this growth will be accompanied by heightened competition, impacting profit margins.

Geopolitical instability, including US-China trade tensions and concerns surrounding Taiwan, directly threatens ASE's supply chain and operations. Export controls and tariffs further fragment global trade, potentially limiting market access and increasing operational costs.

| Threat Category | Specific Threat | Impact on ASE | Relevant Data/Context (2023-2025) |

|---|---|---|---|

| Economic Headwinds | Global Economic Slowdown | Reduced consumer electronics demand, lower order volumes | IMF projected global growth of 2.8% in 2024 (down from 3.2% in 2023) |

| Competitive Landscape | Intensified OSAT Competition (esp. China) | Price erosion, market share challenges, R&D cost pressure | Global OSAT market growth with increased rivalry in 2024 |

| Geopolitical Risks | US-China Trade Tensions & Taiwan Situation | Supply chain disruptions, operational impacts, trade barriers | Ongoing geopolitical tensions impacting global trade flows |

| Supply Chain Vulnerabilities | Raw Material Price Volatility & Lead Times | Increased manufacturing costs, production delays | Polysilicon price increases (up to 15% in late 2023/early 2024 for some grades) |

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including ASE Technology Holding's official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a robust and accurate view of the company's operational landscape.