ASE Technology Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASE Technology Holding Bundle

Navigate the complex external forces shaping ASE Technology Holding's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, environmental regulations, and social trends are impacting the semiconductor packaging industry. Gain a strategic advantage by leveraging these critical insights. Download the full PESTLE analysis now to unlock actionable intelligence and fortify your market position.

Political factors

Geopolitical tensions, especially between the United States and China, continue to cast a long shadow over the semiconductor industry. For ASE Technology Holding, this translates to potential disruptions in the complex global supply chain and challenges in accessing key markets. For instance, the US CHIPS and Science Act, passed in 2022, aims to bolster domestic semiconductor manufacturing, potentially altering global production dynamics and trade flows.

Evolving trade policies, including tariffs and export controls, directly impact ASE's international operations. These measures can restrict access to essential technologies and influence where the company chooses to invest. Navigating this intricate political terrain requires careful strategic planning to mitigate risks and capitalize on opportunities amidst changing global trade landscapes.

Governments globally are increasingly providing significant subsidies and incentives to bolster domestic semiconductor manufacturing and lessen dependence on overseas suppliers. ASE Technology Holding could see benefits from these initiatives, which are designed to spur investment in new fabrication plants, research and development, and workforce training. For instance, the US CHIPS and Science Act, enacted in 2022, allocated over $52 billion for semiconductor manufacturing and research, with many companies announcing new facilities in response. Similarly, the EU's European Chips Act aims to mobilize at least €43 billion in public and private investments by 2030.

The strength and enforcement of intellectual property laws in key operating regions, particularly in Asia where much of the semiconductor manufacturing occurs, are critical for ASE Technology Holding. Robust IP protection safeguards their advanced assembly and testing methodologies, preventing competitors from replicating their innovations and eroding their market position.

In 2024, the global focus on strengthening IP rights, especially concerning advanced manufacturing processes and semiconductor technologies, continues to be a significant political factor. Countries are increasingly recognizing the economic value of intellectual property, leading to more stringent enforcement and higher penalties for infringement, which directly benefits companies like ASE that invest heavily in R&D.

Regulatory Stability and Political Risk

ASE Technology Holding's operations are significantly influenced by the political stability of its key operating regions, particularly Taiwan, a critical hub for the semiconductor industry. Political stability directly impacts the security of investments and the continuity of business operations. For instance, Taiwan's robust democratic framework and its strategic importance in global tech supply chains have historically fostered a stable environment for companies like ASE.

However, shifts in government or policy can introduce political risk. These changes can affect trade relations, regulatory frameworks, and market access, potentially disrupting supply chains and demand for semiconductor services. The geopolitical landscape surrounding Taiwan, including cross-strait relations, remains a key consideration for assessing political risk.

In 2024, ongoing geopolitical tensions continue to underscore the importance of political risk assessment for companies like ASE. While specific policy shifts directly impacting ASE's core business in the immediate short term are not widely publicized, the broader geopolitical climate influences investor sentiment and long-term strategic planning within the semiconductor sector.

Key considerations for ASE Technology Holding regarding political factors include:

- Regulatory Stability: Taiwan's consistent regulatory environment for foreign investment and technology sectors provides a foundation for operational stability.

- Geopolitical Tensions: The ongoing geopolitical situation in the Indo-Pacific region presents potential risks to supply chain integrity and market access.

- Government Support for Tech: Policies aimed at bolstering the semiconductor industry, such as those seen in various global governments, can create opportunities but also signal potential future regulatory shifts.

- Trade Policies: International trade agreements and disputes, particularly between major economic blocs, can indirectly affect ASE's global customer base and market dynamics.

National Security and Technology Control

Governments worldwide are increasingly prioritizing national security, with semiconductor manufacturing at the forefront of this concern. This heightened focus translates into more stringent regulations on technology transfer and foreign investment, directly impacting companies like ASE Technology Holding. For instance, the US CHIPS and Science Act of 2022, with its significant funding for domestic semiconductor production, underscores this trend by aiming to bolster American chip manufacturing capabilities and reduce reliance on foreign sources.

Navigating these evolving geopolitical landscapes presents a significant challenge for ASE Technology Holding. Stricter controls can impede global expansion plans, complicate strategic partnerships, and limit access to certain markets or critical technologies. The company's ability to adapt its operational and investment strategies will be crucial in maintaining its competitive edge amidst these national security-driven technological controls.

- National Security Imperative: Governments view semiconductor independence as vital for economic stability and national defense, leading to increased scrutiny of the industry.

- Regulatory Hurdles: ASE Technology Holding faces potential restrictions on technology sharing, foreign acquisitions, and market access due to national security concerns.

- Impact on Global Operations: These regulations can shape ASE's global footprint, influencing where it can invest, partner, and sell its advanced packaging and semiconductor solutions.

- Strategic Adaptation Required: The company must proactively adjust its business strategies to comply with diverse national security policies and maintain its international market presence.

Geopolitical shifts, particularly the ongoing US-China tech rivalry, continue to shape the semiconductor landscape, impacting ASE Technology Holding's global supply chains and market access. Government incentives, such as the US CHIPS and Science Act (2022) allocating over $52 billion, and the EU's European Chips Act, aim to boost domestic manufacturing, presenting both opportunities and potential shifts in investment for ASE.

National security concerns are driving increased regulatory scrutiny on technology transfer and foreign investment, potentially creating hurdles for ASE's international operations and partnerships. The political stability of key regions like Taiwan remains crucial for ASE's operational continuity and investment security, though cross-strait relations introduce a persistent element of geopolitical risk.

What is included in the product

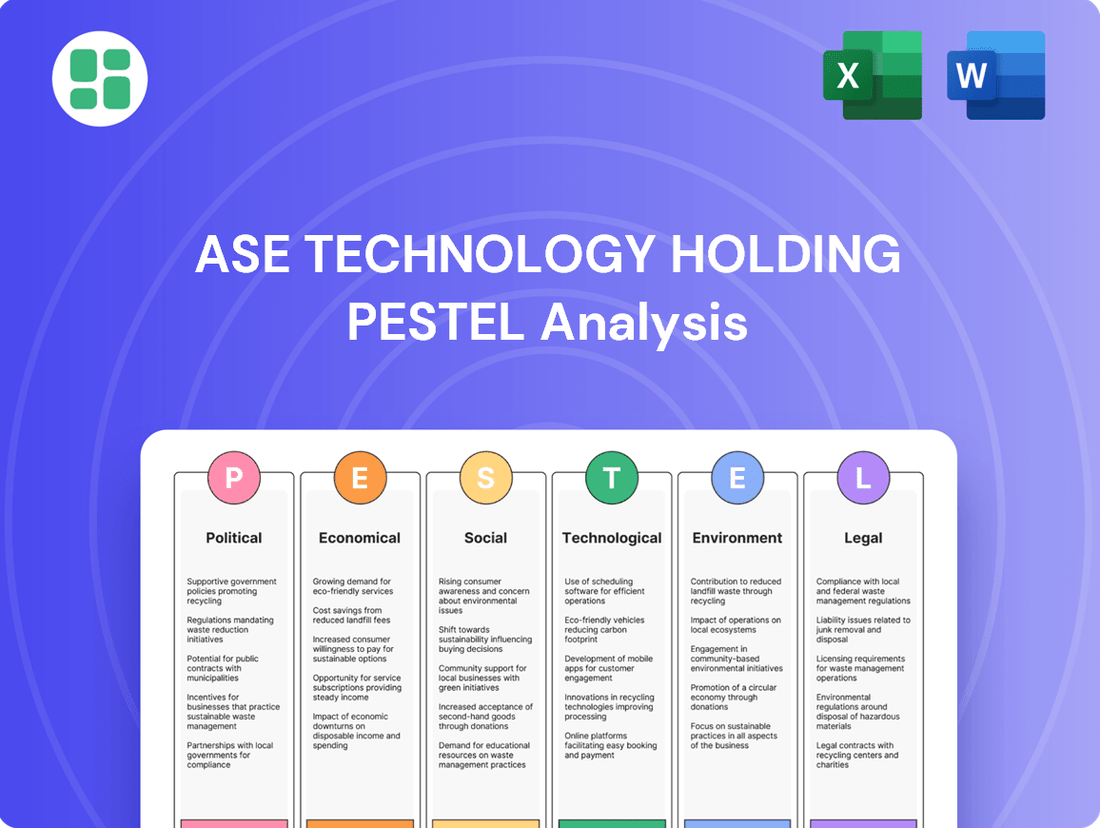

This PESTLE analysis investigates the Political, Economic, Social, Technological, Environmental, and Legal factors impacting ASE Technology Holding, providing a comprehensive understanding of the external forces shaping its operational landscape and strategic decision-making.

A clear, actionable PESTLE analysis for ASE Technology Holding that translates complex external factors into manageable insights, easing the burden of strategic planning.

Economic factors

The global semiconductor market is inherently cyclical, with periods of rapid growth often followed by contractions. This volatility is fueled by the interplay of consumer demand for electronics, enterprise investment in technology, and the pace of innovation. For ASE Technology Holding, a major player in semiconductor assembly and testing, these cycles directly impact order volumes and pricing power.

For instance, the semiconductor industry experienced a significant upswing in 2021, with global sales reaching a record $553 billion according to the Semiconductor Industry Association (SIA). However, by 2023, the market faced a downturn, with SIA reporting a 10.9% decline in sales to $520 billion, highlighting the sharp swings. ASE's performance is thus closely tied to navigating these demand fluctuations and managing inventory effectively.

Looking ahead, forecasts for 2024 suggest a rebound, with the SIA projecting a 13.1% increase in global semiconductor sales to $588.4 billion. This projected growth indicates a potential recovery in demand for ASE's services. However, the industry's sensitivity to economic conditions and geopolitical factors means that careful strategic planning and operational agility remain paramount for sustained success.

ASE Technology Holding, like many global manufacturers, faces headwinds from rising inflation. For instance, the Consumer Price Index (CPI) in the US, a key market, saw a significant increase, reaching 3.4% year-over-year as of April 2024, impacting the cost of essential inputs. This inflationary pressure directly translates to higher expenses for raw materials, energy, and labor, potentially squeezing ASE's profit margins.

The prevailing higher interest rate environment, with central banks like the Federal Reserve maintaining restrictive monetary policy, also presents challenges. For example, the Fed's target range for the federal funds rate remained at 5.25%-5.50% through early 2024. This makes borrowing more expensive for ASE, potentially increasing the cost of capital for crucial investments in advanced manufacturing technologies and capacity expansion, which are vital for staying competitive in the semiconductor industry.

Economic disruptions, like the lingering effects of the COVID-19 pandemic and geopolitical tensions, have significantly exposed weaknesses in global supply chains. This has translated into material shortages and elevated logistics expenses for companies like ASE Technology Holding, impacting their operational costs and ability to meet demand. For instance, shipping costs from Asia to the US saw substantial increases throughout 2023 and into early 2024, with some container rates doubling compared to pre-pandemic levels.

ASE Technology Holding is actively working to bolster its supply chain resilience to navigate these volatile conditions and manage escalating cost pressures. By diversifying its supplier base and exploring nearshoring options, the company aims to mitigate the impact of potential disruptions and maintain competitive pricing for its advanced semiconductor packaging and testing services. The semiconductor industry, in particular, faced significant component shortages in 2023, with lead times for certain materials extending to over a year, underscoring the critical need for robust supply chain strategies.

Currency Exchange Rate Volatility

Currency exchange rate volatility poses a significant challenge for ASE Technology Holding, a global player with extensive operations and a diverse customer base spanning multiple continents. Fluctuations in exchange rates can directly influence its reported financial performance, affecting everything from the value of international sales to the cost of imported components and labor. For instance, a strengthening US dollar against the Taiwanese dollar (TWD), where ASE is headquartered, could reduce the reported revenue from sales denominated in other currencies when translated back for financial reporting.

The impact of these currency shifts is substantial, necessitating robust risk management strategies. ASE must actively employ hedging techniques to mitigate the financial risks associated with international transactions. In 2024, for example, many multinational corporations, including those in the semiconductor sector, faced considerable headwinds from currency markets. The US dollar experienced periods of strength against major currencies like the Euro and Yen, impacting companies with significant European and Asian sales. This trend is expected to continue into 2025, demanding ongoing vigilance from financial teams at ASE.

- Impact on Revenue: A weaker foreign currency against the USD can decrease the dollar value of sales made in that currency.

- Impact on Costs: Conversely, a stronger foreign currency can increase the dollar cost of goods or services purchased abroad.

- Profitability: Net profit margins can be squeezed or expanded depending on the net exposure to currency movements.

- Hedging Costs: Implementing hedging strategies, while necessary, also incurs costs that affect profitability.

Consumer Spending and Demand for Electronics

Global consumer spending on electronics is the primary engine for ASE Technology Holding's business. When consumers are confident and have disposable income, they buy more smartphones, PCs, and vehicles equipped with advanced electronics, directly boosting demand for ASE's assembly and testing services.

Economic slowdowns can significantly dampen this demand. For instance, in 2023, global consumer spending growth moderated due to persistent inflation and higher interest rates, which likely impacted the volume of integrated circuits needing processing by companies like ASE. This trend is expected to continue into early 2024, though a potential rebound in consumer confidence could improve later in the year.

Key factors influencing this include:

- Consumer Confidence: Higher confidence generally correlates with increased spending on discretionary items like new electronic gadgets.

- Disposable Income: Wage growth and job security directly affect how much consumers can spend on electronics.

- Interest Rates: Higher rates can make financing for large purchases, such as cars with advanced electronics, less attractive.

- Technological Innovation: New product launches and compelling features can stimulate demand even in challenging economic periods.

Economic factors significantly shape ASE Technology Holding's operational landscape, from the cyclical nature of semiconductor demand to the impact of inflation and interest rates. The industry's inherent volatility, as seen in the 2023 sales dip to $520 billion followed by a projected 2024 rebound to $588.4 billion, directly influences ASE's order flow and pricing. Rising inflation, with US CPI at 3.4% in April 2024, increases operational costs, while elevated interest rates, with the Fed's rate at 5.25%-5.50%, make capital investments more expensive, impacting ASE's ability to expand and innovate.

Supply chain disruptions and currency fluctuations add further complexity. Lingering pandemic effects and geopolitical tensions have led to material shortages and increased logistics expenses, with shipping costs from Asia to the US doubling in some instances by early 2024. Currency volatility, such as the strengthening US dollar against the Taiwanese dollar, necessitates careful hedging strategies to protect profitability, a challenge many multinational corporations faced throughout 2024.

| Economic Factor | Impact on ASE Technology Holding | Data/Example (2023-2025) |

|---|---|---|

| Semiconductor Market Cycles | Influences order volume and pricing power. | 2023 sales: $520 billion (SIA); Projected 2024 sales: $588.4 billion (SIA) |

| Inflation | Increases raw material, energy, and labor costs, potentially squeezing margins. | US CPI: 3.4% year-over-year (April 2024) |

| Interest Rates | Raises the cost of capital for investments and expansion. | Federal Funds Rate target: 5.25%-5.50% (early 2024) |

| Supply Chain Disruptions | Leads to material shortages and elevated logistics expenses. | Shipping costs from Asia to US doubled compared to pre-pandemic levels (2023-early 2024) |

| Currency Exchange Rate Volatility | Affects reported revenue and the cost of imported components. | USD strength against TWD, EUR, JPY noted throughout 2024, expected into 2025. |

Preview Before You Purchase

ASE Technology Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ASE Technology Holding covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview of the external forces shaping ASE Technology Holding's strategic landscape.

Sociological factors

The semiconductor industry, including ASE Technology Holding, grapples with a significant global deficit of skilled engineers and technicians. This shortage directly impacts talent acquisition and retention, a key sociological challenge.

ASE Technology Holding faces intense competition for specialized talent in advanced packaging, testing, and materials science. To attract and keep these professionals, companies must offer competitive compensation, robust career development paths, and cultivate a positive corporate culture, especially as the demand for semiconductor talent continues to surge.

The global workforce is undergoing significant demographic shifts. In many developed nations, including key manufacturing hubs for ASE Technology Holding, populations are aging. This trend impacts labor availability and can lead to increased healthcare and pension costs. For instance, the median age in Japan, a significant market for electronics manufacturing, was 48.6 years in 2023, highlighting a mature workforce.

Concurrently, younger generations, particularly Millennials and Gen Z, are entering the workforce with a pronounced emphasis on work-life balance. They often prioritize flexibility, purpose-driven work, and continuous learning opportunities. This evolving mindset necessitates that companies like ASE Technology Holding rethink traditional HR approaches, potentially incorporating automation to offset labor shortages and offering flexible work arrangements to attract and retain talent.

Societal expectations for Corporate Social Responsibility (CSR) are intensifying, pushing companies like ASE Technology Holding to prioritize ethical labor, community involvement, and transparent governance. Consumers and employees alike are increasingly scrutinizing a company's commitment to sustainability and responsible practices.

ASE Technology Holding's brand image and its capacity to attract top talent and secure customer loyalty are directly influenced by its demonstrated dedication to these CSR principles. For instance, in 2023, a significant majority of consumers globally indicated they would switch brands if faced with a choice between two similar products where one had a stronger CSR record.

Consumer Trends in Technology Adoption

Sociological shifts are profoundly reshaping technology adoption, directly impacting semiconductor demand. The increasing consumer embrace of artificial intelligence (AI), the Internet of Things (IoT), and electric vehicles (EVs) are key drivers. For instance, the global AI chip market was projected to reach over $100 billion in 2024, highlighting a significant trend. ASE Technology Holding's ability to align its services and research with these evolving consumer preferences is crucial for sustained relevance and future growth.

These consumer trends manifest in several observable ways:

- Increased demand for AI-powered devices: Consumers are seeking smarter, more intuitive technology, driving the need for advanced AI processors.

- Growth of connected living: The widespread adoption of IoT devices, from smart home appliances to wearable technology, necessitates sophisticated connectivity solutions.

- Shift towards sustainable mobility: Consumer preference for electric vehicles is spurring innovation and production in automotive semiconductors.

- Personalization and customization: Consumers expect technology to adapt to their individual needs, pushing for more flexible and adaptable chip designs.

Workplace Diversity and Inclusion

Societal expectations increasingly emphasize workplace diversity and inclusion, recognizing their role in driving innovation and boosting employee satisfaction. ASE Technology Holding’s commitment to these principles directly impacts its creative output and problem-solving effectiveness.

A diverse workforce can lead to a wider range of perspectives, fostering a more dynamic environment. This inclusivity also enhances a company's attractiveness to a broader spectrum of talent, crucial for sustained growth.

- 2024 Data Point: Companies with above-average diversity in management teams reported 19% higher innovation revenues in the previous year, according to a McKinsey report.

- Employee Retention: A 2024 survey indicated that 70% of job seekers consider diversity and inclusion a key factor when evaluating potential employers.

- Talent Acquisition: ASE Technology Holding's ability to attract top global talent is directly linked to its demonstrated commitment to an inclusive culture.

Societal trends significantly influence the demand for semiconductors, with growing consumer adoption of AI, IoT, and EVs directly impacting ASE Technology Holding. For instance, the global AI chip market was projected to exceed $100 billion in 2024, underscoring a major growth area. The increasing preference for electric vehicles also fuels demand for specialized automotive semiconductors.

Workforce demographics present both challenges and opportunities. An aging population in key manufacturing regions, such as Japan where the median age was 48.6 in 2023, can strain labor availability. Conversely, younger generations prioritize work-life balance and purpose, pushing companies to adapt their HR strategies.

Corporate Social Responsibility (CSR) is a growing expectation, with consumers increasingly favoring companies with strong ethical and sustainable practices. In 2023, a significant majority of consumers indicated they would switch brands based on CSR performance, making it a critical factor for brand reputation and talent attraction.

Diversity and inclusion are recognized as drivers of innovation and employee satisfaction. Companies with diverse management teams reported 19% higher innovation revenues in the previous year, and 70% of job seekers consider D&I a key factor in employer evaluation.

| Sociological Factor | Impact on ASE Technology Holding | Supporting Data (2023-2024) |

|---|---|---|

| Consumer Tech Adoption (AI, IoT, EVs) | Increased demand for advanced semiconductor solutions | Global AI chip market projected >$100B in 2024 |

| Demographic Shifts (Aging Workforce) | Potential labor shortages and increased costs | Japan's median age was 48.6 in 2023 |

| Workforce Expectations (Work-Life Balance) | Need for flexible HR strategies and potential automation | Younger generations prioritize flexibility and purpose |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation and talent acquisition | Majority of consumers would switch brands for better CSR |

| Diversity & Inclusion | Improved innovation and talent attraction | 19% higher innovation revenue for diverse management; 70% of job seekers value D&I |

Technological factors

ASE Technology Holding, a leader in semiconductor packaging and testing, is significantly impacted by rapid technological advancements. Innovations like 3D IC stacking, chiplet integration, and advanced System-in-Package (SiP) solutions are reshaping the industry, demanding continuous adaptation and investment from ASE. These technologies enable higher performance and greater functionality in smaller form factors, crucial for next-generation electronics.

The company's commitment to research and development is paramount to maintaining its competitive edge in the outsourced semiconductor assembly and test (OSAT) market. For instance, ASE's substantial R&D expenditure, which has consistently been a significant portion of its revenue, allows it to pioneer and implement these cutting-edge packaging and testing methodologies. This focus ensures ASE can offer clients cost-effective and high-performance solutions, vital for staying ahead in a rapidly evolving technological landscape.

ASE Technology Holding is actively embracing automation and Industry 4.0. In 2023, the company continued its investment in smart manufacturing, aiming to boost productivity and precision across its assembly and testing operations. This strategic focus on integrating AI and advanced robotics is designed to streamline workflows and minimize manual intervention, directly impacting cost efficiencies and throughput.

The semiconductor industry's shift towards Industry 4.0 principles, which include the Internet of Things (IoT) and big data analytics, is a significant technological factor. ASE Technology Holding's adoption of these technologies allows for real-time monitoring and predictive maintenance, reducing downtime and enhancing overall equipment effectiveness. This proactive approach is crucial for maintaining a competitive edge in a rapidly evolving market.

By leveraging automation, ASE Technology Holding can achieve higher yield rates, a critical metric in semiconductor manufacturing where even small improvements can translate to substantial financial gains. For instance, enhanced process control through AI-driven systems can minimize defects, directly contributing to improved profitability and customer satisfaction. This technological integration is not just about efficiency; it's about elevating the quality and reliability of their offerings.

The rapid advancement of artificial intelligence (AI), the Internet of Things (IoT), and high-performance computing (HPC) is significantly reshaping the semiconductor industry. These technologies are driving a substantial demand for specialized, advanced packaging and testing solutions. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to reach over $200 billion by 2030, highlighting the immense growth potential.

ASE Technology Holding, as a leading provider of semiconductor manufacturing services, must proactively adapt its offerings to capitalize on these trends. This involves developing deep expertise in packaging and testing complex chips designed for AI accelerators, which are crucial for machine learning and data analysis. Furthermore, the proliferation of IoT devices, from smart home gadgets to industrial sensors, necessitates tailored solutions for their unique power and connectivity requirements.

The increasing need for HPC in areas like scientific research, cloud computing, and advanced simulations also presents a significant opportunity. ASE Technology Holding’s ability to provide advanced packaging, such as 2.5D and 3D integration, will be critical for enabling the higher performance and efficiency demanded by these applications. The company’s investment in R&D for these areas, evidenced by its continued focus on advanced packaging technologies, positions it to meet the evolving needs of these high-growth markets.

Cybersecurity in Manufacturing Operations

As manufacturing operations increasingly rely on interconnected systems and data, cybersecurity becomes paramount. ASE Technology Holding faces significant risks to its intellectual property, operational continuity, and the security of its supply chain from evolving cyber threats. The increasing sophistication of attacks means that protecting proprietary designs and sensitive customer data from unauthorized access and disruption is a critical challenge.

To counter these threats, ASE Technology Holding must deploy advanced cybersecurity protocols. This includes safeguarding factory automation systems, which are prime targets for cybercriminals aiming to disrupt production or steal sensitive manufacturing data. The company's investment in robust cybersecurity is crucial for maintaining trust and ensuring operational resilience in a digitally integrated manufacturing environment.

- Increased Ransomware Attacks: Global attacks on industrial control systems (ICS) rose by 28% in 2023, impacting operational uptime.

- Intellectual Property Theft: The cost of IP theft globally is estimated to be in the trillions of dollars annually, directly affecting competitive advantage.

- Supply Chain Vulnerabilities: A single breach in a connected supply chain can have cascading effects, disrupting operations for multiple partners.

- Data Breach Costs: The average cost of a data breach in the manufacturing sector reached $4.73 million in 2023, highlighting the financial impact of security failures.

Materials Science Innovations

Breakthroughs in materials science are a cornerstone for advancing semiconductor packaging and testing. Innovations here directly translate to smaller, more potent, and energy-saving electronic devices. ASE Technology Holding must stay ahead by assessing and adopting novel materials and processes to align with next-generation chip architectures and customer expectations for enhanced performance and dependability.

For instance, the development of advanced substrates and encapsulants is crucial for managing thermal stress and improving signal integrity in high-density packaging. The global advanced materials market, including those relevant to semiconductors, was projected to reach approximately $200 billion by 2024, highlighting the significant investment and progress in this area.

- Advanced Substrates: Innovations in organic substrates and ceramic materials are enabling denser interconnects and better thermal management.

- New Encapsulants: Development of low-dielectric constant and high-thermal conductivity encapsulants is vital for performance and reliability.

- Conductive Materials: Research into novel conductive inks and pastes is paving the way for more efficient and flexible interconnections.

- Sustainability Focus: Growing demand for eco-friendly materials is driving research into recyclable and lower-impact alternatives in packaging.

The semiconductor industry's rapid evolution, driven by AI, IoT, and HPC, fuels demand for advanced packaging. ASE Technology Holding's ability to integrate these technologies, such as 2.5D and 3D packaging for AI accelerators and IoT devices, is crucial for market leadership. The global AI chip market's projected growth to over $200 billion by 2030 underscores this trend.

Automation and Industry 4.0 principles are transforming ASE's operations, with continued investment in smart manufacturing in 2023. AI and robotics integration enhance productivity and precision, impacting cost efficiencies and throughput. This focus on advanced manufacturing techniques is essential for maintaining a competitive edge.

Breakthroughs in materials science are critical for developing smaller, more efficient electronics. ASE's adoption of advanced substrates and encapsulants, supported by a global advanced materials market projected to reach $200 billion by 2024, enables better thermal management and signal integrity.

Cybersecurity is a significant concern, with ransomware attacks on industrial control systems rising 28% in 2023. ASE must protect its intellectual property and operational continuity against sophisticated cyber threats, with data breach costs in manufacturing averaging $4.73 million in 2023.

Legal factors

ASE Technology Holding navigates a stringent global environmental regulatory landscape, encompassing waste management, emissions control, chemical handling, and water resource management. Non-compliance can lead to significant financial penalties and operational disruptions, impacting its ability to secure and maintain necessary operating permits. For instance, in 2024, the semiconductor industry faced increasing scrutiny over water consumption, with some regions implementing stricter usage quotas, a factor ASE must actively manage across its facilities.

Operating globally, ASE Technology Holding must navigate a complex web of labor and employment laws across its various locations. These regulations cover critical areas such as minimum wage requirements, working hour limits, workplace health and safety standards, and employee rights regarding unionization. For instance, in 2024, many countries continued to see updates to overtime pay regulations and increased scrutiny on remote work policies, directly impacting operational costs and workforce management.

Strict adherence to these diverse legal frameworks is not merely a matter of compliance but a cornerstone for fostering a stable and ethical work environment. Failure to comply can lead to significant legal challenges, costly penalties, and damage to ASE Technology Holding's reputation, which is particularly sensitive in the tech manufacturing sector where talent retention is key. The International Labour Organization (ILO) reported in early 2025 that global investments in workplace safety training saw a 5% increase in 2024, highlighting the growing importance of these legal obligations.

ASE Technology Holding operates in a sector where intellectual property is paramount. The company could be involved in patent disputes, which are common in the fast-paced semiconductor industry. For instance, in 2023, the semiconductor sector saw a significant number of patent litigation filings, reflecting the intense competition and the value placed on technological innovation.

Protecting its own innovations and defending against infringement claims is crucial for ASE. Legal battles over patents, trademarks, or trade secrets can impact market share and financial performance. A strong legal framework for IP management is therefore essential for maintaining ASE's competitive edge and safeguarding its valuable technological assets.

Antitrust and Competition Laws

ASE Technology Holding, as a significant entity in the outsourced semiconductor assembly and test (OSAT) sector, must meticulously adhere to a complex web of global antitrust and competition regulations. Failure to comply can result in severe penalties, impacting financial performance and market standing.

These laws are designed to prevent monopolistic practices and ensure a fair marketplace. For ASE, this means actively avoiding actions like:

- Price Fixing: Colluding with competitors to set prices for assembly or testing services.

- Market Allocation: Agreeing with rivals to divide up customer segments or geographic regions.

- Abuse of Dominant Position: Leveraging its market share to unfairly disadvantage smaller competitors or customers.

In 2024, regulators worldwide, including the European Commission and the US Federal Trade Commission (FTC), have continued to scrutinize mergers and acquisitions within the semiconductor industry, signaling a heightened enforcement environment. ASE's strategic partnerships and pricing strategies are therefore under constant review to ensure they do not stifle competition.

Data Privacy and Security Regulations

ASE Technology Holding, like many global tech firms, navigates a complex web of data privacy and security regulations. With its extensive operations and client interactions, adherence to laws like the European Union's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) is paramount. These regulations govern how personal data is collected, processed, and stored, directly impacting ASE's operational procedures and customer trust.

Failure to comply can result in significant legal penalties and reputational damage. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. CCPA violations can lead to penalties of $2,500 per unintentional violation and $7,500 per intentional violation, as of 2024. Therefore, robust data protection measures are not just a legal necessity but a strategic imperative for ASE to maintain its competitive edge and client confidence.

- GDPR: Affects all companies processing personal data of EU residents, imposing strict rules on consent, data breach notification, and individual rights.

- CCPA: Grants California consumers rights over their personal information, including the right to know, delete, and opt-out of the sale of their data.

- Penalties: Non-compliance can lead to substantial fines, impacting profitability and market standing.

ASE Technology Holding's legal obligations extend to international trade and customs regulations, impacting its global supply chain and market access. Compliance with export controls, tariffs, and sanctions is crucial to avoid disruptions and penalties. For example, in 2024, geopolitical tensions continued to influence trade policies, requiring companies like ASE to closely monitor and adapt to evolving import/export restrictions impacting semiconductor materials and finished goods.

Environmental factors

Semiconductor manufacturing, a core operation for ASE Technology Holding, is inherently energy-intensive, placing significant environmental scrutiny on its energy consumption and carbon footprint. The company is under increasing pressure from stakeholders and regulators to transition away from fossil fuels, invest in renewable energy alternatives, and implement energy efficiency measures across its global operations.

In 2023, the semiconductor industry, including companies like ASE, continued to grapple with rising energy costs and the imperative to decarbonize. For instance, the global semiconductor manufacturing sector's energy demand is projected to grow substantially, potentially reaching 300 TWh annually by 2030, underscoring the scale of the challenge. ASE's commitment to sustainability, including its progress towards Science Based Targets initiative (SBTi) validation for its emissions reduction goals, directly addresses these environmental factors.

Semiconductor manufacturing, a core activity for ASE Technology Holding, is incredibly water-intensive. The creation of ultra-pure water needed for chip production, along with the subsequent wastewater generation, presents significant environmental challenges. For instance, the electronics industry as a whole is a major consumer of freshwater, and while specific 2024/2025 ASE data isn't publicly detailed yet, industry trends show a growing focus on water efficiency.

To address this, ASE Technology Holding must prioritize advanced water conservation and recycling technologies. Compliance with increasingly strict wastewater discharge regulations is also paramount. Failure to manage water resources effectively and treat wastewater responsibly poses risks, especially in regions facing water scarcity, and can impact operational continuity and regulatory standing.

Semiconductor manufacturing, a core area for ASE Technology Holding, inherently involves the use and generation of hazardous chemicals and waste. In 2024, the industry continued to grapple with the environmental impact of these materials, with companies like ASE investing heavily in advanced waste treatment technologies. For instance, stringent regulations in key operating regions mandate specific disposal protocols, driving up operational costs but also reinforcing a commitment to environmental stewardship.

ASE Technology Holding's operational success is intrinsically linked to its ability to manage these hazardous substances safely and compliantly. Adherence to regulations such as the Resource Conservation and Recovery Act (RCRA) in the US and similar frameworks globally is paramount. This includes rigorous protocols for the handling, storage, and disposal of chemicals like hydrofluoric acid and various solvents, crucial for preventing soil and water contamination and safeguarding employee health.

Supply Chain Sustainability

Environmental factors are increasingly shaping business operations, and supply chain sustainability is a prime example. Customers, investors, and regulators are all pushing for greater transparency and responsibility throughout a company's entire supply chain. This means ASE Technology Holding must actively engage with its suppliers to ensure materials and components are sourced in an environmentally conscious manner, ultimately reducing the ecological footprint of its offerings.

This focus on sustainability is not just an ethical consideration; it's becoming a business imperative. For instance, many major electronics manufacturers, key customers for ASE Technology Holding, have set ambitious Scope 3 emissions reduction targets, which directly impact their supply chain partners. ASE's proactive approach to supplier engagement in 2024 and 2025 will be crucial for meeting these evolving demands and maintaining its competitive edge.

- Growing Pressure: Over 70% of consumers in a 2024 survey indicated they would switch brands if a competitor offered a more sustainable product.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) funds saw continued inflows in 2024, with a significant portion of due diligence focused on supply chain practices.

- Regulatory Landscape: Emerging regulations in 2025 are expected to mandate greater disclosure of supply chain environmental impacts, particularly for the electronics sector.

- Operational Efficiency: Sustainable sourcing can lead to cost savings through reduced waste and more efficient resource utilization, a trend observed across the industry in the past year.

Climate Change Risks and Resilience

Climate change presents significant physical risks to ASE Technology Holding's manufacturing facilities. Extreme weather events, such as intensified droughts that could strain water resources essential for semiconductor production or severe floods that disrupt critical supply chains and logistics, pose direct threats to operational continuity. For instance, the increasing frequency of typhoons in Asia, a key region for electronics manufacturing, highlights these vulnerabilities.

Beyond physical impacts, regulatory shifts driven by climate action also create challenges. Governments worldwide are implementing or considering carbon pricing mechanisms and stricter emissions standards, which could increase operating costs for ASE Technology Holding. For example, the European Union's Carbon Border Adjustment Mechanism (CBAM), phased in from October 2023, is already impacting industries with high carbon footprints, and similar policies could emerge globally, affecting the cost of imported materials and the competitiveness of exported goods.

ASE Technology Holding must proactively assess and enhance its resilience against these climate-related risks. This involves investing in infrastructure that can withstand extreme weather, diversifying supply chains to mitigate disruption, and developing strategies to reduce its carbon footprint. By building resilience, the company can better ensure business continuity and maintain its competitive edge in an evolving global landscape.

- Physical Risks: Increased frequency and intensity of extreme weather events like floods and droughts impacting manufacturing sites and supply chains.

- Regulatory Risks: Potential for higher operating costs due to carbon pricing, emissions taxes, and stricter environmental regulations globally.

- Resilience Strategy: Need for investment in climate-resilient infrastructure and diversified supply chains to ensure business continuity.

- Carbon Footprint Reduction: Proactive measures to lower emissions are crucial for long-term operational viability and regulatory compliance.

ASE Technology Holding's environmental strategy must address the significant energy demands of semiconductor manufacturing, aiming to reduce its carbon footprint. The company is actively pursuing renewable energy sources and efficiency improvements to meet stakeholder expectations and regulatory requirements. For instance, ASE reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity in its 2023 sustainability report, reflecting ongoing efforts.

Water management is another critical environmental factor, given the industry's high water consumption. ASE is investing in water recycling technologies and adhering to stringent wastewater discharge standards to minimize its impact. The company's commitment to water conservation is crucial, especially in water-stressed regions where its operations are located.

The handling and disposal of hazardous materials are paramount for ASE. The company employs advanced waste treatment and adheres to strict global regulations to prevent contamination and ensure safety. This focus on responsible chemical management is essential for maintaining operational integrity and environmental compliance.

Supply chain sustainability is increasingly important, with customers and investors demanding greater transparency. ASE is engaging with its suppliers to promote environmentally responsible practices, aiming to reduce the overall ecological impact of its products and operations. This collaborative approach is vital for meeting evolving market demands and regulatory scrutiny.

| Environmental Factor | ASE's Focus | Industry Trend/Data (2024/2025) |

|---|---|---|

| Energy Consumption & Carbon Footprint | Transition to renewables, energy efficiency | Semiconductor industry energy demand projected to reach 300 TWh by 2030. |

| Water Usage & Wastewater | Water conservation, recycling technologies, discharge compliance | Growing industry focus on water efficiency due to scarcity concerns. |

| Hazardous Materials & Waste | Advanced waste treatment, regulatory adherence | Stringent regulations mandate specific disposal protocols, increasing operational costs. |

| Supply Chain Sustainability | Supplier engagement, reduced ecological footprint | Over 70% of consumers would switch brands for more sustainable products (2024 survey). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for ASE Technology Holding synthesizes data from reputable sources including industry-specific market research reports, financial news outlets, and official government publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the semiconductor assembly and testing sector.