ASE Technology Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASE Technology Holding Bundle

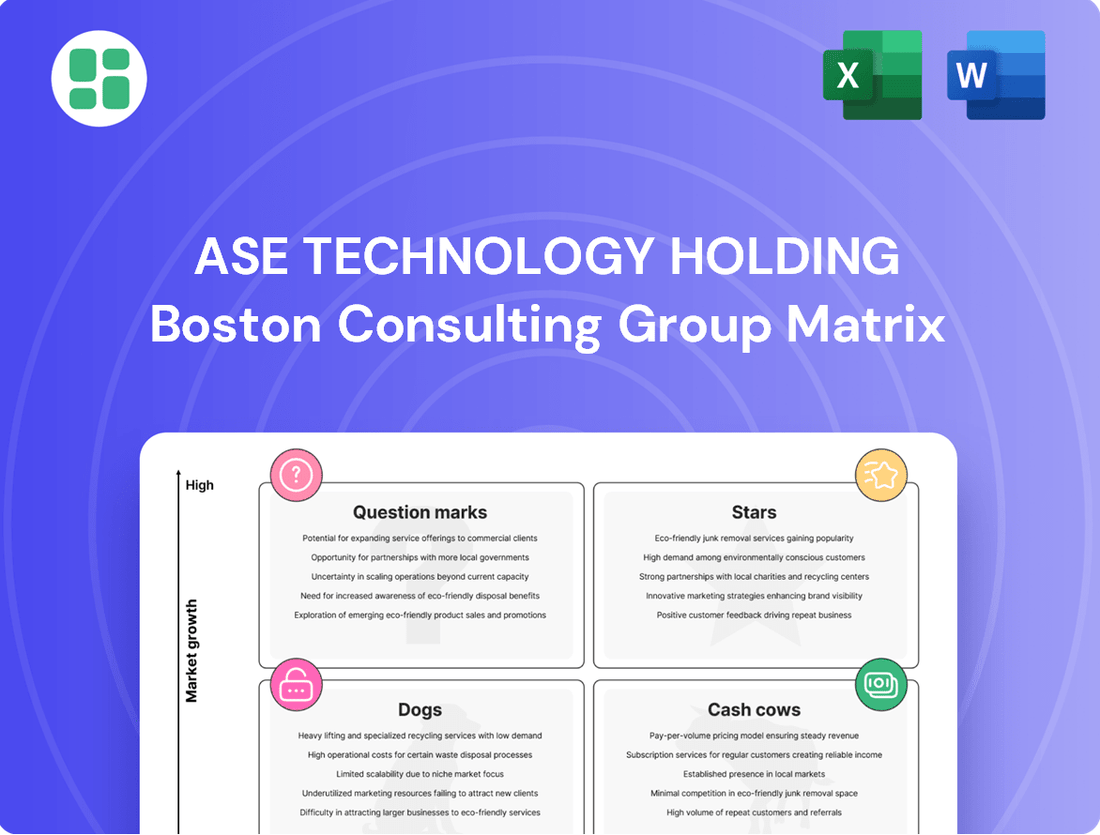

Curious about ASE Technology Holding's product portfolio? This preview offers a glimpse into their market position, but the full BCG Matrix unlocks the complete picture, detailing their Stars, Cash Cows, Dogs, and Question Marks. Gain critical insights into where their growth lies and where resources might be better allocated.

Don't miss out on the strategic advantage. Purchase the full ASE Technology Holding BCG Matrix report to receive a comprehensive breakdown of each product's quadrant placement, along with actionable recommendations for optimizing your investment and product development strategies.

This is your opportunity to move beyond speculation and make informed decisions. Invest in the complete BCG Matrix for ASE Technology Holding and equip yourself with the data-driven clarity needed to navigate the competitive landscape and drive future success.

Stars

ASE's advanced packaging services for AI and High-Performance Computing (HPC) chips clearly position them as a Star in the BCG matrix. The market demand is exceptionally strong, with ASE forecasting a significant revenue jump in advanced packaging and testing. They expect this segment to grow by USD 1 billion in 2025, reaching over $1.6 billion, which is more than double their 2024 figures.

This robust growth is fueled by the widespread adoption of AI and the increasing need for intricate chip integration solutions like 2.5D/3D IC packaging and chiplets. These advanced technologies are critical for enabling the performance required by modern AI and HPC applications.

ASE Technology Holding's leading-edge testing services are a true Star in their BCG portfolio. This segment is experiencing robust expansion, with a notable 9% year-over-year growth recorded in 2024.

The momentum continued strongly into the first half of 2025, demonstrating an impressive 31% year-on-year growth. This surge is directly linked to the increasing complexity of chips driven by demands from AI and High-Performance Computing (HPC) sectors, making advanced testing solutions essential and solidifying ASE's leadership in this high-growth market.

The automotive sector is a significant growth engine for semiconductors, fueled by the surge in electric vehicles (EVs) and sophisticated driver-assistance systems (ADAS). ASE Technology Holding is strategically increasing its advanced packaging capacity for automotive chips, a clear signal of its commitment to this burgeoning market.

This expansion directly addresses the escalating demand for smaller, more powerful, and highly integrated semiconductors essential for modern vehicles. ASE's specialized automotive semiconductor solutions are thus positioned as a Star within the BCG matrix, capitalizing on the increasing electronic content per vehicle. For instance, the average semiconductor content in a new car is projected to reach over $1,000 by 2025, a substantial increase driven by these trends.

Heterogeneous Integration Technologies

As the industry grapples with the slowing pace of Moore's Law, heterogeneous integration has emerged as a critical enabler of advanced chip performance. This includes innovative approaches like chiplet-based architectures and System-in-Package (SiP) solutions, which allow for the combination of different functional blocks into a single package. ASE Technology Holding, with its substantial investments and demonstrated expertise in these cutting-edge packaging technologies, is well-positioned in this rapidly expanding market. This segment is experiencing robust growth, particularly driven by the insatiable demand for AI chips, making it a vital area for future semiconductor innovation.

ASE's commitment to heterogeneous integration is underscored by its significant capital expenditures. For instance, in 2023, the company allocated substantial resources towards expanding its advanced packaging capabilities, anticipating the growing demand for these solutions. This strategic focus has positioned ASE as a leader in a market segment that is projected to see compound annual growth rates exceeding 10% in the coming years, especially within the high-performance computing and AI sectors.

- Market Growth: The global advanced packaging market, encompassing heterogeneous integration, is expected to reach over $70 billion by 2027, with a significant portion driven by SiP and chiplet technologies.

- ASE's Investment: ASE Technology Holding has consistently increased its R&D spending on advanced packaging, with a notable focus on 2.5D/3D integration and fan-out wafer-level packaging (FOWLP) techniques.

- AI Chip Demand: The proliferation of AI applications is a primary catalyst for heterogeneous integration, as it enables the co-packaging of CPUs, GPUs, and specialized AI accelerators for enhanced performance and power efficiency.

Global Capacity Expansion for Advanced Technologies

ASE Technology Holding's aggressive capital expenditure and strategic global expansion demonstrate a clear Star strategy. New facilities in Kaohsiung, Taiwan, and Malaysia are specifically designed to handle advanced packaging and testing, crucial for next-generation semiconductors.

These investments are directly addressing the surging demand for leading-edge solutions. For instance, ASE's 2024 capital expenditure was projected to be between $900 million and $1 billion, a significant portion allocated to advanced technologies.

This expansion bolsters their competitive position in the rapidly evolving semiconductor market, ensuring they can meet the needs of high-growth sectors like AI and 5G. By focusing on these advanced capabilities, ASE is securing its long-term growth trajectory.

- Global Expansion: New facilities in Kaohsiung and Malaysia are key to meeting advanced technology demand.

- Capital Investment: ASE's 2024 capital expenditure, estimated between $900 million and $1 billion, fuels this growth.

- Market Focus: Investments target high-demand areas like advanced packaging and testing for AI and 5G.

- Strategic Positioning: This proactive approach solidifies ASE's leadership in the dynamic semiconductor industry.

ASE's advanced packaging for AI and HPC, along with its leading-edge testing services, are clear Stars in the BCG matrix. The automotive sector, driven by EVs and ADAS, also represents a Star due to increasing semiconductor content per vehicle, projected to exceed $1,000 by 2025.

| Business Segment | BCG Category | Key Growth Drivers | 2024/2025 Outlook |

|---|---|---|---|

| Advanced Packaging (AI/HPC) | Star | AI/HPC demand, 2.5D/3D IC, chiplets | Revenue to double by 2025, exceeding $1.6 billion |

| Testing Services | Star | Chip complexity (AI/HPC), advanced solutions | 9% YoY growth in 2024, 31% YoY H1 2025 |

| Automotive Packaging | Star | EVs, ADAS, increased semiconductor content | Avg. semiconductor content > $1,000 by 2025 |

What is included in the product

This BCG Matrix overview of ASE Technology Holding analyzes its business units, identifying Stars, Cash Cows, Question Marks, and Dogs.

The ASE Technology Holding BCG Matrix provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

ASE Technology Holding's traditional IC packaging services, including wire bonding and standard flip-chip, represent a significant Cash Cow. As the world's largest OSAT provider, ASE commands a substantial market share in these mature but essential segments.

Despite lower growth rates compared to emerging technologies, these services generate consistent, high-volume revenue and robust cash flow. This stability is a direct result of ASE's entrenched market leadership, significant economies of scale, and highly efficient operational infrastructure, making them foundational to the semiconductor supply chain.

Standard wafer probing and final testing are ASE Technology Holding's bedrock, consistently bringing in significant revenue. These services are non-negotiable for every chip maker, guaranteeing quality before products hit the shelves. ASE's strong hold in this fundamental area means reliable cash flow with less need for massive new investments.

Consumer Electronics Back-End Services, encompassing packaging and testing for devices like smartphones, are ASE Technology Holding's cash cows. This segment benefits from the mature but consistent demand in the consumer electronics market, providing a stable revenue stream.

In 2023, ASE reported revenue of $5.1 billion from its packaging and testing business, a significant portion of its overall income, highlighting its role as a reliable cash generator. This business is characterized by high volume and consistent demand, even amidst industry cycles.

Established Semiconductor Material Business

ASE Technology Holding's established semiconductor material business functions as a strong cash cow within its portfolio. This segment is integral to ASE's integrated approach, directly supporting its core packaging and testing operations.

By providing a reliable internal supply chain for critical materials, this business contributes significantly to cost efficiency and maintains stable profit margins within the ATM (Assembly, Testing, and Materials) division. For instance, in 2023, ASE reported that its materials segment played a crucial role in bolstering the performance of its overall integrated solutions.

The captive market generated by its internal demand ensures consistent order flow and predictable revenue streams, characteristic of a mature and stable cash cow. This internal demand, coupled with potential external sales, solidifies its position.

- Internal Supply Chain Advantage: Reduces reliance on external suppliers, enhancing cost control and operational stability.

- Stable Margin Contribution: The materials segment consistently delivers predictable revenue and healthy profit margins, supporting overall company profitability.

- Synergistic Operations: Directly supports ASE's packaging and testing services, creating a robust and integrated business model.

- Market Maturity: Benefits from established demand within the semiconductor industry, ensuring consistent cash generation.

Legacy Computing and Networking Chip Assembly

Legacy computing and networking chip assembly, while not the fastest-growing area for ASE Technology Holding, represents a stable and profitable segment. This part of their business benefits from established relationships and deep expertise, ensuring consistent demand for packaging and testing services. In 2023, ASE's revenue from traditional computing and networking segments continued to be a significant contributor, even as newer technologies gained traction.

This segment acts as a crucial cash cow, generating substantial funds that ASE can reinvest. For instance, in the first half of 2024, ASE reported a consolidated revenue of $8.1 billion, with a significant portion still derived from these mature markets. The company's ability to maintain a high market share in these areas, despite low growth, highlights its competitive advantage and operational efficiency.

- High Market Share: ASE holds a dominant position in packaging and testing for traditional computing and networking chips.

- Stable Cash Generation: This segment consistently provides robust cash flow, underpinning ASE's financial stability.

- Client Longevity: A broad and loyal client base in these legacy sectors ensures sustained demand for services.

- Funding for Innovation: Profits from this cash cow segment are strategically deployed to fuel growth in AI, HPC, and other emerging technologies.

ASE Technology Holding's traditional IC packaging services, including wire bonding and standard flip-chip, represent a significant Cash Cow. As the world's largest OSAT provider, ASE commands a substantial market share in these mature but essential segments, generating consistent, high-volume revenue and robust cash flow due to entrenched market leadership and economies of scale.

Standard wafer probing and final testing are ASE's bedrock, consistently bringing in significant revenue. These services are non-negotiable for chip makers, guaranteeing quality and providing reliable cash flow with less need for massive new investments. Consumer Electronics Back-End Services also act as cash cows, benefiting from mature but consistent demand.

In 2023, ASE reported revenue of $5.1 billion from its packaging and testing business, a significant portion of its overall income, highlighting its role as a reliable cash generator. Legacy computing and networking chip assembly also represent stable and profitable segments, contributing substantially to ASE's financial stability.

| Segment | 2023 Revenue Contribution (Estimated) | Key Characteristics | Cash Flow Generation |

| Traditional IC Packaging | Significant portion of $5.1B Packaging & Testing Revenue | Mature, high volume, essential services | Robust and consistent |

| Wafer Probing & Final Testing | Integral to overall revenue | Non-negotiable, high demand | Reliable, low investment |

| Consumer Electronics Back-End | Stable revenue stream | Mature market demand | Consistent cash flow |

| Legacy Computing & Networking | Significant contributor | Established client base, deep expertise | Substantial funds for reinvestment |

Preview = Final Product

ASE Technology Holding BCG Matrix

The ASE Technology Holding BCG Matrix preview you are seeing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously prepared by industry analysts, will be delivered to you without any watermarks or demo content, ensuring you get a polished and actionable strategic tool.

Dogs

Highly commoditized, low-margin packaging services would fall into the Dogs category within ASE Technology Holding's BCG Matrix. These are services where differentiation is minimal, and price competition is fierce, leading to very thin profit margins. ASE's market share in these specific, older segments might be less dominant, or demand could be on a downward trend.

ASE Technology Holding's older packaging technologies, like leadframe-based packages that are being replaced by smaller, more advanced options, likely reside in the Dogs quadrant. These legacy services have a low market share in a shrinking market, meaning any further investment would struggle to generate meaningful returns.

Certain non-core, underperforming EMS operations within ASE Technology Holding, potentially including segments of USI, might fit into the Dogs category of the BCG Matrix. This is particularly relevant if these operations are experiencing declining revenues, as indicated by a year-over-year net revenue drop in Q2 2025 for EMS operations.

These underperformers likely possess low market share in slow-growing segments of the EMS industry. Such a position necessitates a strategic evaluation, considering options like divestment or a thorough restructuring to improve profitability or exit the market.

Inefficient or Underutilized Older Facilities

Inefficient or underutilized older facilities within ASE Technology Holding could be categorized as Dogs in the BCG Matrix. These are typically manufacturing sites or production lines not updated for advanced packaging and testing, struggling with low utilization rates due to evolving market demands. For instance, older facilities might have significantly higher energy consumption per unit produced compared to newer, more efficient plants, impacting profitability. In 2023, a portion of the semiconductor industry saw increased operational costs for legacy equipment, with some estimates suggesting older lines could be 15-20% less energy-efficient.

- Low Utilization: Facilities with consistently low capacity utilization, potentially below 50%, indicating a lack of demand for their current capabilities.

- Outdated Technology: Older equipment not supporting advanced packaging techniques, limiting competitiveness in high-growth market segments.

- High Operational Costs: Incurring significant maintenance, energy, and labor expenses without generating proportional revenue.

- Resource Drain: Representing a drag on capital and management attention that could be better allocated to growth areas.

Services Highly Susceptible to Geopolitical or Trade Disruptions

Certain service lines within ASE Technology Holding, particularly those heavily reliant on cross-border component sourcing and assembly, could be considered 'Dogs' in a BCG matrix analysis if they are highly susceptible to geopolitical or trade disruptions. For instance, operations concentrated in regions experiencing heightened trade tensions or political instability might face sustained low market share and growth. This vulnerability can act as a drag on the company's overall performance, prompting a strategic re-evaluation of these specific service offerings or regional footprints.

Consider the semiconductor packaging and testing services. In 2024, the global semiconductor industry continued to navigate complex geopolitical landscapes, with export controls and trade restrictions impacting supply chains. ASE Technology Holding, as a major player in this sector, might find specific service segments disproportionately affected. If a significant portion of its packaging capacity or customer base is located in or heavily dependent on regions subject to these trade disputes, those services could exhibit characteristics of a 'Dog' – low growth and low market share.

- Vulnerability to Trade Tensions: Services involving intricate supply chains spanning multiple countries are inherently exposed to tariffs, export bans, and sanctions, potentially hindering market access and increasing operational costs.

- Regional Concentration Risk: If a particular service line is heavily concentrated in a single geographic region that becomes a focal point of geopolitical conflict or trade disputes, its growth prospects can stagnate.

- Impact on Market Share: Disruptions can lead to a loss of competitiveness if alternative sourcing or production locations are not readily available or are prohibitively expensive, thereby eroding market share.

- Strategic Re-evaluation Necessity: Services exhibiting sustained low growth and market share due to these external factors may require divestment, restructuring, or significant strategic repositioning to mitigate ongoing performance drags.

ASE Technology Holding's older, less sophisticated packaging technologies, such as those for legacy consumer electronics or automotive components with declining demand, would be classified as Dogs. These services operate in mature or shrinking markets, where ASE's market share is likely modest and growth prospects are minimal. For example, the demand for certain types of wire bonding, a technology prevalent in older semiconductor packages, has been steadily declining as advanced packaging methods gain traction.

| Category | Description | ASE Example | Market Trend | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low market share in low-growth markets. | Legacy wire bonding services | Declining demand | Divestment or minimal investment |

| Dogs | Low market share in low-growth markets. | Older, less efficient EMS lines | Stagnant or declining | Restructuring or exit |

Question Marks

Within the broader AI packaging category, emerging edge AI segments represent potential question marks. These are niche areas, like custom form factors for AI acceleration directly on devices, experiencing rapid growth. However, ASE Technology Holding's market share in these nascent fields might currently be limited as the market is still developing and standards are yet to solidify.

Significant investment will be crucial for ASE to capture a dominant position in these emerging edge AI packaging and testing markets. Success in these question mark areas depends heavily on securing early adoption from key players and effectively scaling production capabilities to meet future demand. For instance, the global edge AI market was projected to reach over $10 billion in 2024, with specialized packaging solutions being a key enabler.

Next-generation wafer-level packaging, such as advanced 3D integration and heterogeneous integration beyond current SiP, are emerging technologies. These represent potential future growth areas, but are still in their nascent stages of market adoption.

While the market for these cutting-edge solutions is expanding quickly, ASE's current market share may be constrained. Significant investment in research and development, alongside substantial capital expenditure, will be crucial for ASE to secure a leading position in the future.

These ventures carry inherent high risks but also offer the potential for significant rewards. For instance, the advanced packaging market, which includes these next-gen technologies, was projected to reach $30 billion by 2024, indicating substantial future opportunity.

ASE Technology Holding's potential involvement in specialized services for quantum computing chips currently positions it as a Question Mark within the BCG framework. While the quantum computing market is still in its infancy, projections indicate substantial future growth. For instance, the global quantum computing market was valued at approximately $1.5 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of over 30% through 2030, reaching tens of billions of dollars.

ASE's current market share in this niche segment is likely negligible, reflecting the embryonic stage of quantum chip manufacturing and the limited number of companies actively engaged in providing advanced packaging and testing solutions. However, the exceptionally high growth prospects for quantum computing necessitate significant investment in research and development, as well as specialized infrastructure, to capture a meaningful position in this emerging sector.

Advanced Materials for Future Semiconductor Generations

Investing in advanced materials for semiconductors, such as those needed for 2nm nodes and beyond, positions ASE Technology Holding within a high-growth market driven by relentless technological advancement. While the potential is immense, ASE's current market share in these highly specialized, cutting-edge materials may be nascent. This necessitates substantial research and development expenditure, alongside crucial strategic alliances, to effectively capture this emerging opportunity.

The semiconductor industry's trajectory towards smaller, more powerful chips demands innovation in materials science. For instance, the development of new substrates and interconnects capable of supporting 2nm and sub-2nm fabrication processes is critical. The global semiconductor market was valued at approximately $600 billion in 2023 and is projected to grow significantly in the coming years, with advanced materials playing a pivotal role in enabling these next-generation technologies.

- Market Potential: The demand for advanced materials in semiconductors is driven by the continuous push for miniaturization and increased performance, creating a high-growth environment.

- ASE's Position: ASE's current market share in these specific, nascent advanced materials may be relatively low, indicating a need for strategic investment and development.

- Investment Requirements: Significant R&D investment and the formation of strategic partnerships are essential for ASE to gain a competitive edge in this specialized segment.

- Future Outlook: Capitalizing on these advanced materials will be key for ASE to maintain its leadership and participate in the future evolution of semiconductor manufacturing.

Expansion into Untapped Niche Geographies for Advanced Services

ASE Technology Holding's aggressive expansion into emerging geographic markets for advanced semiconductor manufacturing, where it currently lacks a dominant presence, would classify as a Question Mark in the BCG matrix. These regions, such as parts of Southeast Asia or Eastern Europe, represent significant growth opportunities due to increasing demand for sophisticated chip production. For instance, Vietnam's semiconductor industry is projected to grow substantially, with some reports indicating a compound annual growth rate exceeding 10% in the coming years, presenting a prime target.

This strategy necessitates considerable upfront capital investment for establishing new facilities, acquiring talent, and navigating local regulatory landscapes. The high growth potential is counterbalanced by the inherent risks associated with market entry, including intense competition from established players and the uncertainty of achieving significant market share. For example, the initial setup costs for a state-of-the-art advanced packaging facility can easily run into hundreds of millions of dollars, requiring careful financial planning and risk assessment.

- High Growth Potential: Emerging markets are experiencing rapid industrialization and increasing demand for advanced semiconductors.

- Substantial Investment Required: Establishing operations in new territories demands significant capital for infrastructure, technology, and workforce development.

- Market Penetration Challenges: Gaining traction against existing competitors and building brand recognition requires dedicated strategies and resources.

- Risk vs. Reward Balancing: The success of these ventures hinges on effectively managing the risks of market entry against the potential for high returns on investment.

ASE Technology Holding's ventures into cutting-edge areas like advanced materials for next-generation semiconductors and specialized services for quantum computing chips currently represent Question Marks. These segments are characterized by high growth potential but also by ASE's nascent market share, demanding substantial R&D and strategic investments to establish a strong foothold.

The company's expansion into emerging geographic markets for semiconductor manufacturing also falls into the Question Mark category. While these regions offer significant growth opportunities, they require considerable capital outlay and present challenges in market penetration and competition.

| Segment | Market Growth Potential | ASE's Current Market Share | Investment Needs | Key Considerations |

|---|---|---|---|---|

| Edge AI Packaging | High | Low | Significant R&D, scaling capabilities | Standardization, early adoption |

| Next-Gen Wafer-Level Packaging | High | Low | Substantial R&D and CapEx | Market adoption, technological maturity |

| Quantum Computing Services | Very High (CAGR >30%) | Negligible | Specialized infrastructure, R&D | Embryonic market, high risk |

| Advanced Semiconductor Materials | High | Nascent | R&D, strategic alliances | Technological advancement, miniaturization |

| Emerging Geographic Markets | High | Low | Capital investment, talent acquisition | Market entry risks, competition |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.