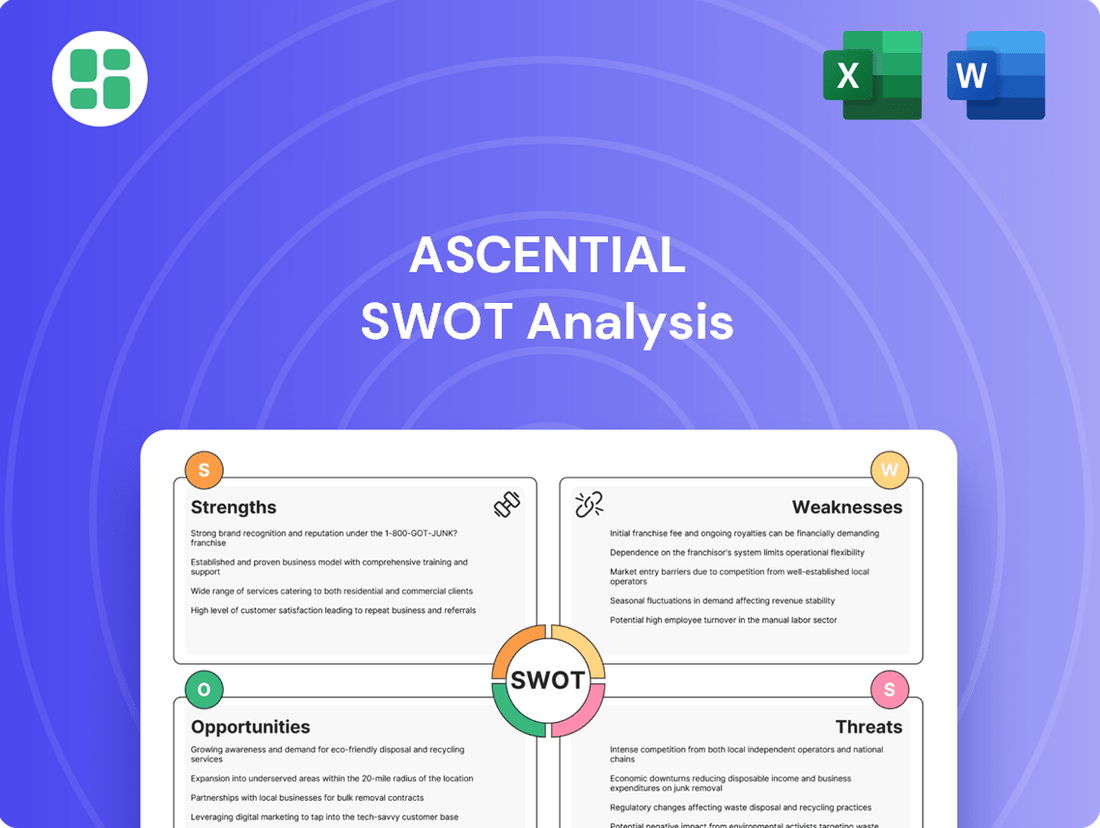

Ascential SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascential Bundle

Ascential's market position is built on strong digital commerce and marketing intelligence capabilities, but faces challenges in adapting to evolving digital landscapes. Unlock the full picture of their competitive advantages and potential threats with our comprehensive SWOT analysis.

Discover the actionable insights and strategic context needed to understand Ascential's future. Our full SWOT analysis provides a deep dive into their strengths, weaknesses, opportunities, and threats, empowering your decision-making.

Ready to move beyond the highlights and gain a strategic edge? Purchase the complete, professionally written SWOT analysis, complete with editable deliverables, to inform your planning, pitches, and investments.

Strengths

Ascential's core business is performing exceptionally well, showcasing significant financial strength. In the first half of 2024, its Marketing (Lions) and Financial Technology (Money20/20) segments achieved robust double-digit revenue growth. This follows a strong 13% revenue increase across the company in 2023, demonstrating consistent upward momentum.

Operationally, Ascential is exceeding targets. For the first half of 2024, the company reported a 15% increase in overall revenue and a substantial 27% rise in Adjusted EBITDA on an organic basis. These figures highlight the effectiveness of its strategic focus and execution within its key business areas.

Ascential's ownership of premier event brands like Cannes Lions and Money20/20 is a significant strength. These aren't just trade shows; they are globally recognized industry benchmarks that foster innovation and connection. For instance, Cannes Lions is a cornerstone of the marketing world, attracting top talent and brands, while Money20/20 is a vital hub for fintech advancements.

Ascential benefits from a robust business model featuring diverse and sustainable revenue streams. These include income from live events, prestigious benchmark awards, digital subscriptions, and specialized advisory services.

This multi-pronged strategy enhances financial resilience, mitigating risks associated with dependence on any single revenue channel. For instance, in the first half of 2024, Ascential reported a notable increase in digital revenue, demonstrating the growing stability of its subscription-based offerings alongside its event portfolio.

Strong Balance Sheet Post-Divestitures

Ascential's balance sheet emerged significantly stronger following the strategic divestitures of its Digital Commerce and WGSN businesses in Q1 2024. This move resulted in a net cash position of £22.4 million by June 30, 2024. The company successfully generated £1.2 billion from these sales, allowing for the return of over £750 million to shareholders and a substantial reduction in prior net debt. This bolstered financial standing provides Ascential with considerable flexibility for future strategic initiatives and investments.

- Net Cash Position: £22.4 million as of June 30, 2024.

- Divestiture Proceeds: £1.2 billion generated from Digital Commerce and WGSN sales.

- Shareholder Returns: Over £750 million returned to shareholders.

- Debt Reduction: Significant decrease in previous net debt levels.

Strategic Focus on Events-Led Platform

Ascential's strategic shift to an events-led platform, particularly post-divestiture, highlights a deliberate focus on its high-value Marketing and Financial Technology segments. This recalibration allows for more concentrated investment and operational efficiency, aiming to bolster its leading global events. These events are crucial for industry participants, acting as key marketplaces and information hubs.

The company's commitment to its events portfolio is a core strength, with significant revenue generation stemming from these platforms. For instance, Ascential's recent financial reports (e.g., for the fiscal year ending December 2023) indicated strong performance in its events business, which remains a primary driver of growth and profitability. This strategic emphasis is expected to continue as the company aims to enhance the value and reach of its flagship events.

- Global Events as a Core Revenue Driver: Ascential's events, such as Cannes Lions and Money 20/20, are recognized industry leaders, attracting significant participation and sponsorship.

- Post-Divestiture Focus: The divestment of its digital services segment in 2023 allowed Ascential to concentrate resources on its more profitable and strategically aligned events business.

- Industry Influence: These events serve as critical platforms for networking, deal-making, and trend-setting within the marketing and fintech sectors, reinforcing Ascential's market position.

- Growth Potential: Management has expressed confidence in further expanding the reach and impact of its events, leveraging their established reputations and industry relevance.

Ascential's core strengths lie in its high-performing events and a significantly strengthened financial position following strategic divestitures. The company's Marketing (Lions) and Financial Technology (Money20/20) segments are experiencing robust double-digit revenue growth, building on a 13% overall revenue increase in 2023. This operational success is underpinned by a robust balance sheet, with a net cash position of £22.4 million as of June 30, 2024, achieved after generating £1.2 billion from the sale of its Digital Commerce and WGSN businesses.

| Metric | Value (as of June 30, 2024) | Significance |

|---|---|---|

| Net Cash Position | £22.4 million | Provides financial flexibility and reduced reliance on debt. |

| Divestiture Proceeds (Digital Commerce & WGSN) | £1.2 billion | Funded shareholder returns and debt reduction, strengthening the balance sheet. |

| H1 2024 Revenue Growth (Organic) | 15% | Demonstrates strong underlying business performance. |

| H1 2024 Adjusted EBITDA Growth (Organic) | 27% | Highlights improved profitability and operational efficiency. |

What is included in the product

Delivers a strategic overview of Ascential’s internal and external business factors, highlighting its market strengths and potential threats.

Ascential's SWOT analysis offers a clear, actionable framework to identify and address critical business challenges, transforming strategic uncertainty into focused solutions.

Weaknesses

Ascential's divestiture of its Digital Commerce and WGSN segments significantly increases business concentration. These businesses previously accounted for a substantial portion of Ascential's revenue and Adjusted EBITDA, meaning the remaining Marketing and Financial Technology segments now bear a greater weight in the company's overall performance.

This heightened focus, while potentially beneficial for strategic alignment, also elevates the company's reliance on these two core areas. For instance, if the Marketing segment, which is crucial for Ascential's future growth, experiences a downturn, the impact on the company's financial health will be more pronounced than in a more diversified structure.

A less diversified business model inherently carries increased risk. Should either the Marketing or Financial Technology segments encounter significant operational challenges or market disruptions, Ascential's overall financial stability could be more vulnerable. This concentration demands robust strategies to mitigate risks within these key segments to ensure sustained profitability and growth.

Ascential's business model, heavily anchored in physical events, exposes it to significant vulnerabilities from external shocks. For instance, the COVID-19 pandemic in 2020 and 2021 led to widespread event cancellations and postponements globally, directly impacting Ascential's revenue streams from ticket sales, exhibitor fees, and sponsorships. This reliance on in-person gatherings means that events like travel bans or geopolitical tensions can drastically reduce participation and thus profitability.

While Ascential has demonstrated adaptability, its core strength in live events also represents a key risk compared to purely digital competitors. A major health crisis or severe travel restrictions, similar to those experienced in early 2020, could again necessitate the cancellation or significant scaling back of physical events. This inherent susceptibility to disruptions can result in substantial revenue shortfalls and necessitate increased investment in contingency planning or digital alternatives, potentially raising operational costs.

The acquisition of Ascential by Informa, valued at approximately £1 billion in early 2024, presents significant integration challenges. Merging two distinct corporate cultures and operational systems can lead to temporary disruptions, potentially impacting employee morale and productivity. For instance, ensuring seamless data migration and aligning IT infrastructures are critical but often complex tasks.

Furthermore, there's a risk of losing key talent during the integration phase, as employees may be uncertain about their roles or prefer to stay with familiar structures. Maintaining the unique brand identities and operational efficiencies that Ascential has cultivated will be paramount to realizing the full value of the acquisition, especially given Informa's stated goal of leveraging Ascential's digital commerce intelligence capabilities.

Sensitivity of Financial Technology Segment to Market Conditions

The Financial Technology segment, exemplified by Money20/20 Europe, demonstrated a notable vulnerability to prevailing market sentiment. In the first half of 2024, this segment saw an 8% decrease in revenue, directly linked to a slowdown in funding within the broader fintech sector. This downturn highlights the segment's susceptibility to fluctuations in investment and economic cycles that affect the financial technology industry.

This sensitivity means that a general cooling of investment in fintech could significantly dampen the performance of Ascential's financial technology offerings. Even with the positive launch of Money20/20 Asia, a sustained period of reduced fintech investment poses a risk to the segment's overall revenue generation and growth trajectory.

- Revenue Decline: Money20/20 Europe recorded an 8% revenue drop in H1 2024.

- Causation: The decline is attributed to challenging funding conditions in the fintech market.

- Market Sensitivity: The segment's performance is closely tied to external investment trends and economic cycles in fintech.

- Growth Risk: A downturn in fintech investment could negatively impact the success of new ventures like Money20/20 Asia.

Ongoing Sustainability Compliance Efforts

Ascential faces challenges in fully meeting all Task Force on Climate-related Financial Disclosures (TCFD) recommendations. While the company is working on climate transition plans for 2024 and 2025, the current partial compliance indicates a need for enhanced governance and reporting structures to satisfy growing stakeholder demands for robust ESG performance.

This ongoing effort in sustainability compliance, particularly concerning TCFD, represents a weakness as it highlights areas requiring further development in Ascential's environmental, social, and governance (ESG) strategy and execution. The gap in full compliance could impact investor confidence and the company's reputation in an increasingly ESG-conscious market.

- TCFD Compliance Gap: Ascential has not yet achieved full compliance with all TCFD recommendations.

- Development Needs: Governance and reporting frameworks require further refinement to meet stakeholder expectations for ESG performance.

- Future Focus: Climate transition plans for 2024 and 2025 are in progress, indicating an area of active development rather than established strength.

Ascential's divestiture of key segments like Digital Commerce and WGSN has led to increased business concentration. This means the remaining Marketing and Financial Technology segments now carry a much heavier burden for the company's overall performance. This heightened focus, while potentially good for strategic alignment, also makes the company more dependent on these two areas.

The company's reliance on physical events is a significant weakness. Events like the COVID-19 pandemic in 2020 and 2021 demonstrated how disruptions such as travel bans or geopolitical tensions could severely impact revenue from ticket sales and exhibitor fees. This makes Ascential vulnerable to external shocks that affect in-person gatherings.

The acquisition by Informa, valued at around £1 billion in early 2024, brings integration challenges. Merging different company cultures and operational systems can cause temporary disruptions and potentially affect employee morale and productivity. There's also a risk of losing key staff during this transition period.

Ascential's Financial Technology segment, particularly Money20/20 Europe, has shown sensitivity to market conditions. In the first half of 2024, this segment experienced an 8% revenue decrease, largely due to a slowdown in funding within the fintech industry. This highlights how economic cycles and investment trends in fintech can directly impact the segment's performance and growth prospects.

Full Version Awaits

Ascential SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a direct preview of the comprehensive report, ensuring you know exactly what you're getting. Unlock the full, detailed Ascential SWOT analysis immediately after checkout.

Opportunities

Informa's acquisition offers Ascential's flagship event brands, Lions and Money20/20, a prime chance to broaden their global footprint. Informa's vast network, encompassing over 600 B2B brands and operations in more than 30 countries, is a powerful engine for Ascential's international growth.

This integration allows Ascential to tap into new markets and leverage Informa's established relationships with suppliers, venues, and trade associations. Such synergies are expected to significantly boost cross-promotional activities and accelerate Ascential's global expansion strategy.

Ascential, as a segment within the Informa Group, is well-positioned to leverage Informa's extensive reach and expertise. This allows for the strategic expansion of Ascential's established event and intelligence platforms into new, specialized market sectors. For instance, Informa's successful acquisition and integration of FinTech events and intelligence services are projected to generate substantial incremental revenues starting in 2025. This expansion is driven by cross-selling opportunities across an enlarged customer base, demonstrating a clear path for revenue acceleration.

The digital economy's rapid expansion presents a significant opportunity for Ascential. As businesses increasingly rely on data for strategic decisions, Ascential's expertise in marketing intelligence and analytics is highly relevant. For instance, the global digital advertising market is projected to reach over $1 trillion by 2025, highlighting the immense value placed on understanding online consumer behavior.

Ascential can leverage this trend by developing and enhancing its digital product suite. This includes expanding its data analytics platforms and advisory services to meet the growing demand for actionable insights in areas like e-commerce optimization and digital marketing effectiveness. The company's ability to provide granular data and strategic guidance positions it to capture a larger share of this burgeoning market.

Advancing Sustainable Event Practices

Ascential is making strides in sustainable event practices, launching its Sustainable Events Standards in 2024. This initiative focuses on reducing the carbon footprint and waste generated at its events, a move that resonates with the increasing global demand for environmentally responsible business operations. By championing sustainability, Ascential can attract and retain clients who increasingly value eco-conscious partners.

This commitment positions Ascential to become a frontrunner in sustainable event management. Such leadership can significantly bolster its brand image and provide a distinct competitive edge in the market. For instance, a 2024 survey by Informa Markets found that 72% of event organizers consider sustainability a key factor when selecting event suppliers.

The opportunity extends to:

- Enhanced Client Acquisition: Attracting businesses with strong ESG (Environmental, Social, and Governance) mandates.

- Improved Brand Reputation: Being recognized as an industry leader in environmental responsibility.

- Operational Cost Savings: Implementing waste reduction and energy efficiency measures can lead to lower operational expenses.

- Innovation in Event Design: Developing new, sustainable event formats and technologies.

Strategic Acquisitions and Organic Growth within Events

Even with significant past acquisitions, Ascential's events division still has room to grow both internally and by acquiring other businesses. The company's ongoing strategy involves expanding its worldwide event offerings, focusing on unique events that are vital to their respective industries.

This expansion could include purchasing smaller, specialized events or intelligence services that complement its existing portfolio, thereby strengthening its market standing. For instance, in 2023, Ascential continued to invest in its digital commerce segment, which includes events, demonstrating a commitment to this growth avenue.

- Organic Expansion: Ascential can foster organic growth by enhancing existing events through better content, increased attendee engagement, and expanded digital offerings, potentially boosting revenue from its 2023 reported figures.

- Strategic Acquisitions: The company can pursue targeted acquisitions of niche event organizers or data providers to broaden its geographic reach and industry coverage, similar to how it has historically strengthened its market intelligence capabilities.

- Market Consolidation: Ascential is well-positioned to capitalize on market consolidation, acquiring smaller players to achieve greater economies of scale and a more dominant market share in key sectors.

Ascential's integration into Informa Group presents a significant opportunity for global expansion, leveraging Informa's extensive network to broaden the reach of brands like Lions and Money20/20. This synergy allows Ascential to tap into new markets and benefit from Informa's established industry relationships, driving cross-promotional activities and accelerating international growth. Informa's successful integration of FinTech events, projected to generate substantial incremental revenues from 2025, exemplifies this growth potential through cross-selling to an enlarged customer base.

Threats

Ascential faces a significant threat from potential economic downturns, particularly as stress testing for early 2025 indicated. Such conditions could severely impact its revenue by prompting businesses to cut back on discretionary spending, including events, sponsorships, and crucial advisory services.

During economic uncertainty, a reduction in delegate volumes for Ascential's events is a likely consequence. This, combined with lower sponsorship revenues and increased pricing pressure, would directly affect the company's overall profitability.

Ascential operates in a crowded B2B events and information services market, facing rivals like Informa and RX Global. This intense competition can limit pricing power and necessitate ongoing investment in new offerings to stay ahead.

Ascential faces a significant threat from the rapid pace of technological advancements, especially in AI and data analytics. Failure to integrate these innovations into its intelligence products and advisory services could render them outdated, impacting its competitive edge. For instance, while Ascential invested in digital capabilities, the continued evolution of AI in content generation and analysis by competitors poses a constant challenge to maintaining market leadership.

Regulatory and Compliance Risks

Ascential faces significant regulatory and compliance risks due to its global operations. The company must navigate a complex web of international laws, including data privacy regulations like GDPR, which impacts how it handles customer information across its digital commerce and market intelligence segments. For instance, in 2023, the global regulatory landscape continued to tighten around data handling, with ongoing enforcement actions and potential fines for non-compliance.

Antitrust scrutiny is another key concern, particularly as Ascential operates in competitive sectors. Changes in competition law or investigations into its market practices could lead to substantial penalties or require divestitures, impacting its business model. The de-listing from the London Stock Exchange in late 2023 also introduces complexities for U.S. investors concerning the enforcement of their rights and adherence to U.S. securities regulations for those holding Ascential shares.

- Data Privacy Compliance: Ascential must continuously adapt to evolving data protection laws like GDPR and CCPA, which can increase operational costs and legal exposure.

- Antitrust Regulations: Potential investigations or stricter enforcement of competition laws in key markets could limit Ascential's growth strategies or result in significant fines.

- Event Licensing and Permits: Operating physical events requires adherence to local and international licensing and permit requirements, with potential disruptions from non-compliance.

- Post-LSE De-listing Considerations: U.S. holders of Ascential shares face new compliance and rights enforcement considerations following the company's delisting from the London Stock Exchange in late 2023.

Dependence on Key Talent and Leadership

Ascential's reliance on specialized expertise means that the departure of key individuals, particularly those with deep industry knowledge or leadership experience, poses a significant threat. This is especially relevant following major strategic shifts, such as the acquisition of its Digital Commerce segment by ECI Partners in early 2024, which could lead to talent reallocation or departures. The ability to retain top performers is crucial for maintaining service quality and client trust.

The competitive landscape for attracting and retaining highly skilled professionals in the information services and events sectors is intense. Ascential faces ongoing challenges in securing and keeping the talent necessary to innovate and execute its strategic vision. For instance, the company's focus on data analytics and market intelligence requires specialized skill sets that are in high demand across various industries.

The impact of leadership changes or the loss of critical team members can directly affect Ascential's ability to deliver its core value propositions. This includes the curation of high-profile events and the provision of expert consulting services. A strong leadership team is essential for navigating market complexities and driving future growth, especially as the company adapts to evolving market demands.

Key talent dependencies can create vulnerabilities:

- Talent Retention Challenges: Ascential operates in sectors where specialized knowledge is paramount, making the retention of experienced staff a continuous operational risk.

- Leadership Stability: The departure of key leaders could disrupt strategic planning and execution, impacting Ascential's market positioning and financial performance.

- Impact on Service Quality: A loss of critical talent may lead to a decline in the quality of consulting services and event experiences, potentially alienating clients.

Ascential faces significant threats from economic downturns, which could reduce client spending on events and advisory services. Intense competition from players like Informa and RX Global also pressures pricing power and necessitates continuous innovation. Rapid technological advancements, particularly in AI, pose a risk of obsolescence if not integrated effectively, while evolving data privacy and antitrust regulations create compliance challenges and potential penalties.

The company's reliance on specialized expertise makes talent retention a critical threat, especially after strategic shifts like the sale of its Digital Commerce segment in early 2024. Loss of key personnel could impact service quality and strategic execution. The competitive market for skilled professionals exacerbates these talent challenges.

| Threat Category | Specific Risk | Potential Impact |

|---|---|---|

| Economic Conditions | Reduced discretionary spending by businesses | Lower event attendance, sponsorship revenue, and advisory service demand. |

| Competition | Intense rivalry from established players | Pressure on pricing, market share erosion, and increased R&D costs. |

| Technological Disruption | Failure to adopt AI and advanced analytics | Outdated products/services, loss of competitive edge. |

| Regulatory & Compliance | Evolving data privacy laws (e.g., GDPR) and antitrust scrutiny | Increased operational costs, legal penalties, potential business model adjustments. |

| Talent Management | Loss of key personnel and difficulty attracting skilled professionals | Degraded service quality, disrupted strategy execution, and innovation lag. |

SWOT Analysis Data Sources

This Ascential SWOT analysis is built upon a robust foundation of data, drawing from Ascential's official financial filings, comprehensive market intelligence reports, and expert industry evaluations to provide a well-rounded and accurate strategic overview.