Ascential Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascential Bundle

Ascential operates in a dynamic market shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating its competitive landscape effectively.

The complete report reveals the real forces shaping Ascential’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ascential's reliance on unique talent for its premier events like Cannes Lions and Money20/20 significantly impacts supplier bargaining power. These events depend on a pool of renowned speakers, industry experts, and creative professionals whose specialized skills are not easily replicated.

The scarcity of such highly sought-after individuals grants them considerable leverage. This can translate into higher fees or more stringent terms for their participation, directly affecting Ascential's operational costs and profitability in these key segments.

For instance, securing top-tier keynote speakers for major industry conferences often involves substantial compensation, reflecting their market value and the direct impact they have on event attendance and perceived quality. Ascential's ability to attract and retain this intellectual capital is crucial for maintaining its competitive edge.

Ascential’s reliance on specific, high-quality data sources for its remaining intelligence products like WARC and Acuity Pricing presents a potential area of supplier bargaining power. If alternative sources for crucial niche datasets are scarce, the providers of this data could wield considerable influence over Ascential.

The proprietary nature of certain datasets further amplifies this supplier leverage. In 2024, the market for specialized data intelligence continues to be fragmented, meaning Ascential may face limited options for obtaining unique or highly granular information, thereby strengthening the position of data suppliers.

Ascential relies on technology and platform providers for its core operations, including event management, content distribution, and data analytics. If these platforms are highly specialized or proprietary, the suppliers could wield significant influence, potentially driving up costs for Ascential. For instance, a significant portion of Ascential's 2024 operating expenses would be tied to its technology infrastructure, making disruptions or price hikes from key vendors a considerable risk.

Venue and Logistics Providers for Global Events

Ascential's reliance on major global event venues and logistics providers grants these suppliers significant bargaining power. The scarcity of world-class venues capable of hosting events like Cannes Lions, coupled with the complexity of managing global logistics, means Ascential often faces limited alternatives. This is especially pronounced for premium, sought-after locations which command higher prices and favorable contract terms.

The bargaining power of venue and logistics providers is amplified by the long-term commitment and intricate planning Ascential undertakes for its flagship events. For instance, securing a venue for an event like Money20/20 might involve contracts signed years in advance, locking Ascential into specific arrangements. In 2024, the events industry continued to see robust demand, with major international event spaces experiencing high occupancy rates, further strengthening supplier leverage.

- Limited Global Venue Options: The pool of venues suitable for Ascential's large-scale, international events is inherently restricted, concentrating power among a few key providers.

- High Switching Costs: The extensive planning and contractual obligations associated with event logistics make it costly and time-consuming for Ascential to switch providers.

- Industry Demand in 2024: The ongoing recovery and growth in the global events sector in 2024 have led to increased demand for venue and logistics services, enhancing supplier negotiating positions.

Specialized Content Contributors and Curators

Ascential's intelligence platforms, such as WARC, rely on a network of specialized content contributors, researchers, and curators. These individuals develop proprietary insights and benchmarks that are crucial to Ascential's value proposition.

The bargaining power of these specialized content contributors can be significant if they possess unique methodologies or exclusive access to data. This distinctiveness directly enhances the value Ascential offers to its clients.

- Proprietary Insights: Contributors often bring unique perspectives and research methodologies, making their content difficult to replicate.

- Exclusive Data Access: Access to niche datasets or early market information grants contributors considerable leverage.

- Content Uniqueness: The distinctiveness of the content directly impacts Ascential's competitive advantage and pricing power.

Ascential faces significant bargaining power from suppliers of unique talent for its premier events, such as Cannes Lions and Money20/20. The scarcity of renowned speakers and industry experts grants them leverage, leading to potentially higher fees and impacting Ascential's operational costs. In 2024, the demand for top-tier talent in the events sector remained robust, further solidifying supplier influence.

Suppliers of specialized data for Ascential's intelligence products, like WARC and Acuity Pricing, also wield considerable power due to the fragmented nature of niche data markets. The proprietary aspect of certain datasets amplifies this leverage, as Ascential may have limited alternative sources for crucial granular information.

Technology and platform providers for Ascential's core operations can exert significant influence, especially if their solutions are highly specialized or proprietary. Ascential's 2024 operating expenses are heavily tied to its technology infrastructure, making price hikes or disruptions from key vendors a notable risk.

Venue and logistics providers for Ascential's global events hold strong bargaining power due to limited options for large-scale international venues and the complex nature of global logistics. The high occupancy rates in major event spaces observed in 2024 further strengthened these suppliers' negotiating positions.

| Supplier Type | Impact on Ascential | 2024 Market Condition Influence |

|---|---|---|

| Unique Talent (Speakers, Experts) | Higher fees, increased operational costs | Robust demand for top-tier talent |

| Specialized Data Providers | Potential for increased data costs, limited alternatives | Fragmented niche data markets, proprietary datasets |

| Technology & Platform Providers | Risk of price hikes, infrastructure dependency | High reliance on specialized/proprietary platforms |

| Venues & Logistics Providers | Higher venue costs, contractual lock-ins | High occupancy in premium global event spaces |

What is included in the product

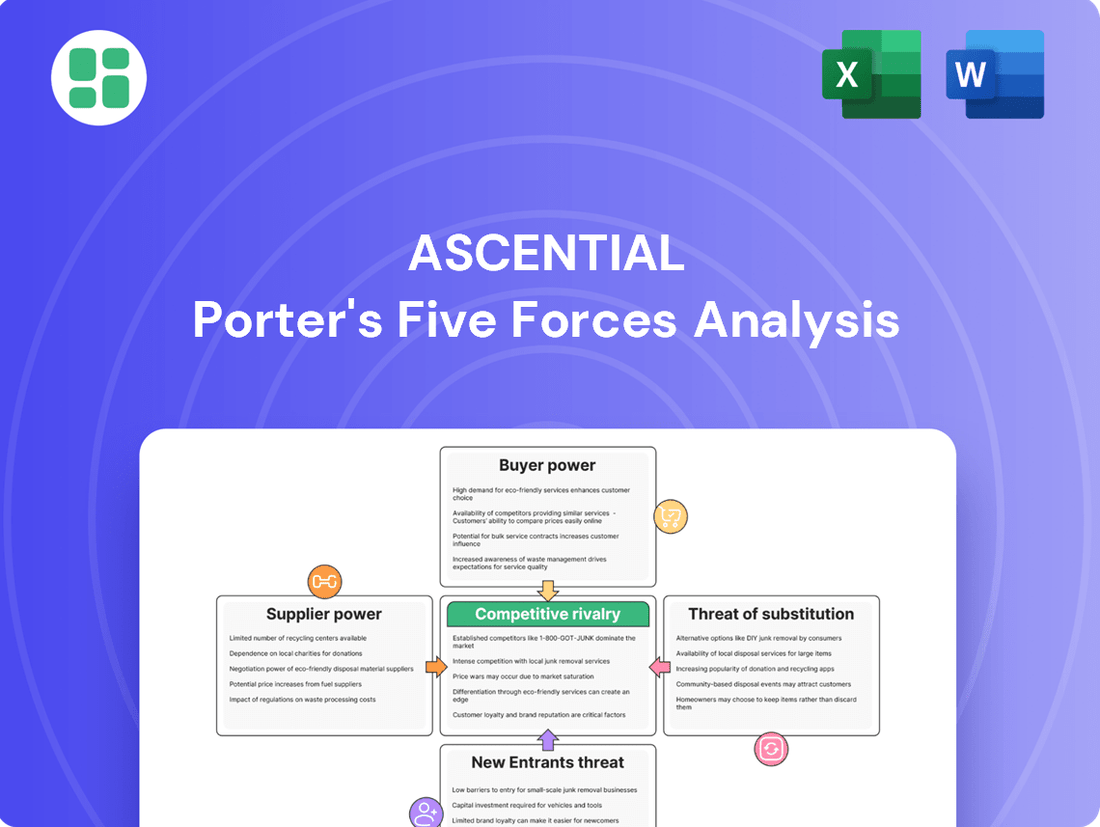

Ascential's Porter's Five Forces analysis reveals the competitive intensity and profitability potential within its markets, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivals.

Effortlessly identify and mitigate competitive threats with a visual, actionable breakdown of market forces.

Customers Bargaining Power

Ascential's customer base for its events and intelligence services is quite spread out, including many different brands, agencies, and financial institutions. This variety in customer needs generally weakens the bargaining power of any single customer, as they lack the collective strength to demand specific terms. For instance, while Ascential serves large enterprise clients, the broad distribution of its revenue across numerous customers means no single entity holds significant sway over pricing or service conditions.

For customers deeply embedded with Ascential's intelligence platforms, like WARC or Acuity Pricing, the cost of switching to a rival is substantial. This involves expenses for retraining personnel, migrating critical data, and reconfiguring existing operational processes. These significant integration costs inherently diminish the customer's leverage to negotiate lower prices or demand extensive bespoke features.

Ascential's marquee events, such as Cannes Lions and Money20/20, coupled with WARC's industry insights, create a powerful value proposition. This unique offering, which customers find difficult to replicate elsewhere, significantly diminishes their bargaining power. For instance, in 2023, Ascential reported strong performance from its Events segment, highlighting the continued demand for these high-value, specialized gatherings.

Price Sensitivity Varies Across Customer Segments

Price sensitivity isn't uniform across Ascential's customer base. Large enterprises, for instance, often demonstrate a lower sensitivity to pricing for premium data and exclusive event access, recognizing the strategic value. This contrasts with smaller businesses or those operating under tighter financial constraints, who are generally more attuned to cost. Ascential’s strategy of offering segmented products and varied pricing tiers aims to cater to these differing sensitivities, though competitive pressures in specific market niches can bolster the bargaining power of price-conscious buyers.

The perceived value of actionable intelligence is a key determinant. For strategic clients, the insights provided by Ascential frequently justify the expenditure, diminishing the impact of price as a primary decision factor. This highlights the importance of demonstrating clear ROI for Ascential's services.

- Customer Price Sensitivity: Varies significantly based on business size and budget.

- Ascential's Strategy: Segmentation of offerings and pricing to manage diverse customer needs.

- Competitive Impact: Intense competition can amplify the bargaining power of price-sensitive customers.

- Value Proposition: Actionable insights often outweigh cost for strategic clients, reducing price sensitivity.

Potential for In-house Development of Insights

Large brands and agencies can leverage their financial strength to build internal data analytics teams. For instance, major consumer goods companies might allocate millions in 2024 to establish sophisticated in-house market intelligence units, potentially reducing reliance on external providers like Ascential for standard data insights.

If Ascential's offerings don't demonstrably outperform or prove more cost-efficient than internal development, particularly for broad data analysis, clients could shift to DIY solutions. This is especially true when the core need is general market understanding rather than Ascential's specialized industry benchmarks or unique event-driven intelligence.

- Resource Allocation: Major corporations in 2024 are significantly investing in data science and analytics infrastructure, potentially exceeding $50 million annually for large enterprises.

- Cost-Benefit Analysis: Customers will compare the cost of Ascential's services against the total cost of ownership for an in-house solution, including salaries, technology, and training.

- Strategic Differentiation: Ascential must highlight its unique value proposition beyond basic data provision to retain clients who could replicate standard analytics internally.

Ascential's diverse customer base, spanning numerous brands and agencies, generally dilutes individual customer bargaining power. However, the high cost of switching from Ascential's integrated intelligence platforms, like WARC, can significantly reduce customers' leverage. The unique value proposition of Ascential's flagship events and specialized insights further limits customer negotiation power.

| Factor | Impact on Ascential | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | Low | Revenue spread across many clients, no single customer dominates. |

| Switching Costs | High | Significant investment in retraining and data migration for clients using platforms like WARC. |

| Differentiation | High | Unique value from events like Cannes Lions and specialized intelligence reduces customer leverage. |

| Price Sensitivity | Variable | Large enterprises are less price-sensitive for strategic value; smaller firms more so. |

Preview the Actual Deliverable

Ascential Porter's Five Forces Analysis

This preview showcases the comprehensive Ascential Porter's Five Forces Analysis you will receive immediately upon purchase. The document presented here is the exact, professionally formatted report, offering a detailed examination of the competitive landscape and its implications for Ascential. You'll gain instant access to this complete analysis, ready for your strategic planning and decision-making needs.

Rivalry Among Competitors

The B2B events and specialized intelligence sectors are highly competitive, with established global giants like Informa, RELX Group, and Daily Mail and General Trust vying alongside a multitude of specialized niche players. Ascential, now integrated into Informa, navigates this landscape, facing direct competition from other major event organizers, agile market research firms, and strategic consulting agencies.

This intense rivalry is fueled by the sheer volume and diverse capabilities of these competitors, each striving to capture market share through innovative offerings and strategic positioning.

Ascential's competitive edge is significantly bolstered by the strong brand recognition of its premier events, including Cannes Lions and Money20/20, and the trusted authority of its intelligence offerings like WARC.

This high level of differentiation, cultivated over many years, erects substantial hurdles for rivals attempting to directly mimic its distinct value proposition and the vibrant communities it has fostered.

For instance, in 2023, Ascential's Digital Commerce segment, which includes key intelligence platforms, demonstrated robust performance, highlighting the value of its differentiated content and data services.

The digital intelligence and marketing analytics market is booming, with projections showing continued strong growth through 2024 and beyond. This expansion offers opportunities for several companies to thrive, potentially easing some competitive pressures as the overall pie gets bigger. For instance, the global marketing analytics market was valued at approximately $5.7 billion in 2023 and is expected to reach over $14.5 billion by 2028, demonstrating significant room for multiple players to capture market share.

Despite this growth, the fundamental strategic importance of data-driven insights in today's digital economy fuels fierce competition. Brands are heavily investing in understanding consumer behavior and optimizing their marketing spend, leading Ascential and its rivals to aggressively pursue market share and customer loyalty. This means companies are constantly innovating and vying for dominance in providing these critical analytics.

Acquisition and Consolidation Trends

The competitive rivalry within the B2B information and events sector is intensifying due to significant acquisition and consolidation trends. Informa's acquisition of Ascential, a deal valued at approximately £1 billion in early 2024, exemplifies this shift. This move consolidates market share, creating a larger entity with enhanced capabilities in integrated offerings and cross-selling.

This consolidation reduces the number of independent competitors, but the remaining players are often larger and more resource-rich. These scaled entities can leverage their size to compete more aggressively on price, service breadth, and market reach, thereby increasing pressure on smaller or less diversified rivals.

- Informa's acquisition of Ascential in early 2024 for roughly £1 billion signals a significant consolidation wave.

- This trend reduces the number of independent players in the B2B information and events market.

- Consolidated entities can compete more effectively through economies of scale and integrated service portfolios.

- Increased competition from larger, consolidated firms can pressure smaller, independent businesses.

Barriers to Exit and High Fixed Costs

Operating large-scale global events and maintaining sophisticated intelligence platforms, like those Ascential is involved in, come with significant fixed costs. Think about venue contracts, advanced technology infrastructure, and highly specialized staff. These upfront and ongoing expenses create a substantial hurdle for companies looking to leave the market.

These high fixed costs can trap competitors, forcing them to stay in the game even when business is slow. This means that even in challenging economic periods, the rivalry among existing players remains intense because exiting is simply too costly. For instance, in 2023, the events industry saw significant investment in digital transformation, further increasing the fixed cost base for many operators.

- High initial investment: Significant capital is required for technology, infrastructure, and talent.

- Operational inflexibility: Fixed costs limit a company's ability to scale down operations quickly.

- Sustained rivalry: Competitors remain engaged, potentially leading to price wars or aggressive market strategies.

The competitive landscape for Ascential, now part of Informa, is characterized by intense rivalry among global leaders and specialized niche players. This rivalry is amplified by ongoing consolidation, such as Informa's acquisition of Ascential in early 2024 for approximately £1 billion, which creates larger, more resource-rich competitors. High fixed costs associated with running global events and intelligence platforms also deter new entrants and keep existing players engaged, even during downturns, leading to sustained competition.

| Competitor | Key Offerings | Market Position |

|---|---|---|

| Informa | B2B Events, Specialized Intelligence | Global Leader (post-Ascential acquisition) |

| RELX Group | Data Analytics, Information Services | Major Global Player |

| Daily Mail and General Trust (DMGT) | Events, Information Services | Significant UK-based competitor |

| Specialized Niche Players | Targeted Market Research, Consulting | Fragmented but influential |

SSubstitutes Threaten

Large enterprises increasingly possess sophisticated in-house data analytics and consulting capabilities. This internal capacity allows many companies to perform functions that Ascential's intelligence services provide, acting as a direct substitute.

For instance, a significant number of Fortune 500 companies now employ dedicated data science teams. In 2024, the average large enterprise is estimated to have invested over $50 million in their internal analytics infrastructure and personnel, a figure projected to grow by 15% annually.

Companies may opt to build these capabilities internally, particularly for more standardized data processing or general strategic advice. This build-versus-buy decision is influenced by cost-effectiveness and the perceived need for Ascential's specialized, niche expertise or proprietary benchmarking data.

The increasing availability of freely accessible information and open-source tools presents a significant threat of substitutes for Ascential's core business. The internet is awash with industry reports, market data, and analysis platforms that are often available at no cost or a low subscription fee. For instance, many government agencies and non-profits publish comprehensive economic and industry data, which can be leveraged for basic market understanding.

While these free resources may not match the depth, proprietary insights, or specialized benchmarking Ascential provides, they can serve as adequate substitutes for businesses with constrained budgets or less demanding intelligence requirements. Companies might opt for readily available data from sources like Statista or publicly traded companies' investor relations sections, especially for initial market exploration or less critical decision-making.

The rise of sophisticated open-source data analysis tools, such as Python libraries (e.g., Pandas, NumPy) and R, further empowers businesses to conduct their own analysis without relying on paid intelligence services. This trend is particularly pronounced in 2024, with advancements in AI and machine learning making data processing and interpretation more accessible than ever before, potentially reducing the perceived value of Ascential's foundational offerings.

The threat of substitutes for Ascential's specialized business conferences and trade shows, like Cannes Lions or Money20/20, is moderate. General business conferences and broader industry trade shows can offer alternative avenues for networking and knowledge sharing. For instance, in 2024, the global events industry saw a significant rebound, with many general business events attracting large numbers of attendees seeking broad industry insights and connections.

While these substitutes may lack the niche focus of Ascential's flagship events, they can still meet a company's fundamental needs for industry engagement and professional development. Companies might opt for these broader events if their objectives are less about highly specific sector advancements and more about general market awareness or cross-industry collaboration. The accessibility and potentially lower cost of some general conferences can also make them an attractive substitute.

Alternative Marketing and Fintech Advisory Services

The threat of substitutes for Ascential's marketing and fintech advisory services is significant. Beyond direct competitors, a wide array of alternative providers, including independent consultants, specialized boutique agencies, and even the advisory divisions of major accounting firms, can offer similar expertise. These substitutes often present varied engagement models and pricing strategies, potentially appealing to different client segments.

For instance, in 2024, the global management consulting market, which encompasses a large portion of advisory services, was projected to reach over $200 billion. This vast market includes many firms and individuals offering specialized fintech and marketing advice, creating a broad competitive base for Ascential. Clients can often find niche expertise or more flexible service packages from these alternatives.

- Independent Consultants: Offer highly specialized, often cost-effective solutions, particularly for smaller projects or specific knowledge gaps.

- Boutique Agencies: Focus on particular industries or service areas, providing deep, tailored expertise that can rival larger firms.

- Accounting Firms' Advisory Arms: Leverage existing client relationships and broad financial expertise to offer integrated marketing and fintech advisory, often at a premium.

- In-house Development: Larger organizations may choose to build their own marketing and fintech capabilities, reducing reliance on external advisors altogether.

Emergence of AI-driven Automated Insights

The growing sophistication of AI in generating market insights and predictive analytics presents a significant threat of substitution for Ascential's data-driven offerings. For instance, by mid-2024, AI platforms are increasingly capable of automating routine data analysis tasks that were previously the domain of specialized intelligence services.

While Ascential's core value lies in its curated data and expert analysis, the increasing ability of AI tools to perform similar functions at a lower cost or faster speed could diminish the perceived need for some of its services. This is particularly relevant for businesses seeking basic market trend identification or performance benchmarking.

Consider these points regarding AI as a substitute:

- Automated Insight Generation: AI algorithms can now process vast datasets to identify patterns and generate actionable insights, potentially replicating the output of some of Ascential's reports.

- Cost-Effectiveness: Many AI-powered analytics tools are offered on a subscription basis, which may be more economical for certain businesses compared to Ascential's premium data products.

- Speed of Analysis: AI can provide real-time or near real-time analysis, offering a speed advantage for time-sensitive decision-making processes.

The threat of substitutes for Ascential's data intelligence services is amplified by the growing trend of large enterprises building robust in-house analytics capabilities. Many Fortune 500 companies, for example, now invest heavily in dedicated data science teams. In 2024, the average large enterprise is estimated to have allocated over $50 million to internal analytics infrastructure and personnel, with projections indicating a 15% annual growth in this spending.

Furthermore, the increasing availability of free information and open-source tools presents a significant substitution threat. Companies can leverage publicly available data from government agencies and non-profits, or utilize powerful tools like Python libraries for their own analysis. This trend is particularly pronounced in 2024, with AI advancements making data processing more accessible than ever, potentially reducing the perceived need for Ascential's foundational offerings.

The threat of substitutes for Ascential's marketing and fintech advisory services is considerable, with a broad range of alternatives available. These include independent consultants, specialized boutique agencies, and the advisory arms of major accounting firms. The global management consulting market, a key area for these services, was projected to exceed $200 billion in 2024, indicating a vast competitive landscape offering diverse engagement models and pricing.

| Substitute Type | Key Characteristics | Potential Impact on Ascential |

|---|---|---|

| In-house Analytics Teams | Cost-effective for standardized tasks, deep organizational knowledge | Reduces reliance on external data providers for core functions. |

| Free/Low-Cost Data Sources | Widely accessible, good for basic market understanding | Adequate for businesses with limited budgets or less complex needs. |

| Open-Source Tools | Empowers self-service analysis, cost-efficient | Diminishes value proposition for foundational data processing. |

| General Business Conferences | Broader networking, general industry insights | Meets basic engagement needs, but lacks niche focus. |

| Independent Consultants/Boutique Agencies | Specialized expertise, flexible pricing | Offers tailored solutions, potentially at lower costs than Ascential. |

| AI-Powered Analytics Platforms | Automated insights, cost-effective, faster analysis | Threatens core data-driven offerings through automation and speed. |

Entrants Threaten

Launching and scaling global, high-profile events like Ascential's Cannes Lions or Money20/20 demands immense upfront capital. Think substantial investments in prime venue bookings, extensive global marketing campaigns, securing top-tier speaker fees, and managing complex operational logistics. This financial hurdle acts as a significant deterrent, making it exceedingly difficult for new players to enter and compete directly within Ascential's established premium events market.

Ascential's formidable brand reputation, exemplified by its flagship events like Cannes Lions and Money20/20, presents a significant barrier to new entrants. These brands have cultivated trust and recognition over decades, fostering powerful network effects within their sectors. For instance, the Cannes Lions International Festival of Creativity, a cornerstone of the advertising and marketing world, consistently attracts top-tier talent and global brands, creating a self-reinforcing ecosystem that is incredibly difficult for newcomers to penetrate.

Even after divesting some data operations, Ascential's core intelligence offerings, like WARC and Acuity Pricing, rely on unique data-gathering techniques, extensive historical datasets, and deep industry know-how. Newcomers would face a significant hurdle in replicating this accumulated expertise and data infrastructure, making it difficult to compete effectively.

Regulatory and Compliance Complexities

The threat of new entrants for Ascential, particularly in its data, analytics, and events sectors, is significantly mitigated by the intricate web of regulatory and compliance complexities. Operating across diverse geographies means grappling with a patchwork of data privacy laws like GDPR, which imposes strict rules on data handling and consent. For instance, in 2024, companies worldwide continued to invest heavily in data compliance, with global spending on data privacy software projected to reach tens of billions of dollars.

New players would need substantial resources and expertise to establish robust compliance frameworks, secure necessary intellectual property protections, and obtain event-specific licenses. This operational burden acts as a considerable barrier, making it challenging and costly for newcomers to compete effectively with established entities like Ascential that have already built these capabilities.

- Data Privacy Regulations: Compliance with evolving data privacy laws (e.g., GDPR, CCPA) requires significant investment in technology and legal expertise.

- Intellectual Property: Protecting proprietary data and analytics necessitates strong IP strategies and enforcement mechanisms.

- Event Licensing and Permits: Securing the myriad of permits and licenses for physical and digital events across different jurisdictions is a complex and time-consuming process.

- Cross-Border Compliance: Navigating differing legal and regulatory requirements in each operating country adds substantial overhead for new entrants.

Talent Acquisition and Retention Challenges

The threat of new entrants for Ascential is amplified by the intense competition for specialized talent. Ascential's core operations in event management, data science, market research, and industry consulting demand a highly skilled workforce. New companies entering this space would face considerable difficulty in attracting and retaining professionals with this niche expertise, as established firms like Ascential already command significant brand recognition and offer competitive compensation packages.

For instance, the demand for data scientists and AI specialists, crucial for Ascential's data-driven insights, remained exceptionally high throughout 2024. Reports indicated a global shortage of these professionals, with average salaries for experienced data scientists often exceeding $150,000 annually. This talent scarcity presents a substantial barrier for any new entrant attempting to build a comparable team.

- Talent Scarcity: High demand for specialized skills in data science, AI, and event management creates a significant hurdle for new entrants.

- Established Player Advantage: Ascential's existing talent pool and employer brand make it difficult for newcomers to attract top-tier professionals.

- High Recruitment Costs: New entrants would face substantial costs and time investment in building a skilled workforce comparable to Ascential's.

- Limited Expertise Pool: The niche nature of Ascential's services means the available pool of highly qualified individuals is already competitive.

The threat of new entrants for Ascential is generally low due to substantial capital requirements for its premium events and data services. These high upfront costs, from venue booking to global marketing, create a significant financial barrier. For example, launching a major international event like Money20/20 requires millions in investment, a sum that many potential newcomers cannot easily match.

Porter's Five Forces Analysis Data Sources

Our Ascential Porter's Five Forces analysis is built on a robust foundation of data, including proprietary market intelligence, company financial filings, and expert industry commentary. We leverage comprehensive datasets from leading market research firms and economic indicators to provide a thorough assessment of competitive intensity.