Ascential Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascential Bundle

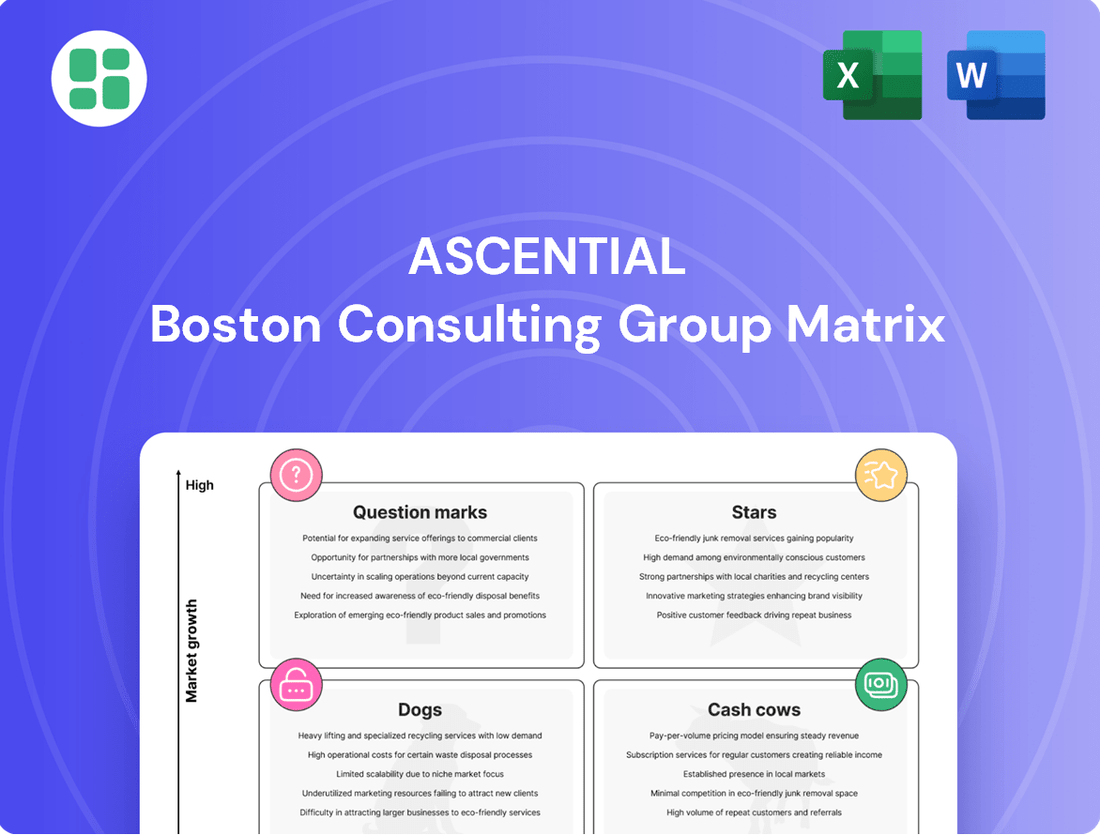

Curious about Ascential's product portfolio performance? This glimpse into their BCG Matrix reveals which products are driving growth and which might be holding them back.

To truly harness this strategic framework, unlock the full Ascential BCG Matrix for a comprehensive quadrant breakdown, actionable insights, and a clear path to optimizing your own product strategy.

Don't miss out on the detailed analysis and expert recommendations that will empower your decision-making. Purchase the complete report today and gain a competitive edge.

Stars

The Cannes Lions International Festival of Creativity stands as the premier global benchmark for creative excellence in branded communications. This segment consistently achieves robust double-digit revenue growth, fueled by rising delegate numbers and sponsorship opportunities, underscoring its significant market share within a booming creative economy.

Money20/20, a cornerstone of the fintech event landscape, has demonstrated impressive resilience and growth. Its European iteration, in particular, stands out as a significant player in connecting financial innovators.

Despite broader market fluctuations impacting fintech investments, Money20/20 has navigated these challenges, achieving robust double-digit revenue growth. This growth is further bolstered by successful expansion into emerging markets, notably in Asia, indicating a strong global demand for its offerings.

The event's substantial market share within the dynamic fintech sector, coupled with its success in attracting high-profile sponsors and a large delegate base, solidifies its position as a Star in the portfolio. For instance, Money20/20 Europe 2024 saw record attendance, with over 10,000 participants and more than 3,000 companies represented, highlighting its continued market leadership and appeal.

The WARC Intelligence Platform, a key component of Ascential's BCG Matrix, operates within the marketing segment, offering extensive global advertising and media intelligence. It serves as an indispensable tool for brands and agencies seeking data and insights.

WARC commands a substantial market share in the rapidly expanding marketing intelligence sector, thanks to its robust data sets and advanced analytical capabilities. This strong position is further bolstered by Ascential's strategic focus on this high-growth area.

Ongoing investment in WARC's data infrastructure and digital subscription services solidifies its market leadership. This continuous enhancement positions WARC to transition into a stable Cash Cow, generating consistent revenue and profits for Ascential.

Contagious Communications

Contagious Communications, acquired to bolster Ascential's marketing intelligence capabilities, offers creative and strategic guidance to brands aiming to boost their marketing impact. This acquisition operates within the rapidly expanding digital marketing intelligence sector, with a clear objective of increasing its market reach.

Its integration into Ascential's Marketing segment strategically places Contagious Communications in the Star category. This positioning allows it to leverage group synergies, thereby accelerating its market share expansion.

- Market Position: Contagious Communications is positioned as a Star within Ascential's BCG Matrix, indicating high market growth and a strong competitive position.

- Strategic Rationale: The acquisition was driven by Ascential's goal to enhance its marketing intelligence offerings, providing brands with tools to improve marketing effectiveness.

- Growth Focus: The company is actively working to expand its market penetration within the high-growth digital marketing intelligence space.

- Synergistic Benefits: As part of Ascential's Marketing segment, Contagious Communications benefits from group synergies that are expected to fuel its market share growth.

Acuity Pricing

Acuity Pricing provides critical real-time data on prices, promotions, and products to major retailers and brands, a vital offering in today's fast-paced digital commerce environment. This service directly addresses a significant market demand for immediate, actionable intelligence regarding competitor pricing and product effectiveness.

The company's focus on this high-growth area, coupled with its contribution to Ascential's robust Marketing segment performance, strongly indicates its position as a Star within the BCG Matrix. Continued investment is essential to capitalize on its substantial market potential and further solidify its leading role.

- Market Need: Addresses the growing demand for real-time competitive pricing and product performance data.

- Growth Potential: Operates in a high-growth digital commerce landscape.

- Strategic Importance: Key contributor to Ascential's strong Marketing segment performance.

- Investment Recommendation: Requires ongoing investment to capture further market share.

Stars, in the context of the BCG Matrix, represent business units or products with high market share in a high-growth industry. They are typically market leaders that require significant investment to maintain their growth trajectory and competitive advantage. The goal is to nurture these Stars to eventually become Cash Cows as market growth slows.

Cannes Lions, with its consistent double-digit revenue growth and strong delegate numbers, exemplifies a Star. Money20/20's resilience and expansion, particularly its record attendance in Europe in 2024 with over 10,000 participants, also firmly places it in this category. WARC Intelligence Platform's substantial market share and Ascential's investment in its infrastructure are building its Star status. Contagious Communications and Acuity Pricing, both within the high-growth marketing intelligence sector, are strategically positioned as Stars due to their market potential and Ascential's focus on their expansion.

| Business Unit | Market Growth | Market Share | BCG Category | Key Data Point |

|---|---|---|---|---|

| Cannes Lions | High | High | Star | Double-digit revenue growth |

| Money20/20 | High | High | Star | 10,000+ participants at Europe 2024 |

| WARC Intelligence Platform | High | High | Star | Robust data sets and analytics |

| Contagious Communications | High | Growing | Star | Acquired to enhance marketing intelligence |

| Acuity Pricing | High | Growing | Star | Real-time pricing data |

What is included in the product

The Ascential BCG Matrix provides a strategic framework for evaluating a company's product portfolio by categorizing business units based on market share and growth rate.

It offers clear guidance on which units to invest in, divest from, or maintain to optimize resource allocation and achieve sustainable growth.

A clear Ascential BCG Matrix overview helps prioritize investments, relieving the pain of resource allocation uncertainty.

Cash Cows

Ascential's established Cannes Lions sponsorships are a prime example of a Cash Cow. These long-standing partnerships with major global brands for sponsorship at the festival are a mature and highly profitable revenue stream. For instance, in 2023, the Cannes Lions International Festival of Creativity reported a significant increase in delegate numbers and brand participation, underscoring the enduring appeal and commercial viability of these sponsorships.

These sponsorships demand less intensive new investment compared to launching nascent ventures, yet they consistently generate substantial cash flow. This is due to the event's established prestige and market dominance, which attract premium sponsorship packages. The stability of this income significantly bolsters Ascential's overall financial health, providing a reliable foundation for other business initiatives.

The Money20/20 Europe event is a prime example of a cash cow within Ascential's portfolio. Its established presence and consistent attendee engagement have solidified its position as a reliable revenue stream.

This mature event commands a significant market share within the European fintech and payments conference landscape. In 2023, Money20/20 Europe attracted over 8,000 attendees, demonstrating its continued relevance and drawing power.

While its growth rate may have stabilized, the sheer volume of participants and sponsors translates into substantial and predictable earnings for Ascential, allowing for investment in other, more nascent business ventures.

WARC's foundational digital subscription services are the bedrock of its business, offering critical advertising and media intelligence. These long-standing offerings likely hold a dominant market share within their niche, reflecting their established value and consistent demand.

These subscriptions function as classic cash cows, generating predictable, high-margin revenue streams. The recurring nature of these sales, coupled with minimal ongoing marketing expenditure, ensures a steady cash flow for Ascential.

For instance, in 2023, Ascential reported that its digital segment, which includes WARC's subscription services, demonstrated resilience. While specific figures for WARC's foundational data subscriptions aren't broken out, the overall digital offerings contributed significantly to the company's profitability, underscoring their cash-generating power.

Seasoned Advisory Services in Marketing

Ascential's seasoned advisory services in marketing represent a classic cash cow within its portfolio. These offerings benefit from years of honed expertise and strong client loyalty, translating into robust profit margins and consistent revenue streams.

The stability of these advisory services is underpinned by their premium pricing, a reflection of the deep industry insights and established brand reputation they command. This allows Ascential to generate reliable cash flow with relatively low reinvestment needs.

- High Profit Margins: Advisory services often carry higher margins due to the intellectual capital and specialized knowledge provided.

- Stable Client Retention: Long-standing client relationships foster repeat business and reduce customer acquisition costs.

- Minimal Investment Needs: Mature services require less capital for expansion compared to high-growth ventures.

- Reliable Cash Flow Generation: These services act as a consistent source of funds to support other business areas.

Benchmark Awards Portfolio

Ascential's Benchmark Awards Portfolio, encompassing more than just the prominent Cannes Lions, represents a significant cash cow within its Marketing segment. These awards, designed to honor and showcase industry achievements, contribute a reliable revenue stream. Their established reputation and consistent annual schedule ensure predictable income with minimal need for substantial reinvestment.

The predictable nature of these awards, with their annual cycles, allows for efficient resource allocation. For instance, in 2024, Ascential continued to leverage these established events to generate consistent cash flow. This stability is a hallmark of a strong cash cow, requiring less management attention and capital infusion compared to growth-oriented ventures.

- Established Industry Recognition: Awards like Cannes Lions have long-standing credibility, attracting consistent participation and sponsorship.

- Predictable Annual Cycle: The recurring nature of these events allows for straightforward financial forecasting and management.

- Steady Revenue Stream: These benchmark awards provide a consistent and reliable source of income for Ascential.

- Low Reinvestment Needs: The mature status of these awards means capital is primarily used for maintenance rather than aggressive expansion.

Cash Cows are Ascential's mature, high-profit businesses with strong market positions that generate more cash than they consume. These units require minimal investment to maintain their market share, effectively funding other parts of the company. Their stability and consistent earnings are crucial for Ascential's overall financial health.

Ascential's established digital subscription services, like those offered by WARC, exemplify Cash Cows. These services provide essential intelligence to the advertising and media industries, commanding a loyal customer base. Their recurring revenue model, coupled with low operational costs, ensures a steady and predictable cash flow.

The Money20/20 events, particularly Money20/20 Europe, function as significant Cash Cows. With a dominant presence in the fintech and payments conference sector, these events consistently attract a large number of attendees and sponsors. For instance, Money20/20 Europe drew over 8,000 participants in 2023, highlighting its established market strength and revenue-generating capacity.

Ascential's portfolio of Benchmark Awards, including the prestigious Cannes Lions, also falls into the Cash Cow category. These events have a long-standing reputation and a predictable annual schedule, which allows for consistent sponsorship revenue and participation. This stability provides a reliable income stream with limited need for aggressive reinvestment.

| Ascential Business Unit | BCG Category | Key Characteristics | 2023/2024 Data Points |

|---|---|---|---|

| Cannes Lions Sponsorships | Cash Cow | Mature, high-profit, established prestige, premium sponsorship packages. | Significant increase in delegate numbers and brand participation in 2023. |

| Money20/20 Europe | Cash Cow | Dominant market share in fintech/payments conferences, consistent attendee engagement. | Attracted over 8,000 attendees in 2023. |

| WARC Digital Subscriptions | Cash Cow | Foundational, high-margin, recurring revenue, critical industry intelligence. | Digital segment, including WARC, demonstrated resilience and contributed significantly to profitability in 2023. |

| Advisory Services (Marketing) | Cash Cow | Honed expertise, strong client loyalty, premium pricing, stable revenue. | Benefits from deep industry insights and established brand reputation, leading to robust profit margins. |

| Benchmark Awards Portfolio | Cash Cow | Established industry recognition, predictable annual cycle, steady revenue. | Continued to generate consistent cash flow in 2024 through established events. |

Delivered as Shown

Ascential BCG Matrix

The Ascential BCG Matrix preview you're viewing is the identical, fully finalized document you will receive immediately after purchase. This means no watermarks, no demo content, and no missing sections – just the complete, professionally formatted strategic tool ready for your immediate application. You can confidently use this preview as a direct representation of the high-quality, analysis-ready BCG Matrix report that will be yours to download and implement. This ensures transparency and guarantees that you're investing in a complete and actionable strategic planning resource.

Dogs

Hudson MX, as of July 2024, was in the process of being sold. This strategic move suggests it was positioned as a potential 'dog' within Ascential's business portfolio, likely due to its low market share in a mature or intensely competitive sector. The divestiture process itself implies that Hudson MX was not generating sufficient growth or profits to justify its continued ownership, potentially tying up capital and management attention.

Legacy Non-Core Digital Products represent older digital offerings that, unlike the strategically divested Digital Commerce and WGSN units, haven't found their footing. These products often struggle in mature or declining markets, failing to capture significant market share and contributing minimally to overall revenue.

These assets typically operate in low-growth sectors or face intense competition, leading to minimal revenue generation. Their continued existence often results in resource drain for upkeep, making them candidates for divestment or careful rationalization. For instance, if a company had a legacy online directory service that saw its user base decline by 15% year-over-year due to newer, more dynamic platforms, it would fit this description.

Certain advisory services, particularly those focused on legacy technologies or outdated market entry strategies, are struggling. For instance, consulting firms specializing in traditional print advertising analytics saw a significant drop in demand as digital advertising spend continued its ascent. In 2024, the global digital advertising market was projected to reach over $600 billion, highlighting the shift away from older channels.

These outdated offerings often become cash traps, consuming valuable talent and capital without generating substantial returns. Firms may find themselves investing in teams that are expert in areas with declining client interest, such as advising on desktop-only software implementations. This misallocation of resources hinders a company's ability to pivot towards more profitable, future-oriented services.

Underperforming Smaller Events

Underperforming smaller events within Ascential's portfolio are those that consistently fail to attract significant attendance, sponsorship, or market relevance. These events often operate in niche areas that are either saturated or experiencing a decline, making growth prospects dim. In 2024, Ascential continued to evaluate its event portfolio, identifying specific smaller conferences that required significant resource allocation with minimal return on investment.

These events typically generate low revenue streams and demand a disproportionate amount of management effort for their upkeep. The challenge lies in their inability to scale or adapt to changing market dynamics, leading to a stagnant or negative growth trajectory. For instance, a hypothetical smaller industry conference that saw a 5% year-over-year decline in delegate numbers in 2023, coupled with a 10% drop in sponsorship revenue, would fit this classification.

- Low Attendance: Exhibited a consistent decline in participant numbers, perhaps falling below 1,000 attendees in 2024 for events previously attracting over 1,500.

- Weak Sponsorship: Sponsorship revenue for these events may have remained flat or decreased, failing to meet targets or cover event costs adequately.

- Limited Growth Potential: Operating in niche markets with little room for expansion or innovation, hindering future revenue generation.

- Resource Drain: Consumed management time and financial resources without yielding proportionate returns, impacting overall portfolio profitability.

Non-Strategic Acquired Assets

Non-strategic acquired assets, often smaller acquisitions that didn't integrate well or meet growth expectations, can become question marks in a company's portfolio. These might be businesses in stagnant markets or those lacking a distinct competitive edge.

Divesting these underperforming assets is a common strategy to unlock capital and redirect resources towards more promising core segments. For instance, a company might have acquired a niche software company in 2023 that, despite initial promise, failed to gain traction against larger competitors, leading to its potential divestiture in 2024.

- Underperforming Acquisitions: Assets acquired previously that have not met strategic or financial objectives.

- Low-Growth Markets: Businesses operating in industries with limited expansion potential.

- Limited Competitive Advantage: Products or services that struggle to differentiate themselves in the marketplace.

- Divestiture Rationale: Selling these assets frees up capital and management focus for core business areas.

Dogs in the Ascential BCG Matrix represent business units or products with low market share in low-growth markets. These are typically underperforming assets that consume resources without generating significant returns. Ascential's portfolio analysis in 2024 identified several areas fitting this description, such as legacy non-core digital products and smaller, underperforming events.

The strategy for these 'dog' assets often involves divestiture or careful rationalization to free up capital and management attention for more promising ventures. For example, the potential sale of Hudson MX in July 2024 signals a move to exit a business unit deemed a 'dog'.

These underperforming segments, like certain advisory services focused on outdated technologies, struggle to adapt to market shifts. The global digital advertising market's growth, projected to exceed $600 billion in 2024, underscores the decline in demand for older advertising channels, making related advisory services 'dogs'.

Divesting non-strategic acquired assets that haven't met growth expectations is another common approach to managing 'dogs'. These businesses, often operating in stagnant markets, are candidates for sale to reallocate resources effectively.

| Ascential Business Segment Example | BCG Matrix Classification | Rationale | 2024 Market Context/Action |

|---|---|---|---|

| Hudson MX | Dog | Low market share in a mature sector, not generating sufficient growth/profits. | Undergoing sale process as of July 2024. |

| Legacy Non-Core Digital Products | Dog | Struggle in mature/declining markets, minimal revenue contribution. | Haven't found footing; require resource allocation without substantial returns. |

| Underperforming Smaller Events | Dog | Low attendance, weak sponsorship, limited growth potential, resource drain. | Continued evaluation in 2024 for resource allocation vs. ROI. |

| Certain Advisory Services (e.g., print advertising analytics) | Dog | Declining demand due to market shifts to digital. | Digital advertising market projected over $600 billion in 2024. |

| Non-Strategic Acquired Assets (underperforming) | Dog | Did not integrate well or meet growth expectations; low-growth markets. | Potential divestiture in 2024 to free up capital. |

Question Marks

Money20/20 Asia's expansion into the burgeoning Asian fintech market positions it as a Question Mark within Ascential's BCG Matrix. This new venture shows strong revenue contribution in H1 2024, demonstrating its potential in a rapidly expanding sector.

While the Asian fintech market is experiencing significant growth, Ascential is actively investing to build its market share for Money20/20 Asia. This strategic focus indicates a high-growth prospect, though current market share is relatively low compared to its ultimate potential.

Significant ongoing investment is crucial for Money20/20 Asia to establish dominance and eventually transition into a Star. This commitment reflects the company's belief in the long-term viability and growth trajectory of this Asian market.

Ascential is actively developing new digital intelligence tools and advisory services, particularly within its Marketing and Financial Technology divisions. These initiatives are targeting fast-expanding digital sectors, though they currently possess a small market share as they work to gain traction and scale.

These emerging offerings represent high-risk, high-reward opportunities that necessitate substantial investment in marketing and ongoing development. For instance, Ascential's recent foray into AI-powered customer insights, launched in late 2023, aims to capture a piece of the burgeoning MarTech market, which is projected to reach $320 billion globally by 2024, according to industry reports.

Ascential's acquisition of Effie Worldwide Inc. in October 2024, just before Ascential itself was acquired by Informa, positions Effie as a potential star or question mark within the BCG Matrix. The strategic intent was to bolster Ascential's marketing effectiveness benchmarking capabilities, a sector experiencing significant growth. Effie's integration into Informa's broader data and analytics offerings will be key to determining its future market share and growth trajectory.

Exploration into New Geographic Markets for Events

Expanding into new geographic markets for events like Money20/20 or Lions presents a strategic opportunity, aligning with the Ascential BCG Matrix's exploration of "Question Marks." These are high-growth regions where Ascential has little to no presence, requiring significant investment to build market share.

For instance, consider the burgeoning fintech and advertising sectors in Latin America or parts of Africa. These regions represent untapped potential but come with inherent risks and the need for substantial upfront capital. Ascential's existing successful events in Europe and the US, and its recent expansion into Asia, provide a foundation, but new territories demand tailored approaches.

- Latin America: High growth potential in fintech, but fragmented regulatory landscapes and varying economic stability.

- Africa: Rapidly growing mobile adoption and digital transformation, particularly in countries like Nigeria and Kenya, offering significant opportunities for events focused on financial inclusion and digital commerce.

- Middle East: Strong government support for innovation and technology, with emerging hubs in Dubai and Riyadh for fintech and creative industries.

- Southeast Asia (beyond current presence): Continued expansion into markets like Indonesia and Vietnam, leveraging existing Asian experience but requiring localized strategies.

Advanced AI/Data Analytics Offerings

Ascential's advanced AI and data analytics offerings would likely be positioned as Stars within the BCG matrix. The demand for AI-driven insights in marketing and fintech is escalating rapidly, with the global AI market projected to reach over $1.5 trillion by 2030, according to some forecasts.

Developing these solutions allows Ascential to leverage cutting-edge technology to enhance its existing intelligence platforms, offering clients more sophisticated predictive capabilities and automated insights. This aligns with the company's strategy to provide high-value, data-centric solutions in dynamic sectors.

- High Growth Potential: The increasing integration of AI and predictive analytics in marketing and fintech signifies a substantial growth trajectory for these capabilities.

- Technological Advancement: Ascential's investment in advanced AI/data analytics positions it at the forefront of technological innovation within its industry.

- Market Fit and Adoption: Success hinges on demonstrating clear market utility and achieving significant user adoption to solidify market share against competitors.

- Augmented Intelligence: These offerings enhance existing platforms, providing deeper, more actionable intelligence for clients.

Question Marks represent business units or products in high-growth markets but with low market share. Ascential's strategy for these involves significant investment to increase market share, aiming to convert them into Stars. Failure to gain traction could lead to divestment.

The Money20/20 Asia expansion is a prime example, operating in the fast-growing Asian fintech sector. Ascential is pouring resources into this venture to build its presence, acknowledging the high investment required to compete effectively in this dynamic region.

Similarly, new digital intelligence tools and advisory services targeting expanding digital sectors are categorized as Question Marks. These initiatives, while promising, are in their early stages with a small market share, necessitating substantial marketing and development efforts.

The company's expansion into new geographic markets for its events, such as Latin America and Africa, also falls under the Question Mark category. These regions offer high growth potential but require tailored strategies and significant capital to establish a foothold.

| Ascential Business Unit/Initiative | Market Growth Rate | Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| Money20/20 Asia | High (Fintech Sector) | Low | Question Mark | Investment to gain market share |

| New Digital Intelligence Tools | High (Digital Sectors) | Low | Question Mark | Marketing and development investment |

| Event Expansion (e.g., Latin America) | High (Emerging Markets) | Low | Question Mark | Tailored strategies and capital investment |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of public company filings, comprehensive market research reports, and proprietary sales data to accurately map business unit performance and market dynamics.