Asahi Kasei PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Kasei Bundle

Asahi Kasei operates within a dynamic global landscape shaped by evolving political stability, economic fluctuations, and technological advancements. Understanding these external pressures is crucial for forecasting the company's trajectory and identifying strategic opportunities. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable intelligence to inform your decisions.

Gain a competitive edge by exploring the social, technological, environmental, and legal forces impacting Asahi Kasei's operations. This ready-made PESTLE analysis provides expert-level insights, perfect for investors, consultants, and business planners seeking to navigate market complexities. Purchase the full version to unlock a complete breakdown and empower your strategic planning.

Political factors

Asahi Kasei, a global player, navigates a complex web of international trade policies. For instance, the ongoing trade tensions between major economies in 2024, including potential adjustments to tariffs on chemicals and advanced materials, directly influence Asahi Kasei's raw material procurement costs and the pricing of its finished goods in export markets. These shifts can significantly impact its competitive edge and overall profitability.

The company's extensive supply chain, which sources materials and distributes products worldwide, is particularly sensitive to trade agreements and their potential renegotiations. For example, changes to existing free trade agreements in key regions where Asahi Kasei operates could alter import duties, affecting the landed cost of components and the attractiveness of its products to international customers. Adapting to these evolving trade landscapes is paramount for maintaining operational efficiency and market access.

Governments globally are prioritizing sustainable development, with many nations offering substantial financial incentives and regulatory support for green technologies. For instance, in 2024, the US Inflation Reduction Act continues to provide significant tax credits for clean energy projects, which directly benefits companies like Asahi Kasei investing in areas such as green hydrogen.

Asahi Kasei's strategic focus on green hydrogen production and biomethane purification positions it to capitalize on these favorable political tailwinds. Initiatives like subsidies, tax holidays, and streamlined permitting processes can significantly de-risk and accelerate the market entry and scaling of its environmentally conscious solutions, as seen with similar government-backed projects in the EU during 2024.

The political stability of nations where Asahi Kasei conducts operations or procures raw materials is a critical determinant of its business continuity and strategic investment choices. For instance, in 2024, ongoing geopolitical shifts in Southeast Asia, a key region for chemical manufacturing, could impact raw material sourcing costs and the reliability of supply chains.

Geopolitical tensions, such as trade disputes or regional conflicts, can significantly disrupt Asahi Kasei's operations by interrupting supply chains, escalating operational risks, and dampening market demand for its wide array of products, from advanced materials to healthcare solutions. In 2025, continued trade friction between major economic blocs could lead to increased tariffs on intermediate goods, directly affecting profitability.

To counter these inherent risks, Asahi Kasei's strategy of diversifying its manufacturing footprint and market presence across different geographies proves essential. This approach helps to buffer the company against localized political instability and ensures greater resilience in its global operations, a strategy that remains paramount as we move through 2024 and into 2025.

Industrial Policy and Strategic Industries

Governments worldwide are increasingly prioritizing industrial policies to bolster key sectors. For instance, the United States' CHIPS and Science Act, enacted in 2022, allocates over $52 billion to boost domestic semiconductor manufacturing, a sector where Asahi Kasei has interests in advanced materials. Similarly, the European Union's Green Deal aims to foster innovation and production in sustainable chemicals and materials, directly aligning with Asahi Kasei's focus on environmental solutions.

Asahi Kasei's diverse operations, spanning chemicals, healthcare, and electronics, position it to capitalize on these government initiatives. Policies designed to encourage domestic production, secure supply chains for critical materials, or drive research and development in advanced sectors can provide significant advantages. This support can manifest as direct R&D grants, tax incentives, or preferential procurement, bolstering Asahi Kasei's competitive edge.

Specific examples of government support that could benefit Asahi Kasei include:

- R&D Funding: Grants for developing next-generation battery materials or sustainable chemical processes.

- Supply Chain Security: Incentives for onshoring or nearshoring production of essential components, such as those used in medical devices or electronics.

- Strategic Industry Designation: Favorable regulatory treatment or access to public procurement for companies operating in designated strategic industries, like advanced polymers or biopharmaceuticals.

Regulatory Environment for Chemical and Healthcare Industries

The chemical and healthcare industries operate under a stringent regulatory framework, encompassing product safety, manufacturing standards, and environmental considerations. Political shifts toward stricter regulations in key markets, for instance, could increase Asahi Kasei's operational expenses and slow down the introduction of new products, impacting their market entry strategies.

Asahi Kasei's operations are directly influenced by governmental decisions on regulatory frameworks. For example, changes in environmental protection laws in Europe, which came into effect in 2024, have mandated stricter emissions controls for chemical manufacturers. This necessitates ongoing investment in advanced pollution abatement technologies, potentially adding to the company's capital expenditure.

- Regulatory Tightening: Increased scrutiny on chemical safety and pharmaceutical efficacy can lead to higher R&D and compliance costs for Asahi Kasei.

- Market Access: Varied regulatory landscapes across regions (e.g., FDA in the US vs. EMA in Europe) require tailored product approvals, affecting global market penetration timelines.

- Environmental Policies: Evolving sustainability mandates, such as those implemented in 2024 concerning plastic waste reduction, directly impact Asahi Kasei's material science and packaging solutions.

Governmental support for strategic industries, such as advanced materials and green technologies, presents significant opportunities for Asahi Kasei. Initiatives like the US CHIPS Act and the EU's Green Deal, offering substantial funding and incentives, directly align with Asahi Kasei's focus areas, potentially boosting R&D and domestic production through 2025.

Regulatory landscapes continue to evolve, with increasing emphasis on environmental protection and product safety. Stricter emissions controls and sustainability mandates, like those implemented in Europe in 2024, necessitate ongoing investment in compliance technologies, impacting operational costs but also driving innovation in greener solutions.

Geopolitical stability and trade policies remain critical factors. Trade tensions and potential tariff adjustments in 2024-2025 can influence raw material costs and market access, underscoring the importance of Asahi Kasei's diversified global footprint for operational resilience.

Governmental industrial policies are increasingly shaping competitive advantages. For instance, the EU's push for sustainable chemicals and materials, alongside US efforts to bolster semiconductor manufacturing, creates a favorable environment for Asahi Kasei's material science innovations.

What is included in the product

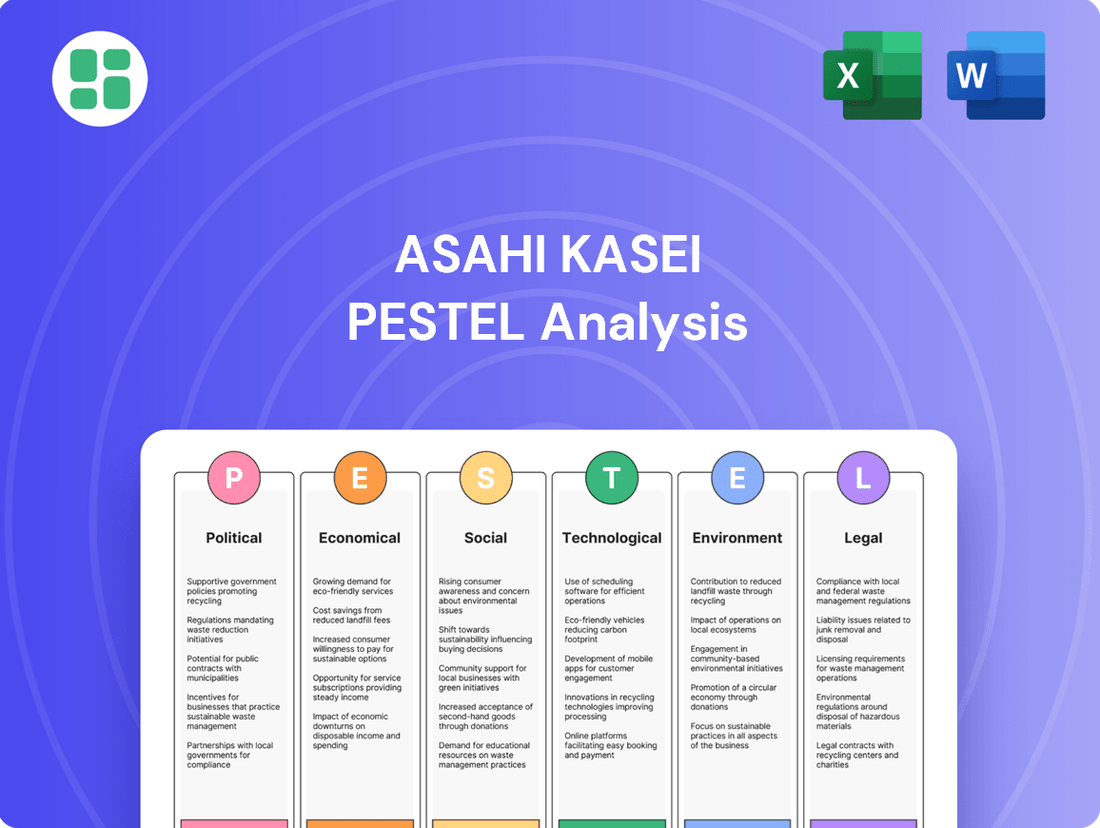

Examines the external macro-environmental factors impacting Asahi Kasei across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Asahi Kasei.

Economic factors

Asahi Kasei's broad portfolio, encompassing materials, housing, and healthcare, is inherently tied to the ebb and flow of the global economy. Strong economic expansion typically fuels demand across these diverse sectors, from construction materials to consumer goods. Conversely, economic downturns can dampen industrial output and consumer purchasing power, impacting sales for Asahi Kasei.

The company demonstrated notable resilience in fiscal year 2024, reporting robust growth in both sales and operating income. This performance suggests an ability to navigate varied economic climates effectively, a crucial factor given the ongoing discussions around potential global recessions in late 2024 and into 2025.

Asahi Kasei's chemical and materials businesses are particularly sensitive to the unpredictable swings in raw material and energy prices. For instance, the price of crude oil, a key feedstock for many petrochemical products, saw significant volatility in late 2023 and early 2024, impacting production costs across the industry.

The cost of natural gas, another critical energy input, also experienced fluctuations, directly affecting the energy-intensive operations of chemical manufacturing. These price movements for essential feedstocks like ethylene and propylene can create substantial pressure on Asahi Kasei's cost structure, making it challenging to maintain stable profitability.

In 2024, global energy markets continued to be influenced by geopolitical events and supply-demand dynamics, leading to unpredictable cost environments. Asahi Kasei's success hinges on its strategic approaches to cost management, including hedging strategies and operational efficiencies, alongside its capacity to adjust product pricing to offset these input cost escalations.

Asahi Kasei, being a Japanese multinational, is significantly impacted by currency exchange rate fluctuations, especially concerning the Japanese Yen against major global currencies like the US Dollar and Euro. These movements directly influence its reported financial performance.

For instance, a weaker Yen in 2024 generally benefits Japanese exporters like Asahi Kasei by increasing the yen-equivalent value of their overseas sales and profits. Conversely, a stronger Yen can make Asahi Kasei's products more expensive for international buyers, potentially dampening export volumes and reducing the translated value of its foreign-earned income.

In the first half of fiscal year 2024, Asahi Kasei reported that currency impacts contributed positively to operating income, largely due to the weaker Yen, which offset some of the cost pressures experienced in other areas of the business.

Inflationary Pressures and Interest Rates

Rising inflation in 2024 and into 2025 presents a significant challenge for Asahi Kasei, potentially escalating operating expenses. Increased costs for raw materials, labor, and logistics directly impact profitability. For instance, global inflation rates remained elevated through much of 2023, and while showing signs of moderation, many economies are still grappling with price pressures.

Higher interest rates, a common response to inflation, also pose a threat to Asahi Kasei's growth strategies. Increased borrowing costs for capital expenditures, research and development, and potential acquisitions can deter investment and slow expansion plans. Central banks globally, including the US Federal Reserve, have maintained higher policy rates through 2023 and early 2024 to combat inflation, making financing more expensive.

- Increased Operating Expenses: Global inflation in 2023 averaged around 5-6%, impacting input costs for chemical and materials companies like Asahi Kasei.

- Higher Borrowing Costs: Key interest rates in major economies, such as the US Federal Funds Rate, remained in the 5.25-5.50% range through early 2024, increasing debt servicing expenses.

- Impact on Growth Initiatives: Elevated financing costs can reduce the attractiveness of new investment projects, potentially delaying or scaling back expansion plans.

- Financial Forecasting Focus: Asahi Kasei's financial outlook acknowledges these economic uncertainties, including the potential impact of US trade policies, while prioritizing internal growth drivers and cost management.

Consumer Spending and Market Demand

Consumer spending trends are a significant driver for Asahi Kasei, particularly impacting its housing and certain material segments. When consumers feel confident about the economy and have more disposable income, they tend to invest in new homes or renovations, boosting demand for construction materials like concrete additives and insulation. For instance, in the US, consumer spending on durable goods, which often includes housing-related items, saw a notable increase in late 2023 and early 2024, reflecting improved economic sentiment.

This heightened consumer demand directly translates into increased sales for Asahi Kasei's products. Beyond housing, consumer-oriented products also benefit. The company's diverse portfolio means that shifts in consumer preferences, whether towards sustainable materials or specific lifestyle goods, can influence market demand across various divisions.

The healthcare sector presents a different, yet equally important, dynamic driven by demographic shifts. An aging global population, a trend projected to continue through 2025 and beyond, ensures a consistent and growing demand for medical devices and pharmaceuticals. Asahi Kasei's involvement in these areas means it is well-positioned to capitalize on this long-term demographic trend.

- Consumer spending growth in major economies like the US and Europe is expected to remain positive in 2024, supporting demand for building materials.

- The global population aged 65 and over is projected to reach approximately 1.0 billion by 2025, a key driver for healthcare product demand.

- Disposable income levels in developed nations are a critical indicator for Asahi Kasei's consumer-facing product sales.

- Asahi Kasei's Material segment, which includes performance polymers and chemicals, is sensitive to industrial production and consumer goods manufacturing output.

Economic factors significantly shape Asahi Kasei's performance, with global growth driving demand across its diverse segments like materials and housing. Conversely, economic slowdowns and volatile commodity prices, particularly for oil and natural gas, directly impact production costs and profitability. The company's resilience in fiscal year 2024, reporting strong sales and operating income, highlights its ability to navigate these economic uncertainties effectively, a critical advantage heading into potential global economic shifts in late 2024 and 2025.

Currency fluctuations, especially the Yen's performance against the US Dollar and Euro, directly influence Asahi Kasei's reported earnings, with a weaker Yen generally benefiting its export-oriented businesses. Rising inflation and higher interest rates in 2024 and 2025 present ongoing challenges, increasing operating expenses and borrowing costs, which can temper investment in growth initiatives.

Consumer spending trends are a vital economic indicator, particularly for Asahi Kasei's housing and materials divisions. Strong consumer confidence and disposable income, as seen with positive spending in durable goods in late 2023 and early 2024, boost demand for construction materials and consumer-oriented products. Simultaneously, demographic shifts, such as an aging global population, ensure sustained demand for its healthcare products.

| Economic Indicator | Asahi Kasei Relevance | 2024/2025 Outlook & Impact |

|---|---|---|

| Global GDP Growth | Drives demand for materials, housing, and consumer products. | Projected moderate growth in 2024, with regional variations. Positive impact on Asahi Kasei's sales volumes. |

| Commodity Prices (Oil, Natural Gas) | Key input costs for chemical and materials production. | Continued volatility expected due to geopolitical factors and supply/demand. Potential margin pressure if costs rise faster than prices. |

| Currency Exchange Rates (JPY/USD, JPY/EUR) | Impacts translation of overseas sales and profits. | Weaker Yen in H1 FY2024 positively contributed to operating income. Continued depreciation would further benefit reported earnings. |

| Inflation Rates | Increases operating expenses (raw materials, labor, logistics). | Elevated inflation in 2023 persisted into 2024, necessitating cost management and pricing strategies. |

| Interest Rates | Affects borrowing costs for capital expenditures and acquisitions. | Major central banks maintained higher rates through early 2024, increasing financing costs and potentially slowing investment. |

| Consumer Spending | Drives demand for housing and consumer-facing materials. | Positive trends in durable goods spending in late 2023/early 2024 supported construction material demand. |

| Demographics (Aging Population) | Sustains demand for healthcare products. | Global population aged 65+ projected to reach ~1 billion by 2025, ensuring long-term growth for healthcare segment. |

Full Version Awaits

Asahi Kasei PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Asahi Kasei delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain actionable insights into market dynamics and strategic considerations.

Sociological factors

The global population is getting older, with the proportion of people aged 65 and over projected to reach 16% by 2050, up from 10% in 2022. This demographic shift directly fuels a growing demand for healthcare services and products. Asahi Kasei, with its focus on medical devices, pharmaceuticals, and critical care, is well-positioned to capitalize on this sustained growth opportunity.

The company has actively developed and showcased health-related solutions, including advanced elderly monitoring systems. These innovations address the increasing need for reliable and accessible care for an aging demographic, aligning with market trends and demonstrating Asahi Kasei's commitment to addressing societal needs through its business operations.

Growing environmental consciousness significantly impacts Asahi Kasei, pushing for more sustainable product development and manufacturing. For instance, by 2024, the company aimed to increase its portfolio of businesses contributing to sustainability, with a target of ¥1 trillion in sales by fiscal 2030. This reflects a direct response to consumer and industry demand for eco-friendly alternatives.

This societal shift drives Asahi Kasei's investment in areas like bio-based chemicals and recycled materials. Their 'Care for Earth' initiative, a core part of their corporate philosophy, directly addresses this trend, aiming to reduce environmental impact throughout their value chain.

Asahi Kasei faces evolving workforce demographics, particularly an aging population in its home market of Japan, which necessitates strategic adjustments to human resource planning. Simultaneously, the company's global expansion ambitions require attracting and retaining a diverse talent pool across various regions.

Securing skilled professionals, especially in critical areas like research and development and advanced technical fields, is paramount for Asahi Kasei's continued innovation and competitive edge. As of 2024, Japan's labor force participation rate for those aged 65 and over reached approximately 25.2%, highlighting the demographic challenge.

The company's commitment to its sustainability principle of 'Care for People' directly informs its approach to talent acquisition and retention, aiming to foster an inclusive and supportive environment that appeals to a broad range of candidates.

Urbanization and Housing Needs

Rapid urbanization continues to be a significant driver for demand in housing and construction, directly benefiting Asahi Kasei's core businesses. As more people move to cities, especially in developing nations, the need for new homes and supporting infrastructure escalates. This trend is particularly relevant for Asahi Kasei, whose housing and construction materials divisions are well-positioned to capitalize on this sustained demand.

Meeting the needs of burgeoning urban populations requires more than just building; it demands innovative, sustainable, and efficient construction solutions. Asahi Kasei is actively involved in developing these advanced building materials and techniques. The company's Homes segment, for instance, has demonstrated robust performance, reflecting the strength of this market trend.

- Global urbanization rate: Forecasted to reach 68% by 2050, up from 57% in 2023, according to UN data.

- Asahi Kasei Homes performance: The segment reported strong operating profit growth in fiscal year 2023, driven by increased housing sales and construction volume.

- Sustainable construction demand: Growing consumer and regulatory pressure for eco-friendly building materials supports Asahi Kasei's investments in green technologies.

Health and Wellness Lifestyle Trends

Societal focus on health and wellness is a significant driver for Asahi Kasei. This trend directly impacts demand for their healthcare products, from pharmaceuticals to advanced materials used in medical devices and wearable technology. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a strong market for Asahi Kasei's innovations in this space.

This emphasis on preventative care and active lifestyles fuels innovation in materials science. Asahi Kasei's advanced polymers and fibers find applications in performance apparel and health monitoring systems, supporting consumers' pursuit of healthier living. The market for smart wearables, a key area for such materials, is expected to exceed $100 billion by 2027, showcasing the commercial potential.

- Growing demand for preventative healthcare solutions

- Increased adoption of wearable technology for health monitoring

- Market growth in advanced materials for active lifestyle products

- Consumer preference for personalized health and wellness services

Societal shifts towards health and wellness are a major boon for Asahi Kasei, driving demand for its healthcare offerings. The global digital health market, valued at around $200 billion in 2023, is set for significant expansion, directly benefiting Asahi Kasei's innovations in this area.

The increasing focus on preventative care and active lifestyles also spurs demand for Asahi Kasei's advanced materials used in performance apparel and health monitoring systems. The smart wearables market, a key sector for these materials, is anticipated to surpass $100 billion by 2027, highlighting the commercial opportunities.

| Societal Trend | Impact on Asahi Kasei | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Aging Global Population | Increased demand for healthcare services and products. | Proportion of 65+ projected to reach 16% by 2050 (vs. 10% in 2022). |

| Growing Environmental Consciousness | Push for sustainable product development and eco-friendly alternatives. | Target of ¥1 trillion in sustainability-related sales by FY2030 (as of 2024). |

| Evolving Workforce Demographics | Need for strategic HR planning and diverse talent acquisition. | Japan's labor force participation for 65+ was approx. 25.2% in 2024. |

| Rapid Urbanization | Increased demand for housing and construction materials. | Global urbanization rate forecast at 68% by 2050 (vs. 57% in 2023). |

| Health and Wellness Focus | Demand for healthcare products and advanced materials for active lifestyles. | Digital health market valued at ~$200 billion in 2023; smart wearables market to exceed $100 billion by 2027. |

Technological factors

Asahi Kasei's significant investment in advanced material science R&D is a cornerstone of its competitive strength. For instance, their work on high ionic conductive electrolytes for lithium-ion batteries is vital for the rapidly growing electric vehicle market, which saw global sales surge by over 30% in 2023 alone. This focus on innovation directly translates to enhanced product performance and opens doors to novel applications across their diverse business segments.

Asahi Kasei is actively integrating digital transformation and Industry 4.0 principles, evident in its pursuit of enhanced operational efficiency. This includes the adoption of technologies like AI, IoT, and automation across its manufacturing and supply chain operations. For instance, the company is developing smart products, such as those for vital sensing and elderly monitoring, demonstrating a commitment to leveraging digital solutions for innovative applications.

Asahi Kasei's healthcare division thrives on advancements in biotechnology and medical device technology. The company actively develops new medical devices, pharmaceuticals, and bioprocess solutions, such as their virus removal filters and contributions to biologics Contract Development and Manufacturing Organization (CDMO) services. This commitment to innovation is paramount to addressing the ever-changing landscape of global healthcare demands.

Sustainable Production Technologies and Green Chemistry

Asahi Kasei is heavily invested in advancing sustainable production technologies, a critical technological factor influencing its operations and future growth. The company recognizes the importance of green chemistry principles in developing more environmentally friendly manufacturing processes.

A prime example of this focus is Asahi Kasei's commitment to green hydrogen production. This technology offers a cleaner alternative to traditional hydrogen generation, significantly reducing carbon emissions. Furthermore, Asahi Kasei is exploring biomethane purification from organic waste, contributing to the circular economy and providing a renewable energy source.

These technological advancements are not merely about environmental responsibility; they represent significant business opportunities. By leading in these areas, Asahi Kasei is positioning itself to capitalize on the growing demand for clean energy solutions and sustainable products. The company's investment in these technologies aligns with global trends towards decarbonization and resource efficiency.

Key technological focuses include:

- Green Hydrogen Production: Developing and scaling up electrolysis technologies powered by renewable energy sources to produce hydrogen with a minimal carbon footprint.

- Biomethane Purification: Enhancing processes to extract and purify methane from organic waste streams, creating a valuable renewable natural gas.

- Advanced Material Science: Utilizing green chemistry principles to develop sustainable and high-performance materials with reduced environmental impact throughout their lifecycle.

Intellectual Property Protection and Management

Protecting its extensive portfolio of innovations through robust intellectual property (IP) management is vital for Asahi Kasei. Asahi Kasei consistently invests in research and development, with R&D expenses reaching approximately ¥80 billion in fiscal year 2023. This continuous innovation necessitates strong patent protection to maintain market exclusivity and a competitive edge.

Safeguarding patents and proprietary knowledge is essential for Asahi Kasei to prevent competitors from replicating its technological advancements. The company actively manages its IP portfolio, which includes numerous patents across its diverse business segments, from performance polymers to healthcare solutions. This proactive approach ensures that its technological breakthroughs translate into sustainable market advantages.

Asahi Kasei's commitment to IP management is a key driver of its long-term growth strategy. By securing its innovations, the company can command premium pricing and foster continued investment in future R&D. This focus on intellectual property underpins its ability to maintain leadership in rapidly evolving technological landscapes.

- Asahi Kasei's R&D expenditure in FY2023 was around ¥80 billion.

- IP protection is crucial for maintaining market exclusivity.

- A strong patent portfolio safeguards against competitive replication.

- Intellectual property is a cornerstone of Asahi Kasei's growth strategy.

Asahi Kasei's technological prowess is evident in its substantial R&D investments, exceeding ¥80 billion in fiscal year 2023, to drive innovation in areas like advanced materials and green technologies. This focus on cutting-edge research, including high ionic conductive electrolytes for EVs, positions them to capitalize on emerging markets. Furthermore, the company's embrace of digital transformation and Industry 4.0 principles, such as AI and IoT integration, enhances operational efficiency and fosters the development of smart products.

The company's strategic technological direction includes a strong emphasis on sustainable production, particularly in green hydrogen and biomethane purification, aligning with global decarbonization trends. Asahi Kasei's commitment to intellectual property management, safeguarding its numerous patents, is crucial for maintaining market exclusivity and supporting its long-term growth strategy.

| Technology Focus | Key Initiatives | Impact/Opportunity |

|---|---|---|

| Advanced Material Science | High ionic conductive electrolytes for Li-ion batteries | Enabling growth in the electric vehicle market |

| Digital Transformation | AI, IoT, automation in manufacturing | Enhanced operational efficiency, smart product development |

| Sustainable Production | Green hydrogen, biomethane purification | Reduced carbon emissions, circular economy contribution |

| Intellectual Property | Patent protection for innovations | Market exclusivity, competitive advantage, R&D support |

Legal factors

Asahi Kasei, as a chemical manufacturer, faces significant legal obligations related to environmental protection. Stringent regulations govern emissions, waste disposal, and the handling of chemical substances across its global operations. For instance, the company must adhere to evolving standards like the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and similar frameworks in other key markets, which dictate chemical safety and usage.

Compliance with these environmental laws, including targets for carbon neutrality and water conservation, demands ongoing capital expenditure. In 2023, Asahi Kasei continued its investments in R&D for sustainable materials and processes, aiming to reduce its environmental footprint. The company's commitment to sustainability is reflected in its efforts to meet increasingly rigorous emissions standards set by bodies like the EPA in the United States and equivalent agencies worldwide.

Asahi Kasei operates under stringent product safety and liability laws across its global markets, especially concerning its healthcare devices and materials integrated into consumer goods. For instance, in 2024, the global medical device market faced increasing regulatory scrutiny, with the U.S. FDA implementing enhanced post-market surveillance measures to ensure product safety.

Compliance with these regulations is paramount for Asahi Kasei to mitigate risks of costly legal battles, product recalls, and significant damage to its brand reputation. Failure to meet these exacting standards can result in substantial financial penalties and loss of consumer trust.

Asahi Kasei must meticulously adhere to a complex web of international trade laws and sanctions. Navigating these regulations is critical for sourcing raw materials and distributing finished products across its global network. For instance, the company's operations in regions subject to evolving sanctions regimes, such as those impacting trade with Russia following the 2022 invasion of Ukraine, require constant vigilance and legal adaptation to avoid penalties and supply chain disruptions.

Labor Laws and Employment Regulations

As a global enterprise, Asahi Kasei navigates a complex web of labor laws and employment regulations across its various operating regions. These laws dictate crucial aspects like minimum wages, working hours, safety standards, and employee benefits, ensuring fair treatment and protecting worker rights. For instance, in Japan, the Labor Standards Act sets the framework for employment conditions, while in the United States, the Fair Labor Standards Act (FLSA) governs minimum wage and overtime pay. Asahi Kasei's commitment to human rights, as outlined in its sustainability initiatives, underscores the importance of strict compliance to prevent legal disputes and maintain a positive corporate image.

The company's adherence to these diverse legal frameworks is paramount. Non-compliance can lead to significant penalties, including fines and litigation, which can disrupt operations and damage brand reputation. Asahi Kasei's sustainability report for 2023 highlighted its ongoing efforts to ensure equitable labor practices globally, aligning with international standards and local legislation. This proactive approach is essential for fostering a stable and productive workforce.

Key legal factors influencing Asahi Kasei's labor practices include:

- Varying Minimum Wage Laws: Asahi Kasei must comply with different minimum wage requirements in countries like Japan, the US, and Germany, which are subject to regular adjustments based on economic conditions.

- Worker Protection and Safety Regulations: Stringent occupational health and safety laws, such as those enforced by OSHA in the US and similar bodies in other nations, mandate safe working environments and employee training.

- Collective Bargaining Agreements: In many regions, Asahi Kasei engages with labor unions and must adhere to negotiated collective bargaining agreements that cover wages, benefits, and working conditions.

- Anti-Discrimination and Equal Opportunity Laws: Legislation in all operating countries prohibits discrimination based on race, gender, religion, and other protected characteristics, requiring fair hiring and promotion practices.

Data Privacy and Cybersecurity Laws

Asahi Kasei faces growing scrutiny regarding data privacy and cybersecurity, especially as its operations become more digitized. Compliance with regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) is paramount for safeguarding sensitive company and customer information. In 2024, the global cost of data breaches was estimated to reach $9.5 trillion, underscoring the financial risks of non-compliance.

To mitigate these risks, Asahi Kasei must maintain stringent information security policies and advanced systems. This is particularly critical for its digital solutions and healthcare divisions, where the protection of personal health information and proprietary digital data is essential for maintaining customer trust and operational integrity. The company’s investment in cybersecurity is a direct response to the evolving threat landscape.

- Data Protection Compliance: Adherence to GDPR, CCPA, and similar global data privacy laws is non-negotiable for Asahi Kasei's international operations.

- Cybersecurity Investments: Increased spending on robust cybersecurity measures is necessary to prevent breaches and protect intellectual property.

- Digital Trust: Maintaining customer confidence in data handling practices is vital, especially in sensitive sectors like healthcare technology.

- Regulatory Landscape: Staying abreast of evolving cybersecurity legislation and data protection mandates is a continuous operational challenge.

Asahi Kasei must navigate a complex legal environment, from environmental regulations like the EU's REACH to product safety standards, particularly for its healthcare products. Compliance with these global mandates, including evolving data privacy laws such as GDPR, is critical to avoid significant financial penalties and reputational damage. The company's investments in sustainability and cybersecurity in 2023 and 2024 reflect its proactive approach to managing these legal risks.

Environmental factors

Asahi Kasei is proactively tackling climate change, setting a goal for carbon neutrality by 2050 and aiming for a substantial reduction in greenhouse gas emissions by 2030. This commitment is backed by significant investments in renewable energy sources and the development of production methods that generate fewer emissions.

The company's strategy includes fostering a circular economy, evidenced by their efforts in material recycling and the creation of products designed for sustainability. For instance, their focus on advanced materials contributes to lighter vehicles, thereby reducing fuel consumption and emissions throughout the product lifecycle.

Growing concerns about the scarcity of essential raw materials are pushing companies like Asahi Kasei to increasingly adopt circular economy principles. This shift is vital for long-term sustainability and operational resilience.

Asahi Kasei is actively promoting the 3Rs: Reduce, Reuse, and Recycle. A key focus is on increasing the incorporation of recycled content into their products, aiming to lessen reliance on virgin resources. For instance, in 2024, the company continued to invest in technologies that enhance the recyclability of plastics, a core area of their business.

Furthermore, Asahi Kasei is developing innovative products designed for resource efficiency across their entire lifecycle. This includes materials that are more durable, require less energy to produce, and are easier to dismantle and recycle at the end of their useful life, contributing to a more closed-loop system.

Water scarcity is a growing global challenge, directly impacting industries reliant on this vital resource. Asahi Kasei addresses this by offering advanced water purification membrane modules and comprehensive water recycling services, aiming to conserve and reuse water effectively. For instance, their Hydro-Quench™ technology is designed for high-efficiency water cooling, reducing consumption in industrial processes.

The company also prioritizes efficient water usage within its own manufacturing facilities. Asahi Kasei actively monitors its water intake and implements strategies to minimize consumption, reflecting a commitment to responsible environmental stewardship. Their sustainability reports often highlight reductions in water withdrawal intensity per unit of production.

Pollution Control and Waste Management

Asahi Kasei places significant emphasis on minimizing environmental pollution stemming from its manufacturing operations and on robust waste management practices. This commitment translates into adopting sophisticated waste treatment technologies and actively working to reduce the generation of hazardous waste. The company ensures that all waste is disposed of responsibly, adhering strictly to all applicable regulatory mandates.

In 2023, Asahi Kasei reported progress in its sustainability initiatives, aiming to reduce greenhouse gas emissions and improve resource efficiency across its global sites. The company's environmental strategy includes investments in cleaner production methods and circular economy principles. For instance, their efforts in waste reduction align with broader industry trends driven by increasing environmental awareness and stricter regulations worldwide.

- Waste Reduction Targets: Asahi Kasei sets specific targets for reducing waste generated per unit of production, aiming for continuous improvement in its environmental performance.

- Advanced Treatment Technologies: The company invests in and utilizes advanced technologies for treating wastewater and air emissions to meet or exceed environmental standards.

- Hazardous Waste Management: A key focus is on minimizing the generation of hazardous waste and ensuring its safe and compliant handling and disposal.

- Circular Economy Initiatives: Exploring and implementing initiatives that promote the reuse and recycling of materials within its production processes, contributing to a more sustainable lifecycle for its products.

Biodiversity Protection and Sustainable Sourcing

Asahi Kasei is actively engaged in protecting biodiversity and ensuring its raw materials are sourced sustainably. The company understands that its operations can impact natural resources and is committed to minimizing this footprint. This focus on ecological conservation is a key part of its environmental strategy.

Efforts include responsible land use and the promotion of sustainable sourcing practices across its supply chain. By aligning its business activities with broader ecological goals, Asahi Kasei aims to contribute positively to biodiversity protection.

For instance, Asahi Kasei's commitment to sustainable sourcing is reflected in initiatives targeting key raw materials. While specific 2024/2025 figures are still emerging, the company's ongoing reporting highlights a growing emphasis on traceable and environmentally sound procurement. This strategy aims to mitigate risks associated with resource depletion and biodiversity loss, which could impact long-term operational continuity and brand reputation.

Key aspects of their approach include:

- Sustainable Forestry Practices: Engaging with suppliers who adhere to certified sustainable forestry management for wood-based raw materials.

- Biodegradable Materials Research: Investing in the development and use of biodegradable and bio-based materials to reduce reliance on fossil fuels.

- Water Resource Management: Implementing measures to reduce water consumption and ensure responsible wastewater discharge in its manufacturing processes.

- Supply Chain Transparency: Working towards greater transparency in its supply chain to identify and address potential environmental impacts, including those on biodiversity.

Asahi Kasei is actively addressing climate change with a goal of carbon neutrality by 2050, targeting a significant reduction in greenhouse gas emissions by 2030. This involves substantial investments in renewable energy and developing lower-emission production methods.

The company champions a circular economy through material recycling and sustainable product design, exemplified by advanced materials that reduce vehicle weight and fuel consumption. This focus on resource efficiency is crucial for long-term sustainability and resilience in the face of raw material scarcity.

Asahi Kasei prioritizes water conservation by offering advanced purification and recycling solutions, such as their Hydro-Quench™ technology, while also focusing on reducing water usage in their own facilities, as evidenced by reported reductions in water withdrawal intensity.

The company is committed to minimizing environmental pollution and managing waste responsibly, investing in advanced treatment technologies and hazardous waste reduction. Their sustainability reports highlight progress in these areas, aligning with global trends toward stricter environmental regulations and awareness.

| Environmental Focus | Key Initiatives/Targets | Data/Progress (as of latest reporting) |

| Climate Change | Carbon Neutrality by 2050; GHG Emission Reduction | Ongoing investments in renewables; development of low-emission processes. |

| Circular Economy | Material Recycling; Sustainable Product Design | Increased use of recycled content in products; focus on recyclability of plastics. |

| Water Management | Water Purification & Recycling; Efficient Internal Usage | Offering advanced membrane modules; reporting reductions in water withdrawal intensity. |

| Biodiversity & Sourcing | Sustainable Sourcing; Biodiversity Protection | Emphasis on traceable and environmentally sound procurement; research into biodegradable materials. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Asahi Kasei is meticulously constructed using data from official government publications, reputable financial institutions, and leading industry analysis firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.