Asahi Kasei Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Kasei Bundle

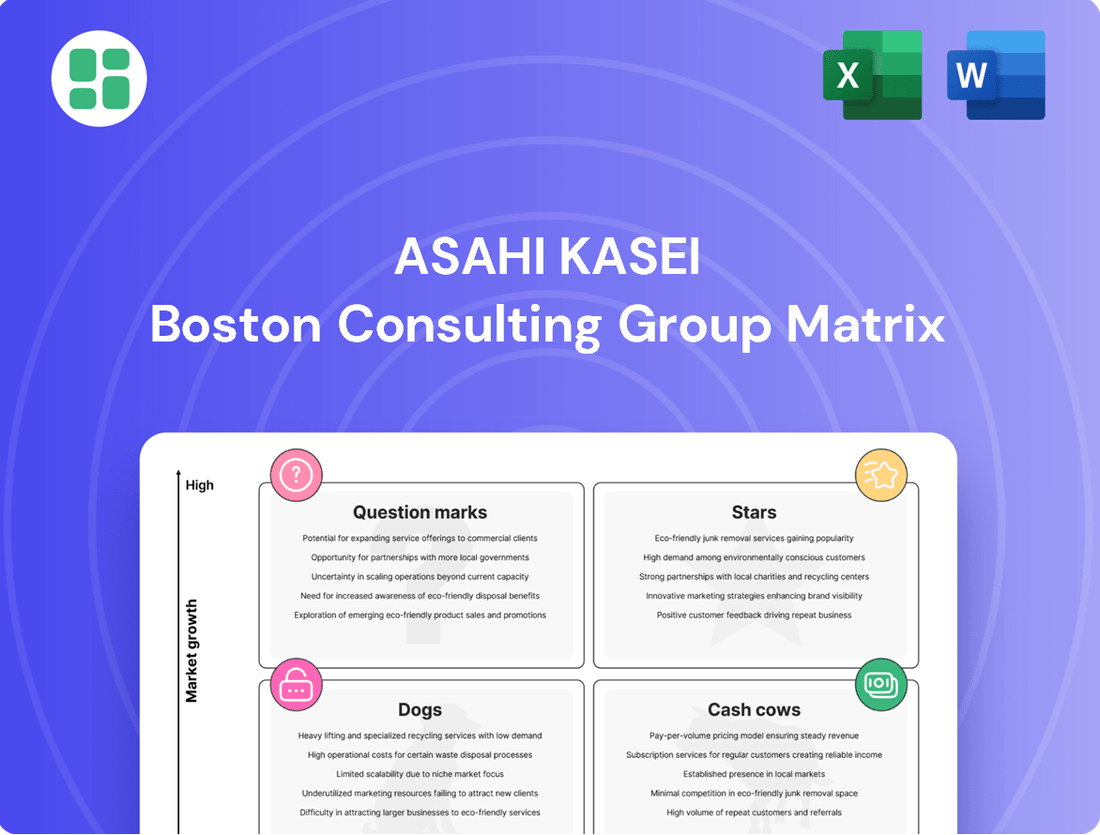

Asahi Kasei's BCG Matrix offers a fascinating glimpse into their diverse portfolio, highlighting potential growth areas and established revenue streams. Understanding which of their products are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed strategic decisions.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Asahi Kasei.

Stars

Asahi Kasei's pharmaceutical segment, significantly enhanced by the 2019 acquisition of Veloxis Pharmaceuticals and the 2024 acquisition of Calliditas Therapeutics, is positioned as a major growth engine, especially within the lucrative U.S. market.

These strategic moves have introduced key products such as Envarsus XR and Tarpeyo, which are experiencing rapid sales expansion and are instrumental in the strong performance of Asahi Kasei's Healthcare division. For instance, Calliditas reported net product sales of $103.8 million for Tarpeyo in 2023, showcasing its early commercial success.

Asahi Kasei is committed to further expanding its pharmaceutical footprint, actively seeking new investment opportunities through mergers, acquisitions, and licensing agreements to maintain momentum in this high-potential sector.

Planova™ virus removal filters are a standout performer in Asahi Kasei's Life Science portfolio, driven by robust demand from the expanding pharmaceutical sector. This product line is a key growth engine, reflecting its strong market position and future potential.

Asahi Kasei has strategically boosted Planova's production capabilities, completing a new assembly plant in 2024. Further expansion is planned with a new spinning plant slated for July 2025, reinforcing its status as a market leader with significant growth prospects.

Asahi Kasei's critical care products, including the LifeVest wearable cardioverter-defibrillator and other defibrillation devices, represent a robust segment within its Healthcare operations. This business has demonstrated impressive financial performance, with operating income showing a healthy increase. For instance, in the fiscal year ending March 2024, the Healthcare segment, which includes these critical care products, saw significant contributions driven by factors like an expanding patient base and improved cost efficiencies.

Advanced Materials for Semiconductor & Electronics

Asahi Kasei's advanced materials for semiconductors and electronics are performing exceptionally well, driven by robust demand and favorable market conditions. These products are considered Stars within the company's portfolio, signifying their high growth potential and strong market share in a rapidly expanding technological landscape.

The company has seen improved terms of trade and increased shipment volumes for these critical components. For instance, in the fiscal year ending March 2024, Asahi Kasei reported significant growth in its Material segment, partly fueled by the strong performance of its electronics-related businesses. The demand for specialized materials used in advanced packaging, high-performance displays, and next-generation semiconductor manufacturing continues to surge.

- Strong Market Position: Asahi Kasei's advanced materials are integral to the semiconductor supply chain, benefiting from the ongoing digital transformation and increased semiconductor content in various devices.

- Favorable Demand: The electronics sector, particularly semiconductors, experienced a rebound and sustained demand throughout 2024, leading to higher sales volumes for Asahi Kasei's material offerings.

- Innovation Focus: Continued investment in research and development for next-generation materials, such as those for advanced lithography and high-speed communication, further solidifies their Star status.

- Revenue Contribution: The Material segment, which includes these advanced materials, is a significant contributor to Asahi Kasei's overall revenue, with specific product lines showing double-digit growth.

Mobility Solutions (Advanced Automotive Materials & HUD)

Asahi Kasei is making significant strides in the mobility sector, particularly with its advanced automotive materials. The company is focusing on innovations like the AZP™ optical resin, designed for the advanced head-up displays (HUDs) that are becoming a key feature in modern vehicles. This strategic investment positions Asahi Kasei to capitalize on the expanding automotive market, aiming for a leadership role through its cutting-edge material science.

The company's commitment extends to technologies like millimeter-wave radar for vital sensing in cars, further embedding its solutions within the automotive ecosystem. This dual focus on display technology and safety systems underscores Asahi Kasei's ambition to be a major player in the automotive industry's technological evolution. The automotive sector is projected to see substantial growth in advanced driver-assistance systems (ADAS) and in-car technology, creating a fertile ground for these innovations.

- AZP™ Optical Resin: Enhances clarity and performance for next-generation Head-Up Displays (HUDs).

- Millimeter-Wave Radar: Enables vital sensing capabilities within vehicles, improving safety and user experience.

- Automotive Sector Focus: Targeting high-growth areas within the automotive industry, including advanced materials and safety features.

- Market Ambition: Aims to establish a leading market presence through continuous innovation and strategic partnerships.

Asahi Kasei's advanced materials for semiconductors and electronics are performing exceptionally well, driven by robust demand and favorable market conditions. These products are considered Stars within the company's portfolio, signifying their high growth potential and strong market share in a rapidly expanding technological landscape.

The company has seen improved terms of trade and increased shipment volumes for these critical components. For instance, in the fiscal year ending March 2024, Asahi Kasei reported significant growth in its Material segment, partly fueled by the strong performance of its electronics-related businesses. The demand for specialized materials used in advanced packaging, high-performance displays, and next-generation semiconductor manufacturing continues to surge.

Strong market position and favorable demand in the electronics sector, particularly semiconductors, led to higher sales volumes throughout 2024. Continued investment in R&D for next-generation materials solidifies their Star status, with the Material segment showing double-digit growth in specific product lines.

Asahi Kasei's pharmaceutical segment, significantly enhanced by the 2019 acquisition of Veloxis Pharmaceuticals and the 2024 acquisition of Calliditas Therapeutics, is positioned as a major growth engine, especially within the lucrative U.S. market. These strategic moves have introduced key products such as Envarsus XR and Tarpeyo, which are experiencing rapid sales expansion. For instance, Calliditas reported net product sales of $103.8 million for Tarpeyo in 2023.

| Product Category | BCG Status | Key Drivers | 2024 Performance Indicators | Future Outlook |

| Advanced Semiconductor Materials | Star | Digital transformation, increased semiconductor content, ongoing demand | Double-digit growth in specific product lines, improved terms of trade | Continued innovation, expansion in advanced packaging and displays |

| Pharmaceuticals (e.g., Tarpeyo) | Star | Acquisitions (Veloxis, Calliditas), rapid sales expansion, U.S. market growth | Tarpeyo 2023 net product sales: $103.8 million | Further M&A, licensing agreements, expanding global footprint |

What is included in the product

The Asahi Kasei BCG Matrix analyzes its business units based on market share and growth.

It guides strategic decisions on investment, divestment, and resource allocation.

The Asahi Kasei BCG Matrix provides a clear snapshot of business unit performance, alleviating the pain of not knowing where to focus resources.

This visual tool streamlines strategic decision-making by simplifying complex portfolio data for Asahi Kasei.

Cash Cows

Asahi Kasei's domestic housing business is a clear Cash Cow, showing robust financial performance. For the fiscal year ending March 2024, this segment reported a significant increase in sales and operating income, underscoring its reliable cash-generating capabilities.

Despite operating in a mature domestic market, Asahi Kasei's housing division maintains a dominant market share. This strength is driven by stable demand, an upward trend in average unit prices, and successful cost reduction initiatives, all contributing to consistent and substantial cash flow generation for the broader company.

Asahi Kasei's Basic Materials division, primarily stabilized petrochemicals, demonstrated resilience in the April-December 2024 period, achieving an operating profit. This turnaround from previous periods was driven by an uplift in petrochemical market prices and successful efforts to reduce fixed costs, signaling a positive cash flow generation from these core chemical products.

Despite operating within a mature industry, the consistent positive cash flow and strong market position of its petrochemical offerings firmly place this unit as a cash cow. This segment's ability to generate substantial profits while requiring minimal investment highlights its maturity and established market dominance.

Within Asahi Kasei's Homes segment, established construction materials such as ALC (Autoclaved Lightweight Concrete) and insulation products function as cash cows. These are mature offerings, likely commanding substantial market share due to their long-standing presence and proven performance.

The steady profits and cash flow generated by these materials are crucial for funding other business areas. While growth prospects are modest, their strong competitive advantages and stable demand ensure their role as reliable profit contributors. For instance, in 2024, the construction materials market in Japan, a key region for Asahi Kasei, continued to show resilience, with demand for energy-efficient insulation materials remaining robust amidst ongoing building regulations and a focus on sustainability.

Traditional Fibers and Plastics

Asahi Kasei's traditional fibers and plastics represent its Cash Cows. These segments benefit from Asahi Kasei's deep-rooted history as a multinational chemical company, ensuring a strong market position.

Although not always the focus of recent growth narratives, these mature industries are anticipated to hold substantial market share. This stability translates into predictable revenue and operational resilience for the company.

- Market Share: These segments likely maintain a dominant share in established markets.

- Revenue Stability: They provide consistent and reliable income streams.

- Operational Efficiency: Mature operations often translate to optimized costs and predictable performance.

- Financial Contribution: These Cash Cows fund investments in other business areas, like Stars.

Select Consumables (e.g., Saran Wrap)

Select Consumables, exemplified by brands like Saran Wrap, are archetypal cash cows within the Asahi Kasei portfolio. These products typically reside in mature markets, benefiting from strong brand equity and established market dominance.

Their consistent, predictable cash generation requires minimal incremental investment, allowing Asahi Kasei to allocate resources to more dynamic business segments. For instance, while specific figures for Saran Wrap are not always granularly disclosed, the broader consumer staples sector, where such products operate, demonstrated resilience in 2024, with many established brands maintaining steady sales volumes despite economic fluctuations.

- Mature Market Dominance: Products like Saran Wrap thrive in markets where brand recognition is paramount and competition is often based on established loyalty rather than disruptive innovation.

- Consistent Cash Flow: These items generate reliable profits with low reinvestment needs, acting as a stable financial foundation for the company.

- Low Investment Requirements: Unlike growth-oriented products, cash cows demand minimal capital for marketing or research and development, freeing up resources.

- Brand Strength: Long-standing consumer brands possess significant pricing power and customer loyalty, contributing to their consistent profitability.

Asahi Kasei's domestic housing business and its Basic Materials segment, particularly petrochemicals, are prime examples of Cash Cows. These divisions benefit from stable demand, strong market positions, and efficient operations, leading to consistent cash generation.

The established construction materials like ALC and insulation products, along with traditional fibers and plastics, also function as cash cows. These mature offerings contribute significantly to Asahi Kasei's financial stability, funding investments in other areas.

Consumable brands such as Saran Wrap are archetypal cash cows, leveraging strong brand equity in mature markets for predictable cash flow with minimal investment needs.

| Segment | Cash Cow Characteristics | Fiscal Year Ending March 2024 Performance Indicator |

| Domestic Housing | Dominant market share, stable demand, upward price trend | Robust financial performance, increase in sales and operating income |

| Basic Materials (Petrochemicals) | Resilient market prices, reduced fixed costs, established market dominance | Achieved operating profit (April-December 2024) |

| Homes (Construction Materials) | Long-standing presence, proven performance, stable demand | Continued resilience in Japanese construction materials market |

| Traditional Fibers & Plastics | Deep-rooted history, strong market position, predictable revenue | Anticipated substantial market share |

| Select Consumables (Saran Wrap) | Strong brand equity, mature market dominance, low reinvestment needs | Demonstrated resilience in consumer staples sector |

What You See Is What You Get

Asahi Kasei BCG Matrix

The Asahi Kasei BCG Matrix report you are previewing is the identical, fully completed document you will receive immediately after your purchase. This means you get the entire analysis, ready for immediate strategic application, without any watermarks or placeholder content. The preview accurately represents the comprehensive market assessment and strategic insights contained within the final, downloadable file.

Dogs

Asahi Kasei's decision to discontinue its methyl methacrylate (MMA) business in the first quarter of fiscal 2025 resulted in recorded losses. This strategic move suggests the MMA segment was likely facing challenges such as limited market share and profitability within a stagnant or shrinking market. Divesting such operations is often a way to prevent them from becoming a drain on company resources.

PTT Asahi Chemical's acrylonitrile operations are classified as a 'Dog' in the BCG Matrix. The company ceased these operations in January 2025, citing irreversible changes in the operating environment. This move reflects a segment with a low market share and likely low profitability within a mature or declining market.

Asahi Kasei is actively addressing underperforming segments within its petrochemical chain, especially those focused on basic materials. This strategic move signals a recognition of units struggling with low profitability and capital efficiency, likely operating in stagnant markets with competitive disadvantages.

For instance, in fiscal year 2023, Asahi Kasei reported that its performance in the chemicals segment, which includes petrochemicals, was impacted by factors such as price fluctuations and increased raw material costs. The company's emphasis on "structural transformation" suggests these basic material businesses are candidates for divestiture, restructuring, or significant operational overhauls to improve their standing.

Outdated Electronic Components

While Asahi Kasei actively develops advanced electronic materials for burgeoning markets, certain legacy electronic components might be categorized as Dogs. These products could be struggling with fierce competition or facing the threat of technological obsolescence, resulting in declining revenues and a negligible market presence.

For instance, Asahi Kasei's portfolio might include older types of passive components or connectors that are being superseded by newer, more integrated solutions. In 2023, the global market for electronic components saw significant shifts, with demand for advanced materials like those used in AI and electric vehicles surging, while demand for more commoditized, older components experienced slower growth or contraction.

- Technological Obsolescence: Products that are no longer at the forefront of technological advancement.

- Intense Competition: Facing pressure from numerous competitors, often with lower cost structures.

- Diminishing Market Share: Experiencing a decline in the percentage of the market controlled.

- Low Growth Potential: Limited opportunities for expansion or increased sales.

Certain Legacy Industrial Chemicals

Certain legacy industrial chemicals within Asahi Kasei's portfolio might be positioned as Dogs in the BCG matrix. These products likely operate in mature, low-growth sectors where competition is intense and differentiation is difficult. Consequently, their market share may be stagnant or declining, leading to limited profitability or even cash burn.

For instance, if a specific legacy chemical product line saw its market share drop from 5% to 3% in a market growing at only 1% annually, it would fit the Dog profile. Such segments often require significant investment to maintain, with little prospect of substantial returns. Asahi Kasei's strategic focus, therefore, would be on divesting or restructuring these underperforming assets to reallocate resources towards more promising growth areas.

- Low Market Growth: Legacy industrial chemicals often face subdued demand in their respective markets, typically growing at or below the overall economic rate.

- Low Market Share: Asahi Kasei may hold a relatively small or decreasing share of these commoditized markets compared to key competitors.

- Cash Generation: These products are unlikely to generate significant positive cash flow and may even require ongoing investment to sustain operations.

- Portfolio Optimization: The company's strategy would involve managing these Dogs to minimize losses and facilitate a transition towards higher-potential business segments.

Asahi Kasei's PTT Asahi Chemical's acrylonitrile operations exemplify a 'Dog' in the BCG matrix. The cessation of these operations in January 2025, due to irreversible environmental changes, highlights a segment with low market share and profitability in a mature or declining market.

Similarly, the discontinuation of the methyl methacrylate (MMA) business in Q1 fiscal 2025, resulting in losses, points to another 'Dog' segment. This move indicates the MMA business faced challenges like limited market share and profitability in a stagnant market, prompting divestment to prevent resource drain.

These strategic decisions reflect Asahi Kasei's proactive approach to addressing underperforming basic material segments. The company is likely reallocating resources from these low-growth, low-share businesses to more promising areas, aligning with its overall portfolio optimization strategy.

Question Marks

Asahi Kasei's biomethane production system, demonstrated in early 2025, represents a significant innovation in the renewable energy sector. This technology, designed for high-yield and high-purity output from organic waste, is slated for commercialization by 2027 with plans for global licensing. The system taps into the burgeoning market for circular economy solutions, a segment experiencing rapid expansion.

Currently, this advanced biomethane technology occupies a nascent position within the market, reflecting its early commercialization phase. Its potential, however, is substantial, aligning with the global drive towards sustainable energy sources and waste valorization. The biomethane market itself is projected to grow considerably, with some estimates suggesting a compound annual growth rate (CAGR) of over 7% in the coming years, driven by policy support and increasing demand for renewable natural gas.

Asahi Kasei's hydrogen-related technologies, including electrolyzers, are positioned as potential stars within its business portfolio. The company's commitment is evident through its $100 million investment in 'Care for Earth' initiatives, which specifically target hydrogen and energy storage. This strategic allocation underscores the perceived high-growth potential in these decarbonization-focused sectors.

A tangible example of this investment is Asahi Kasei's supply of a 1MW-class alkaline-water electrolyzer for a hydrogen project in Finland. While these nascent industries offer significant growth opportunities, reflecting global decarbonization trends, Asahi Kasei's current market share in electrolyzer technology is still developing. This suggests that while the future looks promising, the immediate market penetration is a key area for growth.

Bionova Scientific, an Asahi Kasei Group company, made a strategic move in 2024 to enter the plasmid DNA (pDNA) business, establishing a new manufacturing facility in Texas. This expansion targets the burgeoning biopharmaceutical CDMO sector, a market projected to reach tens of billions of dollars by the end of the decade.

While the pDNA market is experiencing robust growth, driven by advancements in gene therapies and mRNA vaccines, Bionova Scientific's market share is expected to be nascent given its recent entry. The company is entering a competitive landscape where established players already hold significant positions in pDNA production for critical therapeutic applications.

Millimeter-Wave Radar for Vital Sensing & Elderly Monitoring

Asahi Kasei's millimeter-wave radar technology for vital sensing in automotive and elderly monitoring represents a potential star in their portfolio. These advanced solutions are targeting rapidly expanding health-tech and smart mobility sectors, indicating significant future growth potential.

While the technology is innovative and addresses high-demand markets, its current market adoption and share are still in the nascent stages. This positions it as a question mark, with substantial investment needed to capture market share and drive adoption.

- Market Potential: Targeting health-tech and smart mobility, which are projected for significant growth. The global health-tech market was valued at over $200 billion in 2023 and is expected to grow considerably.

- Current Stage: Early adoption and market share, requiring further development and market penetration efforts.

- Strategic Position: High growth potential but currently low market share, fitting the characteristics of a question mark in the BCG matrix.

- Investment Focus: Requires strategic investment to increase market share and solidify its position.

New 3D Printing Filaments and Materials

Asahi Kasei is actively showcasing its advancements in 3D printing filaments and materials at key industry events throughout 2024. This strategic focus aligns with the robust expansion of the 3D printing market, which is projected to reach approximately $23.5 billion by 2027, according to some market analyses. While Asahi Kasei is introducing specialized materials to this burgeoning sector, its precise market share in these niche 3D printing applications is still in its formative stages.

The company’s engagement in 2024 trade shows highlights its commitment to exploring new collaborations and applications within the additive manufacturing space. This includes a particular emphasis on developing high-performance filaments tailored for demanding industrial uses. For instance, the global 3D printing materials market itself saw significant growth, with estimates suggesting it could exceed $5 billion in 2024, driven by innovations in polymers and composites.

- Market Entry: Asahi Kasei is positioning itself in the high-growth 3D printing market with specialized filament offerings.

- Growth Trajectory: The broader 3D printing sector is experiencing substantial expansion, indicating strong potential for material suppliers.

- Niche Focus: The company's current market share in specific 3D printing material segments is likely still developing as it establishes its presence.

- Industry Engagement: Active participation in 2024 trade shows underscores Asahi Kasei's strategy to foster collaborations and explore new applications.

Asahi Kasei's millimeter-wave radar technology for vital sensing and its specialized 3D printing filaments are both examples of potential question marks. These ventures are entering rapidly expanding markets with significant future growth prospects, but currently hold nascent market shares.

The company is investing strategically to build presence in these areas, aiming to capture a larger portion of the projected growth in health-tech, smart mobility, and additive manufacturing materials.

While the specific market share for Asahi Kasei's millimeter-wave radar and 3D printing filaments in 2024 is still developing, the overall markets are robust. The global health-tech market was valued at over $200 billion in 2023, and the 3D printing materials market was estimated to exceed $5 billion in 2024.

These businesses require continued investment and market development to transition from question marks to stronger positions within Asahi Kasei's portfolio.

| Business Area | Market Potential | Current Stage | Strategic Focus | BCG Category |

|---|---|---|---|---|

| Millimeter-Wave Radar (Vital Sensing) | High (Health-tech, Smart Mobility) | Nascent Market Share | Investment for Adoption & Growth | Question Mark |

| 3D Printing Filaments | High (Additive Manufacturing) | Developing Market Share | Market Entry & Application Expansion | Question Mark |

BCG Matrix Data Sources

Our Asahi Kasei BCG Matrix leverages robust data from financial disclosures, market research reports, and internal performance metrics to provide strategic clarity.