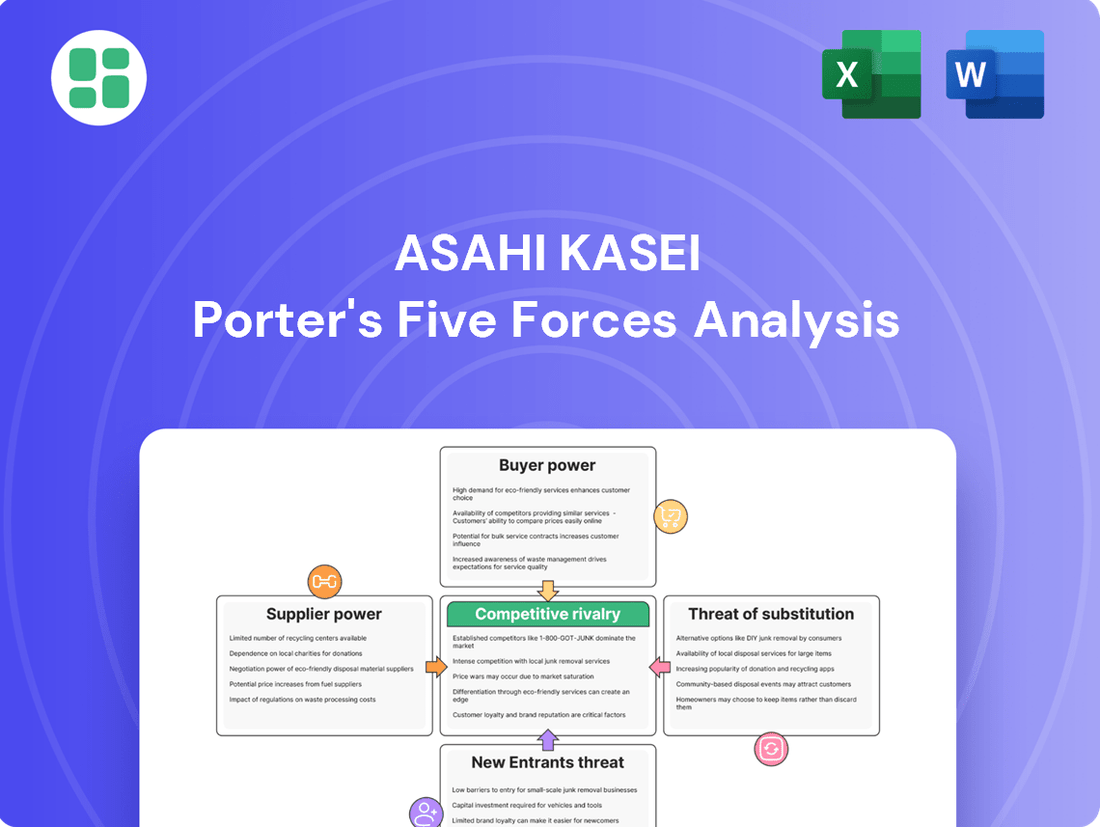

Asahi Kasei Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Kasei Bundle

Asahi Kasei navigates a complex landscape shaped by intense rivalry and the constant threat of substitutes. Understanding the power of their suppliers and buyers is crucial for maintaining their competitive edge.

The complete report reveals the real forces shaping Asahi Kasei’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Asahi Kasei's Material segment, encompassing a wide array of chemicals and plastics, demonstrates a significant dependence on petrochemical raw materials. This inherent reliance positions petrochemical suppliers with considerable bargaining power, especially when global demand surges or when supply chains face disruptions. For instance, in 2023, crude oil prices, a key driver of petrochemical costs, saw volatility, directly impacting the cost base for companies like Asahi Kasei.

The fluctuating prices of these essential inputs directly affect Asahi Kasei's profitability. When petrochemical suppliers can command higher prices, it creates upward cost pressure on the company's material products. This dynamic can squeeze profit margins, particularly if Asahi Kasei cannot fully pass these increased costs onto its customers. In 2024, the ongoing geopolitical landscape and energy market uncertainties continue to be critical factors influencing petrochemical pricing and, consequently, Asahi Kasei's cost structure.

For highly specialized components crucial to industries like semiconductors and advanced batteries, the pool of qualified suppliers is often quite small. This scarcity directly translates into significant bargaining power for these niche producers when dealing with companies like Asahi Kasei.

Consider photosensitive polyimide (PSPI), a key material in semiconductor manufacturing, or advanced separators for lithium-ion batteries. The limited number of companies capable of producing these to the required specifications means they can dictate terms, impacting Asahi Kasei's costs and the reliability of its supply chain for these critical inputs.

Interestingly, Asahi Kasei itself operates as a key supplier in some of these specialized markets, such as battery separators. This dual role underscores the leverage that producers of such niche, high-performance materials possess, influencing pricing and availability across the value chain.

For Asahi Kasei, the bargaining power of suppliers is amplified when switching costs for critical inputs are high. This is evident in sectors like advanced materials and specialized chemicals where changing suppliers can be a complex and expensive undertaking. For instance, re-qualifying a new supplier for a unique polymer or a highly regulated medical device component might involve extensive testing and validation, potentially costing millions and delaying production.

These substantial switching costs, which can include retooling manufacturing lines or navigating new regulatory approvals, foster a strong dependence on existing suppliers. This dependence, especially for proprietary or custom-formulated inputs, significantly strengthens the suppliers' leverage. In 2023, the chemical industry, a key sector for Asahi Kasei, saw significant price volatility, making reliable supply chains even more crucial and thus increasing the bargaining power of established, trusted suppliers of specialized inputs.

Supplier Concentration in Key Segments

In certain specialized areas within Asahi Kasei's broad portfolio, particularly where unique or difficult-to-obtain raw materials are concerned, supplier concentration can be a significant factor. A limited number of suppliers for these critical inputs means they can wield considerable power over pricing and contract conditions, as Asahi Kasei has fewer viable alternatives.

This situation presents a potential strategic weakness. For instance, if a key chemical precursor for their advanced materials is sourced from only a handful of global producers, Asahi Kasei's ability to negotiate favorable terms is diminished. Managing these relationships proactively, perhaps through long-term contracts or exploring alternative sourcing strategies, becomes crucial for mitigating this supplier leverage.

The bargaining power of suppliers is amplified when there are few dominant players in a specific market. For Asahi Kasei, this can translate into higher input costs or less favorable supply agreements if not managed strategically. Consider the market for certain high-performance polymers; if only two or three companies globally produce the specialized monomers required, their collective pricing power is substantial.

- Supplier Concentration Impact: In segments reliant on specialized raw materials, a concentrated supplier base can lead to increased input costs for Asahi Kasei.

- Strategic Vulnerability: Limited sourcing options for critical inputs create a strategic vulnerability, potentially impacting production schedules and profitability.

- Mitigation Strategies: Asahi Kasei may need to focus on building strong, long-term partnerships with key suppliers or invest in diversifying its material sourcing to reduce reliance on a few entities.

Impact of Global Supply Chain Disruptions

The chemical industry, which includes companies like Asahi Kasei, is particularly susceptible to disruptions in global supply chains. These disruptions can stem from various sources, including geopolitical conflicts, severe weather events, or changes in trade regulations such as tariffs.

When supply chains are disrupted, it can result in shortages of essential raw materials and drive up their costs. This scenario directly enhances the bargaining power of suppliers who can consistently deliver their products, putting pressure on manufacturers.

For instance, in 2023, the cost of key chemical feedstocks saw significant volatility. The Suez Canal blockage in early 2024, while a shorter-term event, highlighted the fragility of global shipping routes, impacting delivery times and costs for many chemical producers.

- Increased Supplier Leverage: Geopolitical tensions, like those impacting energy markets in 2024, can concentrate supply and give upstream providers more pricing power.

- Raw Material Volatility: The price of ethylene, a fundamental building block in many chemical processes, experienced fluctuations of up to 15% in early 2024 due to supply-demand imbalances.

- Strategic Sourcing Imperative: Companies must actively explore alternative sourcing options and build robust inventory management systems to mitigate risks associated with supplier dependency.

Asahi Kasei's reliance on petrochemicals means suppliers of these fundamental inputs hold significant sway, especially during periods of high global demand or supply chain disruptions. For example, the price of ethylene, a key petrochemical building block, saw considerable volatility in early 2024, with some market reports indicating price swings of up to 15% due to supply-demand imbalances.

This power is amplified when switching costs are high, as is common with specialized chemicals or polymers. The expense and time involved in re-qualifying new suppliers for critical, often proprietary, materials can lock Asahi Kasei into existing relationships, strengthening supplier leverage.

Furthermore, a concentrated supplier base for niche, high-performance materials, such as those used in advanced batteries or semiconductors, grants those few producers substantial bargaining power. This scarcity means fewer alternatives for Asahi Kasei, potentially leading to higher input costs and impacting supply chain reliability.

| Factor | Impact on Asahi Kasei | Example/Data (2023-2024) |

| Supplier Concentration | Increased input costs, reduced negotiation power | Limited global producers for specialized polymers can dictate terms. |

| Switching Costs | High dependence on existing suppliers | Re-qualifying suppliers for advanced materials can cost millions and delay production. |

| Supply Chain Disruptions | Elevated raw material prices, potential shortages | Ethylene price volatility up to 15% in early 2024 due to market imbalances. |

What is included in the product

Asahi Kasei's Porter's Five Forces analysis reveals the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the overall industry attractiveness for its diverse operations.

Instantly identify and mitigate competitive threats by visualizing Asahi Kasei's industry landscape with a dynamic Porter's Five Forces analysis.

Customers Bargaining Power

Asahi Kasei's broad reach across diverse sectors like automotive, electronics, housing, and healthcare significantly shapes its customer bargaining power. This wide customer base means that the leverage individual customer groups can exert is not uniform. For instance, in 2023, Asahi Kasei reported sales of ¥2,459.6 billion, with a substantial portion coming from its Materials segment, which serves many industrial clients.

Large industrial buyers, particularly in high-volume sectors such as automotive manufacturing, often possess considerable bargaining power due to their ability to purchase in bulk and their potential to switch suppliers if pricing or terms are unfavorable. However, in other segments, such as specialized healthcare or niche consumer markets, customer power may be more limited. This segmentation allows Asahi Kasei to manage its customer relationships and pricing strategies on a case-by-case basis, balancing the influence of powerful buyers with the less concentrated demands of smaller customer groups.

In segments where Asahi Kasei offers more commoditized chemicals and plastics, customers wield significant bargaining power. This stems from the ample availability of alternative suppliers in these markets, making it easier for buyers to switch. For instance, in the global polyethylene market, where Asahi Kasei has a presence, prices are highly competitive, with numerous producers vying for market share. In 2024, the average price for linear low-density polyethylene (LLDPE) fluctuated, demonstrating the sensitivity to supply and demand dynamics and the power of buyers to seek the best available pricing.

For Asahi Kasei's highly differentiated products, like advanced semiconductor materials or specialized medical devices, customer bargaining power is considerably weaker. These solutions often provide unique benefits or are crucial for a customer's own product, making it difficult and undesirable to switch to competitors. This is evidenced by Asahi Kasei's consistent revenue growth in these high-value segments.

Industrial Customer Concentration and Leverage

The bargaining power of customers is a significant factor for Asahi Kasei, particularly due to the concentration of its industrial clientele. Large buyers in sectors such as automotive and electronics often command substantial influence. This is because their considerable purchase volumes and strategic importance allow them to negotiate for better pricing, more flexible payment schedules, and tailored product specifications.

Asahi Kasei's exposure to this dynamic is evident. For instance, sales within the automotive sector represented approximately 30% of its Material segment's revenue in 2024. This reliance on key industrial accounts means that these customers can exert considerable leverage, impacting Asahi Kasei's profitability and operational flexibility.

- Customer Concentration: Asahi Kasei serves large industrial customers, especially in automotive and electronics.

- Leverage through Volume: Significant order sizes grant these customers negotiation power on prices and terms.

- Automotive Segment Exposure: The automotive sector accounted for about 30% of Asahi Kasei's Material segment sales in 2024.

- Impact on Profitability: Customer leverage can directly affect Asahi Kasei's margins and contract conditions.

Impact of End-Market Demand Fluctuations

Weakening demand in key end-markets significantly amplifies customer bargaining power. When sectors like electronics, semiconductors, or construction experience a downturn, buyers gain leverage to negotiate lower prices or more favorable payment schedules. This was evident in Asahi Kasei's performance, where the company noted the impact of these demand shifts on its financial results.

For instance, in the fiscal year ending March 2024, Asahi Kasei's performance in its Material segment, which serves many of these cyclical end-markets, was influenced by global economic slowdowns and inventory adjustments by customers. The company's consolidated net sales for FY2023 decreased by 3.6% year-on-year to ¥2,393.9 billion, reflecting these challenging market conditions and the resulting pressure from customers seeking better terms.

- Weakening Demand: Reduced demand in sectors like electronics and construction strengthens customer negotiation power.

- Price Concessions: Customers can more effectively demand lower prices or extended payment terms during market downturns.

- Impact on Asahi Kasei: Asahi Kasei's financial reports for the fiscal year ending March 2024 showed the effects of these demand fluctuations on its Material segment.

- Sales Decline: Consolidated net sales for FY2023 fell by 3.6% to ¥2,393.9 billion, illustrating the impact of customer leverage in a softer market.

Asahi Kasei's customer bargaining power is notably high in its commodity chemical and plastics segments. This is due to the availability of numerous alternative suppliers, allowing buyers to easily switch and negotiate favorable terms. For example, in the competitive polyethylene market where Asahi Kasei operates, prices are highly sensitive to supply and demand, giving customers significant leverage. This dynamic was reflected in 2024 market conditions for such materials.

| Segment | Customer Bargaining Power | Key Factors |

|---|---|---|

| Materials (Commodities) | High | Availability of substitutes, large buyer volumes, price sensitivity |

| Materials (Specialty) | Moderate to Low | Product differentiation, switching costs, unique performance |

| Homes | Moderate | Brand reputation, customization options, project scale |

| Health Care | Low | Regulatory approval, specialized products, high R&D investment |

Full Version Awaits

Asahi Kasei Porter's Five Forces Analysis

This preview showcases the complete Asahi Kasei Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholders. You're looking at the actual document, ready for your immediate download and use.

Rivalry Among Competitors

Asahi Kasei's competitive landscape is marked by high intensity across its varied business segments, from materials and homes to healthcare. This diversity means the company contends with distinct global and regional competitors in each area, intensifying the rivalry. For example, in the broad chemical industry, a vast number of players vie for market share, creating a highly competitive environment that demands specialized strategies for each of Asahi Kasei's operational units.

The global chemical industry, a key sector for Asahi Kasei, grappled with significant overcapacity in 2024. This was particularly evident with substantial exports from China, flooding markets with lower-cost products. For instance, global chemical production capacity often outstrips demand, creating a persistent supply-demand imbalance.

This oversupply directly translates into intense pricing pressure. Asahi Kasei, like its competitors, faces a scenario where the influx of cheaper imports forces a reduction in its own product prices. This dynamic erodes profit margins, making cost efficiency a critical differentiator in the market.

Companies are compelled to prioritize cost reduction strategies to maintain competitiveness. This might involve optimizing manufacturing processes, streamlining supply chains, or investing in more energy-efficient technologies. The drive for lower production costs becomes paramount when faced with a market characterized by abundant supply and price sensitivity.

Competition within Asahi Kasei's operating sectors, particularly specialty chemicals and advanced materials, is intensely fueled by ongoing innovation and significant investment in research and development. Companies are constantly striving to introduce novel technologies and enhanced product features to capture market share.

Asahi Kasei's strategic emphasis on developing cutting-edge solutions, such as sophisticated photosensitive materials for electronics and advanced health-tech innovations, is paramount for sustaining its competitive advantage. This dedication to R&D allows them to differentiate their offerings in a crowded marketplace.

For instance, in 2023, Asahi Kasei reported R&D expenses of approximately ¥102.5 billion, underscoring their commitment to innovation as a core driver of growth and differentiation against competitors who also heavily invest in similar areas.

Economies of Scale and Market Consolidation

The chemical and materials sectors are characterized by substantial economies of scale. This means that larger companies, like Asahi Kasei, can spread their fixed costs over a greater volume of production, leading to lower per-unit costs in manufacturing, raw material purchasing, and logistics. For instance, in 2023, major chemical producers often reported operating margins that were notably higher for their largest production facilities compared to smaller ones, underscoring the cost benefits of scale.

These cost advantages create a significant barrier to entry for smaller firms, often pushing the market towards consolidation. Companies that cannot achieve a certain production volume struggle to match the pricing of larger, more efficient competitors. This dynamic has led to ongoing mergers and acquisitions within the industry as companies seek to gain scale and market share.

Asahi Kasei leverages its considerable scale and extensive global presence as a key competitive advantage. However, to maintain this edge, the company must consistently focus on optimizing its operational efficiency across all its business segments, from specialty chemicals to housing materials. In 2024, Asahi Kasei continued its strategic investments in advanced manufacturing technologies to further enhance productivity and cost competitiveness.

- Economies of Scale: Larger chemical and materials companies benefit from reduced per-unit costs in production, procurement, and distribution.

- Market Consolidation: Cost advantages of scale make it challenging for smaller players, driving industry consolidation through mergers and acquisitions.

- Asahi Kasei's Advantage: The company's significant scale and global reach provide a competitive edge, necessitating continuous operational optimization.

- Operational Efficiency: Strategic investments in advanced manufacturing in 2024 aim to bolster Asahi Kasei's productivity and cost competitiveness.

Regional Market Dynamics and Trade Policies

Regional market dynamics significantly influence competitive rivalry for companies like Asahi Kasei. For instance, in 2024, the automotive sector, a key market for Asahi Kasei's performance materials, saw varied growth rates across regions. Europe experienced a modest recovery, while Asia, particularly China, continued to be a strong growth engine, albeit with increasing domestic competition.

Evolving trade policies, including tariffs and trade agreements, directly impact Asahi Kasei's cost structure and market access. The imposition of tariffs on certain chemical intermediates, for example, could increase production costs for its materials businesses, potentially affecting pricing strategies and competitiveness against regional players who may have more localized supply chains. Navigating these policy shifts is crucial for maintaining an edge.

- Regional Growth Disparities: In 2024, Asahi Kasei's performance materials segment likely benefited from continued demand in Asia, which often outpaces growth in more mature markets like Europe.

- Tariff Impact: Trade tariffs can increase the cost of imported raw materials, impacting Asahi Kasei's margins in its chemicals and fibers segments.

- Supply Chain Vulnerabilities: Geopolitical tensions and trade disputes highlight the need for resilient, diversified supply chains to mitigate regional policy risks.

Asahi Kasei faces intense competition across its diverse business units, with rivals actively engaging in price wars and innovation races. The global chemical industry, a core area for Asahi Kasei, experienced significant overcapacity in 2024, largely driven by increased exports from China, leading to widespread pricing pressures and reduced profit margins for all players. This environment necessitates a strong focus on cost efficiency and continuous R&D investment to stay ahead.

Companies like Asahi Kasei must leverage their scale and operational efficiency to counter the intense rivalry. In 2024, Asahi Kasei continued investing in advanced manufacturing to improve productivity and cost competitiveness, a crucial strategy given the market's sensitivity to price. The company's commitment to R&D, evidenced by its ¥102.5 billion investment in 2023, is vital for developing differentiated products in sectors like specialty chemicals and health tech.

| Metric | Asahi Kasei (2023) | Industry Trend (2024) | Impact on Rivalry |

| R&D Expenses | ¥102.5 billion | High & Increasing | Drives innovation competition |

| Global Chemical Capacity | High | Overcapacity | Intensifies price competition |

| Economies of Scale | Significant | Essential for competitiveness | Favors larger players, barriers to entry |

SSubstitutes Threaten

In the materials and chemicals sectors, Asahi Kasei faces a significant threat from emerging alternative materials and technologies. The development of bio-based polymers, for instance, offers a potentially sustainable and cost-effective replacement for traditional petroleum-based plastics across numerous applications. Similarly, advanced composite materials are increasingly capable of performing functions previously exclusive to conventional materials, like metals or fibers, often with superior strength-to-weight ratios.

This constant innovation in substitute materials necessitates that Asahi Kasei prioritizes its own research and development efforts. The company's ability to stay ahead of these trends, by developing its own next-generation materials or enhancing the performance and cost-effectiveness of its existing product lines, is crucial for maintaining its competitive edge. For example, in 2023, Asahi Kasei invested heavily in advanced materials research, with a focus on sustainable solutions and high-performance polymers, aiming to preemptively address potential market shifts.

The growing consumer and industrial push for eco-friendly options is a significant force, encouraging the creation and use of alternative products. For instance, by 2024, the global market for sustainable packaging is projected to reach $477.4 billion, highlighting a clear shift away from traditional materials.

Materials boasting reduced carbon emissions, enhanced recyclability, or non-toxic characteristics are increasingly favored, posing a risk to Asahi Kasei's established product lines if they don't adapt to these sustainability demands. Companies that fail to integrate green solutions risk losing market share to more environmentally conscious competitors.

This trend underscores the critical need for Asahi Kasei to actively invest in and develop green technologies and sustainable product alternatives to maintain its competitive edge and meet evolving market expectations.

The threat of substitutes in healthcare treatment alternatives presents a significant consideration for Asahi Kasei. Alternative medical treatments, such as novel therapeutic approaches or less invasive procedures, can directly impact the demand for existing products. For example, advancements in non-invasive diagnostic tools could reduce reliance on certain reagents or devices Asahi Kasei currently provides. The market for pharmaceuticals also sees this threat through the availability of generic versions, which can erode the market share of branded or proprietary drugs.

Performance-Price Trade-offs by Customers

Customers frequently evaluate performance against price when considering alternatives. If a substitute product offers a better balance, perhaps by delivering adequate performance at a significantly lower cost, it can attract Asahi Kasei's customer base. This dynamic is especially potent in markets where products are becoming more commoditized, and price sensitivity is high.

For instance, in the chemical industry, while Asahi Kasei might offer high-performance specialty polymers, a competitor might introduce a slightly less advanced but substantially cheaper alternative. If that alternative meets 80% of the customer's needs at 60% of the price, the switch becomes economically attractive. This pressure forces companies like Asahi Kasei to continuously innovate or manage costs effectively to maintain their competitive edge.

- Price Sensitivity: In 2024, global consumer spending on chemicals saw a notable shift towards value-driven purchases, with price being a primary consideration for 65% of B2B buyers in non-specialty segments.

- Performance Thresholds: A significant portion of customers, estimated at 40% across various industrial applications, are willing to accept a reduction in performance if it leads to a substantial cost saving, particularly when the core functionality is still met.

- Market Commoditization: Industries experiencing commoditization, such as basic plastics and certain industrial gases, often see substitute threats increase by up to 15% annually due to the ease with which similar products can be sourced at lower price points.

- Substitute Adoption Rates: In emerging markets, the adoption rate of substitute materials that offer a price advantage over established products can reach 25% within two years of their market introduction, impacting established players' market share.

Regulatory and Industry Standard Shifts

Changes in regulations and industry standards can significantly impact the threat of substitutes. For instance, stricter environmental regulations enacted in 2024, like those targeting specific chemical compounds used in traditional materials, could push industries towards adopting newer, compliant alternatives. Asahi Kasei, with its diverse portfolio spanning chemicals, fibers, and electronics, must remain agile.

New mandates, such as those promoting the use of bio-based or recycled materials, could directly disadvantage products that don't align with these evolving compliance landscapes. For example, if a new standard in the automotive sector, effective from 2025, requires a certain percentage of recycled content in interior components, Asahi Kasei’s traditional plastic offerings might face increased competition from companies specializing in recycled polymers.

The pace of these regulatory shifts is a critical factor. A rapid acceleration in the adoption of new standards, perhaps driven by public health concerns or climate change initiatives, could quickly render existing product lines less competitive. Asahi Kasei's strategic planning must therefore incorporate robust scenario analysis to anticipate and adapt to these dynamic compliance environments, ensuring its product development pipeline remains aligned with future market demands.

Key considerations for Asahi Kasei regarding regulatory and industry standard shifts include:

- Monitoring global regulatory trends: Tracking emerging legislation and standards in key markets, such as the EU's Green Deal initiatives impacting chemical usage.

- Proactive R&D investment: Allocating resources to develop materials and technologies that anticipate future compliance requirements.

- Industry collaboration: Engaging with industry associations and regulatory bodies to influence the development of standards and ensure a smooth transition.

- Supply chain adaptability: Ensuring the supply chain can support the adoption of new, compliant materials and manufacturing processes.

The threat of substitutes for Asahi Kasei is significant, particularly from emerging materials and technologies that offer comparable or superior performance at a lower cost or with greater sustainability. For instance, bio-based polymers and advanced composites are increasingly viable alternatives to traditional plastics and fibers. In 2024, the global market for sustainable packaging alone was projected to reach $477.4 billion, underscoring a strong consumer and industrial preference for eco-friendly options that can displace conventional materials.

Customers often weigh performance against price, and substitutes that meet essential needs more affordably can capture market share. This is especially true in commoditized segments where price sensitivity is high. For example, a 2024 survey indicated that 65% of B2B buyers in non-specialty chemical segments prioritize price, and 40% are willing to accept reduced performance for significant cost savings.

Regulatory shifts, such as stricter environmental mandates enacted in 2024, further amplify the threat of substitutes. New standards promoting bio-based or recycled content can disadvantage products not aligned with these requirements. For example, if automotive regulations effective from 2025 mandate recycled content in interior parts, Asahi Kasei's traditional plastic offerings could face increased competition from specialized recycled polymer suppliers.

| Factor | Impact on Asahi Kasei | Supporting Data (2024/2025 Projections) |

| Emerging Materials | Direct competition from bio-polymers, advanced composites | Sustainable packaging market projected at $477.4 billion |

| Price Sensitivity | Risk of losing customers to lower-cost alternatives | 65% of B2B buyers prioritize price; 40% accept lower performance for cost savings |

| Regulatory Changes | Potential obsolescence of non-compliant products | New mandates favoring recycled content by 2025 |

Entrants Threaten

Asahi Kasei operates in industries like advanced chemicals and materials, which require massive upfront capital. For instance, building a new petrochemical plant can easily cost billions of dollars, a sum prohibitive for most new players. This financial hurdle significantly deters potential competitors from entering these capital-intensive sectors.

Asahi Kasei's highly specialized product lines, particularly in advanced healthcare solutions and cutting-edge performance materials, necessitate substantial and ongoing investment in research and development. This commitment to innovation is a significant hurdle for potential new entrants.

The company's robust portfolio of patents, coupled with its proprietary technologies and deep scientific knowledge, creates formidable intellectual property barriers. These factors make it exceedingly challenging for new competitors to effectively replicate Asahi Kasei's offerings or enter the market without considerable R&D expenditure and a lengthy development timeline.

Stringent regulatory hurdles and the necessity for extensive certifications significantly deter new entrants in sectors where Asahi Kasei operates, such as advanced materials and healthcare. For instance, obtaining approvals for new medical devices or specialized chemicals can involve years of rigorous testing and compliance, a substantial investment that many startups cannot afford.

In 2024, the global pharmaceutical industry, a sector with overlapping regulatory complexities, saw average drug development costs exceeding $2 billion, with clinical trials alone representing a significant portion of this. This high cost and lengthy approval timeline, including navigating bodies like the FDA or EMA, creates a formidable barrier for any new company looking to compete with established players like Asahi Kasei.

Established Distribution Networks and Customer Trust

Asahi Kasei leverages deeply entrenched distribution networks and a high degree of customer trust, built over decades. These established relationships mean new entrants would struggle to replicate the reach and reliability that Asahi Kasei offers its global clientele. For instance, in the performance materials sector, securing shelf space and consistent delivery is critical, and Asahi Kasei's existing infrastructure provides a significant barrier.

Gaining comparable customer loyalty in markets demanding high product consistency and dependable supply chains presents a formidable hurdle for any new competitor. Asahi Kasei's long history of delivering quality products has fostered strong brand recognition and repeat business, making it difficult for newcomers to penetrate the market. This incumbency advantage is a key deterrent.

- Established Global Reach: Asahi Kasei's existing distribution channels span numerous countries, facilitating efficient product delivery and market access.

- Customer Loyalty: Decades of reliable service and product quality have cultivated strong trust and loyalty among Asahi Kasei's customer base.

- High Entry Costs: New entrants would need substantial investment to build comparable distribution infrastructure and marketing efforts to gain market traction.

- Industry Dependence on Trust: Sectors like automotive and electronics, where Asahi Kasei is prominent, place a premium on supplier reliability and proven performance, favoring established players.

Economies of Scale and Cost Advantages of Incumbents

Established players like Asahi Kasei benefit from substantial economies of scale. This means they can produce goods at a lower cost per unit due to high-volume operations in manufacturing, raw material sourcing, and research and development. For instance, in 2023, Asahi Kasei reported net sales of ¥2,402.8 billion, demonstrating the scale of its operations.

New entrants would find it challenging to replicate these cost efficiencies. Starting at a smaller scale, they would likely face higher per-unit production costs, making it difficult to compete on price against Asahi Kasei and other incumbents. This cost disadvantage serves as a significant barrier, deterring potential new competitors from entering the market.

- Economies of Scale: Asahi Kasei leverages its large production volumes to reduce per-unit costs across its diverse product lines.

- Cost Advantages: Incumbents possess established procurement networks and R&D infrastructure, granting them significant cost advantages over newcomers.

- Price Competition: New entrants face difficulty matching the pricing power of scaled-up competitors, limiting their ability to gain market share.

- Market Entry Barrier: The inherent cost disparity created by economies of scale acts as a substantial deterrent for new companies looking to enter Asahi Kasei's markets.

The threat of new entrants for Asahi Kasei is generally low due to significant barriers to entry. These include the immense capital required for advanced manufacturing facilities, as seen in the billions needed for petrochemical plants, and substantial, ongoing R&D investments in specialized areas like healthcare and performance materials. Asahi Kasei's robust patent portfolio and proprietary technologies further solidify its position, making it difficult for newcomers to replicate its offerings without considerable time and expense.

Regulatory complexities, particularly in sectors like medical devices and specialized chemicals, present another major hurdle. For instance, the pharmaceutical industry in 2024 saw drug development costs exceeding $2 billion, with lengthy approval processes acting as a deterrent. Furthermore, Asahi Kasei benefits from deeply entrenched distribution networks and strong customer loyalty, built over decades, which new entrants would struggle to match.

Economies of scale also play a crucial role, allowing Asahi Kasei to achieve lower per-unit costs. With net sales of ¥2,402.8 billion reported in 2023, the company's operational scale provides a significant cost advantage over smaller, new competitors. This cost disparity limits the ability of new entrants to compete on price, acting as a substantial barrier to market entry.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | High upfront investment needed for facilities. | Petrochemical plant costs can reach billions of dollars. |

| R&D Intensity | Continuous investment in innovation is essential. | Advanced materials and healthcare sectors demand significant R&D spending. |

| Intellectual Property | Patents and proprietary technologies protect market position. | Exceedingly difficult for new competitors to replicate offerings. |

| Regulatory Hurdles | Stringent certifications and approvals required. | 2024 pharmaceutical drug development costs over $2 billion. |

| Distribution & Brand Loyalty | Established networks and customer trust are key. | Decades of reliable service foster strong brand recognition. |

| Economies of Scale | Lower per-unit costs due to high-volume production. | Asahi Kasei's 2023 net sales of ¥2,402.8 billion highlight operational scale. |

Porter's Five Forces Analysis Data Sources

Our Asahi Kasei Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Asahi Kasei's annual reports, investor presentations, and official company disclosures. We also incorporate insights from reputable industry research firms, financial news outlets, and macroeconomic databases to provide a comprehensive view of the competitive landscape.