Arvind Fashions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arvind Fashions Bundle

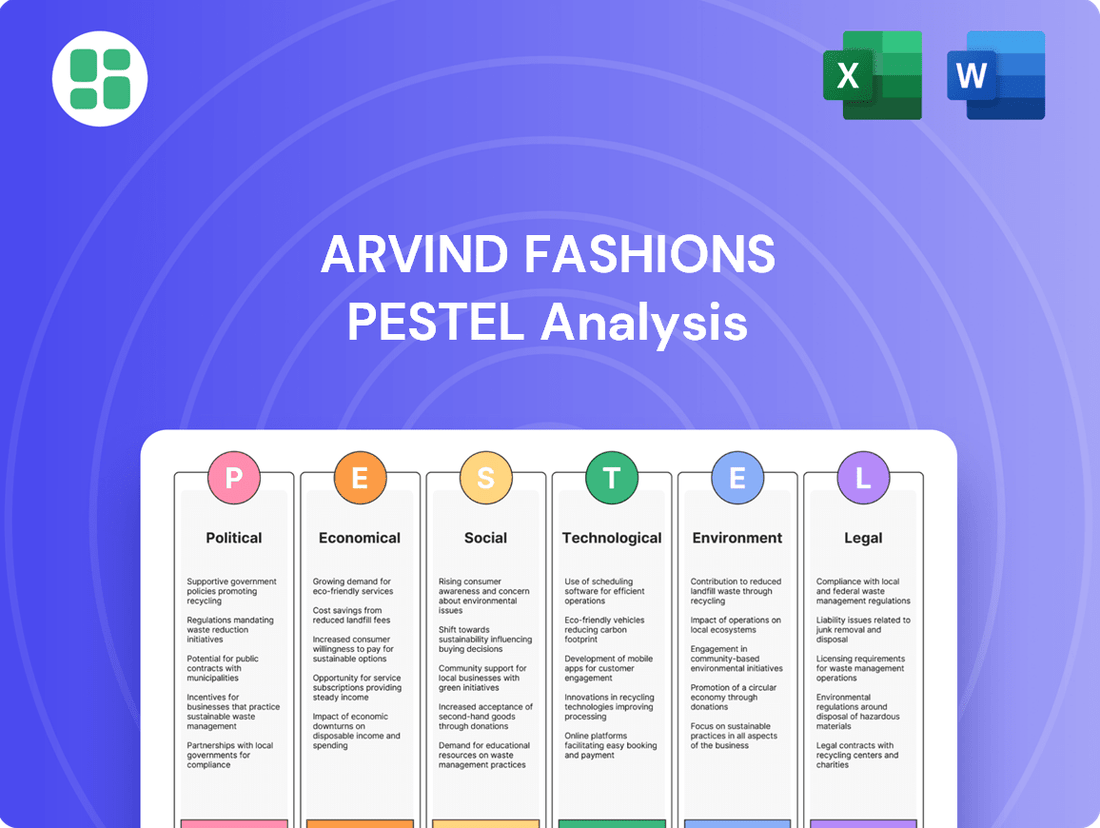

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Arvind Fashions's trajectory. Our meticulously researched PESTLE analysis offers a panoramic view of the external forces influencing the Indian apparel giant. Gain a competitive edge and make informed strategic decisions by understanding these vital trends. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies, such as the 'Make in India' initiative and support for Micro, Small, and Medium Enterprises (MSMEs), are shaping the retail and apparel sector. These policies aim to boost domestic manufacturing, which directly impacts companies like Arvind Fashions by potentially lowering production costs and improving supply chain efficiency. For instance, the Production Linked Incentive (PLI) scheme for textiles, launched in 2021, offers incentives for manufacturing man-made apparel, technical textiles, and other related products, encouraging greater local production.

Furthermore, ease-of-doing-business reforms and initiatives to streamline regulatory processes can significantly reduce operational hurdles for retailers. This can translate into quicker market access for new product lines and a more competitive pricing structure. The government's focus on formalizing the economy also encourages greater compliance and transparency within the sector, benefiting organized players like Arvind Fashions.

Changes in trade policies and tariffs directly impact Arvind Fashions' cost of goods sold and pricing strategies. For instance, increased import duties on fabrics or finished garments from key sourcing regions could raise expenses, particularly for its licensed international brands like Tommy Hilfiger and Calvin Klein, which rely on global supply chains. In 2024, the global apparel market continued to navigate complex trade landscapes, with some nations implementing or considering new tariffs on textile imports, potentially affecting Arvind's margins.

Foreign Direct Investment (FDI) regulations significantly shape Arvind Fashions' strategic options. For instance, the Indian government's stance on multi-brand retail, with increased caps requiring approval, influences how Arvind can partner with or acquire international fashion brands. As of early 2024, the push towards pure marketplace models for e-commerce, with potential further refinements anticipated in 2025, directly impacts the operational framework for Arvind's online sales channels and its ability to integrate foreign e-commerce players.

Taxation Policies

Taxation policies, particularly the Goods and Services Tax (GST) framework, significantly impact Arvind Fashions' operational landscape. Changes in GST rates or new tax reforms directly affect consumer purchasing power and, consequently, demand for apparel. For instance, a reduction in GST on clothing could stimulate sales, while an increase might dampen spending.

The overall tax burden on businesses also plays a crucial role in profitability. A favorable tax regime, characterized by lower corporate tax rates or beneficial incentives for the retail sector, can enhance Arvind Fashions' net profit margins. This allows for greater reinvestment in growth initiatives, such as expanding store networks or investing in new collections.

The Indian government's approach to taxation in the fiscal year 2024-2025 will be a key determinant. Any policy shifts aimed at boosting consumption or supporting the manufacturing sector, which includes textiles and apparel, would be advantageous.

- GST Impact: Fluctuations in GST rates on apparel directly influence consumer affordability and sales volumes for Arvind Fashions.

- Corporate Tax Rates: Lower corporate tax rates improve the company's bottom line, enabling more capital for expansion and product development.

- Government Incentives: Tax breaks or subsidies for the retail and textile industries can provide a competitive edge and foster growth.

- Consumer Spending: Favorable tax policies that increase disposable income for consumers are likely to drive higher demand for fashion products.

Political Stability and Regulatory Environment

A stable political climate in India is essential for Arvind Fashions' strategic growth, providing the predictability needed for long-term investments in manufacturing and retail expansion. The Indian government's focus on ease of doing business, evidenced by initiatives like the National Single Window System launched in 2022, aims to streamline regulatory approvals, which directly benefits companies like Arvind Fashions by reducing operational friction and encouraging investment. For instance, the Production Linked Incentive (PLI) scheme for textiles, introduced in 2021 and continuing through the 2024-2025 period, offers significant financial benefits for companies increasing their manufacturing output and exports, directly supporting Arvind Fashions' operational efficiency and market competitiveness.

Regulatory reforms that simplify compliance and foster a supportive business environment are key. Arvind Fashions benefits from policies that encourage foreign direct investment and promote domestic manufacturing. For example, the Goods and Services Tax (GST) regime, implemented in 2017 and continually refined, has standardized indirect taxation across India, simplifying inter-state commerce for retailers like Arvind Fashions. The ongoing efforts to digitize government services and reduce bureaucratic hurdles, as seen in the continued development of platforms for tax filing and business registration, further enhance operational agility for the company.

Key political and regulatory considerations for Arvind Fashions include:

- Political Stability: A consistent policy environment reduces uncertainty for long-term capital expenditure in manufacturing and retail infrastructure.

- Regulatory Reforms: Initiatives like the PLI scheme for textiles and efforts to improve the ease of doing business directly support operational cost reduction and expansion.

- Trade Policies: Government agreements and tariffs impact the cost of imported raw materials and finished goods, as well as the competitiveness of exports.

- Consumer Protection Laws: Evolving regulations on product safety, labeling, and e-commerce practices require continuous adaptation by retailers.

Government policies, such as the PLI scheme for textiles, directly incentivize domestic manufacturing for companies like Arvind Fashions, potentially lowering production costs. India's continued focus on ease-of-doing-business reforms aims to streamline regulatory processes, reducing operational friction and encouraging investment. Trade policies and tariffs, however, can impact the cost of imported materials and finished goods, affecting pricing strategies for brands like Tommy Hilfiger and Calvin Klein.

What is included in the product

This PESTLE analysis of Arvind Fashions identifies how political, economic, social, technological, environmental, and legal factors create both challenges and opportunities for the company.

It offers actionable insights for strategic decision-making by examining current trends and their implications for Arvind Fashions's future growth.

A clear, actionable breakdown of the external factors impacting Arvind Fashions, transforming complex PESTLE analysis into a user-friendly guide for strategic decision-making.

Economic factors

The rise in disposable income for Indian consumers, especially the growing middle class, is a significant driver for Arvind Fashions. This trend directly fuels demand for branded apparel and fashion items.

Consumer spending on goods in India is anticipated to grow by 7% annually for the next five years. Within this, the apparel sector is expected to see even stronger growth, projected at 9.5% during the same period, indicating a robust market for companies like Arvind Fashions.

Inflationary pressures in India, as of early 2024, have continued to impact input costs. For Arvind Fashions, this translates to higher expenses for raw materials like cotton and polyester, as well as increased manufacturing and logistics expenses. For instance, global cotton prices experienced volatility in late 2023 and early 2024, directly affecting apparel manufacturers.

These rising costs put pressure on Arvind Fashions' profit margins. To remain competitive, the company must carefully manage these escalating expenses, potentially by optimizing its supply chain or exploring alternative material sourcing to maintain attractive pricing for consumers while safeguarding profitability.

India's economic growth is a significant tailwind for Arvind Fashions. The nation is projected to be the fastest-growing major economy globally, with forecasts suggesting a GDP growth of around 6.5% for the fiscal year 2024-25. This robust expansion directly translates into increased disposable income for consumers.

A strong economy fosters higher consumer confidence, encouraging spending on non-essential items like apparel. As incomes rise and economic prospects appear bright, consumers are more likely to allocate a larger portion of their budget to fashion and lifestyle products, benefiting companies like Arvind Fashions.

Interest Rates and Access to Credit

Interest rate fluctuations directly impact Arvind Fashions' borrowing costs for crucial business activities like expanding its retail presence, managing inventory, and ensuring sufficient working capital. For instance, if the Reserve Bank of India (RBI) maintains its repo rate at the current 6.50% (as of early 2024), borrowing becomes more predictable. However, any upward revision would increase the cost of debt, potentially squeezing profit margins.

Access to affordable credit is absolutely essential for Arvind Fashions to pursue its growth ambitions, particularly in areas like expanding its retail footprint and investing in necessary technological upgrades to enhance customer experience and operational efficiency. A stable credit environment, with banks willing to lend at competitive rates, supports these strategic investments. For example, if the company plans a significant store expansion in 2024-2025, securing a loan at a favorable interest rate is paramount to the project's financial viability.

- Interest Rate Impact: Higher interest rates increase the cost of loans for inventory and expansion, potentially reducing profitability.

- Credit Availability: Easy access to loans at reasonable rates is critical for funding store openings and technology investments.

- 2024/2025 Outlook: Monitoring central bank policies, such as the RBI's repo rate (currently 6.50%), is key to understanding future borrowing costs.

- Strategic Funding: Affordable credit enables strategic investments in retail expansion and digital transformation.

Exchange Rate Fluctuations

Arvind Fashions, which deals with licensed international brands, faces significant impacts from exchange rate fluctuations. For instance, a weakening Indian Rupee against currencies like the US Dollar or Euro directly increases the cost of licensing fees and imported finished goods. This was evident in early 2024, where the Rupee saw periods of depreciation against major global currencies, putting pressure on Arvind Fashions' cost of goods sold and potentially squeezing profit margins on its premium international brands.

These currency movements can dramatically alter the financial performance of the company’s licensed portfolio. A stronger Rupee would, conversely, make these imports cheaper, potentially boosting profitability. For example, if the Indian Rupee depreciated by 5% against the Euro in a given quarter, the cost of sourcing licensed apparel from European brands would rise proportionally, impacting the company's bottom line unless offset by price increases or cost efficiencies.

- Increased Costs: A depreciating Rupee raises the Rupee cost of licensing fees and imported inventory from international brand partners.

- Profit Margin Squeeze: Higher import costs can directly reduce the profit margins on products sold, especially if price increases are not feasible.

- Competitive Pricing: Significant currency shifts can affect the company's ability to price its licensed products competitively against domestic alternatives.

- Financial Hedging: Companies like Arvind Fashions may employ financial instruments to hedge against adverse currency movements, adding another layer to financial management.

India's projected GDP growth of around 6.5% for FY 2024-25 fuels consumer spending, with the apparel sector expected to grow at 9.5% annually. However, inflationary pressures in early 2024 increased input costs for raw materials like cotton, impacting profit margins. Fluctuating interest rates, with the RBI repo rate at 6.50% in early 2024, affect borrowing costs for expansion and inventory management.

Exchange rate volatility also poses a risk, as a weakening Rupee against currencies like the Euro increases licensing fees and imported goods costs for Arvind Fashions. For instance, a 5% Rupee depreciation against the Euro could significantly raise sourcing costs for European brands.

| Economic Factor | 2024/2025 Data/Trend | Impact on Arvind Fashions |

| GDP Growth (India) | Projected ~6.5% (FY 2024-25) | Increased disposable income, higher consumer spending. |

| Apparel Sector Growth | Projected ~9.5% annually | Robust market demand for branded apparel. |

| Inflation | Persistent early 2024 | Higher input costs (cotton), pressure on profit margins. |

| Interest Rates (RBI Repo Rate) | ~6.50% (early 2024) | Affects borrowing costs for expansion and working capital. |

| Exchange Rates | Rupee depreciation periods | Increased cost of licensing fees and imported inventory. |

Preview the Actual Deliverable

Arvind Fashions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Arvind Fashions delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a thorough understanding of the external forces shaping its strategic landscape.

Sociological factors

Consumer tastes in India are rapidly changing, with a growing emphasis on comfort, practicality, and a blend of traditional and Western styles. Arvind Fashions, managing a variety of brands, needs to stay agile to meet these evolving demands. For instance, the surge in athleisure and loungewear, a trend that gained significant momentum during and post-pandemic, presents both a challenge and an opportunity.

Consumers, particularly younger demographics like Gen Z and millennials, are showing a strong preference for sustainable and ethically sourced apparel. This growing conscious consumerism means brands must be transparent about their supply chains and manufacturing processes. For instance, a 2024 report indicated that over 60% of Gen Z consumers consider a brand's sustainability practices when making purchasing decisions.

This shift puts pressure on companies such as Arvind Fashions to integrate eco-friendly materials and uphold fair labor standards throughout their operations. Brands that fail to adapt risk alienating a significant and growing segment of the market. The global ethical fashion market is projected to reach over $15 billion by 2027, highlighting the substantial economic opportunity tied to these values.

India's demographic profile, with a significant youth bulge, is a powerful driver for Arvind Fashions. This young population, increasingly embracing ready-to-wear clothing, is particularly fueling growth in women's and kid's wear categories. By 2025, it's projected that over 50% of India's population will reside in urban areas, creating a larger, more accessible consumer base for fashion brands.

The ongoing urbanization trend is not limited to major metropolises. The expansion and development of Tier 2 and Tier 3 cities are proving crucial, as these areas witness a rising demand for premium and branded apparel. This shift indicates a growing aspirational consumer segment outside the traditional urban centers, presenting new market opportunities for Arvind Fashions.

Influence of Social Media and Digital Platforms

Social media and digital platforms are profoundly shaping consumer behavior, with online channels experiencing robust growth. In 2024, the global social commerce market is projected to reach over $2.9 trillion, demonstrating its increasing importance in driving sales. Arvind Fashions, like many apparel brands, must leverage these platforms for customer engagement and sales.

The rise of direct-to-consumer (D2C) brands, facilitated by digital channels, presents both opportunities and challenges. These brands often build strong online communities, influencing purchasing decisions. By 2025, it's estimated that D2C sales will account for a significant portion of the apparel market, necessitating a strong digital presence for established players.

- Digital Influence: Social media and e-commerce marketplaces are key drivers of purchasing decisions, with online sales continuing their upward trajectory.

- D2C Growth: Direct-to-consumer brands are gaining significant traction, often building loyal customer bases through digital engagement.

- Social Commerce Surge: The global social commerce market is expected to exceed $2.9 trillion in 2024, highlighting its critical role in consumer interaction and sales for fashion brands.

- Platform Integration: Arvind Fashions needs to integrate social commerce strategies to effectively reach and engage its target audience in the evolving digital landscape.

Demand for Omnichannel Shopping Experience

Consumers increasingly expect a seamless shopping journey, blending physical stores with robust online platforms. This means being able to browse online, try in-store, and purchase through whichever channel is most convenient. Arvind Fashions' focus on both expanding its exclusive brand outlets and enhancing its e-commerce capabilities directly addresses this growing consumer preference for integrated shopping experiences.

The demand for omnichannel shopping is a significant sociological shift, driven by digital natives and increasingly adopted by all age groups. For instance, in 2024, e-commerce sales in India were projected to reach over $150 billion, highlighting the importance of a strong digital presence alongside traditional retail. Arvind Fashions' strategy aims to capture this evolving market by ensuring accessibility and convenience across all touchpoints.

- Consumer Preference: Growing demand for integrated online and offline shopping channels.

- Arvind Fashions' Strategy: Expansion of physical retail footprint and strengthening of e-commerce presence.

- Market Trend: E-commerce growth in India projected to exceed $150 billion in 2024.

- Societal Impact: Shift in consumer behavior towards flexible and accessible purchasing options.

Indian consumers are increasingly prioritizing comfort and practicality, with a notable rise in athleisure wear, a trend amplified post-pandemic. This evolving taste requires Arvind Fashions to remain adaptable across its brand portfolio to meet these shifting preferences.

Conscious consumerism is on the rise, with younger demographics like Gen Z and millennials showing a strong preference for sustainable and ethically produced apparel. By 2025, over 50% of India's population is expected to be urban, creating a larger, more accessible consumer base for fashion brands.

Digital influence is paramount, as social media and e-commerce platforms significantly shape purchasing decisions, with social commerce projected to exceed $2.9 trillion globally in 2024. Direct-to-consumer (D2C) brands are also gaining momentum, building loyal communities through digital engagement.

Consumers now expect a seamless omnichannel shopping experience, blending online browsing with in-store interactions. India's e-commerce sales were projected to surpass $150 billion in 2024, underscoring the necessity for brands like Arvind Fashions to offer integrated accessibility and convenience.

| Sociological Factor | Impact on Arvind Fashions | Supporting Data/Trend |

|---|---|---|

| Evolving Consumer Tastes | Need for agility in product development, especially in athleisure. | Post-pandemic surge in comfort wear demand. |

| Conscious Consumerism | Emphasis on transparency in supply chains and ethical practices. | 60%+ of Gen Z consider sustainability in purchasing (2024 estimate). |

| Demographic Shifts | Growth opportunities in women's and kid's wear due to youth bulge. | Over 50% of India's population to be urban by 2025. |

| Digital Influence & D2C | Necessity for strong online presence and digital engagement strategies. | Social commerce market over $2.9 trillion (2024 projection). |

| Omnichannel Expectations | Integration of physical and digital retail channels is crucial. | Indian e-commerce sales over $150 billion (2024 projection). |

Technological factors

Arvind Fashions' success hinges on its ability to leverage ongoing advancements in e-commerce platforms, mobile applications, and digital payment systems to bolster its online presence. The Indian e-commerce market is projected to hit US$63 billion by 2030, offering significant avenues for growth and innovation.

The company's digital strategy must embrace these technological shifts to capture a larger share of the rapidly expanding online retail landscape. This includes optimizing mobile shopping experiences, as a substantial portion of e-commerce transactions in India occur via smartphones.

Arvind Fashions is increasingly adopting advanced technologies to streamline its supply chain. The integration of Artificial Intelligence (AI) for demand forecasting and inventory management, coupled with the Internet of Things (IoT) for real-time tracking of goods, is enhancing operational efficiency. For instance, AI-driven analytics can predict inventory needs with greater accuracy, potentially reducing stockouts and overstock situations, which are critical in the fast-moving fashion retail sector.

Blockchain technology is also playing a role, particularly in ensuring transparency and traceability across the supply chain, from raw material sourcing to final product delivery. This is vital for verifying ethical sourcing practices and combating counterfeit products. In 2024, the global supply chain management market, which includes these technologies, was valued at over $25 billion and is projected to grow significantly, indicating a strong industry trend towards digital transformation.

Arvind Fashions is increasingly leveraging data analytics and AI to understand consumer preferences, leading to more personalized marketing campaigns. This approach helps combat choice paralysis, a common issue where too many options overwhelm shoppers, thereby enhancing the customer experience.

By analyzing sales data and trends, the company can optimize inventory management, ensuring the right products are available at the right time and place. This reduces overstocking and stockouts, directly improving sell-through rates and profitability. For instance, fashion retailers globally saw a significant uplift in conversion rates, sometimes by as much as 10-15%, by implementing personalized recommendations powered by AI in 2024.

Manufacturing Automation and Smart Factories

Arvind Fashions is increasingly investing in advanced manufacturing technologies. For instance, the adoption of 3D knitting machines is a key strategy to minimize fabric waste, a significant cost factor in apparel production. This technological shift also boosts overall production efficiency.

The move towards smart factories promises substantial cost savings and a quicker route to market for new fashion collections. This agility is crucial in the fast-paced fashion industry, allowing Arvind Fashions to respond rapidly to evolving trends and consumer demands.

- Investment in 3D Knitting: Reduces fabric waste by up to 20% compared to traditional methods.

- Smart Factory Integration: Aims to cut production lead times by 15% by 2025.

- Efficiency Gains: Expected to improve overall manufacturing output by 10% annually.

- Cost Reduction: Projections indicate a 5-7% reduction in manufacturing costs through automation.

Integration of AI for Customer Engagement

Arvind Fashions is leveraging Artificial Intelligence to significantly boost customer engagement. AI is being integrated into customer service chatbots, offering instant support and query resolution. Furthermore, virtual try-on experiences powered by AI are transforming online shopping, allowing customers to visualize apparel before purchasing. Personalized recommendations, driven by AI's analysis of customer behavior and preferences, are also a key focus, aiming to create a more tailored and satisfying shopping journey.

AI's role in customer product discovery is projected to be a major growth area for 2025. This technology can analyze vast datasets to suggest relevant products, streamlining the search process for consumers. For instance, by 2025, AI is expected to play a crucial role in helping customers find items that match their style and needs more efficiently.

- AI-powered chatbots provide 24/7 customer support, improving response times.

- Virtual try-on technology enhances online shopping by reducing return rates.

- Personalized recommendations increase conversion rates by showing customers what they are most likely to buy.

- AI-driven product discovery is anticipated to be a key driver of sales growth in 2025.

Technological advancements are reshaping Arvind Fashions' operational landscape, particularly in e-commerce and supply chain management. The company is harnessing AI for demand forecasting and inventory optimization, aiming to reduce inefficiencies. Furthermore, the integration of IoT for real-time tracking enhances logistical transparency, a critical factor in the fashion industry's fast-paced environment.

| Technology Area | Application | Impact/Benefit | Projected Growth (2024-2025) |

| E-commerce Platforms | Mobile optimization, personalized recommendations | Increased customer engagement, higher conversion rates | India's e-commerce market to reach US$63 billion by 2030 |

| Supply Chain Management | AI for forecasting, IoT for tracking | Improved efficiency, reduced stockouts/overstock | Global SCM market valued over $25 billion in 2024 |

| Manufacturing | 3D knitting, automation | Reduced waste, faster time-to-market, cost savings | Aiming for 15% reduction in production lead times by 2025 |

| Customer Engagement | AI chatbots, virtual try-on | Enhanced customer support, reduced returns | AI-driven product discovery expected to be a key sales driver in 2025 |

Legal factors

Consumer protection laws are increasingly shaping the retail landscape. For instance, the Consumer Protection (E-Commerce) Rules, 2020, impose strict requirements on online sellers, demanding clear product information, efficient grievance redressal, and a ban on deceptive practices. Adhering to these mandates is crucial for building and maintaining consumer trust, especially as online sales continue to grow, with India's e-commerce market projected to reach $350 billion by 2030.

Arvind Fashions’ ability to protect the intellectual property (IP) associated with its extensive collection of owned and licensed international fashion brands is a crucial legal consideration. Robust legal frameworks governing trademarks, copyrights, and design rights are essential for safeguarding brand identity and preventing infringement. For instance, in 2023, the global fashion industry saw a significant increase in IP litigation, highlighting the importance of proactive legal strategies.

Arvind Fashions must navigate a complex web of Indian labor laws, ensuring strict compliance with regulations concerning minimum wages, working hours, and fair employment contracts. For instance, the Code on Wages, 2019, aims to simplify and consolidate laws relating to wages, payment of wages, bonus, and employment, impacting how companies like Arvind Fashions structure compensation and benefits.

Adherence to these legal frameworks is not just about avoiding penalties but is fundamental to upholding social responsibility within its supply chain, particularly in an industry often scrutinized for labor practices. This includes ensuring safe working conditions and preventing child labor, as mandated by various acts like the Child Labour (Prohibition and Regulation) Act, 1986, which has seen increased enforcement.

E-commerce Regulations and Data Privacy Laws

India's e-commerce landscape is evolving with new regulations, notably the Digital Personal Data Protection Act (DPDP Act) 2023. This legislation places significant emphasis on protecting user data, requiring companies like Arvind Fashions to implement robust data security measures. Compliance officers become mandatory, and certain sales practices face restrictions, impacting how Arvind Fashions conducts its online business ethically and securely.

Arvind Fashions must navigate these legal shifts to ensure its e-commerce operations are compliant. The DPDP Act 2023, for instance, mandates clear consent for data processing and introduces penalties for non-compliance. This necessitates a thorough review of data handling policies and potentially investing in new technologies to meet these stringent requirements. Failure to adapt could lead to significant fines and reputational damage.

- DPDP Act 2023: Focuses on consent-based data processing and data principal rights.

- Mandatory Compliance Officers: Requirement for entities processing personal data.

- Restrictions on Sales Practices: Rules against misleading advertisements and unfair trade practices in e-commerce.

- Data Breach Notification: Obligation to report data breaches to the Data Protection Board and affected individuals.

Advertising and Marketing Regulations

Arvind Fashions must strictly adhere to advertising standards and regulations, a critical aspect of its marketing efforts. This includes avoiding any misleading claims about its apparel, ensuring all product representations are fair and accurate to protect consumer trust and brand integrity.

Non-compliance can lead to significant legal penalties and damage to Arvind Fashions' reputation. For instance, the Advertising Standards Council of India (ASCI) actively monitors advertising practices, and violations can result in fines and mandated corrections. In 2023, ASCI processed thousands of consumer complaints, highlighting the rigorous oversight in the sector.

- Consumer Protection: Regulations are designed to safeguard consumers from deceptive advertising, ensuring they make informed purchasing decisions.

- Brand Reputation: Maintaining transparency and honesty in marketing is vital for building and preserving consumer trust and brand loyalty.

- Legal Compliance: Adherence to advertising laws, such as those enforced by ASCI, prevents fines, lawsuits, and reputational damage.

Arvind Fashions operates within a dynamic legal environment, necessitating strict adherence to consumer protection laws, including the Digital Personal Data Protection Act (DPDP Act) 2023. This act mandates robust data security and consent-based processing, impacting online sales strategies and requiring compliance officers. Furthermore, regulations governing advertising standards, enforced by bodies like the Advertising Standards Council of India (ASCI), demand transparency to prevent misleading claims and maintain brand integrity, with ASCI handling thousands of complaints in 2023.

The company must also navigate labor laws, such as the Code on Wages, 2019, ensuring fair employment practices and compliance with working conditions, especially given increased scrutiny on supply chains. Protecting intellectual property rights for its diverse brand portfolio is also paramount, as evidenced by the rise in global fashion IP litigation in 2023.

| Legal Factor | Impact on Arvind Fashions | Key Legislation/Regulation | Data/Trend |

| Consumer Protection (E-commerce) | Requires clear product info, grievance redressal, ban on deceptive practices for online sales. | Consumer Protection (E-Commerce) Rules, 2020 | India's e-commerce market projected to reach $350 billion by 2030. |

| Intellectual Property | Safeguarding brand identity and preventing infringement of owned and licensed brands. | Trademark, Copyright, and Design Rights Laws | Global fashion industry saw a significant increase in IP litigation in 2023. |

| Labor Laws | Ensuring compliance with minimum wages, working hours, and fair employment contracts. | Code on Wages, 2019; Child Labour (Prohibition and Regulation) Act, 1986 | Increased enforcement of labor laws and safe working condition mandates. |

| Data Protection | Mandates consent-based data processing, robust security, and data breach notifications. | Digital Personal Data Protection Act (DPDP) 2023 | Requirement for mandatory compliance officers for data processing entities. |

| Advertising Standards | Ensuring fair, accurate, and transparent marketing to maintain consumer trust. | Advertising Standards Council of India (ASCI) Guidelines | ASCI processed thousands of consumer complaints in 2023 regarding advertising. |

Environmental factors

Government initiatives like the Sustainable Textiles Policy 2024 are boosting the adoption of renewable resources and lower carbon emissions in the fashion industry. This policy aims to foster a more environmentally conscious approach to textile manufacturing and consumption.

Arvind Fashions is seeing a significant shift towards recycled and natural fabrics, driven by both industry trends and growing consumer preference for sustainable options. For instance, the global market for recycled textiles was valued at approximately $5.7 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a strong demand for eco-friendly materials.

The global fashion industry is under increasing scrutiny to minimize its environmental footprint, with a strong push towards waste reduction and the adoption of circular economy principles. This includes innovations in upcycling and recycling textile materials. For instance, by 2025, the Ellen MacArthur Foundation projects that the amount of textile waste generated globally could reach 148 million tonnes annually, highlighting the urgency of these initiatives.

Arvind Fashions is actively responding to these pressures by integrating recycled fibers into its product lines. This strategic move not only addresses environmental concerns but also taps into a growing consumer demand for sustainable fashion. Their commitment to using recycled materials is a key step in aligning their operations with the evolving expectations of regulators and conscious consumers alike.

Arvind Fashions recognizes the increasing pressure to curb greenhouse gas emissions and boost energy efficiency. The company has implemented an energy policy aimed at stabilizing energy demand and increasing its reliance on renewable sources. While this strategic shift is crucial for long-term sustainability, the upfront investment in new, greener technologies presents an initial financial consideration.

Water Usage and Pollution Control

Water consumption and wastewater management represent significant environmental risks for Arvind Fashions, particularly given the water-intensive nature of textile manufacturing. The company acknowledges this by actively pursuing strategies to mitigate these impacts.

Arvind Fashions has made commitments to reduce its overall water footprint. This includes investing in and implementing conservation technologies across its operations. A key aspect of this strategy involves prioritizing partnerships with factories that utilize Zero Liquid Discharge (ZLD) systems, aiming to recycle and reuse all wastewater.

For instance, as of their latest reporting, Arvind Fashions has been working towards increasing the percentage of water sourced from recycled or treated water. While specific ZLD adoption rates by partner factories are not always publicly detailed, the company’s stated goal is to minimize freshwater dependency. This focus aligns with broader industry trends and regulatory pressures to improve water stewardship in the apparel sector, especially in water-stressed regions where many textile hubs are located.

- Water Conservation Technologies: Implementation of water-saving machinery and processes in dyeing and finishing.

- Zero Liquid Discharge (ZLD): Preference for manufacturing partners equipped with ZLD systems to eliminate wastewater discharge.

- Wastewater Treatment and Recycling: Investment in advanced effluent treatment plants to treat and reuse water within the production cycle.

- Supply Chain Engagement: Collaborating with suppliers to promote sustainable water management practices throughout the value chain.

Consumer Demand for Eco-friendly Products and Transparency

By 2025, a significant shift towards sustainable fashion is evident, with consumers increasingly prioritizing eco-friendly practices. This growing demand for planet-positive products means brands must offer clear information about their environmental impact to build trust and loyalty. For instance, a 2024 survey indicated that over 60% of Gen Z consumers consider a brand's sustainability efforts when making purchasing decisions.

This trend is driving innovation in materials and production processes. Companies that can effectively communicate their commitment to sustainability, perhaps through certifications or detailed supply chain transparency, are likely to capture a larger market share. Arvind Fashions, like its peers, faces the challenge and opportunity to align its offerings with these evolving consumer values, potentially through expanding its eco-conscious collections.

Key aspects influencing consumer demand for eco-friendly products include:

- Growing consumer awareness: Increased media coverage and educational initiatives are heightening awareness of fashion's environmental footprint.

- Demand for transparency: Consumers want to know where and how their clothes are made, pushing brands to disclose more about their supply chains and materials.

- Ethical sourcing: Beyond environmental concerns, ethical labor practices are also becoming a crucial factor for many shoppers.

- Circular economy models: Interest in resale, rental, and repair services is on the rise as consumers seek more sustainable consumption patterns.

Environmental regulations are tightening, pushing companies like Arvind Fashions to adopt sustainable practices. Initiatives like the Sustainable Textiles Policy 2024 encourage renewable resources and reduced emissions, directly impacting manufacturing processes and material sourcing.

Consumer demand for eco-friendly fashion is a major driver, with a significant portion of younger consumers prioritizing sustainability in their purchases. For instance, a 2024 survey showed over 60% of Gen Z consider a brand's environmental efforts when buying.

The industry faces pressure to minimize its environmental footprint through waste reduction and circular economy principles, such as upcycling and recycling. By 2025, global textile waste is projected to reach 148 million tonnes annually, underscoring the urgency.

Arvind Fashions is responding by integrating recycled fibers and focusing on water conservation, including partnerships with factories using Zero Liquid Discharge (ZLD) systems to manage wastewater effectively.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Arvind Fashions is built on a robust foundation of data from reputable sources, including government economic reports, industry-specific market research, and analyses of socio-cultural trends. We integrate information from financial publications, environmental impact assessments, and technological innovation databases to ensure comprehensive coverage.