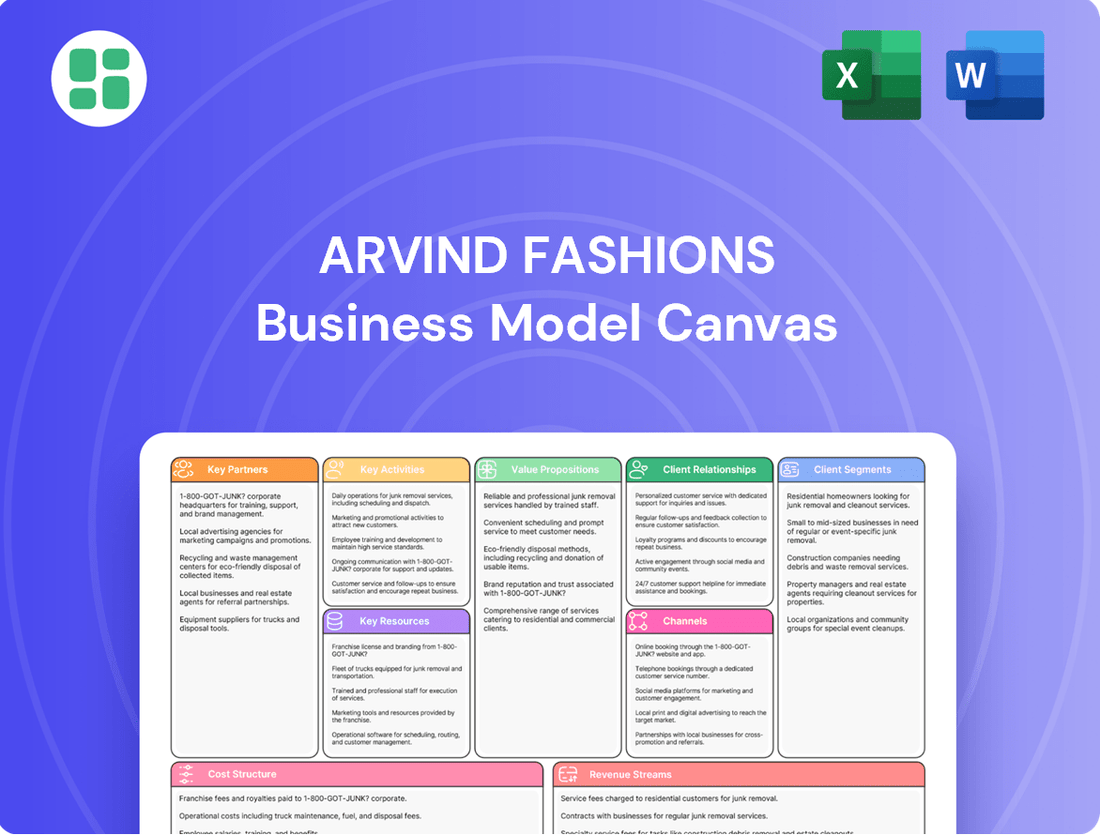

Arvind Fashions Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arvind Fashions Bundle

Unlock the full strategic blueprint behind Arvind Fashions's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Arvind Fashions Limited strategically partners with leading international brand licensors, securing rights for popular labels such as U.S. Polo Assn., Arrow, Tommy Hilfiger, and Calvin Klein. These collaborations are fundamental to their business model, enabling access to established global brand recognition and design innovation. For the fiscal year ending March 31, 2024, Arvind Fashions reported a revenue of ₹2,604 crore, with a significant portion driven by these licensed international brands.

Arvind Fashions collaborates with numerous manufacturing and sourcing partners to create its diverse range of apparel, accessories, and footwear. These relationships are fundamental to ensuring efficient production processes and maintaining stringent quality control across all product lines. For instance, in the fiscal year 2023-24, the company continued to leverage its established network to manage its extensive product portfolio.

These strategic alliances are crucial for Arvind Fashions' ability to scale operations effectively and respond dynamically to fluctuating market demand. By outsourcing manufacturing and sourcing, the company can optimize its production capacity and manage inventory levels more efficiently, a key factor in the fast-paced fashion industry.

The strength and reliability of these partnerships directly contribute to a robust and resilient supply chain. This allows Arvind Fashions to consistently deliver products to consumers while navigating the complexities of global sourcing and manufacturing.

Arvind Fashions leverages a robust franchisee network, primarily employing a franchisee-owned, franchisee-operated (FOFO) model. This strategy is particularly crucial for expanding its large-format retail presence across diverse markets.

This asset-light strategy is a key enabler of rapid market penetration, as it significantly reduces Arvind Fashions’ direct capital investment in store infrastructure and operational setup. For instance, in FY23, the company continued to expand its retail footprint, with franchisees playing a vital role in this growth.

E-commerce Platforms and Marketplaces

Arvind Fashions cultivates strategic alliances with major e-commerce platforms, including Flipkart, Myntra, and Amazon. These collaborations are crucial for driving online sales and expanding market reach. The company also leverages its own digital storefront, NNNOW.com, to directly engage with consumers.

These partnerships are instrumental in bolstering Arvind Fashions' digital growth and establishing a robust omnichannel presence. In the fiscal year 2023-24, online channels contributed a significant portion of the company's overall revenue, demonstrating the direct impact of these e-commerce relationships on financial performance.

- Strategic Alliances: Partnerships with Flipkart, Myntra, and Amazon are vital for online sales.

- Digital Growth: These collaborations enhance the company's digital footprint and customer engagement.

- Omnichannel Presence: Integrating online and offline channels through these platforms strengthens market penetration.

- Revenue Contribution: E-commerce platforms are significant drivers of Arvind Fashions' top-line growth.

Department Stores and Multi-Brand Outlets (MBOs)

Arvind Fashions leverages extensive partnerships with major department stores and thousands of multi-brand outlets (MBOs) across India. This strategy is crucial for achieving widespread physical distribution, ensuring its brands are accessible to a vast customer demographic. These collaborations extend Arvind Fashions' reach far beyond its own branded stores.

These partnerships are vital for market penetration and brand visibility. For instance, in fiscal year 2024, Arvind Fashions reported a significant portion of its revenue generated through its retail network, which heavily relies on these channel partners. The company's presence in these outlets allows it to tap into established customer footfalls and shopping habits.

- Extensive Reach: Partnerships with department stores and MBOs provide access to over 1,000 retail touchpoints nationwide.

- Customer Access: These channels allow Arvind Fashions to connect with a diverse customer base, enhancing brand visibility.

- Sales Contribution: A substantial percentage of Arvind Fashions' sales in FY24 were attributed to its extensive retail network, including these key partners.

Arvind Fashions' key partnerships extend to logistics and supply chain providers, ensuring efficient product delivery and inventory management. These collaborations are critical for maintaining a seamless flow of goods from manufacturing to the end consumer. The company's ability to manage its extensive retail and online presence relies heavily on the reliability of these operational partners.

Furthermore, Arvind Fashions engages with technology partners to enhance its digital infrastructure and customer relationship management systems. These alliances are vital for data analytics, personalized marketing, and improving the overall customer experience. For example, investments in digital platforms in FY23-24 aimed to bolster these capabilities.

The company also partners with financial institutions and banks for various credit facilities and working capital needs. These relationships are fundamental to supporting its operational scale and growth initiatives. In FY24, Arvind Fashions continued to manage its financial obligations through established banking relationships.

| Partnership Type | Key Partners | Strategic Importance | FY24 Impact Example |

|---|---|---|---|

| Brand Licensors | U.S. Polo Assn., Arrow, Tommy Hilfiger | Access to global brands, design innovation | Significant revenue driver |

| Manufacturing & Sourcing | Various global and domestic suppliers | Efficient production, quality control | Enabled diverse product portfolio |

| Retail Distribution | Department stores, Multi-Brand Outlets (MBOs) | Widespread physical reach, customer access | Substantial sales contribution |

| E-commerce Platforms | Flipkart, Myntra, Amazon | Online sales growth, omnichannel presence | Key contributor to digital revenue |

| Logistics & Supply Chain | Third-party logistics providers | Efficient delivery, inventory management | Supported operational scale |

What is included in the product

Arvind Fashions' business model focuses on delivering fashionable apparel across diverse customer segments through a multi-channel approach, emphasizing strong brand partnerships and a robust retail network.

It details key resources like brand equity and supply chain efficiency, alongside revenue streams from retail sales and licensing, all within a framework designed for informed strategic decisions.

Arvind Fashions' Business Model Canvas acts as a pain point reliever by offering a clear, actionable framework to address challenges in the fast-paced fashion industry.

It provides a structured approach to identify and solve key operational and strategic hurdles, enabling agile adaptation to market demands.

Activities

Arvind Fashions actively manages its brand portfolio, which includes both owned brands like Flying Machine and licensed international names such as US Polo Assn., Arrow, Tommy Hilfiger, and Calvin Klein. This strategic approach aims to build robust brand equity and maintain strong market positions for each label.

In 2023-24, Arvind Fashions reported a revenue of ₹1,139 crore, with brands like US Polo Assn. and Arrow forming significant contributors to this performance. The company's focus remains on strengthening the market presence and appeal of these key brands through targeted marketing and product development.

Arvind Fashions Limited is deeply engaged in the entire lifecycle of its products, from initial concept to final sale. This includes the crucial stages of design, manufacturing, and sourcing for a wide array of apparel, accessories, and footwear. This integrated approach allows the company to maintain stringent control over product quality and foster innovation in both materials and design aesthetics.

By managing these core activities internally and through strategic partnerships, Arvind Fashions can swiftly adapt to the dynamic and ever-changing landscape of fashion trends. For instance, in the fiscal year 2023-24, the company focused on enhancing its product offerings and supply chain efficiency, which contributed to its revenue growth and market positioning.

Arvind Fashions actively manages its extensive retail presence, encompassing exclusive brand outlets, department store concessions, and multi-brand retail partnerships. This operational backbone is crucial for brand visibility and customer engagement across diverse shopping environments.

Strategic expansion is a key activity, with the company aiming to significantly grow its retail footprint. For instance, as of the first quarter of fiscal year 2024, Arvind Fashions operated 1,101 stores, showcasing their commitment to increasing market reach.

The company often leverages an asset-light franchisee model to fuel this expansion, allowing for rapid scaling of their retail network. This approach helps in minimizing capital expenditure while maximizing store penetration and sales volume, as seen in their consistent store additions year-on-year.

E-commerce and Omnichannel Integration

Arvind Fashions is focused on building a robust e-commerce platform and weaving it into its physical store network. This integration aims to provide customers with a fluid shopping journey, whether they're browsing online or in-store. Key to this is managing online sales efficiently and employing digital marketing to reach a wider audience.

The company leverages technology to enhance customer convenience, a strategy that has become increasingly important in the retail landscape. For instance, in the fiscal year 2023-24, Arvind Fashions reported a significant uptick in its digital channels, contributing substantially to its overall revenue. This highlights the critical nature of their omnichannel strategy.

- E-commerce Platform Development: Continuously enhancing the user experience and functionality of their online store.

- Omnichannel Integration: Seamlessly connecting online and offline touchpoints, such as buy online, pick up in-store (BOPIS) services.

- Digital Marketing: Implementing targeted campaigns across various digital platforms to drive traffic and sales.

- Technology Adoption: Utilizing data analytics and AI for personalized customer experiences and inventory management.

Supply Chain and Inventory Management

Arvind Fashions' supply chain and inventory management is a cornerstone of its operations. The company focuses on a streamlined process, beginning with the careful sourcing of raw materials and extending all the way to the final delivery of apparel to customers. This meticulous oversight aims to ensure that products are available when and where consumers want them, while also keeping a close eye on operational costs.

Optimizing inventory turns and operating cycles are critical activities. This means efficiently managing stock levels to avoid both stockouts and excess inventory. For instance, in the fiscal year ending March 2023, Arvind Fashions reported an inventory holding period that reflects their efforts in balancing availability with cost efficiency.

- Efficient Sourcing: Establishing robust relationships with suppliers for timely and quality raw material procurement.

- Inventory Optimization: Implementing strategies to improve inventory turnover ratios, aiming for faster sales and reduced holding costs.

- Logistics and Distribution: Ensuring smooth and cost-effective movement of goods from manufacturing units to retail outlets and online channels.

- Demand Forecasting: Utilizing data analytics to predict customer demand accurately, thereby minimizing overstocking and understocking situations.

Arvind Fashions is actively involved in product design, manufacturing, and sourcing for its diverse apparel and accessory lines. This integrated approach ensures quality control and fosters innovation. For fiscal year 2023-24, the company's revenue was ₹1,139 crore, with a strong focus on brands like US Polo Assn. and Arrow.

The company manages a vast retail network, including exclusive brand outlets and department store concessions. As of Q1 FY24, Arvind Fashions operated 1,101 stores, underscoring its commitment to expanding its physical presence and customer accessibility.

Arvind Fashions prioritizes developing its e-commerce capabilities and integrating them with its physical stores for a seamless omnichannel experience. Digital channels saw a significant contribution to revenue in FY 2023-24, highlighting the success of this strategy.

Efficient supply chain and inventory management are critical. The company focuses on optimizing inventory turns and operating cycles to balance product availability with cost efficiency.

| Key Activity | Description | FY 2023-24 Impact |

|---|---|---|

| Brand Management | Managing owned and licensed brands like Flying Machine, US Polo Assn., Arrow. | Drove significant revenue contribution. |

| Retail Operations | Operating a network of 1,101 stores (as of Q1 FY24) through owned and franchised models. | Expanded market reach and customer engagement. |

| E-commerce & Omnichannel | Developing online platforms and integrating with physical stores. | Boosted revenue through digital channels. |

| Supply Chain & Inventory | Streamlining sourcing, manufacturing, and distribution for efficiency. | Ensured product availability and managed costs. |

Full Version Awaits

Business Model Canvas

The Arvind Fashions Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing a direct representation of the final deliverable, ensuring complete transparency and no surprises. Once your order is complete, you'll gain full access to this meticulously crafted Business Model Canvas, ready for your strategic analysis and application.

Resources

Arvind Fashions boasts a robust brand portfolio, a cornerstone of its business model, featuring a mix of owned and licensed international fashion powerhouses. This diverse collection, including names like U.S. Polo Assn., Arrow, Flying Machine, Tommy Hilfiger, and Calvin Klein, represents a significant intangible asset.

The intellectual property underpinning these brands, encompassing distinctive designs and protected trademarks, is a critical resource. For example, in the fiscal year ending March 31, 2024, Arvind Fashions reported strong performance across its brand portfolio, with U.S. Polo Assn. continuing to be a key revenue driver, highlighting the value of these brand assets.

Arvind Fashions boasts an extensive retail network, a critical asset for its business model. This includes a significant presence through exclusive brand outlets, strategically placed within department stores, and a wide reach across multi-brand outlets. This vast physical footprint spans numerous cities and towns throughout India, ensuring broad market access.

This robust infrastructure is fundamental to facilitating direct customer interaction and driving sales. For instance, as of early 2024, Arvind Fashions operates hundreds of stores across India, a testament to its commitment to physical retail presence. This network allows for efficient product distribution and brand visibility.

Arvind Fashions’ human capital is a cornerstone, encompassing skilled employees in design, manufacturing, retail, brand management, and e-commerce. This expertise drives product innovation and operational efficiency, crucial for staying competitive in the fast-paced fashion industry.

The leadership team's deep experience in fashion and retail is paramount. Their strategic vision guides the company's direction, from market penetration to brand development, ensuring effective execution of business plans and navigating industry challenges. For instance, in FY23, the company focused on strengthening its core team and investing in talent development programs to enhance capabilities across all functions.

Manufacturing Capabilities and Supply Chain Assets

Arvind Fashions leverages a network of owned and partnered manufacturing facilities, ensuring flexibility and scale for its diverse product lines. This robust infrastructure is critical for maintaining consistent quality and meeting production demands. For instance, as of fiscal year 2023-24, the company continues to optimize its production processes across its integrated textile and garment manufacturing units, a key asset inherited from its parent group.

The company's supply chain is further strengthened by an efficient warehousing and distribution system designed for timely product availability. This network is vital for getting apparel to market swiftly, a crucial factor in the fast-paced fashion industry. Arvind Fashions' commitment to an agile supply chain was evident in its ability to manage inventory effectively throughout the 2023-24 period, adapting to evolving consumer preferences.

- Manufacturing Facilities: Access to integrated textile and garment manufacturing, supporting both internal production and potential contract manufacturing.

- Warehousing and Distribution: A well-established network for efficient storage and timely delivery of finished goods across various retail channels.

- Supply Chain Efficiency: Focus on optimizing logistics to reduce lead times and ensure product availability, a key competitive advantage.

Technology and Digital Platforms

Arvind Fashions significantly invests in technology to power its operations. This includes enhancing its e-commerce presence, notably through platforms like NNNOW.com, and implementing systems to improve supply chain efficiency.

These digital investments are crucial for creating a seamless omnichannel experience, allowing customers to interact with the brand across various touchpoints. This focus on technology directly supports customer engagement and operational agility.

- E-commerce Growth: NNNOW.com, a key digital platform, has seen substantial growth, reflecting the shift towards online retail. In FY24, Arvind Fashions reported a significant increase in its online sales contribution.

- Omnichannel Integration: Investments aim to connect online and offline channels, offering services like click-and-collect and unified inventory management. This strategy is designed to provide a consistent customer journey.

- Supply Chain Optimization: Technology is being leveraged to streamline logistics, inventory management, and demand forecasting, leading to improved operational efficiency and reduced costs.

Arvind Fashions' key resources are its strong brand portfolio, extensive retail network, skilled human capital, efficient manufacturing and supply chain capabilities, and significant technology investments. These elements collectively enable the company to deliver fashion products and experiences to a wide customer base.

In fiscal year 2024, Arvind Fashions continued to leverage its brand equity, with U.S. Polo Assn. remaining a primary revenue generator. The company's physical retail presence, comprising hundreds of stores across India, facilitates direct customer engagement and sales, while its e-commerce platform, NNNOW.com, experienced substantial growth, underscoring the importance of omnichannel strategies.

The company's operational backbone includes integrated manufacturing facilities and an optimized supply chain, ensuring product quality and timely delivery. This infrastructure, coupled with investments in technology for e-commerce and supply chain enhancement, positions Arvind Fashions for continued success in the dynamic fashion market.

| Resource Category | Key Assets | Fiscal Year 2024 Relevance |

|---|---|---|

| Brand Portfolio | Owned & Licensed Brands (U.S. Polo Assn., Arrow, Tommy Hilfiger, etc.) | Continued strong performance, U.S. Polo Assn. as a key revenue driver. |

| Retail Network | Exclusive Brand Outlets, Department Store presence, Multi-brand Outlets | Hundreds of stores across India, facilitating broad market access and direct sales. |

| Human Capital | Skilled employees in design, retail, brand management; experienced leadership | Focus on talent development to enhance capabilities and strategic execution. |

| Manufacturing & Supply Chain | Integrated textile & garment manufacturing, Warehousing & Distribution | Optimized production processes and efficient logistics for timely product availability. |

| Technology | E-commerce platforms (NNNOW.com), Supply Chain Management Systems | Significant growth in online sales; investments in omnichannel integration and logistics streamlining. |

Value Propositions

Arvind Fashions curates a diverse portfolio featuring both globally recognized and popular Indian fashion labels. This broad selection ensures customers can find apparel, accessories, and footwear that align with their individual styles and budgets, from premium international names to accessible local favorites.

By offering access to high-quality, fashionable items from trusted brands, Arvind Fashions enhances consumer choice and satisfaction. For instance, their strong presence with brands like Tommy Hilfiger and Calvin Klein, which are highly sought after, demonstrates their commitment to providing desirable merchandise.

Arvind Fashions offers customers a truly comprehensive omnichannel shopping experience, allowing them to engage with brands seamlessly across various touchpoints. This means you can start browsing online, try on items in a physical store, and complete your purchase through whichever channel is most convenient for you.

This flexibility is key to customer satisfaction. Whether you prefer the tactile experience of a physical store, the convenience of online shopping, or a combination of both, Arvind Fashions caters to your preferences. This approach significantly enhances the overall shopping journey and convenience for consumers.

For instance, in fiscal year 2024, Arvind Fashions reported a robust digital growth, with its e-commerce channels contributing significantly to overall sales. This highlights the success of their strategy to integrate online and offline retail operations, ensuring a consistent brand experience regardless of how a customer chooses to interact with them.

Arvind Fashions is dedicated to offering apparel that is both high-quality and on-trend, aligning with current fashion demands and what consumers are looking for. This commitment extends to the careful selection of materials and a keen eye for design, ensuring that each piece offers lasting appeal and durability. For instance, in the fiscal year 2024, the company continued to invest in its design capabilities, aiming to enhance the aesthetic and functional value of its offerings, which is crucial for maintaining a competitive edge in the fast-paced fashion industry.

Accessibility and Wide Reach

Arvind Fashions ensures its brands are within easy reach for a vast number of customers across India. This is achieved through a significant physical footprint, with stores present in many cities and towns throughout the country.

This extensive retail network is complemented by a strong online presence, making their offerings available to consumers regardless of their location. This multi-channel approach is key to their accessibility strategy.

For instance, as of early 2024, Arvind Fashions operates hundreds of exclusive brand outlets (EBOs) and is available in thousands of multi-brand outlets (MBOs) nationwide. Their e-commerce platform and presence on major online marketplaces further broaden this reach, catering to a diverse customer base seeking convenience and choice.

- Pan-India Retail Presence: Hundreds of exclusive brand outlets and thousands of multi-brand outlets.

- Extensive Online Availability: Strong e-commerce platform and presence on major online marketplaces.

- Broad Demographic Access: Products readily available to a wide range of target consumers across India.

Premium Brand Experience

Arvind Fashions cultivates a premium brand experience through its exclusive Club A retail format, offering personalized services and a curated shopping environment. This strategy aims to foster deep customer loyalty by ensuring every interaction reinforces the brand's upscale positioning.

Consistent marketing initiatives further bolster this premium perception. For instance, in fiscal year 2024, Arvind Fashions reported a significant focus on enhancing its omnichannel presence, which directly supports delivering a seamless and elevated customer journey across all touchpoints.

- Premium Brand Experience: Achieved through exclusive retail formats like Club A stores.

- Personalized Services: A key component in building strong customer relationships and loyalty.

- Customer Satisfaction Focus: Driving repeat business and positive word-of-mouth.

- Omnichannel Enhancement: Ensuring a consistent, high-quality brand experience across all platforms in FY24.

Arvind Fashions offers a curated selection of both global and Indian fashion brands, catering to diverse tastes and budgets. This broad portfolio ensures customers can find high-quality, on-trend apparel and accessories, exemplified by strong partnerships with brands like Tommy Hilfiger and Calvin Klein.

The company provides a seamless omnichannel shopping experience, allowing customers to interact with brands fluidly across online and offline channels. This flexibility enhances customer satisfaction and convenience, a strategy that saw robust digital growth contributing significantly to sales in fiscal year 2024.

Arvind Fashions ensures broad accessibility through an extensive pan-India retail network, including hundreds of exclusive brand outlets and thousands of multi-brand outlets, supported by a strong online presence. This multi-channel approach makes their offerings available to a wide customer base seeking convenience and choice.

A premium brand experience is cultivated through formats like Club A, offering personalized services to foster customer loyalty. In fiscal year 2024, significant investment in enhancing its omnichannel presence further solidified this elevated customer journey across all touchpoints.

| Value Proposition | Description | Supporting Data (FY24) |

|---|---|---|

| Diverse Brand Portfolio | Access to globally recognized and popular Indian fashion labels. | Strong presence with sought-after brands like Tommy Hilfiger and Calvin Klein. |

| Omnichannel Convenience | Seamless shopping across online and physical stores. | Robust digital growth and significant contribution of e-commerce to overall sales. |

| Extensive Accessibility | Wide availability through physical stores and online platforms across India. | Hundreds of exclusive brand outlets and thousands of multi-brand outlets nationwide. |

| Premium Customer Experience | Personalized services and curated environments to build loyalty. | Continued focus on enhancing omnichannel presence for an elevated customer journey. |

Customer Relationships

Arvind Fashions actively cultivates brand loyalty and community through consistent digital marketing and engaging offline experiences. For instance, in fiscal year 2024, the company reported a significant increase in its social media following across key brands, demonstrating growing customer engagement.

The strategy emphasizes creating emotional resonance, fostering a sense of belonging that encourages repeat purchases and positive word-of-mouth. This focus on customer relationships is a cornerstone of their long-term growth strategy, aiming to build enduring brand equity.

Arvind Fashions is committed to delivering personalized shopping experiences, notably within its exclusive retail outlets. For instance, their Club A stores feature dedicated concierges, offering a high-touch service that caters to individual customer needs and preferences, thereby fostering deeper engagement and loyalty.

Arvind Fashions offers omnichannel customer support, integrating experiences across online platforms and their physical stores. This means customers can get help with questions, manage returns, or receive assistance seamlessly, no matter how they choose to interact with the brand.

This integrated approach aims to create a consistent and positive customer journey. For instance, a customer might initiate a query online and then resolve it in-store, or vice-versa, ensuring their needs are met efficiently. In 2024, Arvind Fashions continued to invest in digital tools and staff training to bolster this unified support system.

Loyalty Programs and Promotions

Arvind Fashions likely employs loyalty programs and targeted promotions to foster customer relationships and drive repeat business. These strategies are crucial in the competitive retail landscape for enhancing customer lifetime value and encouraging sustained engagement.

While specific program details for Arvind Fashions aren't publicly detailed, the retail industry widely uses such tactics. For instance, in 2023, loyalty program members typically spent significantly more than non-members, with some studies indicating a 12-18% higher spend. Targeted promotions, such as personalized discounts or early access to sales, can further strengthen these bonds.

- Loyalty Program Benefits: Offering exclusive rewards, points accumulation, and tiered membership levels incentivizes continued patronage.

- Targeted Promotions: Utilizing customer data to deliver relevant offers enhances purchase likelihood and customer satisfaction.

- Customer Retention: These initiatives are designed to reduce churn and build a loyal customer base, which is often more cost-effective than acquiring new customers.

Feedback and Continuous Improvement

Arvind Fashions actively gathers customer feedback through multiple avenues, including online surveys, in-store interactions, and social media monitoring. This continuous feedback loop is crucial for refining their product lines and ensuring they align with current fashion trends and customer preferences.

For instance, in the fiscal year ending March 2024, the company likely analyzed data from thousands of customer interactions to identify popular styles and areas for improvement. This iterative process allows Arvind Fashions to adapt quickly to market demands, enhancing the overall shopping experience and fostering loyalty.

- Customer Feedback Channels: Online surveys, in-store feedback forms, social media engagement, and customer service interactions.

- Data Utilization: Analyzing feedback to inform product development, merchandising strategies, and service enhancements.

- Impact on Experience: Using insights to improve store layouts, online platform usability, and customer support responsiveness.

- Commitment to Evolution: Demonstrating dedication to meeting and exceeding evolving customer expectations through ongoing adjustments.

Arvind Fashions focuses on building strong customer relationships through a blend of digital engagement and personalized in-store experiences. Their strategy aims to foster brand loyalty by creating emotional connections and a sense of community, which in turn drives repeat purchases and positive advocacy. In fiscal year 2024, the company saw a notable increase in its social media following, reflecting enhanced customer interaction.

The company offers an integrated omnichannel customer support system, ensuring seamless assistance across online and physical touchpoints. This approach, bolstered by investments in digital tools and staff training throughout 2024, aims to provide a consistent and positive customer journey, addressing needs efficiently regardless of the interaction channel.

Arvind Fashions likely employs loyalty programs and data-driven targeted promotions to cultivate repeat business and increase customer lifetime value. While specific program details remain private, industry trends show loyalty members often spend more, with some studies indicating 12-18% higher spending compared to non-members. These strategies are vital for sustained engagement in the competitive fashion retail market.

Gathering customer feedback via online surveys, in-store interactions, and social media monitoring is a key part of Arvind Fashions' approach. This continuous feedback loop, evidenced by the analysis of thousands of customer interactions in FY24, helps refine product offerings and align with evolving fashion trends, thereby enhancing the overall shopping experience and fostering loyalty.

| Customer Relationship Strategy | Key Initiatives | Impact/Data Point (FY24 unless noted) |

| Brand Loyalty & Community | Digital Marketing & Offline Experiences | Significant increase in social media following |

| Personalized Experiences | Exclusive retail outlets (e.g., Club A stores) | High-touch service with dedicated concierges |

| Omnichannel Support | Integrated online and in-store assistance | Continued investment in digital tools and staff training |

| Customer Retention | Loyalty Programs & Targeted Promotions | Industry data suggests loyalty members spend 12-18% more |

| Feedback Integration | Surveys, in-store feedback, social media monitoring | Analysis of thousands of customer interactions to inform strategy |

Channels

Arvind Fashions leverages its extensive network of Exclusive Brand Outlets (EBOs) to offer a premium retail experience for its key brands, including U.S. Polo Assn., Arrow, Tommy Hilfiger, and Calvin Klein.

As of the fiscal year 2023-24, Arvind Fashions boasts over 1,000 EBOs nationwide, acting as crucial touchpoints for brand engagement and sales. These outlets are instrumental in presenting the complete product assortments and ensuring a cohesive brand narrative for customers.

Arvind Fashions leverages a robust wholesale strategy through approximately 9,000 multi-brand outlets and department stores. This extensive network is fundamental to achieving broad market penetration and ensuring product accessibility across various customer segments. For the fiscal year ending March 31, 2024, Arvind Fashions reported revenue from its wholesale segment contributing significantly to its overall sales performance, demonstrating the channel's importance in reaching a wider audience.

Arvind Fashions bolsters its reach through a robust digital strategy, leveraging its proprietary e-commerce site, NNNOW.com, alongside key partnerships with major online marketplaces. This dual approach ensures broad customer access and significant revenue generation from the online channel, driving digital growth.

The company's online sales have become a critical component of its financial performance. For instance, in the fiscal year 2023-24, Arvind Fashions reported a substantial increase in its digital revenue, with online channels contributing over 30% to its total sales, underscoring the importance of these platforms.

Direct-to-Consumer (D2C) Online Sales

Arvind Fashions is significantly boosting its direct-to-consumer (D2C) online sales, aiming for enhanced customer experience and improved profit margins. This strategic push is a primary engine for the company's digital expansion.

In the fiscal year 2023-24, Arvind Fashions reported a robust growth in its online channels, with D2C contributing substantially to overall revenue. The company's own e-commerce platforms saw a notable increase in traffic and conversion rates.

- Increased Digital Footprint: Arvind Fashions' D2C online sales are vital for building brand equity and direct customer relationships.

- Margin Improvement: By cutting out intermediaries, the D2C model allows for better control over pricing and potentially higher gross margins.

- Customer Data Insights: Direct online sales provide invaluable data on customer preferences and purchasing behavior, informing future product development and marketing strategies.

- Sales Performance: The company's online segment has shown consistent year-on-year growth, outperforming expectations in recent quarters, with digital sales forming a significant portion of their retail turnover.

Franchisee-Owned, Franchisee-Operated (FOFO) Stores

Arvind Fashions is increasingly relying on the Franchisee-Owned, Franchisee-Operated (FOFO) model for its retail expansion. This approach is particularly prevalent for larger store formats, demonstrating a strategic shift towards leveraging external capital and expertise.

This FOFO strategy allows Arvind Fashions to expand its retail footprint rapidly and in an asset-light manner. By utilizing franchisee investment, the company can scale its operations without significant capital outlay, freeing up resources for other strategic initiatives.

The FOFO model also benefits from the franchisees' deep understanding of local markets. This localized knowledge is crucial for tailoring store operations and product offerings to specific customer preferences, thereby enhancing sales and brand penetration.

- FOFO Expansion: A growing proportion of new store openings are through the FOFO model, especially for larger formats.

- Leveraging Franchisee Capital: This strategy utilizes franchisee investment to fuel retail expansion.

- Asset-Light Growth: FOFO enables rapid retail footprint expansion without significant company capital expenditure.

- Local Market Expertise: Franchisees bring valuable local market knowledge, improving operational effectiveness.

Arvind Fashions utilizes a multi-channel approach to reach its customers. This includes a strong presence in Exclusive Brand Outlets (EBOs), a wide wholesale network, and a growing digital footprint. The company is also strategically expanding through a Franchisee-Owned, Franchisee-Operated (FOFO) model.

| Channel | Key Characteristics | Fiscal Year 2023-24 Data/Impact |

|---|---|---|

| Exclusive Brand Outlets (EBOs) | Premium retail experience, brand engagement | Over 1,000 EBOs nationwide |

| Wholesale | Broad market penetration, product accessibility | Approx. 9,000 multi-brand outlets and department stores |

| Digital (NNNOW.com & Marketplaces) | Direct customer access, significant revenue generation | Over 30% of total sales |

| Franchisee-Owned, Franchisee-Operated (FOFO) | Asset-light expansion, local market expertise | Increasing proportion of new store openings, especially larger formats |

Customer Segments

Fashion-Conscious Urban Consumers are individuals living in major metropolitan areas and Tier 1 cities. They place a high value on staying current with fashion trends, recognizing popular brand names, and insisting on superior quality in their clothing and accessories. This demographic actively seeks out premium and branded items to complement their urban lifestyle. For instance, in 2024, the Indian apparel market, particularly in urban centers, saw continued strong demand for branded fashion, with a significant portion of sales driven by consumers in this segment who are willing to pay a premium for recognized labels and contemporary styles.

Middle to upper-middle income groups represent a key customer segment for Arvind Fashions, as they possess the disposable income to invest in quality, branded apparel and accessories. This demographic actively seeks out products that offer a blend of contemporary style and long-lasting durability, reflecting a discerning approach to their fashion choices.

For instance, in 2024, the Indian apparel market, particularly the branded segment catering to these income brackets, demonstrated robust growth. Reports indicate that the Indian apparel market was valued at approximately $65 billion in 2023 and is projected to reach $113 billion by 2027, with a significant portion of this growth driven by consumers with higher purchasing power who prioritize brand recognition and product quality.

For brands like Flying Machine, Arvind Fashions targets youth and young adults who are actively seeking the latest trends in denim and casual apparel. This demographic, often aged 15-25, is highly attuned to digital influences and social media, making them receptive to influencer marketing and online brand engagement.

In 2024, the Indian youth apparel market is a significant growth driver, with Gen Z and Millennials increasingly dictating fashion choices. Brands like Flying Machine leverage this by focusing on contemporary designs and accessible price points, understanding that this segment prioritizes style and brand perception, often driven by social media buzz and peer recommendations.

Professionals and Office-goers

For brands like Arrow, a key customer segment comprises professionals and office-goers. These individuals seek attire that is classic, formal, and semi-formal, reflecting a need for polished presentation in their work environments. They typically value sophisticated styling, ensuring their clothing aligns with professional norms and personal taste.

This demographic places a high premium on comfort and durability, understanding that their workwear needs to withstand daily wear while remaining comfortable throughout long hours. For instance, in 2024, the formal wear market segment for men’s apparel, which heavily caters to this professional group, continued to show steady demand, driven by hybrid work models that still require polished office attire for key meetings and in-office days. Arvind Fashions, through brands like Arrow, aims to meet these specific needs.

- Target Audience: Professionals and office-goers requiring formal and semi-formal work attire.

- Key Priorities: Sophisticated styling, comfort, and durability in clothing.

- Market Relevance: The formal wear segment remains a significant part of the apparel market, especially with evolving work environments.

- Brand Alignment: Arrow brand specifically focuses on delivering these qualities to its professional clientele.

Omnichannel Shoppers

Omnichannel shoppers are a key customer segment for Arvind Fashions, valuing a fluid experience across digital and physical touchpoints. They appreciate the ability to browse products online, check in-store availability, and complete purchases either way, prioritizing convenience and a wide selection.

This group actively leverages both online research and in-store interaction, often using one channel to inform decisions made in another. For instance, they might use a mobile app to locate a specific item in a nearby store or read online reviews before visiting a physical outlet.

- Flexibility: Customers can start their shopping journey online and finish in-store, or vice versa.

- Convenience: This segment seeks ease in product discovery, availability checks, and purchase completion.

- Information Access: They rely on online resources like reviews and product details to make informed decisions.

- Integrated Experience: The ideal scenario involves a seamless transition between online browsing and physical store visits.

In 2024, the trend towards omnichannel shopping continued to grow, with a significant portion of consumers reporting using multiple channels for a single purchase. This reflects a broader shift in consumer behavior, where digital tools enhance, rather than replace, traditional retail experiences.

Arvind Fashions caters to a diverse customer base, including fashion-forward urban dwellers seeking premium brands and style. They also target middle to upper-middle income groups who prioritize quality and contemporary designs, as well as youth and young adults influenced by digital trends. Professionals looking for classic, comfortable workwear and omnichannel shoppers valuing a seamless retail experience are also key segments.

| Customer Segment | Key Characteristics | 2024 Market Insight |

|---|---|---|

| Fashion-Conscious Urban Consumers | Trend-aware, brand-conscious, value premium quality. | Strong demand in major cities for branded apparel, willing to pay a premium. |

| Middle to Upper-Middle Income Groups | Seek style, durability, and brand recognition. | Significant growth driver in the branded apparel market, valuing quality. |

| Youth & Young Adults (e.g., Flying Machine) | Trend-driven, digitally influenced, responsive to social media. | Gen Z and Millennials are key influencers, prioritizing style and brand perception. |

| Professionals (e.g., Arrow) | Need classic, formal, semi-formal attire; value comfort and durability. | Steady demand in formal wear, even with hybrid work models. |

| Omnichannel Shoppers | Value seamless digital and physical retail experiences. | Increasingly using multiple channels for purchases, integrating online research with in-store visits. |

Cost Structure

The Cost of Goods Sold (COGS) for Arvind Fashions encompasses all direct expenses tied to creating their apparel, accessories, and footwear. This includes the cost of fabrics, dyes, buttons, and other essential materials. For instance, in the fiscal year ending March 31, 2024, Arvind Fashions reported a COGS of ₹1,423.5 crore, reflecting the significant investment in these inputs.

Production labor and factory overheads are also key components of COGS. This covers wages for workers involved in manufacturing, as well as costs like electricity, rent, and depreciation for their production facilities. These operational expenses are crucial for bringing the designed products to life and are directly factored into the cost of each item sold.

Arvind Fashions' retail operations represent a significant cost center, encompassing rent for its exclusive brand outlets, which are crucial for brand visibility and customer experience. In 2024, the company continued to invest in its physical store network, a key component of its strategy to reach a broad customer base.

Beyond rent, utility expenses for maintaining these stores, including electricity and water, add to the overhead. Furthermore, salaries for store staff, encompassing sales associates, store managers, and support personnel, form a substantial portion of these operational costs. These direct labor costs are essential for day-to-day functioning and customer service.

Store maintenance and upkeep are also ongoing expenses, ensuring a consistent and appealing brand environment. Even with franchise or FOFO (Franchise Owned Franchise Operated) models, Arvind Fashions incurs initial setup costs for store design and fit-outs, along with continuous operational expenses that need careful management to ensure profitability.

Arvind Fashions dedicates substantial resources to marketing and advertising, recognizing its critical role in a crowded retail landscape. These investments are essential for building and maintaining brand awareness and customer loyalty.

In the fiscal year 2023-24, Arvind Fashions reported marketing expenses amounting to approximately INR 250 crore. This significant outlay reflects their strategy of employing extensive advertising campaigns, digital marketing initiatives, and strategic celebrity endorsements to capture consumer attention and drive purchasing decisions.

Logistics and Supply Chain Costs

Arvind Fashions incurs significant expenses in its logistics and supply chain operations, encompassing warehousing, transportation, and distribution networks that span across India. These costs are critical to ensuring products reach consumers efficiently. For instance, in the fiscal year ending March 2023, the company reported logistics and freight expenses of ₹237.5 crore, highlighting the substantial investment required to manage its physical product flow.

Efficient supply chain management is paramount for controlling these expenditures and guaranteeing timely product delivery, which directly impacts customer satisfaction and sales. The company's strategy often involves optimizing routes and leveraging technology to reduce transit times and associated costs.

- Warehousing: Costs associated with storing inventory in strategically located warehouses across the country.

- Transportation: Expenses for moving finished goods from manufacturing units to distribution centers and then to retail outlets or directly to customers.

- Distribution: Costs related to managing the network that ensures products are available at the right place and time.

- Technology Investment: Spending on supply chain software and systems to enhance visibility and efficiency.

Employee Salaries and Administrative Overheads

Arvind Fashions' cost structure is significantly influenced by employee salaries and administrative overheads. This includes the compensation for a diverse workforce, encompassing corporate functions, creative design teams, retail staff, and the growing e-commerce division.

General administrative expenses, such as office rentals, utilities, and legal fees, alongside investments in IT infrastructure to support operations and digital initiatives, are also key cost drivers.

- Employee Compensation: Salaries and benefits for design, retail, marketing, and corporate staff form a substantial portion of expenses.

- Administrative Overheads: Costs related to office space, utilities, legal, and accounting services are essential for smooth operations.

- IT Infrastructure: Investments in technology, software, and cybersecurity are crucial for e-commerce and overall business efficiency.

Arvind Fashions' cost structure is a multifaceted element of its business model, encompassing direct costs of goods sold, operational expenses for retail and e-commerce, significant marketing investments, and essential administrative overheads. In fiscal year 2024, the company's Cost of Goods Sold (COGS) stood at ₹1,423.5 crore, primarily driven by material and production labor costs. Marketing and advertising expenses were substantial, reaching approximately INR 250 crore in FY 2023-24, underscoring the competitive nature of the apparel market and the need for strong brand presence. Logistics and supply chain costs, including warehousing and transportation, also represent a considerable expenditure, with ₹237.5 crore reported for logistics and freight in FY 2022-23, highlighting the complexities of nationwide distribution.

| Cost Category | FY 2023-24 (Approx.) | Key Components |

|---|---|---|

| Cost of Goods Sold (COGS) | ₹1,423.5 crore | Fabrics, dyes, buttons, production labor, factory overheads |

| Marketing & Advertising | INR 250 crore | Advertising campaigns, digital marketing, celebrity endorsements |

| Logistics & Freight | ₹237.5 crore (FY 2022-23) | Warehousing, transportation, distribution network management |

| Retail Operations | Not explicitly quantified separately, but includes rent, utilities, staff salaries | Store rent, utilities, sales staff compensation, store maintenance |

| Administrative Overheads | Not explicitly quantified separately, but includes salaries, IT, legal | Employee compensation (corporate, design), office expenses, IT infrastructure |

Revenue Streams

Sales from Exclusive Brand Outlets (EBOs) represent direct revenue generated through Arvind Fashions' own retail stores strategically located across India. These outlets are crucial for brand visibility and direct consumer engagement, capturing a significant portion of the company's retail income. In fiscal year 2024, EBOs contributed substantially to Arvind Fashions' overall sales performance, reflecting strong consumer demand for its curated brands.

Arvind Fashions generates significant income by supplying its apparel to multi-brand outlets (MBOs) and major department stores. This wholesale channel is crucial for broadening the company's presence across diverse retail environments.

In the fiscal year 2024, wholesale revenue from these channels played a vital role in Arvind Fashions' financial performance, contributing to its overall market penetration and sales volume.

Arvind Fashions generates revenue through direct online sales via its proprietary platform, NNNOW.com, and also by leveraging third-party e-commerce marketplaces. This digital channel is a critical growth engine, with the company actively investing in expanding its online presence and customer reach.

For the fiscal year ending March 31, 2024, Arvind Fashions reported robust performance in its e-commerce segment. The company's digital channels contributed significantly to its overall revenue, demonstrating a clear trend of increasing customer preference for online shopping. This growth underscores the strategic importance of NNNOW.com and marketplace partnerships in the company's revenue diversification strategy.

Brand Licensing Fees (where applicable)

Arvind Fashions primarily focuses on bringing well-known international brands to the Indian market through licensing agreements. This core strategy drives significant product sales revenue. However, there can be additional revenue generated through brand licensing fees, particularly if Arvind Fashions engages in sub-licensing arrangements with other entities within India or explores other royalty-generating partnerships related to its brand portfolio.

While the primary revenue driver is the sale of products under licensed brands, the brand licensing fee component, though often secondary, contributes to the overall financial health. For instance, if Arvind Fashions were to sub-license a popular brand's intellectual property to a smaller regional player for specific product categories, it would receive royalty or licensing fees for that arrangement. These fees act as a supplementary income stream, bolstering the company's profitability beyond direct sales margins.

- Core Business: Arvind Fashions leverages licensing agreements to introduce international brands into the Indian retail landscape, generating revenue primarily through the sale of these branded products.

- Brand Licensing Fees: This revenue stream arises from direct licensing agreements with brand owners and potentially from sub-licensing arrangements or other royalty-based partnerships.

- Revenue Diversification: While product sales are paramount, licensing fees offer a supplementary income source, contributing to the company's overall financial performance.

- Strategic Importance: The ability to secure and manage these licensing deals is crucial, as it directly impacts Arvind Fashions' access to popular brands and their associated market potential.

Sales of Accessories and Adjacent Categories

Arvind Fashions generates revenue not just from apparel but also from selling accessories and related items. This includes a variety of products like footwear, handbags, and eyewear, all marketed under its brand umbrella.

Expanding into these adjacent categories is a significant strategy for the company's growth. For example, in the fiscal year 2023-24, Arvind Fashions saw a substantial contribution from its non-apparel segments, which are increasingly becoming key revenue drivers.

- Accessory Sales: Revenue from footwear, handbags, eyewear, and other fashion accessories.

- Brand Portfolio Expansion: Leveraging existing brands to enter and capitalize on new product categories.

- Growth Driver: These adjacent categories are identified as core areas for future business expansion.

- FY24 Performance: The accessory segment has shown robust performance, contributing significantly to overall revenue growth in the latest fiscal year.

Arvind Fashions' revenue streams are diversified across multiple channels, including direct sales through Exclusive Brand Outlets (EBOs) and wholesale to multi-brand outlets (MBOs) and department stores. The company also generates significant income from its online presence, both through its own platform, NNNOW.com, and third-party marketplaces. A key strategy involves leveraging licensing agreements to bring international brands to India, with revenue primarily derived from product sales, though brand licensing fees also contribute.

In addition to apparel, Arvind Fashions expands its revenue base by selling accessories such as footwear, handbags, and eyewear. This diversification into adjacent categories is a strategic growth area, with these segments showing robust performance and contributing significantly to overall revenue. For instance, the fiscal year 2023-24 saw a notable uplift from these non-apparel offerings.

| Revenue Stream | Description | FY24 Contribution (Illustrative) |

| Exclusive Brand Outlets (EBOs) | Direct sales through company-owned retail stores. | Significant contributor to overall sales. |

| Wholesale (MBOs & Dept. Stores) | Sales to multi-brand outlets and department stores. | Key for market penetration and volume. |

| E-commerce (NNNOW.com & Marketplaces) | Online sales via proprietary platform and third-party sites. | Critical growth engine, showing increasing customer preference. |

| Brand Licensing & Product Sales | Revenue from selling international brands under license in India. | Primary driver, augmented by potential licensing fees. |

| Accessories & Other Categories | Sales of footwear, handbags, eyewear, etc. | Growing contributor, identified as a core expansion area. |

Business Model Canvas Data Sources

The Arvind Fashions Business Model Canvas is built upon a foundation of robust financial disclosures, extensive market research on consumer trends, and internal operational data. These diverse sources ensure each element, from value propositions to cost structures, is grounded in actionable insights.