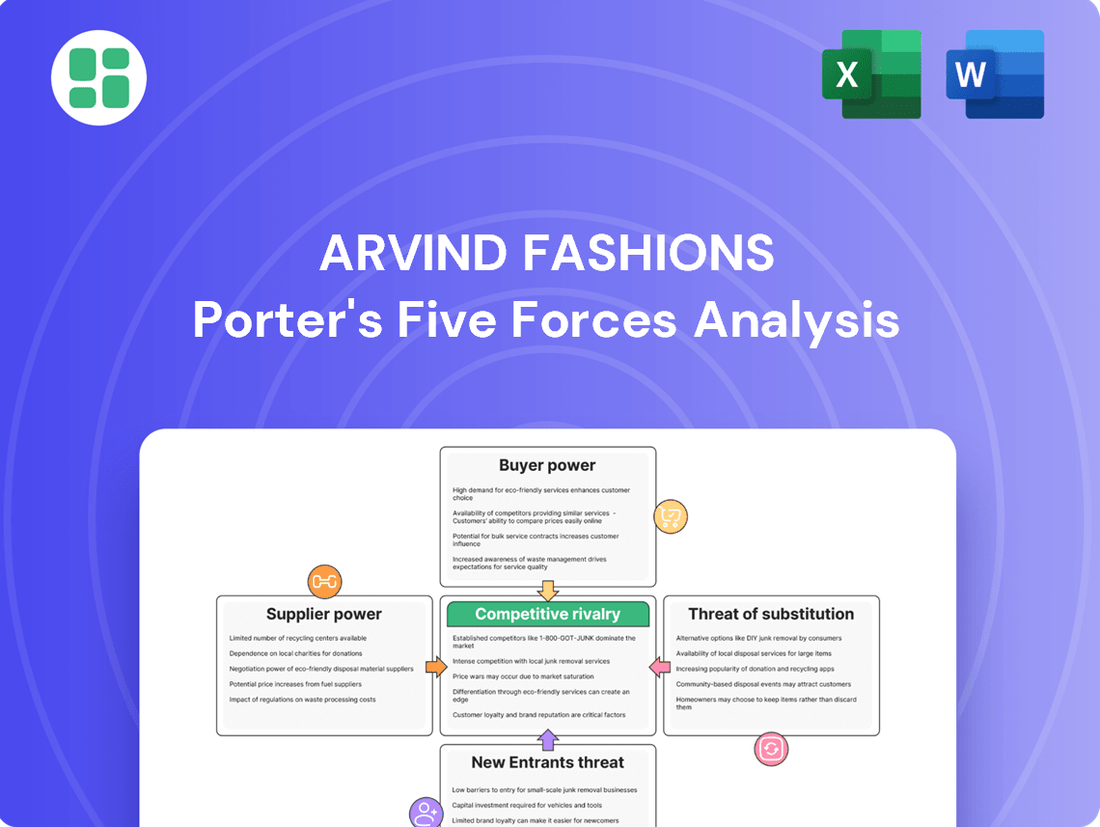

Arvind Fashions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arvind Fashions Bundle

Arvind Fashions faces intense competition from established brands and emerging players, while buyer power is significant due to readily available alternatives. The threat of new entrants is moderate, but the bargaining power of suppliers, particularly for raw materials, can impact margins.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Arvind Fashions’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Arvind Fashions' reliance on licensing popular international brands, such as Tommy Hilfiger and Calvin Klein, significantly amplifies the bargaining power of these licensors. The exclusivity and strong consumer demand for these brands mean Arvind Fashions has limited options if it needs to renegotiate terms or seek alternative brand partnerships, making such transitions costly and complex.

This dependence directly influences Arvind Fashions' profitability through royalty payments and can also shape its strategic direction, as licensor agreements often dictate certain operational and marketing strategies. For instance, in the fiscal year 2023, Arvind Fashions reported significant revenue from its licensed brands, underscoring the critical nature of these relationships.

India's expansive textile sector, a significant global player, offers Arvind Fashions a broad spectrum of raw material suppliers, including fabric mills, dye manufacturers, and accessory providers. This abundance of choices for standard inputs typically dilutes the bargaining power of any single supplier, allowing Arvind Fashions to negotiate favorable terms due to readily available alternatives. For instance, in 2023, India's textile exports reached an estimated USD 44 billion, underscoring the competitive landscape among suppliers.

However, the bargaining power can shift when Arvind Fashions requires specialized or niche materials, such as high-performance technical fabrics or certified sustainable textiles. Sourcing these unique inputs often involves a more limited pool of specialized manufacturers. This concentration can empower these select suppliers, enabling them to command higher prices or stricter terms, as seen with the increasing demand for organic cotton, where a smaller group of certified suppliers holds greater leverage.

The availability and cost of labor in India significantly impact Arvind Fashions' operational costs. In 2024, India's manufacturing sector, a key area for apparel production, faced varying wage pressures. For instance, reports indicated that while overall wage growth in manufacturing was around 5-6% annually, specific skilled roles in design and advanced manufacturing could command higher increases, potentially impacting Arvind's sourcing costs.

Shortages of specialized talent, particularly in areas like technical textile design or advanced garment manufacturing processes, can empower labor as a supplier. This scarcity can drive up wages and make it harder to secure consistent, high-quality production. Effective labor relations are crucial for Arvind to mitigate these risks and ensure a stable workforce for its design, manufacturing, and retail functions.

Technology and Equipment Providers

Technology and equipment providers, particularly those offering specialized retail technology like advanced POS systems or sophisticated e-commerce platforms, can exert significant bargaining power. The high initial investment and the specialized nature of these solutions mean Arvind Fashions relies on a limited pool of capable suppliers. For instance, in 2024, the global retail technology market was valued at over $50 billion, with a substantial portion dedicated to in-store and online infrastructure, indicating the critical role these suppliers play.

Arvind Fashions' commitment to maintaining an efficient and modern operational infrastructure, essential for competing in the fast-paced apparel industry, further strengthens the suppliers' position. This reliance on cutting-edge technology means suppliers can often dictate pricing and terms, as the cost of switching to a less advanced or less capable system could be detrimental to sales and customer experience.

- High Investment Costs: Specialized retail technology often requires significant capital outlay, giving suppliers leverage.

- Specialized Nature: The unique functionalities of advanced equipment limit the number of viable alternatives for Arvind Fashions.

- Industry Dependence: The apparel sector's need for seamless omnichannel experiences amplifies the importance of reliable tech suppliers.

Logistics and Supply Chain Service Providers

The bargaining power of logistics and supply chain service providers is a significant consideration for Arvind Fashions, given its extensive retail network and e-commerce operations. Companies offering specialized warehousing, efficient transportation, and reliable last-mile delivery can wield considerable influence. This is particularly true when they provide integrated solutions that are critical for meeting delivery timelines and managing overall supply chain expenses.

For instance, in 2024, the global third-party logistics (3PL) market was valued at approximately $1.2 trillion, indicating a substantial and competitive landscape. However, providers with advanced technological capabilities, such as real-time tracking and optimized route planning, can command higher rates. Arvind Fashions' reliance on these services means that disruptions or significant price increases from key logistics partners could directly impact its operational efficiency and profitability.

- Specialized Services: Providers offering niche logistics solutions, like cold chain or hazardous materials transport, often have higher bargaining power due to limited alternatives.

- Market Concentration: If a few dominant players control a significant portion of the logistics market in key operational regions for Arvind Fashions, their collective bargaining power increases.

- Contractual Terms: The terms and duration of contracts with logistics providers can either mitigate or amplify their bargaining power, influencing flexibility and cost for Arvind Fashions.

The bargaining power of Arvind Fashions' suppliers is a mixed bag. While the vast Indian textile market offers many choices for standard fabrics, specialized materials and critical technology providers can hold significant sway. Labor costs, particularly for skilled roles, also present a factor influencing supplier leverage.

For instance, the Indian textile industry's robust export performance in 2023, reaching an estimated USD 44 billion, highlights the competitive nature of raw material suppliers. However, the increasing demand for sustainable options like organic cotton has concentrated power among a smaller group of certified manufacturers.

In the technology realm, the global retail technology market, valued at over $50 billion in 2024, demonstrates the essential role of specialized providers. Arvind Fashions' reliance on advanced systems for omnichannel experiences means these tech suppliers can often dictate terms due to the high switching costs and limited alternatives.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Arvind Fashions | Example Data/Trend (2023-2024) |

|---|---|---|---|

| Brand Licensors | Exclusivity, Brand Demand, Switching Costs | High; Dictates royalty terms and strategic direction | Significant revenue contribution from licensed brands (FY23) |

| Raw Material Suppliers (Standard) | Abundance of choices, Market Competition | Low; Allows for favorable price negotiations | India's textile exports: ~$44 billion (2023) |

| Raw Material Suppliers (Specialized) | Limited pool of manufacturers, Niche demand | Moderate to High; Can command higher prices for unique inputs | Increased demand for certified organic cotton |

| Labor | Availability of skilled vs. unskilled labor, Wage pressures | Variable; Skilled labor shortages can increase costs | Manufacturing wage growth ~5-6% annually (2024), higher for skilled roles |

| Technology Providers | High initial investment, Specialized nature, Switching costs | High; Can influence pricing and terms for essential systems | Global retail tech market >$50 billion (2024) |

| Logistics Providers | Service specialization, Market concentration, Contract terms | Moderate to High; Critical for operational efficiency and costs | Global 3PL market ~$1.2 trillion (2024); specialized providers command higher rates |

What is included in the product

This analysis dissects the competitive forces impacting Arvind Fashions, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the apparel industry.

Instantly identify competitive threats and opportunities within Arvind Fashions' market, providing actionable insights to mitigate risks and capitalize on growth.

Customers Bargaining Power

Arvind Fashions boasts a robust portfolio featuring globally recognized brands like U.S. Polo Assn., Arrow, Tommy Hilfiger, and Calvin Klein. This strong brand presence fosters significant customer loyalty.

This cultivated loyalty directly diminishes the bargaining power of customers. When consumers are deeply attached to a brand, their inclination to switch to competitors for better pricing or terms is considerably reduced.

The company's strategic emphasis on premiumization further solidifies this customer loyalty. For instance, Arvind Fashions reported a revenue of ₹1,095 crore for the fiscal year ending March 31, 2024, indicating strong market reception and customer engagement with its premium offerings.

Customers in the Indian apparel market, including those who shop with Arvind Fashions, exhibit considerable price sensitivity, especially in more crowded market segments. This sensitivity means that if prices are perceived as too high, customers have the leverage to look elsewhere.

The sheer volume of choices available significantly amplifies customer bargaining power. With a vast array of domestic and international brands competing for attention, alongside a robust unorganized retail sector, consumers can easily switch if Arvind Fashions' pricing isn't competitive. For instance, the Indian apparel market is projected to grow to $60 billion by 2025, indicating intense competition where price plays a crucial role.

Arvind Fashions' omnichannel strategy, encompassing exclusive brand outlets, department stores, multi-brand outlets, and a robust e-commerce platform, significantly influences customer bargaining power. This integrated approach grants customers unparalleled access to information.

The digital realm, particularly e-commerce, amplifies customer leverage by offering extensive price transparency and facilitating easy product comparisons. In 2024, the fashion e-commerce market in India continued its strong growth trajectory, with online sales contributing a substantial portion of overall apparel revenue, further empowering consumers with choices and the ability to negotiate value.

Impact of Discounts and Promotions

Consumer expectations for discounts and promotional offers, particularly during peak shopping periods like festive seasons and major sales events, significantly amplify customer bargaining power. This persistent demand for value means customers can often dictate terms by choosing to wait for price reductions, thereby pressuring retailers. Arvind Fashions has strategically aimed to curb its reliance on heavy discounting, striving instead to boost full-price sales. This initiative directly addresses the intense customer pressure for perceived value and is crucial for margin improvement.

The impact of discounts and promotions on Arvind Fashions' bargaining power with its customers is evident. For instance, during the fiscal year 2023-24, the company reported a focus on improving its gross margins, partly by optimizing its promotional strategies. While specific figures on the reduction in discount depth aren't publicly detailed for 2024, the stated intent to increase full-price sell-throughs suggests a conscious effort to shift the balance of power back towards the retailer by offering compelling merchandise at its intended price points.

- Consumer demand for discounts remains high, especially during key sales periods.

- Arvind Fashions is actively working to reduce its reliance on promotional pricing.

- The goal is to increase the proportion of sales made at full price to enhance profitability.

- This strategy directly counters the strong bargaining power exerted by price-sensitive customers.

Customer Segmentation and Personalization

Arvind Fashions actively works to reduce customer bargaining power by focusing on customer segmentation and personalization. With a substantial loyalty base exceeding 10 million customers enrolled in various programs, the company is positioned to leverage this data for hyper-personalization.

By deeply understanding individual customer preferences and delivering tailored experiences, Arvind Fashions can foster stronger brand loyalty and encourage repeat business. This strategy aims to make customers less price-sensitive and more invested in the brand, thereby diminishing their ability to exert significant downward pressure on prices.

- Loyalty Base: Over 10 million customers across multiple loyalty programs.

- Strategy: Hyper-personalization through understanding customer preferences.

- Impact: Mitigates customer bargaining power by building stronger relationships.

- Goal: Encourage repeat purchases and reduce price sensitivity.

The bargaining power of customers for Arvind Fashions is influenced by price sensitivity and the availability of numerous alternatives in the Indian apparel market. While the company's strong brand portfolio and loyalty programs aim to mitigate this, the digital landscape and consumer expectations for discounts continue to empower buyers. Arvind Fashions' strategy to increase full-price sales and leverage personalization for its over 10 million loyalty members directly addresses this challenge.

| Factor | Arvind Fashions' Position | Impact on Bargaining Power |

| Brand Loyalty | Strong, with brands like U.S. Polo Assn., Arrow, Tommy Hilfiger, Calvin Klein | Decreases bargaining power |

| Price Sensitivity & Competition | High in crowded segments; vast choices available | Increases bargaining power |

| Omnichannel Presence & E-commerce | Extensive, offering information and price transparency | Increases bargaining power |

| Discount Expectations | High, especially during sales periods | Increases bargaining power |

| Loyalty Programs & Personalization | Over 10 million customers, focus on hyper-personalization | Decreases bargaining power |

Preview Before You Purchase

Arvind Fashions Porter's Five Forces Analysis

This preview shows the exact Arvind Fashions Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape impacting Arvind Fashions, including insights into buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

The Indian apparel retail landscape is incredibly crowded, featuring numerous domestic and international brands. Major conglomerates such as Tata, Reliance, and Aditya Birla also maintain a strong presence, intensifying rivalry for Arvind Fashions.

This fragmentation means Arvind Fashions must contend with fierce competition across a wide array of market segments and price tiers. For instance, in 2024, the Indian apparel market was valued at approximately $65 billion, with numerous players vying for market share.

Arvind Fashions distinguishes itself by offering a robust collection of owned and licensed premium brands, such as Tommy Hilfiger and Calvin Klein. This strategy aims to capture market share in a competitive landscape where product similarity is common. In fiscal year 2024, the company reported a revenue of ₹1,260 crore, underscoring the market's reception to its differentiated brand offerings.

The Indian apparel market is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) of around 10-12% over the next few years, reaching an estimated USD 110-120 billion by 2025. This expansion is fueled by increasing disposable incomes and a shift towards branded and premium wear among consumers.

While this market growth generally tempers intense rivalry by offering ample room for all participants, Arvind Fashions' strategic moves, such as its ambitious plan to open numerous new large-format stores across India, signal a proactive and aggressive approach. This strategy aims to secure a substantial share of the expanding market, potentially intensifying competition for rivals who may not match this pace of expansion.

High Fixed Costs and Exit Barriers

Arvind Fashions, like many in the apparel retail sector, faces significant competitive rivalry fueled by high fixed costs. These costs are tied to everything from manufacturing and maintaining large inventories to the extensive retail store networks required to reach consumers. For instance, establishing and operating a nationwide chain of stores involves considerable investment in leases, staff, and store upkeep.

These substantial fixed costs act as significant exit barriers. Companies find it difficult to simply shut down operations when facing periods of low profitability because they are still obligated to cover these ongoing expenses. This dynamic forces players to remain in the market, often leading to intensified competition as businesses fight for market share to cover their costs, even if margins are thin.

Consider the implications for a company like Arvind Fashions. In 2024, the apparel industry continues to see brands investing heavily in physical retail presence and supply chain infrastructure. This ongoing investment means that once these assets are in place, the cost of exiting the business can be prohibitively high, thereby perpetuating a highly competitive environment where firms must continuously strive for sales volume.

- High Fixed Costs: Apparel retail demands significant capital for manufacturing, inventory management, and extensive retail networks.

- Exit Barriers: Substantial fixed costs make it economically challenging for companies to leave the market, even during downturns.

- Sustained Rivalry: The inability to easily exit forces companies to compete intensely to cover their ongoing expenses and maintain market presence.

- Impact on Profitability: High fixed costs can squeeze profit margins, as companies must achieve high sales volumes to break even.

Online vs. Offline Channel Competition

Competition is intense in both the physical retail and online shopping spaces. Arvind Fashions is actively pursuing an omnichannel approach, with a significant emphasis on expanding its digital presence.

The increasing prevalence of online marketplaces and direct-to-consumer (D2C) brands heightens this rivalry, as they provide alternative channels for businesses to connect with customers.

- Omnichannel Strategy: Arvind Fashions aims to integrate its online and offline experiences, offering a seamless customer journey.

- Digital Focus: The company has identified digital growth as a critical pillar for future expansion.

- D2C Impact: The rise of D2C models allows new and existing players to bypass traditional retail structures, increasing competitive pressure.

- Market Dynamics: In 2024, the Indian apparel market saw continued growth in online sales, with e-commerce contributing a substantial portion to overall revenue for many fashion brands.

The competitive rivalry within the Indian apparel market is extremely high, characterized by a multitude of domestic and international brands, alongside major conglomerates like Reliance and Tata. This crowded environment means Arvind Fashions must constantly innovate and differentiate to capture market share.

The market's growth, projected to reach USD 110-120 billion by 2025 with a CAGR of 10-12%, offers opportunities but also intensifies the fight for consumers. Arvind Fashions' strategy of focusing on premium, licensed brands like Tommy Hilfiger and Calvin Klein is a direct response to this intense competition, aiming to secure a strong position within the expanding market.

High fixed costs associated with manufacturing, inventory, and extensive retail networks create significant exit barriers, compelling companies to remain in the market and compete fiercely to cover their operational expenses. This dynamic, evident in 2024 with continued investment in physical retail, ensures sustained rivalry as brands strive for sales volume to maintain profitability.

| Metric | Arvind Fashions (FY24) | Indian Apparel Market (2024 Est.) | Projected Growth (Next Few Years) |

| Revenue | ₹1,260 crore | Approx. $65 billion | 10-12% CAGR |

| Key Strategy | Premium Brands (Tommy Hilfiger, Calvin Klein) | Omnichannel Presence, D2C Growth | Expansion in Branded/Premium Wear |

| Competitive Factor | Brand Differentiation | Market Fragmentation, Online Sales Growth | Intensified by Market Expansion |

SSubstitutes Threaten

The threat of substitutes for Arvind Fashions, particularly from unbranded and local apparel alternatives in India, remains a significant consideration. Consumers have a wide array of choices in the Indian market, with many unbranded or locally produced garments offering substantially lower price points.

These cost-effective alternatives directly appeal to price-sensitive segments of the population or those who do not place a premium on established brand names. For instance, the unorganized sector in India's apparel market is substantial, with many small-scale manufacturers and local tailors providing competitive pricing that can undercut branded offerings.

The rise of second-hand and rental fashion markets poses a significant threat to Arvind Fashions. Driven by growing consumer interest in sustainability and affordability, platforms like ThredUp and Rent the Runway are gaining traction. For instance, the global second-hand apparel market was valued at approximately $125 billion in 2023 and is projected to reach $350 billion by 2027, indicating a substantial shift in consumer behavior.

These alternative consumption models allow customers to access a wider variety of styles and brands at a lower cost, directly competing with the purchase of new garments. This can erode demand for Arvind Fashions' new collections, particularly among younger demographics who are more open to pre-owned or rented clothing. The increasing accessibility and social acceptance of these options mean consumers can satisfy their fashion needs without a direct purchase from traditional retailers.

Arvind Fashions' apparel offerings face a significant threat from other consumer spending priorities. Consumers allocate their discretionary income across a wide array of goods and services, meaning that spending on clothing directly competes with purchases in sectors like electronics, travel, and entertainment. For instance, in 2024, global consumer spending on experiences was projected to rise, potentially diverting funds that might otherwise go towards apparel.

Custom-Made and Tailored Clothing

For a segment of consumers, custom-made or tailored clothing provides a unique fit and distinct style that mass-produced branded apparel often cannot match. This enduring alternative, particularly for formal occasions or specific cultural garments, can serve as a substitute for the ready-to-wear selections provided by Arvind Fashions.

The demand for bespoke apparel remains significant, especially in niche markets. For instance, the Indian ethnic wear market, where Arvind Fashions operates, saw significant growth, with custom tailoring playing a crucial role in meeting individual preferences. In 2023, the global custom clothing market was valued at approximately $45 billion, indicating a substantial consumer base willing to opt for personalized garments over off-the-rack options.

- Personalized Fit: Tailored clothing offers a superior fit compared to standard sizing, catering to diverse body types and individual preferences.

- Unique Style: Consumers can select fabrics, designs, and embellishments, creating a one-of-a-kind garment.

- Niche Market Demand: This segment is particularly strong for formal wear, special occasion attire, and traditional cultural clothing where exactness in fit and design is paramount.

- Perceived Value: Customization often carries a higher perceived value, justifying potentially higher price points for consumers seeking exclusivity.

Shift in Fashion Trends (e.g., Athleisure, Casual Wear)

The threat of substitutes for Arvind Fashions is amplified by the rapidly evolving fashion landscape. Shifts towards athleisure and casual wear, for instance, can significantly alter consumer preferences, potentially diverting demand away from traditional apparel. In 2024, the global athleisure market was projected to reach approximately $324 billion, highlighting a substantial consumer appetite for comfort-driven apparel that can substitute for more formal wear.

Arvind Fashions' strategic expansion into categories like women's wear and footwear aims to mitigate this threat. However, a dramatic and unforeseen shift in consumer behavior, such as a widespread embrace of entirely different product categories for everyday use, could still present a significant challenge. This could mean consumers opting for functional accessories or even digital experiences over traditional clothing purchases.

- Rapidly evolving fashion cycles

- Shift towards casual wear and athleisure

- Expansion into women's wear and footwear as a counter-strategy

- Potential for consumers to substitute traditional apparel with other clothing types or product categories

The threat of substitutes for Arvind Fashions is multifaceted, encompassing unbranded alternatives, the growing second-hand and rental markets, and even competing consumer spending priorities. The substantial unorganized sector in India offers lower-priced apparel, directly challenging branded offerings, especially among price-sensitive consumers.

The global second-hand apparel market, valued at around $125 billion in 2023, and the rise of rental platforms present a significant challenge by offering affordability and variety, potentially diverting demand from new purchases. Furthermore, consumer spending on experiences like travel and electronics in 2024 competes directly with discretionary spending on clothing.

| Substitute Category | Key Characteristics | Impact on Arvind Fashions | Example Data (2023/2024) |

|---|---|---|---|

| Unbranded/Local Apparel | Lower price points, accessible | Appeals to price-sensitive segments, erodes market share in lower-tier segments | India's unorganized apparel sector is substantial, offering significant price competition. |

| Second-hand & Rental Fashion | Affordability, sustainability, variety | Reduces demand for new garments, particularly among younger demographics | Global second-hand market: ~$125 billion (2023), projected to reach $350 billion by 2027. |

| Competing Consumer Spending | Electronics, travel, entertainment | Diverts discretionary income away from apparel purchases | Global consumer spending on experiences projected to rise in 2024. |

Entrants Threaten

The branded apparel sector, particularly for players operating at Arvind Fashions' scale, demands significant upfront capital. This includes substantial investments in establishing modern manufacturing facilities, creating an extensive retail presence through exclusive brand outlets and partnerships with department stores, and developing an efficient, widespread supply chain. For instance, setting up a single large-scale garment manufacturing unit can easily cost upwards of $10-20 million.

Arvind Fashions benefits from a strong portfolio of established brands, both owned and licensed international names. Building this brand equity has required significant, sustained marketing investment over many years. For instance, in fiscal year 2024, the company continued to invest in brand promotion to enhance its market presence.

New entrants face a considerable hurdle in achieving comparable brand recognition and customer loyalty. The fashion retail landscape is highly competitive, demanding substantial resources and time to cultivate trust and attract a loyal customer base. This challenge is amplified by the need to differentiate in a saturated market, making it difficult for newcomers to gain traction against established players.

Arvind Fashions boasts an impressive distribution infrastructure, featuring over 900 exclusive brand outlets and a presence in thousands of multi-brand outlets and department stores. This is further bolstered by a robust e-commerce platform.

The sheer scale and established nature of Arvind Fashions' retail and online distribution network present a significant barrier for new entrants. Replicating such an extensive and integrated system would require substantial investment and considerable time, making it challenging for newcomers to gain immediate market access and visibility.

Regulatory Hurdles and Compliance

The Indian apparel sector faces significant regulatory complexities. New entrants must contend with stringent labor laws, environmental compliance requirements, and intricate import/export regulations. For instance, compliance with the Factories Act, 1948, and various state-specific labor laws can be challenging for businesses without established operational structures.

Navigating these diverse compliance landscapes presents a substantial barrier to entry. Companies lacking prior experience or robust internal compliance frameworks may find it difficult and costly to establish operations. This regulatory burden can deter potential new players, thereby protecting existing market participants like Arvind Fashions.

- Labor Laws: Compliance with minimum wage, working hours, and safety standards.

- Environmental Standards: Adherence to pollution control norms for manufacturing processes.

- Import/Export: Navigating customs duties and trade agreements.

Established Supply Chain and Operational Expertise

Arvind Fashions benefits from its deeply entrenched operational expertise across the entire value chain, from design and manufacturing to sourcing and retail. This extensive experience, honed over years, translates into significant efficiencies and cost advantages that are difficult for newcomers to replicate quickly.

New entrants face a substantial hurdle in establishing comparable operational capabilities and forging reliable supplier relationships. This process is not only time-consuming but also capital-intensive, potentially leading to higher initial operating costs and lower margins compared to an established player like Arvind Fashions.

For instance, in 2024, the Indian apparel market, a key focus for Arvind Fashions, continued to show robust growth, with projections indicating a compound annual growth rate (CAGR) of around 10-12% through 2028. New entrants would need to navigate this dynamic landscape while simultaneously building the foundational operational strength that Arvind Fashions already possesses.

- Deep Operational Expertise: Arvind Fashions has built decades of experience in design, manufacturing, sourcing, and retail management.

- Established Supplier Network: The company maintains strong, long-standing relationships with a diverse range of suppliers.

- Barriers to Entry: New entrants must invest heavily and spend considerable time developing similar operational efficiencies and supply chain networks.

- Cost Disadvantage for Newcomers: Without established scale and expertise, new players are likely to face higher initial costs and potential inefficiencies.

The threat of new entrants for Arvind Fashions is moderate to low. Significant capital investment is required for manufacturing, retail, and supply chain development. For example, establishing a new, large-scale garment manufacturing unit can cost upwards of $10-20 million. Furthermore, building brand equity and customer loyalty demands substantial, sustained marketing investment, a challenge for newcomers aiming to compete with established brands.

The existing extensive distribution network of Arvind Fashions, comprising over 900 exclusive brand outlets and a strong online presence, presents a considerable barrier. Replicating this infrastructure would be both time-consuming and capital-intensive for any new player. Navigating complex regulatory environments, including labor and environmental laws, also adds to the difficulty and cost of entry.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront investment for manufacturing, retail, and supply chain. | Significant financial hurdle. |

| Brand Equity | Established brands require years of marketing and customer trust. | Difficult for new entrants to achieve comparable recognition. |

| Distribution Network | Extensive retail and online presence of over 900 outlets. | Challenging and costly for new players to replicate. |

| Operational Expertise | Decades of experience in the value chain. | New entrants face inefficiencies and higher initial costs. |

| Regulatory Compliance | Complex labor, environmental, and trade laws. | Adds significant cost and operational complexity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Arvind Fashions leverages data from annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.

We also incorporate information from financial news outlets, competitor websites, and government economic indicators to provide a comprehensive view of the forces impacting Arvind Fashions.