Arteria Networks SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arteria Networks Bundle

Arteria Networks shows impressive strengths in its robust network infrastructure and strategic partnerships, but faces potential threats from evolving cybersecurity landscapes and intense market competition. Understanding these dynamics is crucial for any forward-thinking investor or business strategist.

Want the full story behind Arteria Networks' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

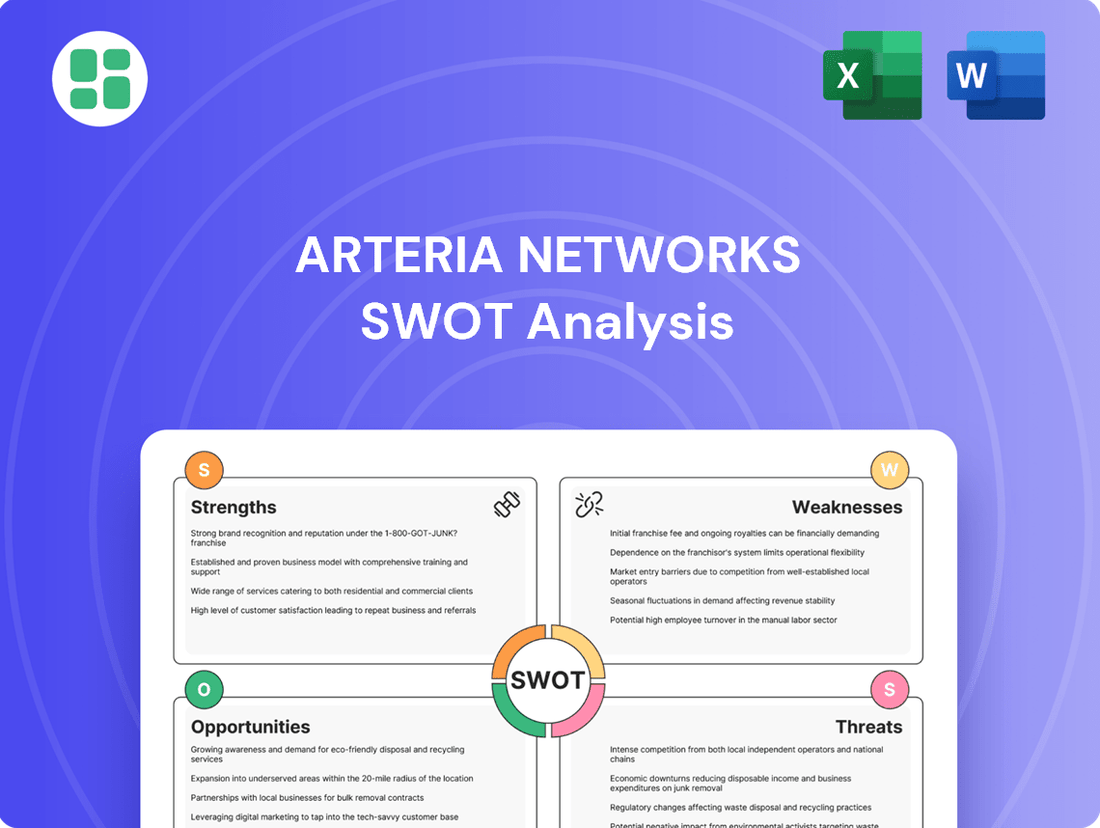

Strengths

Arteria Networks boasts a significant advantage with its extensive owned fiber-optic network, a critical asset for its operations. This proprietary infrastructure spans major Japanese cities, allowing for the strategic deployment of high-capacity optical fiber. This network is the backbone for delivering efficient and high-quality services in areas with substantial demand.

This owned network acts as a vital information artery, enabling Arteria Networks to provide services characterized by low latency and high reliability. As of early 2025, the company continues to invest in expanding this network's reach and capacity, supporting the growing digital needs of businesses across Japan.

Arteria Networks boasts a dominant position in Japan's condominium internet service provider (ISP) market, a significant strength that underpins its business. As of the close of fiscal year 2024, the company successfully connected over 1,000,000 paying units within residential buildings across the nation.

This leadership stems from Arteria's dedicated focus and extensive expertise in delivering reliable, high-speed internet solutions tailored for multi-unit dwellings. Their long-standing specialization has cultivated deep understanding of the unique infrastructure and service demands of condominium complexes, solidifying their competitive edge.

Arteria Networks boasts a diverse service portfolio specifically designed for businesses, encompassing leased circuits, VPNs, and robust internet access. This comprehensive offering allows them to cater to a wide range of corporate needs, from basic connectivity to advanced cloud and data center solutions. For instance, in 2023, Arteria reported a significant increase in its business client base, driven by demand for its integrated communication packages.

Strategic Data Center Connectivity and Resilience

Arteria Networks is significantly bolstering its data center connectivity, a key strength that underpins its value proposition. The company is actively forging partnerships and launching new infrastructure projects, exemplified by the installation of fiber optic cables at new data centers like OPTAGE OC1. This strategic expansion ensures robust and reliable connections for critical information infrastructure.

Furthermore, Arteria Networks' commitment to network resilience is evident in its infrastructure development, such as traversing Tokyo Port with AT TOKYO. These efforts directly translate into enhanced availability and low-latency routes, crucial for businesses reliant on high-capacity data transfer and seamless operations. For instance, in 2023, Arteria Networks reported a significant increase in its fiber optic network footprint, reaching over 10,000 kilometers, which directly supports these enhanced connectivity initiatives.

- Enhanced Data Center Interconnections: Arteria Networks is actively upgrading its data center links through strategic alliances and new fiber optic deployments, such as at OPTAGE OC1.

- Improved Network Resilience: Projects like the AT TOKYO fiber optic route enhance network availability and provide low-latency paths for critical data.

- High-Capacity Data Transfer: These infrastructure improvements ensure high-capacity, low-latency connectivity, vital for modern digital services and operations.

- Growing Fiber Network: By the end of 2023, Arteria Networks' fiber optic network expanded to over 10,000 kilometers, directly supporting its strategic connectivity goals.

Participation in International Submarine Cable Projects

Arteria Networks is actively expanding its global footprint through strategic involvement in key international submarine optical cable projects. This includes participation in initiatives like AUG East, connecting Japan and Singapore, and the JAKO project linking Japan and Korea. These ventures are vital for bolstering the resilience of Japan's digital infrastructure.

These submarine cable projects are instrumental in providing essential backhaul connectivity from cable landing stations directly to major data centers. For instance, the AUG East project, expected to be operational by late 2024, will significantly enhance data transfer speeds and reliability between these critical hubs.

Arteria Networks' participation in these projects underscores its commitment to strengthening global digital connectivity and its strategic position within the Asia-Pacific region's telecommunications landscape. The company's involvement ensures robust and efficient data pathways.

- Global Reach: Arteria Networks is expanding internationally by participating in submarine cable projects like AUG East and JAKO.

- Critical Infrastructure: These projects are essential for providing backhaul from landing stations to data centers, enhancing Japan's digital infrastructure resilience.

- Operational Impact: Projects like AUG East are slated for operational readiness by late 2024, improving data transfer capabilities.

Arteria Networks possesses a robust, owned fiber-optic network spanning key Japanese urban centers, providing a significant competitive advantage. This extensive infrastructure enables high-capacity, low-latency service delivery, crucial for meeting escalating digital demands. As of early 2025, continued investment in network expansion further solidifies this strength.

The company holds a leading position in Japan's condominium ISP market, having connected over 1,000,000 units by the end of fiscal year 2024. This dominance is built on specialized expertise in multi-unit dwelling internet solutions, reflecting a deep understanding of this niche market.

Arteria Networks offers a comprehensive suite of business services, including leased circuits and VPNs, catering to diverse corporate connectivity needs. Its expanding data center connectivity, highlighted by partnerships and new fiber deployments like at OPTAGE OC1, ensures reliable, high-speed data transfer. The company's fiber optic network reached over 10,000 kilometers by the end of 2023, enhancing its connectivity capabilities.

Furthermore, Arteria's strategic involvement in international submarine cable projects, such as AUG East (expected operational by late 2024) and JAKO, bolsters Japan's digital infrastructure resilience and expands its global reach. These projects are vital for providing essential backhaul connectivity from cable landing stations to major data centers.

What is included in the product

Delivers a strategic overview of Arteria Networks’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and mitigate potential business risks.

Weaknesses

Arteria Networks' significant reliance on the Japanese market, especially within urban centers and for condominium infrastructure, presents a notable weakness. This geographic concentration limits its exposure to diverse international growth opportunities and makes it more susceptible to the economic cycles and regulatory shifts specific to Japan.

Arteria Networks operates in a telecommunications landscape characterized by intense competition and rapid market shifts. This sector sees numerous established giants and agile newcomers constantly battling for customer acquisition and retention, creating a volatile environment.

The pressure to innovate is relentless, forcing Arteria Networks to continuously invest in new technologies and service enhancements to stay ahead. Failing to differentiate its offerings risks market share erosion against competitors who may offer more attractive pricing or cutting-edge solutions.

For instance, in 2024, the global telecommunications market revenue was projected to reach approximately $1.6 trillion, highlighting the sheer scale and competitive intensity Arteria Networks navigates. Major players are consistently investing billions in 5G deployment and fiber optic expansion, setting a high bar for any company seeking to gain or maintain a significant market presence.

Arteria Networks faces a significant hurdle with its high capital expenditure requirements for network infrastructure. The company must invest heavily in building, maintaining, and expanding its extensive optical fiber network, alongside participation in costly submarine cable projects. For instance, major telecommunication infrastructure projects often run into hundreds of millions, if not billions, of dollars, directly impacting Arteria's financial flexibility.

This substantial upfront and ongoing investment can put a strain on profitability and cash flow. When Arteria undertakes large-scale infrastructure developments, such as deploying new fiber routes or upgrading existing capacity, these capital outlays are considerable. This directly affects the company's ability to reinvest in other areas or distribute returns to shareholders.

Vulnerability to Technological Obsolescence

Arteria Networks faces a significant threat from the relentless pace of technological advancement in telecommunications. The rapid rollout of 5G, coupled with breakthroughs in AI-driven networking and the growing accessibility of satellite internet, means existing infrastructure can quickly become outdated. For instance, investments in fiber optic networks, while substantial, must be constantly evaluated against emerging wireless and satellite solutions that could offer comparable or superior performance at a lower cost for certain applications.

To counter this, Arteria Networks needs to allocate substantial and ongoing resources to research and development. This commitment is crucial for ensuring its services and infrastructure remain competitive and relevant in a dynamic market. For example, a significant portion of capital expenditure in 2024 and projected for 2025 will likely be directed towards upgrading core network components and exploring next-generation technologies, potentially exceeding the 15% of revenue typically earmarked for R&D by leading telecom firms.

- Rapid technological shifts: 5G, AI in networking, and satellite internet threaten to make current infrastructure obsolete.

- Need for continuous R&D investment: Arteria must invest heavily to keep services and infrastructure cutting-edge.

- Competitive pressure: Competitors adopting new technologies faster could gain market share.

- Risk of stranded assets: Older infrastructure may become uneconomical to maintain or upgrade.

Potential for Service Delivery and Scaling Challenges

Arteria Networks faces potential hurdles in delivering consistent service and scaling its operations effectively. Serving over a million residential units and numerous business clients presents a significant challenge in maintaining high service quality and providing prompt customer support across its entire user base.

The sheer complexity of managing an extensive network infrastructure, coupled with the diverse requirements of its varied clientele, necessitates highly robust and adaptable operational capabilities to prevent service degradation.

- Service Quality at Scale: Ensuring uniform service quality across a million-plus residential units and diverse business clients is a considerable operational challenge.

- Customer Support Responsiveness: Maintaining responsive customer support as the client base grows demands significant investment in staffing and efficient support systems.

- Network Complexity Management: The intricate nature of a vast network infrastructure requires constant oversight and advanced management tools to ensure reliability and performance.

Arteria Networks' significant reliance on the Japanese market, particularly in urban centers and for condominium infrastructure, presents a notable weakness. This geographic concentration limits its exposure to diverse international growth opportunities and makes it more susceptible to the economic cycles and regulatory shifts specific to Japan.

The telecommunications sector is intensely competitive, with rapid market shifts and constant battles for customer acquisition. Arteria Networks faces pressure to innovate relentlessly, requiring continuous investment in new technologies and service enhancements. Failing to differentiate its offerings risks market share erosion against competitors offering more attractive pricing or cutting-edge solutions. For instance, the global telecommunications market revenue was projected to reach approximately $1.6 trillion in 2024, underscoring the competitive intensity.

Arteria Networks faces high capital expenditure requirements for its extensive optical fiber network and participation in costly submarine cable projects. These substantial upfront and ongoing investments can strain profitability and cash flow, impacting the company's ability to reinvest or distribute returns. Major telecommunication infrastructure projects frequently cost hundreds of millions, if not billions, of dollars.

The rapid pace of technological advancement, including 5G, AI in networking, and satellite internet, threatens to make Arteria's current infrastructure obsolete. This necessitates substantial and ongoing investment in research and development to maintain competitiveness. For example, a significant portion of capital expenditure in 2024 and projected for 2025 will likely be directed towards upgrading core network components and exploring next-generation technologies, potentially exceeding the 15% of revenue typically earmarked for R&D by leading telecom firms.

Ensuring consistent service quality and scaling operations effectively for over a million residential units and numerous business clients is a considerable challenge. The complexity of managing a vast network infrastructure requires constant oversight and advanced management tools to ensure reliability and performance, alongside responsive customer support.

Full Version Awaits

Arteria Networks SWOT Analysis

This preview reflects the real Arteria Networks SWOT analysis document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

Opportunities

The relentless digital transformation across industries is fueling a significant surge in demand for high-speed, low-latency, and dependable internet connectivity. Globally, the average broadband speed has continued its upward trend, with many regions now seeing average download speeds exceeding 100 Mbps, a testament to this growing need. This escalating requirement for robust digital infrastructure presents a prime opportunity for Arteria Networks to leverage its capabilities and capture market share by offering enhanced bandwidth and superior reliability.

The accelerating migration of government and enterprise core systems to cloud platforms, coupled with the global expansion of data centers, presents a significant opportunity. For instance, the global data center market was valued at an estimated $241 billion in 2023 and is projected to reach over $400 billion by 2029, indicating substantial growth. This trend is also evident in Japan, where investments in digital infrastructure continue to rise.

Arteria Networks is strategically positioned to capitalize on this trend. Their robust data center solutions and established connectivity infrastructure enable them to meet the escalating demand for secure, high-capacity access to cloud services. This allows them to serve businesses and government entities transitioning their critical operations to the cloud.

Arteria Networks' involvement in international submarine cable projects like AUG East and JAKO presents a significant growth opportunity. These initiatives allow the company to expand its network footprint globally, connecting key regions and enhancing its ability to serve international customers.

By participating in these ventures, Arteria Networks can tap into the growing demand for robust international data transmission. For instance, the global submarine cable market was valued at approximately $25 billion in 2023 and is projected to grow substantially, offering a fertile ground for Arteria's expansion.

Strategic Partnerships and Collaborations

Arteria Networks can significantly expand its reach by forming strategic alliances with real estate developers. This allows for early integration of their network infrastructure into new condominium constructions, securing a customer base from the outset. For instance, a partnership with a developer building 5,000 units in a prime urban area in 2024 could provide Arteria with a substantial new revenue stream.

Collaborating with other technology and data center operators presents another key opportunity. These partnerships can lead to the development of more comprehensive, integrated solutions that cater to a wider range of client needs. By pooling resources and expertise, Arteria can enhance its service offerings and gain a competitive edge. For example, a joint venture announced in early 2025 with a leading cloud provider could unlock new markets for hybrid cloud solutions.

These strategic moves are not just theoretical; Arteria has demonstrated a proactive approach to leveraging external synergies. Recent collaborations, such as the one with a major smart home technology provider in Q3 2024, highlight their commitment to this strategy.

- Partnerships with real estate developers to embed fiber optic networks in new residential and commercial properties.

- Collaborations with complementary technology firms to offer bundled services like IoT connectivity and managed IT solutions.

- Joint ventures with data center providers to expand colocation and cloud connectivity options.

- Strategic alliances with telecommunications equipment manufacturers to gain preferential access to new technologies and supply chains.

Development of Smart City and IoT Infrastructure

The global smart city market is projected to reach $2.5 trillion by 2026, a significant increase from $1.5 trillion in 2023, fueling demand for advanced connectivity. Arteria Networks' established fiber-optic infrastructure is ideally positioned to capitalize on this growth, providing the high-speed, reliable data transmission essential for smart city applications like traffic management and public safety systems.

The proliferation of IoT devices, expected to exceed 29 billion by 2030, necessitates scalable and secure network solutions. Arteria Networks' capabilities in deploying and managing data infrastructure directly support the backbone required for these interconnected environments, creating substantial opportunities for network expansion and service provision.

- Market Growth: Global smart city market to reach $2.5 trillion by 2026.

- IoT Expansion: Over 29 billion IoT devices anticipated by 2030.

- Infrastructure Synergy: Arteria's fiber expertise matches smart city connectivity needs.

- Data Demand: Increased IoT adoption drives demand for robust data solutions.

Arteria Networks is well-positioned to benefit from the increasing demand for robust digital infrastructure driven by global digital transformation. The continued expansion of data centers and cloud migration, with the data center market projected to exceed $400 billion by 2029, presents a significant avenue for growth. Furthermore, participation in international submarine cable projects, like AUG East and JAKO, expands the company's global reach and capacity for international data transmission, a market valued around $25 billion in 2023.

Strategic partnerships offer substantial opportunities. Collaborating with real estate developers to integrate network infrastructure into new constructions, as seen with potential projects involving thousands of units in 2024, secures early customer adoption. Aligning with other technology and data center operators allows for the creation of more comprehensive solutions, like hybrid cloud services, as demonstrated by potential joint ventures in early 2025.

The burgeoning smart city market, expected to reach $2.5 trillion by 2026, and the proliferation of IoT devices, anticipated to exceed 29 billion by 2030, are key growth drivers. Arteria's fiber-optic infrastructure is crucial for supporting these advancements, providing the essential high-speed connectivity for smart city applications and the vast data demands of interconnected IoT environments.

| Opportunity Area | Market Projection/Data Point | Arteria's Relevance |

|---|---|---|

| Digital Transformation & Cloud Migration | Data Center Market: >$400B by 2029 | Leverages existing infrastructure for cloud connectivity |

| International Connectivity | Submarine Cable Market: ~$25B (2023) | Expands global footprint via projects like AUG East, JAKO |

| Real Estate Partnerships | New Unit Developments (e.g., 5,000 units in 2024) | Secures early customer base in new constructions |

| Smart Cities & IoT | Smart City Market: $2.5T by 2026 | Provides essential high-speed connectivity for smart city applications |

| IoT Device Growth | IoT Devices: >29B by 2030 | Supports the backbone for interconnected IoT environments |

Threats

The internet service provider landscape is notoriously competitive, with players frequently engaging in aggressive pricing to win and retain customers. This intense rivalry risks turning basic internet connectivity into a commodity, where price becomes the primary differentiator. For Arteria Networks, this means a constant threat to its profit margins if it can't effectively highlight and monetize its more advanced service offerings beyond mere bandwidth.

The telecommunications sector is experiencing swift technological shifts, with 5G network rollouts accelerating and low-earth orbit (LEO) satellite internet emerging as a significant contender. These advancements, alongside sophisticated AI for network optimization, pose a threat by potentially rendering current infrastructure and service models obsolete, forcing rapid adaptation.

Arteria Networks, as a provider of critical communication infrastructure and data center services, faces substantial cybersecurity threats. The increasing sophistication of cyberattacks means that a successful breach could severely disrupt services for its clients, leading to significant reputational damage and potential regulatory fines. For instance, the global average cost of a data breach reached $4.35 million in 2022, a figure that continues to rise, highlighting the financial exposure.

Regulatory Changes and Compliance Burden

The telecommunications sector faces evolving regulatory landscapes, potentially impacting Arteria Networks. For instance, the Federal Communications Commission (FCC) in the US consistently reviews and updates rules concerning net neutrality, spectrum allocation, and broadband deployment. These changes can necessitate significant operational adjustments and compliance investments, directly affecting profitability and strategic planning.

Ensuring adherence to a growing number of regulations, such as data privacy laws like GDPR or CCPA, presents a substantial compliance burden. In 2024, the cost of regulatory compliance for telecommunications companies globally is estimated to be in the billions, diverting resources that could otherwise be used for innovation or expansion. Arteria Networks must allocate substantial capital and personnel to maintain compliance across its operating regions.

- Regulatory Uncertainty: Potential shifts in government policies regarding infrastructure build-out or service provision could alter market dynamics.

- Compliance Costs: Adhering to new data privacy or security mandates can lead to increased operational expenses.

- Licensing Requirements: Changes in licensing fees or renewal processes for spectrum or operational permits could impact financial outlays.

Economic Downturn and Market Sensitivity

An economic downturn poses a significant threat to Arteria Networks. A recession typically leads to reduced spending by both businesses and consumers on telecommunications, especially for premium or non-essential services. This cyclical sensitivity directly impacts revenue streams and can hinder planned investments.

For instance, a projected global economic slowdown in late 2024 or early 2025 could see businesses cutting back on IT and communication budgets, impacting Arteria's enterprise services. Similarly, consumers facing job losses or reduced disposable income might downgrade their plans or delay upgrades, affecting residential service revenue.

- Economic Slowdown Impact: Reduced consumer and business spending on telecommunication services.

- Revenue Sensitivity: Arteria Networks' revenue growth is vulnerable to economic cycles.

- Investment Constraints: Downturns can limit capital for network expansion and technology upgrades.

- Discretionary Spending Cuts: Premium services and upgrades are often the first to be reduced by customers during economic hardship.

Intense competition in the ISP market, driven by aggressive pricing, threatens Arteria Networks' profit margins by commoditizing services. Rapid technological advancements, such as 5G and LEO satellites, could make current infrastructure obsolete, demanding costly adaptations. Furthermore, sophisticated cyberattacks pose a significant risk, with the global average cost of a data breach at $4.35 million in 2022, potentially leading to service disruptions, reputational damage, and fines.

SWOT Analysis Data Sources

This Arteria Networks SWOT analysis is built upon a foundation of robust data, including official financial filings, comprehensive market intelligence reports, and expert industry evaluations, ensuring a precise and informed strategic assessment.