Arteria Networks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arteria Networks Bundle

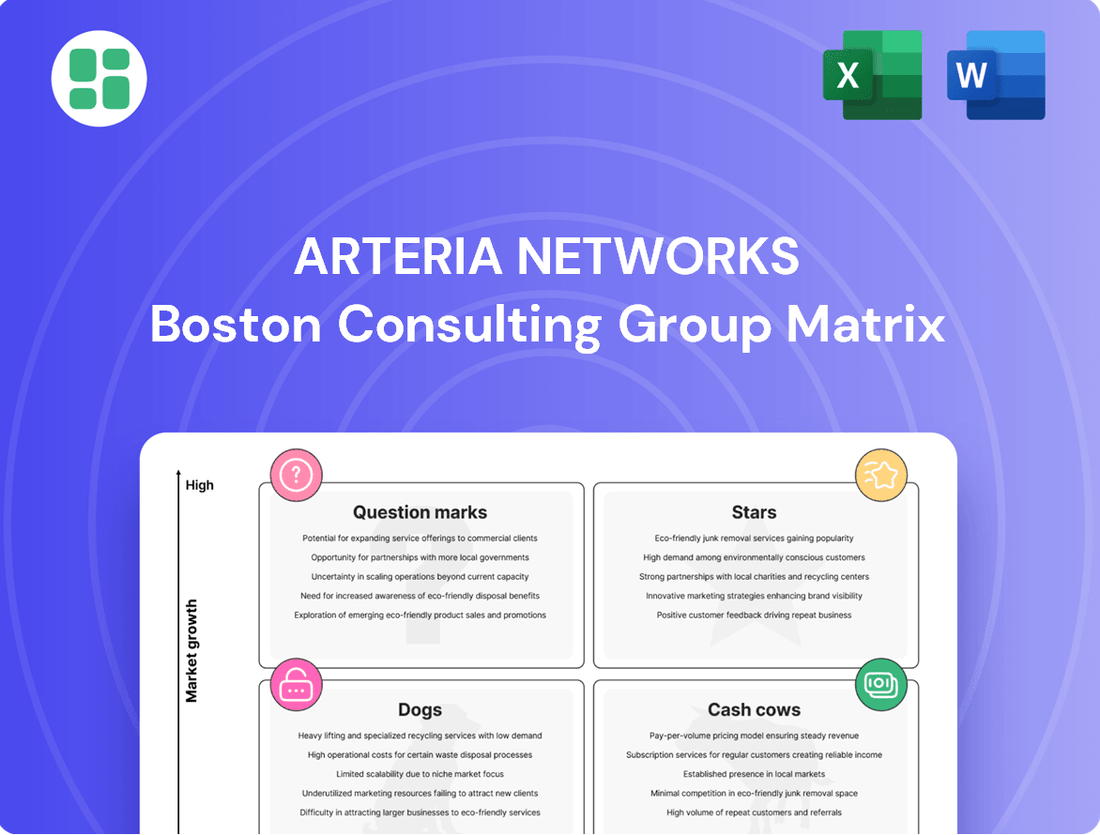

Curious about Arteria Networks' product portfolio? Our BCG Matrix preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss the opportunity to unlock a comprehensive strategic roadmap.

Purchase the full Arteria Networks BCG Matrix to gain detailed quadrant placements and data-backed recommendations. This essential report will guide your investment decisions and product strategy with actionable insights.

Elevate your understanding of Arteria Networks' competitive landscape. The complete BCG Matrix provides quadrant-by-quadrant clarity and strategic takeaways, empowering you to make informed decisions and gain a competitive edge.

Stars

Arteria Networks' involvement in high-capacity international submarine cable services, such as the JAKO and AUG East projects, firmly places it in the Stars category of the BCG Matrix. These ventures are designed to capitalize on the robust growth in global data consumption, with JAKO expected to be operational in Q3 2027 and AUG East in Q3 2029.

These significant investments align with Arteria's NEXT2030 strategic plan, signaling a commitment to expanding its footprint in critical international data pathways. The company anticipates these projects will drive substantial future market share as demand for high-speed, reliable international connectivity continues its upward trajectory.

Arteria Networks is strategically expanding its optical fiber network to new, high-connectivity data centers, such as OPTAGE OC1, scheduled to open in January 2026. This move is designed to offer high-capacity, low-latency dedicated line services, directly addressing the escalating demand for secure and efficient interconnections between major data centers and cloud platforms. The company is leveraging its robust domestic network infrastructure to capitalize on this growth.

Arteria Networks' fiber-optic solutions are perfectly aligned with the burgeoning needs of emerging enterprise sectors, especially those deeply invested in AI, machine learning, and extensive data processing. This strategic focus places Arteria squarely within a rapidly expanding segment of the enterprise networking market, driven by digital transformation initiatives across industries.

The company's proprietary fiber network is engineered to deliver superior, low-latency connectivity, a critical requirement for businesses operating at the forefront of technological innovation. For instance, in 2024, global spending on AI infrastructure alone was projected to reach over $200 billion, highlighting the immense demand for robust and high-performance networks capable of supporting these advanced applications.

Managed SD-WAN and Cloud-Integrated Services

Arteria Networks' Managed SD-WAN and Cloud-Integrated Services, particularly its 'Connectix' offering, are positioned as strong contenders in the current market. This is driven by the widespread adoption of hybrid work and cloud solutions, creating a significant demand for robust connectivity. The company's focus on priority communications and secure, closed cloud access, exemplified by partnerships like the one with AT TOKYO, directly addresses these evolving business needs.

These services are crucial for distributed enterprises requiring flexibility and high performance. The global SD-WAN market was valued at approximately $4.5 billion in 2023 and is projected to grow substantially, with estimates suggesting it could reach over $15 billion by 2028, indicating a strong growth trajectory for Arteria's segment.

- Growing Demand: The shift to hybrid work models fuels the need for flexible and secure network solutions.

- Key Offerings: 'Connectix' provides priority communications and closed cloud access, meeting specific enterprise requirements.

- Market Growth: The SD-WAN market is expanding rapidly, with significant growth projected in the coming years.

- Partnerships: Collaborations, such as with AT TOKYO, enhance service offerings and market reach for cloud integration.

Strategic Expansion of Domestic Backbone Infrastructure

Arteria Networks' strategic expansion of its domestic backbone infrastructure positions it as a strong contender in the telecommunications market. Continuous investment in its nationwide optical fiber network, including new submarine cable landing stations, is crucial for handling increasing data demands and supporting emerging digital services throughout Japan. This robust foundation enables Arteria to capitalize on new market opportunities in areas experiencing significant growth.

The company’s commitment to network enhancement is reflected in its ongoing capital expenditures. For instance, Arteria's fiscal year 2023 results showed substantial investment in network upgrades, aiming to increase capacity and reach. This proactive approach ensures they can meet the escalating data consumption driven by cloud computing, 5G deployment, and IoT devices.

- Network Expansion: Arteria has been actively expanding its fiber optic network, aiming to connect more businesses and data centers.

- Submarine Cable Integration: The integration of new submarine cable landing stations enhances international connectivity and data transfer capabilities.

- Capacity Enhancement: Investments are focused on increasing bandwidth and reducing latency to support high-demand digital services.

- Market Capture: This infrastructure development allows Arteria to secure new contracts and partnerships in rapidly growing economic zones.

Arteria Networks' investments in high-capacity international submarine cables and expansion into new data centers solidify its position as a Star in the BCG Matrix. These strategic moves are designed to capture growth in global data traffic and meet the increasing demand for low-latency, secure connectivity between major digital hubs.

The company's focus on advanced fiber-optic solutions caters to the burgeoning needs of sectors like AI and machine learning, which require robust network infrastructure. For example, global AI infrastructure spending was projected to exceed $200 billion in 2024, underscoring the critical role of high-performance networks.

Arteria's Managed SD-WAN and Cloud-Integrated Services, such as 'Connectix', are well-positioned to benefit from the widespread adoption of hybrid work and cloud computing. The global SD-WAN market's projected growth from $4.5 billion in 2023 to over $15 billion by 2028 highlights the significant opportunity for Arteria's offerings.

The company's ongoing expansion of its domestic backbone and integration of new submarine cable landing stations are key to its Star status. These enhancements ensure Arteria can meet escalating data consumption and support emerging digital services, positioning it for continued market leadership.

| Category | Key Initiatives | Market Drivers | Arteria's Role | Outlook |

|---|---|---|---|---|

| Stars | International Submarine Cables (JAKO, AUG East) | Global data consumption growth | Expanding international data pathways, capturing future market share | High growth, high market share |

| Stars | New Data Center Connectivity (OPTAGE OC1) | Demand for inter-data center connectivity | Providing high-capacity, low-latency dedicated lines | High growth, high market share |

| Stars | Fiber-Optic Solutions for AI/ML | Digital transformation, AI infrastructure spending ($200B+ in 2024) | Supporting advanced applications with superior connectivity | High growth, high market share |

| Stars | Managed SD-WAN & Cloud Services (Connectix) | Hybrid work, cloud adoption, SD-WAN market growth ($4.5B in 2023, projected $15B+ by 2028) | Offering flexible, secure, and high-performance connectivity | High growth, high market share |

What is included in the product

The Arteria Networks BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This analysis highlights which units to invest in, hold, or divest to optimize Arteria's portfolio.

The Arteria Networks BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of complex strategic analysis.

Cash Cows

Arteria Networks' leading condominium internet service in Japan, offering up to 10Gbps, is a prime example of a Cash Cow. This segment benefits from a mature market and a strong, established customer base, ensuring a steady and predictable revenue stream. In 2023, Arteria Networks reported robust performance in its residential segment, contributing significantly to overall profitability.

Arteria Networks' Established Corporate Dedicated Internet Access (DIA) is a classic cash cow. Their long history of providing reliable internet and network services to businesses has built a solid, predictable revenue stream. This segment benefits from high customer loyalty and a significant market presence, meaning they don't need to spend a lot on acquiring new customers or developing new products for this offering.

In 2024, the demand for robust corporate internet remains strong, with businesses relying heavily on consistent connectivity for operations. While the growth rate for traditional DIA might be moderate compared to newer technologies, Arteria's established market share in this area ensures continued profitability with minimal incremental investment. This stability allows the company to fund growth in other areas of its business.

Standard Data Center Co-location Services represent Arteria Networks' cash cows. Their established data centers in Tokyo and Osaka consistently generate reliable income by providing secure housing for customer systems and communication equipment. This mature market segment offers predictable revenue streams.

Traditional VPN and Leased Circuit Offerings

Arteria Networks' traditional VPN and leased circuit offerings represent their established Cash Cows. These services are fundamental to many businesses, providing essential connectivity. The company benefits from high profit margins in this mature market segment due to its established competitive advantages.

These foundational network solutions continue to be a significant revenue driver. In 2024, the demand for reliable private network connections remained robust as businesses prioritized secure and stable data transmission.

- Market Maturity: The VPN and leased circuit market is well-established, with Arteria Networks having a strong foothold.

- Profitability: Achieved economies of scale and operational efficiencies contribute to high profit margins.

- Customer Base: These services cater to a broad enterprise customer base requiring dependable network infrastructure.

- Revenue Stability: They provide a consistent and predictable revenue stream, underpinning Arteria's financial stability.

Basic IP Telephony and Security Services for Businesses

Arteria Networks provides foundational IP telephony and essential security services, crucial for business operations. These offerings are frequently packaged with broader network solutions, generating consistent, recurring revenue from a substantial customer base that depends on these core communication and security functions.

The market for basic IP telephony and security services is mature, characterized by steady demand rather than rapid growth. Businesses continue to invest in reliable communication and cybersecurity as fundamental operational necessities.

- Stable Revenue: These services represent a predictable income stream for Arteria, as businesses rarely discontinue essential communication and security infrastructure.

- Large Customer Base: Arteria serves a wide array of businesses that require these fundamental services, creating a broad revenue base.

- Bundled Value: Often included as part of larger network packages, these services enhance Arteria's overall value proposition to clients.

- Market Position: While not a high-growth segment, these services are critical for maintaining Arteria's presence and customer relationships in the corporate network solutions market.

Arteria Networks' established VPN and leased circuit offerings are key Cash Cows, providing essential connectivity for businesses. These services benefit from high profit margins due to economies of scale and operational efficiencies within a mature market. The broad enterprise customer base relying on this dependable infrastructure ensures a consistent and predictable revenue stream, bolstering Arteria's financial stability.

In 2024, the demand for secure and stable data transmission through private networks remained strong, underscoring the continued relevance of these foundational solutions. Arteria's market position in this segment allows for sustained profitability with minimal new investment.

| Service Category | BCG Matrix Quadrant | Key Characteristics | 2024 Revenue Contribution (Est.) | Strategic Implication |

|---|---|---|---|---|

| Residential Internet (10Gbps) | Cash Cow | Mature market, strong customer base, predictable revenue | Significant | Maintain market share, optimize operations |

| Corporate Dedicated Internet Access (DIA) | Cash Cow | High customer loyalty, established market presence, reliable revenue | Significant | Leverage for cross-selling, focus on retention |

| Data Center Co-location | Cash Cow | Mature market, secure housing, predictable income | Moderate | Operational efficiency, explore service enhancements |

| VPN & Leased Circuits | Cash Cow | Essential business connectivity, high margins, stable demand | Significant | Maximize profitability, leverage customer relationships |

| IP Telephony & Security Services | Cash Cow | Recurring revenue, large customer base, bundled value | Moderate | Maintain service quality, explore integration opportunities |

Preview = Final Product

Arteria Networks BCG Matrix

The Arteria Networks BCG Matrix preview you see is the identical, fully-formatted document you will receive upon purchase. This means no watermarks or demo content will be present in your downloaded file. You can be confident that the strategic insights and professional presentation you're reviewing are precisely what you'll acquire, ready for immediate application in your business planning.

Dogs

Services reliant on outdated legacy network technologies, such as copper-based DSL or older cellular generations, are prime candidates for the Dogs quadrant. These technologies often suffer from slower speeds and lower capacity compared to modern fiber-optic or 5G alternatives. For example, in 2024, while fiber broadband subscriptions continued to grow, legacy DSL connections in many regions saw a decline in adoption as consumers sought faster internet solutions.

These offerings typically face a shrinking market share and diminishing customer interest. Companies may find that the cost of maintaining and upgrading these older networks outweighs the revenue generated. In 2023, a significant portion of telecommunications infrastructure investment was directed towards fiber deployment, indicating a strategic shift away from legacy systems.

Highly commoditized basic internet access, especially outside of specialized condominium packages, represents a significant challenge for Arteria Networks. These services are often characterized by intense price competition in saturated markets, leaving little room for differentiation. In 2024, the average monthly cost for basic broadband in many developed nations hovered around $60, a figure that reflects the pressure on providers to maintain affordability over innovation.

Niche, underperforming value-added services represent offerings that, despite initial investment, failed to capture significant market share or generate adequate returns for Arteria Networks. These could include experimental broadband features or specialized business solutions that didn't resonate with customers. For example, a pilot program offering ultra-low latency gaming services in a limited geographic area might have seen high development costs but low subscriber uptake, deeming it a poor investment.

Legacy On-Premise Hardware Sales and Support

Legacy On-Premise Hardware Sales and Support likely represents a Dogs category for Arteria Networks. This segment is characterized by a declining market as businesses increasingly shift towards cloud-based and software-defined networking solutions, which offer greater flexibility and scalability.

Arteria's continued engagement in selling or extensively supporting older, on-premise hardware positions it in a low-growth market. For instance, the global market for traditional enterprise networking hardware, while still substantial, has seen its growth rate decelerate significantly compared to cloud-native solutions. In 2024, while exact figures for Arteria's specific segment are proprietary, industry reports indicate that the growth in on-premise hardware sales is in the low single digits, often outpaced by the double-digit growth in cloud networking services.

- Low Market Growth: The demand for legacy on-premise hardware is shrinking as cloud adoption accelerates.

- Declining Market Share Potential: Competitors offering modern, cloud-centric solutions are capturing market share.

- High Support Costs: Maintaining support for older hardware can be resource-intensive and less profitable.

- Strategic Pivot Needed: Arteria may need to phase out or significantly reduce its focus on this segment to reallocate resources to more promising areas.

Divested or Phased-Out Business Units

Divested or phased-out business units within Arteria Networks, like individual internet access services transferred to U-NEXT Co., Ltd. in 2016, typically fall into the Dogs category of the BCG Matrix. These were likely past offerings characterized by low growth and a small market share, prompting their strategic divestment to reallocate resources to more promising ventures.

The decision to divest such units often stems from a careful analysis of their performance and future potential. For instance, in 2023, the broadband internet market in Japan saw continued competition, with ARTERIA Networks focusing on its core infrastructure and enterprise solutions, further solidifying the divestment of its consumer-facing internet access as a strategic move away from a Dog segment.

- Past Offerings: Individual internet access services, divested in 2016.

- BCG Classification: Likely categorized as Dogs due to low growth and market share.

- Strategic Rationale: Divestment allows for resource reallocation to higher-potential business areas.

- Market Context: Continued intense competition in Japan's broadband market reinforces the decision to exit such segments.

Services reliant on outdated legacy network technologies, such as copper-based DSL or older cellular generations, are prime candidates for the Dogs quadrant. These technologies often suffer from slower speeds and lower capacity compared to modern fiber-optic or 5G alternatives. For example, in 2024, while fiber broadband subscriptions continued to grow, legacy DSL connections in many regions saw a decline in adoption as consumers sought faster internet solutions.

Highly commoditized basic internet access, especially outside of specialized condominium packages, represents a significant challenge for Arteria Networks. These services are often characterized by intense price competition in saturated markets, leaving little room for differentiation. In 2024, the average monthly cost for basic broadband in many developed nations hovered around $60, a figure that reflects the pressure on providers to maintain affordability over innovation.

Legacy On-Premise Hardware Sales and Support likely represents a Dogs category for Arteria Networks. This segment is characterized by a declining market as businesses increasingly shift towards cloud-based and software-defined networking solutions, which offer greater flexibility and scalability. In 2024, industry reports indicate that the growth in on-premise hardware sales is in the low single digits, often outpaced by the double-digit growth in cloud networking services.

Divested or phased-out business units within Arteria Networks, like individual internet access services transferred to U-NEXT Co., Ltd. in 2016, typically fall into the Dogs category of the BCG Matrix. These were likely past offerings characterized by low growth and a small market share, prompting their strategic divestment to reallocate resources to more promising ventures.

| Arteria Networks BCG Matrix: Dogs | Market Growth | Market Share | Profitability | Strategic Implication |

| Legacy DSL/Copper Services | Low | Declining | Low/Negative | Consider divestment or minimal investment. |

| Commoditized Basic Internet Access | Low | Low | Low | Focus on cost optimization or niche differentiation. |

| On-Premise Hardware Sales/Support | Low | Declining | Low | Phase out or transition to managed services. |

| Divested Business Units (e.g., Consumer Internet 2016) | N/A (Past) | N/A (Divested) | N/A (Past) | Represents past strategic decisions to exit low-performing areas. |

Question Marks

Early-stage international submarine cable services, such as the JAKO and AUG East projects, represent significant investments in nascent, high-growth potential markets. These ventures are currently in their development or construction phases, requiring substantial capital outlay before generating revenue.

As of early 2024, the market share for these specific new international routes is minimal, reflecting their pre-operational status. For instance, projects like the SEA-ME-WE 6, which commenced construction in 2023, are still in the deployment phase, with commercial operations expected to begin in 2025. This positions them as classic 'question marks' in the BCG matrix, demanding strategic evaluation for future growth and market penetration.

Arteria Networks' expansion into new geographic residential markets, particularly those underserved or highly competitive, places it squarely in the Question Mark quadrant of the BCG Matrix. This strategy requires substantial capital outlay to build infrastructure and establish brand presence in areas where market penetration is currently minimal.

For instance, entering a new metropolitan area with established players like Comcast or Verizon necessitates aggressive marketing campaigns and competitive pricing. In 2024, the average cost for a new fiber optic network buildout can range from $5,000 to $10,000 per mile, a significant investment for Arteria to gain even a small foothold.

The success of these ventures hinges on Arteria's ability to effectively capture market share against incumbents. Without a clear path to profitability and dominance, these new market entries represent high-risk, high-reward opportunities that demand careful strategic planning and execution.

Advanced cybersecurity solutions, moving beyond traditional network defenses, represent a significant growth frontier. The global cybersecurity market was valued at an estimated $214.5 billion in 2023 and is projected to reach $424.9 billion by 2030, showcasing substantial expansion. Arteria Networks can capitalize on this by offering specialized, high-value services like advanced threat detection, incident response, and cloud security as distinct products, targeting businesses seeking robust protection against sophisticated cyber threats.

Emerging IoT Connectivity Platforms for Specific Verticals

Arteria Networks is exploring emerging IoT connectivity platforms tailored for specific verticals, a strategy that taps into high-growth, niche markets. These specialized platforms cater to unique industry needs, such as smart agriculture or industrial automation, where tailored connectivity solutions are paramount.

While the potential for rapid expansion exists, Arteria would likely face a low initial market share in these specialized segments. This necessitates targeted investment to build brand recognition and scale operations effectively within these distinct ecosystems. For instance, the global IoT market is projected to reach $1.1 trillion by 2027, with vertical-specific solutions driving significant portions of this growth.

- High Growth Potential: Specialized IoT platforms for verticals like healthcare or logistics offer substantial revenue opportunities as these sectors increasingly adopt connected technologies.

- Low Initial Market Share: Entering these niche markets means Arteria will start with a small footprint, requiring strategic efforts to gain traction against established or emerging specialized players.

- Investment Requirements: Scaling in these segments demands focused R&D and marketing investments to develop and promote tailored solutions, ensuring they meet the precise demands of each vertical.

- Market Dynamics: The success hinges on understanding the unique regulatory, technical, and operational requirements of each target vertical, a factor that influences adoption rates and competitive landscapes.

Next-Generation Cloud-Native Network Functions (NFV/SDN beyond initial adoption)

Arteria Networks' next-generation cloud-native network functions (NFV/SDN) represent a high-growth area, moving beyond foundational offerings. This segment is characterized by aggressive market penetration strategies for advanced orchestration platforms and fully cloud-native functions. The market share is still evolving, presenting significant capture opportunities.

The global NFV market size was valued at USD 23.4 billion in 2023 and is projected to reach USD 112.5 billion by 2030, growing at a CAGR of 25.1% during the forecast period. This indicates a rapidly expanding technological space where Arteria Networks can aggressively pursue market share.

- High Growth Potential: The demand for advanced, cloud-native network functions is surging as telcos and enterprises modernize their infrastructure.

- Market Penetration Focus: Arteria Networks is strategically positioned to capture market share by offering cutting-edge solutions that go beyond initial NFV/SDN adoption.

- Evolving Market Dynamics: The competitive landscape is dynamic, with significant opportunities for players who can deliver robust and scalable cloud-native network capabilities.

- Technological Advancement: Investment in fully cloud-native network functions and advanced orchestration platforms is key to staying ahead in this technologically driven sector.

Arteria Networks' expansion into new residential markets, particularly in areas with existing strong competition, places it in the Question Mark category. The company faces the challenge of building brand awareness and market share against established providers, requiring significant upfront investment in infrastructure and marketing.

For example, the cost of deploying fiber optic networks can be substantial, with estimates ranging from $5,000 to $10,000 per mile in 2024. This high capital expenditure for new market entries, where initial market penetration is low, aligns with the characteristics of a Question Mark in the BCG matrix.

These ventures represent high-risk, high-reward opportunities, as success depends on Arteria's ability to effectively compete and capture a meaningful share of the target markets.

The strategic decision to enter these new residential areas necessitates careful analysis of competitive landscapes and potential return on investment.

BCG Matrix Data Sources

Our Arteria Networks BCG Matrix leverages a robust dataset, integrating financial disclosures, market growth projections, and competitor performance benchmarks to inform strategic decisions.