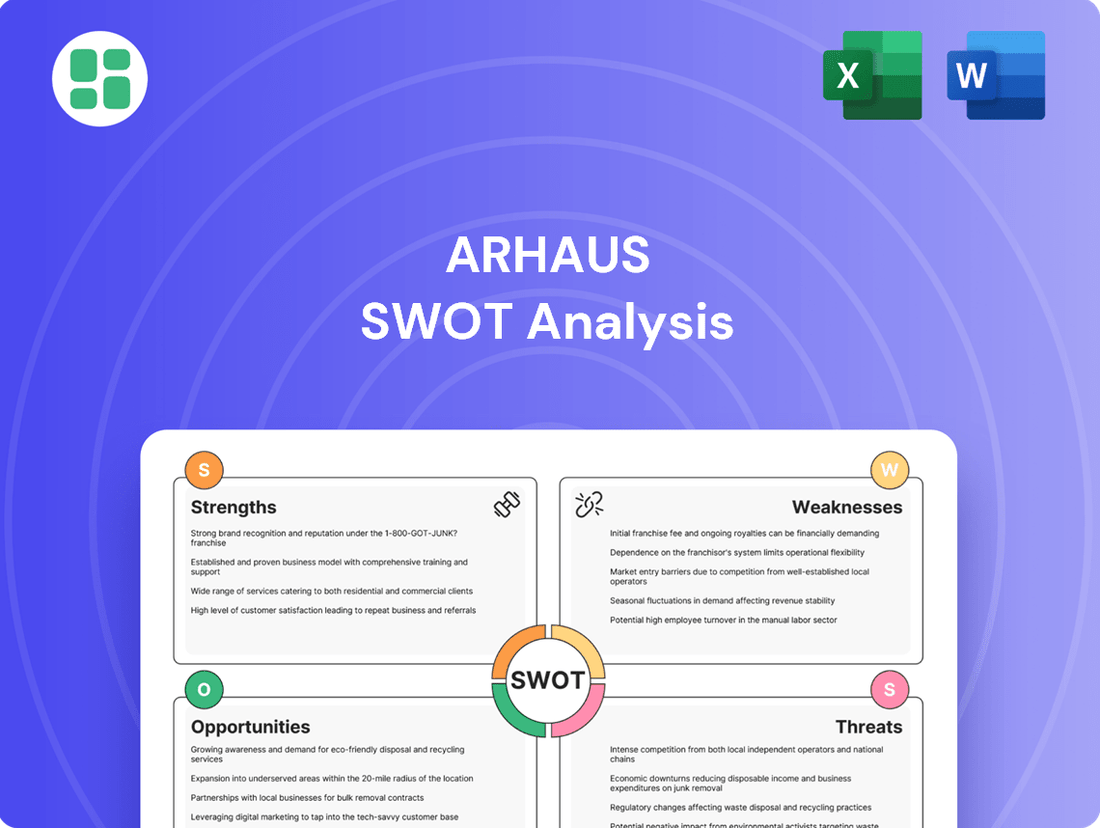

Arhaus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arhaus Bundle

Arhaus boasts strong brand recognition and a unique product offering, but faces intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for navigating the evolving furniture market.

Want the full story behind Arhaus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Arhaus boasts a strong brand reputation built on high-quality, handcrafted furniture and distinctive designs. This allows them to charge premium prices and cultivate a loyal customer base, setting them apart from more mass-produced competitors. In 2023, Arhaus reported robust sales growth, indicating the market's continued appreciation for their unique offerings.

Arhaus's dedication to sustainable and ethical sourcing is a significant strength, appealing strongly to today's environmentally aware consumer base. The company actively utilizes recycled, reclaimed, and responsibly harvested materials in its product lines, a practice that directly addresses growing market demand for eco-friendly options.

This focus on sustainability not only bolsters Arhaus's brand image and corporate social responsibility standing but also creates a distinct competitive advantage. For instance, in 2024, the home furnishings market saw a notable increase in consumer preference for brands demonstrating clear environmental commitments, with studies indicating that over 60% of consumers are willing to pay more for sustainable products.

Arhaus excels with its integrated omnichannel approach, seamlessly blending its physical showrooms with a robust online presence. This strategy allows customers to interact with the brand across various channels, providing convenience and choice in how they discover and buy products.

The company's commitment to physical retail is evident in its ongoing showroom expansion. Arhaus aims to open between five and seven new Traditional Showrooms each year, a move designed to increase brand visibility and make its offerings more accessible to a wider customer base.

Targeting the Premium Home Furnishings Market

Arhaus's strategic focus on the premium home furnishings market allows it to tap into a customer base with higher disposable income. This segment is generally more resilient to economic fluctuations, meaning these customers are more likely to continue investing in quality home goods even during challenging economic periods. For instance, the global luxury furniture market was valued at approximately $25.5 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of around 4.5% through 2030, presenting a robust demand environment.

This specialization enables Arhaus to command higher profit margins compared to mass-market retailers. By avoiding direct price wars with budget-friendly brands, Arhaus cultivates an image of exclusivity and superior craftsmanship. This positioning is crucial for maintaining brand value and attracting discerning consumers.

- Niche Market Focus: Caters to affluent customers less affected by economic downturns.

- Higher Profit Margins: Achieved by avoiding price competition with budget retailers.

- Brand Positioning: Establishes Arhaus as a luxury choice in the home furnishings sector.

- Market Growth: Benefits from the projected significant growth in the luxury furniture market.

Solid Financial Position and Debt-Free Balance Sheet

Arhaus boasts a robust financial standing, notably its absence of long-term debt. As of the first quarter of 2024, the company reported approximately $200 million in cash and cash equivalents, providing significant financial maneuverability.

This debt-free status empowers Arhaus to pursue strategic growth initiatives, including showroom enhancements and technology investments, without the burden of interest payments or the need for external funding. For instance, in 2023, Arhaus invested in opening new locations and enhancing its e-commerce platform, funded entirely through internal resources.

A strong balance sheet translates to greater resilience during economic downturns and supports sustained long-term value for stakeholders. This financial health is a key differentiator in the competitive home furnishings market.

- Debt-Free Operations: Arhaus carries no long-term debt, enhancing financial flexibility.

- Significant Cash Reserves: Q1 2024 cash and equivalents stood around $200 million.

- Strategic Investment Capacity: Enables funding of growth without external financing.

- Market Resilience: A healthy balance sheet provides stability against economic fluctuations.

Arhaus's commitment to handcrafted quality and unique designs cultivates strong brand loyalty and allows for premium pricing. Their robust sales growth in 2023 underscores market appreciation for their distinctive offerings, setting them apart from mass-market competitors.

The company's focus on sustainable and ethical sourcing resonates with environmentally conscious consumers, a growing segment in the home furnishings market. Studies in 2024 indicated over 60% of consumers are willing to pay more for sustainable products, validating Arhaus's strategic approach.

Arhaus operates with no long-term debt, holding approximately $200 million in cash and cash equivalents as of Q1 2024. This financial strength allows for self-funded growth initiatives and provides significant resilience against economic volatility.

| Metric | Value | Source/Period |

|---|---|---|

| Brand Reputation | High Quality, Handcrafted | Arhaus Brand Identity |

| Sales Growth | Robust | 2023 Performance |

| Sustainability Focus | Key Consumer Appeal | 2024 Market Trends |

| Omnichannel Strategy | Integrated Physical & Online | Arhaus Business Model |

| Showroom Expansion | 5-7 New Locations Annually | Arhaus Growth Strategy |

| Target Market | Affluent Consumers | Premium Market Positioning |

| Profit Margins | Higher than Mass-Market | Niche Market Advantage |

| Long-Term Debt | None | Arhaus Financials |

| Cash & Equivalents | ~$200 Million | Q1 2024 |

What is included in the product

Delivers a strategic overview of Arhaus’s internal and external business factors, highlighting its brand equity and customer loyalty while addressing potential supply chain vulnerabilities and competitive pressures.

Offers a clear, actionable breakdown of Arhaus's competitive landscape, simplifying complex strategic decisions.

Weaknesses

Arhaus's premium pricing, while beneficial for its profit margins, naturally narrows its customer appeal, primarily attracting higher-income households. This can hinder its ability to capture a larger market share when compared to brands offering more accessible price points. For instance, in the first quarter of 2024, Arhaus reported net sales of $371.5 million, indicating a strong performance within its target demographic but also highlighting the inherent limitation of its price strategy.

This focus on a more affluent customer base also makes Arhaus more susceptible to economic downturns that impact discretionary spending among wealthier consumers. During periods of economic uncertainty, even high-income individuals may curb spending on luxury home furnishings, potentially affecting Arhaus's sales volume more significantly than less premium-priced competitors. The challenge lies in broadening its appeal without compromising the brand's perceived luxury and quality.

Arhaus's commitment to unique materials and specialized craftsmanship necessitates a reliance on intricate global supply chains. This dependency exposes the company to significant risks, including geopolitical tensions, shipping disruptions, and volatile freight costs, which can directly impact product availability and delivery times for customers.

The fluctuation in raw material prices is another critical weakness stemming from this global sourcing model. For instance, disruptions in the availability of specific hardwoods or artisanal textiles, essential for Arhaus's distinctive product lines, can lead to increased manufacturing costs and potential inventory shortages, affecting sales and customer satisfaction.

Arhaus has faced pressure on its profitability, with gross margins and net income showing a downward trend in recent quarters. This is partly due to rising showroom occupancy expenses and broader economic challenges impacting consumer spending.

Despite a rise in net revenue to $319.6 million in the first quarter of 2025, Arhaus saw a substantial drop in net and comprehensive income. This suggests that while sales are growing, the costs associated with generating those sales are increasing at a faster rate, squeezing profitability.

These declining margins signal potential underlying issues with cost management or pricing power. If these cost pressures persist, they could significantly hinder Arhaus's ability to maintain and grow its overall profitability in the near future.

Vulnerability to Economic Downturns Affecting Discretionary Spending

Arhaus, as a purveyor of premium, non-essential home furnishings, faces a significant weakness in its vulnerability to economic downturns. When the economy tightens, or inflation surges, consumers naturally shift their spending towards necessities, directly impacting demand for high-end furniture. This inherent sensitivity to economic cycles translates into potential revenue fluctuations and decreased sales volumes.

This susceptibility is underscored by broader retail trends. For instance, during periods of economic uncertainty, consumer confidence often dips, leading to a pullback in discretionary purchases. Data from the U.S. Bureau of Economic Analysis in late 2023 and early 2024 indicated a slowdown in durable goods spending, a category that includes furniture, as consumers grappled with persistent inflation and higher interest rates.

- Economic Sensitivity: Arhaus's reliance on discretionary spending makes it highly susceptible to recessions and inflationary pressures, which can suppress demand for luxury home goods.

- Revenue Volatility: Economic contractions can lead to unpredictable sales patterns and a decline in revenue as consumers cut back on non-essential purchases.

- Impact on Sales Volume: During economic slowdowns, lower consumer confidence and reduced disposable income directly translate to lower sales volumes for retailers like Arhaus.

Limited Specific Carbon Emissions Data and Reduction Targets

While Arhaus highlights its dedication to sustainability and ethical sourcing, a notable weakness is the absence of specific, publicly disclosed carbon emissions data. This lack of quantifiable environmental metrics, including concrete reduction targets, could be a point of concern for investors and consumers who increasingly demand transparency and measurable progress on environmental impact.

This gap in reporting makes it challenging for stakeholders to assess Arhaus's actual environmental performance against industry benchmarks or its own stated commitments. For instance, many competitors in the furniture and home goods sector are beginning to publish Scope 1, 2, and 3 emissions, providing clear pathways for improvement. Without such data, Arhaus may struggle to meet the expectations of environmentally conscious stakeholders.

- Lack of Quantifiable Data: Arhaus does not publicly share specific carbon emissions figures.

- Absence of Reduction Targets: There are no documented, measurable targets for reducing environmental impact.

- Investor and Consumer Scrutiny: This transparency gap can be a disadvantage with increasingly environmentally aware investors and consumers.

- Competitive Disadvantage: Competitors are increasingly providing detailed sustainability reports, creating a disparity in perceived commitment.

Arhaus's premium pricing strategy, while supporting its brand image, limits its addressable market to higher-income consumers. This exclusivity, though profitable within its niche, restricts broad market penetration compared to competitors with more accessible price points. For example, in Q1 2024, Arhaus reported net sales of $371.5 million, reflecting strong performance among its target demographic but also highlighting the inherent ceiling imposed by its pricing.

The company's reliance on global supply chains for unique materials and craftsmanship exposes it to significant risks. Geopolitical instability, shipping delays, and fluctuating freight costs can disrupt product availability and impact delivery timelines, potentially frustrating customers. Additionally, volatility in raw material prices, such as specific hardwoods or artisanal textiles, can directly increase manufacturing costs and lead to inventory shortages.

Profitability has been a concern, with gross and net margins showing a downward trend. This pressure is exacerbated by rising showroom expenses and broader economic challenges. Despite a rise in net revenue to $319.6 million in Q1 2025, net income saw a substantial drop, indicating that cost increases are outpacing sales growth, squeezing profitability.

Same Document Delivered

Arhaus SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You're getting a genuine look at the Arhaus SWOT analysis. Upon purchase, you'll receive the complete, detailed report.

The preview you see is the actual document you will receive after purchasing the Arhaus SWOT analysis. No watered-down samples here, just the full, professional report.

Opportunities

Arhaus is strategically expanding its physical presence, aiming for 165 traditional showrooms by 2025, a significant increase from its current footprint. This expansion targets affluent, underserved markets across North America, tapping into new customer bases.

Beyond traditional showrooms, Arhaus is also piloting smaller, more intimate design studios. This dual approach allows for broader market penetration and caters to different customer engagement preferences, potentially driving incremental sales and brand awareness.

The company's expansion strategy is designed to capture new customer segments and fuel continued growth. For instance, in 2023, Arhaus reported a 9.4% increase in net sales compared to 2022, reaching $1.2 billion, demonstrating the effectiveness of its strategic store openings.

Consumers are increasingly prioritizing sustainability, with a significant portion of shoppers willing to pay more for eco-friendly products. For Arhaus, this translates into a prime opportunity to attract a growing market segment that values ethical sourcing and environmental responsibility. By highlighting and potentially obtaining certifications for its sustainable practices, Arhaus can further solidify its brand appeal.

Arhaus can significantly broaden its customer base by investing more in its e-commerce platform and digital marketing efforts. This includes improving the online shopping experience and using data to tailor marketing messages. In 2023, Arhaus reported a notable increase in online sales, contributing to its overall revenue growth, demonstrating the impact of these digital initiatives.

By adopting advanced digital tools like virtual reality for product previews and optimizing online checkout, Arhaus can attract a wider audience and drive more sales. This digital transformation is crucial for sustained growth in the competitive home furnishings market, as seen by the continued rise in e-commerce adoption across the retail sector.

Strategic Partnerships and Collaborations

Forging strategic partnerships with interior designers, architects, and real estate developers presents a significant opportunity for Arhaus to tap into the professional design market. These collaborations can lead to increased brand visibility within influential circles and unlock new revenue streams through project-specific placements and co-branded initiatives. For instance, a partnership with a high-end real estate developer could see Arhaus furnishing model homes, directly showcasing products to potential affluent buyers.

Collaborating with complementary luxury brands or well-aligned influencers offers another avenue for growth. This strategy can introduce Arhaus to new, affluent demographics who value quality and design, potentially driving bulk sales and enhancing brand prestige. Imagine a joint campaign with a luxury home goods brand or a prominent interior design influencer, reaching a curated audience eager for sophisticated home furnishings.

- Targeted Reach: Partnerships with design professionals expose Arhaus to clients actively seeking high-end furnishings.

- Brand Elevation: Collaborations with luxury brands and influencers can bolster Arhaus's image and appeal to a discerning clientele.

- New Market Access: Aligning with real estate developers can place Arhaus products directly in front of potential buyers in premium properties.

- Revenue Diversification: These collaborations can create new sales channels beyond direct-to-consumer retail.

Product Innovation and Diversification into Complementary Categories

Arhaus has a prime opportunity to innovate its product line by introducing new wood furniture selections and versatile designs. The company can also leverage advancements in technology by expanding its offering of sophisticated power motion furniture, catering to evolving consumer preferences for both style and functionality.

Diversifying into complementary high-end home decor categories presents another significant avenue for growth. This could include curated selections of art, premium textiles, or unique lighting fixtures, allowing Arhaus to capture a larger portion of the customer's overall home furnishing expenditure.

Expanding into smart home integration solutions, such as connected furniture or integrated lighting systems, could tap into a growing market segment. This strategic move not only creates new revenue streams but also positions Arhaus as a forward-thinking brand in the evolving home furnishings landscape.

- Product Innovation: Introduction of new wood furniture lines and advanced power motion options.

- Category Diversification: Expansion into high-end home decor accessories and lighting.

- Smart Home Integration: Potential to incorporate smart technology into furniture and home solutions.

Arhaus is strategically expanding its physical footprint, with plans to reach 165 traditional showrooms by 2025, indicating a strong push into new and underserved affluent markets. This growth is complemented by smaller design studios, broadening market reach and catering to varied customer preferences, which has already shown success with a 9.4% net sales increase in 2023, totaling $1.2 billion.

The company can capitalize on the growing consumer demand for sustainability by highlighting eco-friendly practices and certifications, appealing to a segment willing to pay more for ethical products. Furthermore, enhancing its e-commerce platform and digital marketing, including virtual reality previews and optimized checkouts, presents a significant opportunity to attract a wider audience and boost online sales, which already contributed notably to 2023 revenue growth.

Strategic partnerships with interior designers, architects, and real estate developers offer a pathway to penetrate the professional design market and secure project-specific placements, potentially furnishing model homes for direct exposure to affluent buyers. Collaborations with complementary luxury brands and influencers can elevate brand prestige and introduce Arhaus to new, discerning demographics, fostering bulk sales and brand recognition.

Product line innovation, including new wood furniture selections and advanced power motion options, alongside diversification into high-end home decor categories like art and lighting, allows Arhaus to capture a larger share of consumer spending. Exploring smart home integration, such as connected furniture, could tap into emerging market trends and position Arhaus as an innovative leader in the evolving home furnishings sector.

| Opportunity Area | Specific Initiative | Potential Impact |

|---|---|---|

| Market Expansion | Increase traditional showrooms to 165 by 2025 | Reach new affluent customer segments |

| Digital Engagement | Enhance e-commerce and virtual try-on features | Drive online sales and customer acquisition |

| Brand Partnerships | Collaborate with interior designers and luxury brands | Increase brand visibility and access new clientele |

| Product Development | Introduce sustainable lines and smart home integration | Attract eco-conscious consumers and tap into tech trends |

Threats

A significant threat to Arhaus is a broad economic recession or a prolonged period of high inflation. These conditions directly impact consumer discretionary spending, particularly on high-ticket, non-essential items like luxury furniture. For instance, if inflation remains elevated, as seen in some periods of 2023 and early 2024 with CPI figures fluctuating, consumers may postpone or cancel purchases of premium home furnishings.

Such an economic downturn could translate into decreased sales volumes for Arhaus, putting pressure on their profit margins. Additionally, a slowdown in demand might lead to increased inventory levels, tying up capital and potentially requiring markdowns. Arhaus's premium positioning, while a strength, makes it especially vulnerable to these economic shifts as consumers tighten their belts.

The home furnishings sector is intensely competitive, with Arhaus facing pressure from both established luxury players and nimble online-only competitors. For instance, the U.S. furniture and home furnishings market was valued at approximately $260 billion in 2023, a figure expected to grow. This crowded landscape means rivals employing aggressive pricing, novel product introductions, or superior digital engagement can significantly impact Arhaus's market standing and financial performance.

Global supply chain vulnerabilities, exacerbated by geopolitical tensions and labor issues, present a substantial threat to Arhaus's operational efficiency and product availability. For instance, the ongoing global shipping container shortages and port congestion experienced throughout 2023 and into early 2024 have significantly impacted delivery times and increased freight costs for many retailers.

Furthermore, rising costs for key raw materials like lumber and metal, coupled with escalating manufacturing and international shipping expenses, could squeeze Arhaus's profit margins. The company's strategic move to reduce reliance on China sourcing, a trend observed across many industries in 2023 to diversify production bases, aims to mitigate some of these cost and availability risks.

Shifts in Consumer Preferences and Design Trends

Consumer tastes and interior design trends are in constant flux, posing a significant challenge for Arhaus. A sudden move away from the brand's characteristic handcrafted, rustic, or sustainably-minded aesthetic could dampen demand for its core offerings.

For instance, if the market pivots sharply towards minimalist or ultra-modern styles, Arhaus's signature look might lose its appeal. This necessitates continuous market observation and agile adaptation to evolving preferences to prevent the accumulation of slow-moving, out-of-style inventory.

- Evolving Tastes: The interior design market saw a continued emphasis on natural materials and artisanal craftsmanship in 2024, but a rapid shift towards synthetic or mass-produced aesthetics could negatively impact Arhaus.

- Trend Responsiveness: Failure to quickly integrate emerging design elements, such as the growing interest in biophilic design or smart home integration in furniture, could lead to a competitive disadvantage.

- Inventory Risk: The risk of carrying substantial inventory that no longer aligns with prevailing design trends is a direct threat, potentially leading to markdowns and reduced profitability.

Reputational Risks from Sustainability or Quality Concerns

Arhaus faces reputational risks if its sustainability or quality claims don't hold up. For instance, if customers perceive a disconnect between their ethical sourcing commitments and actual practices, it could erode brand loyalty. A significant product recall due to quality issues, especially in 2024 or early 2025, could trigger negative social media attention and impact sales.

Any misstep in communicating its environmental, social, and governance (ESG) initiatives could also backfire. For example, if Arhaus's 2024 sustainability reports are questioned for transparency, it might alienate environmentally conscious consumers. This could lead to a tangible drop in revenue, potentially impacting their projected 2025 performance.

- Brand Image Vulnerability: Negative press regarding material sourcing or production ethics can quickly tarnish Arhaus's carefully cultivated image.

- Consumer Trust Erosion: Perceived lapses in product durability or ethical supply chains can lead to a loss of faith among its customer base.

- Sales Impact: Public dissatisfaction, amplified by social media, can directly translate into reduced sales figures.

Arhaus faces the threat of intense competition within the home furnishings market, valued around $260 billion in 2023, from both established luxury brands and agile online retailers. This competitive pressure can lead to pricing wars or necessitate increased marketing spend, impacting profitability.

Economic downturns, such as potential recessions or sustained high inflation seen in 2023-2024, directly curb discretionary spending on premium furniture. This vulnerability is heightened for Arhaus, whose higher price points make it susceptible to consumer belt-tightening.

Supply chain disruptions, including shipping delays and rising raw material costs experienced through 2023-2024, continue to pose a risk to Arhaus's operational efficiency and cost management. Diversifying sourcing, as many companies did in 2023, is a strategy to mitigate these issues.

Shifting consumer tastes and interior design trends present a challenge; a rapid move away from Arhaus's signature aesthetic could lead to inventory obsolescence and reduced demand.

SWOT Analysis Data Sources

This Arhaus SWOT analysis is built upon a foundation of credible data, including Arhaus's official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a robust understanding of the company's performance and the competitive landscape.