Arhaus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arhaus Bundle

Arhaus navigates a competitive landscape shaped by buyer power and the threat of substitutes, impacting its pricing and product innovation. Understanding these forces is crucial for any stakeholder in the home furnishings sector.

The complete report reveals the real forces shaping Arhaus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in Arhaus's bargaining power of suppliers. Arhaus's commitment to craftsmanship and sustainable sourcing means it often relies on a select group of specialized suppliers for unique materials and ethically sourced components. If these suppliers are limited in number, their ability to dictate terms, including pricing and availability, significantly increases.

This reliance on a concentrated supplier base can create vulnerability for Arhaus. Should these few key suppliers decide to raise prices or face disruptions, Arhaus could experience increased costs or delays in production, impacting its ability to meet customer demand and maintain its brand promise. For instance, in early 2024, the furniture industry experienced supply chain challenges impacting the availability of certain hardwoods, a common material in Arhaus's product lines, highlighting the potential impact of supplier concentration.

Arhaus's reliance on suppliers for its unique, artisan-crafted furniture means that switching could be quite expensive. Imagine the effort to find new partners who can consistently deliver the same level of craftsmanship and adhere to Arhaus's strict standards for sustainable materials. This process would likely involve significant investment in product redesign and the establishment of new quality assurance protocols.

For Arhaus, the costs associated with changing suppliers are substantial. These include the expense of redesigning furniture to match new material specifications or production capabilities, as well as the time and resources needed to vet and onboard new manufacturing partners. In 2023, Arhaus reported net sales of $1.3 billion, highlighting the scale of their operations and the potential impact of supply chain disruptions or the cost of switching.

Suppliers offering rare materials or possessing unique artisan skills vital to Arhaus’s product differentiation inherently wield greater bargaining power. Arhaus's emphasis on heirloom quality and sustainable sourcing necessitates distinct inputs that are not readily available from common suppliers, thereby increasing the leverage of these specialized providers.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while not a dominant force in the furniture sector, could significantly shift bargaining power. If a major supplier were to establish their own retail presence, they could directly compete with Arhaus, giving them leverage in negotiations.

However, this risk is generally contained. Launching a successful retail operation, particularly in the premium home furnishings market where Arhaus competes, demands substantial capital investment and considerable effort in brand development. These barriers make it less likely for suppliers to pursue this strategy.

For instance, establishing a new retail store can cost anywhere from $250,000 to over $1 million depending on size and location, a significant hurdle for many suppliers. Furthermore, building brand recognition and customer loyalty in a crowded market like home furnishings requires sustained marketing and operational excellence, areas where specialized manufacturers may lack expertise.

- Forward Integration Threat: Suppliers entering Arhaus's retail market increases their bargaining power.

- Mitigating Factors: High capital costs and brand-building requirements deter suppliers.

- Industry Context: Premium retail segment presents significant barriers to entry for new players.

Importance of Arhaus to Suppliers

The bargaining power of Arhaus's suppliers is influenced by how crucial Arhaus is to their overall business. If Arhaus accounts for a significant percentage of a supplier's revenue, that supplier may have less leverage to demand higher prices or more favorable terms, as they would want to protect their substantial business relationship.

Conversely, if Arhaus is a relatively small customer for a specialized supplier, that supplier's bargaining power increases. This is especially true if the supplier offers unique or hard-to-replicate components essential to Arhaus's product quality and differentiation.

Arhaus's substantial scale and consistent demand for high-quality materials and finished goods can also impact supplier power. For instance, Arhaus's commitment to sourcing unique, handcrafted furniture means its demand for specialized artisanal components can give those niche suppliers more leverage.

- Supplier Dependence: If a supplier relies heavily on Arhaus for a large share of its sales, its bargaining power diminishes.

- Arhaus's Client Size: When Arhaus is a minor client to a large, specialized supplier, the supplier's bargaining power is amplified.

- Component Uniqueness: The availability of specialized, high-quality components that Arhaus requires can shift power towards suppliers.

- Demand Consistency: Arhaus's steady demand for specific product lines can solidify relationships but also create dependence for suppliers.

The bargaining power of Arhaus's suppliers is moderately high, primarily due to the specialized nature of the materials and craftsmanship required for its premium furniture. Many of Arhaus's products rely on unique, ethically sourced components and artisan skills that are not widely available, giving these select suppliers significant leverage.

Arhaus's reliance on a concentrated supplier base for these specialized inputs means that disruptions or price increases from these few key providers can directly impact Arhaus's costs and production timelines. For example, in early 2024, the industry faced challenges with hardwood availability, a material critical to Arhaus's offerings.

The cost and complexity of switching suppliers for Arhaus are substantial, involving product redesign and new quality assurance processes. In 2023, Arhaus reported net sales of $1.3 billion, indicating the scale at which these supply chain dynamics can affect overall financial performance.

While suppliers entering Arhaus's retail market (forward integration) could increase their power, the high capital investment and brand-building requirements in the premium home furnishings sector act as significant deterrents, limiting this threat.

| Factor | Arhaus Impact | Supplier Leverage |

|---|---|---|

| Supplier Concentration | High reliance on few specialized suppliers | Increased leverage for suppliers |

| Switching Costs | High due to product design and quality control | Suppliers benefit from customer stickiness |

| Component Uniqueness | Arhaus requires rare materials and artisan skills | Suppliers with unique offerings have greater power |

| Forward Integration Threat | Low due to high barriers to entry | Limited threat to Arhaus's market position |

What is included in the product

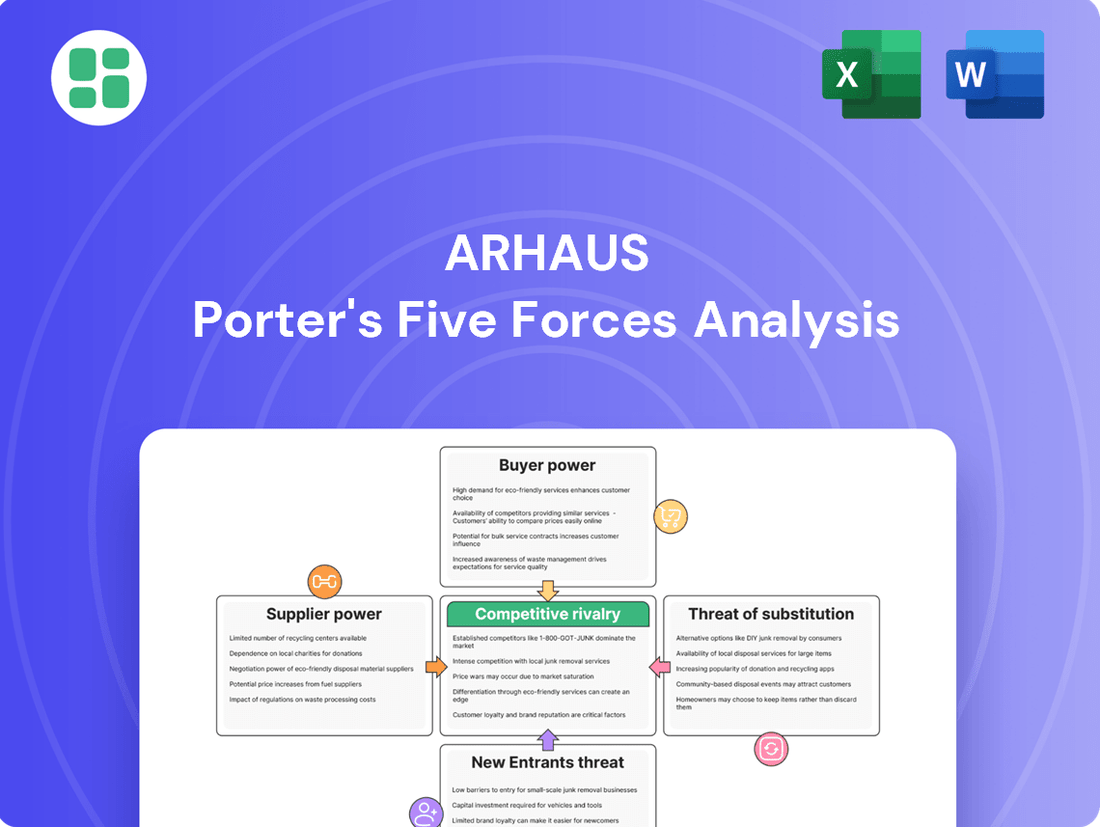

This Porter's Five Forces analysis for Arhaus examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on the home furnishings market.

Instantly identify strategic vulnerabilities and opportunities within the furniture industry with a clear, actionable Arhaus Porter's Five Forces analysis.

Customers Bargaining Power

Customers looking for home furnishings have a vast selection, from large retailers like Pottery Barn and West Elm to boutique luxury brands and even direct-to-consumer online options. This abundance of choices means Arhaus faces significant pressure from buyers who can easily compare prices, styles, and quality across numerous competitors. For instance, the online furniture market alone is projected to reach $177.3 billion by 2027, highlighting the sheer volume of alternatives available.

While Arhaus positions itself with high-quality home goods, potentially making its customers less price-sensitive than those seeking mass-market options, broader economic conditions can shift this dynamic. For instance, persistent inflation and general economic uncertainty, prevalent in 2024, can lead even affluent consumers to scrutinize prices more closely, thereby increasing their bargaining power.

Data from 2024 indicates that a notable percentage of consumers, even those with higher incomes, have postponed discretionary purchases, including furniture, due to inflationary pressures. This postponement directly translates to heightened buyer power for customers, as retailers like Arhaus may need to offer more competitive pricing or value-added services to entice these hesitant buyers.

The increasing availability of product information and price comparisons online significantly boosts customer bargaining power. With e-commerce platforms and digital tools, consumers can easily research Arhaus's offerings against competitors, scrutinizing features, quality, and pricing. This transparency allows them to identify the best value proposition, putting pressure on Arhaus to remain competitive.

Low Switching Costs for Customers

For consumers, the effort and expense involved in switching from one furniture retailer to another are typically minimal. This low barrier means customers can easily opt for a different brand or store for their next furniture acquisition. Consequently, Arhaus needs to consistently deliver attractive value, distinctive design, and superior service to keep its customers and mitigate the influence of buyer power.

The low switching costs empower customers, as they can readily explore alternatives if Arhaus's offerings don't meet their expectations or if a competitor presents a more appealing proposition. This dynamic necessitates Arhaus maintaining a strong value proposition and excellent customer relationships.

- Low Switching Costs: Customers can easily shift between furniture retailers without incurring significant financial penalties or operational disruptions.

- Impact on Arhaus: This necessitates continuous efforts in product innovation, pricing strategies, and customer service to maintain loyalty and reduce the bargaining power of buyers.

- Customer Choice: The ease of switching allows customers to readily compare offerings and select the best value, design, and quality available in the market.

Customer Concentration (Low)

Arhaus benefits from serving a wide array of individual consumers rather than relying on a few major clients. This broad customer base, as of their 2024 financial reporting, indicates a low degree of customer concentration. For instance, their diverse sales channels, including e-commerce and numerous physical showrooms, cater to a dispersed demographic, preventing any single buyer or small group from wielding substantial influence.

The diffusion of bargaining power across a large number of individual customers means that Arhaus is not beholden to the demands of a select few. This structure limits the ability of any one customer or small segment to dictate terms, pricing, or product specifications. While individual customer power is minimal, Arhaus still monitors broader consumer preferences and market trends, which collectively shape demand and influence the business environment.

- Low Customer Concentration: Arhaus's business model is built on reaching a broad consumer market, not a few large institutional buyers.

- Distributed Bargaining Power: No single buyer or small group of buyers holds significant leverage due to this wide customer distribution.

- Individual vs. Collective Influence: While individual customers have limited power, collective consumer sentiment and trends still impact Arhaus.

- Market Reach: Arhaus's extensive network of showrooms and online presence facilitates broad consumer engagement, reinforcing low customer concentration.

The bargaining power of customers in the home furnishings sector remains a significant factor for Arhaus. With a crowded marketplace offering abundant choices, consumers can easily compare prices and styles, increasing their leverage. Economic conditions in 2024, marked by inflation, have made consumers more price-conscious, even among higher-income demographics, potentially delaying discretionary purchases and amplifying buyer power.

The ease with which customers can switch between retailers, coupled with readily available online information and price comparisons, further empowers them. Arhaus must therefore focus on delivering exceptional value, unique designs, and superior customer service to retain loyalty and mitigate the influence of this buyer power.

Arhaus's broad customer base, rather than reliance on a few large clients, limits the concentration of bargaining power. This wide distribution means no single buyer or small group can dictate terms, although collective consumer sentiment and market trends continue to shape demand and influence Arhaus's strategies.

| Factor | Arhaus Impact | 2024 Context |

|---|---|---|

| Abundant Choices | Increased price and style comparison | Vast online and brick-and-mortar competition |

| Low Switching Costs | Need for continuous value proposition | Minimal financial or operational barriers for customers |

| Price Sensitivity | Potential for postponed purchases | Inflationary pressures leading to more cautious spending |

| Information Transparency | Pressure for competitive pricing and clear value | Easy access to competitor data online |

What You See Is What You Get

Arhaus Porter's Five Forces Analysis

This preview displays the Arhaus Porter's Five Forces Analysis in its entirety, showcasing the precise document you will receive instantly upon purchase. You're not seeing a sample; this is the complete, professionally formatted analysis ready for your immediate use. Every detail, from the in-depth examination of competitive rivalry to the assessment of buyer and supplier power, is included here and will be yours to download. Rest assured, what you see is exactly what you get, providing a transparent and reliable resource for your strategic planning.

Rivalry Among Competitors

The home furnishings market is exceptionally fragmented, featuring a broad spectrum of players. Arhaus contends with large big-box retailers, niche luxury brands, and a growing number of online-only purveyors, all vying for consumer attention and dollars.

Arhaus experiences direct competition from other premium home furnishings brands that offer similar quality and design aesthetics. However, it also faces indirect rivalry from more generalist home goods retailers that may not specialize in the same segment but still capture a portion of home decorating budgets.

This multifaceted competitive environment, characterized by both direct and indirect challengers across various price points and distribution channels, significantly amplifies the intensity of rivalry within the industry.

The luxury furniture market is projected for robust expansion, with forecasts pointing to continued growth in the coming years. This positive outlook for the sector, alongside steady growth in the broader home furnishings market, suggests a favorable environment for companies like Arhaus.

However, this attractive growth rate also acts as a magnet for new competitors and incentivizes existing players to ramp up their investments and expansion efforts. This dynamic can intensify the rivalry as companies vie more aggressively for market share within this expanding segment.

Arhaus cultivates competitive rivalry through its emphasis on craftsmanship, sustainable sourcing, and distinctive furniture designs, fostering a loyal customer base. This differentiation strategy is crucial in the luxury furniture sector where brand perception and aesthetic appeal are paramount.

While Arhaus excels in these areas, many rivals also highlight design, quality, and eco-friendly initiatives. For instance, many high-end furniture brands in 2024 are investing heavily in artisanal techniques and transparent supply chains to capture market share. This necessitates Arhaus to consistently innovate and clearly communicate its unique value proposition to maintain its competitive edge in a saturated market.

Exit Barriers

High exit barriers are a significant factor in competitive rivalry. When companies have substantial fixed assets, like Arhaus's extensive network of physical showrooms and significant inventory, they are often reluctant to leave the market, even when facing challenging economic conditions. This can intensify competition as these businesses are essentially locked in and must continue to operate and vie for market share.

Arhaus's strategic expansion of its showroom footprint, with plans to open approximately 15 new locations in 2024, indicates a considerable investment in physical retail. This growth directly contributes to higher exit barriers. The capital expenditure required for these new showrooms, coupled with ongoing operational costs and established supply chain relationships, makes it more difficult and costly for Arhaus to divest or exit the market if faced with sustained downturns.

- Arhaus's 2023 revenue reached $1.3 billion.

- The company plans to open around 15 new showrooms in 2024.

- High fixed asset investment, including showrooms and inventory, creates significant exit barriers.

- These barriers can lead to prolonged and intense competition within the furniture retail sector.

Aggressiveness of Competitors

Competitors in the luxury home furnishings sector are notably aggressive. RH, for instance, has been actively expanding its showroom concepts, often integrating them with dining and design services, a strategy designed to deepen customer engagement and capture a larger share of wallet. This push for innovative retail experiences and comprehensive design solutions creates a dynamic and challenging environment.

This intense rivalry extends to pricing, marketing, and physical footprint. Companies like RH are investing heavily in creating immersive brand experiences, which can necessitate significant capital expenditure. Arhaus must continually adapt its strategies to counter these moves, potentially impacting its own pricing flexibility and marketing budgets to retain its market standing.

- Aggressive Showroom Expansion: Competitors like RH are expanding their physical presence with larger, more experiential showrooms.

- Integrated Design Services: Offering in-house design services is a key strategy to attract and retain high-end clientele.

- Pricing and Marketing Campaigns: Intense competition often involves aggressive pricing and marketing efforts to capture market share.

- Pressure on Market Position: These combined competitive actions can exert significant pressure on Arhaus to maintain its competitive edge and market share in the luxury segment.

Competitive rivalry within the home furnishings market is intense, driven by a fragmented industry landscape and aggressive strategies from key players. Arhaus faces competition from large retailers, niche luxury brands, and online purveyors, all vying for market share. The luxury segment, specifically, is experiencing robust growth, attracting further investment and intensifying competition as companies like RH expand experiential showrooms and integrated design services.

Arhaus's differentiation through craftsmanship and design is crucial, but rivals also highlight similar attributes, necessitating continuous innovation. High exit barriers, such as Arhaus's significant investment in its showroom network, with plans for approximately 15 new locations in 2024, can lock companies into the market, prolonging competitive pressures.

| Competitor Action | Impact on Arhaus | 2024 Context |

|---|---|---|

| Aggressive Showroom Expansion (e.g., RH) | Increased market saturation, potential for price wars | Arhaus plans ~15 new showrooms, mirroring competitor growth |

| Integrated Design & Experiential Retail | Pressure to enhance customer experience and service offerings | Rivals focus on immersive brand experiences beyond just product |

| Emphasis on Quality & Sustainability | Need for clear communication of unique value proposition | Many high-end brands invest in artisanal techniques and transparent supply chains |

| High Fixed Asset Investment | Contributes to higher exit barriers, prolonging rivalry | Arhaus's significant showroom investment (~$1.3 billion 2023 revenue) creates these barriers |

SSubstitutes Threaten

The rise of DIY and second-hand markets presents a substantial threat to Arhaus. Consumers increasingly turn to do-it-yourself furniture projects or seek out vintage, refurbished, and pre-owned pieces as more budget-friendly and unique alternatives to new, high-end items. This trend taps into a desire for personalization and cost savings, directly challenging the value proposition of purchasing new furniture.

Furniture rental and staging services present a notable threat of substitutes for Arhaus. For consumers needing furniture for a limited time, such as for a home staging to sell a property or for a temporary living situation, these services offer a viable alternative to purchasing new. In 2024, the home staging industry continued its growth, with many real estate professionals recommending it to accelerate sales, potentially diverting demand from permanent furniture purchases.

Consumers seeking to refresh their living spaces may opt for alternative home decor categories instead of purchasing large furniture pieces. This includes investing in items like wall art, lighting fixtures, textiles such as rugs and curtains, or smaller decorative accessories. The broader home decor market, valued at approximately $149 billion in 2023 and projected for continued growth, offers numerous avenues to enhance aesthetics without the significant investment of new furniture.

Multi-functional and Space-saving Furniture

The rise of multi-functional and space-saving furniture presents a significant threat of substitutes for companies like Arhaus. As urban living becomes more prevalent, consumers increasingly seek furniture that serves multiple purposes and maximizes limited living areas. This often means a single, adaptable piece can replace several specialized items, reducing the overall need for a comprehensive furniture collection.

This trend is directly impacting consumer purchasing decisions. For instance, in 2024, the global market for smart furniture, which often incorporates multi-functional elements, is projected to reach over $5 billion, indicating strong consumer interest in these alternatives. Retailers offering innovative solutions in this space can draw customers away from traditional, single-purpose furniture providers.

- Increasing Demand: Urbanization and smaller living spaces are driving a higher demand for furniture that combines multiple functions, like sofa beds or tables with built-in storage.

- Cost-Effectiveness: Consumers may perceive multi-functional pieces as more economical than purchasing separate items for different needs.

- Availability: A wide array of retailers, from large chains to online direct-to-consumer brands, now offer these space-saving solutions, increasing accessibility and choice for buyers.

Delaying or Forgoing Purchases

During periods of economic strain, such as the inflation experienced in early 2024, consumers often postpone or completely bypass furniture purchases. This means they might keep their current furniture for longer or reallocate funds to more immediate needs.

Consumer confidence, a key indicator of spending habits, saw fluctuations throughout 2024. For instance, the University of Michigan Consumer Sentiment Index, a widely watched metric, reported varying levels of optimism, directly impacting discretionary spending on items like home furnishings.

This behavior presents a significant threat of substitutes for Arhaus. When consumers delay purchases, they are essentially substituting the need for new furniture with the continued use of existing items, or by prioritizing other expenditures like travel or essential goods.

- Economic Uncertainty Impact: Inflationary pressures in 2024 led many households to reduce spending on non-essential goods.

- Consumer Sentiment: Fluctuations in consumer confidence directly correlate with the likelihood of delaying furniture purchases.

- Substitute Behavior: Consumers opt to extend the life of current furniture or redirect funds to other priorities, acting as substitutes for new Arhaus products.

The threat of substitutes for Arhaus is significant, encompassing DIY projects, the second-hand market, and furniture rental services. These alternatives offer cost savings and unique appeal, directly challenging Arhaus's value proposition. In 2024, the growing popularity of home staging, which utilizes rental furniture, further diverted potential buyers from outright purchases.

Consumers are also increasingly choosing to invest in other home decor categories, such as art and lighting, as a way to refresh their spaces instead of buying new furniture. The broader home decor market's continued growth, projected to exceed $149 billion in 2023, highlights the availability of these alternative spending avenues.

Multi-functional and space-saving furniture also poses a threat, especially with increasing urbanization. The global smart furniture market, valued at over $5 billion in 2024, demonstrates a strong consumer interest in adaptable pieces that can replace multiple traditional items.

Economic factors, like the inflation experienced in early 2024, also play a role. Consumers facing economic strain often delay or forgo furniture purchases, opting to extend the life of existing items or prioritize other expenses, effectively substituting new furniture with continued use of current possessions.

| Threat of Substitutes | Description | 2024 Relevance |

| DIY & Second-Hand Market | Budget-friendly and unique alternatives to new furniture. | Continued consumer interest in personalization and cost savings. |

| Furniture Rental & Staging | Viable for temporary needs and property sales. | Home staging industry growth accelerated sales, diverting demand. |

| Alternative Home Decor | Investing in art, lighting, textiles to refresh spaces. | Broader home decor market valued at ~$149B in 2023, offering alternatives. |

| Multi-functional Furniture | Space-saving and adaptable pieces replacing multiple items. | Global smart furniture market projected over $5B in 2024, indicating demand. |

| Economic Downturns | Delayed purchases due to inflation and consumer sentiment. | Inflationary pressures led to reduced non-essential spending. |

Entrants Threaten

Entering the premium home furnishings market, particularly with a hybrid model blending physical showrooms and robust e-commerce like Arhaus, demands significant upfront capital. This includes substantial investments in acquiring and maintaining quality inventory, securing prime real estate for showrooms, establishing reliable manufacturing partnerships, and executing comprehensive marketing campaigns. These considerable capital requirements act as a formidable barrier, deterring many potential new competitors from entering the space.

Established brands like Arhaus have cultivated strong brand loyalty and a reputation for quality, craftsmanship, and sustainability over many years. This deep customer connection makes it difficult for newcomers to lure away existing clientele. For instance, Arhaus reported a 10.5% increase in net sales for the first quarter of 2024, indicating continued consumer confidence in their brand.

New entrants face the significant hurdle of building similar trust and recognition. This endeavor demands considerable investment in marketing and brand building, often taking years to yield comparable results. Without a strong existing reputation, new companies struggle to command premium pricing or secure customer commitment, directly impacting their ability to compete effectively.

Arhaus relies on its established network of physical stores and a robust e-commerce platform to reach customers. For new entrants, gaining access to desirable retail locations and building efficient omnichannel distribution systems presents a significant hurdle, requiring substantial capital investment and strategic partnerships.

Proprietary Sourcing and Design

Arhaus's unique approach to product development, which involves directly designing and sourcing from global manufacturers and artisans, presents a significant hurdle for potential new competitors. This proprietary model fosters exclusivity and a distinct brand identity that is challenging for newcomers to emulate.

Developing comparable exclusive sourcing relationships and cultivating in-house design expertise requires substantial time, investment, and established networks. These are not easily replicated, thereby deterring new entrants from easily entering the market.

- Proprietary Design and Sourcing: Arhaus's direct engagement with manufacturers and artisans creates unique product offerings.

- Barrier to Entry: Replicating these exclusive sourcing relationships and design capabilities is difficult and time-consuming for new companies.

- Brand Differentiation: This model allows Arhaus to offer distinctive products that set it apart in the competitive furniture market.

Regulatory Hurdles and Sustainability Standards

The increasing focus on sustainability and ethical sourcing presents significant regulatory challenges for new entrants in the furniture industry. Companies must now contend with evolving environmental standards and consumer demand for transparency in supply chains. For instance, by 2024, many regions are implementing stricter regulations on material sourcing and waste management, requiring substantial upfront investment in compliance.

Navigating these sustainability standards is particularly daunting for newcomers aiming to compete in the luxury home furnishings market, where Arhaus operates. These requirements can translate into higher operational costs and a longer time-to-market as new entrants establish compliant processes and certifications. Failure to meet these benchmarks can lead to reputational damage and market exclusion.

- Regulatory Compliance Costs: New entrants face significant initial outlays for certifications like FSC (Forest Stewardship Council) for wood products or GREENGUARD for indoor air quality, which can add 5-15% to initial setup costs.

- Supply Chain Scrutiny: Consumers and regulators increasingly demand proof of ethical labor practices and sustainable material sourcing, necessitating robust auditing and traceability systems from day one.

- Brand Reputation Risk: A single lapse in sustainability standards can severely damage a new brand's reputation, especially in the discerning luxury market, making compliance a critical competitive factor.

The threat of new entrants into the premium home furnishings market, where Arhaus competes, is generally low. Significant capital is required for inventory, prime real estate, and marketing, creating a high barrier. Furthermore, established brands like Arhaus benefit from strong brand loyalty built on quality and craftsmanship, making it difficult for newcomers to gain traction and trust.

Arhaus's proprietary design and sourcing model, which involves direct relationships with global artisans, further deters new entrants. Replicating these exclusive networks and design capabilities demands substantial time and investment. Additionally, increasing regulatory focus on sustainability and ethical sourcing adds complexity and cost for new companies, requiring significant upfront investment in compliance and certifications.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for inventory, showrooms, and marketing. | Deters many potential competitors due to financial demands. |

| Brand Loyalty & Reputation | Established trust in quality, craftsmanship, and sustainability. | Difficult for newcomers to attract customers from established brands. |

| Proprietary Design & Sourcing | Exclusive relationships with global artisans and designers. | Challenging for new entrants to replicate unique product offerings. |

| Distribution Channels | Established network of physical stores and robust e-commerce. | Requires significant investment and strategic partnerships for new entrants to build comparable reach. |

| Sustainability Regulations | Increasingly stringent environmental and ethical sourcing standards. | Adds compliance costs and time-to-market for new companies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Arhaus is built upon comprehensive data from Arhaus's own investor relations website, SEC filings, and annual reports. This allows for a deep understanding of their financial health, strategic direction, and operational capabilities.

We supplement internal data with insights from leading industry research firms like IBISWorld and Statista, as well as market share data from reputable sources, to accurately assess the competitive landscape and external forces impacting Arhaus.