Arhaus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arhaus Bundle

Unlock the full picture of Arhaus's operating environment with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are shaping the furniture industry and Arhaus's strategic direction. Download the complete analysis to gain actionable insights and refine your own market approach.

Political factors

Changes in international trade policies and tariffs directly influence Arhaus's operational costs. For instance, a shift in tariffs on furniture or raw materials imported from key sourcing regions could increase the cost of goods sold. This is particularly relevant given Arhaus's reliance on global artisan craftsmanship.

The furniture industry, including companies like Arhaus, faces ongoing uncertainty regarding tariffs in 2025. For example, potential tariffs on goods from China could force a reassessment of sourcing strategies and impact the final price of products for consumers.

Trade relations with countries like Canada and Mexico are also crucial. Any changes in trade agreements or the imposition of new tariffs could disrupt Arhaus's supply chain, leading to higher expenses and potentially affecting its pricing competitiveness in the market.

Government regulations on product safety, including material composition and flammability, significantly shape Arhaus's product design and manufacturing. For instance, adherence to evolving standards like those concerning formaldehyde emissions or updated fire safety requirements is paramount. Failure to comply can lead to costly product recalls, hefty legal penalties, and severe damage to Arhaus's brand reputation.

Consumer protection laws are constantly evolving, impacting how Arhaus advertises and manages customer information. For instance, the Federal Trade Commission (FTC) actively enforces truth-in-advertising standards, which directly influence how Arhaus describes its furniture and pricing. Failure to comply can lead to significant penalties and reputational damage.

Adherence to these regulations is critical for Arhaus to maintain consumer trust and avoid legal entanglements. This includes ensuring accuracy in product descriptions, the clarity of warranties, and the secure handling of customer data, especially in light of increasing data privacy concerns and regulations like the California Consumer Privacy Act (CCPA).

Political Stability in Sourcing Regions

Political stability in Arhaus's sourcing regions is a critical factor. Geopolitical tensions or instability in countries where Arhaus procures materials or manufactures goods can significantly disrupt its supply chains. For instance, if a key supplier is located in a region experiencing political unrest, it could lead to production halts and delivery delays. This directly impacts Arhaus's ability to maintain product availability and meet customer demand.

The impact of such disruptions can be substantial. Increased shipping costs due to rerouting or transit delays can eat into profit margins. Furthermore, maintaining consistent product quality and availability becomes a challenge when supply chains are compromised by political instability. For example, in 2024, ongoing geopolitical conflicts in Eastern Europe and the Middle East have led to significant increases in global shipping costs, with some routes experiencing surcharges of over 50% compared to pre-conflict levels, affecting companies with international supply chains like Arhaus.

- Supply Chain Vulnerability: Arhaus's reliance on global sourcing makes it susceptible to disruptions from political instability in key manufacturing or raw material sourcing countries.

- Increased Operational Costs: Geopolitical events can drive up transportation expenses and potentially necessitate finding alternative, more expensive suppliers.

- Product Availability Issues: Political unrest can cause delays in production and shipping, leading to stockouts and impacting Arhaus's ability to fulfill orders promptly.

Taxation Policies

Changes in corporate tax rates, such as potential adjustments in the U.S. federal corporate tax rate, could directly impact Arhaus's net income and its ability to reinvest in growth. For instance, if corporate tax rates were to increase, Arhaus's profitability per dollar of revenue would decrease, potentially leading to higher prices for consumers or reduced investment in new store openings or product lines. Conversely, a decrease in corporate taxes would offer a boost to the company's bottom line.

Fluctuations in sales tax rates across different states where Arhaus operates can also influence consumer purchasing decisions and the company's revenue streams. For example, an increase in sales tax in a key market might deter some customers, while a reduction could stimulate demand. Furthermore, changes to import duties on furniture and home decor items, which Arhaus likely sources internationally, can significantly affect the cost of goods sold and, consequently, Arhaus's pricing and profit margins.

Opportunities may arise from tax policies that incentivize environmentally friendly business practices. If governments offer tax credits or deductions for companies investing in sustainable sourcing, manufacturing, or supply chain initiatives, Arhaus could leverage these to reduce its tax burden while enhancing its brand image. For example, a hypothetical tax credit for using recycled materials in furniture production could lower Arhaus's effective tax rate.

- U.S. Corporate Tax Rate: The Tax Cuts and Jobs Act of 2017 set the U.S. federal corporate tax rate at 21%. Discussions around potential future adjustments to this rate remain a factor for companies like Arhaus.

- Sales Tax Variations: Sales tax rates vary significantly by state in the U.S., with rates ranging from 0% in some states to over 7% in others, impacting the final price consumers pay for Arhaus products.

- Import Duties: Tariffs on imported goods, particularly those from countries with which the U.S. has trade disputes, can directly increase the cost of inventory for retailers like Arhaus.

Government regulations on product safety and consumer protection significantly shape Arhaus's operations. Adherence to evolving standards for materials and advertising is crucial to avoid recalls, penalties, and reputational damage. For instance, compliance with the California Consumer Privacy Act (CCPA) affects how customer data is handled.

Political stability in sourcing regions directly impacts Arhaus's supply chain. Geopolitical events can cause production halts and delivery delays, increasing shipping costs. For example, ongoing conflicts in 2024 led to over 50% surcharges on some global shipping routes, affecting companies like Arhaus.

Changes in corporate and sales tax rates influence Arhaus's profitability and pricing. For example, the U.S. federal corporate tax rate is currently 21%, and any adjustments can affect net income. Import duties on furniture also directly impact the cost of goods sold.

Trade policies and tariffs are critical for Arhaus, especially concerning imported furniture and raw materials. Potential tariffs in 2025, such as those on goods from China, could necessitate sourcing strategy reassessments and affect consumer prices.

What is included in the product

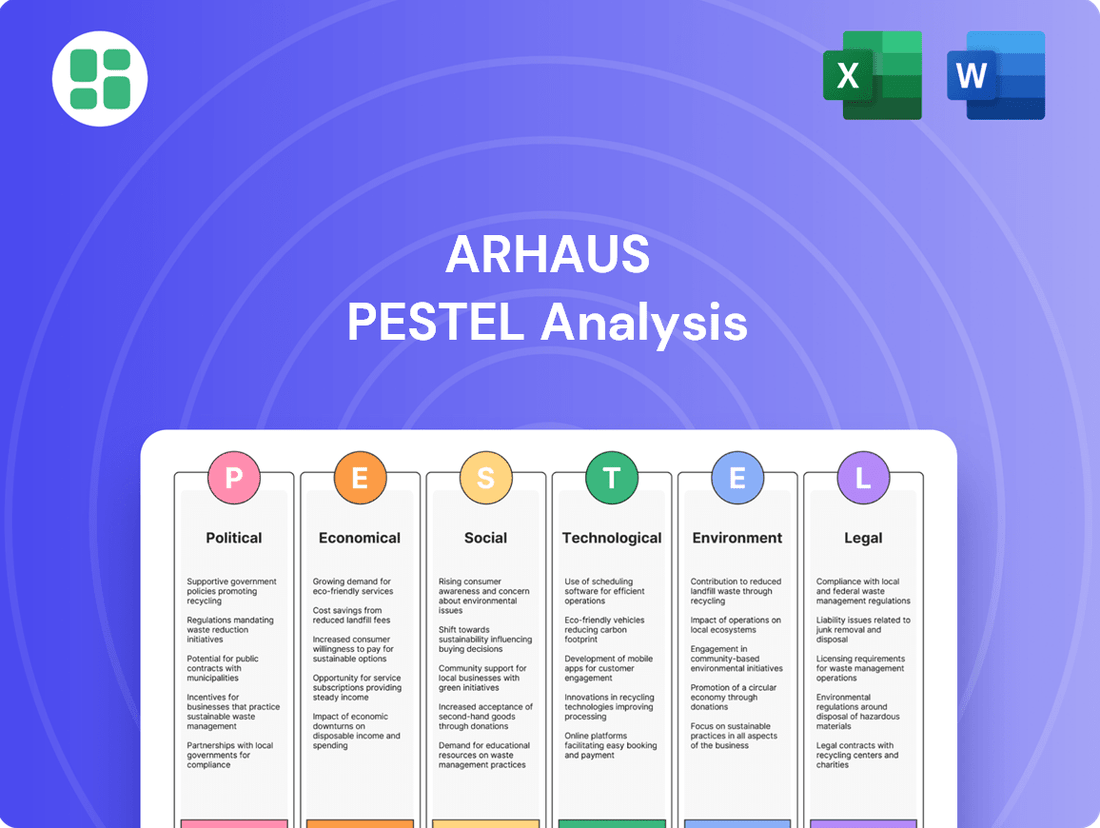

This Arhaus PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors influence the company's operations and strategy.

It provides actionable insights for Arhaus to navigate external challenges and capitalize on emerging opportunities within the furniture and home decor market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions around external factors impacting Arhaus.

Helps support discussions on external risk and market positioning during planning sessions, offering a clear overview of the political, economic, social, technological, environmental, and legal landscape for Arhaus.

Economic factors

Arhaus's reliance on premium home furnishings means its sales are closely tied to how much disposable income consumers have left after covering essentials. When the economy is strong, people feel more confident spending on higher-ticket items like Arhaus furniture. For instance, in early 2024, many consumers were still feeling the pinch of inflation, which can temper spending on discretionary goods.

Economic headwinds like rising interest rates, which make financing larger purchases more expensive, or persistent inflation, which erodes purchasing power, directly impact Arhaus. If consumers have less discretionary income due to these factors, they are less likely to invest in non-essential, luxury furniture. This was a concern throughout 2023 and into 2024, as inflation remained a key economic indicator.

The health of the housing market is a significant driver for Arhaus, as new home sales and renovation projects directly correlate with demand for home furnishings. A robust housing market in 2024 and 2025, characterized by strong new home sales and increased renovation spending, is anticipated to provide a favorable environment for Arhaus. For instance, the U.S. Census Bureau reported that new single-family home sales reached a seasonally adjusted annual rate of 693,000 in April 2024, indicating continued activity that benefits furniture retailers.

Conversely, a downturn in the housing sector, marked by declining sales or reduced renovation investment, could present headwinds for Arhaus. If interest rates remain elevated or economic uncertainty dampens consumer confidence, fewer new homes being built or fewer homeowners undertaking renovations would naturally lead to lower demand for furniture and decor. This trend was observed in late 2023, where higher mortgage rates contributed to a cooling of the housing market, impacting discretionary spending on home goods.

Inflationary pressures continue to be a significant concern for the furniture industry, directly impacting Arhaus's cost of goods sold. Rising prices for key raw materials like lumber and textiles, coupled with increased labor and shipping expenses, are squeezing profit margins. For instance, the Producer Price Index for furniture and related products saw a notable increase in late 2024, reflecting these higher input costs.

Furniture businesses, including Arhaus, are closely monitoring macroeconomic trends, particularly inflation and interest rates, as they plan for 2025. These factors influence consumer spending power and borrowing costs, both critical for big-ticket purchases like furniture. The Federal Reserve's stance on interest rates in 2025 will likely play a crucial role in shaping demand and Arhaus's pricing strategies.

Interest Rates

Interest rates significantly impact Arhaus's business. As of mid-2024, the Federal Reserve has indicated a cautious approach to rate cuts, with projections suggesting rates may remain elevated through much of 2025. This environment makes it more expensive for consumers to finance large purchases like furniture, potentially dampening demand.

For Arhaus specifically, higher interest rates translate to increased borrowing costs for operational needs and any expansion initiatives. This can affect profitability and the feasibility of new store openings or capital investments. The furniture sector, being sensitive to discretionary spending, often sees a direct correlation between interest rate levels and sales performance.

- Consumer Spending Impact: Higher rates increase the cost of mortgages and auto loans, leaving consumers with less disposable income for big-ticket items like furniture.

- Cost of Capital: Arhaus's own borrowing costs for inventory financing, store leases, and potential expansion projects will rise, squeezing profit margins.

- Market Outlook (2025): Analysts anticipate that persistent inflation concerns will keep benchmark interest rates higher than in previous years, creating a challenging operating environment for retailers.

Exchange Rate Fluctuations

Arhaus, with its significant global sourcing operations, is directly exposed to the volatility of exchange rates. For instance, if the US dollar weakens against currencies in countries where Arhaus sources furniture and decor, the cost of those imported goods will rise. This can squeeze profit margins or necessitate price increases for consumers.

Consider the period leading up to mid-2024. The US dollar experienced periods of strength against several major trading partners. A stronger dollar generally makes imports cheaper for U.S. companies like Arhaus, potentially lowering their cost of goods sold. However, the reverse is also true; a weakening dollar would increase these costs.

- Impact on Sourcing Costs: A depreciation of the USD against the Euro or Chinese Yuan, for example, would directly increase the cost of Arhaus's imported inventory.

- Margin Pressure: Higher sourcing costs due to unfavorable exchange rates can reduce Arhaus's gross profit margins if these costs cannot be fully passed on to customers.

- Pricing Strategy: Arhaus may need to adjust its retail pricing to offset currency-related cost increases, potentially affecting sales volume and competitiveness.

- Hedging Strategies: Companies like Arhaus often employ financial instruments to hedge against currency risks, aiming to stabilize the cost of international transactions.

Consumer spending power is a primary economic driver for Arhaus. As of early 2024, persistent inflation continued to impact household budgets, potentially limiting discretionary spending on premium home furnishings. For instance, the Consumer Price Index (CPI) showed a year-over-year increase of 3.4% in April 2024, indicating ongoing price pressures that affect consumer purchasing power.

The housing market's performance directly influences demand for Arhaus products. Strong new home sales and renovation activity, as seen with the 693,000 seasonally adjusted annual rate of new single-family home sales in April 2024, generally correlate with increased furniture purchases. However, higher mortgage rates, which remained elevated in early 2024, can cool housing market activity and subsequently dampen demand for home goods.

Interest rates play a critical role in both consumer financing and Arhaus's operational costs. With the Federal Reserve signaling a cautious approach to rate cuts through 2025, borrowing costs for consumers and the company are likely to remain higher. This can reduce consumer confidence for large purchases and increase Arhaus's cost of capital for inventory and expansion.

Arhaus's global sourcing exposes it to foreign exchange rate fluctuations. A strengthening US dollar, as observed at various points in early 2024, can make imported goods cheaper, potentially benefiting Arhaus's cost of goods sold. Conversely, a weakening dollar would increase these costs, impacting margins if not passed on to consumers.

Full Version Awaits

Arhaus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Arhaus PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Arhaus's strategic landscape.

Sociological factors

The significant increase in remote work, with an estimated 27% of American workers working remotely full-time in 2024 according to a recent survey, has profoundly shifted consumer priorities. This has fueled a greater emphasis on creating comfortable and aesthetically pleasing home environments, directly benefiting furniture retailers like Arhaus. Consumers are investing more in their living spaces, seeking pieces that offer both style and durability.

Furthermore, a growing preference for minimalism and functionality is evident in consumer purchasing habits. This trend, where consumers favor fewer, high-quality items over disposable goods, perfectly complements Arhaus's brand positioning. The company's commitment to artisanal craftsmanship and sustainable sourcing resonates with this desire for enduring, purposeful home furnishings.

Consumers are increasingly seeking out products that reflect their values, with sustainability and ethical sourcing becoming major decision drivers. This trend strongly benefits Arhaus, as the company's commitment to craftsmanship and responsible material sourcing directly appeals to this growing demographic. The global sustainable home decor market was valued at approximately $13.6 billion in 2023 and is projected to reach over $25 billion by 2030, showcasing a significant and expanding opportunity.

Demographic shifts are significantly reshaping the furniture market. As millennials, a generation known for prioritizing experiences and personal expression, increasingly enter the homeownership phase, their spending on home decor is notably higher than that of Baby Boomers. This trend is evident as millennials are projected to spend over $300 billion on home furnishings in the coming years, reflecting a strong demand for stylish and functional pieces.

Concurrently, an aging population is driving demand for furniture that offers comfort, accessibility, and ease of use. This segment of the market values durability and ergonomic design, influencing product development and marketing strategies for companies like Arhaus. The growing number of individuals aged 65 and older, expected to represent over 20% of the US population by 2030, presents a substantial opportunity for specialized furniture solutions.

Influence of Social Media and Design Trends

Social media platforms like Instagram and Pinterest are powerful drivers of home decor trends, with design influencers significantly shaping consumer preferences. In 2024, platforms like TikTok saw a surge in DIY and home renovation content, influencing purchasing decisions for furniture and decor. Arhaus must actively utilize these channels to highlight its distinctive designs and connect with a sophisticated clientele who value unique and aesthetically pleasing living spaces.

The rapid dissemination of trends through social media necessitates agility in product development and marketing. For instance, a particular color palette or furniture style can gain widespread popularity almost overnight, driven by viral content. Arhaus's ability to monitor these shifts and respond by showcasing relevant collections can enhance brand visibility and customer engagement. By mid-2025, it's projected that visual discovery platforms will continue to be primary sources for home inspiration, making a strong digital presence crucial for Arhaus's market position.

- Social media drives rapid trend cycles in home decor.

- Design influencers are key opinion leaders for consumer choices.

- Arhaus needs to leverage visual platforms for showcasing unique designs.

- Customer engagement on social media is vital for brand relevance.

Preference for Personalized and Unique Items

Consumers today have a strong desire for items that feel one-of-a-kind and express their personal tastes. This trend is particularly evident in home decor, where uniqueness is highly valued.

Arhaus directly addresses this by offering artisan-crafted furniture and decor. This approach sets them apart from competitors that rely on mass production, appealing to customers looking for something special.

For instance, Arhaus's commitment to quality and unique designs aligns with a market where consumers are willing to spend more for distinctive pieces. In 2024, the global home decor market was valued at approximately $750 billion, with a significant portion driven by demand for personalized and artisanal goods.

- Rising Demand for Individuality: Consumers are actively seeking home furnishings that tell a story and reflect their personal style, moving away from generic, mass-produced items.

- Arhaus's Market Position: The company's emphasis on handcrafted, heirloom-quality pieces directly taps into this preference, offering a distinct value proposition.

- Market Growth Drivers: The increasing appreciation for artisanal craftsmanship and unique design elements is a key factor contributing to growth in the premium home furnishings sector.

Societal values are increasingly emphasizing sustainability and ethical production, with a growing number of consumers prioritizing brands that demonstrate corporate responsibility. Arhaus's dedication to artisanal craftsmanship and responsible sourcing aligns perfectly with these evolving consumer expectations, positioning the company favorably within a market that values authenticity and ethical practices.

The rise of the experience economy also impacts furniture purchasing, as consumers seek not just products but also the story and craftsmanship behind them. Arhaus's focus on unique, handcrafted items caters to this desire for meaningful purchases, resonating with a clientele that appreciates quality and narrative in their home furnishings.

Consumer demand for personalization and unique expression in home decor is a significant trend, with individuals seeking pieces that reflect their personal style and values. Arhaus's emphasis on artisan-made furniture and decor directly addresses this desire for individuality, differentiating it from mass-market competitors and appealing to customers looking for distinctive, heirloom-quality items.

Technological factors

The furniture e-commerce market is experiencing robust growth, with projections indicating continued expansion through 2024 and 2025. This trend necessitates Arhaus to enhance its online presence, ensuring a smooth transition between digital browsing and in-store experiences. A key strategy involves investing in a sophisticated omnichannel platform that seamlessly connects online catalogs, virtual consultations, and physical showroom visits.

Artificial intelligence is revolutionizing how customers interact with furniture retailers like Arhaus. AI-powered tools now offer highly personalized product recommendations, taking the guesswork out of finding the perfect piece. For instance, by analyzing past purchases and browsing behavior, AI can suggest items that align with a customer's evolving style.

Beyond recommendations, AI is also stepping in as a virtual design consultant. These systems can provide tailored advice on color palettes, room layouts, and complementary furnishings, boosting customer confidence. This enhanced guidance is crucial for higher-ticket items, ensuring customers feel secure in their investment.

The integration of augmented reality (AR) with AI is a game-changer for visualization. Customers can now see how furniture will look in their actual living spaces before buying, a feature that significantly reduces return rates. Reports from 2024 indicate that AR shopping experiences can increase conversion rates by as much as 94% for furniture.

Technological advancements are revolutionizing supply chain management for companies like Arhaus. Artificial intelligence (AI) is increasingly being used for inventory optimization, predictive analytics to forecast demand, and route optimization for logistics, all of which are crucial for managing costs and ensuring timely product delivery.

In 2025, the furniture industry continues to grapple with supply chain disruptions, making efficient inventory management a paramount concern. For Arhaus, leveraging technologies that provide real-time visibility into their supply chain can significantly reduce overstocking and mitigate the impact of unforeseen delays.

Data Analytics for Customer Insights

Arhaus leverages data analytics to understand customer behavior and preferences, enabling more tailored marketing campaigns and product assortments. This focus on data allows for a more responsive approach to evolving market demands.

By analyzing customer data, Arhaus can identify purchasing patterns and trends, leading to improved inventory management and more efficient operational planning. For instance, in 2024, retailers saw a significant uplift in sales when personalizing offers based on past purchase history.

The insights gained from data analytics directly inform Arhaus's product development strategies, ensuring offerings align with current consumer tastes and lifestyle needs. This data-driven approach helps minimize the risk associated with new product launches.

- Customer Segmentation: Identifying distinct customer groups based on demographics, purchase history, and online behavior.

- Personalized Marketing: Delivering targeted promotions and content to individual customers.

- Trend Forecasting: Utilizing data to predict future product demand and market shifts.

- Operational Efficiency: Optimizing supply chain and inventory management based on sales data.

Manufacturing Innovations and Sustainable Production

Technological advancements in manufacturing are significantly enhancing efficiency and sustainability in furniture production. Innovations like advanced robotics and AI-driven design optimization are streamlining processes, reducing material waste, and lowering energy consumption. This directly supports Arhaus's dedication to responsible sourcing and craftsmanship, allowing them to integrate more reclaimed and recycled materials without compromising quality.

Arhaus's focus on sustainability is further bolstered by technologies that enable more precise material utilization and waste reduction. For instance, computer-aided design (CAD) and computer-aided manufacturing (CAM) systems allow for intricate designs with minimal offcuts, contributing to a reduced environmental impact. This aligns with the growing consumer demand for eco-friendly products, a trend that gained considerable momentum through 2024 and is projected to continue through 2025.

- Automation in woodworking: Reduces labor costs and improves precision, leading to less material waste.

- 3D printing for components: Enables the creation of custom parts and prototypes with minimal material waste, supporting unique designs.

- Sustainable material sourcing technologies: Blockchain and AI are being used to track and verify the origin of materials, ensuring ethical and environmentally sound practices.

- Energy-efficient machinery: New equipment consumes less power, lowering operational costs and the carbon footprint of manufacturing facilities.

Technological advancements are key for Arhaus to enhance its online presence and customer engagement. AI-powered personalization and AR visualization are transforming the shopping experience, with AR potentially boosting conversion rates by up to 94% in furniture retail as seen in 2024. Furthermore, AI is optimizing supply chains for efficiency and better inventory management, a critical factor given ongoing disruptions projected into 2025.

Legal factors

Arhaus, like all home furnishing retailers, must navigate a complex web of product liability laws and safety standards. These regulations cover everything from the materials used in upholstery to the flammability of fabrics and the structural soundness of furniture. For instance, the Consumer Product Safety Commission (CPSC) in the US continuously updates standards, and adherence is paramount. Failure to comply can result in costly recalls, hefty fines, and severe damage to Arhaus's carefully cultivated brand image.

Arhaus must navigate a complex web of data privacy regulations, including California's Consumer Privacy Act (CCPA) and the European Union's General Data Protection Regulation (GDPR). These laws dictate how Arhaus collects, uses, and stores customer data from its online sales and physical stores. Failure to comply can result in significant penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Arhaus, as a retailer operating physical stores and sourcing globally, navigates a complex web of labor laws. This includes adhering to fair labor practices, minimum wage requirements, and overtime regulations across its various operating locations. For instance, in the US, the Fair Labor Standards Act (FLSA) sets standards for minimum wage, overtime pay, and recordkeeping, which Arhaus must consistently meet for its domestic workforce.

Workplace safety is another critical legal factor. Arhaus must ensure compliance with occupational safety and health regulations, such as those enforced by OSHA in the United States, to protect its employees. This extends to its supply chain, requiring diligence in ensuring that artisan partners also uphold safe working conditions, especially when dealing with handcrafted goods where specific safety protocols might be less standardized.

Intellectual Property Rights

Intellectual property rights are crucial for Arhaus to safeguard its distinctive furniture designs and brand identity in the competitive home furnishings sector. This protection is essential for preventing design infringements and ensuring the integrity of its premium market positioning.

Arhaus actively works to protect its intellectual property, which includes design patents and trademarks, to prevent unauthorized replication of its unique offerings. This proactive approach is fundamental to maintaining its brand value and market differentiation.

- Design Patents: Arhaus likely holds numerous design patents for its proprietary furniture styles, preventing competitors from legally copying these specific aesthetics. While specific numbers are proprietary, the company's emphasis on unique design suggests a robust patent portfolio.

- Trademark Protection: The Arhaus brand name and logo are protected trademarks, preventing their use by other entities in the home furnishings market. This is vital for brand recognition and consumer trust.

- Copyrights: Original artistic elements, patterns, or decorative features incorporated into Arhaus products may also be protected by copyright, further shielding unique creative works.

- Enforcement: Arhaus's legal strategy would involve monitoring the market for potential infringements and taking legal action, such as cease and desist letters or lawsuits, to defend its intellectual property rights.

Environmental Compliance Laws

Arhaus is deeply committed to sustainable practices, which means they must meticulously follow environmental laws covering everything from where they get their materials to how they handle waste and pollution. For instance, new rules like the EU's deforestation-free timber law, which came into effect in late 2024, directly affect companies like Arhaus that source wood products globally, requiring stringent due diligence to ensure timber isn't linked to deforestation.

This focus on sustainability means Arhaus needs to be particularly mindful of regulations concerning the sourcing of materials, the environmental impact of their manufacturing, and how they manage waste and emissions. The company's adherence to these laws is crucial for maintaining its brand reputation and operational integrity in an increasingly environmentally conscious market.

Key areas of compliance for Arhaus include:

- Sustainable Sourcing: Ensuring materials like wood and textiles are obtained responsibly, avoiding deforestation and harmful agricultural practices.

- Manufacturing Emissions: Complying with regulations on air and water pollution generated during the production of furniture and home decor.

- Waste Management: Adhering to laws regarding the disposal and recycling of manufacturing byproducts and end-of-life products.

- Chemical Regulations: Meeting standards for the safe use of chemicals in finishes, treatments, and materials, such as those outlined in REACH in the EU.

Arhaus must adhere to evolving consumer protection laws, ensuring product safety and accurate marketing. Regulations such as the FTC's Green Guides, updated in 2024, impact how Arhaus communicates its sustainability claims, requiring substantiation to avoid deceptive practices. Compliance with these standards is vital for maintaining consumer trust and avoiding regulatory scrutiny.

Environmental factors

Arhaus's dedication to sustainability is evident in its rigorous approach to sourcing materials, prioritizing those that are ethically and sustainably obtained. This includes a significant focus on reclaimed wood and fabrics derived from responsibly managed forests, aligning with a market trend where consumers increasingly value eco-conscious products.

For instance, Arhaus has highlighted its use of reclaimed wood, a material that diverts waste from landfills and reduces the demand for virgin timber. This practice is particularly relevant as global deforestation remains a concern, with organizations like the World Wildlife Fund (WWF) reporting that unsustainable logging contributes to habitat loss and climate change.

The company's commitment extends to recycled metals and other innovative, sustainable materials, catering to a growing consumer base that actively seeks out environmentally friendly home furnishings. This proactive stance on material sourcing not only supports Arhaus's brand image but also positions it favorably in a market where environmental, social, and governance (ESG) factors are becoming increasingly important for purchasing decisions.

Arhaus is focusing on reducing waste throughout its operations, from how its furniture is made to how it's sold in stores. This includes implementing robust recycling programs across its supply chain. For instance, in 2024, Arhaus reported a 15% increase in the diversion of materials from landfills through its enhanced recycling efforts at distribution centers.

A significant aspect of Arhaus's environmental strategy involves ensuring its products, particularly furniture, do not contribute to landfill waste. This commitment is evident in their 2025 initiative to partner with specialized recycling facilities to process end-of-life furniture, aiming to recover materials like wood and metal for reuse.

Arhaus faces environmental pressures to measure and reduce its carbon footprint across its global supply chain, transportation, and operations. While the company highlights sustainability initiatives, detailed public data on specific carbon emissions or concrete reduction targets for 2024 or 2025 is not readily available, suggesting an opportunity for increased transparency in this area.

Consumer Demand for Eco-Friendly Products

Consumers increasingly favor home goods that are eco-friendly, non-toxic, and certified sustainable, directly influencing Arhaus's market approach. This trend necessitates continuous innovation and transparent communication about the company's environmental commitments to resonate with this growing segment.

For instance, a 2024 report by NielsenIQ indicated that 60% of consumers are willing to pay more for sustainable products, a figure that has steadily climbed over the past few years. Arhaus's focus on ethically sourced materials and durable construction aligns with this demand, positioning them favorably.

- Growing Market Share: The global market for sustainable home furnishings is projected to reach over $200 billion by 2027, demonstrating significant growth potential.

- Consumer Trust: Certifications like FSC (Forest Stewardship Council) for wood products and OEKO-TEX for textiles build consumer confidence in Arhaus's sustainability claims.

- Brand Differentiation: Highlighting sustainable practices, such as using recycled materials or supporting artisan communities, helps Arhaus stand out from competitors.

Climate Change Impact on Supply Chains

Climate change, with its increasing frequency of extreme weather events like hurricanes and droughts, directly impacts Arhaus's reliance on natural materials and global logistics. These disruptions can lead to shortages of key resources, such as timber for furniture, and impede the transportation of finished goods. For instance, the increasing severity of storms in regions where Arhaus sources materials could lead to price volatility and supply interruptions throughout 2024 and into 2025.

To counter these environmental risks, Arhaus must prioritize supply chain diversification and resilience. This involves identifying alternative sourcing locations and developing contingency plans for transportation and manufacturing. A proactive approach to managing these environmental factors is essential for maintaining operational stability and meeting customer demand in an increasingly unpredictable climate.

- Supply Chain Vulnerability: Extreme weather events in 2024 have already highlighted the fragility of global supply chains, with sectors reliant on natural resources experiencing significant delays and cost increases.

- Resource Availability: Arhaus's dependence on materials like wood and textiles makes it susceptible to climate-driven impacts on agriculture and forestry, potentially affecting raw material costs and availability.

- Mitigation Strategies: Investing in supply chain mapping and risk assessment tools can help Arhaus identify and address potential environmental vulnerabilities before they escalate.

- Resilience Building: Developing alternative transportation routes and fostering stronger relationships with suppliers in less vulnerable regions will be critical for maintaining business continuity.

Arhaus's commitment to sustainability is a key environmental factor, with a strong emphasis on ethically and sustainably sourced materials like reclaimed wood. This aligns with a growing consumer demand for eco-friendly products, with reports in 2024 showing a significant portion of consumers willing to pay more for sustainable goods.

The company is also focused on waste reduction, implementing recycling programs that saw a reported 15% increase in material diversion from landfills in 2024. Arhaus is further planning initiatives for 2025 to process end-of-life furniture, aiming to recover materials for reuse.

Climate change poses risks to Arhaus's supply chain and material sourcing, potentially leading to resource shortages and price volatility. Diversifying sourcing locations and building supply chain resilience are crucial strategies to mitigate these environmental impacts.

| Environmental Factor | Arhaus's Approach | Market Impact/Data (2024/2025) |

|---|---|---|

| Sustainable Material Sourcing | Prioritizes reclaimed wood, recycled metals, and responsibly managed forest products. | 60% of consumers willing to pay more for sustainable products (NielsenIQ, 2024). Global sustainable home furnishings market projected to exceed $200 billion by 2027. |

| Waste Reduction & Recycling | Implementing robust recycling programs across operations. | 15% increase in landfill diversion via enhanced recycling efforts in 2024. Planning end-of-life furniture processing for 2025. |

| Climate Change Impact | Faces risks from extreme weather affecting natural materials and logistics. | Increased storm severity in sourcing regions can cause price volatility and supply interruptions (2024-2025 outlook). Supply chain disruptions in 2024 highlighted sector fragility. |

PESTLE Analysis Data Sources

Our Arhaus PESTLE Analysis is built on a robust foundation of data from reputable sources, including government economic reports, industry-specific market research, and international trade publications. We analyze political stability, economic growth trends, and evolving consumer behavior to provide a comprehensive overview.