Arco Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arco Construction Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Arco Construction's trajectory. This expertly crafted PESTLE analysis provides actionable insights to navigate market complexities and identify emerging opportunities. Download the full report to gain a competitive edge and make informed strategic decisions.

Political factors

Government investment, particularly through initiatives like the Infrastructure Investment and Jobs Act (IIJA), continues to be a significant driver for the construction industry. Billions of dollars have been allocated for infrastructure projects through 2026, directly impacting ARCO Construction's opportunities in sectors like transportation, energy, and broadband. This sustained federal funding creates a stable pipeline for large-scale developments, offering ARCO a consistent stream of potential work.

Changes in trade policies and tariffs present a significant variable for Arco Construction. For example, a potential increase in tariffs on imported steel, which in 2024 saw some rates double to 50%, directly inflates material costs for construction projects. This can lead to higher overall project expenses and potentially impact the feasibility of certain bids.

Such policy shifts can disrupt established supply chains, creating uncertainty around the availability and cost of essential materials like lumber and specialized components. Arco must remain agile, perhaps diversifying its material sourcing or exploring domestic alternatives to mitigate the impact of these trade adjustments on its project timelines and budget adherence.

The regulatory landscape for construction is continuously evolving, with stricter building codes and environmental mandates shaping industry practices. For instance, the push for near-zero fossil fuel use in federal buildings by 2030, alongside updated LEED (Leadership in Energy and Environmental Design) standards, directly impacts design and material choices.

ARCO Construction must proactively adapt to these increasingly stringent requirements. This means investing in new materials and innovative construction techniques to meet decarbonization targets and enhance energy efficiency, ensuring compliance and maintaining a competitive edge in a sustainability-focused market.

Political Stability and Election Impact

Political stability is a cornerstone for the construction sector, and shifts in government can significantly alter the landscape. For Arco Construction, upcoming elections in 2024 and potential policy changes thereafter introduce a degree of uncertainty, especially concerning federal infrastructure funding. For instance, the Biden administration's Infrastructure Investment and Jobs Act (IIJA), enacted in 2021 with $1.2 trillion allocated, and the Inflation Reduction Act (IRA) of 2022, which includes significant clean energy and infrastructure investments, are crucial for large-scale projects. A change in administration could potentially lead to a reassessment or even a freeze of these committed funds, directly impacting project pipelines and investor sentiment in sectors reliant on these subsidies.

The outcome of elections can directly affect the continuity of vital subsidy schemes. For example, the IIJA has already spurred significant investment, with over $200 billion announced for projects across the US as of early 2024. However, a future administration might prioritize different areas or reduce overall spending, creating a ripple effect on companies like Arco Construction that depend on these government initiatives. Investor confidence is also closely tied to political predictability; any perceived instability or drastic policy reversal could lead to a slowdown in capital deployment for major construction ventures.

- Federal Funding Uncertainty: The continuation of programs like the IIJA, which has allocated substantial funds for transportation and broadband, could be jeopardized by a change in political leadership, impacting project viability.

- Investor Confidence: Policy shifts or political instability can deter private investment in large-scale construction projects, particularly those reliant on government incentives or contracts.

- Regulatory Environment: New administrations may introduce or alter environmental regulations, labor laws, or permitting processes, which can affect project timelines, costs, and overall feasibility for Arco Construction.

Government Incentives for Green Building

Government incentives significantly influence the green building sector, directly impacting demand for sustainable construction. For instance, the Inflation Reduction Act of 2022, a major piece of U.S. legislation, offers substantial tax credits and grants for energy-efficient building designs and the use of renewable energy sources. These incentives, often available through 2032, aim to accelerate the transition to net-zero emissions in the built environment.

ARCO Construction can strategically capitalize on these government initiatives. By developing expertise in eco-friendly building solutions, ARCO can align its services with federal and state sustainability goals. This specialization not only makes ARCO's offerings more appealing to clients seeking to reduce their carbon footprint and benefit from financial advantages but also positions the company as a leader in a rapidly growing market segment. For example, projects incorporating high-efficiency HVAC systems or solar panel installations might qualify for credits up to 30% of project costs under certain federal programs.

- Tax Credits: Federal programs like those in the Inflation Reduction Act offer significant tax credits for energy-efficient building improvements and renewable energy integration, potentially reducing project costs for clients.

- Grants and Rebates: Various government agencies and utility providers offer grants and rebates for adopting green building materials and technologies, further incentivizing sustainable construction.

- Alignment with Net-Zero Goals: ARCO's focus on green building aligns with national targets for reducing greenhouse gas emissions, creating a strong market position and potential for government-supported projects.

- Market Demand Shaping: These incentives directly shape market demand, making sustainable construction a more financially viable and attractive option for developers and property owners.

Government spending on infrastructure remains a critical driver for Arco Construction, with the Infrastructure Investment and Jobs Act (IIJA) continuing to fund projects through 2026. This sustained federal investment, totaling $1.2 trillion, supports sectors like transportation and energy, providing a consistent pipeline of work. However, potential policy shifts following the 2024 elections introduce uncertainty regarding the continuation of these vital funding streams.

Changes in trade policies, such as tariffs on imported steel, directly impact material costs. For example, steel tariffs that doubled in 2024 to 50% increase project expenses, potentially affecting bid feasibility and supply chain stability. Arco must adapt by diversifying material sourcing to mitigate these economic volatilities.

The evolving regulatory landscape, including stricter building codes and environmental mandates like the push for near-zero fossil fuel use in federal buildings by 2030, necessitates adaptation. Arco must invest in new materials and techniques to meet these sustainability requirements and maintain a competitive edge.

Government incentives, particularly through the Inflation Reduction Act of 2022, are boosting the green building sector. Tax credits for energy-efficient designs and renewable energy integration, available through 2032, incentivize sustainable construction, creating new market opportunities for Arco.

What is included in the product

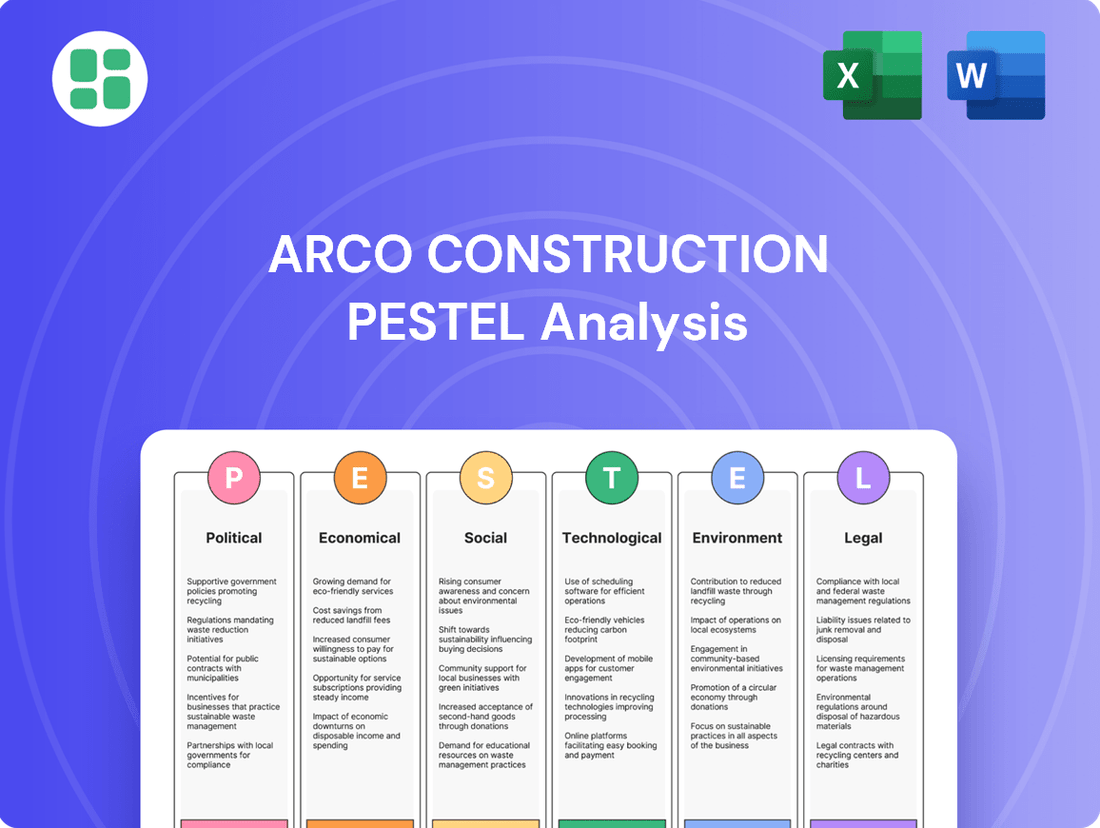

The Arco Construction PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operating landscape.

This comprehensive overview is designed to equip stakeholders with actionable insights into external forces, enabling strategic decision-making and risk mitigation.

The Arco Construction PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

Fluctuations in interest rates directly impact the cost of borrowing for construction projects. For ARCO and its clients, higher rates mean increased financing expenses, potentially making new developments less attractive and slowing down project pipelines. This is a critical factor for project viability.

While forecasts suggest a gradual decrease in interest rates through 2025, they are anticipated to remain above the historically low levels seen before the pandemic. For instance, the Federal Reserve's target range for the federal funds rate, which influences broader borrowing costs, was around 5.25%-5.50% in early 2024. This sustained higher cost of capital is likely to foster a more cautious investment climate, potentially leading to delays in project initiations, especially within the residential and commercial real estate sectors.

Ongoing inflationary pressures and volatility in material prices, including steel, concrete, and roofing materials, continue to challenge the construction industry. For instance, the Producer Price Index for construction materials saw a significant increase in 2024, impacting project bids.

These elevated costs can directly impact project budgets and ARCO's profitability. Managing these fluctuations requires robust cost management and strategic procurement, especially as forecasts for 2025 suggest continued, albeit potentially moderating, price increases for key commodities.

The United States economy is expected to experience moderate growth in 2025, a key factor influencing demand for Arco Construction's services across industrial, commercial, and multi-family residential markets. This steady economic expansion suggests a continued, albeit measured, pipeline of new projects.

While specific construction sector growth forecasts for 2025 project a slowdown compared to previous years, with some analysts predicting growth around 1-2%, this still translates to a significant volume of work. For instance, the U.S. Census Bureau reported a 1.6% increase in total construction spending in April 2024 compared to April 2023, indicating underlying activity.

The strength observed in manufacturing and industrial sectors, often driven by reshoring initiatives and infrastructure investment, provides a more robust outlook for these specific segments of Arco Construction's business. This contrasts with potentially softer demand in other areas due to higher interest rates and tighter credit conditions impacting new residential development.

Commercial and Residential Market Dynamics

ARCO Construction's project pipeline is heavily influenced by real estate sector performance. While industrial and data center construction show continued strength, office and some multifamily segments face headwinds. For instance, the U.S. industrial sector saw a robust 17.3% year-over-year increase in construction starts in Q1 2024, according to Dodge Construction Network data.

Multifamily construction is projected to stabilize through late 2025, with forecasts suggesting a potential easing of vacancies and a rebound in rents. Conversely, office markets are undergoing a normalization period, with vacancy rates in major U.S. cities hovering around 18-20% as of early 2024, impacting demand for new builds.

- Industrial Sector Strength: Continued high demand for logistics and warehousing facilities supports robust construction activity.

- Office Market Challenges: Elevated vacancy rates and shifts towards hybrid work models are tempering new office construction starts.

- Multifamily Stabilization: Expect a gradual recovery in multifamily construction and rental income by late 2025 after a recent slowdown.

Labor Costs and Workforce Availability

Persistent labor shortages, especially for skilled trades like electricians and plumbers, remain a significant economic hurdle for the construction sector. This scarcity directly impacts companies like ARCO, driving up wages as demand outstrips supply.

While the overall number of job openings in construction saw a slight decrease in late 2024, the underlying talent gap persists. For instance, the U.S. Bureau of Labor Statistics reported over 400,000 job openings in construction in November 2024, highlighting ongoing demand. This continued shortage can lead to increased labor costs and potential project delays for ARCO.

- Skilled Trade Shortage: Critical roles such as carpenters, masons, and HVAC technicians are particularly difficult to fill.

- Wage Inflation: The average hourly wage for construction laborers saw an increase of approximately 5% year-over-year through Q3 2024, impacting project budgets.

- Project Delays: Inability to secure sufficient skilled labor can push project timelines back, incurring additional costs and impacting ARCO's ability to meet deadlines.

- Workforce Availability: An aging workforce and challenges in attracting younger talent exacerbate the availability issue.

Economic factors significantly shape ARCO Construction's operating environment, with interest rate fluctuations and inflation posing direct challenges to project financing and material costs. While moderate economic growth is anticipated for 2025, the construction sector faces segment-specific headwinds, particularly in office markets, contrasted by strength in industrial development.

The persistent shortage of skilled labor continues to drive up wages and poses a risk of project delays. For instance, construction job openings remained high in late 2024, exceeding 400,000 according to the Bureau of Labor Statistics, indicating ongoing demand for talent that outstrips supply.

| Economic Factor | Impact on ARCO Construction | 2024/2025 Data/Outlook |

|---|---|---|

| Interest Rates | Increased borrowing costs, potentially slowing project pipelines. | Federal funds rate target range 5.25%-5.50% (early 2024); gradual decrease expected through 2025, but remaining above pre-pandemic lows. |

| Inflation/Material Costs | Higher project budgets and reduced profitability. | Producer Price Index for construction materials saw significant increases in 2024; continued, moderating price increases expected for commodities in 2025. |

| Economic Growth | Influences demand across industrial, commercial, and residential markets. | Moderate U.S. economic growth projected for 2025; construction sector growth forecast around 1-2% for 2025. |

| Labor Shortages | Increased labor costs and potential project delays. | Over 400,000 construction job openings (Nov 2024); average hourly wage for construction laborers up ~5% YoY (Q3 2024). |

What You See Is What You Get

Arco Construction PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Arco Construction PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the construction industry, providing valuable insights for strategic planning.

Sociological factors

Global population is projected to reach 8.5 billion by 2030, a significant increase that directly fuels construction demand. Urbanization continues at a rapid pace, with the UN estimating that 68% of the world's population will live in urban areas by 2050. This trend means more demand for housing, infrastructure, and commercial spaces in cities.

Changing household structures, with more single-person households and smaller families, are shifting preferences towards apartments and smaller, more efficient homes. For instance, in the US, the number of one-person households has been steadily increasing, contributing to a greater need for multi-family housing developments. ARCO must adapt its project portfolio to cater to these evolving living arrangements.

The ongoing shift towards remote and hybrid work models is significantly reshaping demand in the construction sector. As of early 2024, studies indicate that a substantial percentage of companies plan to maintain flexible work arrangements, directly impacting the need for traditional office footprints. This trend fuels a decreased demand for large, centralized commercial office spaces while simultaneously boosting interest in suburban and rural residential developments as people seek more space and a better work-life balance.

Arco Construction must adapt to these evolving lifestyle and work trends. For commercial projects, this means designing more adaptable spaces that cater to collaboration and flexibility rather than just individual workstations. On the residential side, capitalizing on the migration away from dense urban centers presents a prime opportunity, with increased demand for single-family homes and townhouses in less populated areas. The market for mixed-use developments that integrate living, working, and recreational spaces outside of traditional city limits is also likely to grow.

Public perception significantly shapes the construction sector's ability to attract talent and maintain positive community ties. Concerns about safety, environmental footprint, and the industry's appeal as a career path are paramount. For instance, in 2023, construction industry fatalities in the US remained a concern, though efforts are underway to improve this. ARCO's commitment to robust safety protocols and transparent reporting can directly counter negative perceptions.

A proactive approach to showcasing sustainable building practices and engaging with local communities can foster goodwill and enhance ARCO's brand image. This includes highlighting projects that minimize environmental impact and contribute positively to urban development. For example, many construction firms are increasingly investing in green building certifications, a trend likely to continue and be recognized by the public in 2024 and 2025.

Demand for Sustainable and Healthy Buildings

Public awareness regarding the environmental impact and health benefits of buildings is significantly shaping consumer preferences. This growing demand for sustainable and healthy structures presents a clear opportunity for Arco Construction. By highlighting its capabilities in green building practices, including the use of eco-friendly materials and design strategies that enhance occupant well-being, Arco can align with these evolving societal values.

The market is increasingly favoring construction that prioritizes energy efficiency and occupant health. For instance, a 2024 report indicated that over 60% of commercial real estate investors consider sustainability a key factor in their investment decisions. Arco's commitment to these principles, such as incorporating advanced insulation and natural ventilation systems, directly addresses this trend.

- Growing demand for LEED-certified buildings: In 2024, the number of LEED-certified projects globally increased by 15%.

- Increased focus on indoor air quality: Studies show a 20% higher willingness to pay for buildings with superior indoor air quality features.

- Preference for renewable energy integration: Solar panel installations on new residential builds saw a 25% year-over-year increase in 2024.

- Client emphasis on biophilic design: Incorporating natural elements into building design is becoming a key differentiator, with a 30% rise in projects featuring green walls and natural light optimization.

Workforce Diversity and Inclusion

Societal expectations are increasingly emphasizing diversity and inclusion within the workforce, and the construction industry is no exception. This trend directly influences how companies like ARCO approach recruitment and talent retention. For instance, a 2024 report by the Construction Industry Council highlighted that 70% of construction firms are actively reviewing their D&I policies to meet evolving stakeholder demands.

By actively implementing inclusive hiring practices and cultivating a diverse work environment, ARCO can significantly strengthen its employer brand. This not only helps attract a wider range of skilled professionals but also improves employee morale and retention. Data from 2025 suggests that companies with robust D&I initiatives see a 15% lower employee turnover rate compared to their less diverse counterparts.

- Enhanced Employer Brand: Demonstrating a commitment to diversity and inclusion makes ARCO a more attractive employer.

- Broader Talent Pool Access: Inclusive practices open doors to a wider range of candidates, including underrepresented groups.

- Improved Retention Rates: A diverse and inclusive workplace fosters a sense of belonging, leading to higher employee satisfaction and loyalty.

- Innovation and Problem-Solving: Diverse teams often bring varied perspectives, leading to more creative solutions and better decision-making.

Societal shifts towards sustainability and health are significantly impacting construction preferences, with a growing demand for eco-friendly and well-being-focused buildings. Arco Construction can leverage this by highlighting its green building expertise and commitment to occupant health, aligning with market trends that favor energy efficiency and biophilic design elements.

The increasing emphasis on diversity and inclusion within the workforce is reshaping recruitment and retention strategies in construction. Companies like ARCO that prioritize inclusive hiring and cultivate diverse environments benefit from an enhanced employer brand, access to a broader talent pool, and improved employee retention, as evidenced by data suggesting lower turnover rates in diverse organizations.

| Sociological Factor | Trend | Impact on Arco Construction | Data Point (2024/2025) |

|---|---|---|---|

| Sustainability & Health Focus | Growing demand for green buildings and healthy environments. | Opportunity to showcase eco-friendly practices and well-being design. | 60% of commercial real estate investors consider sustainability key (2024). |

| Diversity & Inclusion | Increased societal expectation for diverse workforces. | Enhances employer brand, broadens talent pool, improves retention. | 70% of firms reviewing D&I policies (2024); 15% lower turnover in diverse companies (2025 est.). |

Technological factors

Building Information Modeling (BIM) continues to revolutionize construction, offering detailed 3D models, improved collaboration, and more efficient project management. ARCO's adoption of advanced BIM platforms is projected to significantly cut down on design mistakes and enhance material quantity assessments.

By leveraging BIM, ARCO can anticipate faster project completion times and achieve greater operational efficiency. For instance, a 2024 report indicated that BIM implementation can reduce rework by up to 30% on complex projects, directly impacting cost savings and project schedules.

The construction industry is rapidly embracing automation, robotics, and AI, transforming everything from laying bricks to managing complex project timelines and predicting potential issues. ARCO can capitalize on these advancements to boost output, lessen reliance on manual labor, improve safety in dangerous settings, and make better use of its resources.

For instance, AI-powered scheduling tools can optimize project workflows, potentially reducing project completion times by 10-15% based on industry trends observed in 2024. Robotic bricklayers, like those developed by companies such as Construction Robotics, can lay up to 1,000 bricks per hour, significantly increasing efficiency compared to manual labor rates.

Innovation in construction materials, like self-healing concrete, is changing how buildings are made. For instance, the global advanced construction materials market was valued at approximately $160 billion in 2023 and is projected to grow significantly. ARCO can leverage these advancements to enhance project durability and reduce long-term maintenance costs.

The rise of modular and prefabricated construction offers substantial benefits. In 2024, the modular construction market is expected to reach over $200 billion globally, driven by demand for faster build times and cost savings. By adopting these techniques, ARCO can improve efficiency, reduce waste, and ensure higher quality control, making projects more competitive.

Integrating these new materials and methods allows ARCO to offer more sustainable and efficient building solutions. For example, using recycled materials in construction can reduce a project's carbon footprint by up to 30%. This aligns with increasing client and regulatory demands for environmentally conscious building practices.

Digital Collaboration Tools and Cloud Technology

The widespread adoption of cloud-based platforms and digital collaboration tools is transforming how construction projects are managed. These technologies enable real-time information sharing and seamless communication among all parties involved, from architects and engineers to contractors and clients. For ARCO Construction, this means improved coordination and fewer communication breakdowns, leading to more efficient project execution and potentially faster completion times. For example, by mid-2024, the global construction collaboration software market was projected to reach over $2.5 billion, indicating significant investment and reliance on these digital solutions.

ARCO can leverage these advancements to streamline workflows and enhance project oversight. Tools like Autodesk Construction Cloud or Procore offer integrated platforms for document management, scheduling, and communication, allowing for a centralized hub of project information. This digital transformation is crucial for maintaining competitiveness, especially as the industry increasingly embraces remote work and distributed teams. The benefits extend to better risk management and improved decision-making through readily accessible project data.

- Enhanced Project Coordination: Cloud platforms facilitate instant updates and feedback loops between design and construction teams.

- Improved Communication Efficiency: Digital tools reduce reliance on traditional, often slower, communication methods.

- Data Accessibility: Real-time access to project documents and progress reports empowers better decision-making.

- Market Growth: The construction technology sector, including collaboration tools, saw significant growth, with spending on software and digital services expected to rise by 12% in 2024.

Drone Technology for Site Monitoring and Data Collection

Drone technology is revolutionizing construction site monitoring. Advanced sensors and AI capabilities allow for precise surveying, real-time progress tracking, and early detection of potential problems. For instance, by mid-2024, construction firms were reporting a significant reduction in site inspection time, with some seeing up to a 50% decrease in man-hours dedicated to progress reporting thanks to drone data collection.

ARCO Construction can leverage these advancements to gain a competitive edge. Deploying drones equipped with high-resolution cameras and thermal imaging, ARCO can gather detailed, real-time data for comprehensive site inspections and accurate progress assessments. This data-driven approach enhances project oversight, enabling faster and more informed decision-making.

- Improved Site Surveying: Drones offer faster and more accurate topographical data collection compared to traditional methods, with some projects seeing a 30% increase in surveying efficiency.

- Real-time Progress Monitoring: Regular aerial surveys provide visual documentation of construction phases, allowing for immediate identification of deviations from the plan.

- Predictive Issue Identification: AI analysis of drone imagery can flag potential structural weaknesses or safety hazards before they escalate, potentially saving significant costs.

- Enhanced Data Accuracy: Drones equipped with LiDAR and photogrammetry can generate highly accurate 3D models of sites, crucial for quality control and clash detection.

Technological advancements are fundamentally reshaping the construction landscape. Building Information Modeling (BIM) adoption, for instance, is projected to reduce rework by up to 30% on complex projects, as noted in a 2024 industry report, directly impacting cost savings and schedules for firms like ARCO Construction.

The integration of AI-powered scheduling tools can optimize workflows, potentially cutting project completion times by 10-15%, while robotic bricklayers can lay up to 1,000 bricks per hour, significantly boosting efficiency.

The global advanced construction materials market was valued at approximately $160 billion in 2023, with innovations like self-healing concrete offering enhanced project durability and reduced long-term maintenance costs for ARCO.

Modular construction, a sector expected to exceed $200 billion globally in 2024, allows for faster build times and cost savings, improving efficiency and quality control.

| Technology | Impact on Construction | ARCO's Potential Benefit | Industry Data Point (2024/2025 Projection) |

|---|---|---|---|

| Building Information Modeling (BIM) | Improved design accuracy, collaboration, and project management | Reduced design errors, better material estimation | Up to 30% reduction in rework |

| Automation & AI | Increased efficiency, safety, and predictive capabilities | Boosted output, optimized scheduling | 10-15% reduction in project completion times (AI scheduling) |

| Advanced Materials | Enhanced durability, sustainability, and reduced maintenance | Improved project lifespan, lower lifecycle costs | Global advanced materials market ~$160 billion (2023) |

| Modular/Prefabrication | Faster construction, cost savings, and quality control | More competitive project delivery | Modular construction market >$200 billion globally (2024) |

Legal factors

ARCO Construction must strictly adhere to occupational health and safety regulations, like those mandated by OSHA, to prevent accidents and safeguard its workforce. In 2023, construction remained one of the most dangerous industries, with the Bureau of Labor Statistics reporting 1,069 fatalities. This underscores the critical need for ARCO to maintain robust safety protocols and comprehensive training programs to comply with these laws and minimize risks on all its project sites.

Arco Construction must meticulously adhere to national, state, and local building codes. These regulations cover critical aspects like structural integrity, fire safety protocols, and energy efficiency standards, with non-compliance leading to significant fines and project delays. For instance, the International Building Code (IBC) is widely adopted, with states and cities often layering their own amendments, requiring constant vigilance from Arco.

Shifting zoning laws represent another key legal hurdle. These regulations determine land use, density, and building height, directly influencing where Arco can undertake projects and the scope of their designs. In 2024, many urban areas are seeing updated zoning to encourage mixed-use development and higher density, impacting project feasibility and requiring Arco to adapt its planning and bidding strategies accordingly.

Environmental regulations are a significant legal factor for ARCO Construction. These laws cover waste management, emissions, water discharge, and land use, all of which require specific permits and compliance measures for construction projects. For instance, in 2024, the EPA continued to enforce strict standards on construction site runoff, with fines for non-compliance potentially reaching tens of thousands of dollars per violation.

ARCO must meticulously navigate these complex legal frameworks. Failure to do so can lead to substantial penalties, project delays, and reputational damage. Staying abreast of evolving environmental legislation, such as potential updates to the Clean Air Act or new state-level land use regulations, is crucial for maintaining operational legality and minimizing environmental impact. As of early 2025, many states are also increasing scrutiny on construction material sourcing and disposal, adding another layer of legal complexity.

Labor Laws and Employment Regulations

Labor laws, encompassing minimum wage requirements, overtime rules, and proper worker classification, directly influence ARCO Construction's operating expenses and its approach to managing its workforce. For instance, the Fair Labor Standards Act (FLSA) in the United States mandates minimum wage and overtime pay, affecting project budgeting and labor scheduling. As of January 1, 2024, the federal minimum wage remained at $7.25 per hour, though many states and cities have higher rates, adding complexity to ARCO's payroll management across different jurisdictions.

Adherence to evolving employment standards, such as those related to workplace safety and anti-discrimination, is paramount for ARCO to ensure a reliable and motivated workforce. Non-compliance can lead to significant penalties and reputational damage. The Occupational Safety and Health Administration (OSHA) reported in 2023 that construction remains one of the most dangerous industries, highlighting the critical need for ARCO to maintain rigorous safety protocols and training, which are often mandated by labor regulations.

Union agreements, where applicable, can further shape ARCO's labor costs and operational flexibility. Collective bargaining agreements often dictate wage scales, benefits, and work rules. For example, in 2024, construction industry unions across various regions continued to negotiate for improved wages and benefits, reflecting ongoing trends in labor relations that ARCO must navigate.

- Wage and Hour Compliance: Ensuring all employees are paid at least the applicable federal, state, and local minimum wage, and that overtime is calculated and paid correctly, is a fundamental legal requirement impacting ARCO's payroll.

- Worker Classification: Properly classifying workers as employees or independent contractors is critical to avoid penalties related to taxes, benefits, and labor law protections. Misclassification risks can be substantial for construction firms.

- Union Relations: For projects involving unionized labor, ARCO must adhere to the terms of collective bargaining agreements, which can influence wage rates, working conditions, and dispute resolution processes.

- Workplace Safety Regulations: Compliance with OSHA standards and other safety mandates is not only a legal obligation but also crucial for preventing accidents, reducing insurance costs, and maintaining operational continuity.

Contract Law and Dispute Resolution

The legal framework for construction contracts is paramount for ARCO Construction. This includes clearly defined terms of engagement, liability clauses, and warranty provisions. Understanding these legal aspects ensures ARCO operates within established parameters and protects its interests.

Effective dispute resolution mechanisms are crucial for managing client relationships and mitigating financial risks. ARCO's ability to navigate legal recourse, whether through negotiation, mediation, or litigation, directly impacts project success and financial stability. For instance, in 2024, the average cost of construction disputes in the US reached $15 million, highlighting the importance of robust contract management.

- Contractual Clarity: Ensuring all contracts clearly outline scope, payment terms, and responsibilities to prevent future disputes.

- Liability Management: Understanding and managing potential liabilities related to project delays, defects, or accidents is vital.

- Dispute Resolution Strategies: Implementing pre-agreed dispute resolution clauses, such as arbitration, can offer a more efficient path than traditional litigation.

- Regulatory Compliance: Adhering to all relevant building codes and safety regulations is a legal necessity that impacts project execution and liability.

ARCO Construction must navigate a complex web of legal requirements, from stringent occupational health and safety mandates like those from OSHA, which reported 1,069 construction fatalities in 2023, to adherence to national and local building codes. Shifting zoning laws in 2024, encouraging higher density in urban areas, also directly impact project feasibility and planning.

Environmental regulations, such as the EPA's enforcement of construction site runoff standards in 2024, impose significant compliance burdens with potential fines. Labor laws, including minimum wage and overtime rules governed by the FLSA, affect operational costs, with many states enforcing higher minimums than the federal $7.25 per hour as of January 1, 2024.

Contractual clarity, liability management, and dispute resolution are crucial legal considerations, especially given that construction disputes in the US averaged $15 million in 2024. Staying compliant with evolving employment standards and union agreements, which saw ongoing negotiations for improved benefits in 2024, is vital for workforce management and operational stability.

Environmental factors

The escalating frequency and severity of extreme weather events, driven by climate change, present significant operational challenges for Arco Construction. These events, such as increased hurricane activity and more intense rainfall, can lead to project delays, damage to ongoing work, and a subsequent rise in insurance premiums. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, totaling over $92.9 billion in damages, underscoring the growing financial exposure.

To mitigate these risks, Arco must proactively integrate climate resilience into its project planning and execution. This involves specifying more robust building materials and adopting construction techniques designed to withstand harsher environmental conditions. A proactive approach, including enhanced site preparation for flood control and wind resistance, can significantly reduce potential losses and ensure project continuity in the face of unpredictable weather patterns.

The increasing client demand for green building certifications, such as LEED, directly shapes project requirements for construction firms like ARCO. In 2024, the global green building market was valued at approximately $332.5 billion, with a projected compound annual growth rate (CAGR) of 9.8% through 2030, indicating a robust and expanding sector.

ARCO's capacity to successfully deliver LEED-certified projects is a significant differentiator, showcasing its dedication to sustainable practices and potentially attracting a wider range of environmentally conscious clients. This capability can translate into a tangible competitive edge in a market increasingly prioritizing eco-friendly construction solutions.

Regulations around construction waste and recycling are tightening. For instance, the UK government aims to reduce construction and demolition waste by 50% by 2030 compared to 2018 levels, pushing companies like ARCO to adopt more robust waste reduction and material reuse strategies.

ARCO must integrate efficient waste management plans to comply with these evolving legal mandates and minimize its environmental impact. This includes exploring innovative recycling techniques and prioritizing the reuse of salvaged materials on-site, which can also lead to cost savings.

Resource Scarcity and Sustainable Material Sourcing

Growing concerns over the depletion of natural resources are pushing the construction industry towards sustainable material sourcing. This shift emphasizes the use of recycled, upcycled, and renewable materials to minimize environmental impact. For Arco Construction, this means a strategic focus on procurement, prioritizing suppliers who demonstrate a commitment to eco-friendly practices and responsible sourcing.

By integrating these materials, Arco can not only improve its environmental footprint but also contribute to the development of a circular economy within the construction sector. This approach aligns with global sustainability goals and can lead to long-term cost efficiencies as virgin resource prices potentially increase.

- Increased Demand for Recycled Content: The global market for recycled construction materials is projected to reach $77.4 billion by 2028, indicating a strong trend towards their adoption.

- Focus on Renewable Materials: Wood, bamboo, and other bio-based materials are gaining traction, with the global engineered wood market expected to grow significantly.

- Supplier Vetting for Sustainability: Arco's strategy should include rigorous vetting of suppliers to ensure their materials meet stringent environmental and ethical sourcing standards.

- Circular Economy Integration: Embracing materials that can be easily reused or recycled at the end of a building's life cycle is crucial for long-term sustainability.

Energy Efficiency and Decarbonization Goals

The increasing global emphasis on energy efficiency and ambitious decarbonization targets, such as the U.S. federal government's mandate to phase out fossil fuels in new buildings by 2030, significantly influences ARCO Construction. This regulatory environment necessitates a pivot towards sustainable building practices and materials.

ARCO must integrate advanced energy conservation techniques and clean energy solutions into its project designs and execution. For instance, the adoption of high-performance insulation, energy-efficient HVAC systems, and renewable energy sources like solar photovoltaics will become standard requirements. The U.S. Green Building Council reported that LEED-certified buildings save an average of 25% on energy costs, highlighting the financial benefits of these strategies.

- Federal Mandate: U.S. federal buildings must eliminate fossil fuel use by 2030, driving demand for electric and renewable energy systems.

- Market Demand: Growing client preference for sustainable and energy-efficient structures is a key driver for ARCO's strategic planning.

- Cost Savings: Implementing energy-efficient designs can lead to substantial long-term operational cost reductions for building owners, making them more attractive investments.

- Innovation: ARCO's ability to adopt and implement cutting-edge green building technologies will be a critical differentiator in the competitive landscape.

Arco Construction faces increased operational costs due to extreme weather events, with the U.S. experiencing $92.9 billion in damages from 28 billion-dollar weather disasters in 2023 alone. The company must integrate climate resilience into its planning, using more robust materials and advanced site preparation to mitigate risks and ensure project continuity.

The construction industry is increasingly adopting green building practices, with the global market valued at $332.5 billion in 2024 and projected to grow at a 9.8% CAGR. Arco's ability to deliver LEED-certified projects offers a competitive advantage, aligning with client demand for eco-friendly solutions.

Stricter regulations on construction waste, aiming for a 50% reduction by 2030 in places like the UK, compel Arco to enhance waste management and material reuse strategies, potentially yielding cost savings.

The growing emphasis on energy efficiency and decarbonization, including U.S. federal mandates to phase out fossil fuels in new buildings by 2030, requires Arco to adopt sustainable building practices and clean energy solutions, leading to an average 25% reduction in energy costs for LEED-certified buildings.

| Environmental Factor | Impact on Arco Construction | Data/Trend |

|---|---|---|

| Extreme Weather Events | Project delays, increased costs, higher insurance premiums | $92.9 billion in U.S. weather/climate disaster damages in 2023 |

| Green Building Demand | Opportunity for competitive differentiation, increased project pipeline | Global green building market valued at $332.5 billion (2024), 9.8% CAGR |

| Waste & Recycling Regulations | Need for improved waste management, potential cost savings through reuse | UK target: 50% construction waste reduction by 2030 |

| Energy Efficiency Mandates | Shift to sustainable practices, long-term operational cost savings for clients | U.S. federal buildings to eliminate fossil fuels by 2030; LEED buildings save 25% on energy |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Arco Construction is built on a robust foundation of data from official government publications, reputable economic forecasting agencies, and leading industry analysis firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant to the construction sector.