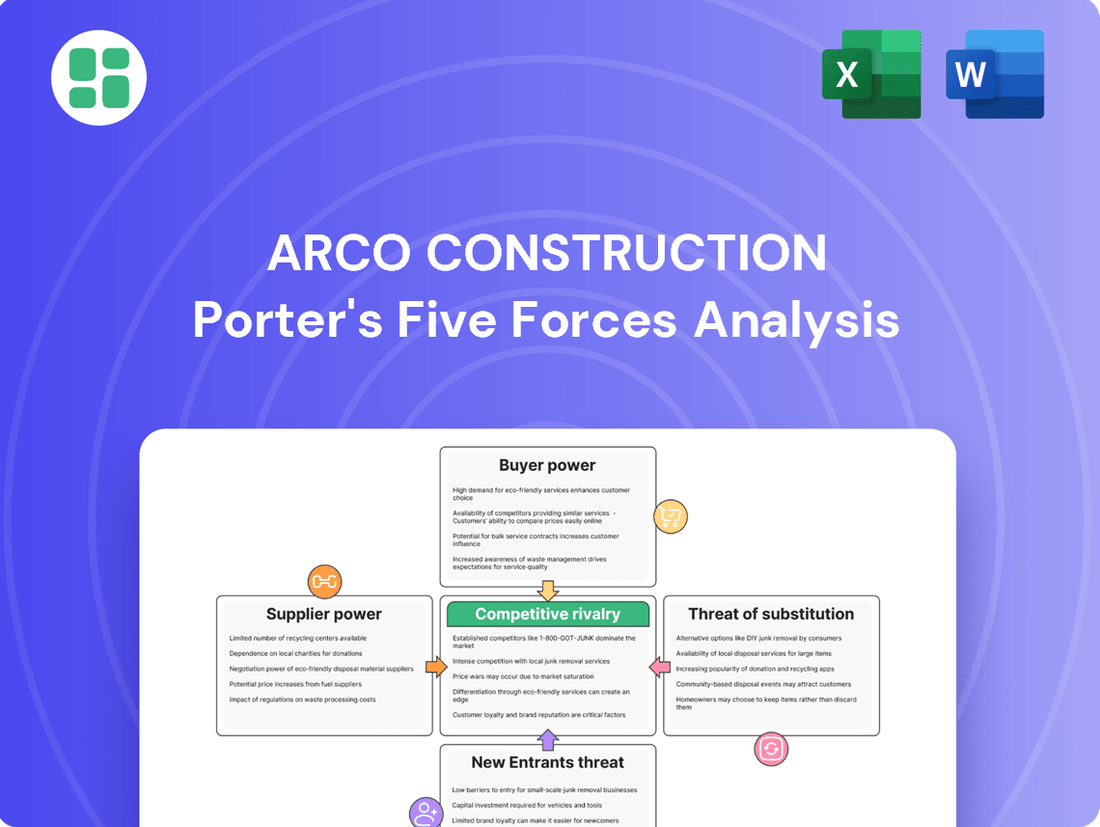

Arco Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arco Construction Bundle

Arco Construction faces moderate bargaining power from both suppliers and buyers, with the threat of new entrants being a significant concern in the construction sector. The intensity of rivalry among existing firms also shapes their strategic landscape.

The complete report reveals the real forces shaping Arco Construction’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The construction sector, including companies like ARCO Construction, is grappling with a significant shortage of skilled labor. This scarcity directly translates to higher wage demands from workers, increasing overall labor expenses for contractors. For instance, in 2024, the Associated General Contractors of America reported that over 70% of construction firms struggled to find enough qualified craft workers, a trend that has been intensifying.

This widening gap is driven by a combination of factors, including a retiring experienced workforce and a surge in demand from major infrastructure and manufacturing projects. Consequently, ARCO must often offer premium compensation packages to attract and retain essential talent, which directly impacts project margins and overall profitability.

While building material prices have seen some easing, they remain notably higher than pre-pandemic figures. Key commodities such as steel, lumber, and concrete continue to experience price fluctuations. For instance, lumber prices in early 2024, while down from their 2021 peaks, were still approximately 40% higher than in 2019.

These ongoing cost pressures, driven by persistent supply chain disruptions and robust demand, directly impact ARCO Construction's project budgets. This necessitates the implementation of sophisticated procurement strategies and proactive risk management to mitigate the financial effects of volatile material expenses.

When ARCO Construction needs highly specialized subcontractors, like those for complex data center electrical systems or advanced manufacturing cleanrooms, they often find a limited pool of qualified providers. This concentration means these specialized firms have considerable sway. For example, in 2024, the demand for skilled trades in sectors like renewable energy construction surged, leading to increased rates for specialized labor, impacting general contractors like ARCO.

Equipment and Technology Providers

The bargaining power of equipment and technology providers for a company like ARCO Construction is significant, largely due to the increasing reliance on advanced tools for project efficiency and quality. Specialized providers offering cutting-edge solutions in areas like Building Information Modeling (BIM), artificial intelligence (AI) for project management, and advanced surveying equipment can leverage this demand. While ARCO can opt for leasing, the necessity of staying competitive with the latest technology means these suppliers can influence pricing and subscription terms. For instance, the global construction technology market was valued at approximately USD 13.9 billion in 2023 and is projected to grow substantially, indicating strong demand for these specialized services and equipment.

- High Demand for Specialized Tech: The need for BIM and AI in construction projects increases supplier leverage.

- Leasing vs. Purchasing Decisions: ARCO's ability to lease offers some negotiation power, but reliance on new tech limits it.

- Market Growth: The expanding construction technology market (e.g., projected CAGR of 12.5% from 2024-2030) underscores supplier influence.

- Pricing Power: Suppliers of essential, advanced equipment and software can command premium prices or subscription fees.

Supply Chain Disruptions

Ongoing global and regional supply chain disruptions significantly bolster supplier bargaining power. Limited material availability and extended lead times, a trend persisting into 2024-2025, compel contractors like Arco Construction to adjust their sourcing methods. This often translates to paying higher prices for prompt deliveries, as evidenced by the increased industry emphasis on supply chain resilience and diversification.

- Increased Material Costs: Reports from early 2024 indicated that the cost of key construction materials, such as lumber and steel, remained elevated due to supply constraints, impacting project budgets.

- Extended Project Timelines: Delays in material delivery are a common occurrence, pushing back project completion dates and increasing overhead costs for contractors.

- Supplier Concentration: In certain specialized material markets, a limited number of suppliers can exert considerable influence, dictating terms and pricing.

- Geopolitical Impact: International trade disputes and regional conflicts can further exacerbate supply chain vulnerabilities, giving suppliers in stable regions more leverage.

The bargaining power of suppliers for ARCO Construction is substantial, particularly concerning specialized labor and advanced materials. The persistent shortage of skilled trades, with over 70% of firms reporting difficulties in finding qualified workers in 2024, allows these workers and their representatives to demand higher wages, directly impacting ARCO's project costs. Furthermore, while some material prices have softened from their peaks, key commodities like steel and lumber remained significantly elevated in early 2024 compared to pre-pandemic levels, with lumber prices still approximately 40% higher than in 2019, giving material suppliers considerable pricing influence.

| Factor | Impact on ARCO Construction | Supporting Data (2024) |

|---|---|---|

| Skilled Labor Shortage | Increased labor costs, wage pressure | Over 70% of firms struggled to find qualified craft workers (AGC) |

| Material Price Volatility | Higher procurement costs, budget impacts | Lumber prices ~40% higher than 2019 levels (early 2024) |

| Specialized Subcontractors | Limited options, higher rates for niche services | Surge in demand for renewable energy trades increased rates |

| Construction Technology Suppliers | Influence on pricing for essential advanced tools | Construction tech market valued at ~$13.9 billion (2023) |

What is included in the product

This analysis reveals the competitive intensity within the construction industry for Arco Construction, examining supplier and buyer power, the threat of new entrants and substitutes, and the bargaining power of customers.

Instantly visualize competitive intensity across all five forces, allowing for rapid identification of key strategic pressures.

Customers Bargaining Power

ARCO Construction's engagement in large-scale industrial, commercial, and multi-family residential projects inherently places them before sophisticated clients like major developers and large corporations. These clients, possessing substantial capital and well-defined project requirements, wield significant bargaining power.

This client sophistication translates into a strong ability to solicit and compare competitive bids, directly influencing ARCO's pricing and putting downward pressure on profit margins. For instance, in 2024, the average value of large commercial construction projects in the US exceeded $50 million, a scale where client negotiation leverage is particularly pronounced.

Customers are increasingly drawn to the design-build approach for its clear cost certainty and accelerated project timelines. This growing preference means clients are better positioned to dictate terms, as they are seeking predictable results and are less willing to absorb unforeseen expenses. For ARCO Construction, while their proficiency in design-build meets these client expectations, it also reduces their leverage in negotiating fundamental service benefits.

The construction industry, even for a national player like ARCO Construction, is characterized by a multitude of general contractors and specialized design-build firms. This sheer volume of available options means clients aren't locked into a single provider.

Clients can readily obtain multiple bids for their projects, comparing not only price but also scope of work, timelines, and past performance. This practice directly amplifies customer bargaining power, as ARCO faces constant pressure to remain competitive against a wide array of alternatives.

For instance, in 2024, the U.S. construction industry saw thousands of active general contractors, creating a highly fragmented market. This fragmentation means that for any given project, clients often have a significant pool of qualified firms to choose from, intensifying the competitive landscape for established companies like ARCO.

Economic Sensitivity and Project Deferrals

Elevated interest rates and persistent inflation throughout 2024 and into 2025 are making customers more hesitant. This economic climate often prompts a delay or outright cancellation of construction projects. For instance, the Federal Reserve's benchmark interest rate remained at a high level through early 2024, impacting borrowing costs for developers and end-users alike.

This heightened economic sensitivity directly amplifies customer bargaining power. Contractors find themselves vying for a smaller number of available projects, especially in sectors highly susceptible to interest rate fluctuations like residential and commercial real estate development. Data from the U.S. Bureau of Labor Statistics in late 2023 showed a slowdown in new construction starts, reflecting this trend.

- Economic Headwinds: Persistent inflation and high interest rates in 2024-2025 increase customer caution.

- Project Deferrals: Customers are more likely to postpone or cancel construction projects due to economic uncertainty.

- Increased Competition: Contractors face a shrinking market for new projects, intensifying competition for work.

- Sector Sensitivity: Rate-sensitive sectors like real estate are particularly affected, giving customers more leverage.

Government and Public Sector Influence

For projects heavily reliant on government funding, such as infrastructure development or manufacturing incentives, the government emerges as a significantly influential customer. Their extensive involvement in awarding contracts for public works, for instance, grants them considerable sway. In 2024, government spending on infrastructure projects globally continued to be a major driver for construction firms.

Governments often employ standardized procurement procedures and enforce stringent compliance mandates. This allows them to dictate contract terms, timelines, and pricing, thereby amplifying their bargaining power over construction companies like Arco Construction. For example, the bidding process for large-scale public projects typically involves detailed specifications and rigorous evaluation criteria that favor cost-effectiveness and adherence to regulations.

- Government as a Major Buyer: In 2024, government contracts represented a substantial portion of the revenue for many large construction firms, particularly in sectors like transportation and energy.

- Standardized Procurement: Government agencies typically use competitive bidding processes with predefined requirements, limiting negotiation flexibility for contractors.

- Compliance and Regulation: Strict adherence to safety, environmental, and quality standards, often mandated by government bodies, can increase project costs and reduce contractor margins.

- Ability to Dictate Terms: Governments can leverage their position to impose specific payment schedules, performance bonds, and penalty clauses, further enhancing their bargaining power.

ARCO Construction's sophisticated clientele, often large corporations and developers, possess significant bargaining power due to their substantial capital and clear project needs. This sophistication allows them to solicit and compare multiple bids, which in turn pressures ARCO's pricing and profit margins.

The prevalence of design-build methods, favored for cost certainty, further empowers clients to dictate terms, as they seek predictable outcomes and are less tolerant of unexpected expenses. In 2024, the average value of major US commercial construction projects exceeded $50 million, a scale where client negotiation leverage is particularly strong.

The fragmented nature of the construction market, with numerous general and specialized contractors available, means clients have ample choice. This intensifies competition, forcing ARCO to remain competitive against a wide array of alternatives, a situation exacerbated by the thousands of active general contractors in the U.S. construction industry in 2024.

Economic conditions in 2024 and 2025, marked by high inflation and interest rates, have made clients more cautious, leading to project deferrals or cancellations. This economic sensitivity amplifies customer bargaining power, as contractors compete for fewer projects, especially in rate-sensitive sectors like real estate, a trend reflected in the slowdown of new construction starts observed by the U.S. Bureau of Labor Statistics in late 2023.

| Factor | Impact on ARCO | 2024 Data/Observation |

|---|---|---|

| Client Sophistication | Increased negotiation leverage, downward price pressure | Average US commercial project value > $50M |

| Market Fragmentation | Intensified competition, reduced pricing power | Thousands of US general contractors active in 2024 |

| Economic Climate | Project deferrals, heightened client price sensitivity | High interest rates (e.g., Federal Reserve benchmark) impacting borrowing costs |

| Design-Build Preference | Client control over terms and timelines | Growing demand for predictable project costs and schedules |

Preview the Actual Deliverable

Arco Construction Porter's Five Forces Analysis

This preview shows the exact Arco Construction Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products. This detailed analysis is ready for your strategic planning and decision-making.

Rivalry Among Competitors

The U.S. construction market is incredibly fragmented, boasting a vast number of general contractors and design-build firms. This means ARCO Construction encounters significant competition from both large national companies and robust regional players across its industrial, commercial, and multi-family construction sectors.

In the construction sector, securing new projects often involves intense bidding wars. This aggressive competition, particularly as of 2024 with some economic uncertainties, directly squeezes profit margins for companies like ARCO Construction. For instance, a report from Dodge Construction Network in early 2024 indicated a slight slowdown in non-residential construction starts compared to the previous year, intensifying the need for competitive pricing.

While the broader construction market shows resilience, certain segments are indeed facing headwinds. For instance, the traditional commercial office sector, a significant area for many construction firms, saw a noticeable slowdown in new project starts through 2024, with some analysts projecting a continued contraction in this specific niche. This uneven growth pattern is forcing companies to re-evaluate their strategies.

This slowdown in areas like traditional office space intensifies competition in more promising sectors. As firms seek out growth, they are increasingly targeting high-demand areas such as manufacturing facilities, data centers, and critical infrastructure projects. This influx of competition into these robust segments means that companies like Arco Construction must contend with a more crowded field, driving up the pressure to secure lucrative contracts.

Differentiation through Design-Build and Specialization

Competitive rivalry within the construction sector is intensified by differentiation strategies, where firms like ARCO Construction leverage specialized capabilities to gain an edge. ARCO's design-build expertise, for instance, allows them to offer a more integrated and often more efficient project delivery method compared to traditional, fragmented approaches. This specialization extends to their focus on specific market segments, such as industrial facilities or cold storage, where deep understanding of sector-specific needs provides a distinct advantage.

Companies are actively competing by developing unique value propositions. This includes incorporating advanced technological integrations, like Building Information Modeling (BIM) for enhanced project planning and execution, and embracing sustainable construction practices. For example, the global green building market was valued at approximately $107.7 billion in 2023 and is projected to grow significantly, highlighting the increasing importance of sustainability as a differentiator. Firms are investing in these areas to capture market share and build stronger client relationships in a highly competitive landscape.

- Design-Build Expertise: ARCO Construction's focus on integrated design and construction services offers clients a streamlined project lifecycle.

- Sector Specialization: Targeting niche markets like industrial and cold storage allows for tailored solutions and deeper client engagement.

- Technological Integration: Adoption of advanced technologies such as BIM is a key differentiator, improving efficiency and reducing project risks.

- Sustainable Practices: A growing emphasis on eco-friendly construction methods appeals to environmentally conscious clients and meets evolving regulatory standards.

Talent and Technology Acquisition

The competition in construction goes beyond just winning bids; it's also a fierce battle for talent and technology. Companies are vying to attract and keep skilled workers, from project managers to specialized tradespeople. For instance, in 2024, the construction industry continued to grapple with a significant labor shortage, with estimates suggesting millions of unfilled positions across various trades.

Furthermore, the race to adopt advanced technologies like Building Information Modeling (BIM), drones for site surveying, and AI-powered project management software is intensifying rivalry. Firms that successfully integrate these innovations often see improvements in efficiency, safety, and project outcomes. In 2023, for example, construction technology investments were projected to grow by over 10%, highlighting the sector's commitment to digital transformation.

- Talent Acquisition: The construction sector faced a projected shortage of over 500,000 skilled workers in the US in 2024, driving up labor costs and competition for qualified personnel.

- Technology Adoption: Investments in construction technology, including AI and automation, saw a notable increase in 2023, with companies seeking to improve productivity and project delivery timelines.

- Competitive Edge: Firms prioritizing workforce training and the integration of digital tools are better positioned to enhance efficiency and quality, thereby outperforming competitors.

- Innovation Drive: The need to attract and retain talent, coupled with the drive for technological advancement, creates a continuous cycle of innovation and heightened rivalry among construction firms.

The competitive rivalry within the construction sector, particularly for ARCO Construction, is intense due to a fragmented market and aggressive bidding. As of early 2024, Dodge Construction Network data indicated a slight slowdown in non-residential construction starts, which amplified price competition and squeezed profit margins for firms like ARCO.

This intensified rivalry is further fueled by companies differentiating themselves through specialized capabilities like ARCO's design-build expertise and sector focus. The global green building market, valued at approximately $107.7 billion in 2023, also highlights how sustainable practices are becoming a key competitive differentiator, influencing client choices and market share battles.

The battle for talent and technology adoption also heightens rivalry. In 2024, the industry continued to face a significant labor shortage, with millions of unfilled skilled positions, driving up labor costs. Simultaneously, investments in construction technology, projected to grow over 10% in 2023, are crucial for firms seeking efficiency and a competitive edge.

| Factor | Impact on ARCO Construction | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | High competition from numerous firms | Vast number of general contractors and design-build firms |

| Bidding Wars | Pressure on profit margins | Intensified by economic uncertainties and project slowdowns |

| Talent Shortage | Increased labor costs and competition for skilled workers | Projected shortage of over 500,000 skilled workers in the US |

| Technology Adoption | Need for investment in BIM, AI, etc. for efficiency | Construction tech investments grew over 10% in 2023 |

SSubstitutes Threaten

Clients increasingly consider renovating or adaptively reusing existing structures as a viable alternative to new construction, especially given ARCO's own expansion into capital projects and tenant improvements. This trend offers a compelling substitute, often proving more economical and quicker than ground-up development.

For instance, the adaptive reuse market saw significant activity in 2024, with numerous projects focusing on converting older commercial buildings into residential or mixed-use spaces. This strategy can significantly reduce material costs and embodied carbon compared to new builds, making it an attractive option for budget-conscious developers and owners.

The rise of modular and prefabricated construction presents a significant threat of substitutes for traditional building methods. These off-site construction techniques offer advantages like faster project completion and more predictable costs, appealing to clients seeking efficiency. For instance, the modular construction market was valued at approximately $129.6 billion in 2023 and is projected to grow substantially, indicating a clear shift in client preferences that ARCO must acknowledge.

Clients, particularly those in multi-family and commercial real estate, may opt to buy existing, move-in-ready properties instead of commissioning new builds. This is especially true when market conditions favor sellers or when immediate occupancy is a critical requirement. For instance, in 2024, the U.S. saw a significant number of existing commercial properties trade hands, with transaction volumes indicating a strong preference for readily available assets in certain sectors, potentially diverting demand from new construction projects.

In-house Construction Capabilities of Large Clients

Very large corporations, especially those with ongoing building projects, might establish their own construction divisions. This can significantly reduce the need for external general contractors like ARCO. For instance, a major retail chain needing frequent store renovations or a large industrial company expanding its facilities could justify the investment in an in-house team. This directly impacts ARCO's potential project pipeline.

These in-house capabilities allow clients to gain greater control over project timelines and costs, potentially bypassing the markups associated with third-party contractors. This is particularly relevant in 2024 for large-scale infrastructure or real estate development projects where cost efficiencies are paramount. Companies that previously relied on general contractors may now be evaluating the economic viability of bringing these services in-house, especially with advancements in construction technology and project management software.

- Reduced Market Opportunity: Large clients developing in-house construction capabilities directly shrink the pool of projects available to external general contractors.

- Cost Control for Clients: Building in-house allows clients to manage costs more directly, potentially reducing project expenses compared to hiring an external firm.

- Strategic Vertical Integration: Some large entities may see in-house construction as a strategic move towards vertical integration, gaining more control over their supply chain and operations.

Non-Construction Solutions

For certain client requirements, solutions outside of traditional construction can act as effective substitutes. For example, advancements in logistics software can streamline operations, potentially reducing the need for extensive warehouse construction. This trend is underscored by the continued growth in e-commerce, which relies heavily on efficient digital management of inventory and distribution networks.

Furthermore, the persistent rise of remote and hybrid work models directly impacts the demand for new office construction. Companies are re-evaluating their physical space needs, with many opting for smaller, more flexible footprints or entirely remote setups. This shift away from traditional office environments represents a significant substitution threat for new commercial building projects.

- Logistics Software Impact: Enhanced logistics platforms can optimize warehouse utilization, potentially decreasing the square footage required by up to 15% for some businesses.

- Remote Work Adoption: As of early 2024, approximately 30% of the global workforce is engaged in hybrid or fully remote work arrangements, a substantial increase from pre-pandemic levels.

- Office Space Reduction: Major corporations have announced plans to reduce their office footprints by an average of 20-25% in the coming years, directly impacting new construction demand.

The threat of substitutes for ARCO Construction is significant, encompassing alternatives like renovating existing structures and the growing modular construction market. These options often present cost and time efficiencies that traditional new builds cannot match.

Adaptive reuse projects, for instance, gained traction in 2024, with many commercial buildings being converted to residential use, reducing material costs and embodied carbon. Modular construction, valued at approximately $129.6 billion in 2023, offers faster completion and predictable costs, directly appealing to clients seeking efficiency.

Furthermore, clients may opt to purchase ready-to-occupy properties instead of commissioning new builds, a trend evident in 2024's robust existing commercial property transactions. The rise of remote work also diminishes demand for new office construction, with companies reducing their physical footprints by an average of 20-25%.

| Substitute Option | Key Advantages | 2024/2023 Data Point |

|---|---|---|

| Adaptive Reuse | Cost savings, faster timelines, reduced environmental impact | Significant activity in commercial to residential conversions |

| Modular Construction | Speed, cost predictability, quality control | Market valued at ~$129.6 billion in 2023 |

| Purchasing Existing Properties | Immediate availability, potentially lower upfront costs | Strong transaction volumes in existing commercial real estate |

| Remote/Hybrid Work Models | Reduced need for office space | ~30% global workforce hybrid/remote; companies reducing office footprints by 20-25% |

Entrants Threaten

Entering the general contracting and design-build sector, particularly for significant industrial and commercial undertakings, demands a considerable outlay of capital. This includes funds for essential equipment, operational cash flow, and the crucial requirement to secure large project bonds, which can run into millions of dollars.

These substantial financial hurdles act as a significant deterrent for many prospective new companies aiming to enter the market. For instance, in 2024, the average bid bond for a major infrastructure project could easily exceed $5 million, a figure that many smaller or newer firms simply cannot afford to post.

Arco Construction's formidable reputation, built over decades and evidenced by an extensive portfolio of successfully completed projects, acts as a significant deterrent to new entrants. This established track record, coupled with long-standing relationships with repeat clients, makes it exceptionally challenging for newcomers to gain traction in the market. In 2024, for instance, companies with less than five years of operational history often face significant hurdles in securing contracts for projects exceeding $50 million, a segment where Arco consistently excels.

New construction firms struggle to attract and retain skilled labor, a significant barrier to entry. In 2024, the U.S. construction industry faced an estimated shortage of 546,000 workers, making it difficult for new companies to build a qualified workforce.

Establishing robust and cost-effective supply chain relationships presents another hurdle for new entrants. Securing reliable access to materials and equipment at competitive prices is challenging when competing with established firms that have long-standing supplier agreements.

Regulatory Complexity and Licensing

The construction sector is rife with regulatory hurdles, demanding extensive licenses and permits that differ based on location and project scope. This intricate web of compliance acts as a substantial barrier, increasing both the difficulty and expense for any new company attempting to enter the market. For instance, in 2024, navigating environmental regulations alone could add significant lead times and costs to project initiation.

These regulatory complexities directly impact the threat of new entrants by escalating the capital and expertise required to even begin operations. New firms must invest heavily in understanding and adhering to these rules, diverting resources that could otherwise be used for competitive pricing or innovation. A 2024 report indicated that compliance costs in construction could represent up to 10% of a project’s total budget in some regions.

- High Compliance Costs: New entrants face substantial upfront expenses for licensing and permits.

- Jurisdictional Variations: Regulations differ significantly, requiring specialized knowledge for each market.

- Time Delays: Obtaining necessary approvals can be a lengthy process, hindering market entry speed.

Economies of Scale and Cost Disadvantages

Established construction giants like ARCO Construction leverage significant economies of scale, particularly in bulk material procurement and streamlined project management, leading to lower per-unit costs. For instance, in 2024, major construction firms often secure discounts of 5-10% on raw materials due to their large order volumes, a benefit unavailable to smaller, newer companies. This cost disadvantage for new entrants makes it challenging to match the competitive pricing of incumbents.

New entrants often face higher initial capital outlays for equipment and technology, further exacerbating their cost disadvantages compared to ARCO. These upfront investments, coupled with less efficient operational processes at a smaller scale, create a substantial barrier. For example, the average cost of specialized heavy machinery for large-scale projects can range from $500,000 to over $2 million, a significant hurdle for startups.

- Economies of Scale: ARCO benefits from bulk purchasing power, reducing material costs.

- Operational Efficiencies: Established processes and experienced teams enhance productivity.

- Cost Disadvantage for Newcomers: Smaller scale leads to higher per-unit expenses.

- Capital Investment Barrier: Significant upfront costs for equipment deter new market entrants.

The threat of new entrants for Arco Construction is moderate, primarily due to high capital requirements and established brand loyalty. Significant upfront investments in equipment, bonding, and securing skilled labor present substantial barriers. For example, in 2024, securing performance bonds for projects over $100 million could cost upwards of $1 million, a steep price for newcomers.

Furthermore, Arco's strong reputation and existing client relationships, cultivated over years of successful project delivery, make it difficult for new firms to penetrate the market. In 2024, companies with less than five years in operation often struggled to secure contracts exceeding $25 million, a segment where Arco has a dominant presence.

| Barrier to Entry | Impact on New Entrants | Example (2024 Data) |

|---|---|---|

| Capital Requirements | High | Performance bond costs for large projects can exceed $1 million. |

| Brand Reputation & Client Loyalty | High | New firms struggle to win contracts over $25 million without a proven track record. |

| Skilled Labor Shortage | Moderate | Industry-wide shortage of 546,000 workers makes workforce building difficult. |

| Regulatory Compliance | Moderate | Compliance costs can add up to 10% of a project budget. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Arco Construction leverages data from industry-specific market research reports, construction trade publications, and publicly available financial statements from major competitors. This ensures a comprehensive understanding of the competitive landscape.