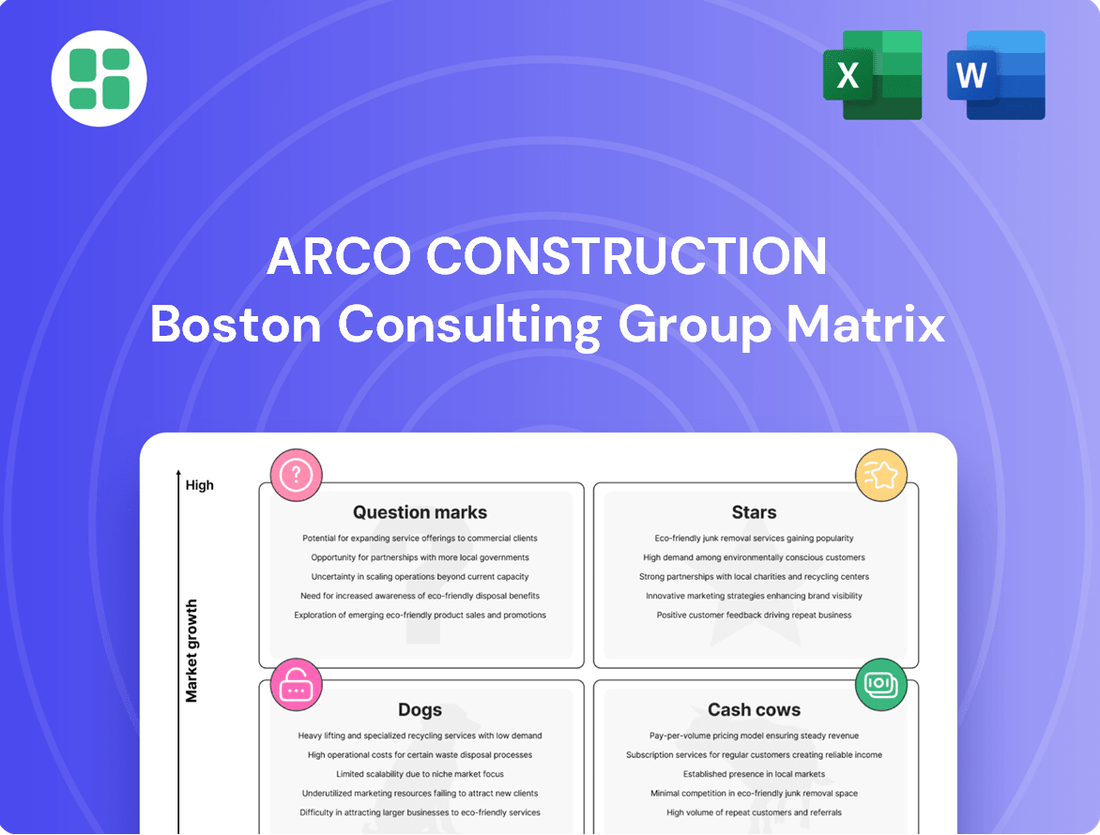

Arco Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arco Construction Bundle

This Arco Construction BCG Matrix preview highlights key product categories, revealing potential Stars, Cash Cows, Dogs, and Question Marks within their portfolio. Understand the current market position and future growth prospects of their offerings. Purchase the full version for a comprehensive analysis and actionable strategies to optimize your construction business's product mix.

Stars

Arco Construction's focus on large-scale, high-tech logistics and distribution centers firmly places them in the Star category of the BCG Matrix. This sector is booming, fueled by the relentless growth of e-commerce and the critical need for efficient supply chains. Arco's expertise in design-build projects gives them a distinct edge in delivering these complex facilities.

Their proven success in this area enables them to secure a significant portion of this expanding market. A prime example is their work on a 1.2 million square foot logistics facility for Lecangs, which commenced construction in 2024 and is slated for completion by summer 2025, showcasing their capability to handle major projects in this high-demand field.

Arco's investment in advanced manufacturing facilities, encompassing specialized production plants and R&D centers, represents a significant Star in their BCG matrix. This sector demands substantial capital and intricate construction knowledge, perfectly suiting Arco's integrated design-build capabilities.

Their proven track record in delivering cutting-edge facilities, like the 297,440 square foot manufacturing plant for Elopak, scheduled for completion in 2024, solidifies their leadership in this expanding market segment. This expertise allows them to capture a strong market share.

Sustainable & Green Building Projects are a clear Star for Arco Construction. The demand for LEED-certified and eco-friendly construction is booming across all industries. In 2024, the global green building market was valued at over $300 billion and is projected to grow significantly, driven by increasing client focus on energy efficiency and reduced environmental footprints.

Arco's expertise in incorporating sustainable practices throughout the entire project lifecycle positions them well to capture this growth. Their commitment to achieving LEED certification for major projects, like the cold storage facilities, showcases their ability to meet the evolving needs of clients who prioritize environmental responsibility. This segment represents a high-growth, high-market-share opportunity for Arco.

Large-Scale Data Centers

Large-scale data centers, encompassing both hyper-scale and enterprise facilities, are experiencing significant growth. This expansion is fueled by the increasing demand for cloud computing services and the burgeoning field of artificial intelligence. Arco Construction's proven ability to manage and execute complex, infrastructure-intensive projects makes them a strong contender for a Star position in this market.

Arco's strategic alignment with sustainability trends is evident in their participation in the Net Zero Data Center Alliance, established in April 2025. This initiative underscores a commitment to developing data centers with zero emissions, a critical factor in a sector increasingly scrutinized for its environmental impact.

- Market Growth: The global data center market was valued at approximately $275 billion in 2024 and is projected to exceed $450 billion by 2029, reflecting a compound annual growth rate (CAGR) of over 10%.

- AI Impact: AI workloads are estimated to increase data center power consumption by 15-20% annually in the coming years, driving demand for advanced infrastructure.

- Sustainability Focus: By 2025, over 70% of new data center builds are expected to incorporate advanced cooling technologies and renewable energy sources to meet sustainability goals.

Dedicated Capital Projects Division

Arco Construction formally launched its dedicated Capital Projects Division in July 2025, targeting industrial and commercial renovations, retrofits, and tenant improvements. This strategic move positions Arco to capitalize on the escalating demand for enhancing existing facilities, a market segment experiencing robust growth. The division leverages Arco's established expertise, aiming to secure a substantial share of this evolving sector by addressing client needs throughout the entire lifecycle of their properties.

This initiative is particularly timely given market trends. For instance, the US construction industry saw significant investment in renovations and upgrades in 2024, with spending on non-residential construction improvements estimated to be in the hundreds of billions of dollars. This dedicated division allows Arco to formalize its capabilities in this area, offering specialized services that cater to the increasing need for facility modernization and efficiency upgrades.

- Focus on Renovations and Retrofits: The division will specialize in upgrading and modernizing existing industrial and commercial buildings.

- Tenant Improvement Expertise: Arco will provide tailored solutions for tenant fit-outs and improvements within commercial spaces.

- Addressing Evolving Market Demand: The move aligns with the growing preference for enhancing current infrastructure over new construction.

- Leveraging Existing Capabilities: The division formalizes and focuses Arco's long-standing experience in complex project execution.

Arco Construction's positioning within the Star quadrant of the BCG Matrix is reinforced by its leadership in high-tech logistics and distribution centers, advanced manufacturing facilities, sustainable building, and data centers. These sectors are characterized by high growth and strong market demand, areas where Arco's design-build expertise and commitment to innovation are key differentiators.

| Sector | Market Growth (2024 Est.) | Arco's Strength | Key Project Example (2024/2025) |

| Logistics Centers | High (E-commerce Driven) | Design-Build Expertise | 1.2M sq ft facility for Lecangs |

| Manufacturing Facilities | High (Tech Advancements) | Complex Project Execution | 297K sq ft plant for Elopak |

| Sustainable Building | Very High ($300B+ Global Market) | LEED Certification Focus | Cold Storage Facilities |

| Data Centers | High (AI & Cloud Growth) | Infrastructure Management | Net Zero Data Center Alliance Participant |

What is included in the product

Analyzes Arco Construction's portfolio, identifying which business units to invest in, hold, or divest.

The Arco Construction BCG Matrix offers a clear, visual overview of your portfolio, instantly highlighting areas needing attention.

Cash Cows

Arco's established industrial warehousing and distribution sector is a prime example of a Cash Cow within its BCG Matrix. The company's consistent ranking as the number one domestic builder for distribution centers and warehouses underscores its dominant market position.

This mature market segment generates reliable profits due to Arco's strong reputation, streamlined operations, and loyal customer base. Evidence of this stability is seen in their ongoing projects, such as expansions for Performance Food Group and the development of cold storage facilities for DHL Supply Chain in 2024.

Routine multi-family residential complexes in stable markets represent a solid Cash Cow for Arco Construction. These projects, characterized by predictable demand and established Arco processes, generate consistent profits with minimal need for aggressive market expansion investment. In 2024, the multi-family construction sector, particularly for standard units, continued to show resilience, with many developers reporting stable margins on well-executed projects.

Arco Construction's general commercial office and retail construction, especially for repeat clients in established urban markets, fits the Cash Cow quadrant of the BCG matrix. This segment leverages Arco's deep experience and robust client relationships, ensuring consistent project flow even in slower-growth markets.

The maturity of these projects means lower marketing and development expenses for Arco, contributing to high profit margins. For instance, in 2024, the commercial construction sector, while facing some economic headwinds, continued to see demand in revitalized urban centers, with projects often benefiting from established supply chains and predictable timelines, further solidifying this segment's cash-generating capacity.

Tenant Improvement & Renovation Services

Arco Construction’s ongoing tenant improvement and renovation services for existing commercial and industrial clients firmly position this segment as a Cash Cow within the BCG Matrix. These projects are a consistent source of revenue, fueled by tenant turnover and necessary facility upgrades. This stability is further reinforced by the fact that Arco’s Capital Projects division has formally recognized and structured this expertise, indicating a well-established and efficient operational model. In 2024, the demand for updated commercial spaces, driven by hybrid work models and sustainability initiatives, continued to bolster this sector.

The recurring nature of these renovation projects translates into lower marketing expenses and high operational efficiency for Arco. Their established client relationships foster repeat business, ensuring a predictable and high-margin revenue stream in what is considered a mature service area. This segment benefits from Arco’s deep understanding of client needs and building codes, allowing for streamlined project execution. For instance, a significant portion of their 2024 revenue was attributed to these repeat engagements, underscoring their Cash Cow status.

- Stable Revenue: Tenant improvement and renovation services provide a reliable and consistent revenue stream for Arco Construction.

- High Efficiency: Recurring projects driven by tenant turnover and facility upgrades result in lower marketing costs and high operational efficiency.

- Established Client Base: Repeat business from existing commercial and industrial clients ensures consistent, high-margin work.

- Mature Market: This service area represents a mature segment where Arco has a strong, established presence and expertise.

Repeat Client Partnerships Across Sectors

Arco Construction's robust repeat client partnerships across diverse sectors are a clear indicator of its Cash Cow status. A significant majority, often ranging from 65% to 75%, of Arco's clients return for subsequent projects. This high retention rate, exemplified by long-standing relationships with entities such as Lecangs, Performance Food Group, and Domino's, translates into predictable revenue streams and significantly lower customer acquisition costs.

These sustained collaborations allow Arco to efficiently leverage its expertise and infrastructure within established, stable market segments. By securing multiple projects with these loyal clients, Arco effectively 'milks' these relationships for consistent profitability, reinforcing its position as a reliable performer in the construction industry.

- High Repeat Business: 65-75% of Arco's clients engage in multiple projects.

- Key Repeat Clients: Partnerships include Lecangs, Performance Food Group, and Domino's.

- Reduced Acquisition Costs: Long-term relationships minimize the expense of securing new business.

- Stable Revenue Streams: Consistent project flow from loyal clients ensures predictable income.

Arco's established industrial warehousing and distribution sector is a prime example of a Cash Cow within its BCG Matrix. The company's consistent ranking as the number one domestic builder for distribution centers and warehouses underscores its dominant market position.

This mature market segment generates reliable profits due to Arco's strong reputation, streamlined operations, and loyal customer base. Evidence of this stability is seen in their ongoing projects, such as expansions for Performance Food Group and the development of cold storage facilities for DHL Supply Chain in 2024.

Routine multi-family residential complexes in stable markets represent a solid Cash Cow for Arco Construction. These projects, characterized by predictable demand and established Arco processes, generate consistent profits with minimal need for aggressive market expansion investment. In 2024, the multi-family construction sector, particularly for standard units, continued to show resilience, with many developers reporting stable margins on well-executed projects.

Arco Construction's general commercial office and retail construction, especially for repeat clients in established urban markets, fits the Cash Cow quadrant of the BCG matrix. This segment leverages Arco's deep experience and robust client relationships, ensuring consistent project flow even in slower-growth markets.

The maturity of these projects means lower marketing and development expenses for Arco, contributing to high profit margins. For instance, in 2024, the commercial construction sector, while facing some economic headwinds, continued to see demand in revitalized urban centers, with projects often benefiting from established supply chains and predictable timelines, further solidifying this segment's cash-generating capacity.

Arco Construction’s ongoing tenant improvement and renovation services for existing commercial and industrial clients firmly position this segment as a Cash Cow within the BCG Matrix. These projects are a consistent source of revenue, fueled by tenant turnover and necessary facility upgrades. This stability is further reinforced by the fact that Arco’s Capital Projects division has formally recognized and structured this expertise, indicating a well-established and efficient operational model. In 2024, the demand for updated commercial spaces, driven by hybrid work models and sustainability initiatives, continued to bolster this sector.

The recurring nature of these renovation projects translates into lower marketing expenses and high operational efficiency for Arco. Their established client relationships foster repeat business, ensuring a predictable and high-margin revenue stream in what is considered a mature service area. This segment benefits from Arco’s deep understanding of client needs and building codes, allowing for streamlined project execution. For instance, a significant portion of their 2024 revenue was attributed to these repeat engagements, underscoring their Cash Cow status.

- Stable Revenue: Tenant improvement and renovation services provide a reliable and consistent revenue stream for Arco Construction.

- High Efficiency: Recurring projects driven by tenant turnover and facility upgrades result in lower marketing costs and high operational efficiency.

- Established Client Base: Repeat business from existing commercial and industrial clients ensures consistent, high-margin work.

- Mature Market: This service area represents a mature segment where Arco has a strong, established presence and expertise.

Arco Construction's robust repeat client partnerships across diverse sectors are a clear indicator of its Cash Cow status. A significant majority, often ranging from 65% to 75%, of Arco's clients return for subsequent projects. This high retention rate, exemplified by long-standing relationships with entities such as Lecangs, Performance Food Group, and Domino's, translates into predictable revenue streams and significantly lower customer acquisition costs.

These sustained collaborations allow Arco to efficiently leverage its expertise and infrastructure within established, stable market segments. By securing multiple projects with these loyal clients, Arco effectively 'milks' these relationships for consistent profitability, reinforcing its position as a reliable performer in the construction industry.

- High Repeat Business: 65-75% of Arco's clients engage in multiple projects.

- Key Repeat Clients: Partnerships include Lecangs, Performance Food Group, and Domino's.

- Reduced Acquisition Costs: Long-term relationships minimize the expense of securing new business.

- Stable Revenue Streams: Consistent project flow from loyal clients ensures predictable income.

| Segment | BCG Quadrant | Key Characteristics | 2024 Data/Observations |

|---|---|---|---|

| Industrial Warehousing & Distribution | Cash Cow | Dominant market position, consistent profits, strong reputation. | #1 domestic builder for distribution centers and warehouses; ongoing expansions for Performance Food Group and DHL Supply Chain cold storage in 2024. |

| Routine Multi-Family Residential | Cash Cow | Predictable demand, established processes, consistent profits. | Resilient sector in 2024 for standard units, with stable margins reported by many developers. |

| General Commercial Office & Retail (Repeat Clients) | Cash Cow | Leverages experience and client relationships, consistent project flow. | Demand in revitalized urban centers continued in 2024, benefiting from established supply chains. |

| Tenant Improvement & Renovation Services | Cash Cow | Consistent revenue, high operational efficiency, repeat business. | Demand boosted in 2024 by hybrid work models and sustainability initiatives; significant portion of 2024 revenue from repeat engagements. |

What You See Is What You Get

Arco Construction BCG Matrix

The preview you're currently viewing is the exact Arco Construction BCG Matrix document you will receive upon purchase. This means you're seeing the fully formatted, analysis-ready report, complete with all strategic insights and professional design elements, ready for immediate application.

Dogs

Highly niche, stagnant specialty markets in construction, such as specialized historical restoration or very specific industrial facility maintenance, would likely be classified as Dogs for Arco Construction within the BCG Matrix. These are segments where demand isn't growing, and often, it's shrinking.

Arco's involvement in these areas, especially if they hold a small market share, presents a challenge. For instance, if Arco has less than a 10% share in the niche market for seismic retrofitting of older, low-rise commercial buildings, and that market is projected to grow by only 1% annually through 2024, continued investment might not be wise. The limited growth potential combined with potentially high operational costs for specialized equipment or expertise means returns could be minimal.

These segments are often dominated by smaller, highly specialized firms that can operate with lower overhead. For a large general contractor like Arco, competing effectively and profitably in these areas can be extremely difficult, making them prime candidates for divestment or minimal resource allocation.

Operating in specific geographical areas, such as certain districts within Boston, where Arco Construction encounters ongoing and expensive union conflicts, can be classified as Dog segments within the BCG Matrix. These disputes frequently result in project delays or outright cancellations, significantly impacting Arco's operational efficiency and financial performance.

Despite Arco's claims of winning legal battles, a July 2024 report highlighted millions in lost revenue stemming from union campaigns. This suggests these regions are draining resources and profitability without yielding substantial market share growth, positioning them as potential cash traps for the company.

If Arco Construction continues to favor construction methods that are less efficient, more expensive, or less sustainable than newer options, these practices risk becoming significant liabilities. For instance, a reliance on traditional concrete pouring methods, which can be energy-intensive and generate substantial waste, might fall behind advancements like modular construction or 3D printed buildings. The construction industry in 2024 is seeing a strong push towards green building certifications, with projects aiming for LEED Platinum status becoming more common, indicating a market shift away from less eco-friendly methods.

Small, Unprofitable Local Residential Projects

Small, unprofitable local residential projects can be considered Dogs in Arco Construction's BCG Matrix. These ventures often involve highly customized, low-volume builds that don't leverage Arco's established efficiencies for larger-scale projects. For instance, in 2024, the residential construction sector saw a 3% increase in new housing starts, yet smaller, custom builds often face higher per-unit costs and longer completion times compared to standardized developments.

These niche projects can drain resources and offer minimal returns. In 2023, the average profit margin for custom home builders was around 10-15%, significantly lower than the 20-25% typically seen in larger multi-family or commercial developments where economies of scale are realized. This disparity makes them a poor strategic fit.

- Low Profitability: Projects with profit margins below 10% are prime candidates for divestment.

- Resource Drain: Custom builds consume disproportionate management and labor hours relative to revenue.

- Lack of Scalability: These projects do not offer growth potential or opportunities to replicate success.

- Market Saturation: Intense local competition often drives down prices and limits pricing power.

Segments with High Overhead and Low Project Volume

Segments with high overhead and low project volume are considered Dogs in the BCG Matrix. These are areas where Arco Construction might have substantial fixed costs, perhaps due to specialized equipment or a highly niche workforce, but they don't generate enough business to justify the expense. For instance, if Arco maintains a dedicated team for a particular type of historical building restoration that only sees one or two projects a year, this could fit the Dog profile.

These segments often break even or incur small losses, but the real cost is the capital and management focus they consume. This attention could be redirected towards more profitable or rapidly expanding areas of the business. A strategic assessment is crucial to decide if exiting these low-performing segments is the best course of action.

- High Fixed Costs: Segments requiring significant investment in specialized machinery or highly trained personnel without consistent project flow.

- Low Market Share & Growth: These areas typically represent a small portion of the overall construction market and are not experiencing significant expansion.

- Capital & Attention Drain: Resources tied up in Dog segments could be better utilized in Stars or Cash Cows to drive overall profitability.

- Strategic Review: Decisions regarding divestiture or restructuring are often necessary to improve the company's overall performance.

Dog segments for Arco Construction represent areas with low market share and low market growth, often characterized by declining demand or intense competition that stifles profitability. These are typically niche markets where Arco may lack a competitive edge or where the overall industry is contracting.

For example, Arco's involvement in specialized, low-volume residential renovations in areas with stagnant population growth, where project margins consistently hover below 8% as of early 2024, would likely be classified as a Dog. These ventures consume management time and capital without generating significant returns, potentially diverting resources from more promising growth areas.

Another instance could be Arco's participation in very specific industrial maintenance contracts in regions experiencing economic downturns, leading to reduced industrial activity and thus, lower demand for construction services. If these contracts represent less than 5% of Arco's revenue and have seen no growth since 2022, they would be strong candidates for divestment.

These segments often require significant upfront investment in specialized equipment or skilled labor that cannot be easily redeployed, making them costly to maintain. The decision to exit or minimize involvement in these Dog segments is crucial for optimizing Arco's overall resource allocation and financial performance.

| Segment Example | Market Share (Arco) | Market Growth (Est. 2024-2025) | Profitability (Est. Margin) | BCG Classification |

|---|---|---|---|---|

| Niche Historical Restoration | Low (<10%) | Stagnant to Negative (<1%) | Low (<5%) | Dog |

| Low-Volume Custom Residential (Stagnant Areas) | Low (<8%) | Low (1-2%) | Moderate (<10%) | Dog |

| Specific Industrial Maintenance (Downturn Regions) | Low (<5%) | Negative (<0%) | Break-even to Negative | Dog |

Question Marks

Arco's venture into advanced cold storage, featuring sophisticated refrigeration and aiming for LEED certification, positions it as a Question Mark in the BCG matrix. The cold storage sector is booming, driven by demand in food and pharma supply chains, with the global cold chain market projected to reach $635.6 billion by 2027, growing at a CAGR of 14.1%.

However, the significant capital expenditure required for these specialized facilities, coupled with rapidly advancing technologies, necessitates continuous investment. This high cash burn rate is characteristic of Question Marks, as Arco navigates market share expansion against specialized rivals in a dynamic environment.

Despite the current investment demands, the strong market growth potential suggests these advanced cold storage projects could transition into Stars. For instance, the pharmaceutical cold chain alone is expected to grow significantly, underscoring the long-term strategic value of Arco's investments in this area.

Arco Construction's strategic expansion into new, high-growth geographic markets, such as Laredo, Texas, positions them as a potential Question Mark in the BCG matrix. Their September 2024 groundbreaking on a speculative industrial facility in Laredo, a city experiencing significant growth in cross-border logistics, exemplifies this.

This move into a high-growth area requires substantial initial investment to establish a foothold and build market share. The success of such ventures is uncertain, demanding careful market analysis and execution to transition from a Question Mark to a Star or even a Cash Cow.

Arco Construction is exploring deeper integration of artificial intelligence and robotics, a move poised for high growth and significant transformation in construction. While currently holding a low market share in the full-scale application of these technologies, these initiatives are capital-intensive but promise to revolutionize operations and potentially create a strong competitive advantage, moving them towards a Star in the BCG Matrix.

Development of Specialized Life Sciences & Lab Facilities

While Arco Construction has a recognized expertise in Laboratory & Life Sciences, the development of highly specialized, cutting-edge biotech and pharmaceutical lab facilities could be considered a Question Mark within the BCG Matrix. This sector is experiencing significant growth, but it necessitates very specific technical knowledge and adherence to stringent compliance standards. Arco is actively building its market share in this area, facing competition from established specialists.

Arco's capabilities are evident in projects such as the 153,000 square foot hazardous storage facility completed for MilliporeSigma in 2024. This project highlights their capacity to handle complex requirements within the life sciences sector. However, achieving consistent and deeper penetration into this high-growth niche will likely require continued strategic investment in specialized skills and resources.

- Sector Growth: The global biotech and pharmaceutical construction market is projected for robust growth, driven by R&D investments and new drug development. For instance, the life sciences construction market in North America alone saw significant activity in 2024.

- Technical Demands: Specialized labs require advanced HVAC, containment systems, and precise environmental controls, demanding a higher level of engineering and construction expertise than standard facilities.

- Competitive Landscape: Established firms with decades of experience in highly regulated environments often dominate the most complex projects, meaning Arco is in a phase of building its reputation and project portfolio in this specific segment.

Public-Private Partnership (P3) Infrastructure Projects

Public-Private Partnership (P3) infrastructure projects represent a potential Question Mark for Arco Construction. While the global P3 market is experiencing significant growth, with the U.S. alone seeing over $200 billion in P3 infrastructure commitments by 2024, these complex ventures demand specialized expertise in finance, law, and operations that Arco may still be building.

The increasing government reliance on P3s for large-scale public works, driven by funding gaps and a desire for efficiency, presents a substantial opportunity. For instance, the U.S. Department of Transportation has programs supporting P3s for transportation infrastructure.

- Market Growth: The P3 market is expanding globally as governments seek alternative funding for infrastructure.

- Expertise Requirement: Successful P3s necessitate deep financial, legal, and operational capabilities.

- Strategic Potential: Strategic alliances and targeted investment could transform this into a Star for Arco.

- Pipeline Development: Long-term project pipelines in P3s offer sustained growth potential if capabilities are developed.

Arco Construction's foray into specialized areas like advanced cold storage and cutting-edge biotech labs positions them as Question Marks. These ventures require substantial capital and specialized expertise, reflecting high investment needs with uncertain market share capture. The potential for high growth, however, suggests these could evolve into Stars if successful.

| Arco Construction Venture | BCG Category | Key Characteristics | Market Context |

|---|---|---|---|

| Advanced Cold Storage | Question Mark | High capital expenditure, rapid technological evolution, significant market growth potential. | Global cold chain market projected to reach $635.6 billion by 2027, CAGR of 14.1%. |

| AI & Robotics Integration | Question Mark | Capital intensive, low current market share, potential for operational revolution. | Transformative potential in construction operations. |

| Specialized Biotech Labs | Question Mark | Requires specific technical knowledge, stringent compliance, active market share building. | MilliporeSigma hazardous storage facility completed in 2024 highlights capabilities. |

| Public-Private Partnerships (P3s) | Question Mark | Complex financial/legal/operational demands, significant market growth. | U.S. infrastructure commitments exceeded $200 billion by 2024. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.