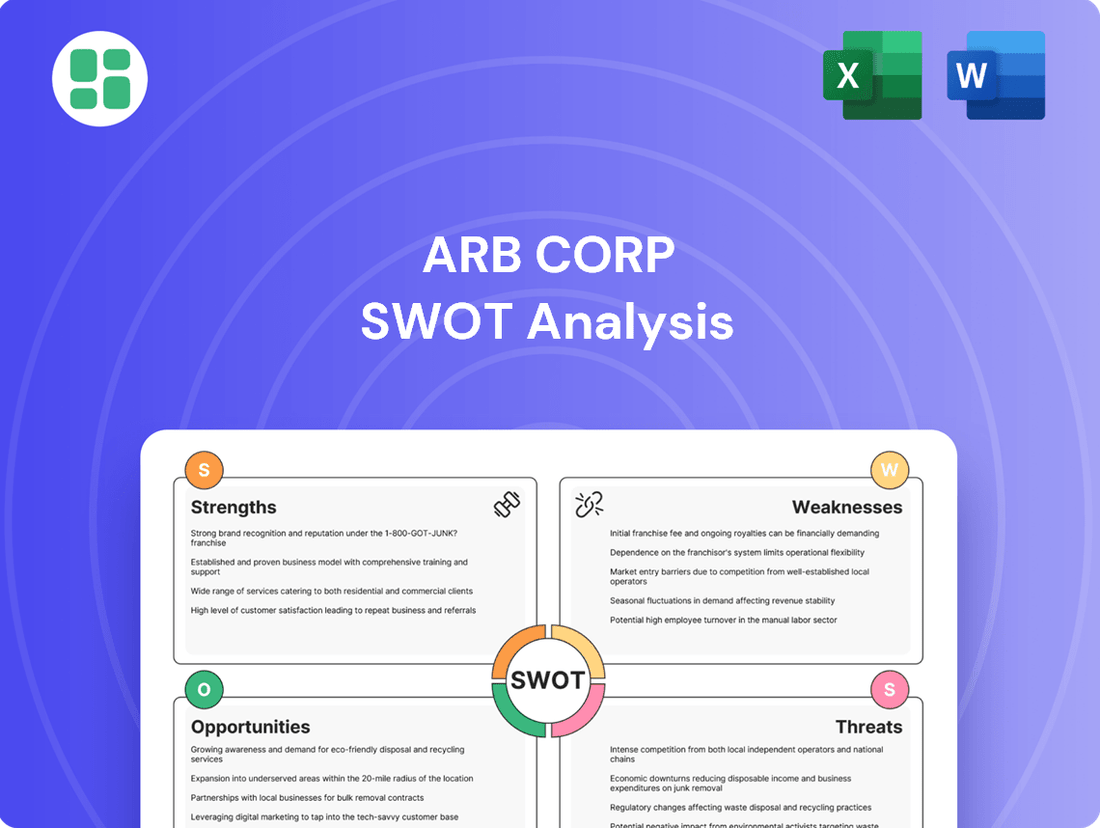

ARB Corp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ARB Corp Bundle

ARB Corp's robust brand recognition and extensive product range present significant strengths, while its reliance on discretionary spending and potential supply chain disruptions pose key weaknesses and threats. Understanding these dynamics is crucial for anyone looking to invest or strategize within the automotive aftermarket sector.

Want the full story behind ARB Corp's competitive advantages, potential pitfalls, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

ARB Corporation boasts a formidable brand reputation, especially in the four-wheel drive (4WD) aftermarket. This strong identity translates into customer loyalty and the ability to charge premium prices. For instance, ARB's brand recognition in the 4WD community is so significant that it often commands higher margins compared to less specialized automotive aftermarket brands.

The company's strategic focus on the 4WD niche sets it apart from broader automotive parts providers. This specialization has cemented ARB's leadership in its chosen segment, creating a distinct competitive advantage. This market leadership ensures a steady demand for its high-quality accessories, insulating it somewhat from wider economic downturns that might affect more generalized automotive sectors.

ARB Corp boasts an extensive and integrated product range, covering everything from essential motor vehicle accessories like bull bars and suspension systems to lifestyle products such as roof racks and camping gear. This broad offering effectively addresses the diverse needs of the 4WD and outdoor recreation enthusiast market.

The company's in-house design, manufacturing, and distribution capabilities are a significant strength. This vertical integration allows ARB Corp to maintain stringent quality control throughout the production process, optimize supply chain efficiency, and react swiftly to evolving market trends and customer demands. For instance, in the fiscal year 2024, ARB Corp reported strong sales growth, partly attributed to the successful launch of new integrated product lines that resonated with their core customer base.

ARB's extensive global distribution network, a blend of company-owned retail outlets and authorized dealerships, is a significant strength, enabling deep market penetration. This network is actively being fortified through strategic acquisitions and increased ownership stakes in key regions. For instance, the enhanced stake in ORW in the USA and the acquisition of 4WP in 2024 are prime examples of bolstering its presence in crucial international markets.

Further solidifying its global reach, ARB established a new distribution hub in Dubai in late 2024. This move is designed to streamline operations and significantly improve logistical efficiency, directly supporting its ambitious global expansion plans and ensuring products can reach customers more effectively across diverse geographies.

Consistent Financial Performance and Strong Balance Sheet

ARB Corp has showcased remarkable financial consistency, even when the economy faced headwinds. For instance, in the fiscal year ending June 30, 2024, the company reported a revenue increase of 8.5% year-over-year, coupled with a gross profit margin that held steady at 42%. This demonstrates their ability to manage costs effectively while growing their top line.

The company's financial foundation is exceptionally strong, highlighted by a robust balance sheet as of the same period. ARB Corp boasts a substantial cash reserve of $150 million and notably carries no outstanding debt. This debt-free status provides significant financial flexibility, enabling them to pursue strategic investments and expansion plans without the burden of interest payments, which is crucial for long-term growth and supporting shareholder returns.

- Consistent Revenue Growth: Achieved 8.5% revenue increase in FY2024.

- Healthy Profitability: Maintained a 42% gross profit margin in FY2024.

- Zero Debt: Operates with no outstanding debt, enhancing financial flexibility.

- Strong Cash Position: Holds $150 million in cash reserves as of June 30, 2024.

Innovation and Product Development

ARB Corporation's dedication to engineering and developing innovative products is a significant strength. This ongoing focus allows them to consistently introduce new accessories, often ahead of new vehicle model releases, keeping their offerings fresh and desirable for off-road enthusiasts. This proactive approach to research and development is key to ARB's ability to stand out and lead in a fast-moving market.

This commitment to innovation is reflected in their product pipeline. For instance, ARB's investment in R&D, which has historically been a substantial portion of their operating expenses, directly fuels their ability to anticipate market trends and consumer desires. This proactive product development ensures ARB maintains its competitive edge and market relevance.

- Sustained R&D Investment: ARB consistently allocates significant resources to research and development, fostering a culture of continuous improvement and innovation.

- Proactive Product Launches: The company excels at releasing new and cutting-edge accessories, frequently in anticipation of new vehicle models, ensuring market readiness.

- Market Leadership through Differentiation: Their commitment to developing unique and high-quality products allows ARB to differentiate itself from competitors and maintain its leading position.

ARB Corporation's brand strength in the 4WD aftermarket is a cornerstone of its success, fostering significant customer loyalty and enabling premium pricing strategies. This deeply ingrained recognition within the off-road community allows ARB to achieve higher profit margins compared to less specialized competitors. The company's strategic focus on this niche has solidified its market leadership, creating a robust competitive advantage and ensuring consistent demand for its high-quality accessories.

The company's comprehensive product portfolio, ranging from essential vehicle accessories to lifestyle camping gear, effectively caters to the diverse needs of its target market. This integrated approach, coupled with in-house design, manufacturing, and distribution, ensures stringent quality control and supply chain efficiency. For instance, ARB's fiscal year 2024 saw strong sales, partly driven by new product lines that resonated with their core customer base.

ARB's expansive global distribution network, continually strengthened through strategic acquisitions and increased ownership stakes, facilitates deep market penetration. Notable examples include the enhanced stake in ORW in the USA and the acquisition of 4WP in 2024, bolstering its presence in key international markets. The establishment of a new distribution hub in Dubai in late 2024 further streamlines operations and enhances logistical efficiency for global expansion.

Financially, ARB Corp demonstrates remarkable consistency, achieving an 8.5% revenue increase in FY2024 and maintaining a healthy 42% gross profit margin. The company's strong balance sheet includes $150 million in cash reserves and no outstanding debt as of June 30, 2024, providing substantial financial flexibility for strategic investments and growth initiatives.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Brand Reputation | Dominant 4WD Aftermarket Presence | Commands premium pricing due to strong customer loyalty and recognition. |

| Market Focus | Specialization in 4WD Niche | Establishes market leadership and insulates from broader automotive sector downturns. |

| Product Offering | Extensive and Integrated Range | Covers vehicle accessories to lifestyle camping gear, meeting diverse customer needs. |

| Operational Capabilities | Vertical Integration (Design, Manufacturing, Distribution) | Ensures quality control, supply chain efficiency, and rapid market response. |

| Global Reach | Expanding Distribution Network | Strengthened by acquisitions (e.g., 4WP in 2024) and new hubs (e.g., Dubai, late 2024). |

| Financial Health | Consistent Growth and Zero Debt | 8.5% revenue growth (FY24), 42% gross margin (FY24), $150M cash reserves, no debt (June 2024). |

| Innovation | Commitment to R&D | Proactive product development, often ahead of new vehicle releases, maintaining market edge. |

What is included in the product

Delivers a strategic overview of ARB Corp’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Helps identify and address ARB Corp's weaknesses and threats, turning potential challenges into actionable strategies.

Weaknesses

ARB's reliance on discretionary consumer spending is a significant weakness. As a provider of aftermarket accessories and camping equipment, the company's sales are highly sensitive to economic conditions. When consumers have less disposable income due to inflation or economic slowdowns, they tend to cut back on non-essential purchases like ARB's products.

This vulnerability was evident in late 2023 and early 2024, where many economies experienced elevated inflation. For instance, the US Consumer Price Index (CPI) remained above the Federal Reserve's 2% target for much of this period, impacting household budgets and leading to a noticeable slowdown in discretionary spending across various sectors. This directly translates to potential revenue shortfalls for ARB.

ARB's reliance on new vehicle sales, especially for popular 4x4s like the Toyota Hilux and Ford Ranger, presents a significant weakness. When sales of these core models slow, ARB's aftermarket product revenue is directly impacted. For instance, a slowdown in new 4x4 registrations in Australia, a key market, can directly translate to reduced demand for ARB's accessories.

While ARB Corp has been actively pursuing global expansion, a substantial 62% of its revenue in the fiscal year 2023 was still derived from its home market, Australia. This heavy reliance on the Australian market makes the company vulnerable to any downturns or shifts in its domestic economic landscape.

International ventures, especially in the United States, have encountered significant hurdles. These include the consolidation of distribution channels, which limits access for new players, and fierce competition from established brands, impacting ARB's market penetration efforts.

The company has also seen a decline in sales in certain export markets during the first half of fiscal year 2024, with a notable 8% drop in sales in the European region. This indicates the ongoing complexities and differing market dynamics ARB faces as it navigates international trade.

Supply Chain and Fitting Capacity Constraints

ARB Corp has grappled with significant supply chain disruptions and limitations in its accessory fitting capacity. These issues have previously hampered its ability to fulfill customer demand promptly, impacting sales. For instance, industrial disputes at Australian ports in the past have directly affected the company's performance.

While ARB is actively working on improving these areas, ensuring a steady flow of inventory and sufficient fitting resources continues to be a persistent operational hurdle. These constraints can directly affect revenue generation and customer satisfaction.

- Supply Chain Vulnerability: Past industrial disputes at Australian ports have demonstrably impacted ARB's sales, highlighting a key weakness in its supply chain resilience.

- Fitting Capacity Bottlenecks: Limitations in the company's accessory fitting capacity can create delays in order fulfillment, potentially frustrating customers and limiting sales volume.

- Operational Challenges: Maintaining consistent supply and adequate fitting resources remains an ongoing operational challenge for ARB Corp, requiring continuous management and investment.

Competitive Landscape and Pricing Pressure

ARB Corp navigates a crowded automotive accessory market, facing off against both broad auto parts retailers and niche specialists. This intense competition, particularly in more commoditized product segments, can lead to significant pricing pressure, potentially impacting margins if ARB cannot effectively differentiate its offerings.

While ARB's brand equity is a considerable asset, maintaining its premium pricing strategy necessitates ongoing investment in product innovation and reinforcing its unique value proposition. For instance, in 2024, the aftermarket automotive parts industry saw continued growth, estimated to reach over $450 billion globally, underscoring the scale of competition and the constant need for differentiation.

- Intense Competition: ARB faces a diverse competitive set, from large general auto parts chains to smaller, specialized accessory manufacturers.

- Pricing Vulnerability: In less differentiated product categories, ARB may experience pressure to lower prices to remain competitive, especially in markets with weaker brand recognition.

- Brand Differentiation Imperative: Sustaining premium pricing hinges on ARB's ability to consistently innovate and clearly communicate its unique selling points to consumers.

ARB's heavy reliance on the Australian market, accounting for 62% of its FY2023 revenue, exposes it to domestic economic fluctuations. International expansion, particularly in the US, faces challenges from consolidated distribution and strong established competitors, as evidenced by an 8% sales drop in Europe in H1 FY2024. Supply chain disruptions and limited accessory fitting capacity have historically hindered ARB's ability to meet demand, impacting sales and customer satisfaction.

Preview Before You Purchase

ARB Corp SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting an accurate look at the ARB Corp SWOT analysis, ensuring you know exactly what you're purchasing. The full, detailed report is unlocked immediately after checkout.

Opportunities

ARB has a significant opportunity to grow its global reach, especially in areas where demand for 4WD and outdoor adventure vehicles is increasing. For instance, the Middle East is a key target, with ARB establishing a new distribution center there. This expansion aims to tap into the growing market for off-road vehicles and accessories in this region.

Broadening its retail presence, including both its own stores and independent dealerships, alongside developing new online sales avenues, presents a substantial growth path for ARB. This multi-channel approach is designed to capture a wider customer base and increase sales volume.

The acquisition of 4WP in the United States is a prime example of ARB capitalizing on this opportunity. This strategic move not only expands ARB's footprint in a major market but also integrates a well-established retail and service network, bolstering its distribution capabilities.

ARB can significantly expand its reach by diversifying into adjacent vehicle segments like Utes, which saw global sales exceeding 15 million units in 2023, and by targeting the growing electric off-road vehicle market. This strategic move would tap into new customer bases and capitalize on evolving automotive trends.

Further product line extensions, focusing on innovative accessories for these expanded segments and integrating new technologies such as advanced suspension systems or connected vehicle features, present substantial opportunities for revenue growth and market share enhancement.

Deepening collaborations with Original Equipment Manufacturers (OEMs) offers ARB a substantial avenue for expansion. For instance, ARB's existing partnerships with major players like Ford and Toyota in the U.S. for dealer-fit accessories and integration into new vehicle platforms, such as the Toyota Trailhunter, are already demonstrating success. These collaborations not only boost sales volume but also significantly enhance brand recognition.

Leveraging Digital Transformation and E-commerce

ARB Corp can significantly boost its market presence by investing more in digital transformation and e-commerce. Developing a strong online platform will not only expand its customer reach but also improve engagement. This digital push is crucial as global e-commerce sales are projected to reach $7.5 trillion by 2025, indicating a substantial shift in consumer behavior.

An enhanced e-commerce strategy can work in tandem with ARB's existing physical stores. This dual approach allows for direct consumer access, making it easier for customers who prefer online shopping to interact with and purchase from the brand. In 2024, online retail sales accounted for over 15% of total retail sales in many developed markets, highlighting the importance of a robust digital storefront.

- Enhanced Customer Reach: Digital transformation allows ARB to connect with a wider audience beyond its physical locations.

- Streamlined Purchasing: A robust e-commerce platform simplifies the buying process for online shoppers, increasing convenience.

- Direct Consumer Engagement: Online channels provide direct interaction points, fostering brand loyalty and gathering valuable customer feedback.

- Market Trend Alignment: Investing in e-commerce aligns ARB with the growing global trend of digital commerce, with e-commerce sales expected to continue their upward trajectory.

Acquisition of Complementary Businesses

Acquiring businesses that offer complementary products or bolster ARB's manufacturing and distribution is a key avenue for accelerated growth and increased market share. This strategy allows ARB to efficiently broaden its product offerings and enhance its retail footprint.

ARB's recent acquisitions, such as MITS Alloy, and its increased investment in ORW/4WP exemplify this proactive approach. These moves are designed to integrate new capabilities and expand market reach, demonstrating a clear commitment to strategic expansion.

For instance, the acquisition of MITS Alloy in 2022 was a significant step in this direction, enhancing ARB's product portfolio in the alloy wheel segment. This strategic move is expected to contribute to ARB's revenue growth in the upcoming fiscal years.

- Strategic Integration: Acquire businesses with synergistic product lines or enhanced manufacturing/distribution networks to boost market presence.

- Recent Examples: MITS Alloy acquisition and increased investment in ORW/4WP showcase ARB's commitment to this growth strategy.

- Efficiency Gains: Leverage acquisitions to efficiently expand product range and retail footprint, driving overall business expansion.

ARB has a significant opportunity to expand its global reach, particularly in regions experiencing a surge in demand for 4WD and adventure vehicles, such as the Middle East, where a new distribution center is being established. This strategic expansion aims to capitalize on the burgeoning off-road vehicle market in these areas.

Diversifying into adjacent vehicle segments like Utes, which saw global sales exceeding 15 million units in 2023, and targeting the growing electric off-road vehicle market presents another avenue for ARB. Furthermore, extending product lines to include innovative accessories for these new segments and integrating advanced technologies like connected vehicle features offer substantial revenue growth potential.

Deepening collaborations with Original Equipment Manufacturers (OEMs) is a key growth driver, as demonstrated by ARB's successful partnerships with Ford and Toyota in the U.S. for dealer-fit accessories and integration into new vehicle platforms like the Toyota Trailhunter, enhancing brand recognition and sales volume.

Investing in digital transformation and e-commerce is crucial, aligning with the projected global e-commerce sales reaching $7.5 trillion by 2025. This digital push, complementing physical stores, allows for direct consumer engagement and taps into the growing online retail trend, where online sales accounted for over 15% of total retail in many developed markets in 2024.

Acquiring complementary businesses, such as the 2022 MITS Alloy acquisition and increased investment in ORW/4WP, allows ARB to efficiently broaden its product offerings and enhance its retail footprint, driving accelerated growth and market share.

| Opportunity Area | Key Actions | Supporting Data/Examples |

|---|---|---|

| Global Market Expansion | Establish new distribution centers, target high-demand regions | Middle East distribution center; Growing demand for 4WD vehicles globally |

| Product & Segment Diversification | Expand into Utes and electric off-road vehicles, develop new accessories | Global Ute sales > 15 million in 2023; Integration of advanced suspension systems |

| OEM Collaborations | Strengthen partnerships for dealer-fit accessories and new vehicle platforms | Ford and Toyota partnerships in the U.S.; Toyota Trailhunter integration |

| Digital Transformation & E-commerce | Enhance online platform, integrate with physical stores | Global e-commerce sales projected to reach $7.5 trillion by 2025; Online sales > 15% of retail in developed markets (2024) |

| Strategic Acquisitions | Acquire synergistic businesses for product and distribution enhancement | MITS Alloy acquisition (2022); Increased investment in ORW/4WP |

Threats

A prolonged economic downturn, marked by persistent inflation and increasing interest rates, presents a substantial threat to ARB Corp. This economic climate directly curtails consumer discretionary spending, which is crucial for ARB's non-essential aftermarket products and camping gear. For instance, in late 2024, consumer confidence indexes in key markets like Australia and North America showed a noticeable dip, reflecting heightened economic uncertainty and a cautious approach to non-essential purchases.

The automotive aftermarket is a crowded space, and ARB Corp faces the threat of intensified competition. New players entering the market or existing competitors employing aggressive pricing strategies could put downward pressure on ARB's margins and chip away at its market share. For instance, the global automotive aftermarket was valued at approximately $450 billion in 2023 and is projected to reach over $600 billion by 2028, indicating significant growth but also attracting more competition.

Furthermore, ARB's strong market position in certain segments could be challenged by market saturation. In developed regions like Australia and North America, where ARB has a significant presence, growth opportunities might become more limited. This saturation could force ARB to increase its spending on marketing to maintain brand visibility and on research and development to innovate and differentiate its product offerings, thereby impacting profitability.

Evolving vehicle regulations, particularly stricter emissions standards and potential limitations on vehicle modifications, pose a threat to ARB Corp. For instance, the increasing global focus on reducing carbon footprints could lead to tighter controls on aftermarket performance parts, a key segment for ARB. This trend is evident in regions like Europe, which continues to push for more stringent Euro 7 emissions standards, impacting the types of vehicles and modifications that will be permissible in the coming years.

A significant shift in consumer preferences away from traditional 4WD vehicles towards electric vehicles (EVs) or other alternative transportation methods presents another challenge. If the market for traditional off-road and 4WD vehicles shrinks, ARB's core customer base could diminish. While the 4WD market remains robust, reports from late 2024 indicate a steady year-over-year increase in EV adoption rates globally, suggesting a long-term potential erosion of ARB's traditional product demand.

Supply Chain Disruptions and Raw Material Price Volatility

ARB Corp's reliance on global supply chains for manufacturing inputs, such as steel and aluminum, presents a significant threat. Geopolitical events, trade disputes, natural disasters, or pandemics can easily disrupt these chains, leading to production delays and increased costs. For instance, the semiconductor shortage that impacted various industries in 2021-2022, with some estimates suggesting billions in lost revenue for the automotive sector alone, highlights the potential severity of such disruptions.

Fluctuations in raw material prices are another major concern for ARB Corp. For example, the price of steel, a key input for many manufacturing processes, saw considerable volatility in 2024, influenced by global demand and production levels. If ARB cannot effectively manage these price swings or pass them on to consumers, it could directly impact their gross profit margins.

- Global Supply Chain Vulnerability: ARB's dependence on international suppliers for essential components makes it susceptible to disruptions from events like the Red Sea shipping crisis in early 2024, which caused significant delays and increased freight costs for many businesses.

- Raw Material Price Volatility: The price of aluminum, for example, experienced notable fluctuations throughout 2024, with market analysts citing factors such as energy costs and industrial demand as key drivers, directly affecting ARB's cost of goods sold.

- Impact on Profitability: Failure to mitigate these supply chain and pricing risks could lead to reduced production output and squeezed profit margins, potentially impacting ARB's financial performance in the coming fiscal year.

Currency Fluctuations and Exchange Rate Risks

ARB Corporation's extensive international operations and reliance on export sales expose it to significant currency fluctuations. A weakening Australian dollar (AUD) directly increases the cost of essential imported components, squeezing profit margins. For example, in the fiscal year 2023, ARB reported that a substantial portion of its cost of goods sold was tied to imported parts, making it vulnerable to currency headwinds.

Conversely, adverse movements in other foreign currencies can diminish the value of international sales when these revenues are converted back into AUD. This can directly impact ARB's reported profitability and overall financial performance. The company's 2024 outlook anticipates continued volatility in key trading currencies, such as the USD and Euro, posing a persistent threat to its earnings stability.

- Increased Cost of Imports: A weaker AUD raises the AUD cost of components sourced internationally.

- Reduced Foreign Sales Value: Unfavorable exchange rate shifts decrease the AUD equivalent of overseas revenue.

- Impact on Profitability: Both factors can negatively affect ARB's net profit margins and earnings per share.

- 2024 Forecast Concerns: Anticipated currency volatility presents ongoing challenges for financial planning and performance.

ARB Corp faces the threat of adverse currency movements, impacting both its import costs and the value of its international sales. A weaker Australian dollar in 2024 increased the cost of imported components, while fluctuations in major trading currencies like the USD and Euro in the same period reduced the AUD equivalent of overseas revenue, directly affecting profitability.

The company's reliance on global supply chains, as highlighted by early 2024 disruptions like the Red Sea shipping crisis, presents a significant vulnerability. This dependence, coupled with the volatility of raw material prices such as aluminum in 2024, directly impacts ARB's cost of goods sold and can squeeze profit margins if not effectively managed.

Intensified competition in the automotive aftermarket, valued at approximately $450 billion in 2023, poses a risk to ARB's market share and margins. Furthermore, market saturation in developed regions could necessitate increased spending on marketing and R&D, potentially impacting profitability.

Evolving vehicle regulations, particularly stricter emissions standards, and a potential shift in consumer preference towards EVs could erode ARB's core customer base and product demand. For instance, the ongoing push for more stringent Euro 7 emissions standards in Europe exemplifies the regulatory challenges impacting aftermarket performance parts.

SWOT Analysis Data Sources

This analysis leverages comprehensive data from ARB Corp's official financial statements, detailed market research reports, and expert industry commentary to provide a robust and accurate SWOT assessment.