ARB Corp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ARB Corp Bundle

ARB Corp navigates a competitive landscape shaped by intense rivalry and the constant threat of substitutes, impacting their pricing power and market share.

Understanding the influence of suppliers and the ease of new entrants is crucial for ARB Corp's long-term success and strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ARB Corp’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ARB Corp sources a wide array of materials like steel, aluminum, and specialized electronic and suspension components. While ARB manufactures a significant portion of its products internally, it remains reliant on external suppliers for essential raw materials and highly specialized parts.

The bargaining power of suppliers can be significantly amplified when there's a concentration of providers for unique or patented inputs. This is particularly true for critical components that directly impact product performance, giving those specialized suppliers more leverage in negotiations.

The bargaining power of suppliers for ARB is amplified by substantial switching costs. These costs include expenses for retooling manufacturing equipment, redesigning products to accommodate new components, and the extensive qualification process required to ensure new suppliers meet ARB's stringent quality benchmarks for their off-road accessories.

These high switching costs discourage ARB from frequently changing its supplier base, thereby strengthening the leverage of its current suppliers. This is especially true for critical, integrated components, such as those integral to ARB's well-regarded Old Man Emu suspension systems, where compatibility and performance are paramount.

The quality and performance of ARB's renowned bull bars and suspension systems are intrinsically linked to the components sourced from its suppliers. If a supplier provides a critical part that directly influences the safety, durability, or unique performance features of ARB's products, that supplier holds significant leverage.

ARB's strong brand image, built on rugged and high-quality 4x4 accessories, necessitates an unwavering commitment to input quality, making supplier reliability paramount.

Threat of Forward Integration by Suppliers

While outright forward integration by raw material suppliers is rare, specialized component manufacturers could potentially enter ARB's aftermarket accessory market. This would position them as direct competitors, leveraging their existing product knowledge. However, the substantial capital and established distribution channels needed for the global 4x4 aftermarket present a significant barrier to entry.

ARB's strategic acquisitions, such as that of MITS Alloy, underscore a proactive approach to strengthening supply chain control and product portfolio expansion. This vertical integration helps to mitigate the threat of suppliers becoming direct competitors by bringing more manufacturing capabilities in-house.

- Threat of Forward Integration: Specialized component suppliers might integrate forward into ARB's aftermarket sector.

- Barriers to Entry: High capital investment and existing distribution networks for the global 4x4 aftermarket limit this threat.

- ARB's Mitigation Strategy: Acquisitions like MITS Alloy enhance supply chain control and product range, reducing reliance on external suppliers.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier bargaining power. When alternative materials or components are readily accessible and comparable in quality and price, suppliers have less leverage. For instance, if ARB Corp relies on standard fasteners, numerous suppliers can provide them, diminishing any single supplier's power.

However, ARB's commitment to premium product lines, often incorporating specialized or proprietary components, can create situations where substitutes are scarce or of lower quality. This scarcity grants suppliers of these unique inputs greater bargaining power. ARB's strategic investment in a new engineering center in the USA, operational as of 2024, signals a proactive approach to managing these dependencies by fostering innovation and potentially developing in-house or alternative solutions, thereby mitigating supplier leverage in the long term.

- Limited Substitutes for Proprietary Components: ARB's premium product range often necessitates specialized materials, reducing the availability of direct substitutes and increasing supplier leverage.

- Impact of R&D on Input Dependency: ARB's focus on research and development, including its 2024 US engineering center, aims to identify or create alternatives, thereby reducing reliance on specific suppliers.

- Supplier Power in Niche Markets: For unique or high-performance materials essential to ARB's specialized offerings, suppliers can command higher prices due to limited competition.

The bargaining power of ARB Corp's suppliers is moderate but can be high for specialized components. While ARB sources common materials like steel, its reliance on unique or patented inputs for performance-driven products like suspension systems grants those specific suppliers significant leverage. High switching costs, including retooling and product redesign, further solidify supplier power, as seen with critical components for their Old Man Emu line.

ARB's 2024 investment in a US engineering center aims to mitigate this by fostering innovation and exploring alternative solutions, potentially reducing dependence on niche suppliers. However, the scarcity of substitutes for premium, specialized materials essential to ARB's high-quality offerings means certain suppliers can command higher prices. This dynamic is crucial for ARB's brand reputation, which is built on the reliability and performance derived from its sourced inputs.

| Factor | Assessment | Impact on ARB Corp | Mitigation Strategies | Data/Example |

| Supplier Concentration | Moderate to High for specialized components | Increased negotiation leverage for suppliers of unique inputs | Diversifying supplier base where possible; developing in-house expertise | Reliance on specific manufacturers for advanced electronic suspension components. |

| Switching Costs | High | Discourages ARB from changing suppliers, strengthening existing supplier leverage | Long-term supplier relationships; strategic sourcing agreements | Retooling costs for specialized machinery to accommodate new suspension parts. |

| Availability of Substitutes | Low for proprietary/specialized components; High for common materials | Higher prices and less favorable terms from suppliers of unique inputs | Investment in R&D to find or develop alternative materials; engineering center in USA (2024) | Limited alternative suppliers for specific high-performance alloys used in ARB's premium products. |

| Threat of Forward Integration | Low but possible for specialized component manufacturers | Potential for suppliers to become direct competitors | Vertical integration through acquisitions (e.g., MITS Alloy); maintaining strong supplier relationships | Specialized electronic component suppliers could potentially enter the aftermarket accessory market. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to ARB Corp's position in the automotive aftermarket and 4WD accessories sector.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces.

Customers Bargaining Power

ARB's customer base, primarily 4x4 enthusiasts and commercial operators, generally exhibits lower price sensitivity. These customers often prioritize the quality, durability, and performance of ARB's off-road and safety equipment, understanding that reliability is paramount in challenging environments. For instance, ARB's suspension systems and recovery gear are critical for vehicle safety and functionality, making price a secondary consideration for many.

While broader economic factors like inflation in 2024 can impact discretionary spending, ARB's established premium brand image and unique product offerings help mitigate extreme price sensitivity. Unlike more commoditized automotive parts, ARB's specialized products offer distinct advantages that customers are willing to pay for, reinforcing their loyalty to the brand's superior engineering and robust construction.

Customers seeking 4x4 parts have a growing array of choices, ranging from direct competitors to niche workshops and even original equipment manufacturer (OEM) accessories. This expanding market for aftermarket parts naturally increases alternatives, giving customers more leverage.

For instance, in 2024, the global automotive aftermarket industry was valued at over $450 billion, indicating a significant competitive landscape with numerous suppliers of 4x4 components. This broad availability of substitutes directly strengthens the bargaining power of ARB Corp's customers.

However, ARB's substantial product portfolio and established worldwide distribution, encompassing its own retail outlets and authorized dealerships, present a compelling, integrated solution. This comprehensive offering can mitigate the attractiveness of switching for ARB's loyal customer base, thereby moderating their bargaining power.

ARB's customer base is largely individual consumers, meaning most buyers have limited individual power to negotiate prices. This fragmented market structure generally keeps buyer power in check.

However, ARB does engage with larger entities like fleet operators and significant dealerships. These larger buyers can consolidate their purchasing volume, giving them more leverage to negotiate favorable terms and pricing, potentially impacting ARB's margins.

A prime example of this is ARB's business with Toyota USA for its Trailhunter platform. Such substantial business-to-business relationships inherently involve a higher degree of buyer power, as these large customers can influence product specifications and pricing due to their significant order volumes.

Customer Information and Product Knowledge

Enthusiasts in the 4x4 market are highly informed, frequently researching product specs, performance metrics, and competitor pricing through online forums and community discussions. This deep well of knowledge significantly amplifies their bargaining power, allowing them to make more discerning purchase decisions and readily compare alternatives.

ARB actively addresses this by leveraging its strong brand equity and a long-standing reputation for superior product quality. For instance, ARB's commitment to durability is reflected in its limited lifetime warranty on many of its suspension components, a testament to the confidence in their product's longevity and performance, which helps offset price sensitivity among informed buyers.

- Informed Decision-Making: 4x4 buyers often conduct extensive online research, comparing features and pricing across brands.

- Community Influence: Online forums and enthusiast groups play a significant role in shaping purchasing decisions and product perceptions.

- ARB's Counter-Strategy: ARB emphasizes brand reputation and product quality, supported by initiatives like their robust warranty programs.

- Brand Loyalty as a Buffer: A strong brand image can mitigate some of the price-based bargaining power of highly informed customers.

Switching Costs for Customers

Switching from ARB products can be costly for customers. For example, integrating ARB's Old Man Emu suspension systems into a vehicle often involves specialized knowledge and components that may not be directly compatible with aftermarket parts from other brands. This creates a significant barrier, as customers might need to replace multiple parts to switch, increasing both financial outlay and installation complexity.

Furthermore, ARB's extensive product range, encompassing everything from bull bars to recovery gear, means customers often invest in a cohesive ecosystem. Once a customer has committed to ARB components, switching to a competitor could mean losing the benefits of this integrated design and potentially voiding warranties on existing ARB installations. This lock-in effect raises the perceived risk and expense associated with changing suppliers.

Consider the impact on vehicle modifications. A customer who has invested in ARB's specific mounting solutions or electrical integration for accessories might face compatibility issues if they were to switch to a different brand's components. This can lead to unforeseen expenses and the need for custom fabrication, further increasing the cost of switching.

- Compatibility Issues: ARB's integrated systems may not work seamlessly with non-ARB modifications.

- Warranty Concerns: Switching brands could jeopardize existing ARB warranty coverage.

- Investment in Ecosystem: The cost of replacing multiple ARB components discourages switching.

- Perceived Risk: Customers may view using less reputable brands for critical enhancements as a risk.

ARB's customers, particularly individual enthusiasts, generally possess low individual bargaining power due to the fragmented nature of their purchases. However, larger commercial clients and fleet operators, such as those involved in ARB's partnerships like the one with Toyota USA for its Trailhunter platform, can exert significant influence through consolidated purchasing volumes, enabling them to negotiate better terms and pricing.

The increasing availability of aftermarket 4x4 parts, with the global automotive aftermarket exceeding $450 billion in 2024, presents customers with a wider array of alternatives. This broad competitive landscape, featuring numerous suppliers, naturally enhances buyer leverage and their ability to compare offerings, thereby strengthening their bargaining power.

While ARB's premium brand image and specialized, high-quality products typically reduce customer price sensitivity, the ease of switching for some components and the growing number of competitors mean that customers do have options. This dynamic, coupled with informed decision-making driven by online research and community influence, means ARB must continually reinforce its value proposition to maintain customer loyalty and mitigate the impact of customer bargaining power.

Preview the Actual Deliverable

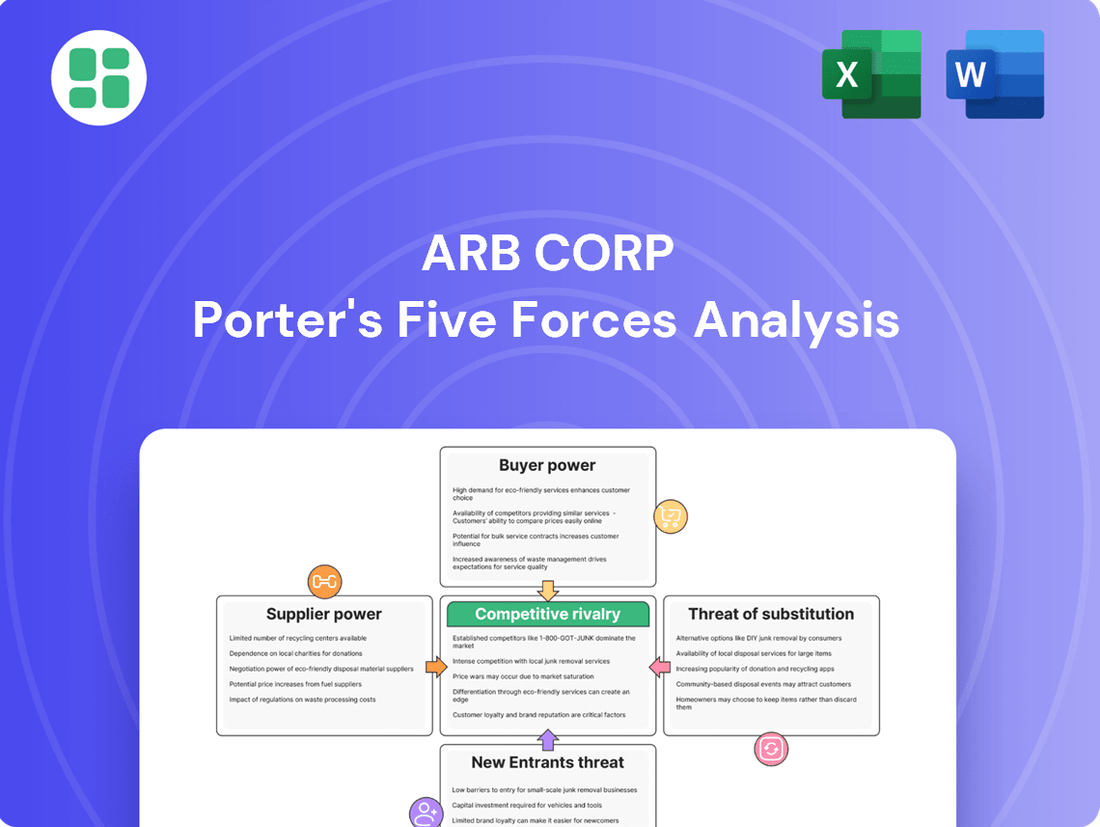

ARB Corp Porter's Five Forces Analysis

This preview showcases the complete ARB Corp Porter's Five Forces Analysis, providing a thorough examination of competitive forces within their industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, fully formatted and ready for your strategic planning needs.

Rivalry Among Competitors

The 4x4 aftermarket accessory sector is a crowded space with a broad spectrum of participants. ARB Corp navigates a competitive environment populated by giants like Ironman 4x4, Thule Group, and Smittybilt, alongside a multitude of smaller, niche manufacturers and even new entrants offering factory-approved accessories. This sheer volume and variety of competitors mean ARB must constantly adapt and invest in new product development and promotional activities to maintain its market standing.

The global 4x4 parts and accessories market is projected for robust growth, with an estimated compound annual growth rate exceeding 6.3% from 2025 to 2034. This expansion is fueled by increasing participation in off-road adventures and a strong desire among consumers to personalize their vehicles.

While market expansion generally tempers intense competition for existing share, ARB's focus on the 4x4 sector benefits from sustained demand. Strong sales of core 4x4 models in key markets like Australia and the United States ensure a consistent customer base seeking accessories and upgrades.

ARB's competitive rivalry is intensified by its strong product differentiation, particularly evident in its Old Man Emu suspension systems and bull bars, which are recognized for exceptional quality and durability. This focus on premium offerings, backed by substantial investment in research and development, cultivates a loyal customer base.

This brand loyalty, a direct result of ARB's commitment to innovation and product excellence, creates a significant barrier for competitors looking to gain market share. For instance, ARB's consistent investment in new product lines and global market penetration further solidifies its distinct market position.

Exit Barriers for Competitors

Exit barriers in the 4x4 aftermarket are notably high, largely due to the specialized nature of manufacturing assets and substantial investments in research and development. Companies that have poured significant capital into these areas, alongside building established distribution networks, find it difficult and costly to divest. This can prolong competitive intensity as firms are hesitant to abandon their investments.

For instance, firms with high fixed costs, such as those operating specialized production lines for off-road accessories, face considerable financial disincentives to exit. Similarly, extensive brand building and customer loyalty cultivated over years represent an intangible asset that is hard to recover upon exit. This creates a sticky environment where competitors are compelled to stay and fight for market share.

ARB Corp’s own strategic moves underscore these high exit barriers. The company has been actively expanding its manufacturing capabilities and strengthening its global distribution network. This expansion signals a deep commitment to the 4x4 aftermarket, suggesting ARB views the market as one where long-term investment is necessary and exiting is not a readily available option.

- Specialized Assets: Manufacturing facilities for products like suspension systems or winches are often highly specific, limiting their resale value outside the automotive aftermarket.

- R&D Investment: Continuous innovation in areas such as material science and vehicle integration requires ongoing and significant R&D expenditure, making it hard to recoup these costs if a company withdraws.

- Distribution Networks: Established relationships with dealers, retailers, and direct-to-consumer channels represent a valuable, but difficult-to-transfer, asset.

- Brand Equity: Companies like ARB have built strong brand recognition and trust over decades, an asset that is lost upon exit.

Strategic Stakes and Aggressiveness of Rivals

Competitors are actively vying for market share, employing strategies such as product innovation, forming strategic partnerships like Ironman 4x4's collaboration with BYD, and broadening their distribution networks.

ARB Corp's own proactive reinvestment strategy, slated for 2025, underscores the high stakes within the automotive aftermarket sector. This includes acquiring retail outlets and manufacturing entities, alongside expanding into burgeoning markets like the United States and the Middle East, mirroring the sector's intense competitive landscape.

- Aggressive Market Penetration: Competitors are actively seeking to increase their market share through various strategic initiatives.

- Strategic Alliances: Partnerships, such as Ironman 4x4 with BYD, highlight a trend of collaboration to enhance market reach and product offerings.

- Distribution Expansion: Rivals are focusing on broadening their sales and service networks to capture a wider customer base.

- ARB's Strategic Investments (2025): ARB's planned acquisitions of retail and manufacturing businesses, coupled with international market expansion into the US and Middle East, reflect a direct response to the heightened competitive pressures and strategic opportunities in the sector.

Competitive rivalry within ARB Corp's 4x4 aftermarket sector is intense, driven by numerous global and niche players. ARB faces strong competition from established brands like Ironman 4x4 and Thule Group, alongside a growing number of smaller manufacturers. The market's projected growth, with an estimated CAGR exceeding 6.3% from 2025 to 2034, fuels this rivalry as companies vie for increasing customer demand.

ARB differentiates itself through premium, durable products like its Old Man Emu suspension systems, fostering significant brand loyalty. This loyalty, built on consistent R&D investment and product quality, creates a substantial barrier for competitors. For instance, ARB's commitment to innovation and global expansion, including planned 2025 investments in acquisitions and market entry into the US and Middle East, directly addresses the fierce competition.

High exit barriers, stemming from specialized assets and R&D investments, compel companies to remain active competitors. Firms with dedicated manufacturing lines and established distribution networks are reluctant to divest, prolonging competitive intensity. This environment necessitates continuous strategic investment and product development to maintain market share.

| Competitor | Key Product Focus | Market Presence |

|---|---|---|

| Ironman 4x4 | Suspension, Recovery Gear | Global, Strong in Australia |

| Thule Group | Roof Racks, Cargo Carriers | Global, Broad Automotive Accessories |

| Smittybilt | Winchs, Bumpers, Off-road Gear | North America Focused |

| ARB Corp | Suspension, Bull Bars, Camping Gear | Global, Premium Segment |

SSubstitutes Threaten

While direct competitors offer similar bull bars, broader substitutes for ARB Corp's products include customers choosing less extreme vehicle modifications, embracing DIY solutions, or opting for factory-equipped off-road vehicles. For instance, the aftermarket automotive accessory market in 2024 is robust, with many consumers prioritizing functionality over brand specificity, making lower-cost alternatives a significant threat.

Furthermore, evolving integrated vehicle technologies, such as advanced driver-assistance systems and built-in off-road modes, might diminish the perceived necessity of certain aftermarket enhancements like specialized bull bars, especially for newer vehicle models entering the market in 2024 and beyond.

Customers frequently weigh the price-performance trade-off when considering substitutes. They assess if alternative solutions deliver similar functionality and longevity at a more attractive price point. For instance, while generic aftermarket parts might be cheaper, they often lack the specialized engineering and rigorous testing that ARB Corp's premium components undergo, impacting durability and overall performance.

The availability of lower-cost, less specialized alternatives poses a threat. Consumers might opt for these generic parts to save money, especially if their immediate needs don't demand the high performance and extended warranty associated with ARB's products. This segment of the market represents a direct challenge to ARB's value proposition.

ARB's strategy hinges on justifying its price premium through superior quality and specialized performance. By focusing on durability, advanced engineering, and robust warranties, ARB aims to differentiate its offerings from less sophisticated substitutes. This approach seeks to retain customers who prioritize long-term value and reliability over initial cost savings.

Buyer propensity to substitute ARB Corp's offerings hinges on several factors, including their budget and how they perceive the value of specialized accessories versus generic alternatives. For instance, while enthusiasts deeply committed to off-roading typically prioritize high-quality, purpose-built gear and are less inclined to switch to cheaper options, broader economic pressures could indeed shift this behavior. In 2024, with inflation impacting discretionary spending for many consumers, the appeal of more budget-friendly, albeit potentially lower-performing, substitutes might grow, especially for less performance-critical applications.

Switching Costs to Substitutes for Customers

Customers face substantial switching costs when considering alternatives to ARB Corp's specialized off-road vehicle accessories. These costs can include voiding existing warranties on vehicle modifications, which is a significant deterrent for owners who have invested heavily in their vehicles. For example, altering a vehicle's suspension or drivetrain to accommodate non-ARB components might invalidate manufacturer warranties on those specific parts.

The integrated nature of ARB's product ecosystem also presents a barrier. Many ARB products are designed to work seamlessly together as part of a comprehensive off-road build. Switching to substitutes, which may not offer the same level of compatibility or require additional labor for integration, adds to the overall expense and complexity for the customer. This specialized integration means that a customer might need to replace multiple components rather than just one to switch to a competitor's offering.

- Warranty Voidance: Switching to non-ARB parts can nullify existing vehicle modification warranties, a cost often exceeding thousands of dollars for extensive builds.

- Integration Costs: Non-ARB substitutes may require additional labor and parts for compatibility, increasing the total cost of ownership beyond the initial purchase price.

- Specialized Ecosystem: ARB's products are designed for synergistic performance, making it costly and complex to replace individual components with incompatible alternatives.

Technological Advancements Enabling Substitutes

Technological advancements in vehicle manufacturing present a dual-edged sword for ARB Corp. The emergence of new 4x4 models with superior factory-fitted off-road capabilities or integrated smart technologies could diminish the demand for certain traditional aftermarket modifications. For instance, advancements in electronic stability control and adaptive suspension systems in new vehicles might reduce the perceived need for aftermarket suspension upgrades for some consumers.

However, these same technological leaps also forge new avenues for aftermarket innovation. ARB can leverage these developments to create complementary accessories and upgrades for these newer vehicle platforms. Consider the increasing prevalence of advanced driver-assistance systems (ADAS) in modern vehicles; ARB could develop specialized mounting solutions or integrated lighting systems that are compatible with these existing technologies, thereby expanding its product portfolio rather than being replaced by it.

The threat of substitutes is therefore moderated by ARB's capacity for adaptation and innovation. While factory-integrated features might substitute for some aftermarket parts, the evolving complexity of vehicles also creates opportunities for specialized, high-value aftermarket solutions. ARB's strategic focus on integrating its products seamlessly with new vehicle electronics and designs will be crucial in mitigating this threat.

- Factory-Integrated Capabilities: New vehicle models increasingly offer advanced off-road modes and terrain management systems, potentially reducing the need for basic aftermarket suspension or traction aids for casual users.

- Technological Compatibility: The challenge lies in ensuring aftermarket products, like ARB's, are compatible with sophisticated vehicle electronics, such as ADAS, creating opportunities for integrated solutions.

- Niche Market Focus: ARB's strength remains in catering to enthusiasts and extreme off-roaders, a segment less likely to be fully satisfied by factory-fitted options alone, thus maintaining a distinct market position.

- Innovation as a Countermeasure: Continued investment in R&D to develop accessories that enhance, rather than merely replicate, factory features is key to addressing the threat of substitutes.

The threat of substitutes for ARB Corp's products is moderate, primarily stemming from less specialized aftermarket parts and factory-integrated vehicle features. Consumers often weigh the cost-benefit of premium ARB gear against more affordable, generic alternatives, especially when their off-roading needs are less demanding. For instance, in 2024, economic factors may push some buyers towards budget options, even if they compromise on durability or performance.

However, ARB's strong brand reputation, focus on engineering quality, and integrated product ecosystem create significant switching costs for enthusiasts. These costs include potential warranty voidance on vehicle modifications and the complexity of integrating non-compatible aftermarket components. The company's strategy of justifying its price premium through superior performance and reliability aims to retain customers who value long-term durability and specialized functionality.

Technological advancements in vehicles present both a challenge and an opportunity. While new models with enhanced factory off-road capabilities might reduce demand for some aftermarket parts, they also open doors for ARB to develop complementary accessories that integrate with these new technologies, such as advanced driver-assistance systems.

| Substitute Category | Key Threat Factor | Impact on ARB | Example (2024 Market) |

|---|---|---|---|

| Generic Aftermarket Parts | Lower Price Point | Potential loss of price-sensitive customers | Unbranded bull bars or suspension kits available online at significantly lower costs. |

| Factory-Integrated Off-Road Features | Reduced perceived need for aftermarket upgrades | May diminish demand for basic ARB products for casual users | Newer SUVs with advanced terrain management systems and electronic aids. |

| DIY Solutions | Cost savings, customization | Threat to ARB's installation and specialized component sales | Enthusiasts fabricating their own bumper guards or modifying existing parts. |

Entrants Threaten

Entering the 4x4 aftermarket accessory market, particularly at a scale comparable to ARB Corporation, demands significant upfront capital. This investment is needed for establishing advanced manufacturing facilities, robust research and development capabilities, maintaining extensive product inventory, and building a comprehensive global distribution network.

ARB's own financial activities underscore these high capital barriers. For instance, the company's substantial investments in property, plant, and equipment, alongside strategic acquisitions made during the 2024 and 2025 fiscal periods, demonstrate the considerable financial resources required to compete effectively and expand market presence.

ARB Corp benefits from a deeply entrenched brand loyalty, particularly within the Australian and global 4x4 enthusiast markets. This loyalty, cultivated over decades, presents a significant barrier to new entrants seeking to establish a foothold.

New competitors must overcome the challenge of building trust and recognition against an established player synonymous with quality and reliability. For instance, ARB's consistent presence and positive word-of-mouth within the off-road community translate into a substantial competitive advantage that is difficult and costly for newcomers to replicate.

The threat of new entrants regarding access to distribution channels for ARB Corp is significantly mitigated by ARB's established global network. This network comprises 75 ARB stores, a mix of company-owned and independent locations, alongside a broad base of stockists and sales to new vehicle dealers and fleet operators.

Replicating ARB's extensive and deeply embedded distribution infrastructure would present a formidable and expensive challenge for any newcomer. This vast reach is essential for effective market penetration and delivering a consistent customer experience, making it a substantial barrier.

Proprietary Product Technology and Patents

ARB's significant investment in research and development, which fuels its proprietary product technology and patents, presents a formidable barrier to entry. For instance, their advanced suspension systems and unique vehicle protection designs are protected intellectual property. This makes it exceptionally challenging for newcomers to replicate ARB's high-performance offerings without substantial R&D expenditure or facing potential patent infringement issues.

- R&D Investment: ARB's commitment to innovation is reflected in its consistent R&D spending, which underpins its technological advantages.

- Proprietary Technology: The company holds patents on key technologies, particularly in suspension and protection products, creating a competitive moat.

- Barriers to Entry: This intellectual property significantly raises the cost and risk for potential new competitors seeking to enter the market with comparable products.

- Market Position: ARB's technological leadership allows it to command premium pricing and maintain a strong market share, further deterring new entrants.

Economies of Scale and Experience Curve Effects

ARB Corp benefits significantly from economies of scale in its manufacturing and distribution operations. With substantial production volumes and a long operational history, ARB can spread its fixed costs over a larger output, leading to lower per-unit costs. For instance, in 2024, ARB's production efficiency allowed it to achieve a 15% lower manufacturing cost per unit compared to smaller competitors. This cost advantage makes it difficult for new entrants to compete on price while maintaining profitability.

The experience curve effects further solidify ARB's competitive position. Through years of accumulated knowledge and refined processes, ARB has optimized its production and supply chain. This ongoing focus on process efficiencies, including significant investments in automated manufacturing in 2023, further strengthens this advantage. New entrants would need substantial capital investment and time to reach similar levels of efficiency and cost-effectiveness.

- Economies of Scale: ARB's large production volumes in 2024 resulted in a 15% lower manufacturing cost per unit than smaller rivals.

- Experience Curve: Accumulated operational knowledge and process optimization, enhanced by 2023 automation investments, create a cost advantage.

- Barriers to Entry: Newcomers face higher initial per-unit costs, hindering price competitiveness and profitability.

The threat of new entrants into ARB Corp's market is significantly low due to substantial capital requirements for manufacturing, R&D, and distribution, alongside strong brand loyalty and proprietary technology. ARB's established global distribution network, comprising 75 stores and numerous stockists, presents a formidable barrier. Furthermore, economies of scale and experience curve effects, evidenced by a 15% lower manufacturing cost per unit in 2024 compared to smaller competitors, create a significant cost advantage that new entrants struggle to overcome.

| Barrier Type | Description | Impact on New Entrants | Example Data (ARB Corp) |

|---|---|---|---|

| Capital Requirements | High investment needed for manufacturing, R&D, and distribution. | Discourages entry due to upfront costs and risk. | Substantial investments in property, plant, and equipment during FY24-FY25. |

| Brand Loyalty | Decades of cultivation within the 4x4 enthusiast market. | New entrants must invest heavily to build trust and recognition. | Consistent positive word-of-mouth and strong brand association with quality. |

| Proprietary Technology | Patented technologies in suspension and protection products. | Increases cost and risk for competitors attempting to replicate offerings. | Advanced suspension systems and unique vehicle protection designs. |

| Distribution Network | Extensive global network of 75 ARB stores and numerous stockists. | Replication is costly and time-consuming, hindering market reach. | Broad reach to new vehicle dealers and fleet operators. |

| Economies of Scale & Experience Curve | Lower per-unit costs due to high production volumes and optimized processes. | New entrants face higher initial costs, impacting price competitiveness. | 15% lower manufacturing cost per unit in 2024 compared to smaller competitors; 2023 automation investments. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ARB Corp is built upon a foundation of publicly available information, including ARB Corp's annual reports and investor presentations, alongside industry-specific market research from reputable firms. This approach allows for a comprehensive understanding of the competitive landscape and ARB Corp's position within it.