ARB Corp PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ARB Corp Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping ARB Corp's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain a competitive advantage and make informed decisions.

Political factors

Governments worldwide are tightening vehicle emission rules, with Australia's New Vehicle Efficiency Standard (NVES) kicking in January 2025. This standard mandates lower CO2 emissions for new vehicles, pushing manufacturers towards more fuel-efficient models like EVs.

These stricter standards are designed to curb carbon dioxide output and promote the adoption of greener transportation. The NVES, for instance, aims to reduce emissions by 100 million tonnes of CO2 over the first decade of its operation.

While the direct impact is on new car sales, these regulations could ripple through to the aftermarket sector. Consumers may seek specialized accessories to enhance the efficiency or performance of their new, more environmentally friendly vehicles.

Global trade policies and the imposition of tariffs present a significant challenge for ARB Corp. For instance, the United States' announced 25% tariffs on automotive parts from various countries, effective May 2025, could directly impact ARB's international supply chain and the cost of its goods.

These trade barriers already affect Australia's automotive exports, including 4WD components, by increasing costs in specific markets and potentially diminishing competitiveness. Navigating these intricate trade landscapes is crucial for ARB, given its extensive global distribution network, to ensure sustained profitability and continued market access.

ARB Corp's operations are significantly influenced by political stability across its key markets, including Australia, the USA, Thailand, and the broader Middle East, Europe, and UK regions. For instance, Australia, a primary market, has maintained a relatively stable political environment, which supports consistent business operations.

Geopolitical events pose a tangible risk, as seen with recent global trade tensions that have led to increased shipping costs for ARB. In 2024, global supply chain disruptions, partly fueled by geopolitical instability, saw freight costs rise by an average of 15% compared to 2023, impacting ARB's cost of goods sold.

ARB's diversified international presence, with significant sales in North America and Europe, makes it vulnerable to regional political shifts. For example, changes in trade policies or import tariffs in the USA could directly affect ARB's market access and profitability in that crucial region.

Government Support for Local Industry

Government support plays a crucial role in bolstering local industries, and for a company like ARB Corporation, this translates into tangible benefits. Programs designed to foster manufacturing and encourage exports, such as Australia's Export Market Development Grants (EMDG), can significantly aid ARB. These grants are instrumental in helping Australian businesses, particularly those excelling in niche sectors like 4WD components, to expand their reach into international markets and enhance their global competitiveness. In 2023, the EMDG program allocated $100 million to support Australian exporters, a clear indication of government commitment.

Furthermore, the political landscape's stance on fair competition and access to vehicle repair information directly impacts the aftermarket automotive sector where ARB operates. Policies that champion these principles ensure a level playing field and prevent monopolistic practices, which is vital for ARB's continued success. For instance, ongoing discussions around Right to Repair legislation in various developed markets aim to ensure independent repairers have access to the necessary parts and diagnostic tools, a positive development for aftermarket businesses.

- Government grants like Australia's EMDG program provide financial assistance for export promotion, with $100 million allocated in 2023.

- Supportive policies for local manufacturing can reduce ARB's production costs and enhance its domestic supply chain.

- Advocacy for fair competition and repair access in key markets benefits ARB's aftermarket sales and service operations.

Consumer Protection and Right to Repair Legislation

There's a noticeable global push to enhance consumer rights, particularly through 'Right to Repair' legislation. This movement aims to ensure consumers and independent repair shops have access to necessary vehicle data, diagnostic tools, and parts. For instance, the European Union has been at the forefront, with regulations like the Ecodesign Directive impacting product repairability, and similar discussions are gaining traction in North America and Australia.

These legislative changes present a significant opportunity for ARB Corp. By mandating fair access to information and parts, these laws can level the playing field, fostering a more competitive aftermarket sector. This could directly benefit ARB by expanding the market for its own aftermarket parts and accessories, as well as supporting the independent repair businesses that utilize them. In 2024, the aftermarket parts industry globally was valued at over $450 billion, with a projected growth rate of around 4-5% annually, indicating a substantial market for ARB to tap into with increased repairability.

- Increased Market Access: Right to Repair laws can unlock ARB's potential in markets previously restricted by manufacturer monopolies on parts and data.

- Fairer Competition: Legislation promotes a more equitable environment, allowing ARB's quality aftermarket products to compete directly with OEM parts.

- Support for Independent Repairers: Empowering independent mechanics with access to data and tools indirectly benefits ARB by increasing the demand for compatible aftermarket components.

- Global Regulatory Alignment: As more regions adopt similar legislation, ARB can benefit from a more consistent and favorable operating landscape across its international markets.

Government regulations, such as Australia's New Vehicle Efficiency Standard (NVES) effective January 2025, are pushing for lower vehicle emissions, influencing the automotive sector towards greener technologies. This shift impacts the demand for traditional components and may spur innovation in the aftermarket for more efficient vehicle accessories.

Trade policies and tariffs, like the US's 25% tariffs on auto parts from May 2025, directly affect ARB's supply chain costs and international competitiveness. Navigating these trade barriers is crucial for ARB's profitability and market access across its global distribution network.

Political stability in key markets like Australia and the USA underpins ARB's consistent operations, while geopolitical tensions can increase shipping costs, as seen with a 15% rise in freight costs in 2024 due to supply chain disruptions.

Government support through programs like Australia's Export Market Development Grants (EMDG), which allocated $100 million in 2023, aids ARB in expanding its international reach and competitiveness in niche sectors.

What is included in the product

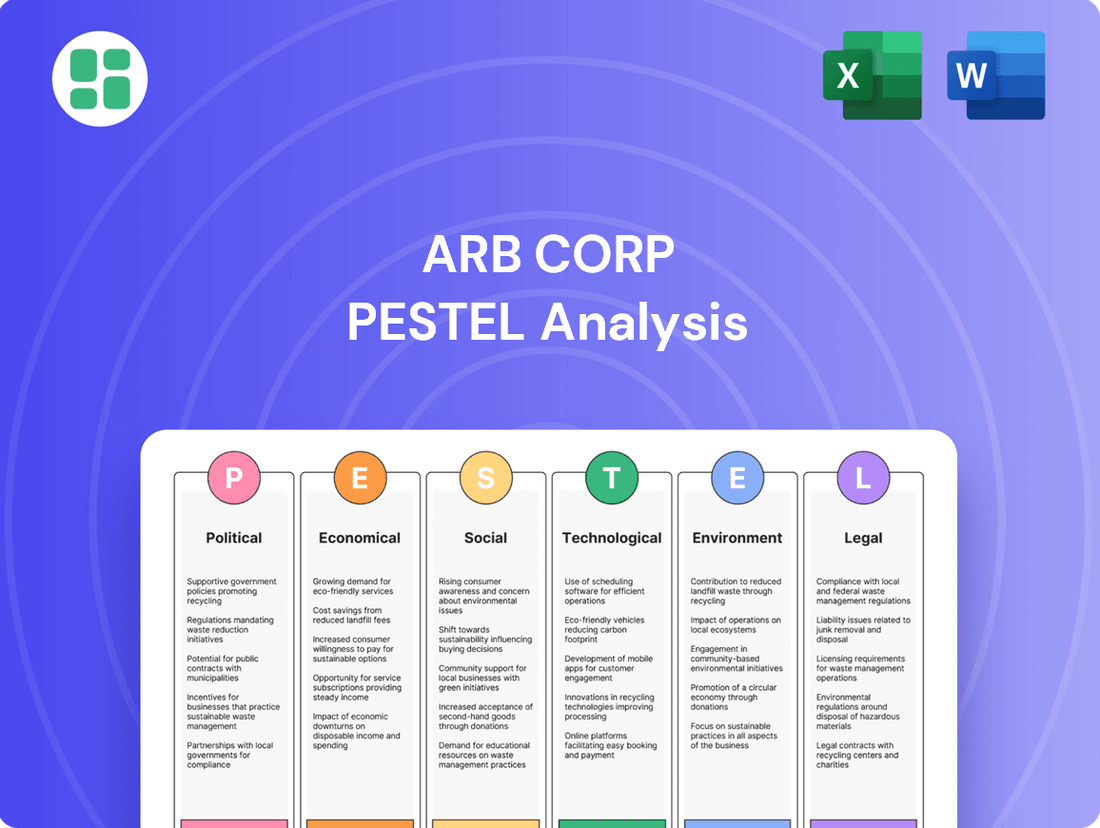

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting ARB Corp, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces shape its operational landscape.

It offers actionable insights and forward-looking perspectives to guide ARB Corp's strategic decision-making and identify potential threats and opportunities within its operating environment.

The ARB Corp PESTLE Analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain point of information overload.

Visually segmented by PESTEL categories, the ARB Corp PESTLE Analysis allows for quick interpretation at a glance, simplifying complex external factors for better strategic decision-making.

Economic factors

ARB Corp's financial health is significantly influenced by global and local economic conditions. For instance, in FY2024, the company saw a 3.3% increase in sales revenue, followed by a 5.9% rise in the first half of FY2025, indicating resilience. However, the broader economic landscape presents headwinds, with Australia experiencing a downturn in new vehicle sales, impacting demand for ARB's core products.

Consumer spending habits are also a critical factor. In many of ARB's key markets, including the USA and other international regions, consumers are showing caution, leading to constrained discretionary spending. This trend directly affects sales of non-essential vehicle accessories, a significant portion of ARB's revenue, as economic uncertainty often leads individuals to postpone or reduce purchases of such items.

Inflationary pressures significantly impact ARB Corporation’s manufacturing costs, particularly for raw materials and labor, which could squeeze profit margins. For instance, the Australian Consumer Price Index (CPI) rose by 3.6% in the March quarter of 2024, indicating ongoing cost increases for businesses.

Furthermore, elevated cost of living pressures can dampen consumer discretionary spending. This directly affects sales of non-essential items like vehicle modifications and recreational gear, potentially impacting ARB’s GoActive segment. In 2023, Australian retail sales growth slowed, reflecting cautious consumer behavior amidst persistent inflation.

Despite these challenges, ARB has shown an ability to exercise pricing power, particularly within its core Australian market. This has allowed the company to partially offset rising input costs and maintain profitability, as evidenced by their ability to pass on some of these increases to consumers.

ARB Corp's global manufacturing in Thailand and widespread distribution expose it to significant exchange rate risks. For instance, if the Thai Baht strengthens against the US Dollar, ARB's production costs in Thailand, when converted back to USD for reporting, would effectively increase. Conversely, a weaker Baht would lower these costs.

These fluctuations directly affect ARB's profitability and pricing. A stronger USD, for example, makes ARB's products cheaper for buyers in countries using the Euro, potentially boosting sales volume. However, if the USD weakens considerably, the cost of imported components or raw materials for ARB's operations outside Thailand could rise, forcing price adjustments or margin squeezes.

In 2024, currency volatility remained a key concern for international businesses. The US Dollar experienced fluctuations against major currencies, with the USD Index showing a general trend of appreciation early in the year before facing some headwinds. This dynamic directly impacts companies like ARB, influencing the cost-competitiveness of their goods across different international markets.

Automotive Aftermarket Market Growth

The Australian automotive aftermarket market is set for a period of consistent expansion. Projections indicate the market could reach approximately USD 12.1 billion by 2032, reflecting a compound annual growth rate of 5.5% between 2025 and 2032. Another forecast suggests a slightly different trajectory, estimating the market at USD 18.27 billion by 2032 with a CAGR of 3.9% over the same period.

Several key economic drivers are fueling this anticipated growth. Strong new vehicle sales contribute to a larger overall vehicle parc, which in turn increases the potential customer base for aftermarket services and parts. Furthermore, rising per capita income levels mean consumers have more disposable income available for vehicle maintenance and upgrades.

An aging vehicle fleet also plays a significant role. As vehicles get older, they naturally require more frequent repairs and replacement parts, directly boosting demand within the aftermarket sector. This trend creates sustained opportunities for businesses operating in this space.

- Projected Market Size (2032): USD 12.1 billion (5.5% CAGR 2025-2032) or USD 18.27 billion (3.9% CAGR 2025-2032)

- Key Growth Drivers: Robust new vehicle sales, increasing per capita income, rising average vehicle age.

- Impact of Aging Fleet: Increased demand for replacement parts and maintenance services.

Consumer Spending and Discretionary Income

Consumer confidence and the amount of money people have left over after essential expenses, known as discretionary income, are key drivers for ARB's sales. Since many of ARB's products, like vehicle accessories for off-roading and camping gear, are not necessities, their demand is closely tied to how much extra cash consumers have and their willingness to spend it.

While sales of new vehicles that are the base for ARB's enhancements have seen a slowdown in certain areas, the broader market for 4x4 vehicles and outdoor adventure activities remains robust. This growth is fueled by people prioritizing lifestyle choices and the increasing popularity of adventure tourism.

- Consumer Confidence Index: In Q1 2024, the U.S. Consumer Confidence Index averaged 103.1, indicating a cautious but generally stable consumer sentiment.

- Discretionary Spending Trends: Projections for 2024 suggest continued growth in the outdoor recreation sector, with spending expected to increase by an estimated 3-5% year-over-year.

- 4x4 Vehicle Market: The global market for 4x4 vehicles is forecast to reach over $200 billion by 2025, demonstrating sustained consumer interest in vehicles suited for adventure.

Economic factors significantly shape ARB Corp's performance, with inflation and consumer spending being paramount. Rising costs for raw materials and labor, exemplified by Australia's March quarter 2024 CPI of 3.6%, directly impact profit margins. Furthermore, cautious consumer sentiment and reduced discretionary income, evident in a 3.6% growth in Australian retail sales in 2023, affect demand for ARB's non-essential accessories.

Currency fluctuations also present a notable risk, particularly for ARB's manufacturing base in Thailand. A strengthening Thai Baht, for instance, would increase production costs when converted to USD. The US Dollar's volatility in 2024, showing an early appreciation trend, directly influences the cost-competitiveness of ARB's products globally.

Despite these economic headwinds, the Australian automotive aftermarket is projected for growth, with estimates suggesting a market size of USD 12.1 billion by 2032, driven by a larger vehicle parc and increasing per capita income. ARB has demonstrated an ability to pass on some cost increases, as seen in its FY2024 sales revenue growth of 3.3% and a further 5.9% in the first half of FY2025.

| Economic Factor | Impact on ARB Corp | Relevant Data/Trend (2024/2025) |

|---|---|---|

| Inflation | Increased manufacturing costs, potential margin squeeze | Australia CPI: 3.6% (March quarter 2024) |

| Consumer Spending/Confidence | Reduced demand for discretionary accessories | Australian retail sales growth slowed in 2023; US Consumer Confidence Index averaged 103.1 (Q1 2024) |

| Currency Exchange Rates | Impacts production costs and product pricing competitiveness | USD generally appreciated early 2024 before facing headwinds |

| Market Growth (Automotive Aftermarket) | Opportunities for sales, driven by vehicle parc and income | Australian market projected USD 12.1 billion by 2032 (5.5% CAGR 2025-2032) |

Preview Before You Purchase

ARB Corp PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of ARB Corp.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ARB Corp.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for ARB Corp’s strategic planning.

Sociological factors

The global enthusiasm for outdoor adventures, including road trips and unique travel experiences, is on a significant upswing. This surge in interest directly translates to a growing demand for recreational vehicles (RVs) and off-roading vehicles. For instance, the RV Industry Association reported that shipments of new RVs reached approximately 430,000 units in 2023, a figure that underscores the popularity of this travel style.

This expanding lifestyle trend creates a robust market for accessories that enhance outdoor exploration and off-road capabilities. Specifically, demand for 4x4 accessories, essential camping equipment, and specialized overlanding gear is climbing. This directly benefits companies like ARB Corporation, whose product portfolio is intrinsically linked to these growing consumer preferences.

The aging vehicle fleet presents a significant opportunity for ARB Corp. In Australia, for instance, the average vehicle age reached 11.2 years in 2024. This upward trend, fueled by cost-of-living pressures and elevated new car prices, means consumers are extending the lifespan of their existing vehicles.

Consequently, older cars necessitate more frequent maintenance and replacement of parts. This directly translates into sustained demand for ARB's aftermarket products, servicing, and repair solutions, establishing a reliable and consistent market for the company.

Consumers are increasingly looking to make their vehicles stand out, both in looks and in how they perform. This trend is especially strong in the 4x4 market, where owners want their vehicles to be unique and better suited for adventure or specific tasks. For instance, a 2024 survey indicated that over 60% of off-road enthusiasts consider aftermarket modifications a key part of their vehicle ownership experience.

This growing demand for personalization directly benefits companies like ARB, whose extensive catalog of suspension upgrades, bull bars, and interior accessories caters precisely to this desire for customisation. The market for automotive customization accessories in North America alone was valued at approximately $45 billion in 2023 and is projected to grow steadily.

Influence of Social Media and Digital Communities

The increasing prevalence of social media and digital communities has a significant impact on ARB Corp's target market. Platforms like Instagram, Facebook groups, and dedicated forums focused on 4x4, off-roading, and overlanding lifestyles are becoming central hubs for enthusiasts. These communities not only share experiences but also actively influence purchasing decisions through peer recommendations and product reviews.

ARB can strategically utilize these digital spaces for robust brand building and product promotion. By actively engaging with these communities, ARB can showcase its latest innovations and connect directly with consumers. For example, a 2024 study indicated that over 65% of off-road enthusiasts follow brands and influencers on social media for product discovery and inspiration, highlighting the direct channel ARB can exploit.

- Social Media Engagement: Platforms like YouTube and Instagram are crucial for showcasing ARB products in action, with many channels dedicated to off-road builds and adventure travel.

- Community Influence: Online forums and Facebook groups act as powerful word-of-mouth channels, where user-generated content and discussions heavily sway purchasing choices.

- Direct Consumer Interaction: ARB can host Q&A sessions, run contests, and gather feedback directly from its most passionate customer base through these digital communities.

- Trend Identification: Monitoring these online conversations allows ARB to stay ahead of emerging trends in vehicle modifications and adventure gear preferences.

Urbanization and Demand for Versatile Vehicles

Urbanization trends are reshaping vehicle preferences, pushing demand towards versatile options. While city living often implies smaller cars, the desire for weekend getaways and navigating varied urban terrains fuels the need for vehicles that can do more. This shift is evident in the growing popularity of SUVs and crossovers, which blend urban practicality with off-road capability.

ARB's market is expanding as 4WD technology becomes integrated into more vehicle types. This includes its application in SUVs and crossovers, catering to consumer desires for enhanced safety, all-weather performance, and adaptability. For instance, in 2024, the SUV segment continued its strong growth globally, accounting for a significant portion of new vehicle sales, demonstrating a clear consumer appetite for these versatile platforms.

- Growing Urban Mobility Needs: Urban populations increasingly require vehicles that can handle diverse driving conditions, from city traffic to unpaved roads or recreational areas.

- SUV and Crossover Dominance: The global market share of SUVs and crossovers reached approximately 45% of all passenger car sales in 2024, highlighting a strong consumer preference for versatile vehicles.

- 4WD Integration: Manufacturers are increasingly offering 4WD options across a broader spectrum of vehicles, including compact SUVs and crossovers, to meet demand for enhanced capability and safety.

- Recreational Lifestyle Appeal: Urban dwellers often seek to escape the city for outdoor activities, driving demand for vehicles equipped to handle varied terrains and carry associated gear.

The increasing emphasis on personal expression and vehicle customization is a significant sociological driver for ARB Corp. Consumers are actively seeking ways to personalize their vehicles, reflecting individual lifestyles and adventure aspirations. This trend is particularly pronounced in the off-road and 4x4 communities, where modifications are seen as essential for both performance and aesthetic appeal.

The rise of digital communities and social media platforms plays a crucial role in shaping consumer preferences and driving demand for ARB's products. Enthusiasts share their experiences, showcase their customized vehicles, and influence purchasing decisions through peer recommendations and online reviews. This creates a powerful channel for ARB to engage with its target audience and promote its brand.

Urbanization and evolving lifestyle choices are also impacting vehicle preferences, leading to increased demand for versatile vehicles capable of handling diverse driving conditions. The growing popularity of SUVs and crossovers, often equipped with 4WD capabilities, presents a direct opportunity for ARB to expand its market reach and offer its range of accessories and upgrades.

The aging vehicle fleet, with the average vehicle age in Australia reaching 11.2 years in 2024, directly benefits ARB. As vehicles age, they require more maintenance and replacement parts, creating a sustained demand for ARB's aftermarket products and servicing solutions, ensuring a consistent revenue stream.

Technological factors

The automotive sector's swift shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) presents both challenges and avenues for ARB Corp. While ARB's core business focuses on traditional 4x4 vehicles, the aftermarket is actively developing EV-compatible modifications and accessories, signaling potential new product lines.

Furthermore, the increasing prevalence of ADAS in modern vehicles necessitates specialized calibration tools for automotive workshops. This creates a distinct opportunity for ARB to either develop its own calibration solutions or partner with existing providers, potentially offering a new service specialization.

Advances in manufacturing, like the growing popularity of carbon fiber, present a significant opportunity for ARB. This means ARB can create lighter, tougher, and more resilient products. For instance, the global carbon fiber market was valued at approximately $21.5 billion in 2023 and is projected to reach over $40 billion by 2030, indicating strong demand for such materials.

These material innovations directly translate to better product performance and improved fuel efficiency for vehicles equipped with ARB components. By reducing overall vehicle weight, ARB products can help meet the increasing consumer preference for eco-friendlier and more economical transportation solutions.

The automotive aftermarket is increasingly moving online, with a significant expansion of e-commerce platforms. ARB Corporation is actively participating in this shift, having launched a direct-to-consumer e-commerce site in the United States. This digital initiative is yielding positive outcomes, enhancing ARB's understanding of consumer behavior and expanding its market reach.

Integration of AI and Smart Technologies

The automotive aftermarket is seeing a significant surge in AI and smart technology integration. This means components like suspension systems are becoming 'smarter,' adjusting in real-time to driving conditions, and diagnostic tools are increasingly AI-powered, offering more precise insights into vehicle health and performance tuning. For ARB Corp, this presents a clear opportunity to innovate.

ARB can leverage these advancements to create cutting-edge accessories. Imagine ARB's renowned suspension systems enhanced with AI to optimize ride comfort and off-road capability based on terrain data. Furthermore, AI-driven diagnostic features could be integrated into their product lines, providing users with personalized maintenance advice and performance tuning recommendations. This aligns with a growing consumer demand for sophisticated, data-driven vehicle enhancements. For instance, the global automotive AI market was valued at approximately $3.7 billion in 2023 and is projected to grow substantially, indicating strong market potential for AI-integrated automotive solutions.

- AI-powered suspension systems can offer adaptive damping and ride height adjustments for optimal performance across diverse terrains.

- Smart diagnostics integrated into ARB products can provide predictive maintenance alerts and personalized tuning advice to users.

- Data analytics from connected ARB accessories can inform future product development and enhance customer support.

- The increasing adoption of advanced driver-assistance systems (ADAS) also creates a synergistic opportunity for ARB to integrate its aftermarket solutions with a vehicle's existing smart technology ecosystem.

Product Innovation and Development Pipeline

ARB's dedication to product innovation is a significant technological factor. The company consistently invests in long-term development projects, with a robust pipeline of new and improved products slated for release through 2025. This forward-looking approach ensures ARB stays ahead in a rapidly evolving automotive aftermarket.

This commitment is exemplified by strategic partnerships with major vehicle manufacturers. Collaborations with brands like Toyota, for instance, on specialized editions such as the Tacoma Trailhunter and 4Runner Trailhunter, demonstrate ARB's ability to integrate its technology and expertise directly into new vehicle platforms. These alliances not only validate ARB's product development but also expand its market reach and relevance.

The technological factors influencing ARB Corp's product innovation and development pipeline are critical for its sustained competitiveness. ARB's ongoing investment in R&D is geared towards bringing cutting-edge products to market, with several key releases planned for 2025. These advancements are crucial for maintaining ARB's position as a leader in the off-road and 4x4 accessories sector.

Key aspects of ARB's product innovation include:

- Continuous R&D Investment: ARB channels significant resources into research and development to foster a consistent stream of new and enhanced product offerings.

- Strategic OEM Partnerships: Collaborations with vehicle manufacturers, such as the integration of ARB products into Toyota's Trailhunter models, highlight ARB's technological relevance and market penetration capabilities.

- 2025 Product Release Schedule: The planned releases throughout 2025 underscore ARB's commitment to innovation and its proactive strategy to meet evolving consumer demands and technological advancements in the automotive industry.

Technological advancements are reshaping the automotive aftermarket, pushing ARB Corp to innovate. The rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) presents opportunities for EV-compatible modifications and specialized calibration tools. ARB is also exploring lighter materials like carbon fiber, with the global market valued at $21.5 billion in 2023, to enhance product performance and fuel efficiency.

Legal factors

ARB Corp must navigate a complex web of vehicle safety standards and certifications across its international operations. For instance, compliance with Australian Design Rules (ADRs) is paramount for products sold domestically, while markets in Europe require adherence to stringent standards like Euro 6d equivalent emissions regulations, impacting everything from raw material sourcing to final product assembly.

These varying regulations directly influence ARB's product development lifecycle, potentially increasing costs and lead times as designs must be adapted for different regions. Failure to meet these safety benchmarks can result in product recalls, fines, and significant damage to brand reputation, underscoring the critical importance of robust compliance strategies in 2024 and beyond.

ARB Corp's international trade is significantly impacted by complex import and export regulations and tariffs. For instance, the United States' imposition of tariffs on certain auto parts, a key component for many automotive suppliers, directly increases ARB's sourcing costs and can affect its final product pricing. Navigating these evolving legal landscapes is crucial for maintaining efficient global supply chains and ensuring competitive cost structures in its international operations.

Reforms in Australian consumer law, potentially strengthening consumer guarantees, will require ARB Corp to ensure its products consistently meet high quality and performance benchmarks. This focus on robust consumer rights means ARB must have clear and accessible processes for customers seeking remedies, directly impacting customer satisfaction and brand reputation. For instance, the Australian Competition and Consumer Commission (ACCC) actively pursues businesses for breaches of consumer law, with significant penalties often imposed.

Product liability laws place a direct responsibility on manufacturers like ARB for any defects in their goods that cause harm. This necessitates stringent quality control measures throughout the production process, from sourcing materials to final assembly, to mitigate the risk of costly recalls or lawsuits. In 2023, product liability claims in Australia continued to be a significant concern for businesses across various sectors, highlighting the importance of proactive risk management.

Intellectual Property Rights Protection

Protecting its intellectual property, such as designs, patents, and trademarks for its specialized vehicle accessories, is vital for ARB Corp's sustained competitive edge. This is particularly important as ARB operates globally, with its products sold in over 100 countries.

Legal frameworks for intellectual property protection differ significantly across these international markets. ARB must therefore be proactive in enforcing its rights to combat counterfeiting and the unauthorized use of its innovative product designs and technologies.

For instance, in 2023, ARB reported that its ongoing efforts to protect its IP led to the successful resolution of several infringement cases, safeguarding its brand integrity and market share.

- Global IP Enforcement: ARB's commitment to protecting its designs, patents, and trademarks is essential for maintaining its market position.

- Varied Legal Landscapes: Navigating and enforcing IP rights across over 100 countries presents a complex legal challenge.

- Combating Counterfeiting: Proactive legal action is necessary to prevent unauthorized use and protect against counterfeit products that can damage brand reputation.

- 2023 Case Resolutions: ARB's successful IP enforcement actions in 2023 underscore the importance of legal vigilance in safeguarding its innovations.

Environmental Regulations and Compliance

ARB Corp operates within a framework of environmental regulations that impact its manufacturing, waste handling, and product lifecycle management. For instance, the company must adhere to Australia's National Environment Protection Measures and Thailand's Factory Act, which govern emissions and waste disposal.

Failure to comply with these environmental laws, such as those concerning hazardous waste management or air quality standards, can lead to significant fines and reputational damage. ARB's proactive approach includes investing in cleaner production technologies and waste reduction initiatives to ensure ongoing compliance and uphold its commitment to environmental stewardship.

- Manufacturing Emissions: ARB must manage emissions from its production facilities, aligning with national and international air quality standards.

- Waste Management: Compliance with regulations on hazardous and non-hazardous waste disposal is critical, particularly in regions with strict environmental protection laws.

- Product Lifecycle: ARB faces regulations concerning the end-of-life management of its products, including recycling and disposal protocols.

- Environmental Penalties: Non-compliance can result in substantial financial penalties, impacting profitability and operational continuity.

ARB Corp's operations are heavily influenced by product safety and consumer protection laws across its global markets. Adherence to standards like the Australian Design Rules (ADRs) and international equivalents, such as European emissions regulations, dictates product development and manufacturing processes, impacting costs and timelines. Failure to meet these legal requirements can lead to severe penalties, including fines and product recalls, as seen with the Australian Competition and Consumer Commission's (ACCC) enforcement actions against non-compliant businesses, underscoring the critical need for diligent compliance in 2024 and 2025.

Intellectual property (IP) protection is a key legal consideration for ARB, especially given its presence in over 100 countries. Navigating diverse IP laws to safeguard designs, patents, and trademarks against counterfeiting and infringement is crucial for maintaining its competitive edge. ARB's proactive IP enforcement efforts, including successful case resolutions in 2023, demonstrate the ongoing importance of legal vigilance in protecting its innovations and market share.

Environmental regulations present another significant legal challenge for ARB Corp, affecting its manufacturing, waste management, and product lifecycle. Compliance with measures like Australia's National Environment Protection Measures and Thailand's Factory Act is mandatory, with non-compliance risking substantial fines and reputational damage. ARB's investment in cleaner technologies and waste reduction initiatives aims to ensure ongoing adherence to these evolving environmental laws.

International trade laws, including import/export regulations and tariffs, directly influence ARB's global supply chain and cost structures. For example, tariffs on automotive parts can increase sourcing expenses, impacting final product pricing. Effectively managing these evolving legal frameworks is essential for ARB to maintain efficient operations and competitive pricing in its international markets throughout 2024 and 2025.

Environmental factors

Australia's New Vehicle Efficiency Standard (NVES), commencing in 2025, mandates stricter emissions limits, compelling manufacturers to prioritize fuel-efficient and electric vehicles. This regulatory push will likely reshape consumer purchasing habits, steering demand towards vehicles that align with environmental goals.

For ARB, a key player in the automotive aftermarket, this evolving landscape presents both challenges and opportunities. While ARB caters to the existing vehicle parc, the increasing adoption of greener vehicles could influence the types of accessories in demand, potentially favoring those that complement or enhance the performance and utility of these newer, more environmentally conscious models.

ARB Corp is actively embedding environmental sustainability into its manufacturing and supply chain processes. This includes a focus on operational efficiency, reducing waste generation, and ensuring ethical sourcing practices throughout its network.

Their manufacturing facilities in Thailand, for instance, incorporate sustainable design elements such as energy-efficient LED lighting and enhanced ventilation systems to minimize their environmental footprint.

The company also actively monitors the sustainability performance of its suppliers, a practice that aligns with a growing industry-wide imperative for greater supply chain responsibility and transparency.

For example, in 2024, ARB reported a 7% reduction in energy consumption per unit produced across its Thai operations, demonstrating tangible progress in their sustainability initiatives.

Consumer demand for eco-friendly products is a significant environmental factor influencing ARB Corporation. There's a noticeable shift towards environmentally conscious choices, especially in sectors like recreational vehicles and outdoor activities. This growing preference for sustainable solutions presents a clear opportunity for ARB to innovate.

For instance, ARB can capitalize on this trend by developing and marketing products that support sustainability. This could include lightweight components designed to enhance fuel efficiency, a crucial aspect for off-road vehicles. Furthermore, as the market for electric 4x4s expands, ARB has a chance to create specialized accessories catering to this growing segment of eco-conscious consumers.

Data from 2024 indicates a strong consumer willingness to pay a premium for sustainable goods. Market research suggests that over 60% of consumers consider environmental impact when making purchasing decisions, a figure that has steadily increased over the past few years. This growing awareness directly translates into market demand for ARB's potential eco-friendly product lines.

Climate Change and Impact on Outdoor Activities

Climate change poses a significant environmental factor for ARB Corp, potentially altering seasonal outdoor activities and the accessibility of off-road terrains. For instance, warmer winters or unpredictable weather patterns could impact the traditional peak seasons for activities like camping and 4x4 touring, directly affecting consumer demand for ARB's specialized equipment. This volatility might necessitate adjustments in product development and marketing strategies to align with shifting outdoor recreation trends.

Conversely, increased global investment in national parks and outdoor infrastructure, often driven by climate resilience initiatives, presents a counterbalancing opportunity. These investments, aimed at enhancing natural areas and promoting sustainable tourism, could stimulate demand for overlanding and off-road accessories. For example, upgrades to park accessibility or the development of new eco-tourism routes might encourage more individuals to engage in outdoor pursuits, benefiting ARB's product lines.

- Impact on Seasonality: Shifting weather patterns due to climate change could shorten or extend traditional outdoor activity seasons, influencing sales cycles for products like camping gear and vehicle accessories.

- Terrain Accessibility: Changes in precipitation and temperature can affect the condition of off-road trails, impacting their usability and potentially influencing demand for robust 4x4 equipment.

- Infrastructure Investment: Government and private sector spending on national parks and outdoor recreation infrastructure, partly as a climate adaptation strategy, could create new opportunities for ARB's product offerings.

- Consumer Behavior Shifts: Growing awareness of climate change may also drive consumer preferences towards more sustainable outdoor practices, potentially influencing the demand for eco-friendly or durable ARB products.

Waste Management and Recycling Regulations

ARB Corp navigates a complex web of waste management and recycling regulations globally, impacting its manufacturing and distribution operations. These rules, which vary significantly by country, dictate how ARB must handle everything from production byproducts to packaging materials. For instance, in the European Union, the Waste Framework Directive sets ambitious recycling targets, with member states implementing specific national laws that ARB must adhere to. Failure to comply can result in substantial fines and reputational damage.

Effective waste stream management is not just about compliance; it's a strategic imperative for ARB. The company must actively implement robust recycling programs and minimize landfill waste to maintain a positive environmental footprint. This includes investing in technologies for material recovery and optimizing logistics to reduce transportation-related waste. For example, in 2024, many Asian countries, including China and South Korea, have intensified regulations on electronic waste recycling, requiring manufacturers like ARB to take greater responsibility for product end-of-life management.

Key considerations for ARB include:

- Compliance with diverse international waste disposal standards.

- Investment in efficient recycling technologies and processes.

- Minimizing landfill dependency to improve environmental metrics.

- Adapting to evolving regulations on circular economy principles.

Australia's New Vehicle Efficiency Standard (NVES), starting in 2025, will push for lower emissions, encouraging a shift towards more fuel-efficient and electric vehicles.

This regulatory environment, coupled with a growing consumer preference for sustainable products, as evidenced by over 60% of consumers considering environmental impact in 2024 purchasing decisions, presents ARB with opportunities to innovate in eco-friendly accessories.

ARB's proactive approach to sustainability, including a 7% reduction in energy consumption per unit produced in its Thai operations in 2024, demonstrates a commitment to minimizing its environmental footprint.

Climate change impacts, such as altered weather patterns affecting outdoor activity seasonality, also require ARB to adapt its product development and marketing strategies to align with evolving consumer trends.

PESTLE Analysis Data Sources

Our PESTLE analysis for ARB Corp is meticulously crafted using data from reputable sources including government economic reports, international trade organizations, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting ARB Corp.