Aptar SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aptar Bundle

Aptar demonstrates robust strengths in its diverse product portfolio and global reach, but also faces opportunities in emerging markets and potential threats from evolving consumer preferences. Understanding these dynamics is crucial for any strategic investor or business planner.

Want the full story behind Aptar’s competitive advantages, potential pitfalls, and avenues for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

AptarGroup stands as a global leader in dispensing, sealing, and active packaging, a strength amplified by its presence across diverse sectors like beauty, personal care, pharma, and food. This wide market reach, supported by operations spanning North America, Europe, Asia, and South America, creates a robust and diversified revenue base, mitigating risks associated with any single market. For instance, Aptar’s Pharma segment has been a consistent profit driver, underscoring its dominant position in essential product categories.

AptarGroup's financial performance has been exceptionally strong, with double-digit earnings per share growth reported in Q4 2024 and Q2 2025. This consistent growth highlights the company's ability to generate value for its investors.

The company's robust financial health is further evidenced by its increased net income and significant free cash flow generation in 2024. These metrics point to efficient operations and sound financial management.

Aptar has a proven commitment to shareholder returns, boasting 31 consecutive years of increasing annual dividends. This long-term dedication, coupled with active share repurchase programs, underscores its focus on rewarding its shareholders.

Aptar's robust innovation pipeline, backed by over 7,000 active and pending patents as of early 2024, is a significant strength. This extensive intellectual property portfolio fuels the development of cutting-edge solutions, particularly in advanced drug delivery systems.

The company's focus on smart packaging, incorporating features like embedded sensors, and user-centric designs for consumer goods showcases this innovative capacity. These advancements position Aptar to capture high-value market segments and respond effectively to evolving industry demands.

Commitment to Sustainability Leadership

Aptar's dedication to sustainability leadership is a significant strength. The company has earned recognition as one of TIME's World's Most Sustainable Companies for two consecutive years and secured a Platinum rating from EcoVadis, underscoring its commitment. Aptar's strategy, centered on care, collaboration, and circularity, has driven tangible results, including achieving 97.5% renewable electricity usage globally in 2024 and making substantial strides in waste reduction.

This robust sustainability focus acts as a powerful strategic advantage. It not only mitigates environmental risks but also elevates Aptar's brand reputation and fosters deeper trust among investors, customers, and employees. The company's proactive approach to environmental, social, and governance (ESG) factors positions it favorably in an increasingly conscious market.

- Industry Recognition: Named one of TIME's World's Most Sustainable Companies (2023, 2024) and EcoVadis Platinum rated.

- Renewable Energy Adoption: Achieved 97.5% global electricity from renewable sources in 2024.

- Strategic Differentiator: Enhances brand value and stakeholder trust through a clear sustainability strategy.

- Operational Efficiency: Demonstrates progress in reducing operational waste and minimizing environmental impact.

Strategic Acquisitions and Capacity Expansion

Aptar consistently strengthens its market standing and operational capabilities through strategic acquisitions and focused capacity expansions, especially targeting high-growth sectors. A prime example is the acquisition of Mod3 Pharma, which significantly boosts Aptar's offerings in clinical trial manufacturing, thereby enhancing its support for early-stage pharmaceutical development and proprietary device sales.

The company's commitment to growth is further evidenced by substantial investments in expanding its manufacturing capacity for injectables and advanced drug delivery systems. These expansions, notably in North America, are designed to proactively address increasing customer demand and fortify its supply chain resilience.

- Strategic Acquisitions: Aptar's acquisition strategy, including that of Mod3 Pharma, enhances its capabilities in specialized pharmaceutical services.

- Capacity Expansion: Significant investments in manufacturing capacity, particularly for injectables in North America, are underway to meet growing market needs.

- Market Position: These moves are designed to solidify Aptar's position in high-growth segments of the pharmaceutical and consumer product markets.

Aptar's diversified market presence across beauty, personal care, pharma, and food provides a resilient revenue stream. Its Pharma segment, in particular, consistently demonstrates strong performance, highlighting its leadership in critical product categories.

What is included in the product

Explores the strategic advantages and threats impacting Aptar’s success by detailing its strengths in innovation and market leadership, weaknesses in supply chain reliance, opportunities in emerging markets and sustainable solutions, and threats from competition and economic volatility.

Offers a clear, actionable framework for identifying and addressing Aptar's strategic challenges and opportunities.

Weaknesses

Aptar is experiencing a slowdown in certain consumer-focused markets. For instance, demand for prestige beauty products and consumer healthcare items, such as nasal decongestants, has softened. This weakness in key segments presents a challenge to overall revenue growth.

Furthermore, the company anticipates a moderation in its emergency medicine segment. Following a period of significant expansion, particularly with naloxone sales, growth in this area is expected to be less pronounced in the immediate future. This normalization will likely temper the segment's contribution to Aptar's top line.

These specific market headwinds, stemming from shifting consumer spending habits and the natural lifecycle of certain products, necessitate strategic responses. Aptar must navigate these fluctuating dynamics to maintain its growth trajectory and mitigate the impact of these segment-specific vulnerabilities.

Aptar's extensive global footprint means it's susceptible to currency fluctuations, a factor that can impact its financial results. For 2025, management has specifically flagged currency headwinds as a significant challenge, projecting a negative effect on adjusted earnings per share.

This inherent volatility in exchange rates can make financial forecasting more complex and may require the company to implement hedging strategies or other financial tools to mitigate the associated risks.

Aptar anticipates a significant increase in legal expenses, particularly concerning ongoing intellectual property litigation. These costs are projected to add between $5 million and $6 million quarterly over the next few quarters, acting as a short-term headwind to earnings.

This escalation in legal fees can directly impact Aptar's profitability and potentially divert essential resources away from other strategic growth initiatives. Effectively managing and resolving these legal disputes is therefore critical for maintaining the company's financial stability and operational focus.

Inventory Management Challenges

Aptar has grappled with inventory management issues, notably destocking within its pharmaceutical and beauty segments. This has been compounded by excess cough and cold inventory in Europe, impacting order visibility and slowing sales in those areas. For instance, in Q1 2024, Aptar reported that destocking in pharma and beauty continued to be a headwind, affecting their order book.

Effective inventory optimization is crucial for Aptar to mitigate these challenges. By better managing stock levels, the company can reduce carrying costs and improve its ability to adapt to fluctuating market demands. This focus is particularly important given the dynamic nature of consumer preferences and the pharmaceutical supply chain.

The consequences of these inventory hurdles can be significant, leading to:

- Reduced order visibility: Making it harder to forecast future sales accurately.

- Slower sales in affected categories: As excess inventory needs to be worked through.

- Increased carrying costs: Due to holding more stock than immediately needed.

Concentration in Key Geographic Markets

Aptar's significant reliance on Europe and the United States for its revenue presents a notable weakness. In 2023, these two regions accounted for a combined 81% of the company's net sales, with Europe contributing 49% and the U.S. 32%. This concentration makes Aptar particularly vulnerable to economic slowdowns or shifts in regulatory landscapes within these key markets. A downturn in either region could disproportionately impact overall financial performance.

The company's geographic sales concentration, as detailed in its 2025 outlook, highlights a potential risk. While Aptar operates globally, a substantial portion of its annual net sales remains tied to these primary regions. This dependence could expose Aptar to greater volatility from regional economic downturns or adverse regulatory changes than a more geographically diversified sales base would allow. Enhancing its presence in emerging markets could bolster resilience.

- Geographic Sales Concentration: In 2023, Europe represented 49% and the United States 32% of Aptar's net sales, totaling 81%.

- Economic Sensitivity: This reliance on a few key markets increases vulnerability to regional economic downturns.

- Regulatory Risk: Changes in regulations within Europe or the U.S. could have a more significant impact on Aptar's business.

- Diversification Need: Greater geographic diversification could improve Aptar's overall business resilience and reduce concentrated risk.

Aptar faces challenges with inventory destocking in its pharmaceutical and beauty segments, impacting order visibility and sales, as seen in Q1 2024. Excess inventory in Europe for cough and cold products further exacerbates this issue. These inventory hurdles can lead to slower sales and increased holding costs.

The company's significant revenue concentration in Europe (49% in 2023) and the United States (32% in 2023) makes it susceptible to regional economic downturns and regulatory shifts. This geographic dependency, totaling 81% of net sales, heightens vulnerability compared to a more diversified sales base. Management has flagged currency headwinds as a challenge for 2025, projecting a negative impact on adjusted earnings per share.

Aptar also anticipates increased legal expenses, with quarterly costs projected between $5 million and $6 million due to intellectual property litigation, impacting short-term profitability. A slowdown in consumer-focused markets, particularly prestige beauty and consumer healthcare, is also a concern.

The company expects a moderation in growth for its emergency medicine segment following strong performance, particularly from naloxone sales. This normalization will temper the segment's contribution to Aptar's revenue.

| Weakness Area | Specifics | Impact |

| Inventory Management | Destocking in Pharma/Beauty, Excess Cough & Cold inventory in Europe | Reduced order visibility, slower sales, increased carrying costs |

| Geographic Concentration | 81% of 2023 Net Sales from Europe (49%) & US (32%) | Vulnerability to regional economic/regulatory changes |

| Currency Fluctuations | Projected negative impact on 2025 adjusted EPS | Financial forecasting complexity, potential need for hedging |

| Legal Expenses | $5-6 million quarterly increase due to IP litigation | Short-term headwind to earnings, potential resource diversion |

| Market Slowdown | Prestige beauty, consumer healthcare (e.g., nasal decongestants) | Challenge to overall revenue growth |

| Segment Normalization | Emergency medicine (post-naloxone sales surge) | Tempered segment contribution to top line |

Preview Before You Purchase

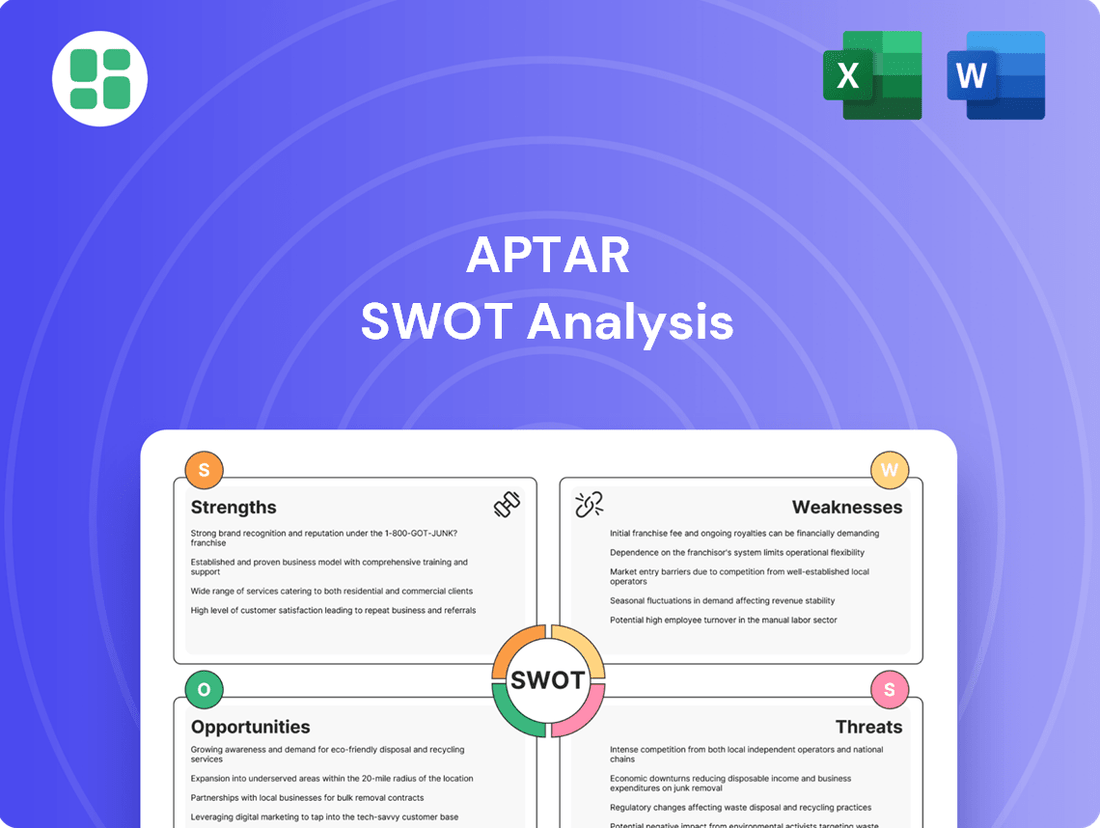

Aptar SWOT Analysis

This is the actual Aptar SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats, offering valuable strategic insights.

The preview below is taken directly from the full Aptar SWOT report you'll get. Purchase unlocks the entire in-depth version, allowing you to leverage detailed analysis for informed decision-making.

Opportunities

Aptar's pharmaceutical segment continues to be a powerhouse for growth, driven by persistent demand for its specialized drug delivery systems and injectable solutions. This robust performance is a key strength, positioning the company well within a vital sector.

The rising tide of biologics and GLP-1 therapies, coupled with stringent Annex 1 compliance needs, directly translates to a surge in demand for Aptar's high-value elastomeric components. This trend is a significant tailwind for the company.

This dynamic environment offers Aptar a prime opportunity to not only solidify but also expand its market share. Capitalizing on the sustained long-term growth of the global pharmaceutical industry is a clear strategic advantage.

Aptar aims to bolster its presence in burgeoning regions such as Asia and Latin America, areas that currently represent a smaller portion of its overall revenue. This strategic push into emerging economies presents a significant avenue for expanding sales and increasing market share.

The company sees considerable untapped potential for revenue expansion by deepening its operations and market penetration within these high-growth geographies. This geographic diversification is key to reducing reliance on more mature markets and capitalizing on increasing consumer and healthcare expenditures in these developing economies.

The global smart packaging market is projected to reach $75.1 billion by 2027, growing at a CAGR of 6.7%, driven by demand for enhanced traceability and consumer engagement. Aptar is strategically positioned to benefit from this, investing in technologies that support circular economy principles, such as increased use of recycled materials in its dispensing solutions. Furthermore, its development of smart packaging with embedded sensors for tracking and monitoring offers significant value, aligning with both regulatory pressures and growing consumer preference for sustainable, intelligent products.

Strategic Collaborations and Partnerships

Aptar can leverage strategic collaborations to drive innovation and progress in sustainability. Partnering with customers, suppliers, and organizations like the Ellen MacArthur Foundation allows for advancements in system-scale change and product development. These alliances can speed up the introduction of new products and expand market access.

These partnerships are crucial for fostering a circular economy, a key global trend. By working with various stakeholders, Aptar can strengthen its entire ecosystem and enhance its competitive position.

- Innovation Acceleration: Collaborations can shorten product development cycles, bringing new sustainable solutions to market faster.

- Market Expansion: Partnerships can open doors to new customer segments and geographical regions, increasing Aptar's reach.

- Circular Economy Leadership: Aligning with organizations focused on circularity allows Aptar to be at the forefront of sustainable business practices.

- Ecosystem Strengthening: Building strong relationships across the value chain creates a more resilient and interconnected business environment.

Digital Health Integration

The integration of digital health solutions offers a substantial growth avenue for Aptar, particularly in enhancing patient experiences through connected technologies for medication management. This focus on solutions that provide dosage reminders, track medication usage, and transmit data to healthcare providers is poised to improve patient adherence and generate valuable health outcomes data. The digital health market is projected to reach approximately $678.8 billion by 2023, with continued robust growth expected through 2025, highlighting the significant potential in this sector.

Aptar's strategic positioning in this area allows for long-term innovation and market leadership. By leveraging connected technologies, the company can tap into the growing demand for personalized and efficient healthcare solutions. For instance, the global connected drug delivery market alone was valued at around $1.5 billion in 2023 and is anticipated to expand significantly in the coming years.

- Enhanced Patient Adherence: Digital health solutions directly address medication adherence, a critical factor in treatment efficacy, with studies indicating improved adherence rates in digitally supported patient populations.

- Valuable Health Data Generation: Connected devices enable the collection of real-world data on medication usage and patient responses, providing insights for both pharmaceutical companies and healthcare providers.

- Market Growth Potential: The expanding digital health and connected medical devices market, projected for substantial growth through 2025, represents a significant opportunity for Aptar to capture market share.

- Innovation in Drug Delivery: Aptar's investment in these technologies positions it at the forefront of innovation in smart drug delivery systems, catering to evolving patient and provider needs.

Aptar is well-positioned to capitalize on the growing demand for biologics and GLP-1 therapies, which require specialized drug delivery systems. The company's expansion into emerging markets like Asia and Latin America presents a significant opportunity for increased sales and market share, as these regions show strong growth potential in healthcare spending. Furthermore, Aptar's investment in smart packaging and digital health solutions aligns with market trends for traceability, consumer engagement, and improved patient adherence, offering substantial revenue expansion avenues.

| Opportunity Area | Market Projection/Data Point | Aptar's Relevance |

|---|---|---|

| Biologics & GLP-1 Therapies | Continued strong demand for advanced drug delivery systems. | Aptar's specialized solutions are critical for these high-growth therapeutic areas. |

| Emerging Markets Expansion | Projected growth in healthcare expenditure in Asia and Latin America. | Aptar aims to increase its footprint and sales in these developing economies. |

| Smart Packaging | Global smart packaging market projected to reach $75.1 billion by 2027. | Aptar is investing in technologies for traceability and sustainability. |

| Digital Health Solutions | Connected drug delivery market valued at ~$1.5 billion in 2023, with strong growth expected. | Aptar is developing solutions to enhance patient adherence and data collection. |

Threats

Global macroeconomic uncertainties, such as the potential for economic downturns and shifts in consumer spending, present a significant threat to Aptar's varied market segments. While the pharmaceutical sector has demonstrated resilience, a slowdown in consumer-facing markets like beauty and certain consumer healthcare products, driven by economic pressures or changing consumer habits, could negatively affect Aptar's overall sales and profitability. For instance, if inflation continues to impact discretionary spending in 2024, it could lead to reduced demand for beauty products, a key segment for Aptar.

The packaging and dispensing solutions market is a crowded space, with many companies, both large and small, competing for business. This means Aptar faces constant pressure on pricing, which can impact its profit margins. For instance, in 2023, Aptar reported net sales of $3.57 billion, and maintaining this level of revenue requires navigating these competitive pressures effectively.

To stay ahead, Aptar needs to consistently innovate and offer unique products that stand out from competitors. This requires ongoing investment in research and development. The company must also focus on keeping its operational costs low to remain competitive, especially against rivals who may have different cost structures.

Raw material price volatility poses a significant challenge for Aptar, directly impacting its profitability. Fluctuations in the cost of essential inputs, from plastics and resins to metals, can quickly erode margins if not managed proactively. For instance, the global supply chain disruptions experienced in 2021 and 2022 led to substantial increases in many of Aptar's key material costs, with some commodity prices surging by over 20% year-over-year.

Aptar's manufacturing processes are inherently exposed to these price swings and potential supply chain interruptions. This exposure means that unexpected spikes in the cost of components or delays in delivery can directly increase production expenses, potentially impacting delivery schedules and overall operational efficiency. The company's ability to navigate these challenges hinges on its capacity to absorb or pass on these increased costs.

Effectively mitigating the impact of inflation and raw material cost increases is paramount for Aptar to maintain healthy profit margins. This involves a dual strategy: relentless pursuit of productivity enhancements within its operations to reduce waste and improve efficiency, alongside strategic price adjustments to reflect the higher input costs. For example, Aptar's ability to implement price increases, as it did in response to inflationary pressures throughout 2022, is crucial for preserving profitability in a volatile cost environment.

Regulatory Changes and Increased Tax Rates

Aptar faces potential headwinds from evolving regulations, especially within the pharmaceutical sector. For instance, new requirements like Annex 1 can drive substantial spending on compliance and advanced technologies.

Furthermore, shifts in corporate tax policies present a direct threat. An anticipated rise in the French corporate tax rate, for example, could negatively affect Aptar's effective tax rate and overall profitability, impacting its financial performance.

- Increased compliance costs due to evolving pharmaceutical regulations.

- Potential impact of higher corporate tax rates on profitability.

- Need for investment in new technologies to meet regulatory standards.

- Uncertainty surrounding future tax legislation and its financial implications.

Supply Chain Disruptions and Labor Shortages

Ongoing risks related to supply chain disruptions, including challenges in the cost of materials, components, and transportation, represent a significant threat to Aptar. For instance, the global semiconductor shortage, which began impacting various industries in 2020 and continued through 2024, has affected the availability and pricing of electronic components used in some of Aptar's dispensing systems. These disruptions can lead to production delays and increased operational costs, potentially impacting revenue and customer satisfaction.

Potential labor shortages also pose a threat. As of early 2025, many manufacturing sectors continue to grapple with difficulties in attracting and retaining skilled workers. This scarcity can further exacerbate production delays and increase labor costs for Aptar. Effectively managing labor resources and mitigating the impact of these shortages are ongoing challenges that require strategic attention.

- Supply Chain Volatility: Aptar faces continued threats from fluctuating material costs and component availability, a trend observed throughout 2023 and 2024.

- Labor Market Pressures: Persistent labor shortages in manufacturing sectors can drive up wage costs and limit production capacity for Aptar in 2024-2025.

- Operational Impact: Disruptions can result in missed delivery targets and higher operational expenses, directly affecting Aptar's profitability and market responsiveness.

Aptar's reliance on specific raw materials makes it vulnerable to price volatility and supply chain disruptions. For example, the cost of key polymers, a significant input for Aptar, saw increases of up to 15% in certain regions during 2023 due to global supply constraints. This directly impacts production costs and can squeeze profit margins if these increases cannot be passed on to customers, especially in competitive markets where pricing power is limited.

SWOT Analysis Data Sources

This Aptar SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of Aptar's strategic position.