Aptar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aptar Bundle

Uncover Aptar's strategic product portfolio with our comprehensive BCG Matrix analysis. See which products are driving growth and which require a closer look. Purchase the full report for a detailed breakdown and actionable insights to optimize your investment strategy.

Stars

Aptar's proprietary drug delivery systems, crucial for prescription medications such as emergency treatments, allergy relief, and CNS therapies, are a key driver of its business. These advanced systems, including those for injectables like GLP-1 components, are central to the company's success.

The Pharma segment demonstrated robust performance in 2024, posting 8% core sales growth. This segment consistently contributes to Aptar's overall profitability, boasting impressive adjusted EBITDA margins in the vicinity of 35%.

To meet escalating demand and leverage ongoing market expansion, Aptar is actively increasing its manufacturing capacity. Significant investments are being channeled into these high-growth sectors, underscoring their strategic importance for the company's future.

Aptar's active material science solutions, particularly those designed to manage both moisture and oxygen for sensitive pharmaceutical products, are in high demand. This specialized area is a significant growth driver for the company.

The company reported an 11% increase in core sales within this segment during the second quarter of 2025. This robust growth underscores Aptar's strong competitive position in a rapidly expanding market.

These advanced solutions are vital for maintaining the quality and extending the shelf life of cutting-edge drug formulations. Aptar's leadership in this niche market is solidified by its innovative offerings.

Aptar's dedication to sustainable packaging, featuring fully recyclable dispensing pumps and bio-based materials, is a significant advantage. This focus addresses the growing market demand for environmentally responsible options.

These innovations are crucial for Aptar's competitive standing and add substantial value for global brands. The company's efforts in this area are directly contributing to its market position.

With increasing consumer and regulatory pressure for eco-friendly choices, Aptar's sustainable packaging solutions are positioned for high growth. This segment is key to the company's future market leadership.

Injectables and Biologics Components

Aptar's injectable and biologics components are a significant driver of growth, particularly due to the increasing demand for elastomeric solutions used in advanced drug delivery systems. This segment is experiencing robust expansion, fueled by the pharmaceutical industry's focus on biologics and the burgeoning market for medications like GLP-1 agonists. Aptar's strategic investments, including the July 2025 acquisition of Mod3 Pharma's clinical trial manufacturing business, underscore its commitment to capturing this high-growth opportunity and reinforcing its market leadership.

The company's proactive capacity expansion and capability enhancement are directly addressing the escalating demand in this critical sector. This strategic move positions Aptar to capitalize on the pharmaceutical industry's ongoing shift towards more complex and specialized drug formulations. The market for these components is projected to continue its upward trajectory, driven by innovation in drug delivery and the increasing prevalence of chronic diseases requiring advanced treatment modalities.

- Strong Demand: Aptar's elastomeric components for biologics and GLP-1 medications are seeing significant demand growth.

- Capacity Expansion: The company is investing in increasing its manufacturing capacity and capabilities to meet this demand.

- Strategic Acquisition: The acquisition of Mod3 Pharma's clinical trial manufacturing business in July 2025 further strengthens Aptar's position in this segment.

- High-Growth Market: Injectables and biologics represent a key high-growth area within the pharmaceutical market where Aptar is solidifying its presence.

Advanced Nasal Drug Delivery Systems

Aptar Pharma is a major player in advanced nasal drug delivery, particularly with its Unidose Nasal Spray Systems. The company is heavily investing in expanding its manufacturing capabilities for these proprietary systems and exploring new applications for drug repositioning. This strategic focus aligns with the increasing demand for treatments that offer quick action and are administered non-invasively, making nasal delivery a key growth area.

The precision offered by Aptar's nasal delivery solutions is a significant advantage. For instance, the global nasal drug delivery market was valued at approximately USD 5.5 billion in 2023 and is projected to grow substantially, with an estimated compound annual growth rate (CAGR) of around 6.8% from 2024 to 2030. This expansion is driven by the development of new formulations and the increasing adoption of nasal sprays for various therapeutic indications, including allergies, pain management, and neurological disorders.

- Market Leadership: Aptar Pharma is a recognized leader in nasal drug delivery technology.

- Investment Focus: Significant capital is being allocated to expand manufacturing capacity for Unidose Nasal Spray Systems and to develop solutions for drug repositioning.

- Therapeutic Advantages: These systems provide benefits such as rapid onset of action and non-invasive administration, addressing growing patient preferences.

- Market Growth: The nasal drug delivery market is expanding, with projections indicating continued growth driven by innovation and new therapeutic applications.

Aptar's proprietary drug delivery systems, especially for injectables and nasal sprays, are considered Stars in the BCG matrix due to their high growth and strong market position. The company's Pharma segment, a significant contributor, saw 8% core sales growth in 2024 and boasts impressive adjusted EBITDA margins around 35%. Continued investment in manufacturing capacity for these advanced solutions, including the July 2025 acquisition of Mod3 Pharma's clinical trial business, highlights their strategic importance and Aptar's commitment to leading these high-growth sectors.

What is included in the product

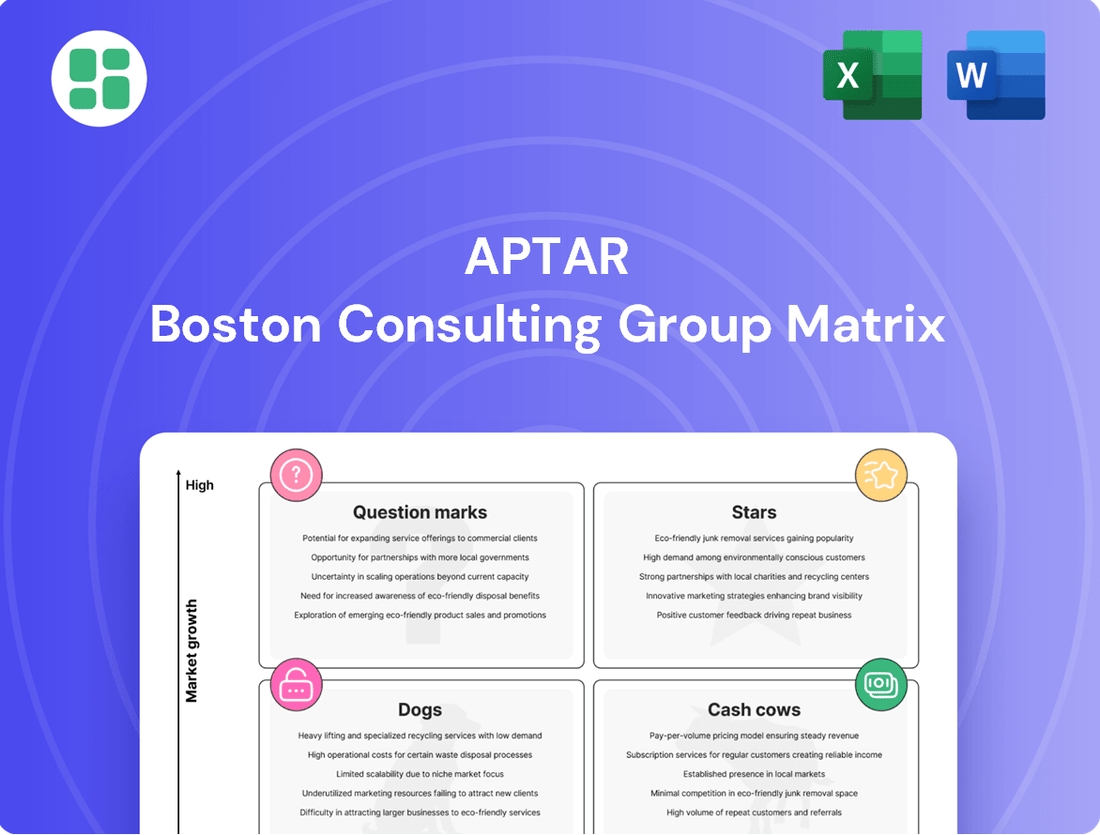

The Aptar BCG Matrix provides a strategic overview of its product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis helps Aptar make informed decisions on resource allocation, focusing on high-growth Stars and profitable Cash Cows while managing Question Marks and divesting Dogs.

Provides a clear visual of Aptar's portfolio, simplifying strategic decisions.

Cash Cows

Aptar's Closures segment, especially for food and beverage, is a strong performer. This business unit consistently brings in substantial cash. It's back within its long-term target range in the latter half of 2024.

Expect solid core sales growth of 7-8% in Q2 2025. This is largely thanks to the robust performance within their food and beverage product lines. This steady growth highlights the segment's reliable cash-generating capabilities.

Even though it operates in mature markets, Aptar holds a significant market share. This, coupled with a strong competitive edge, means it needs less investment to maintain its position. This efficiency further boosts its cash cow status.

Standard beauty and personal care dispensing pumps represent Aptar's cash cows. Despite a somewhat challenging environment in the broader beauty sector, these pumps for established personal care and home care items are experiencing robust and steady demand.

These products are situated in mature, stable markets where Aptar enjoys a leading market share. This dominance stems from their long-standing customer relationships and well-established product portfolios, ensuring consistent revenue streams.

The reliable cash generation from these pumps requires minimal promotional investment, contributing significantly to Aptar's financial stability. For instance, Aptar's Beauty + Home segment, which includes these pumps, saw net sales of $771 million in the first half of 2024, demonstrating sustained performance.

Classic Aerosol Valves represent a cornerstone of Aptar's business, leveraging their long-standing global leadership in this mature but indispensable market. These valves are critical components for a vast array of consumer products, from personal care to household goods.

Given Aptar's established market position, these valves likely command a substantial market share, generating consistent and predictable cash flow for the company. Their widespread adoption and optimized production processes mean they are a reliable revenue stream, requiring minimal incremental investment compared to emerging product lines.

In 2023, Aptar's Dispensing segment, which includes aerosol valves, reported net sales of $2.1 billion. This segment's performance underscores the enduring strength and cash-generating ability of these foundational products within Aptar's diverse portfolio.

Established Pharmaceutical Consumer Healthcare Dispensers

Aptar's established pharmaceutical consumer healthcare dispensers are likely positioned as cash cows. These solutions serve mature markets for widely used health products, generating consistent revenue streams. Their reliability and Aptar's strong brand recognition help maintain significant market share.

These established products contribute reliably to Aptar's profitability, requiring minimal additional investment for growth. For instance, in 2023, Aptar’s Pharma segment, which includes these dispensers, reported net sales of $2.1 billion, showcasing the substantial revenue generated by its mature product lines.

- Mature Market Dominance: Aptar holds a strong position in the established consumer healthcare dispensing market, benefiting from brand loyalty and consistent demand.

- Steady Revenue Generation: These products provide a predictable and stable income source for Aptar, supporting overall financial performance.

- Low Investment Needs: Unlike growth-stage products, these cash cows require limited capital expenditure, maximizing their contribution to profits.

- Profitability Contribution: The high market share and mature nature of these dispensers translate into significant and consistent profitability for Aptar.

Mature Industrial and Technical Dispensing Solutions

Aptar’s mature industrial and technical dispensing solutions represent a significant portion of its business, acting as reliable cash cows. These segments, characterized by stable demand and deeply entrenched customer relationships, consistently generate revenue and profits for the company.

In 2024, Aptar’s diverse portfolio, including these mature segments, demonstrated resilience. For instance, the company’s broad reach across various end markets, from consumer goods to highly specialized industrial applications, allowed it to leverage its established dispensing and sealing technologies. This stability is crucial for funding innovation in higher-growth areas.

- Mature Segments Contribute Stable Revenue: Aptar's long-standing presence in industrial and technical markets ensures a consistent revenue stream due to established customer bases and steady demand for its dispensing and sealing solutions.

- High Market Penetration: The company enjoys high market penetration in these mature areas, further solidifying its position as a reliable cash generator, essential for reinvestment and growth initiatives.

- Resilience in 2024: Aptar's industrial and technical divisions showcased their inherent stability throughout 2024, providing a dependable financial foundation amidst evolving market dynamics.

Aptar's established beauty and personal care dispensing pumps are prime examples of cash cows. They benefit from mature markets and Aptar's significant market share, requiring minimal investment to maintain their strong position and generate consistent revenue.

The classic aerosol valves also act as cash cows, serving essential roles in consumer goods and generating predictable cash flow due to Aptar's global leadership and optimized production. This stability is crucial for Aptar's financial health.

Pharmaceutical consumer healthcare dispensers are another key cash cow for Aptar. These products cater to stable, mature markets for widely used health items, ensuring reliable revenue streams and contributing significantly to profitability with limited need for further investment.

Aptar's mature industrial and technical dispensing solutions are also reliable cash cows. These segments, with their stable demand and deep customer relationships, consistently generate revenue and profits, providing a dependable financial foundation.

| Product Category | Market Maturity | Aptar's Market Position | Cash Generation | Investment Needs |

|---|---|---|---|---|

| Beauty & Personal Care Pumps | Mature | Significant Market Share | High & Consistent | Low |

| Classic Aerosol Valves | Mature | Global Leader | Predictable & Stable | Low |

| Pharma Consumer Healthcare Dispensers | Mature | Strong Brand Recognition | Reliable & Consistent | Minimal |

| Industrial & Technical Dispensing | Mature | High Penetration | Stable Revenue | Low |

Delivered as Shown

Aptar BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully-formatted document you will receive immediately after your purchase. This ensures you know exactly what you are acquiring—a professionally designed strategic tool ready for immediate application. You can confidently expect the same high-quality analysis and clear presentation in the purchased version, enabling swift integration into your business planning and decision-making processes.

Dogs

Certain Prestige Fragrance Dispensing Technologies, within Aptar's portfolio, likely falls into the question mark category of the BCG matrix. The prestige fragrance market itself is experiencing subdued demand, with Aptar Beauty reporting core sales declines of 3-4% in Q1 and Q2 2025 for its fragrance and color cosmetics segments.

This slowdown is attributed to factors like tariff uncertainties and reduced tooling sales, signaling a low-growth environment. For Aptar's dispensing technologies in this niche, this suggests a potential for lower market share or even a declining one, which could hinder overall segment growth and require careful strategic consideration.

Aptar's specific consumer healthcare products, like Naloxone and certain cold/flu remedies, are currently navigating markets with uncertain growth trajectories. The company experienced a notable 17% sales dip in Q4 2024 within this segment, largely attributed to a less severe cold and flu season and strategic inventory adjustments by customers.

Looking ahead, sales for Naloxone are projected to normalize, indicating a slowdown in the latter half of 2025. This suggests these product lines operate in environments characterized by either fluctuating demand or a general decline, potentially posing a risk of resource allocation without commensurate returns for Aptar.

Within Aptar's Beauty segment, legacy or commoditized skincare and color cosmetics dispensing solutions have seen a slowdown. These products, often found in mature or highly competitive markets, are experiencing muted demand. For example, in 2024, the broader beauty market saw growth tempered by economic uncertainties, impacting even established product categories.

These older dispensing technologies likely struggle against newer, innovative solutions that offer enhanced user experience or sustainability features. This intensified competition in low-growth sub-segments can lead to decreased market share and profitability for these legacy products, making them prime candidates for strategic review, potential divestiture, or a significant overhaul to regain relevance.

Underperforming Product Lines from Acquired Businesses

Underperforming product lines inherited from acquisitions can become Aptar's dogs if they operate in stagnant markets and fail to capture meaningful market share. These legacy products might require substantial investment for minimal returns, draining resources that could be better allocated to growth opportunities. For instance, a historical acquisition of a niche packaging technology for a declining industry might represent such a dog, especially if its market growth was projected to be below 2% annually, as is typical for many mature or declining sectors.

These product lines often struggle to compete due to outdated technology or a lack of differentiation. Their contribution to Aptar's overall revenue may be minimal, and their profitability could be negligible or even negative. Consider a scenario where an acquired business unit focused on a specific type of rigid plastic container for a shrinking consumer segment; if this segment's demand has been declining by an average of 3% per year, and the acquired product line holds less than 5% market share, it would likely fit the dog category.

- Low Market Growth: Products in industries with annual growth rates below 3%.

- Declining Market Share: Acquired product lines that have not increased their market share post-acquisition, potentially holding less than 10% of their respective markets.

- Resource Drain: Business units requiring significant R&D or marketing investment without commensurate revenue generation.

- Limited Strategic Fit: Legacy products that do not align with Aptar's current focus on innovative dispensing solutions and sustainable packaging.

Inefficient or Outdated Manufacturing Processes/Facilities

Products manufactured using outdated methods or in underutilized facilities within slow-growing markets can be considered dogs in the Aptar BCG Matrix. These operations often drain resources without generating substantial growth or profits, thereby hindering overall company performance.

Aptar's strategic initiatives, such as its ongoing focus on productivity enhancements and operational efficiency improvements, are designed to address these potential dog segments. For instance, in 2024, Aptar continued to invest in modernizing its manufacturing capabilities to boost output and reduce costs.

- Inefficient processes lead to higher production costs for Aptar.

- Facilities with low utilization rates represent underused capital.

- Stagnant market demand limits revenue potential for these products.

- Aptar's productivity drives aim to improve the profitability of older product lines.

Aptar's "Dogs" likely encompass legacy dispensing technologies in mature or declining markets, characterized by low growth and potentially shrinking market share. These might include older skincare or color cosmetics solutions where innovation has outpaced them, or products from acquired businesses that haven't integrated well into Aptar's growth strategy. For example, a niche packaging technology for a consumer segment experiencing a consistent annual decline of 3% or more, holding a market share below 10%, would fit this category.

These underperforming assets often drain resources through R&D or marketing without generating significant returns, hindering overall company performance. Aptar's focus on operational efficiency and productivity improvements in 2024 aims to address such segments by either revitalizing them or facilitating their divestiture.

The key indicators for these "Dogs" are low market growth (typically under 3% annually), declining or stagnant market share, and a poor return on investment, making them candidates for strategic review and potential divestment to reallocate capital to more promising ventures.

| Category | Characteristics | Aptar Examples (Hypothetical) | Market Growth Rate | Market Share |

| Dogs | Low market growth, declining market share, resource drain, limited strategic fit | Legacy skincare dispensers in mature markets, acquired niche packaging for declining industries | < 3% | < 10% |

Question Marks

Aptar Digital Health is making strides in the burgeoning digital health sector, focusing on Software-as-a-Medical-Device (SaMD), connected devices, patient services, and comprehensive disease management platforms. This segment is experiencing robust growth, with projections indicating a significant expansion in the coming years, driven by increasing patient engagement and the demand for personalized healthcare solutions.

The digital health market is a dynamic space, with global revenue expected to reach hundreds of billions of dollars by the end of the decade. Aptar's investment in this area positions it to capitalize on this trend, though its current market share is likely in its early phases. Significant investment will be crucial for Aptar to build brand recognition, secure regulatory approvals, and achieve widespread adoption of its offerings.

Aptar's nasal drug delivery systems are showing promise for advanced therapeutic areas like Alzheimer's, offering direct brain delivery. This innovation taps into a high-growth potential market. For instance, studies in 2024 continue to validate the efficacy of these systems for precise drug targeting.

Despite the revolutionary potential, these applications are in their nascent stages, reflected by low current market penetration. Significant investment in research and development, alongside extensive clinical trials, is essential for Aptar to capture a substantial share of this specialized market.

Aptar's N-Sorb nitrosamine mitigation solution, recognized by the US FDA's Emerging Technology Program in 2024, targets a significant and expanding challenge within pharmaceutical safety. This innovative technology addresses the critical need for reducing harmful nitrosamine impurities in drugs, a market driven by stringent regulatory compliance and patient well-being.

Positioned as a potential star in Aptar's portfolio, N-Sorb operates in a high-growth segment focused on regulatory compliance and safety. The pharmaceutical industry's increasing scrutiny on nitrosamines, with regulatory bodies worldwide implementing stricter guidelines, creates a substantial market opportunity for effective mitigation solutions.

As an emerging technology, N-Sorb likely holds a minimal current market share, reflecting the early stage of its adoption. Significant investment in research, development, and market penetration will be crucial for Aptar to scale this solution and capture a dominant position in this vital market, transforming it from a question mark to a strong contender.

New Regional Market Expansions (e.g., deeper penetration in Asia and Latin America)

Aptar is strategically targeting deeper penetration in high-growth regions, specifically Asia and Latin America. In 2023, Asia accounted for 11% of Aptar's total sales, while Latin America represented 8%. This expansion is driven by the significant growth potential these markets present.

Capturing a larger market share in Asia and Latin America necessitates substantial investment. Aptar will need to focus on building robust infrastructure, adapting products to local market needs, and strengthening its distribution networks. These efforts are crucial for unlocking the full growth potential in these emerging economies.

- Asia Sales: 11% of total sales in 2023.

- Latin America Sales: 8% of total sales in 2023.

- Strategic Focus: Increased investment in infrastructure, market adaptation, and distribution.

- Growth Objective: To significantly increase market share in these high-potential regions.

Bio-Based and Advanced Recyclable Packaging Beyond Current Applications

While sustainable packaging is a Star for Aptar, the frontier of bio-based and advanced recyclable materials for entirely new applications falls into the Question Mark category. These innovative solutions, like Aptar's recent development of a nasal pump utilizing 52% bio-based material, tap into significant growth opportunities driven by sustainability demands. However, their market acceptance and scalability are still in nascent stages, requiring considerable investment to capture wider market share.

These emerging packaging technologies are poised to capitalize on strong consumer and regulatory pushes for environmental responsibility. For example, the global sustainable packaging market was valued at approximately USD 270 billion in 2023 and is projected to grow significantly in the coming years, with bio-based plastics expected to be a key driver. Aptar's investment in these areas, though currently representing a smaller portion of their overall business, reflects a strategic bet on future market leadership.

- New Applications: Development of bio-based and advanced recyclable packaging for sectors beyond traditional uses, such as advanced food preservation or specialized medical devices.

- Market Penetration: Early-stage commercialization efforts for these novel materials, facing challenges in consumer education and infrastructure development for recycling.

- Investment Needs: Significant R&D and capital expenditure required to scale production and achieve widespread market adoption, typical of Question Mark products.

- Growth Potential: High anticipated growth driven by increasing environmental regulations and consumer preference for sustainable alternatives, offering substantial future returns if successful.

Aptar's ventures into bio-based and advanced recyclable packaging for novel applications represent classic Question Marks. These innovations, such as their 52% bio-based nasal pump, tap into the burgeoning demand for sustainable materials, a market valued at approximately USD 270 billion in 2023. While the growth potential is substantial, driven by environmental consciousness and regulations, these nascent technologies require significant investment to achieve market acceptance and scalability.

The challenge for these Question Marks lies in their current low market share and the substantial capital needed for research, development, and market penetration. Aptar's strategic investment in these areas signals a long-term vision to transform these early-stage products into future market leaders, capitalizing on the increasing global emphasis on sustainability.

Aptar's digital health segment, encompassing SaMD and connected devices, is also a Question Mark. While the digital health market is projected for significant growth, reaching hundreds of billions globally, Aptar's current market share is likely minimal. Success hinges on substantial investment in brand building, regulatory approvals, and driving widespread adoption.

Similarly, Aptar's advanced nasal drug delivery systems for conditions like Alzheimer's are in their early stages, despite promising 2024 research validating their efficacy for targeted drug delivery. These specialized applications, though holding high growth potential, require extensive R&D and clinical trials to gain traction and capture market share.

| Product/Segment | Market Growth Potential | Current Market Share | Investment Needs | BCG Category |

| Bio-based Packaging (New Applications) | High | Low | High | Question Mark |

| Digital Health | High | Low | High | Question Mark |

| Nasal Drug Delivery (Advanced Therapies) | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Aptar BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.