Aptar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aptar Bundle

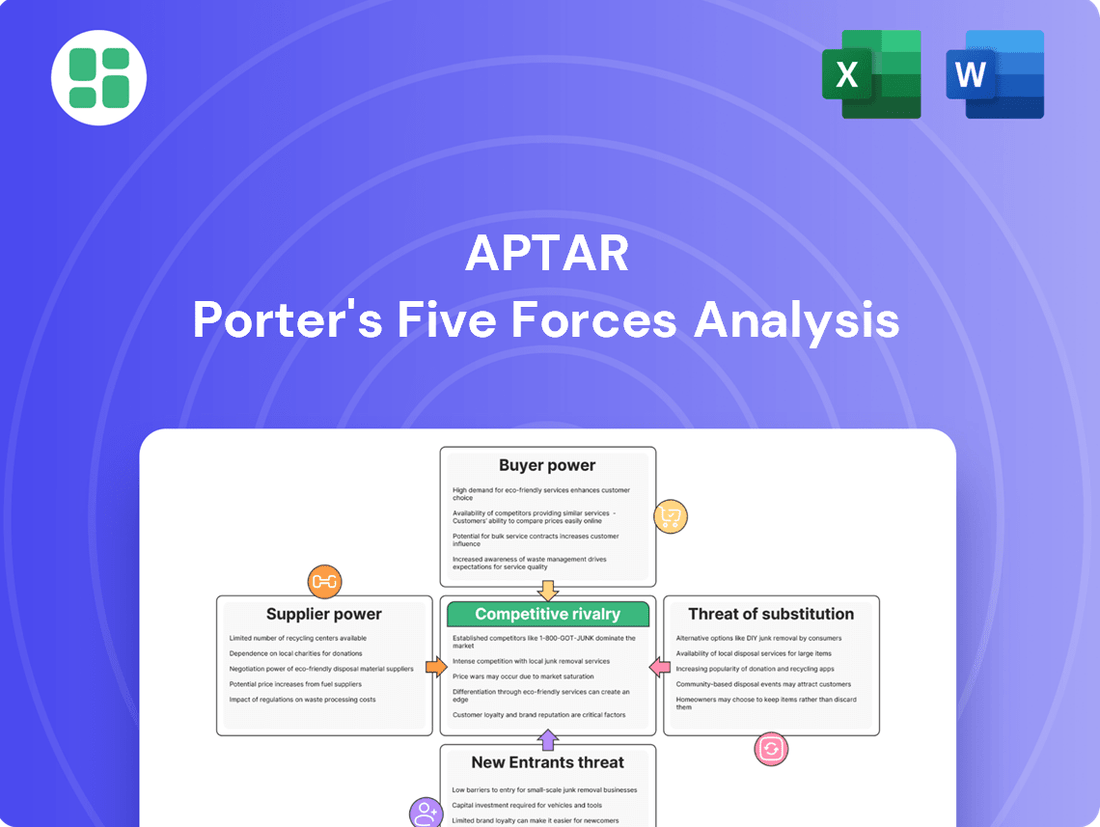

Aptar's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of substitute products. Understanding these dynamics is crucial for any investor or strategist looking to navigate Aptar's market.

The complete report reveals the real forces shaping Aptar’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aptar's reliance on plastics as a primary raw material presents a potential area of supplier leverage. While the overall plastics market is vast, the availability of specialized grades and high-performance polymers essential for Aptar's precision dispensing and pharmaceutical packaging solutions can be more limited, potentially concentrating power among fewer qualified suppliers.

Aptar's reliance on advanced manufacturing and specialized machinery for its complex dispensing and drug delivery systems highlights the significant bargaining power of its suppliers. These suppliers of unique components and high-precision equipment often command leverage due to the substantial costs and technical expertise involved in switching, making it difficult for Aptar to find alternative sources. For example, suppliers of specialized molds and automated assembly lines are critical to Aptar's production capabilities.

Aptar's deep commitment to sustainability, evident in its drive to boost recycled content and achieve 100% recyclable solutions, inherently requires robust partnerships with its suppliers. This strategic emphasis can inadvertently strengthen the hand of suppliers who provide certified sustainable materials or cutting-edge eco-friendly innovations, potentially enabling them to negotiate for premium pricing.

The significant portion of Aptar's environmental footprint, with roughly 80% of its Scope 3 emissions stemming from purchased goods and services, underscores the considerable influence raw material suppliers wield in achieving the company's sustainability objectives.

Supplier Switching Costs

Supplier switching costs can significantly impact Aptar's operational flexibility. For critical components or specialized raw materials, the expense and time involved in changing suppliers are substantial. This often necessitates lengthy re-qualification procedures, potential interruptions to ongoing production schedules, and even the need to redesign existing product components to accommodate new materials or suppliers.

These high switching costs inherently strengthen the bargaining power of Aptar's established and dependable suppliers. When suppliers are deeply integrated into Aptar's existing supply chain and product development processes, their position becomes more formidable. For instance, a supplier providing a highly customized dispensing mechanism for a major pharmaceutical client might command higher prices due to the extensive validation and integration work already completed.

- High Switching Costs: Re-qualification, production disruption, and re-engineering expenses make it difficult for Aptar to change suppliers for critical inputs.

- Supplier Integration: Established suppliers with deep integration into Aptar's product lines and processes possess greater leverage.

- Impact on Pricing: Increased supplier power can translate into higher raw material and component costs for Aptar, affecting profit margins.

Supplier Engagement and Long-Term Relationships

Aptar prioritizes building robust, long-term relationships with its suppliers, recognizing their crucial role in its operations. This is evident in initiatives like their global supplier summits and the implementation of sustainable purchasing charters, designed to foster collaboration and shared strategic objectives, such as reducing emissions. For instance, in 2023, Aptar reported that approximately 80% of its key suppliers were engaged in its sustainability programs.

While these deep partnerships can help to temper the bargaining power of suppliers by creating mutual trust and operational efficiencies, they also inherently highlight Aptar's dependence on these key relationships. This interdependence means that significant suppliers, particularly those providing specialized materials or components, can still exert considerable influence. Aptar's stated preference is to partner with suppliers who not only meet quality and cost requirements but also demonstrate a commitment to shared values, including ethical practices and environmental responsibility.

- Supplier Engagement: Aptar conducts regular global supplier summits to enhance communication and strategic alignment.

- Sustainable Charters: The company actively promotes sustainable purchasing charters to drive shared environmental goals.

- Relationship Dependence: While fostering partnerships, Aptar acknowledges its reliance on key suppliers, which can influence bargaining power.

- Value Alignment: Aptar seeks long-term partners who align with its corporate values, including sustainability and ethical conduct.

Aptar's suppliers, particularly those providing specialized plastics and high-precision components for its advanced dispensing systems, hold considerable bargaining power. This leverage is amplified by high switching costs, which include lengthy re-qualification processes and potential production disruptions. For instance, suppliers of custom molds and automated assembly lines are critical, making it difficult for Aptar to find readily available alternatives.

Aptar's strategic focus on sustainability, including the use of recycled materials, also strengthens the position of suppliers offering certified eco-friendly innovations. In 2023, approximately 80% of Aptar's key suppliers were engaged in its sustainability programs, highlighting their integral role and potential influence on pricing for premium, sustainable inputs. This interdependence means that while partnerships foster collaboration, significant suppliers can still exert considerable influence over raw material and component costs, impacting Aptar's profit margins.

| Supplier Characteristic | Impact on Aptar | Example |

|---|---|---|

| Specialized Materials & Components | High Bargaining Power | Suppliers of high-performance polymers for pharmaceutical packaging |

| High Switching Costs | Increased Supplier Leverage | Costs associated with re-qualifying suppliers for critical dispensing mechanisms |

| Sustainability Focus | Potential for Premium Pricing | Suppliers of certified recycled content or innovative eco-friendly materials |

| Supplier Integration | Strengthened Supplier Position | Suppliers deeply embedded in Aptar's product development and validation processes |

What is included in the product

This analysis unpacks the competitive intensity within Aptar's markets, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and Aptar's strategic positioning against rivals.

Effortlessly visualize competitive pressures with an intuitive, interactive dashboard, eliminating the guesswork in strategic planning.

Customers Bargaining Power

Aptar's diverse customer base, spanning approximately 5,000 clients across pharmaceutical, beauty, personal care, home care, food, and beverage sectors, significantly dilutes individual customer bargaining power. This broad market reach means no single customer represents more than 6% of Aptar's net sales, as reported in their 2024 financial statements, effectively spreading customer reliance and minimizing the impact of any one client's demands.

While Aptar's customer base is generally diverse, the pharmaceutical segment presents a notable area of customer concentration. Here, large global pharmaceutical brands and drug manufacturers are significant purchasers, often requiring substantial volumes of specialized and regulatory-compliant drug delivery systems.

These major players can exert considerable purchasing power due to their scale and the critical nature of Aptar's proprietary drug delivery solutions for their high-value products. For instance, in 2023, Aptar's Pharma segment generated approximately $2.0 billion in revenue, underscoring the importance of these large customers.

Aptar’s focus on value-added and innovative solutions significantly strengthens its position against customer bargaining power. By offering dispensing, sealing, and active packaging that genuinely enhance brand appeal and user experience, Aptar creates a sticky customer relationship. For instance, their advanced drug delivery systems, like those for biologics, are highly specialized and require significant integration, making it difficult for customers to simply switch to a cheaper, less capable provider.

The company’s substantial investments in research and development, particularly in areas like smart packaging and sophisticated drug delivery mechanisms, directly combat commoditization. This innovation means customers are less likely to find readily available, lower-cost substitutes that offer the same level of performance or unique features. Aptar’s 2023 R&D spending, which represented a notable portion of its revenue, underscores this commitment to creating differentiated products that customers value and are less inclined to abandon.

Customers actively recognize the tangible benefits of Aptar's innovations. The enhanced product efficacy, improved patient compliance in healthcare, and elevated brand perception in consumer goods are all factors that contribute to customer loyalty. This perceived value, driven by Aptar's technological advancements, directly limits the customers' ability to exert downward price pressure or demand less sophisticated, cheaper alternatives.

Regulatory Compliance and Quality Demands

In markets like pharmaceuticals, Aptar's products must adhere to strict regulations and maintain exceptionally high quality. This necessity makes it difficult and costly for customers to switch to alternative suppliers, as any new provider would also need to prove their compliance and reliability. This significantly curtails the bargaining power of customers.

For instance, Aptar's expertise in sterile drug delivery systems, particularly for injectables and biologics, means that customers are deeply reliant on their proven track record and regulatory approvals. The high switching costs associated with ensuring equivalent quality and compliance for these critical applications limit customer leverage.

- High Regulatory Hurdles: Pharmaceutical and medical device sectors demand adherence to rigorous standards like FDA and EMA regulations, making supplier changes complex.

- Quality Assurance Costs: Customers face substantial costs in re-validating and qualifying new suppliers for critical components, particularly in sensitive applications.

- Supplier Reliability: Aptar's established reputation for consistent quality and supply chain integrity reduces customer willingness to risk disruption by switching.

Customer Inventory Management and Destocking

Customer inventory management, particularly destocking trends seen in certain consumer healthcare segments during 2024, can temporarily shift bargaining power. When customers reduce their existing stock and place fewer new orders, they gain leverage by decreasing their immediate demand for Aptar's products.

However, this heightened customer power is often transient. As these destocking periods conclude and underlying consumer demand recovers, Aptar's established relationships and the indispensable nature of its dispensing solutions help to rebalance the scales, mitigating sustained pressure on its pricing power.

- Destocking Impact: In 2024, some consumer healthcare markets experienced destocking, leading to reduced customer orders and a temporary increase in customer bargaining power.

- Normalization of Cycles: As these inventory cycles normalize and demand rebounds, the leverage customers gain from destocking diminishes.

- Aptar's Mitigation Strategies: Aptar leverages its strong customer relationships and the essential nature of its dispensing technologies to counter prolonged shifts in bargaining power.

While Aptar's broad customer base generally limits individual customer power, the pharmaceutical sector represents a concentration where large, sophisticated buyers can exert influence. These clients, often global pharmaceutical giants, rely on Aptar's specialized and highly regulated drug delivery systems, giving them leverage due to their significant purchasing volumes and the critical nature of these components for their high-value products. For example, Aptar's Pharma segment achieved approximately $2.0 billion in revenue in 2023, highlighting the scale of these relationships.

Aptar's innovation and the high switching costs associated with its advanced, regulatory-compliant solutions significantly mitigate customer bargaining power. By offering differentiated products, such as specialized drug delivery systems for biologics, Aptar creates strong customer loyalty and reduces the likelihood of price-based competition. The company's commitment to R&D, evidenced by its substantial 2023 investment, further solidifies its position by making its offerings difficult to substitute with less capable or cheaper alternatives.

The stringent regulatory environment in sectors like pharmaceuticals, requiring adherence to standards such as FDA and EMA regulations, presents high hurdles for customers considering supplier changes. The substantial costs involved in re-validating and qualifying new suppliers for critical components, particularly in sensitive applications, coupled with Aptar's established reputation for quality and reliability, significantly limits customers' ability to leverage their purchasing power.

| Customer Segment | Aptar's Revenue Contribution (2023) | Key Customer Bargaining Power Factors | Mitigating Factors |

|---|---|---|---|

| Pharmaceutical | Approx. $2.0 billion | High volume purchases, critical product reliance | High switching costs, regulatory compliance, specialized technology |

| Beauty & Personal Care | Significant portion of remaining revenue | Brand differentiation, product innovation | Proprietary dispensing technology, brand appeal enhancement |

| Food & Beverage | Significant portion of remaining revenue | Volume purchasing, cost sensitivity | Product innovation, supply chain reliability |

What You See Is What You Get

Aptar Porter's Five Forces Analysis

This preview showcases the complete Aptar Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally crafted strategic assessment.

Rivalry Among Competitors

Aptar's extensive global manufacturing footprint, spanning North America, Europe, Asia, and South America, significantly intensifies competitive rivalry. This broad operational reach allows them to serve multinational customers efficiently and absorb regional market downturns, presenting a formidable challenge to less geographically diversified competitors.

The company's diverse product portfolio, serving multiple end markets such as beauty, personal care, home care, and pharmaceutical, further strengthens its competitive position. This diversification reduces reliance on any single market segment, enabling Aptar to maintain stability and market share even when specific industries face headwinds, thereby intensifying rivalry across a wider spectrum of businesses.

Aptar's competitive rivalry is significantly shaped by its commitment to innovation and intellectual property. The company invests heavily in research and development, boasting a substantial portfolio of over 7,000 active and pending patents. This robust IP foundation, particularly in areas like drug delivery systems, smart packaging, and advanced material science, allows Aptar to offer unique products that are challenging for rivals to imitate, thereby solidifying its market standing.

The packaging industry is a crowded space with many companies vying for market share. This means Aptar, despite its leadership in certain niches, constantly faces pressure from rivals who compete on price, the quality of their products, how innovative they are, and their ability to serve customers worldwide. For example, in 2023, the global packaging market was valued at approximately $1.1 trillion, showcasing the sheer scale and competitive nature of the industry.

Key competitors like Berry Global and Amcor are significant players, often engaging in strategic moves that reshape the competitive landscape. The industry is also seeing a trend of consolidation, with frequent mergers and acquisitions occurring as companies seek to expand their capabilities and market reach. This ongoing M&A activity, such as the acquisition of Meggitt by Parker Hannifin in 2022 for $8.3 billion (though not directly packaging, it shows industry consolidation trends), highlights the dynamic environment Aptar operates within.

Strategic Acquisitions and Partnerships

Aptar's approach to competitive rivalry is significantly shaped by its strategic acquisitions and partnerships. The company pursues a disciplined strategy, focusing on targets that enhance its technological prowess and market reach. For instance, acquisitions like Mod3 Pharma and SipNose, which occurred around the 2024-2025 timeframe, are prime examples of this strategy in action.

These carefully selected acquisitions bolster Aptar's capabilities, particularly in specialized areas such as clinical trial manufacturing services. By integrating these new operations, Aptar not only diversifies its product portfolio but also strengthens its competitive edge in rapidly expanding sectors like biologics and precision medicine. This proactive approach ensures Aptar remains a formidable player by continually upgrading its offerings and expanding into high-demand markets.

The impact of these strategic moves on competitive rivalry is substantial. They allow Aptar to:

- Enhance technological capabilities: Acquiring companies with advanced technologies directly integrates cutting-edge solutions into Aptar's existing framework.

- Expand service offerings: The integration of clinical trial manufacturing services broadens the scope of services Aptar provides to its clients.

- Diversify product portfolio: Adding new products and solutions reduces reliance on any single market segment, offering greater resilience.

- Strengthen market position: These strategic integrations solidify Aptar's standing in high-growth segments, making it a more attractive partner and competitor.

Sustainability as a Competitive Differentiator

Aptar's strong focus on sustainability sets it apart from competitors. This commitment is reflected in its Platinum EcoVadis rating and an 'A' score from CDP, demonstrating leadership in environmental and social governance.

As more consumers and businesses prioritize eco-conscious choices, Aptar's proven sustainable practices and its development of recyclable and reusable packaging solutions give it a significant edge. This focus on sustainability is not just an ethical stance but a tangible competitive advantage, attracting environmentally aware clients and potentially commanding premium pricing.

- EcoVadis Platinum Rating: Achieved by a select few companies, signifying top-tier sustainability performance.

- CDP 'A' Score: Indicates Aptar's leadership in environmental transparency and action on climate change.

- Growing Demand for Sustainable Packaging: Market trends show increasing consumer preference for products with minimal environmental impact.

- Recyclable and Reusable Solutions: Aptar's product innovation directly addresses the market's need for more sustainable packaging options.

Aptar faces intense competition from numerous players in the fragmented packaging industry, where rivals frequently compete on price, quality, innovation, and global reach. The sheer size of the global packaging market, valued at approximately $1.1 trillion in 2023, underscores this fierce rivalry. Companies like Berry Global and Amcor are major competitors, actively engaging in strategic maneuvers and industry consolidation through mergers and acquisitions to bolster their market positions and capabilities.

| Competitor | Market Presence | Key Strengths |

|---|---|---|

| Berry Global | Global | Diverse product portfolio, large-scale manufacturing |

| Amcor | Global | Extensive range of packaging solutions, innovation in flexible packaging |

| Sealed Air | Global | Protective packaging solutions, focus on sustainability |

| Sonoco Products Company | Global | Paper-based packaging, industrial packaging solutions |

SSubstitutes Threaten

The threat of substitutes for Aptar's packaging solutions is significant, stemming from alternative materials like glass, metal, and paper-based options. These substitutes can often perform similar dispensing or protection functions, especially as consumer demand for sustainable packaging grows. For instance, the global market for sustainable packaging is projected to reach $413.1 billion by 2027, indicating a strong shift away from traditional plastics.

The pharmaceutical and consumer health sectors face a growing threat from the move towards solid dosage forms like pills and tablets, or entirely different drug delivery systems. This shift could lessen the demand for Aptar's specialized dispensing technologies, such as pumps and aerosols.

Innovations in areas like oral biologics and transdermal patches present a significant alternative, potentially bypassing the need for Aptar's proprietary injectable or nasal delivery solutions. For instance, the global oral drug delivery market is projected to reach over $130 billion by 2026, indicating a substantial shift away from traditional delivery methods.

A shift towards non-dispensing or bulk packaging, often fueled by environmental consciousness or a desire for cost reduction, presents a significant threat to Aptar's dispensing solutions. Consumers might increasingly favor refillable containers or simpler packaging formats that bypass the need for sophisticated pumps or closures. For instance, the growing popularity of solid shampoo bars or concentrated cleaning tablets, which require minimal or no dispensing mechanisms, illustrates this trend.

Technological Advancements in Competitor Offerings

The threat of substitutes for Aptar's products is elevated by rapid technological advancements. Competitors or new market entrants could introduce highly innovative and cost-effective substitute technologies for dispensing or active packaging. These might involve novel materials, simpler mechanical designs, or integrated smart features that present a superior value proposition, directly challenging Aptar's current product lines.

For instance, advancements in biodegradable polymers could offer more sustainable alternatives to Aptar's plastic-based dispensing systems, potentially attracting environmentally conscious consumers and brands. Furthermore, the integration of IoT capabilities into packaging by competitors could provide enhanced product tracking and consumer engagement features, creating a substitute that offers added functionality beyond simple dispensing.

- Innovation in Materials: Development of advanced biodegradable or compostable materials that match the performance and cost-effectiveness of Aptar's current offerings.

- Simpler Mechanical Designs: Competitors could engineer dispensing mechanisms that are less complex, easier to manufacture, and therefore cheaper to produce, impacting Aptar's cost structure.

- Integrated Smart Features: The incorporation of sensors, NFC tags, or other smart technologies directly into packaging by rivals could offer enhanced product authentication, tracking, or consumer interaction.

- Cost-Effectiveness: Substitutes that achieve similar or better functionality at a significantly lower price point pose a direct competitive threat, especially in high-volume markets.

DIY and Reusable Consumer Trends

The increasing consumer embrace of Do-It-Yourself (DIY) projects and reusable packaging presents a significant threat of substitution for companies like Aptar. As consumers opt to make their own products or refill existing containers from bulk suppliers, demand for new, single-use packaging with integrated dispensing solutions naturally diminishes. This shift is particularly noticeable in sectors such as personal care and home care, where DIY formulations and refillable options are gaining traction.

This trend directly impacts Aptar by potentially reducing the volume of its dispensing systems sold. For instance, a growing number of consumers are opting for solid shampoo bars or making their own cleaning solutions, bypassing the need for liquid formulations and the pumps or sprayers that accompany them. Data from 2024 indicates a continued rise in consumer interest in sustainable and cost-effective alternatives, with surveys showing a significant percentage of individuals actively seeking out refillable options or engaging in DIY personal care product creation.

- DIY Product Popularity: Reports from 2024 highlight a surge in online searches and sales for DIY beauty and home cleaning ingredients, indicating a growing consumer willingness to create their own products.

- Reusable Packaging Adoption: A notable percentage of consumers, as per 2024 market research, are actively choosing brands that offer robust refill programs or easily reusable packaging formats.

- Market Impact: This substitution threat can lead to reduced unit sales for Aptar's dispensing closures and pumps in categories where DIY and refillable alternatives are becoming mainstream.

The threat of substitutes for Aptar's dispensing solutions is multifaceted, encompassing alternative materials, evolving product formats, and changing consumer behaviors. Innovations in sustainable materials, like advanced biodegradable polymers, offer direct competition by matching performance and cost-effectiveness. For example, the global market for sustainable packaging is projected to grow significantly, with many consumers actively seeking eco-friendly alternatives.

Furthermore, shifts in drug delivery, such as the rise of oral biologics and transdermal patches, bypass the need for Aptar's specialized injectable or nasal dispensing systems. The oral drug delivery market's substantial projected growth by 2026 underscores this trend.

Consumer preferences for DIY products and reusable packaging also pose a threat. In 2024, there was a notable increase in consumers seeking refillable options and engaging in DIY personal care, directly impacting demand for new dispensing closures and pumps.

| Substitute Category | Key Drivers | Impact on Aptar |

|---|---|---|

| Sustainable Materials | Environmental consciousness, regulatory pressure | Potential shift away from traditional plastics, demand for eco-friendly dispensing solutions |

| Alternative Drug Delivery | Advancements in biotech, patient convenience | Reduced demand for specialized pumps and aerosol systems in pharmaceuticals |

| DIY & Refillable Packaging | Cost savings, sustainability, consumer engagement | Lower unit sales for new dispensing closures and pumps in personal/home care |

Entrants Threaten

The specialized dispensing and active packaging market demands significant upfront capital. Think millions, even tens of millions, for state-of-the-art manufacturing plants, sophisticated machinery, and the sterile environments crucial for pharmaceutical-grade products. This high barrier makes it tough for newcomers to even get a foot in the door.

Established companies, like Aptar, have already made these investments and leverage substantial economies of scale. This means they can produce goods at a lower cost per unit, a significant advantage that new entrants struggle to match. For instance, in 2023, Aptar’s revenue reached $3.3 billion, showcasing the scale of operations already in place.

The packaging industry, particularly for specialized solutions like those Aptar offers, necessitates substantial and ongoing investment in research and development. This commitment is crucial for creating novel products, protecting innovations through patents, and adapting to changing customer demands and regulatory landscapes.

For any new company looking to enter this space, the sheer scale of R&D required presents a significant hurdle. They would need to allocate considerable capital to develop a competitive range of products and secure the necessary intellectual property, making it difficult to compete with established players.

New companies entering Aptar's markets, especially in pharmaceuticals and medical devices, confront formidable regulatory obstacles. Obtaining approvals from bodies like the U.S. Food and Drug Administration (FDA) and other international health authorities is a protracted and expensive undertaking.

The process of securing necessary certifications and proving adherence to stringent standards is a significant deterrent. For instance, the average time to bring a new drug to market can extend over a decade and cost billions, a substantial barrier for any nascent competitor.

Established Customer Relationships and Brand Loyalty

Aptar benefits from deeply entrenched customer relationships, particularly with major global brands across diverse sectors. These long-standing partnerships, cultivated over years, foster significant brand loyalty and trust, acting as a substantial barrier to entry for newcomers.

The high switching costs associated with Aptar's established customer base make it difficult for new entrants to disrupt the market. For instance, in 2023, Aptar reported that over 90% of its revenue came from existing customers, underscoring the stickiness of its client relationships.

- Customer Retention: Aptar's ability to maintain long-term contracts with leading companies in beauty, personal care, and food and beverage industries limits opportunities for new competitors.

- Switching Costs: The integration of Aptar's dispensing solutions into existing manufacturing processes and product lines creates significant operational and financial hurdles for customers looking to change suppliers.

- Brand Trust: Decades of reliable performance and innovation have built a strong reputation, making customers hesitant to risk product quality or supply chain stability by switching to an unproven entrant.

Proprietary Technology and Intellectual Property Barriers

Aptar's formidable intellectual property, boasting over 7,000 patents globally, creates a significant hurdle for potential competitors. This extensive patent portfolio protects its proprietary technologies, making it exceptionally difficult for new entrants to develop comparable solutions without facing infringement risks and substantial legal challenges.

The sheer volume and breadth of Aptar's patents mean that any new player would need to invest heavily in research and development to innovate around these existing protections. This process requires not only advanced technical capabilities but also considerable legal acumen, thereby escalating the financial and operational barriers to entry in the markets Aptar serves.

- Proprietary Technology: Aptar's innovation pipeline is protected by a vast patent library, covering diverse dispensing technologies.

- Intellectual Property Barriers: Over 7,000 patents act as a strong deterrent, requiring significant investment in R&D and legal expertise for new entrants.

- Market Entry Costs: Developing non-infringing alternatives substantially increases the cost and risk associated with entering Aptar's established markets.

The threat of new entrants for Aptar is generally low due to substantial capital requirements for advanced manufacturing and R&D, along with significant regulatory hurdles in key markets like pharmaceuticals. Established customer relationships and extensive patent portfolios further solidify Aptar's position, making it challenging for newcomers to compete effectively.

New entrants face considerable financial barriers, needing millions for specialized equipment and sterile facilities. Aptar's 2023 revenue of $3.3 billion highlights the scale advantage it holds, allowing for lower per-unit costs that are difficult for startups to match.

The market demands continuous innovation, with Aptar investing heavily in R&D to maintain its edge. New companies must also commit substantial resources to develop competitive products and secure intellectual property, a costly endeavor.

Navigating stringent regulations, such as FDA approvals, adds significant time and expense for new entrants. The lengthy and costly process of obtaining certifications acts as a major deterrent, especially in the life sciences sector.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for specialized manufacturing and sterile environments. | Significant financial hurdle, requiring millions in initial outlay. |

| R&D Investment | Ongoing need for innovation, new product development, and patent protection. | Demands substantial and continuous financial commitment. |

| Regulatory Approvals | Protracted and expensive processes for certifications in sectors like pharma. | Increases time-to-market and overall entry costs. |

| Customer Loyalty & Switching Costs | Entrenched relationships and integrated solutions make switching difficult. | New entrants struggle to displace established, trusted suppliers. |

| Intellectual Property | Extensive patent portfolio protects proprietary technologies. | Requires significant investment in R&D and legal expertise to avoid infringement. |

Porter's Five Forces Analysis Data Sources

Our Aptar Porter's Five Forces analysis is built upon a robust foundation of data, including Aptar's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports from firms like Mintel and Euromonitor, alongside macroeconomic data from sources such as the World Bank.