Appen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Appen Bundle

Appen leverages its vast data annotation capabilities and global workforce to capitalize on the booming AI and machine learning market. However, it faces intense competition and potential reliance on key clients, creating significant market pressures.

Want the full story behind Appen's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Appen’s global crowd is a powerhouse, boasting over 1 million annotators in more than 200 countries. This massive network speaks over 500 languages, providing unparalleled linguistic diversity for AI training data. This reach is critical for developing AI that understands and functions across varied global markets.

Appen stands as a global leader in supplying meticulously annotated data, the bedrock of machine learning and AI. Their comprehensive services, from data collection to evaluation, position them as an indispensable partner throughout the AI development process.

The increasing integration of AI across diverse sectors amplifies Appen's significance. In 2023, the global AI market was valued at an estimated $200 billion, with projections indicating substantial growth, underscoring the critical demand for the high-quality, human-annotated data Appen provides.

Appen has demonstrated a strong pivot into generative AI, with this sector becoming a significant revenue driver, accounting for over 40% of total revenue in the second half of fiscal year 2024. This strategic shift highlights their capability in a high-growth market.

The company's proficiency in developing specialized datasets for Large Language Models (LLMs) is a key strength, enabling them to support complex AI innovations. Their expertise extends to multilingual and multimodal AI, a critical area for advanced generative AI applications.

Technological Platform and AI-Assisted Tools

Appen's technological platform is a significant strength, featuring an advanced AI data platform and AI-assisted annotation tools. This integration streamlines workflows, boosting both efficiency and the accuracy of data annotation. For instance, in 2023, Appen reported that its AI-powered solutions contributed to a substantial reduction in project turnaround times for clients.

These technological advancements, coupled with human oversight, enable Appen to effectively manage vast datasets and deliver high-quality annotations. This hybrid approach is particularly crucial for complex or sensitive data annotation tasks, minimizing manual labor while upholding precision. The company's investment in these tools positions it well to handle the increasing demand for sophisticated AI training data.

- AI-Powered Efficiency: Appen's platform uses AI to speed up data annotation processes.

- Enhanced Accuracy: AI assistance helps minimize errors in data labeling.

- Scalability: The technology allows Appen to manage large-scale data projects effectively.

- Human-AI Synergy: Combining AI tools with human expertise ensures quality and precision.

Strategic Cost Management and Profitability Focus

Appen's strategic cost management is a significant strength, particularly evident in its FY24 initiatives. The company successfully implemented a $13.5 million cost-out program, directly impacting its operational efficiency.

This focus on reducing expenses has yielded tangible results, contributing to a return to cash EBITDA profitability. Such financial discipline underscores Appen's commitment to strengthening its core business and improving overall financial health.

Key aspects of this strength include:

- Dedicated cost-reduction programs: The $13.5 million cost-out program in FY24 demonstrates a proactive approach to expense management.

- Improved profitability metrics: These cost-saving efforts have directly led to a return to cash EBITDA profitability, a crucial indicator of financial performance.

- Focus on sustainable operations: The emphasis on efficiency signals a commitment to building a more resilient and financially sound business model for the future.

Appen's extensive global crowd, numbering over 1 million annotators across 200+ countries and speaking over 500 languages, provides unparalleled linguistic and cultural diversity for AI training data. This vast, multilingual resource is crucial for developing AI that performs effectively in diverse global markets. The company's leadership in data annotation services, from collection to evaluation, makes it an essential partner in the AI development lifecycle.

Appen's strategic pivot into generative AI is a significant strength, with this segment contributing over 40% of its revenue in the latter half of fiscal year 2024, reflecting its ability to capitalize on high-growth market trends. Their expertise in creating specialized datasets for Large Language Models (LLMs) and supporting multilingual and multimodal AI applications further solidifies their position in advanced AI innovation.

The company's advanced AI data platform and AI-assisted annotation tools significantly enhance operational efficiency and accuracy, as evidenced by reduced project turnaround times reported in 2023. This technological infrastructure, combined with human oversight, allows Appen to manage massive datasets and deliver high-quality annotations, a critical advantage for complex AI projects.

Appen's commitment to cost management, highlighted by a $13.5 million cost-out program in FY24, has directly contributed to a return to cash EBITDA profitability. This financial discipline demonstrates a focus on operational efficiency and building a more sustainable business model.

What is included in the product

Analyzes Appen’s strengths in its global data annotation workforce and market leadership, alongside weaknesses like reliance on a few large clients and opportunities in AI advancements, while also considering threats from increased competition and evolving data privacy regulations.

Appen's SWOT analysis provides a clear, actionable framework to identify and address critical business challenges, transforming potential weaknesses into strategic advantages.

Weaknesses

Appen's historical reliance on a few major clients presents a significant weakness. The termination of its contract with Google in the first quarter of fiscal year 2024 exemplifies this, causing a substantial drop in group operating revenue.

While Appen has seen revenue growth from other areas since the Google contract ended, this past dependence underscores its vulnerability. Changes in the strategies or partnership decisions of key clients can have a disproportionately large impact on Appen's financial performance.

Appen's financial performance has been notably weak, with a significant 14.2% drop in group operating revenue for FY24. This decline was largely a consequence of the termination of its contract with Google, a major blow to its earnings. The company has described its financial situation as a 'financial free-fall,' with revenues falling sharply from their previous highs.

While some segments of Appen are showing signs of revenue recovery, the overall financial picture remains volatile. The company has reported considerable losses, which has understandably made investors hesitant. This inconsistency in performance raises concerns about its long-term financial stability and ability to generate consistent returns.

The data annotation market is incredibly crowded, featuring many competitors like SuperAnnotate, Prolific, and Amazon's own offerings such as AWS Glue and SageMaker Ground Truth. This intense competition puts significant pressure on Appen to stand out, continuously innovate its services, and remain competitive on pricing.

This competitive environment directly impacts Appen's ability to maintain healthy profit margins and protect its market share. Companies in this space must constantly adapt to evolving AI needs and technological advancements to avoid falling behind.

Operational and Contractor-Related Challenges

Appen has faced significant headwinds concerning its operational backbone: its global contractor workforce. Reports have surfaced detailing issues such as unreasonable project deadlines and delays in contractor payments, which directly impact the morale and retention of these crucial workers. For instance, during the first half of 2024, some contractor feedback highlighted extended payment cycles, a stark contrast to the company's need for a responsive and motivated crowd. This strain on contractor relations poses a substantial threat to Appen's ability to consistently deliver high-quality data annotation services, a core component of its value proposition.

These operational friction points can severely damage Appen's reputation within the gig economy and among potential contractors. A tarnished employer brand makes it harder to attract the specialized talent needed for complex AI training tasks. In 2023, the company's ability to scale quickly for certain projects was reportedly hampered by the need to onboard new contractors due to attrition linked to dissatisfaction. This directly impacts project timelines and cost-effectiveness.

- Contractor dissatisfaction: Allegations of unreasonable deadlines and late payments have been a recurring theme in contractor feedback throughout 2023 and early 2024.

- Reputational damage: Negative contractor experiences can deter new talent, impacting Appen's access to a skilled global workforce.

- Talent retention: The company's reliance on a flexible, skilled contractor base means that issues with working conditions can lead to higher turnover.

- Operational efficiency: Poor contractor relations can directly translate to project delays and reduced data quality, impacting service delivery.

Impact of AI Automation on Manual Annotation

The growing capability of generative AI and AI-powered tools for data labeling presents a significant challenge to Appen's core business, which heavily relies on manual annotation. As these technologies advance, the demand for extensive human input in data labeling may decrease, potentially impacting Appen's revenue streams.

While Appen is actively integrating these AI advancements, a swift transition to fully automated labeling or synthetic data generation could undermine the need for their human-in-the-loop services. This shift poses a long-term risk to their established business model.

- Reduced Demand for Manual Labor: As AI tools become more adept at data annotation, the need for large teams of human annotators, a cornerstone of Appen's operations, is likely to shrink.

- Competitive Pressure from AI Solutions: Companies developing advanced AI labeling platforms could offer more cost-effective and faster solutions, directly competing with Appen's service offerings.

- Need for Strategic Adaptation: Appen must continuously adapt its service portfolio to incorporate AI-driven solutions and focus on areas where human expertise remains critical, such as complex, nuanced, or highly specialized data annotation tasks.

Appen's historical dependence on a few major clients, notably Google, proved to be a significant vulnerability. The termination of its contract with Google in Q1 2024 resulted in a substantial 14.2% drop in group operating revenue for the first half of 2024, highlighting its susceptibility to the strategic decisions of key partners.

The company's financial performance has been characterized by significant losses and volatility, with revenues falling sharply. This instability makes investors cautious and raises concerns about Appen's long-term financial stability and its ability to achieve consistent profitability.

Intense competition in the data annotation market, with players like SuperAnnotate and Amazon's offerings, puts pressure on Appen's pricing and profit margins. Furthermore, contractor dissatisfaction due to issues like late payments and unreasonable deadlines in 2023 and early 2024 can damage its reputation and hinder talent acquisition and retention.

The increasing sophistication of generative AI and AI-powered labeling tools poses a direct threat to Appen's core business model, which relies heavily on manual annotation. This trend could reduce the demand for human annotators, impacting revenue streams if Appen cannot effectively adapt its service offerings.

Same Document Delivered

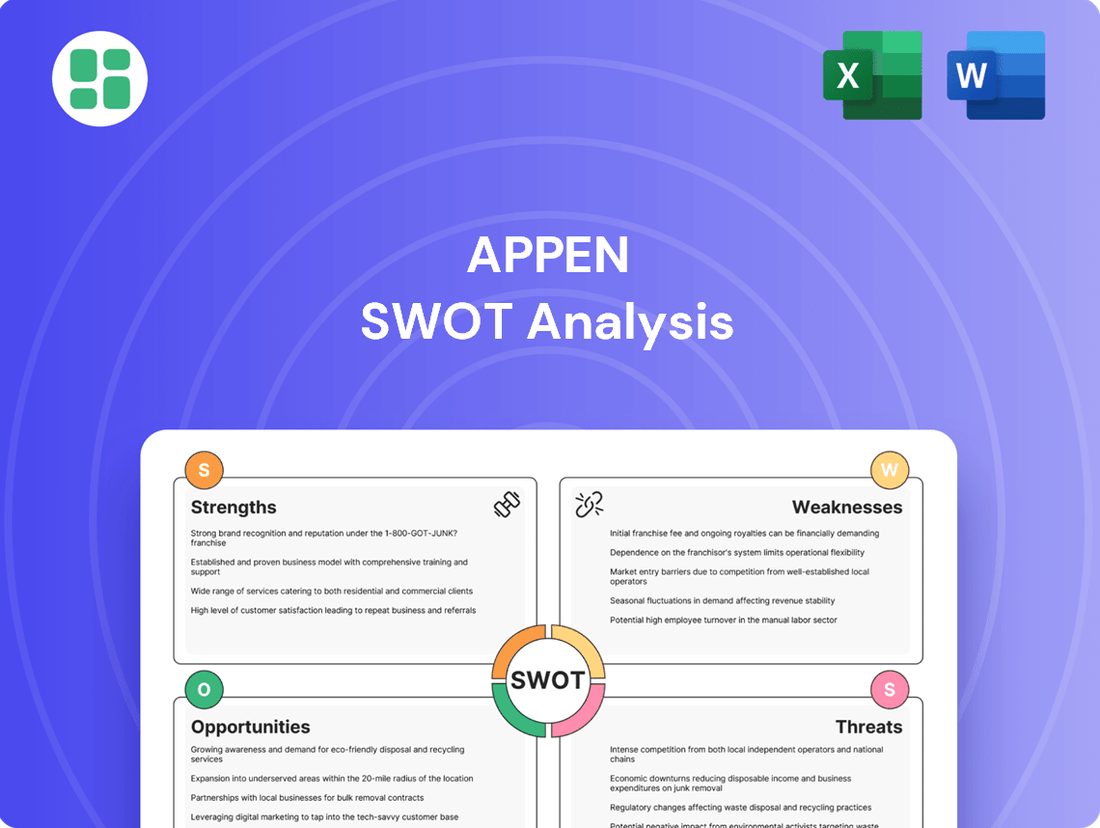

Appen SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Appen's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

Opportunities

The global AI and machine learning market is projected to reach $1.81 trillion by 2030, according to Statista, a substantial increase from its estimated $207.9 billion in 2023. This rapid expansion fuels an ever-growing need for high-quality, accurately labeled training data across sectors like healthcare, automotive, and finance.

Appen is well-positioned to capitalize on this trend, as the complexity and sophistication of AI models demand increasingly diverse, precise, and ethically sourced datasets. The company's established expertise in data annotation and collection directly addresses this intensifying market requirement.

The explosion in generative AI and Large Language Models (LLMs) presents a massive new opportunity for data annotation firms. Appen's existing expertise in handling complex, nuanced data, especially for AI training, directly aligns with the growing demand for high-quality datasets required for these advanced models.

Appen has already secured significant projects in the generative AI space, including work on LLM evaluation and data curation for AI safety. For instance, in 2024, the company reported a substantial portion of its revenue coming from these advanced AI initiatives, demonstrating its capability to capitalize on this trend.

Appen's strategic expansion into new geographies and industries presents a significant opportunity. The company demonstrated robust growth in China, with revenue seeing a notable increase in FY24, solidifying its position as the market leader for LLM builders in that region.

Further capitalizing on this momentum, Appen can focus on expanding its presence and forging new partnerships within emerging technology hubs. Diversifying into sectors experiencing rapid AI adoption, such as healthcare, automotive, and finance, offers substantial avenues for continued growth and market penetration.

Leveraging Automation and AI for Enhanced Efficiency

Appen's strategic integration of AI and automation into its data annotation processes presents a significant opportunity. By streamlining workflows, the company can achieve greater operational efficiency and cost reductions. This is crucial as the demand for high-quality labeled data continues to surge, driven by advancements in AI and machine learning across various industries.

This technological enhancement allows Appen to process vast datasets more rapidly, directly addressing the growing market need. For instance, by Q1 2024, the global AI market was projected to reach $200 billion, with data labeling being a critical component. Appen's ability to scale its operations through automation ensures it can capture a larger share of this expanding market.

- Enhanced Efficiency: AI-driven tools can automate repetitive tasks in data annotation, speeding up project turnaround times.

- Cost Reduction: Automation lowers labor costs associated with manual annotation, improving profit margins.

- Scalability: Automated workflows allow Appen to handle larger volumes of data, meeting the increasing demand from clients.

- Quality Assurance: While automating, maintaining human oversight for critical tasks ensures high-quality output and accuracy.

Focus on Data Quality, Ethics, and Bias Mitigation

The growing reliance on AI amplifies the demand for high-quality, ethically sourced training data. Appen's established human-in-the-loop model positions it advantageously to meet this need by providing services focused on data integrity and bias reduction.

This trend is supported by market projections anticipating significant growth in the data labeling and annotation sector, driven by AI adoption. For instance, the global data annotation market was valued at approximately $1.5 billion in 2023 and is projected to reach over $6 billion by 2028, exhibiting a compound annual growth rate (CAGR) of over 30%.

- Enhanced Data Integrity: Appen can leverage its global workforce to ensure data accuracy and completeness, crucial for reliable AI model performance.

- Ethical Sourcing and Compliance: Offering services that guarantee data is collected ethically and adheres to regulations like GDPR and CCPA will be a key differentiator.

- Bias Mitigation Expertise: Developing and promoting tools and processes to identify and reduce bias in datasets will address a critical concern for AI developers.

- Market Demand Alignment: Capitalizing on the increasing market need for trustworthy AI training data aligns directly with Appen's core capabilities.

The burgeoning generative AI and Large Language Model (LLM) markets present a significant growth avenue for Appen. The company's established expertise in complex data annotation directly addresses the escalating demand for high-quality datasets crucial for training these advanced models. Appen's proactive engagement in LLM evaluation and data curation for AI safety, as evidenced by substantial revenue contributions in 2024 from these initiatives, highlights its capacity to leverage this trend.

Appen's strategic expansion into new markets, particularly in China, demonstrates a strong opportunity for continued growth. The company's notable revenue increase in China during FY24 solidifies its leadership in the LLM builder segment there. Further diversification into sectors with high AI adoption, such as automotive and healthcare, also offers substantial potential for market penetration and revenue generation.

The integration of AI and automation into Appen's data annotation processes offers a pathway to enhanced efficiency and cost reduction. By streamlining workflows, Appen can better meet the surging demand for labeled data, driven by AI advancements. This technological enhancement allows for faster processing of vast datasets, enabling Appen to capture a larger share of the expanding AI market, which saw its data labeling segment valued at approximately $1.5 billion in 2023.

Appen is well-positioned to meet the increasing demand for high-quality, ethically sourced training data, a critical component for reliable AI performance. The company's human-in-the-loop model emphasizes data integrity and bias reduction, aligning with market needs. The data annotation market is projected for substantial growth, with an expected CAGR of over 30% from 2023 to 2028, indicating a strong demand for Appen's core services.

Threats

The data annotation landscape is rapidly fragmenting, with specialized firms and major tech giants now offering competing services. This intensified competition, exemplified by platforms like SuperAnnotate and Amazon SageMaker Ground Truth, puts significant pressure on Appen regarding pricing, the pace of innovation, and attracting new clients.

The rapid evolution of artificial intelligence, especially in areas like synthetic data generation and increasingly autonomous data labeling, poses a significant threat to Appen's foundational business. These advancements could diminish the demand for human annotators, the very core of Appen's service offering.

While human oversight remains vital for nuanced and complex tasks, a substantial move towards AI-generated data could contract the market for conventional annotation services. For instance, by early 2025, projections suggest that AI models will be capable of generating a significant portion of training data, potentially impacting the volume of human-labeled data required.

The recent termination of Appen's contract with Google highlights a critical vulnerability: revenue concentration. This single event, which reportedly impacted a substantial portion of Appen's business, demonstrates the precariousness of relying heavily on a few major clients.

Looking ahead, Appen faces continued threats from other large clients potentially insourcing data annotation services, diversifying their vendor relationships, or scaling back their project volumes. Such shifts could significantly impair Appen's financial performance, directly affecting its revenue streams and overall profitability.

Economic Downturns and Reduced AI Spending

Global economic uncertainties, particularly the risk of a recession in major markets, could significantly dampen corporate spending on AI initiatives. This directly translates to reduced demand for data annotation services, Appen's core business. For instance, if a significant portion of Appen's client base, like automotive or tech companies, faces revenue pressures, their AI project budgets are likely to be among the first to be cut.

A slowdown in AI investment could manifest as lower project volumes and delayed project starts for Appen. Clients might become more price-sensitive, seeking cost reductions in their data annotation contracts. This environment could put pressure on Appen's margins and hinder its ability to achieve its projected revenue growth for 2024 and into 2025.

- Economic Uncertainty: Increased global economic volatility and potential recessions in key markets pose a direct threat to discretionary AI spending by clients.

- Reduced AI Budgets: Companies facing economic headwinds are likely to scale back investments in AI development, impacting demand for data annotation services.

- Price Sensitivity: Clients may become more aggressive in negotiating pricing for data annotation, potentially squeezing Appen's profit margins.

- Project Delays: Economic downturns often lead to the postponement or cancellation of AI projects, directly affecting Appen's revenue pipeline.

Talent Acquisition and Retention Challenges for Annotators

Appen faces significant hurdles in attracting and keeping a robust global workforce of data annotators. The company's reliance on a large, skilled, and content crowd is fundamental to its service delivery.

Reported issues like inadequate compensation, less-than-ideal working environments, and delayed payments, as experienced by some contractors, can directly hinder Appen's ability to secure and retain top-tier annotator talent. This directly impacts the quality of data produced and the timely completion of projects. For instance, in early 2024, reports indicated ongoing discussions and some contractor dissatisfaction regarding pay rates and work allocation, potentially affecting long-term retention.

- Talent Pool Strain: Persistent low pay and poor conditions can shrink the available pool of skilled annotators, making it harder to staff projects efficiently.

- Quality Degradation: Difficulty in retaining experienced annotators can lead to increased errors and inconsistencies in the annotated data, impacting AI model performance.

- Operational Disruptions: High turnover rates can cause project delays and increased recruitment costs, affecting Appen's ability to meet client demands and maintain profitability.

Intensifying competition from specialized firms and tech giants like Amazon SageMaker Ground Truth pressures Appen on pricing and innovation, while advancements in AI-generated data, projected to capture a significant portion of training data needs by early 2025, threaten the core demand for human annotation.

Appen's heavy reliance on a few major clients, underscored by the significant impact of its Google contract termination, leaves it vulnerable to revenue concentration risks, with other large clients potentially insourcing services or reducing project volumes, directly affecting financial performance.

Economic uncertainties and potential recessions in key markets could curb corporate AI spending, leading to reduced project volumes, delayed starts, and increased price sensitivity from clients, potentially squeezing Appen's profit margins throughout 2024 and 2025.

Challenges in attracting and retaining skilled data annotators due to issues like inadequate compensation and delayed payments can lead to a strained talent pool, quality degradation, and operational disruptions, impacting Appen's ability to meet client demands and maintain profitability.

SWOT Analysis Data Sources

This Appen SWOT analysis is built upon a robust foundation of data, including Appen's official financial filings, comprehensive market research reports, and insights from industry experts to ensure a well-rounded and accurate assessment.