Appen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Appen Bundle

Appen's competitive landscape is shaped by intense rivalry, the bargaining power of its clients, and the ever-present threat of new entrants in the AI data services market. Understanding these forces is crucial for navigating the industry.

The complete report reveals the real forces shaping Appen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Appen's primary suppliers are its vast global network of human annotators. The bargaining power of these individual suppliers is typically quite low. This is because the crowd is large, fragmented, and spread across the globe, with many possessing similar, fundamental annotation skills. For instance, in 2024, Appen continued to leverage a crowd of hundreds of thousands of contributors worldwide, making it difficult for any single annotator or small group to exert significant influence over pricing or terms.

The bargaining power of suppliers for Appen can be significant, particularly for specialized annotation services. For instance, in areas like medical imaging or legal document review, where specific expertise is crucial, suppliers can command higher prices due to a limited pool of qualified annotators. This niche demand drives up costs for companies like Appen that rely on these specialized skills.

The bargaining power of suppliers for Appen, particularly concerning annotators, is influenced by evolving labor dynamics. The increasing visibility of worker advocacy groups and a growing emphasis on fair labor in the gig economy could potentially strengthen annotators' collective voice. This could translate into demands for improved compensation and working conditions, thereby enhancing their ability to negotiate terms.

Supplier Power 4

Appen's reliance on a vast, global network of freelance annotators significantly dilutes the bargaining power of individual suppliers. This diverse crowd, numbering in the millions, means that the loss of any single contributor or small group has a minimal impact on Appen's operations or costs. For instance, in 2023, Appen continued to leverage its extensive contributor base to manage project needs efficiently.

The sheer scale of Appen's workforce allows for effective management of fluctuations in contributor availability and pricing. This broad supplier base prevents any concentrated group from dictating terms, thereby reducing the overall supplier power.

- Supplier Concentration: Appen's global crowd model minimizes reliance on any single supplier, distributing risk across millions of individuals.

- Cost Management: The wide availability of annotators allows Appen to manage labor costs effectively by sourcing talent from various regions.

- Operational Resilience: A large, diverse workforce ensures continuity of service even with localized changes in contributor availability or pricing expectations.

Supplier Power 5

Technological advancements are a key factor influencing the bargaining power of suppliers for Appen. Innovations like automated pre-labeling and quality checks can significantly reduce the need for certain manual data annotation tasks. This shift can decrease Appen's reliance on suppliers providing commoditized services, thereby lessening their leverage.

As Appen integrates more sophisticated AI-driven tools, the demand for basic, labor-intensive data annotation may decline. This could lead to a surplus of suppliers for these simpler tasks, driving down prices and empowering Appen. However, the demand for highly specialized data validation and complex annotation tasks, requiring human expertise, will likely persist, giving those suppliers more significant bargaining power.

- Reduced Reliance on Basic Annotation: As of early 2024, Appen’s investment in AI-powered annotation tools aims to automate up to 50% of routine data labeling tasks, directly impacting suppliers of these services.

- Shift to Specialized Skills: The market is seeing a growing demand for suppliers with expertise in niche areas like medical imaging annotation or complex natural language understanding, where bargaining power remains high.

- Supplier Consolidation: In 2023, the data annotation market saw some consolidation, with smaller, less technologically advanced suppliers struggling to compete, potentially increasing the bargaining power of larger, more capable entities.

The bargaining power of Appen's suppliers, primarily its global network of human annotators, is generally low due to the sheer size and fragmentation of this workforce. In 2024, Appen continued to leverage hundreds of thousands of contributors worldwide, making it difficult for any single annotator or small group to exert significant influence over pricing or terms.

However, for specialized annotation services, such as medical imaging or legal document review, supplier bargaining power can increase. This is due to a more limited pool of qualified annotators for these niche areas, allowing them to command higher prices. For example, the demand for AI model training data in specialized fields often outstrips the supply of expert annotators.

The evolving labor dynamics in the gig economy, including increased visibility of worker advocacy groups, could potentially strengthen annotators' collective bargaining power. This might lead to demands for better compensation and working conditions, impacting Appen's cost structure.

| Factor | Impact on Appen's Supplier Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Low due to large, fragmented global workforce | Millions of contributors worldwide |

| Specialized Skills Demand | High for niche annotation services | Growing demand in AI fields like autonomous driving and healthcare |

| Labor Advocacy | Potential to increase power through collective action | Increased focus on fair labor practices in the gig economy |

| Technological Automation | Decreases power for commoditized tasks | AI tools automating routine tasks, reducing reliance on basic annotators |

What is included in the product

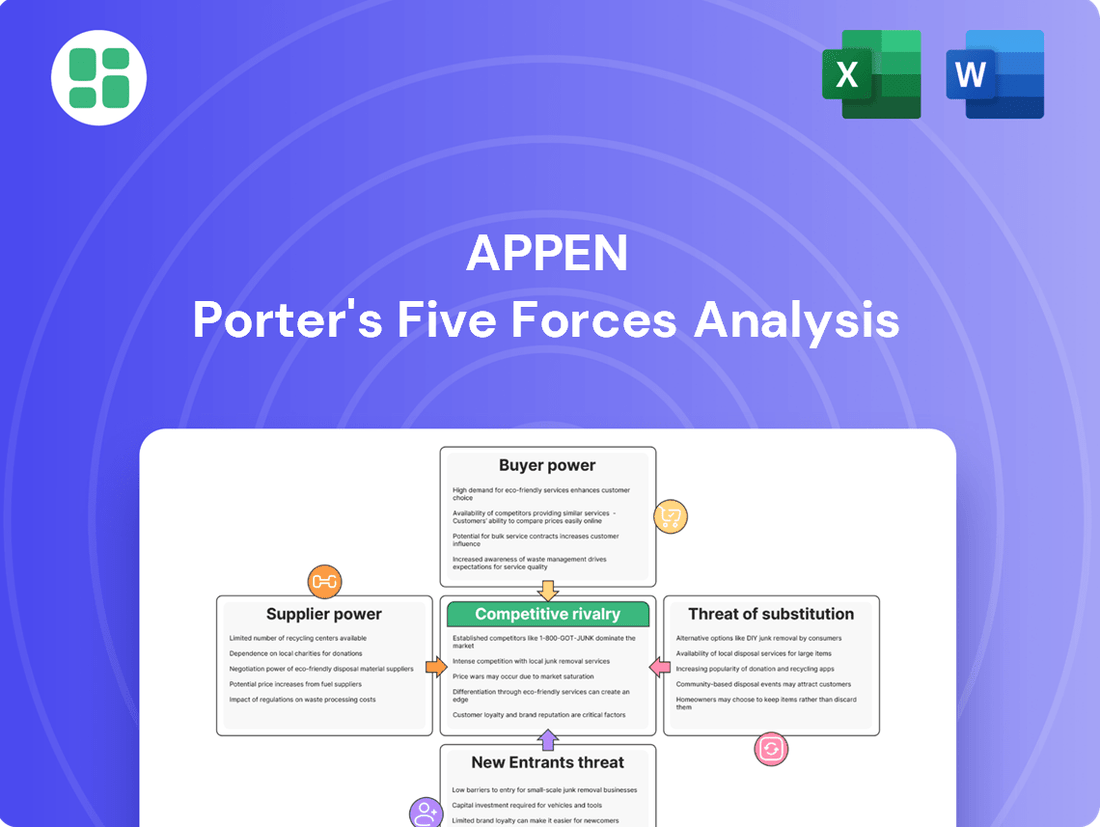

Appen's Porter's Five Forces analysis examines the intensity of competition, buyer and supplier power, threat of new entrants and substitutes, providing a strategic overview of its market position.

Effortlessly visualize competitive intensity across all five forces with a dynamic, interactive dashboard, simplifying complex market analysis for strategic planning.

Customers Bargaining Power

Appen's customer base is dominated by large enterprises and major tech companies, a factor that significantly amplifies their bargaining power. These clients often represent substantial portions of Appen's revenue, allowing them to negotiate favorable pricing and stringent service level agreements. For instance, in 2023, Appen reported that its top 10 customers accounted for approximately 64% of its revenue, highlighting the concentrated nature of its client relationships and the leverage these major players hold.

Customers of data annotation services, like those provided by Appen, often have a wide array of choices. They can turn to numerous other vendors in the market, opt for smaller, specialized firms that cater to niche needs, or even decide to build their own internal data labeling teams. This abundance of alternatives significantly strengthens their bargaining position.

This increased leverage means customers are more likely to be price-sensitive when negotiating contracts with Appen. For instance, in the competitive AI training data sector, pricing can be a major deciding factor. Appen's revenue from its data services segment was impacted by these market dynamics in recent periods, reflecting the pressure from buyer power.

The bargaining power of customers is a significant factor for Appen, particularly in its core data labeling services. As these services become more commoditized, clients can readily switch providers if they find more competitive pricing or quicker delivery. For instance, in 2023, the market for basic AI training data was highly competitive, with numerous smaller players emerging, intensifying price pressures.

While switching costs are generally low for straightforward labeling tasks, they can escalate for projects requiring specialized expertise or deep integration with a client's existing workflows. This means that for highly customized or complex AI development projects, Appen might retain more leverage due to the difficulty and expense of transferring such specialized operations to another vendor.

Buyer Power 4

Customers, particularly large enterprises, wield significant bargaining power over Appen. They often demand highly specific quality standards, customized data formats, and robust security protocols. This ability to dictate terms can put considerable pressure on Appen, influencing pricing, operational processes, and ultimately, profitability.

The concentration of buyers is a key factor. For instance, a few major technology companies or government agencies might represent a substantial portion of Appen's revenue. If these key clients switch providers or negotiate aggressively, it can have a material impact on Appen's financial performance. In 2023, Appen faced challenges in retaining some of its larger clients, highlighting this buyer power.

Furthermore, the switching costs for customers can be relatively low, especially if they are not deeply integrated with Appen's proprietary systems. This ease of switching reinforces the customers' leverage. Appen's efforts to differentiate through specialized AI training data and services aim to mitigate this, but the underlying threat remains.

- Customer Concentration: A few large clients can significantly influence Appen's revenue.

- Demand for Customization: Specific quality, format, and security needs increase customer leverage.

- Switching Costs: Relatively low switching costs empower customers to negotiate or move to competitors.

- Impact on Profitability: Buyer demands can compress margins and reduce operational flexibility for Appen.

Buyer Power 5

As the AI market matures, customers are becoming more sophisticated, demanding specialized expertise and scalable solutions. This shift empowers them to negotiate for tailored services, moving away from generic offerings. For instance, in 2024, major tech companies with significant AI investments are increasingly seeking niche data annotation providers that can meet very specific project requirements, giving them greater leverage in pricing and service delivery.

Appen's customers, particularly large enterprises in sectors like automotive and healthcare, wield considerable bargaining power. Their ability to switch providers or develop in-house capabilities, coupled with the sheer volume of data they represent, allows them to exert pressure on pricing and contract terms. The increasing availability of alternative data annotation platforms and the potential for in-house development further amplify this buyer power.

- Increased Customer Sophistication: Buyers are more knowledgeable about AI data needs, leading to demands for specialized services.

- Scalability Demands: Customers require solutions that can grow with their AI projects, giving them leverage.

- Provider Alternatives: The growing number of AI service providers creates more options for buyers.

- Potential for In-house Development: Large clients may consider building their own data annotation capabilities, reducing reliance on external vendors.

Appen's customers, especially large tech firms, possess significant bargaining power due to their substantial revenue contributions. In 2023, Appen's top 10 clients accounted for roughly 64% of its revenue, demonstrating the concentrated nature of its customer base and the leverage these major players hold. This allows them to negotiate favorable pricing and stringent service level agreements, often impacting Appen's margins.

The abundance of alternative data annotation providers, including smaller niche firms and the possibility of in-house development, further empowers customers. This competition means clients can readily switch vendors if they find better pricing or more specialized services, especially for more commoditized labeling tasks. For instance, the AI training data market in 2023 was highly competitive, with numerous emerging players intensifying price pressures.

| Factor | Appen's Situation | Customer Leverage |

| Customer Concentration | Top 10 clients = ~64% of 2023 revenue | High leverage for major clients |

| Provider Alternatives | Many competitors, niche specialists, in-house potential | Low switching costs, price sensitivity |

| Demand for Customization | High for specialized AI projects | Leverage for complex, integrated needs |

Same Document Delivered

Appen Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Appen, detailing the competitive landscape and strategic implications. The document you see here is precisely the same professionally formatted and insightful analysis you will receive instantly after completing your purchase. You can be confident that no placeholders or sample sections are included; what you preview is your final, ready-to-use deliverable.

Rivalry Among Competitors

The data annotation market is incredibly crowded. Appen faces rivals of all sizes, from global giants to niche startups, and even budget-friendly offshore operations. This means there's a constant battle on price, especially for straightforward annotation tasks that have become quite commoditized.

The artificial intelligence sector is experiencing explosive growth, drawing numerous new players into the market. This influx significantly heightens competition, especially in the general data labeling segment, as companies battle for dominance in this rapidly expanding yet increasingly saturated arena.

By mid-2024, the global AI market was valued at an estimated $200 billion, with data labeling being a critical component. This rapid expansion has seen a surge in specialized data annotation firms, many of whom can offer services at lower price points, directly challenging established players like Appen.

Competitive rivalry in the data annotation space is intense, particularly for basic tasks where differentiation is difficult. Companies like Appen often find rivals competing on factors such as specialized data types, advanced platform technology, speed of project completion, stringent quality assurances, or innovative approaches to managing their annotation workforce.

The market saw significant consolidation in 2023 and early 2024, with larger players acquiring smaller ones to gain scale and technological capabilities. For instance, the acquisition of companies with specialized AI training data capabilities highlights this trend. This competitive pressure forces firms to continually invest in technology and talent to maintain an edge.

Competitive Rivalry 4

Competitive rivalry for Appen is intensified by a broad spectrum of players, extending beyond direct data labeling specialists. Companies offering comprehensive AI platforms, which often incorporate proprietary data preparation tools, present a more integrated competitive threat. This means Appen competes not just on labeling quality but also on the broader AI solution ecosystem.

The market is characterized by a significant number of smaller, niche providers, alongside larger, diversified technology companies. This creates a fragmented landscape where price competition can be fierce, particularly for standardized data labeling tasks. For instance, in 2024, the global AI market, which encompasses data labeling as a critical component, was projected to reach hundreds of billions of dollars, indicating substantial investment and numerous participants vying for market share.

- Broadening Competition: Appen faces rivals offering end-to-end AI solutions, not just data labeling services.

- Market Fragmentation: Numerous smaller, specialized firms compete on price, especially for routine data annotation.

- AI Ecosystem Play: Competition is increasingly about integrated AI platforms rather than isolated data preparation.

- 2024 Market Context: The vast size of the AI market in 2024 signifies intense competition across all its segments, including data labeling.

Competitive Rivalry 5

The competitive rivalry within the data annotation and AI services sector, where Appen operates, is intense. High fixed costs for building and maintaining global crowd platforms and technology infrastructure, coupled with the necessity for continuous innovation, fuel significant competitive pressures. Companies strive for economies of scale and operational efficiency to gain an edge.

This dynamic forces players like Appen to constantly invest in technology and talent, leading to a battle for market share. The need to achieve scale is critical for cost-effectiveness in a market where price is often a key differentiator.

- High Fixed Costs: Developing and maintaining a global crowd platform and sophisticated technology infrastructure requires substantial upfront and ongoing investment, creating a barrier to entry but also intensifying competition among established players.

- Innovation Imperative: The rapidly evolving AI landscape necessitates continuous innovation in data annotation techniques, quality assurance, and platform capabilities, putting pressure on companies to stay ahead technologically.

- Economies of Scale: To offset high fixed costs and achieve competitive pricing, companies must scale their operations significantly, leading to a drive for market consolidation and intense competition for larger contracts.

- Operational Efficiency: Streamlining workflows, optimizing crowd management, and leveraging technology for efficiency are crucial for profitability, making operational excellence a key competitive battleground.

Appen faces fierce competition from a wide array of players, from large tech companies offering integrated AI solutions to smaller, specialized annotation firms that compete aggressively on price. The sheer growth of the AI market, projected to reach hundreds of billions by 2024, attracts constant new entrants, intensifying rivalry for even basic data labeling tasks.

This intense competition forces companies like Appen to differentiate through specialized data types, advanced technology, speed, and robust quality assurance. The market saw significant consolidation in late 2023 and early 2024, with larger entities acquiring smaller ones to bolster capabilities and scale, further concentrating competitive pressures.

The battle for market share is also driven by the need to achieve economies of scale, as high fixed costs for global platforms and technology infrastructure demand significant operational efficiency to remain competitive on pricing.

| Competitive Factor | Appen's Challenge | Market Trend (2023-2024) |

|---|---|---|

| Price Competition | High, especially for commoditized tasks. | Intensified by numerous smaller, lower-cost providers. |

| Technological Advancement | Constant need for innovation in annotation tools and platforms. | Driven by AI sector growth and integrated AI solution providers. |

| Market Consolidation | Acquisitions by larger players to gain scale and capabilities. | Significant M&A activity observed in late 2023/early 2024. |

| Specialization | Need to offer niche expertise beyond general labeling. | Emergence of specialized firms focusing on specific AI training data needs. |

SSubstitutes Threaten

The threat of substitutes for Appen's services is growing, particularly from advancements in synthetic data generation. AI models can now create artificial datasets that closely mimic real-world data, potentially reducing the demand for human-annotated data in certain AI training scenarios. This trend is critical as the AI market continues to expand; for instance, the global synthetic data market was projected to reach $1.4 billion in 2023 and is expected to grow significantly in the coming years.

The threat of substitutes for Appen's services is growing as advancements in AI, particularly unsupervised and self-supervised learning, reduce the need for extensive human data annotation. These new methods allow AI models to learn from unlabeled data, making it easier and cheaper to build AI without relying on large human workforces. This directly challenges Appen's core business model, which has historically been built on providing human-labeled data.

The threat of substitutes for Appen's services is significant. Companies might choose to build their own in-house data annotation teams, especially for highly sensitive data or when they need very specific, tailored workflows. This can reduce reliance on third-party providers and offer greater control over the process.

Furthermore, the availability of open-source annotation tools and publicly available datasets presents another substitute. For less complex or commercially sensitive projects, these free resources can be a cost-effective alternative to outsourcing, allowing companies to manage data annotation internally without incurring external service fees.

In 2023, the global data annotation market was valued at approximately $5.4 billion, with projections suggesting substantial growth. However, the rise of accessible AI-powered annotation tools and the increasing ease of setting up internal annotation infrastructure could put pressure on external service providers like Appen, particularly for smaller projects or those with less stringent data privacy requirements.

4

The threat of substitutes for Appen's core data annotation services is growing, primarily driven by advancements in artificial intelligence itself. Pre-trained models and transfer learning techniques allow developers to adapt existing AI models to new tasks with significantly less new labeled data. This drastically reduces the need for extensive, bespoke annotation projects, which is Appen's bread and butter.

For instance, in 2024, the efficiency gains from transfer learning mean that a task that previously required 10,000 labeled data points might now be achievable with only 1,000, representing a tenfold reduction in the demand for human annotation for that specific use case. This trend directly impacts the volume of work available for annotation providers.

Key factors contributing to this threat include:

- Advancements in AI: Technologies like self-supervised learning and few-shot learning minimize the reliance on large, manually labeled datasets.

- Open-Source Models: The widespread availability of powerful, pre-trained models from sources like Hugging Face allows companies to build AI solutions with less custom data.

- Synthetic Data Generation: AI can now generate realistic synthetic data, further reducing the need for real-world, human-annotated data in certain applications.

- In-House Capabilities: Larger tech companies are increasingly developing their own internal annotation platforms and AI-driven data labeling tools, reducing their outsourcing needs.

5

The threat of substitutes for Appen's data annotation services is increasing due to advancements in active learning and weak supervision. These techniques enable AI systems to pinpoint the most valuable data for human review and learn from less precise labels, streamlining the annotation process and reducing dependence on extensive manual work. This efficiency gain could lead to alternative solutions that are more cost-effective.

For instance, in 2024, companies are investing heavily in AI-powered data labeling platforms. These platforms aim to automate a significant portion of the annotation workflow, thereby lowering the cost per data point labeled. This trend directly challenges traditional, labor-intensive annotation models.

- Growing AI capabilities in data annotation: Active learning and weak supervision are making AI more adept at identifying crucial data points and learning from imperfect labels, reducing the need for massive human annotation efforts.

- Cost-efficiency of alternative solutions: As AI-driven annotation tools improve, they offer a more cost-effective alternative to traditional, human-heavy annotation services, impacting Appen's pricing power.

- Potential for in-house solutions: Companies can increasingly develop or adopt internal AI tools for data annotation, bypassing third-party providers like Appen altogether.

The threat of substitutes for Appen's services is considerable, driven by technological advancements and the increasing capability of AI to reduce the need for human data annotation. Companies are exploring various alternatives to traditional data labeling, impacting the demand for Appen's core offerings.

Synthetic data generation is a key substitute, as AI can now create realistic datasets that mimic real-world data, decreasing the reliance on human-annotated real data. For example, the global synthetic data market was projected to reach $1.4 billion in 2023 and is expected to experience substantial growth. Furthermore, advancements in AI, such as unsupervised and self-supervised learning, allow models to learn from unlabeled data, bypassing the need for extensive human annotation. The efficiency gains from techniques like transfer learning in 2024 mean that tasks requiring large datasets can now be accomplished with significantly less labeled data, a tenfold reduction in some cases.

Companies can also opt for in-house annotation teams or leverage open-source annotation tools and publicly available datasets, especially for less sensitive projects. The global data annotation market was valued at approximately $5.4 billion in 2023, but these alternatives can offer cost-effective solutions, challenging external service providers.

| Substitute Type | Description | Impact on Appen | Example Data/Trend |

|---|---|---|---|

| Synthetic Data | AI-generated datasets mimicking real-world data. | Reduces demand for human-annotated data. | Global synthetic data market projected at $1.4 billion in 2023. |

| Advanced AI Learning | Unsupervised, self-supervised, and transfer learning. | Minimizes need for large, manually labeled datasets. | Transfer learning in 2024 can reduce data needs tenfold for some tasks. |

| In-House Solutions | Building internal annotation teams or platforms. | Decreases reliance on third-party providers. | Companies developing internal AI-driven data labeling tools. |

| Open-Source Resources | Free annotation tools and public datasets. | Cost-effective alternative for less complex projects. | Availability of pre-trained models from Hugging Face. |

Entrants Threaten

The threat of new entrants for Appen's core data annotation services is generally considered moderate to high. This is primarily because the capital investment needed to establish a basic crowd-sourcing platform for simple annotation tasks is relatively low. This accessibility allows numerous smaller players to enter the market, increasing competition.

In 2024, the market for AI data labeling, a key area for Appen, continued to see new companies emerge, particularly those focusing on niche AI applications or specialized data types. For instance, while Appen's revenue for the fiscal year 2023 was reported as $470.5 million, the proliferation of smaller, agile competitors offering specific services can fragment the market and put pressure on pricing for more commoditized tasks.

For basic data annotation, the threat of new entrants is moderate. However, for enterprise-grade, high-quality, and specialized data annotation services, the barriers to entry are significantly higher. These include substantial investment in technology platforms, robust quality control processes, and the ability to manage a large, skilled, and secure global crowd. For instance, companies like Appen require sophisticated AI-powered annotation tools and rigorous data security protocols to serve major tech clients, making it difficult for smaller players to compete at that level.

New entrants face substantial hurdles in the data annotation and AI training sector, particularly when targeting large enterprise clients. These clients demand robust data security, strict privacy compliance, and consistently high-quality output, all of which are difficult for unproven newcomers to guarantee.

Appen's established reputation and long-standing relationships with major technology and automotive companies, for instance, represent a significant barrier. In 2023, Appen reported revenue of $455.7 million, demonstrating its scale and ability to attract and retain demanding clients who value reliability and expertise over novelty.

4

The threat of new entrants for Appen is moderate. Building the necessary infrastructure to access a diverse and scalable global workforce, coupled with sophisticated project management and quality assurance systems, represents a significant hurdle for newcomers. These capabilities are crucial for delivering high-volume, high-accuracy data, a core requirement in the AI data services market.

New companies face substantial upfront investment in technology and talent acquisition to compete effectively. For instance, establishing robust data annotation platforms and ensuring data privacy compliance requires considerable capital and expertise. Appen’s established global network and proprietary technologies provide a competitive moat.

Key challenges for new entrants include:

- Establishing a reliable global talent pool: Sourcing, vetting, and managing a large, distributed workforce is complex and time-consuming.

- Developing advanced data processing capabilities: Investing in AI-powered tools for data annotation, validation, and quality control is essential.

- Achieving economies of scale: New entrants struggle to match the cost-efficiency of established players with significant operational volume.

- Building trust and client relationships: Securing contracts with major technology companies requires a proven track record of quality and reliability.

5

The threat of new entrants in the data annotation sector, where Appen operates, is generally considered moderate. Established players like Appen benefit significantly from economies of scale. This allows them to manage complex data annotation workflows and cater to diverse client needs more efficiently and cost-effectively than newcomers could initially. For instance, Appen's extensive global workforce and established project management systems provide a competitive edge that is hard for nascent companies to replicate quickly.

New entrants face substantial barriers to entry, particularly concerning the capital investment required for sophisticated technology platforms and the time needed to build a reputation for quality and reliability. Furthermore, the industry often demands adherence to strict data privacy and security protocols, which can be challenging and costly for startups to implement from the outset. Appen's long-standing relationships with major technology companies also create a significant hurdle for new competitors seeking to secure large-scale contracts.

- Economies of Scale: Appen leverages its size to reduce per-unit costs in data annotation, making it difficult for smaller new entrants to match pricing.

- Experience Curve: Years of experience in managing diverse annotation projects have honed Appen's operational efficiencies and quality control, a steep learning curve for new players.

- Capital Investment: Significant upfront investment is needed for advanced annotation tools, infrastructure, and skilled personnel, posing a barrier to entry.

- Client Relationships: Appen's established partnerships with major tech firms provide a stable revenue base and a deterrent to new entrants seeking initial market penetration.

The threat of new entrants for Appen remains moderate, particularly for its core data annotation services. While the initial investment for basic crowd-sourcing platforms is low, making it accessible for smaller competitors, securing large enterprise clients requires significant capital and expertise. Appen's established infrastructure, global workforce management, and proprietary technologies act as substantial barriers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Economies of Scale | Appen's large operational volume allows for lower per-unit costs in data annotation. | New entrants struggle to match Appen's pricing and cost-efficiency. |

| Capital Investment | Developing advanced annotation tools, secure infrastructure, and skilled personnel requires significant upfront capital. | High initial costs deter many potential new entrants, especially those targeting enterprise-level services. |

| Client Relationships | Appen's long-standing partnerships with major technology and automotive companies provide a stable revenue base. | Newcomers find it challenging to penetrate the market and secure contracts with these established clients. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and expert commentary from financial analysts.