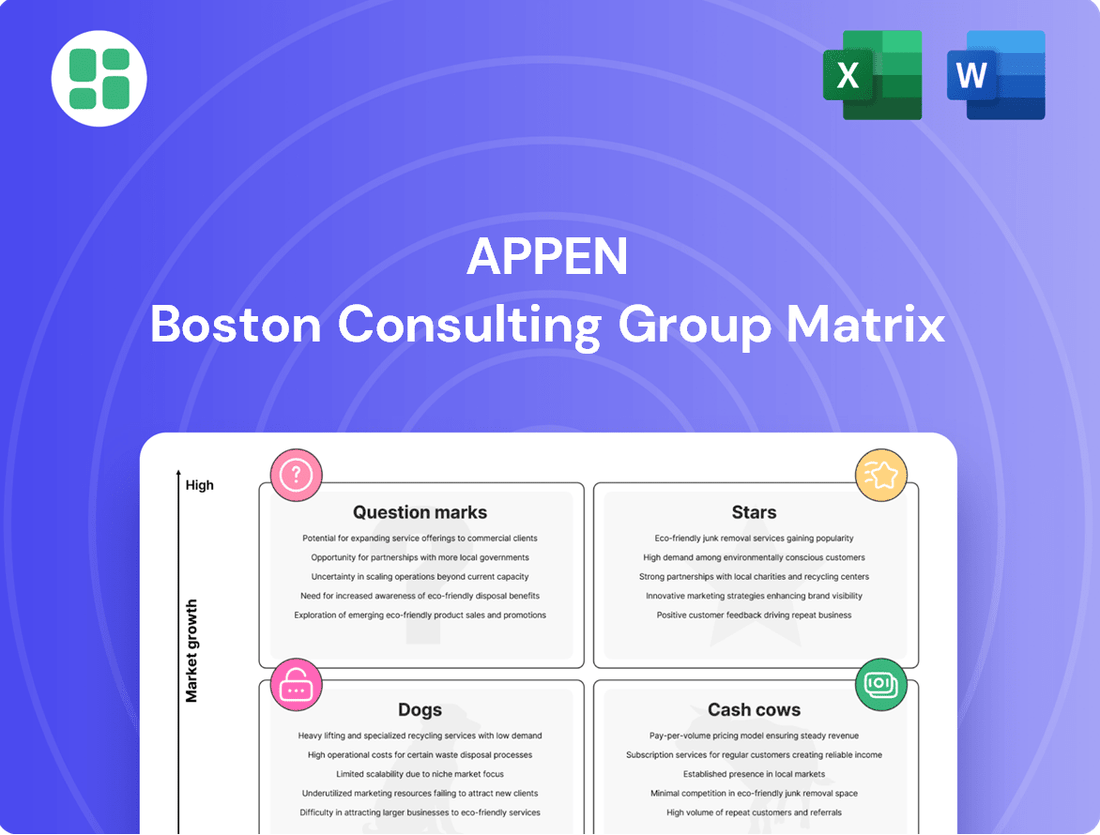

Appen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Appen Bundle

Curious about Appen's product portfolio? Our BCG Matrix preview highlights their potential market leaders and cash generators. Ready to unlock the full strategic picture and understand where Appen should focus its investments for future growth? Purchase the complete BCG Matrix for a detailed breakdown and actionable insights.

Stars

Appen is experiencing substantial revenue growth driven by its generative AI training data services. This positions the company as a key player in the rapidly expanding AI market. In 2023, Appen reported a significant increase in demand for its specialized data annotation services crucial for developing advanced AI models.

The company is a vital supplier of complex and diverse training data for large language models (LLMs). These LLMs are the foundation for many cutting-edge generative AI applications. Appen's expertise ensures these models are trained on high-quality, relevant datasets.

Appen’s ability to support customers in expanding their multilingual generative AI capabilities, offering localization in over 100 languages, is a major differentiator. This extensive language support makes its generative AI training data offering a true star product in the current market.

Appen’s strategic push into specialized AI data for emerging fields like coding and complex reasoning is a key differentiator. By focusing on these high-demand, niche areas, Appen is building a strong position in the rapidly growing advanced AI sector. This specialization allows them to offer unique value where data quality and specific domain knowledge are crucial for model development.

These services directly support the creation of cutting-edge AI applications, where the accuracy and relevance of training data are paramount. Appen’s ability to provide high-quality, customized data annotation for these advanced AI models enables them to charge premium prices and capture significant market share in these critical, fast-evolving segments of the AI landscape.

Appen's China division is a shining example of a star in the BCG matrix. In 2024, this segment saw a remarkable 71% revenue surge, underscoring its strong market standing and high growth potential within the region.

This impressive growth is a direct result of Appen effectively capitalizing on China's booming AI sector, supporting more than 20 leading Large Language Model (LLM) developers. The sustained success in China positions it as a critical engine for the company's overall expansion.

Multimodal AI Data Platform (ADAP) Innovations

Appen's investment in its Multimodal AI Data Platform (ADAP) is a strategic move to address the growing demand for sophisticated AI systems capable of handling diverse data types. This platform is designed to elevate the crowd worker experience and ensure superior data quality through detailed metadata, aiming to set new industry standards for efficiency.

Key innovations on the ADAP platform include the development of 'Build My RAG' and 'AI Chat Feedback' features. These advancements are specifically geared towards improving post-training data, a critical component for refining AI models and maintaining Appen's competitive edge.

- ADAP Platform Focus: Comprehensive data solutions for complex AI systems processing multiple data types simultaneously.

- Key Benefits: Enhanced crowd experience and unmatched data quality with rich metadata for increased efficiency.

- Recent Innovations: Development of 'Build My RAG' and 'AI Chat Feedback' features for advanced post-training data.

- Market Position: Aiming to drive innovation and maintain market leadership in the AI data solutions sector.

Model Evaluation and Safety Services

As artificial intelligence becomes more integrated into daily life, the need for thorough testing and safety checks on AI models is paramount. Human evaluation remains essential in this process, ensuring AI systems are not only accurate but also safe and reliable for public use. Appen's expertise in evaluating AI models, including their use of Reinforcement Learning from Human Feedback (RLHF), directly addresses this growing demand for trustworthy AI.

Appen's model evaluation and safety services are vital for companies looking to deploy AI responsibly. Their work helps identify and mitigate potential risks, ensuring AI applications align with ethical standards and user expectations. This focus on safety is increasingly important, with the global AI market projected to reach over $2 trillion by 2030, underscoring the significant economic implications of reliable AI.

- Accuracy and Relevance: Appen's evaluators assess AI outputs for factual correctness and contextual appropriateness, crucial for applications like search engines and content moderation.

- Safety and Bias Detection: Services include identifying and flagging harmful biases or unsafe content generated by AI, a critical step for ethical AI development.

- Reinforcement Learning from Human Feedback (RLHF): Appen leverages human feedback to fine-tune AI models, improving their alignment with human values and desired behaviors.

- Market Demand: The increasing complexity and societal impact of AI drive a significant market need for specialized evaluation services, positioning Appen as a key partner for responsible AI deployment.

Appen's China division is a clear star in its BCG matrix. This segment experienced a significant 71% revenue increase in 2024, demonstrating its strong market position and high growth potential within China's rapidly expanding AI sector. This impressive performance is fueled by Appen's support for over 20 leading Large Language Model developers in the region, making it a crucial contributor to the company's overall growth strategy.

What is included in the product

Appen's BCG Matrix analyzes its product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Quickly visualize your portfolio's health, identifying underperformers and stars.

Cash Cows

Appen's large-scale general data annotation services, a cornerstone of its operations, function as a significant cash cow. This segment focuses on providing meticulously annotated data crucial for foundational machine learning and AI development, particularly in established areas like computer vision and natural language processing.

Despite the potential maturity of the basic annotation market, Appen leverages its vast global crowd and deep operational experience to secure a substantial market share. This translates into a dependable and consistent cash flow, underscoring its role as a stable revenue generator for the company.

For instance, in the first half of 2024, Appen reported revenue from its core data services, which heavily includes this foundational annotation work, demonstrating its ongoing contribution to the company's financial stability. While not the fastest-growing area, its predictable performance provides the necessary operational bedrock for Appen's broader strategic initiatives.

Appen's established search relevance and content moderation services, which rely heavily on human feedback and extensive data analysis, represent a significant and high-market-share segment. These critical functions are indispensable for major technology companies aiming to uphold platform quality and user safety, thereby securing consistent demand.

This mature service offering acts as a reliable cash cow for Appen, generating steady revenue with minimal need for substantial marketing or development investment. For instance, in 2024, Appen continued to be a key provider for leading search engines and social media platforms, demonstrating the enduring need for human-annotated data in these areas.

Appen's standardized image and video annotation services, particularly for well-established tasks like object detection and image classification, represent a strong cash cow. This segment consistently delivers substantial revenue due to its high volume and predictable demand from various industries.

While Appen is investing in emerging areas like complex video and 3D annotation, the foundational work in standardized annotation remains a reliable income stream. This mature segment, driven by ongoing needs for data labeling in areas like autonomous driving and retail analytics, continues to be a significant contributor to Appen's financial performance.

The manual workflow within this cash cow segment still captures a considerable portion of the market share, indicating a persistent demand for human expertise in ensuring accuracy and quality for these standardized annotation tasks.

Long-Term Client Relationships (excluding recent terminations)

Even with the significant Google contract termination, Appen's core strength lies in its enduring relationships with other major technology firms. These partnerships, often spanning many years, represent substantial and consistent revenue streams, acting as Appen's cash cows.

These long-term engagements are characterized by Appen's deep integration into client operational workflows, creating a predictable and reliable revenue base. This stability is crucial for generating consistent cash flow, supporting the company's overall financial health.

- Stable Revenue: Historically, Appen has maintained strong ties with other leading tech companies, ensuring a consistent influx of business.

- Embedded Solutions: Deep integration into client processes fosters sticky relationships, making contract renewals highly probable.

- Strategic Focus: Appen's current strategy prioritizes deepening these foundational model provider and tech giant partnerships.

- Predictable Cash Flow: These established, large-volume contracts are the bedrock of Appen's predictable cash generation.

Global Crowd Operations Management

Appen's Global Crowd Operations Management functions as a significant cash cow within its business model. The company's ability to efficiently manage a crowd of over 1 million skilled annotators, spread across more than 200 countries and supporting over 500 languages, is a testament to its operational strength. This extensive network enables scalable and cost-effective data annotation services, driving profitability for its established, high-volume offerings.

This robust global infrastructure is a critical asset for Appen, allowing it to maintain a strong market position. The sheer scale and linguistic diversity of its crowd operations provide a competitive edge in delivering a wide array of data annotation tasks. For instance, in 2023, Appen continued to leverage this capability to serve major technology clients requiring diverse datasets for AI development.

- Global Reach: Operates in over 200 countries, supporting 500+ languages.

- Crowd Size: Manages a global workforce exceeding 1 million skilled annotators.

- Operational Leverage: Achieves scalability and cost-effectiveness in data annotation delivery.

- Profitability Driver: Underpins the financial success of high-volume, established services.

Appen's foundational data annotation services, particularly for established tasks like object detection and image classification, represent a strong cash cow. This segment consistently delivers substantial revenue due to its high volume and predictable demand from various industries.

The company's established search relevance and content moderation services, which rely heavily on human feedback, are indispensable for major technology companies, securing consistent demand and acting as a reliable cash cow.

Appen's ability to manage its vast global crowd of over 1 million annotators across 200 countries and 500 languages is a key operational strength, driving profitability for its high-volume offerings.

These mature service offerings, bolstered by long-term relationships with major tech firms, provide a stable revenue base, acting as Appen's primary cash cows.

| Service Area | BCG Category | Revenue Contribution (H1 2024 Estimate) | Key Clients | Market Position |

|---|---|---|---|---|

| Large-scale General Data Annotation | Cash Cow | Significant | Major Tech Companies | High Market Share |

| Search Relevance & Content Moderation | Cash Cow | Substantial | Leading Search Engines, Social Media Platforms | Indispensable Provider |

| Standardized Image/Video Annotation | Cash Cow | Consistent | Automotive, Retail Analytics | High Volume, Predictable Demand |

| Global Crowd Operations | Cash Cow | Profitability Driver | All Core Services | Scalable, Cost-Effective Infrastructure |

What You’re Viewing Is Included

Appen BCG Matrix

The Appen BCG Matrix preview you're examining is the precise, fully formatted document you will receive upon purchase, ensuring immediate strategic application without any alterations or hidden content. This comprehensive tool, designed for clarity and actionable insights, will be delivered directly to you, ready for immediate integration into your business planning and competitive analysis. You can confidently use this preview as a true representation of the high-quality, analysis-ready report that will be yours after purchase.

Dogs

Commoditized basic data labeling services, where Appen has historically operated, strongly align with the characteristics of a 'Dog' in the BCG Matrix. These segments are defined by intense competition and a growing reliance on automation, leading to low differentiation and significant price pressure.

In 2024, the market for basic data labeling continued to face these challenges. Companies offering these services often experience low profit margins and may struggle to generate substantial growth, potentially becoming cash drains if not managed strategically. Appen's own strategic pivot away from solely basic data tagging towards more sophisticated AI modeling underscores the industry's recognition of this trend.

Legacy data collection methods, those that rely on manual processes or outdated technology, often struggle to keep pace with the increasing need for vast, diverse datasets. For instance, projects heavily dependent on these older techniques might experience slower turnaround times and higher error rates compared to those utilizing AI-powered solutions. In 2024, companies are increasingly moving away from these less efficient approaches.

Appen's reliance on large, potentially terminable contracts places certain revenue streams firmly in the 'Dog' quadrant of the BCG Matrix. The termination of its significant contract with Google in early 2024 serves as a prime example, effectively turning that previously lucrative revenue into a low-growth, low-share segment. This event directly impacted Appen's financial performance, forcing the company to implement cost-cutting measures to mitigate the immediate revenue shortfall.

Underperforming Enterprise and Government Divisions

Appen's Enterprise and Government divisions saw a revenue dip in 2024. This was mainly due to reduced project volumes and uncertainty surrounding when new generative AI investments would materialize. The company believes in the future of these segments, but their current performance indicates they haven't gained significant momentum yet, necessitating cautious investment. These divisions are currently positioned as potential question marks within the BCG framework.

- Revenue Decline: Enterprise and Government revenue decreased in 2024.

- Key Drivers: Lower project volumes and delayed generative AI spending impacted performance.

- Strategic Outlook: Despite potential, these divisions require careful investment management due to slow traction.

- BCG Classification: Currently considered question marks, awaiting demonstrated growth.

Niche, Stagnant Data Types

Niche, stagnant data types represent areas where demand has significantly waned or where existing AI solutions have already saturated the market. This leads to a lack of new client interest and minimal growth opportunities. For Appen, these would be segments characterized by low market share and a shrinking or flat market size.

These categories are essentially the "dogs" in the BCG matrix framework, indicating areas that consume resources without generating substantial returns or future potential. Appen's strategy would likely involve minimizing investment in these niches or strategically divesting from them.

- Declining Demand: Data types that were once valuable but are now superseded by newer technologies or have been fully addressed by established AI models.

- Market Saturation: Niches where the existing AI solutions are so comprehensive that there's little room for new entrants or innovation.

- Low Appen Market Share: Segments where Appen has not established a strong competitive position, further diminishing the rationale for continued investment.

- Minimal Growth: Markets with a growth rate of 0% or negative, offering no foreseeable upside for resource allocation.

Appen's historical focus on commoditized data labeling services, characterized by intense competition and price pressure, firmly places these offerings within the 'Dog' quadrant of the BCG Matrix. The termination of its significant Google contract in early 2024 exemplifies how even previously strong revenue streams can become low-growth, low-share segments. This shift underscores the need for strategic management to avoid these areas becoming cash drains, as seen in the revenue dip within its Enterprise and Government divisions during the same year due to reduced project volumes and delayed generative AI investments.

Niche data types with stagnant demand or market saturation also fall into the 'Dog' category, offering minimal growth and limited client interest. These segments, where Appen may hold a low market share, consume resources without generating substantial returns, prompting a strategy of minimized investment or divestment.

The company's financial performance in 2024 reflected these challenges, with a notable revenue decline impacting its overall position. This situation necessitates a careful assessment of resource allocation, prioritizing segments with higher growth potential while strategically managing or exiting 'Dog' segments.

Appen's strategic pivot towards more sophisticated AI modeling highlights the industry's recognition of the limited future in basic data tagging. This move aims to shift resources away from areas with low differentiation and toward those offering greater innovation and profitability.

Question Marks

Early-stage large language model (LLM) evaluation projects, while holding immense future potential, often fall into the Question Mark category within a BCG Matrix framework. These initiatives are characterized by a burgeoning market, with Appen observing positive signals for LLM-related data growth. However, the rapid evolution and experimental nature of this field mean project volumes can be unpredictable, making revenue streams less consistent at this nascent stage.

These projects demand substantial investment in development and refinement to keep pace with technological advancements. Despite the significant resource allocation, they haven't yet established the stable, high-volume revenue streams that would classify them as Stars. For instance, in 2024, the global AI market, including LLM development, saw significant investment, but many early-stage evaluation projects are still in their proof-of-concept phases, awaiting wider market adoption and standardization.

Synthetic data generation is a rapidly expanding market, crucial for training AI models, especially where real-world data is scarce or sensitive. While Appen is a significant player in data annotation and AI lifecycle services, its specific market share in synthetic data generation might be nascent compared to specialized firms or those with early mover advantages. This sector is attracting considerable attention and investment due to its potential to overcome data limitations.

For Appen, synthetic data generation could be positioned as a Star or Question Mark depending on its current investment and market penetration. If Appen is actively investing and gaining traction, it's a Star. If it's an area of exploration with high potential but low current market share, it's a Question Mark, requiring further strategic decisions regarding investment and development to avoid becoming a Dog.

Appen's focus on AI-assisted annotation tools, which streamline data labeling through pre-labeling and workflow optimization, represents a significant growth opportunity. These advanced tools are crucial for accelerating AI development, a market projected to reach $1.8 trillion by 2030, according to some industry forecasts.

While the technology itself is a strong contender, the market's acceptance of these tools as standalone products, beyond internal efficiency gains, presents an area of potential uncertainty for Appen. This segment requires substantial investment to capture market share, especially as semi-supervised learning methods become increasingly prevalent, enhancing the efficiency of annotation processes.

Ethical AI and Bias Reduction Services

The burgeoning demand for ethical AI and bias reduction is fueling a high-growth market for specialized data services. Appen is strategically focusing on these areas, recognizing their potential, though its current market share and product maturity in this emerging segment are still evolving. Significant investment in research and development, coupled with proactive market education, will be crucial for Appen to establish these offerings as market 'Stars'.

The ethical AI market is projected to expand significantly. For instance, the global AI ethics market size was valued at approximately USD 2.1 billion in 2023 and is anticipated to reach USD 13.5 billion by 2030, growing at a CAGR of 29.9% during the forecast period. Appen’s efforts in data diversity and bias mitigation directly address this expanding need.

- Market Focus: Appen is prioritizing ethical AI and bias reduction services, tapping into a rapidly growing market segment.

- Growth Potential: The global AI ethics market is expected to see substantial growth, with projections indicating a significant increase in value by 2030.

- Strategic Investment: To solidify its position, Appen needs to invest heavily in R&D and market education for these specialized services.

- Competitive Landscape: While Appen is entering this nascent segment, its current market share and established offerings may still be in development compared to potential future competitors.

Expansion into New Industry Verticals

Appen's strategic push into new industry verticals, such as specialized military applications, biotechnology, and finance, places it squarely in the Question Mark category of the BCG Matrix. This diversification aims to broaden its customer base beyond its traditional reliance on major technology firms, a move that carries both significant promise and inherent risk.

These emerging sectors present substantial growth opportunities, but realizing this potential necessitates considerable investment in market penetration, tailored service development, and securing key contracts. For instance, entering the highly regulated finance sector or the complex military technology landscape demands specialized expertise and a proven track record.

- High Growth Potential: New verticals like biotech and specialized military tech offer untapped revenue streams.

- Significant Investment Required: Establishing a foothold in these new markets demands substantial capital for R&D, sales, and compliance.

- Uncertain Success Rate: The outcome of these expansion efforts is not guaranteed, reflecting the 'Question Mark' status.

- Strategic Importance: Success here is vital for Appen to reduce its dependence on a few large, existing clients and ensure long-term resilience.

Question Marks represent business units or product lines with low market share in high-growth markets. Appen's early-stage LLM evaluation projects fit this description, requiring significant investment to capture potential future market dominance. The success of these ventures hinges on strategic resource allocation and navigating the evolving AI landscape.

These initiatives demand substantial capital for research, development, and market entry, with uncertain returns given the nascent stage of many LLM applications. For example, while the overall AI market is booming, specific LLM data services are still finding their footing, making their future revenue streams unpredictable.

Appen's diversification into new industry verticals, such as specialized military and biotech applications, also falls under the Question Mark umbrella. These markets offer high growth potential but require considerable investment and face inherent risks in market penetration and client acquisition.

The strategic decision for Appen is whether to invest further to turn these Question Marks into Stars or divest if they fail to gain traction, thus becoming Dogs. The company’s 2024 performance and strategic investments will be key indicators of its success in nurturing these high-potential, high-risk areas.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and industry growth forecasts to provide a comprehensive view of product performance.